- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1779 Courses

New Functions in Microsoft Excel 2021 Course

By One Education

Microsoft Excel 2021 has quietly slipped in a bundle of new functions that can turn even the most mundane spreadsheets into efficient data-processing machines. This course introduces the latest features like XLOOKUP, LET, FILTER, SEQUENCE, and TEXTSPLIT, which not only simplify formulas but make spreadsheets smarter and tidier. Whether you’re an analyst trying to avoid circular references or someone who’s simply tired of tangled VLOOKUPs, this course brings clarity to your cells—no pun intended. Tailored for Excel users who know the ropes but want to keep up with what's new, this course ensures you don’t fall behind the curve. You’ll explore function upgrades that tidy up old formulas, save time, and help you work cleaner and quicker. With a thoughtful structure and a lightly witty tone, the course content walks you through updates that genuinely make a difference—without drowning you in geek speak. Excel’s had a makeover, and it's about time your formulas caught up. Learning Outcomes: Understand the purpose and benefits of new Excel functions. Apply the RANDARRAY function to generate random data. Use the UNIQUE function to extract unique values from a data range. Create custom number sequences with the SEQUENCE function. Sort data effectively with the SORT and SORTBY functions. Filter data easily with the FILTER function. Unlock the full potential of Microsoft Excel with our new course, "The Theory of Constraints and Throughput Accounting." In just a few modules, you'll learn how to utilise the latest functions in Excel to quickly sort, filter, and analyse data. By the end of the course, you'll be equipped with the knowledge to efficiently organise even the most complex datasets. But this course isn't just about learning new functions - it's about applying them to real-world scenarios. With practical examples and exercises throughout the course, you'll learn how to use these functions in meaningful ways. The benefits of this course are clear: increased productivity, better data analysis, and more efficient workflow. Don't miss out on this opportunity to take your Excel skills to the next level - enroll in "The Theory of Constraints and Throughput Accounting" today. How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The course is ideal for highly motivated individuals or teams who want to enhance their professional skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Upon completing the Functional Maths Training Course, you can venture into diverse job opportunities across various industries, encompassing positions and pay scales that include: Data Analyst - £31,000 per year (average salary) Financial Analyst - £34,000 per year (average salary) Business Intelligence Analyst - £39,000 per year (average salary) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

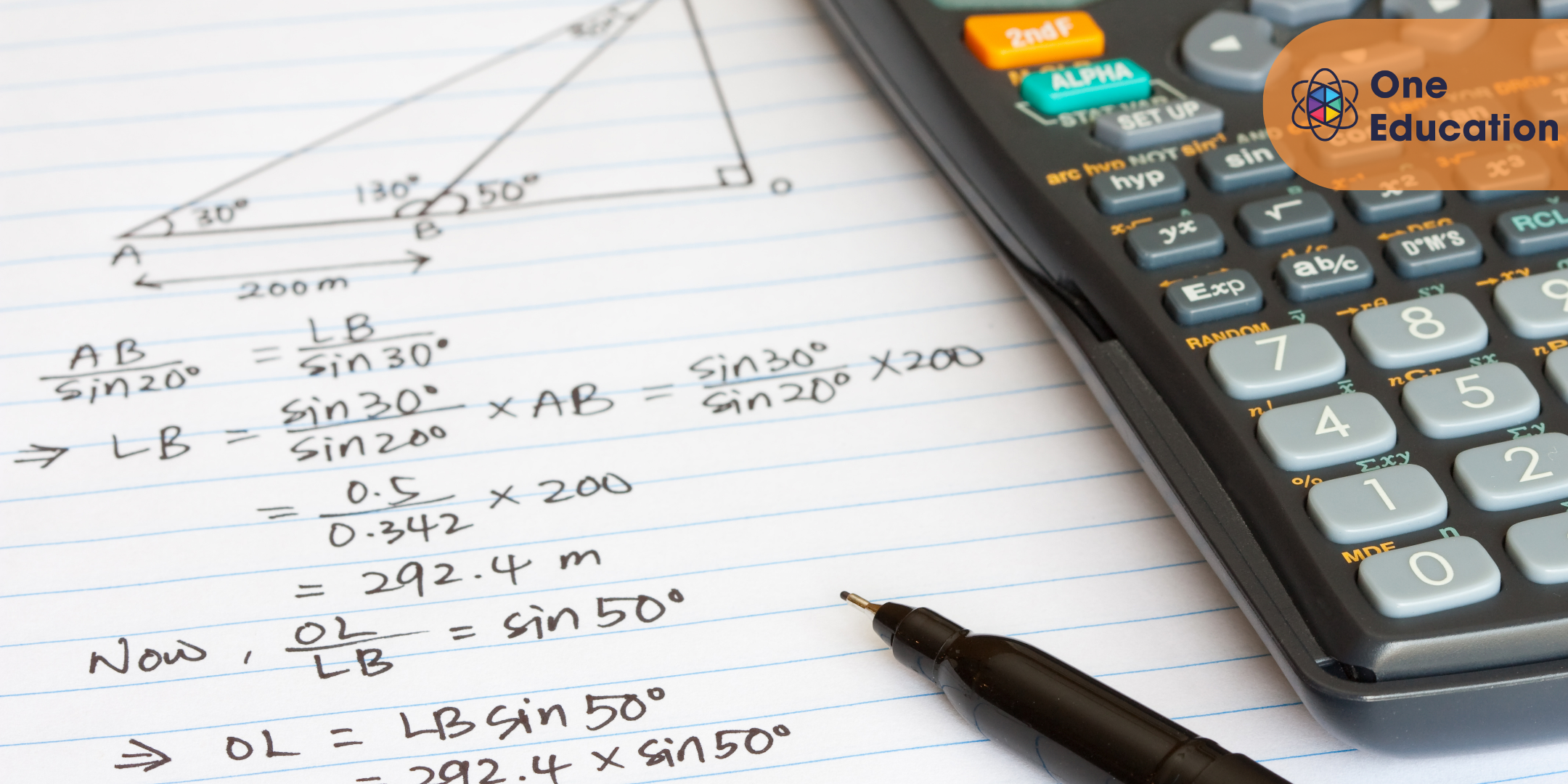

Mathematics Fundamentals - Fraction Course

By One Education

Fractions are the building blocks of many mathematical concepts, and this course is designed to make them approachable and clear. Whether you’re revisiting fractions after some time or encountering them with fresh curiosity, this course offers a straightforward exploration of how fractions work, why they matter, and how to confidently manipulate them. From recognising numerators and denominators to mastering addition, subtraction, multiplication, and division of fractions, you’ll develop a solid grasp that forms the foundation for further mathematical learning. With carefully structured lessons that break down each concept into digestible parts, this course avoids unnecessary jargon and keeps the focus on what really matters—understanding fractions with clarity and confidence. Suitable for learners at various levels, it provides the clarity and support needed to boost both knowledge and self-assurance. If numbers sometimes seem like a puzzle, this course is the friendly guide to making fractions less puzzling and more manageable. Learning Outcomes: Develop a foundational understanding of fractions and their applications in math Learn how to add, subtract, multiply, and divide fractions Gain confidence in solving fraction problems and applying mathematical concepts Expand your understanding of practical applications of fractions in real-world scenarios Prepare for more advanced math courses or exams that involve fractions The Mathematics Fundamentals - Fraction course is designed to provide learners with a comprehensive understanding of fractions and their applications in math. Through engaging lessons, expert guidance, and a proven curriculum, learners will gain the skills and confidence they need to solve fraction problems. Upon completing this course, learners will have a solid foundation in fractions and be prepared for more advanced math courses or exams. With a focus on developing practical skills in adding, subtracting, multiplying, and dividing fractions, this course is the key to unlocking your potential and achieving success in math. Mathematics Fundamentals - Fraction Course Curriculum Introduction Introduction Fractions Lesson 1 - Finding fractions of whole numbers Lesson 2 - Multiplying fractions Lesson 3 - Simplifying fractions Lesson 4 - Simplifying fractions Lesson 5 - The 3 times table Lesson 6 - Tips for simplifying any fraction Lesson 7 - Multiplying fractions with whole numbers Lesson 8 - Dividing fractions Lesson 9 - Turning improper fractions into mixed fractions Lesson 10 - Turning improper fractions into mixed fractions Lesson 11 - Turning improper fractions into mixed fractions Lesson 12 - Turning improper fractions into mixed fractions Lesson 13 - Turing mixed fractions into improper fractions Lesson 14 - Turning mixed fractions into improper fractions Lesson 15 - Dividing fractions Lesson 16 - Dividing fractions Lesson 17 - Dividing with fractions and whole numbers Lesson 18 - Dividing with fractions and whole numbers Lesson 19 - Adding fractions Lesson 20 - Adding fractions Lesson 21 - Adding fractions Lesson 22 - Adding fractions Lesson 23 - Adding fractions Lesson 24 - Subtracting fractions Lesson 25 - Subtracting fractions Lesson 26 - Subtracting fractions Lesson 27 - Whole numbers subtracting fractions Lesson 28 - Whole numbers subtracting fractions Lesson 29 - Recap Lesson 30 - Practice questions Lesson 31 - Practice questions Lesson 32 - Practice questions Lesson 33 - Practice questions Lesson 34 - Practice questions Lesson 35 - Practice questions Lesson 36 - Practice questions Lesson 37 - Practice questions How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Students struggling with fractions in their math classes Individuals seeking to improve their math skills for personal or professional reasons Professionals seeking to enhance their math skills in their careers Anyone interested in expanding their understanding of fractions and their applications in math Students preparing for math exams or courses that involve fractions Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Engineer Architect Mathematician Statistician Financial analyst £20,000 - £70,000+ (depending on career path and experience) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Mathematics Fundamentals - Percentages Course

By One Education

Percentages play a silent yet powerful role in our everyday decisions—whether it’s sorting out discounts, understanding interest rates, or figuring out proportions. The Mathematics Fundamentals - Percentages Course is tailored to help learners grasp the core principles of percentages without any complicated jargon or overwhelming equations. Clear, engaging, and neatly structured, this course takes the mystery out of percentage calculations and turns confusion into confidence. Designed for learners of all levels, this course breaks down the essentials into bite-sized, logical steps—making each concept stick with ease. Whether you're brushing up for exams, sharpening your skills for work, or just trying to finally make sense of supermarket sales, you’ll find this course refreshingly clear. From calculating increase and decrease to working through percentage change and reverse percentages, everything you need is right here—well explained and easy to follow. Learning Outcomes: Develop a foundational understanding of percentages and their applications in math Learn how to calculate percentages of numbers, increase or decrease numbers by percentages, and calculate compound interest Gain confidence in solving percentage problems and applying mathematical concepts Expand your understanding of practical applications of percentages in real-world scenarios Prepare for more advanced math courses or exams that involve percentages The Mathematics Fundamentals - Percentages course is designed to provide learners with a comprehensive understanding of percentages and their applications in math. Through engaging lessons, expert guidance, and a proven curriculum, learners will gain the skills and confidence they need to solve percentage problems. Upon completing this course, learners will have a solid foundation in percentages and be prepared for more advanced math courses or exams. With a focus on developing practical skills in calculating percentages, increasing or decreasing numbers by percentages, and calculating compound interest, this course is the key to unlocking your potential and achieving success in math. Mathematics Fundamentals - Percentages Course Curriculum Introduction Introduction Percentages Lesson 1 - Finding 10% by dividing by 10 Lesson 2 - Dividing by 10 with numbers that don't end in a zero Lesson 3 - Dividing decimals by 10 Lesson 4 - Dividing by 10 with decimals less than 10 Lesson 5 - Dividing by 10 with whole numbers less than 10 Lesson 6 - Dividing pennies by 10 Lesson 7 - Finding 20% of a number Lesson 8 - Practise finding 20% of a number Lesson 9 - Finding 5% of a number Lesson 10 - Practise finding 5% of a number Lesson 11 - Finding 1% of a number Lesson 12 - Practise finding 1% of a number Lesson 13 - Finding 2% of a number Lesson 14 - Finding 50% of a number Lesson 15 - Practise finding 50% of a number Lesson 16 - Finding 25% of a number Lesson 17 - Finding any percentage of any number Lesson 18 - Ways to find different percentages Lesson 19 - Practise finding any percentage of any number Lesson 20 - Practise finding any percentage of any number Lesson 21 - Using a calculator Lesson 22 - Practise using a calculator to find percentages of numbers Lesson 23 - Let's practise Lesson 24 - Let's practise Lesson 25 - Let's practise Lesson 26 - Let's practise Lesson 27 - Let's practise Lesson 28 - Let's practise Lesson 29 - Let's practise Lesson 30 - Let's practise Lesson 31 - Let's practise Lesson 32 - Let's practise Lesson 33 - Increasing a number by a percentage Lesson 34 - Increasing a number by a percentage Lesson 35 - Increasing a number by a percentage Lesson 36 - Increasing a number by a percentage on a calculator Lesson 37 - Increasing a number by a percentage on a calculator Lesson 38 - Increasing a number by a percentage on a calculator Lesson 39 - Decreasing a number by a percentage Lesson 40 - Decreasing a number by a percentage Lesson 41 - Decreasing a number by a percentage Lesson 42 - Decreasing a number by a percentage on a calculator Lesson 43 - Decreasing a number by a percentage on a calculator Lesson 44 - Simple interest and compound interest Lesson 45 - Simple interest and compound interest Lesson 46 - Compound interest formula Lesson 47 - Interest questions Lesson 48 - Interest questions Lesson 49 - Reverse percentages Lesson 50 - Reverse percentages Lesson 51 - Reverse percentages How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Students struggling with percentages in their math classes Individuals seeking to improve their math skills for personal or professional reasons Professionals seeking to enhance their math skills in their careers Anyone interested in expanding their understanding of percentages and their applications in math Students preparing for math exams or courses that involve percentages Career path Accountant Financial analyst Statistician Data analyst Economist £20,000 - £70,000+ (depending on career path and experience) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Xero Accounting & Bookkeeping + Tax, Finance & Financial Management

By Compliance Central

***Small Businesses FEAR This Simple Financial Secret!** (Learn it with the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management Course!)*** Did you know that according to a recent Federation of Small Businesses report, 72% of small business owners in the UK believe strong financial management is crucial for success? The Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course equips you with the theoretical knowledge and understanding to excel in this critical area. This Xero Accounting & Bookkeeping + Tax, Finance & Financial Management comprehensive course is designed to provide a solid foundation in Xero accounting software, tax accounting principles, and financial management strategies. Throughout the course, you'll gain the theoretical knowledge needed to navigate the financial world with confidence, helping you make informed decisions for your business or future career. 3 CPD Accredited Courses Are: Course 01: Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 Course 02: Tax Accounting Course 03: Financial Management Learning Outcome: Going through our interactive modules of Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course , you will be able to - Gain a working knowledge of Xero Accounting & Bookkeeping software. Master essential tasks like creating invoices, managing bills, and reconciling bank accounts in Xero. Understand core accounting principles like double-entry accounting and VAT returns. Develop strong financial management skills, including budgeting, analyzing financial statements, and interpreting financial data. Gain a theoretical grounding in tax accounting, including capital gains tax and import/export considerations. Confidently navigate the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management landscape. Key Highlights of Xero Accounting & Bookkeeping + Tax, Finance & Financial Management: CPD Accredited Xero Accounting & Bookkeeping + Tax, Finance & Financial Management Course Unlimited Retake Exam & 24/7 Tutor Support Easy Accessibility to the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management Course Materials 100% Learning Satisfaction Guarantee Lifetime Access Self-paced online Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course Modules Covers to Explore Multiple Job Positions Curriculum Topics: Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7e Xero Accounting & Bookkeeping + Tax, Finance & Financial Management begins with a deep dive into Xero accounting software. This course equips you with the theoretical knowledge to navigate Xero's functionalities for various bookkeeping tasks. You'll learn how to set up your Xero account, manage contacts, create invoices and bills, reconcile bank statements, and track inventory. Xero Accounting & Bookkeeping + Tax, Finance & Financial Management also covers essential bookkeeping principles like double-entry accounting and chart of accounts. Section 01: Introduction Introduction Section 02: Getting Started Introduction - Getting Started Signing up Quick Tour Initial Settings Chart of Accounts Adding a Bank Account Demo Company Tracking Categories Contacts Section 03: Invoices and Sales Introduction - Invoices and Sales Sales Screens Invoice Settings Creating an Invoice Repeating Invoices Credit Notes-03 Quotes Settings Creating Quotes Other Invoicing Tasks Sending Statements Sales Reporting Section 04: Bills and Purchases Introduction - Bills and Purchases Purchases Screens Bill Settings Creating a Bill Repeating Bills Credit Notes-04 Purchase Order Settings Purchase Orders Batch Payments Other Billing Tasks Sending Remittances Purchases Reporting Section 05: Bank Accounts Introduction - Bank Accounts Bank Accounts Screens Automatic Matching Reconciling Invoices Reconciling Bills Reconciling Spend Money Reconciling Receive Money Find and Match Bank Rules Cash Coding Remove and Redo vs Unreconcile Uploading Bank Transactions Automatic Bank Feeds Section 06: Products and Services Introduction - Products and Services Products and Services Screen Adding Services Adding Untracked Products Adding Tracked Products Section 07: Fixed Assets Introduction - Fixed Assets Fixed Assets Settings Adding Assets from Bank Transactions Adding Assets from Spend Money Adding Assets from Bills Depreciation Section 08: Payroll Introduction - Payroll Payroll Settings Adding Employees Paying Employees Payroll Filing Section 09: VAT Returns Introduction - VAT Returns VAT Settings VAT Returns - Manual Filing VAT Returns - Digital Filing Free Course 01: Tax Accounting Xero Accounting & Bookkeeping + Tax, Finance & Financial Management delves into the world of tax accounting. This course provides a theoretical understanding of tax principles, regulations, and calculations relevant to businesses. You'll explore topics like income tax, corporation tax, value added tax (VAT), and payroll taxes. Xero Accounting & Bookkeeping+ Tax, Finance & Financial Management equips you with the knowledge to identify tax implications for business transactions and ensure compliance with tax authorities. Module 01: Capital Gain Tax Module 02: Import and Export Module 03: Double Entry Accounting Module 04: Management Accounting and Financial Analysis Module 05: Career as a Tax Accountant in the UK Free Course 02: Financial Management Xero Accounting & Bookkeeping + Tax, Finance & Financial Management concludes with a focus on financial management. This course explores the theoretical underpinnings of financial decision-making. You'll learn how to create financial statements, analyze financial data, develop budgets and forecasts, and manage cash flow effectively. Xero Accounting & Bookkeeping+ Tax, Finance & Financial Management empowers you to make informed financial decisions that contribute to the overall success of a business. Module 01: Introduction to Financial Management Module 02: Fundamentals of Budgeting Module 03: The Balance Sheet Module 04: The Income Statement Module 05: The Cash Flow Statement Module 06: Statement of Stockholders' Equity Module 07: Analysing and Interpreting Financial Statements Module 08: Inter-Relationship Between all the Financial Statements Module 09: International Aspects of Financial Management Each topic has been designed to deliver more information in a shorter amount of time. This makes it simple for the learners to understand the fundamental idea and apply it to diverse situations through Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course. Certification Free CPD Accredited (CPD QS) Certificate. Quality Licence Scheme Endorsed Certificate of Achievement: Upon successful completion of the course, you will be eligible to order an original hardcopy certificate of achievement. This prestigious certificate, endorsed by the Quality Licence Scheme, will be titled 'Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7'. Your certificate will be delivered directly to your home. The pricing scheme for the certificate is as follows: £129 GBP for addresses within the UK. Please note that delivery within the UK is free of charge. Disclaimer This Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course will teach you about Xero accounting software and help you improve your skills using it. It's created by an independent company, & not affiliated with Xero Limited. Upon completion, you will earn a CPD accredited certificate, it's not an official Xero certification. CPD 30 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course. Besides, this Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course particularly recommended for- Anyone interested in learning Xero can progress from a beginner to a knowledgeable user in just one day. Small business owners that want to handle their own accounting in Xero Xero Practice Manager Bookkeepers who wish to learn Xero rapidly Requirements Students seeking to enrol for Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course should meet the following requirements; Basic knowledge of English Language is needed for Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course, which already you have. Basic Knowledge of Information & Communication Technologies for studying Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course in online or digital platform. Stable Internet or Data connection in your learning devices to complete the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course easily. Career path The Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course will enable you to explore in Xero related trendy and demanding jobs, such as: Bookkeeping Specialist Client Experience Specialist Accounting Advisory Apprentice Cloud Accountant Education Specialist Management Accountant Finance Manager Tax Implementation Specialist Xero Practice Manager Certificates CPD QS Certificate of completion Digital certificate - Included After successfully completing this course, you can get CPD accredited digital PDF certificate for free.

This course aims to prepare individuals for the AWS Certified Solutions Architect Associate exam. It covers essential AWS services, cloud architecture design, deployment strategies, and best practices for managing various AWS components. Learning Outcomes: Understand the fundamental concepts of AWS Cloud Services and their application in real-world scenarios. Design and implement AWS Storage and Virtual Private Cloud (VPC) solutions. Learn how to design, implement, and manage Compute Services effectively. Master Identity and Access Management (IAM) and its best practices for secure access control. Explore Auto Scaling Solutions and Virtual Network Services to optimize AWS infrastructure. Gain proficiency in deploying applications and databases on AWS. Discover additional AWS services and their integration for comprehensive cloud solutions. Develop insights into achieving operational excellence with AWS services. Why buy this AWS Certified Solutions Architect Associate Preparation? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the AWS Certified Solutions Architect Associate Preparation there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This AWS Certified Solutions Architect Associate Preparation course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This AWS Certified Solutions Architect Associate Preparation does not require you to have any prior qualifications or experience. You can just enrol and start learning.This AWS Certified Solutions Architect Associate Preparation was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This AWS Certified Solutions Architect Associate Preparation is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Section 01: Introduction Introduction 00:03:00 Section 02: Exam Tips and Tricks What is AWS? 00:02:00 Why use AWS? 00:03:00 How to Get Started with AWS 00:04:00 AWS Certifications 00:04:00 Preparation Resources 00:02:00 Benefits of Certification 00:02:00 AWS CSA-A Overview 00:04:00 What's New on the 2020 Updated Exam? 00:03:00 AWS CSA-A Exam Objectives 00:06:00 The Four Key Areas (Compute, Networking, Storage, and Databases) 00:04:00 Master the Knowledge Areas 00:02:00 Use the System 00:05:00 Take Notes 00:03:00 Be Mentally and Physically Prepared 00:04:00 Take the Exam 00:04:00 Section 03: AWS Cloud Services Overview Cloud Computing Defined 00:08:00 Benefits of Cloud Computing 00:10:00 Cloud Computing Models 00:07:00 History 00:07:00 Platform 00:06:00 Services, Part 1 00:10:00 Services, Part 2 00:08:00 Security and Compliance 00:07:00 Regions and Availability 00:06:00 Section 04: AWS Storage Design Storage Services 00:07:00 S3 Storage Class 00:07:00 S3 Terminology 00:09:00 S3 Advanced Features 00:08:00 Creating S3 Buckets Lab 00:08:00 S3 Bucket Properties 00:08:00 S3 Managing Objects Lab 00:11:00 Glacier 00:07:00 Setting up a Glacier Vault Lab 00:08:00 S3 and Tape Gateway 00:06:00 S3 Enhanced Features 00:08:00 Elastic Block Store (EBS) 00:08:00 Creating EBS Volumes Lab 00:07:00 Elastic File System (EFS) 00:07:00 Creating an EFS File System Lab 00:07:00 EFS and PrivateLink 00:03:00 Intro to Amazon FSx 00:06:00 Hands-on with FSx 00:06:00 Integrating on-Premises Storage 00:07:00 Storage Access Security Lab 00:10:00 Storage Performance 00:08:00 Section 05: Virtual Private Cloud (VPC) Virtual Private Cloud (VPC) Overview 00:10:00 Creating a VPC Lab 00:11:00 Configuring DHCP Options Lab 00:04:00 Elastic IP Addresses 00:07:00 Elastic Network Interfaces (ENIs) 00:05:00 Endpoints 00:07:00 VPC Peering 00:08:00 Creating a VPC Peering Connection Lab 00:10:00 Security Groups Overview 00:07:00 Network Address Translation (NAT) 00:11:00 Gateways (VPGs and CGWs) 00:08:00 VPN Configuration Option 00:04:00 Section 06: Compute Services Design EC2 Overview 00:11:00 EC2 Instance Types 00:11:00 EC2 Pricing 00:13:00 EBS and EC2 00:05:00 Section 07: Compute Services Implementation Launching an EC2 Linux Instance Lab 00:13:00 Configuring an EC2 Linux Instance Lab 00:08:00 Setting up an EC2 Windows Instance Lab 00:12:00 Shared Tenancy 00:05:00 Dedicated Hosts 00:08:00 Dedicated Instances 00:06:00 AMI Virtualization 00:12:00 Section 08: Compute Services Management Instance Management 00:09:00 Connecting to Instances Lab 00:09:00 Working with Security Groups 00:10:00 Working with Security Groups Lab 00:10:00 Advanced EC2 Management 00:06:00 AWS Batch 00:06:00 Elastic Container Service (ECS) 00:08:00 Elastic Beanstalk Environment 00:11:00 Section 09: Identity and Access Management (IAM) Identity and Access Management (IAM) Overview 00:07:00 Principals 00:10:00 Root User 00:06:00 Authentication 00:06:00 Authorization Policies 00:13:00 Multi-Factor Authentication 00:08:00 Key Rotation 00:10:00 Multiple Permissions 00:06:00 AWS Compliance Program 00:07:00 AWS Security Hub 00:06:00 Shared Responsibility Models 00:06:00 Section 10: IAM Best Practices User Accounts 00:11:00 Password Policies 00:09:00 Credential Rotation 00:06:00 Principle of Least Privilege 00:05:00 IAM Roles 00:08:00 Policy Conditions 00:08:00 CloudTrail 00:12:00 Section 11: Auto Scaling Solutions Auto Scaling Overview 00:06:00 Auto Scaling Groups 00:04:00 Termination Policies 00:07:00 Auto Scaling Configuration Lab 00:13:00 Launch Methods 00:04:00 Load Balancer Concepts 00:08:00 Elastic Load Balancing (ELB) 00:10:00 Section 12: Virtual Network Services DNS 00:14:00 Configuring DNS Lab 00:07:00 Configuring Route 53 Lab 00:13:00 Configuring ACLs and NACLs Lab 00:09:00 Flow Logs 00:07:00 Section 13: AWS Application Deployment Application and Deployment Services 00:04:00 Lambda 00:06:00 API Gateway 00:09:00 Kinesis 00:06:00 Kinesis Data Streams and Firehose 00:06:00 Kinesis Data Analytics 00:04:00 Reference Architectures 00:06:00 CloudFront 00:10:00 Web Application Firewall (WAF) 00:09:00 Simple Queue Service (SQS) 00:10:00 Simple Notification Service (SNS) 00:08:00 Simple Workflow (SWF) 00:07:00 Step Functions 00:05:00 OpsWorks 00:08:00 Cognito 00:04:00 Elastic MapReduce (EMR) 00:05:00 CloudFormation 00:10:00 CloudFormation Properties 00:03:00 CloudWatch 00:06:00 Trusted Advisor 00:07:00 Organizations 00:09:00 Section 14: AWS Database Design Database Types 00:08:00 Relational Databases 00:08:00 Database Hosting Methods 00:05:00 High Availability Solutions 00:06:00 Scalability Solutions 00:06:00 Database Security 00:08:00 Aurora 00:06:00 Redshift 00:11:00 DynamoDB 00:10:00 Section 15: Database Deployment DynamoDB Tables Lab 00:08:00 MySQL Lab 00:13:00 Configuration Lab 00:13:00 Backups Lab 00:04:00 Restore Lab 00:04:00 Snapshot Lab 00:08:00 Monitoring Lab 00:06:00 Section 16: Additional AWS Services Media Content Delivery 00:13:00 Desktop and Appstreaming 00:06:00 ElastiCache 00:05:00 Security Services Lab 00:12:00 Analytics Engines 00:11:00 Development Operations (DevOps) 00:12:00 AWS Solutions 00:05:00 AWS Transit Gateway 00:03:00 AWS Backup 00:04:00 AWS Cost Explorer 00:04:00 Section 17: Operational Excellence with AWS The Operational Excellence Process 00:08:00 Widget Makers Scenario 00:06:00 Resilient Design 00:08:00 Resilient Design Scenario 00:05:00 Performant Design 00:09:00 Performant Design Scenario 00:06:00 Secure Design 00:08:00 Secure Design Scenario 00:05:00 Cost Optimization 00:07:00 Cost Optimization Scenario 00:05:00 General Best Practices 00:07:00

The Corporate Finance course covers essential financial concepts and analysis techniques relevant to businesses. Students will learn about financial analysis, cash forecasting, present value, future value, rate of return, adding debt, risk management, and practical applications of finance in real-world scenarios. Learning Outcomes: Understand the principles of financial analysis and how to assess the financial health of a company. Learn how to forecast cash flows to make informed financial decisions. Gain proficiency in calculating present value and future value to evaluate investment opportunities. Explore the impact of adding debt to a company's capital structure and its effect on overall risk and returns. Develop risk management skills to mitigate financial uncertainties and maximize profitability. Apply corporate finance concepts to real-world situations, making informed financial decisions in practical scenarios. Why buy this Corporate Finance? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Corporate Finance there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? Aspiring finance professionals seeking a foundational understanding of corporate finance. Business owners aiming to fortify their financial decision-making prowess. Students of finance and related fields eager to augment their academic knowledge with practical skills. Entrepreneurs needing to navigate the financial aspects of running a business. Individuals keen on a career change towards the finance sector. Prerequisites This Corporate Finance does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Corporate Finance was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path Financial Analyst: £30,000 - £50,000 Per Annum Cash Flow Manager: £35,000 - £55,000 Per Annum Investment Advisor: £40,000 - £60,000 Per Annum Risk Management Specialist: £45,000 - £65,000 Per Annum Corporate Finance Consultant: £50,000 - £70,000 Per Annum Chief Financial Officer: £80,000 - £120,000 Per Annum Course Curriculum Corporate Finance Learn More About This Course! 00:06:00 Financial Analysis 00:09:00 Cash Forecast 00:03:00 Present Value 00:13:00 Future Value 00:07:00 Rate of Return and Adding Debt 00:14:00 Risk Management 00:13:00 Finance in Practice 00:07:00 Assignment Assignment - Corporate Finance 00:00:00

In an unpredictable world, the need for adept security and fraud prevention strategies is paramount. Our 'Security Management and Fraud Prevention Training' serves as a beacon of enlightenment, illuminating the intricate nuances of comprehensive security. Journey through a meticulously crafted curriculum, traversing the landscapes of organisational security, cyber resilience, and insightful risk analysis. Dive into the multifaceted domains of both physical and digital realms, and emerge equipped with strategies to fortify and safeguard businesses from looming threats. Learning Outcomes Understand the foundational principles and nuances of security management. Gain proficiency in organisational security measures and risk reduction methodologies. Develop expertise in implementing physical and information security protection. Grasp the intricacies of business resilience, crisis management, and cyber threat counteraction. Delve into the legal frameworks guiding security protocols and measures. Why choose this Security Management and Fraud Prevention Training? Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments are designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Security Management and Fraud Prevention Training Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Who is this Security Management and Fraud Prevention Training for? Aspiring security consultants looking to solidify their expertise. Business owners keen to enhance their organisation's protection. IT professionals aiming to broaden their horizon into cyber security and fraud prevention. Management personnel responsible for crisis and resilience protocols. Law enthusiasts focusing on security regulations and compliance. Career path Security Consultant: £30,000 - £60,000 Risk Analyst: £35,000 - £70,000 Cyber Security Specialist: £40,000 - £80,000 Fraud Prevention Analyst: £28,000 - £55,000 Crisis Management Expert: £37,000 - £65,000 Compliance Officer: £32,000 - £68,000 Prerequisites This Security Management and Fraud Prevention Training does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Security Management and Fraud Prevention Training was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Certification After studying the course materials, there will be a written assignment test which you can take at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £4.99 Original Hard Copy certificates need to be ordered at an additional cost of £8. Course Curriculum Security Management and Fraud Prevention Training Module 01: Introduction to Security Management 00:30:00 Module 02: Organisational Security Management 00:26:00 Module 03: Security Risk Analysis and Risk Reduction 00:23:00 Module 04: Physical and Information Security Protection 00:32:00 Module 05: Business Resilience and Crisis Management 00:17:00 Module 06: Cyber Security and Fraud Prevention 00:25:00 Module 07: Security Investigations and Threat Awareness 00:24:00 Module 08: Laws and Regulations 00:25:00 Mock Exam Mock Exam - Security Management and Fraud Prevention Training 00:20:00 Final Exam Final Exam - Security Management and Fraud Prevention Training 00:20:00

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents and interests with our special Corporate Finance: Working Capital Management Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides professional training that employers are looking for in today's workplaces. The Corporate Finance: Working Capital Management Course is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Corporate Finance: Working Capital Management Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Corporate Finance: Working Capital Management Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At StudyHub, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from StudyHub, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Corporate Finance: Working Capital Management? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Corporate Finance: Working Capital Management there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Corporate Finance: Working Capital Management course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Corporate Finance: Working Capital Management does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Corporate Finance: Working Capital Management was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Corporate Finance: Working Capital Management is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Section 01: Course Introduction Preview 00:01:00 Section 02: Introduction to Working Capital Management What Is Working Capital and What Are Working Capital Elements 00:05:00 What Are the Benefits and Cost of Various Working Capital Elements 00:07:00 Operating and Cash Conversion Cycle with Practical Example 00:09:00 Cash Conversion Cycle of Different Companies 00:03:00 Working Capital Impact on Company Value 00:04:00 Understanding Working Capital Requirements and Different Approaches in Management 00:05:00 Section 03: Trade Credit and Receivable Management Understand Trade Credits In Business 00:10:00 How Do We Manage Receivables 00:05:00 Understanding How to Change Credit Policies and Evaluate the Impact 00:06:00 Monitoring Receivables 00:05:00 Section 04: Payables Management Payable Management 00:04:00 Section 05: Inventory Management Practices Inventory Management and Pro and Cons of High Inventory 00:05:00 Inventory Management - EOQ, Reorder Levels, Lead Time 00:09:00 ABC System of Managing Inventory 00:04:00 Section 06: Cash Management Practice Cash Management Process 00:06:00 Assignment Assignment - Corporate Finance: Working Capital Management 00:00:00

The Facilitation Training and Strategic Operations Management Diploma course focuses on the essential skills of facilitation and strategic operations management. Participants will learn about the facilitation process, differentiating between process and content, team development models, building consensus, handling difficult individuals, and intervention techniques. Learning Outcomes: Understand the fundamentals of facilitation and its role in strategic operations management. Distinguish between process and content in facilitating effective group discussions and decision-making. Learn how to lay the groundwork for successful facilitation sessions and team development. Familiarize with the Tuckman and Jensen's Model of Team Development and its application in group dynamics. Develop skills in building consensus among team members and reaching critical decision points. Gain techniques to handle challenging individuals and address group dysfunction during facilitation. Learn about different intervention techniques and their appropriate usage in facilitation scenarios. Why buy this Facilitation Training and Strategic Operations Management Diploma? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Facilitation Training and Strategic Operations Management Diploma you will be able to take the MCQ test that will assess your knowledge. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Facilitation Training and Strategic Operations Management Diploma does not require you to have any prior qualifications or experience. You can just enrol and start learning. Prerequisites This Facilitation Training and Strategic Operations Management Diploma was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Facilitation Training and Strategic Operations Management Diploma is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Facilitation Training and Strategic Operations Management Diploma Understanding Facilitation 00:30:00 Process vs. Content 01:00:00 Laying the Groundwork 00:30:00 Tuckman and Jensen's Model of Team Development 01:00:00 Building Consensus 00:30:00 Reaching a Decision Point 01:00:00 Dealing with Difficult People 01:00:00 Addressing Group Dysfunction 01:00:00 About Intervention 00:30:00 Intervention Techniques 00:30:00 Mock Exam Mock Exam- Facilitation Training and Strategic Operations Management Diploma 00:20:00 Final Exam Final Exam- Facilitation Training and Strategic Operations Management Diploma 00:20:00

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents and interests with our special Level 3 Investment Analyst / Advisor Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides professional training that employers are looking for in today's workplaces. The Level 3 Investment Analyst / Advisor Course is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Level 3 Investment Analyst / Advisor Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Level 3 Investment Analyst / Advisor Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At StudyHub, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from StudyHub, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Level 3 Investment Analyst / Advisor? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Level 3 Investment Analyst / Advisor there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Level 3 Investment Analyst / Advisor course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Level 3 Investment Analyst / Advisor does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Level 3 Investment Analyst / Advisor was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Level 3 Investment Analyst / Advisor is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Module 01: Introduction to Financial Investigator Introduction to Financial Investigation 00:12:00 Module 02: Introduction to Financial Investigation Introduction to Financial Investigator 00:21:00 Module 03: Valuation Methods in Investment Banking Valuation Methods in Investment Banking 00:29:00 Module 04: Leveraged Buyout (LBO) Leveraged Buyout (LBO) 00:21:00 Module 05: Initial Public Offering (IPO) Initial Public Offering (IPO) 00:28:00 Module 06: Merger and Acquisition Merger and Acquisition 00:15:00 Module 07: Characteristics of Financial Crimes Characteristics of Financial Crimes 00:13:00 Module 08: Categories of Financial Crimes Categories of Financial Crimes 00:20:00 Module 09: Financial Crime Response Plan Financial Crime Response Plan 00:18:00 Module 10: Collecting, Preserving and Gathering Evidence Collecting, Preserving and Gathering Evidence 00:13:00 Module 11: Laws against Financial Fraud Laws against Financial Fraud 00:18:00

Search By Location

- Exam Prep Courses in London

- Exam Prep Courses in Birmingham

- Exam Prep Courses in Glasgow

- Exam Prep Courses in Liverpool

- Exam Prep Courses in Bristol

- Exam Prep Courses in Manchester

- Exam Prep Courses in Sheffield

- Exam Prep Courses in Leeds

- Exam Prep Courses in Edinburgh

- Exam Prep Courses in Leicester

- Exam Prep Courses in Coventry

- Exam Prep Courses in Bradford

- Exam Prep Courses in Cardiff

- Exam Prep Courses in Belfast

- Exam Prep Courses in Nottingham