- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

6298 Courses

Financial Regulation: The International Regulatory Environment

5.0(4)By LGCA | London Governance and Compliance Academy

Description A key component to the development of financial markets is to agree standards of behaviour and provide mechanisms for dispute resolution. These standards, rules and codes of conduct may be established through self-regulation of the industry, or by means of a statutory approach where governments provide enabling legislation and establish statutory-based regulatory authorities. Integrity and ethical behaviour are key parts of any code of conduct and have, as a result of the financial crisis, experienced renewed focus from professional bodies, governments and regulators. As financial markets have become increasingly global in nature and interdependence has grown, the financial sector has moved from self-regulation to a statutory approach. This has facilitated international cooperation and the development of improved and common standards. The objectives and benefits of regulation is summarised as follows: • increase in confidence and trust in financial markets, systems and products • establish an environment to encourage economic development and wealth creation • reduce the risk of market and system failures including their economic consequences • enhance consumer protection, giving them the reassurance they need to save and invest, and • reduce financial crime by ensuring financial systems cannot easily be exploited. By attending this course participants will be able to understand the objectives and benefits of regulation and the various agencies that make up the current international and national regulatory environment. Training Duration This course may take up to 2 hours to complete. However, actual study time differs as each learner uses their own training pace. Participants This course is ideal for anyone wishing to know the essentials of financial regulation and the international regulatory environment, and the regulatory requirements for investment firms, insurance and banking institutions. It is also suitable to professionals pursuing regulatory CPD in Financial Regulation (such as the FCA etc). Training Method The course is offered fully online using a self-paced approach. The learning units consist of video presentations and reading material. Learners may start, stop and resume their training at any time. At the end of each session, participants take a Quiz to complete their learning unit and earn a Certificate of Completion once all quizzes have been passed successfully. Accreditation and CPD Recognition This programme has been developed by the London Governance and Compliance Academy (LGCA), a UK-recognised training institution. The syllabus is verified by external subject matter experts and may be accredited by financial regulators, such as FCA and general financial training accreditation bodies, such as CISI, for 2 CPD Units. Eligibility criteria and CPD Units are verified directly by your association or other bodies in which you hold membership. Registration and Access To register to this course, click on the Get this course button to pay online and receive your access instantly. If you are purchasing this course on behalf of others, please be advised that you will need to create or use their personal profile before finalising your payment. If you wish to receive an invoice instead of paying online, please contact us at info@lgca.uk. Access to the course is valid for 365 days.

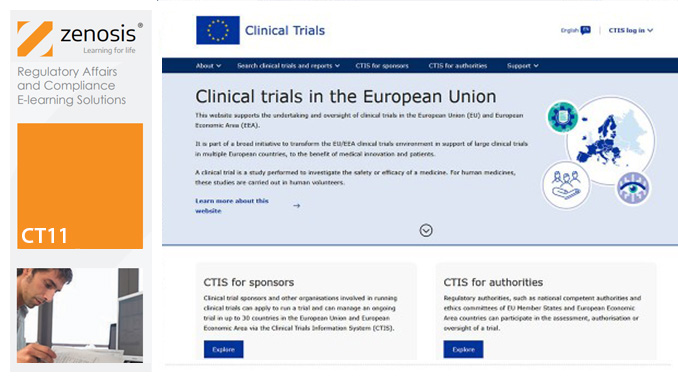

CT11: How to Gain Authorisation for Clinical Research Under the EU Clinical Trials Regulation

By Zenosis

This course sets out the procedures that sponsors need to follow to gain authorisation to conduct clinical trials under the Regulation, and it summarises and links to the extensive guidance available from the European Commission and the European Medicines Agency. Its companion course CT12 sets out the procedures that sponsors need to follow to conduct authorised clinical trials in compliance with the Regulation. The two courses therefore provide an ideal foundation for understanding and complying with the new law.

A five day Refrigeration Electrics Maintenance course aimed at anyone involved with refrigeration, air conditioning and heat pump electrical control systems. The Refrigeration Electrics Maintenance course covers the three elements which are common to most refrigeration and air conditioning systems, namely, protection, control and motors. For example, a typical air conditioning split system will have protection provided by the fuse in the fused connection unit, and further protection provided to the cable feeding the fused connection unit, probably by a circuit breaker, control provided by thermostat and time clock etc… and motor driven fans and compressor. During the Refrigeration Electrics Maintenance course emphasis is also placed upon the applicable wiring regulations to ensure the constructed system is compliant with BS7671:2018 The aim of the Refrigeration Electrics Maintenance course is to provide enough knowledge to allow maintenance and fault finding to be safely and effectively carried out. The Refrigeration Electrics Maintenance course comprises of: Essential Electrics Module City and Guilds 2382-22 Level 3 – 18th Edition Wiring Regulations Refrigeration Electrics Module The Refrigeration Electrics Maintenance course costs include examination entry fees.

C&G 2392-10 – Level 2 Certificate in Fundamental Inspection, Testing & Initial Verification

4.7(1243)By Technique Learning Solutions

City & Guilds 2392 10 level 2 is a short course aimed at newcomers to inspection and testing of electrical installations, and also the logical route towards 2391-50, 2391-51, or 2391-52. City & Guilds 2392 10 level 2 Certification is achieved on successful completion of both the practical assessment and PC based examination. A four day course for a student possessing a working knowledge of the wiring regulations, to the level of City and Guilds 2382. We strongly recommend City and Guilds 2382 is achieved prior to sitting this City & Guilds 2392 10 level 2 course, though this is NOT an entry requirement. The City & Guilds 2392 10 level 2 exam is a PC based multiple choice examination has 50 questions, is 1 hour 40 mins long and is closed book, with instant result. To further support this City & Guilds 2392 10 level 2 course, we offer a 1 day practical workshop available to candidates who have completed the course and require further ‘hands on’ practical experience prior to their practical examination. Most students who take this option, elect to complete this the day before their practical assessment. The practical assessment takes approximately 2 hours, this can, if available, be taken on the day following the on-line examination or at a later date at a time which is mutually convenient to both student and centre. The City & Guilds 2392 10 level 2 course costs include examination entry fees, a buffet lunch and refreshments throughout the day. The course costs include examination entry fees.

Certified GDPR Foundation

By Training Centre

The GDPR Foundation training enables delegates to understand how to define and implement a privacy compliance framework aligned to best practice. During this training course, you will be able to understand the fundamental privacy principles and become familiar with the role of the Data Protection team and the DPO. About This Course At Foundational level, candidates prove they have understood the fundamental methodologies, requirements, best practice and management approach of a Privacy Compliance Framework. Learning principles; Understand the General Data Protection Regulation requirements and the fundamental principles of privacy Understand the obligations, roles and responsibilities of the Data Protection Officer Understand the concepts, approaches, methods and techniques to effectively participate in the implementation process of a compliance framework with regard to the protection of personal data. Educational approach; Lecture sessions are illustrated with practical questions and examples Practical exercises include examples and discussions Practice tests are similar to the Certification Exam Course Agenda Day 1: Introduction to GDPR and Data Protection Principles Day 2: The General Data Protection Regulation requirements and Certification Exam Prerequisites There are no prerequisites for this course. What's Included? Refreshments & Lunch (Classroom courses only Course Slide Deck CPD Certificate Who Should Attend? Individuals involved in the processing of Personal Data and Information Security Individuals seeking to gain knowledge about the main privacy principles Individuals interested to pursue a career in Data Protection Provided by This course is Accredited by NACS and Administered by the IECB Assessment Delegates sit a combined exam, consisting of in-course quizzes and exercises, as well as a final 40 question, multiple choice exam on Day 2 of the course. The overall passing score is 70%, to be achieved within the 60 minute time allowance. Exam results are provided within 24 hours, with both a Certificate and a digital badge provided as proof of success.

Completing Client and Matter Risk Assessments Course

By DG Legal

Despite being a requirement under the Money Laundering Regulations 2017 (MLR 2017), in 2023/24 the SRA found that 19% of files reviewed did not contain a client and matter risk assessment (CMRA), with a further 12% of files containing ineffective CMRAs. At best, the firms conducting these files were putting themselves at risk of regulatory action for failure to comply with the MLR 2017. More seriously, firms may have been facilitating money laundering through their failure to adequately assess and address the risks posed by clients and matters. The SRA has issued a number of significant fines to firms with no, or insufficient, CMRAs in place. In the year August 2024 to July 2025, firms were fined over £950,000 where ineffective or missing CMRAs were noted. Although a firm’s MLRO, MLCO or its managers bear ultimate responsibility for ensuring its compliance with the MLR 2017, it is the responsibility of all those working on behalf of the firm to conduct and document the appropriate processes and checks on a day-to-day basis. Therefore, it is imperative that all staff understand not only how to complete a CMRA, but also the importance of doing so thoroughly and correctly. This course will assist fee earners and support staff in confidently and competently completing client and matter risk assessments, understanding the types of risks to be identified and the importance of correctly identifying these. Where the SRA has found failings at firms in respect of CMRAs, it has almost unanimously also found shortcomings in other areas of AML compliance. Where concerns are raised regarding a firm’s compliance with any aspect of the MLR 2017, the SRA will probe further and look into all areas of AML compliance. For information about DG Legal’s full range of AML training courses, please visit https://dglegal.co.uk/training/upcoming-premier-training-courses/. Target Audience This online course is suitable for staff of all levels, from support staff to senior partners. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Paul Wightman, Consultant, DG Legal A qualified barrister, Paul graduated in Law from Birmingham University and was called to the Bar in 1994. He subsequently spent almost 20 years working for the Law Society of England and Wales, initially within the Office for the Supervision of Solicitors, then the Legal Complaints Service (LCS), and ultimately the Solicitors Regulation Authority (SRA). Paul is adept at undertaking audits and providing succinct reports on areas for improvement and can assist firms with advice on all aspects of SRA compliance and Anti-Money Laundering procedures.

Source of Funds and Source of Wealth Checks Course

By DG Legal

Source of funds and source of wealth are two important verification steps a firm can take to identify potential money laundering activities or other financial crime. The Money Laundering Regulations 2017 (MLR 2017) require firms, where necessary, to scrutinise the source of funds of a transaction to ensure they are consistent with their knowledge of the customer, their business and risk profile. In addition, where a matter is considered to be higher risk and therefore subject to enhanced due diligence, firms must also investigate the client’s overall source of wealth. Law firm staff must be able to differentiate between source of funds and source of wealth, having knowledge of how to verify each and identify any anomalies that do not align with their understanding of the client or the matter. Staff must have the knowledge and confidence to challenge clients and seek further clarification where the source may be unclear or highlight concerns. A number of firms who failed to sufficiently identify the source of funds and/or source of wealth have recently been fined by the SRA. In the year August 2024 to July 2025, fines in excess of £475,000 were recorded for AML breaches that included source of funds and source of wealth failings. This course will assist fee earners and support staff in understanding the difference between source of funds and source of wealth, enabling them to capably identify and verify funds in a matter. Where the SRA has found failings at firms in respect of source of funds or source of wealth, it has almost unanimously also found shortcomings in other areas of AML compliance. Where concerns are raised regarding a firm’s compliance with any aspect of the MLR 2017, the SRA will probe further and look into all areas of AML compliance. For information about DG Legal’s full range of AML training courses, please visit: https://dglegal.co.uk/training/upcoming-premier-training-courses/. Target Audience This online course is suitable for staff of all levels, from support staff to senior partners. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Paul Wightman, Consultant, DG Legal A qualified barrister, Paul graduated in Law from Birmingham University and was called to the Bar in 1994. He subsequently spent almost 20 years working for the Law Society of England and Wales, initially within the Office for the Supervision of Solicitors, then the Legal Complaints Service (LCS), and ultimately the Solicitors Regulation Authority (SRA). Paul is adept at undertaking audits and providing succinct reports on areas for improvement and can assist firms with advice on all aspects of SRA compliance and Anti-Money Laundering procedures.

Explore the intricate world of Finance Law in our comprehensive course, focusing on Securities Regulation & Market Manipulation. Delve into banking, investment, derivatives, and consumer finance regulations, gaining insights into international finance law. Navigate ethical considerations and compliance challenges for a holistic understanding of the financial legal landscape. Join us to develop critical skills for analyzing and applying finance laws in real-world scenarios. Elevate your expertise in securities regulation, market integrity, and ethical finance practices.

QA Level 3 Award In First Aid At Work (RQF) Three-day course Gives learners the knowledge and skills to be a first aider Recommended by HSE for high risk workplaces Course Contents: The Roles and Responsibilities of an Emergency First Aider Assessing an Incident Minor Injuries Cuts, Grazes and Bruises Minor Burns and Scalds Managing an Unresponsive Casualty CPR Safe Use of an AED (Automated External Defibrillator) Choking Seizures Wounds and Bleeding Shock Eye Injuries Angina Heart Attack Stroke Asthma Diabetes Anaphylaxis Head Injuries Spinal Injuries Chest Injuries Fractures Sprains, Strains and Dislocations Poisoning Benefits of this course: 1.1 million workers in Britain had an accident at work in 2014/2015 Of those, 2,700 were from the East Midlands On average, one out of every 370 people received an injury at work The estimated cost of injuries and ill health last year was £15 billion The Health and Safety (First Aid) Regulations 1981 require all employers to make arrangements to ensure their employees receive immediate attention if they are injured or taken ill at work. This includes carrying out a risk assessment, appointing a suitable amount of first aiders and providing adequate first aid training Typically, first aiders will hold a valid certificate in either First Aid at Work (FAW) or Emergency First Aid at Work (EFAW) Our QA Level 3 Award in First Aid at Work (RQF) - FAW - training course is the one recommended for first aiders in a high risk workplace Having the correct first aid provision in the workplace is not just a legal requirement, it is incredibly important for the safety of all members of staff! As this is a Regulated Qualification, employers can book this course for their employees in the safe knowledge that they have fulfilled their legal responsibilities for providing quality first aid training, without having to undertake any lengthy due diligence checks Accredited, Ofqual regulated qualification: Our First Aid at Work (FAW) course is a nationally recognised, Ofqual regulated qualification accredited by Qualsafe Awards. This means that you can be rest assured that your First Aid at Work Certificate fulfills the legal requirements and is a very good way to make sure you and your employees are trained in First Aid, having the ability to save lives should the situation occur. The Ofqual Register number for this course is 603/2384/X

General Data Protection Regulation Online Training Course

By Lead Academy

General Data Protection Regulation Training Course Overview Are you looking to begin your General Data Protection Regulation or GDPR career or want to develop more advanced skills in General Data Protection Regulation or GDPR? Then this general data protection regulation online training course will set you up with a solid foundation to become a confident data controller or data protection officer and help you to develop your expertise in General Data Protection Regulation or GDPR. This general data protection regulation online training course is accredited by the CPD UK & IPHM. CPD is globally recognised by employers, professional organisations and academic intuitions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD certified certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Whether you are self-taught and you want to fill in the gaps for better efficiency and productivity, this general data protection regulation online training course will set you up with a solid foundation to become a confident data controller or data protection officer and develop more advanced skills. Gain the essential skills and knowledge you need to propel your career forward as a data controller or data protection officer. The general data protection regulation online training course will set you up with the appropriate skills and experience needed for the job and is ideal for both beginners and those currently working as a data controller or data protection officer. This comprehensive general data protection regulation online training course is the perfect way to kickstart your career in the field of General Data Protection Regulation or GDPR. This general data protection regulation online training course will give you a competitive advantage in your career, making you stand out from all other applicants and employees. If you're interested in working as a data controller or data protection officer or want to learn more skills on General Data Protection Regulation or GDPR but unsure of where to start, then this general data protection regulation online training course will set you up with a solid foundation to become a confident data controller or data protection officer and develop more advanced skills. As one of the leading course providers and most renowned e-learning specialists online, we're dedicated to giving you the best educational experience possible. This general data protection regulation online training course is crafted by industry expert, to enable you to learn quickly and efficiently, and at your own pace and convenience. Who should take this course? This comprehensive general data protection regulation online training course is suitable for anyone looking to improve their job prospects or aspiring to accelerate their career in this sector and want to gain in-depth knowledge of General Data Protection Regulation or GDPR. Entry Requirement There are no academic entry requirements for this general data protection regulation online training course, and it is open to students of all academic backgrounds. As long as you are aged seventeen or over and have a basic grasp of English, numeracy and ICT, you will be eligible to enrol. Method of Assessment On successful completion of the course, you will be required to sit an online multiple-choice assessment. The assessment will be evaluated automatically and the results will be given to you immediately. Career path This general data protection regulation online training course opens a brand new door for you to enter the relevant job market and also provides you with the chance to accumulate in-depth knowledge at the side of needed skills to become flourishing in no time. You will also be able to add your new skills to your CV, enhance your career and become more competitive in your chosen industry. Course Curriculum Introduction Trainer Introduction and Course Outline Why Data Protection. What Exactly is Why Deal with Data Protection Anyway. How is the Protection of Data Guaranteed. The Five Basic Principles of Data Protection Introduction Principle 1: Prohibition of Data Processing and Exceptions to Consent Principle 2: Purpose of Data Collection Principle 3: Data Collection Limits Principle 4: Data Security Principle 5: Transparency Summary The Foundations of Data Processing Introduction Data Processing with Consent Data Processing without Consent Rights of Data Subjects Rights of Data Subjects Responsibility of Data Controller or Processor Introduction Maintaining a Record of Processing Activities Technical and Organizational Measures (TOM) Data Processing Data Breaches Summary The Data Protection Officer The Data Protection Officer Summary Summary Recognised Accreditation CPD Certification Service This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Many organisations look for employees with CPD requirements, which means, that by doing this course, you would be a potential candidate in your respective field. Quality Licence Scheme Endorsed The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. It will give you a competitive advantage in your career, making you stand out from all other applicants and employees. Certificate of Achievement Endorsed Certificate from Quality Licence Scheme After successfully passing the MCQ exam you will be eligible to order the Endorsed Certificate by Quality Licence Scheme. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. It will give you a competitive advantage in your career, making you stand out from all other applicants and employees. There is a Quality Licence Scheme endorsement fee to obtain an endorsed certificate which is £65. Certificate of Achievement from Lead Academy After successfully passing the MCQ exam you will be eligible to order your certificate of achievement as proof of your new skill. The certificate of achievement is an official credential that confirms that you successfully finished a course with Lead Academy. Certificate can be obtained in PDF version at a cost of £12, and there is an additional fee to obtain a printed copy certificate which is £35. FAQs Is CPD a recognised qualification in the UK? CPD is globally recognised by employers, professional organisations and academic intuitions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD-certified certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Are QLS courses recognised? Although QLS courses are not subject to Ofqual regulation, they must adhere to an extremely high level that is set and regulated independently across the globe. A course that has been approved by the Quality Licence Scheme simply indicates that it has been examined and evaluated in terms of quality and fulfils the predetermined quality standards. When will I receive my certificate? For CPD accredited PDF certificate it will take 24 hours, however for the hardcopy CPD certificate takes 5-7 business days and for the Quality License Scheme certificate it will take 7-9 business days. Can I pay by invoice? Yes, you can pay via Invoice or Purchase Order, please contact us at info@lead-academy.org for invoice payment. Can I pay via instalment? Yes, you can pay via instalments at checkout. How to take online classes from home? Our platform provides easy and comfortable access for all learners; all you need is a stable internet connection and a device such as a laptop, desktop PC, tablet, or mobile phone. The learning site is accessible 24/7, allowing you to take the course at your own pace while relaxing in the privacy of your home or workplace. Does age matter in online learning? No, there is no age limit for online learning. Online learning is accessible to people of all ages and requires no age-specific criteria to pursue a course of interest. As opposed to degrees pursued at university, online courses are designed to break the barriers of age limitation that aim to limit the learner's ability to learn new things, diversify their skills, and expand their horizons. When I will get the login details for my course? After successfully purchasing the course, you will receive an email within 24 hours with the login details of your course. Kindly check your inbox, junk or spam folder, or you can contact our client success team via info@lead-academy.org

Search By Location

- regulation Courses in London

- regulation Courses in Birmingham

- regulation Courses in Glasgow

- regulation Courses in Liverpool

- regulation Courses in Bristol

- regulation Courses in Manchester

- regulation Courses in Sheffield

- regulation Courses in Leeds

- regulation Courses in Edinburgh

- regulation Courses in Leicester

- regulation Courses in Coventry

- regulation Courses in Bradford

- regulation Courses in Cardiff

- regulation Courses in Belfast

- regulation Courses in Nottingham