- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

5018 Courses

***24 Hour Limited Time Flash Sale*** An Comprehensive Introduction to Bookkeeping and Accounting Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Are you a professional feeling stuck in your career, struggling to keep up with the ever-changing demands of the industry? Or perhaps you're a beginner, unsure of where to start or how to break into your desired field. Whichever stage you're in, our exclusive An Comprehensive Introduction to Bookkeeping and Accounting Bundle provides unique insights and tools that can help you achieve your goals. Designed to cater to the needs of both seasoned professionals and aspiring newcomers, our An Comprehensive Introduction to Bookkeeping and Accounting bundle is a comprehensive program that will equip you with the essential skills and knowledge you need to succeed. Whether you're looking to advance in your current role or embark on a new career journey, this bundle has everything you need to take your professional life to the next level. But that's not all. When you enrol in An Comprehensive Introduction to Bookkeeping and Accounting Online Training, you'll receive 30 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this An Comprehensive Introduction to Bookkeeping and Accounting Career Bundle: Course 01: Xero Accounting and Bookkeeping Online Course 02: Introduction to Accounting Course 03: Finance and Accounting Course 04: Sage 50 Accounting & Payroll Course 05: Professional Bookkeeping Course 06: Business Accounting Training Course 07: Purchase Ledger Course 08: Financial Management Course 09: Soft Skills for Workplace Course 10: Managerial Accounting Masterclass Course 11: Anti-Money Laundering (AML) and Financial Crime Course 12: Business English and Communication Course 13: Decision-Making in High-Stress Situations Course 14: Corporate Finance Course 15: Bookkeeping Tool : Google Sheets Course 16: Investment Banking Course 17: Create Website for Accounting Business Course 18: Fundamental Accounting for Small Hotel Business Course 19: Changes in Accounting: Latest Trends Encountered by CFOs in 2022 Course 20: Corporate Finance: Profitability in a Financial Downturn Course 21: The Theory of Constraints and Throughput Accounting Course 22: Financial Reporting Course 23: Investment Analyst Course 24: Diploma in Business Analysis Course 25: Economics Course 26: Business Writing Course 27: Applied Accounting Course 28: Charity Accounting Course 29: Financial Statement Analysis Masterclass Course 30: Tax Accounting Diploma With An Comprehensive Introduction to Bookkeeping and Accounting, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. And with 24/7 tutor support, you'll never feel alone in your journey, whether you're a seasoned professional or a beginner. Don't let this opportunity pass you by. Enrol in An Comprehensive Introduction to Bookkeeping and Accounting today and take the first step towards achieving your goals and dreams. Why buy this An Comprehensive Introduction to Bookkeeping and Accounting? Get a Free CPD Accredited Certificate upon completion of the course Get a free student ID card with this training program The course is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Lifetime access to the course materials The training program comes with 24/7 tutor support Start your learning journey straightaway with our An Comprehensive Introduction to Bookkeeping and Accounting Training! An Comprehensive Introduction to Bookkeeping and Accounting premium bundle consists of 30 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of An Comprehensive Introduction to Bookkeeping and Accounting is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the An Comprehensive Introduction to Bookkeeping and Accounting course. After passing the An Comprehensive Introduction to Bookkeeping and Accounting exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 300 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This bundle is ideal for: Students seeking mastery in this field Professionals seeking to enhance their skills Anyone who is passionate about this topic Requirements This An Comprehensive Introduction to Bookkeeping and Accounting doesn't require prior experience and is suitable for diverse learners. Career path This An Comprehensive Introduction to Bookkeeping and Accounting bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates CPD Accredited Digital certificate Digital certificate - Included CPD Accredited Hard copy certificate Hard copy certificate - Included If you are an international student, then you have to pay an additional 10 GBP for each certificate as an international delivery charge.

Developing the Business Case

By IIL Europe Ltd

Developing the Business Case Business analysts must be able to create business case documents that highlight project benefits, costs, and risks. The business case is based on the real business need to be solved. These become parts of proposals, feasibility studies, and other decision support documents. This course teaches the purpose, structure, and content of a business case. It presents the basic techniques for determining financial ROI, non-tangible benefits, and the probability of meeting expectations. What you will Learn At the end of this program, you will be able to: Perform feasibility studies Justify the business investment to solve the business problem Prepare an effective business case document Plan and implement a business case approval process Foundation Concepts The role of the BA An introduction to the BABOK® Guide The business analyst and the product / project life cycle (PLC) The business case deliverable Introducing the Business Case Process The BA and strategy analysis The BA and the business case process (BCP) The BA during the business case process (BCP) The BA after the business case process (BCP) Importance of defining solution performance metrics Defining the Business Need Overview of defining the business need Business needs: problem / opportunity statement Product vision Objectives and constraints Exploring Business Case Solutions Overview of exploring solutions Solution identification for feasibility Solution definition for analysis Assessing project risks Justifying the Business Case Overview of justifying the business case Qualitative justification Quantitative justification Approving the Business Case Overview of business case approval Developing recommendations Preparing the decision package - documents Preparing the decision package - presentations

Developing the Business Case: In-House Training

By IIL Europe Ltd

Developing the Business Case: In-House Training Business analysts must be able to create business case documents that highlight project benefits, costs, and risks. The business case is based on the real business need to be solved. These become parts of proposals, feasibility studies, and other decision support documents. This course teaches the purpose, structure, and content of a business case. It presents the basic techniques for determining financial ROI, non-tangible benefits, and the probability of meeting expectations. What you will Learn At the end of this program, you will be able to: Perform feasibility studies Justify the business investment to solve the business problem Prepare an effective business case document Plan and implement a business case approval process Foundation Concepts The role of the BA An introduction to the BABOK® Guide The business analyst and the product / project life cycle (PLC) The business case deliverable Introducing the Business Case Process The BA and strategy analysis The BA and the business case process (BCP) The BA during the business case process (BCP) The BA after the business case process (BCP) Importance of defining solution performance metrics Defining the Business Need Overview of defining the business need Business needs: problem / opportunity statement Product vision Objectives and constraints Exploring Business Case Solutions Overview of exploring solutions Solution identification for feasibility Solution definition for analysis Assessing project risks Justifying the Business Case Overview of justifying the business case Qualitative justification Quantitative justification Approving the Business Case Overview of business case approval Developing recommendations Preparing the decision package - documents Preparing the decision package - presentations

PVOL303: Solar Training - Advanced PV Multimode and Microgrid Design (Battery-Based) - Online

By Solar Energy International (SEI)

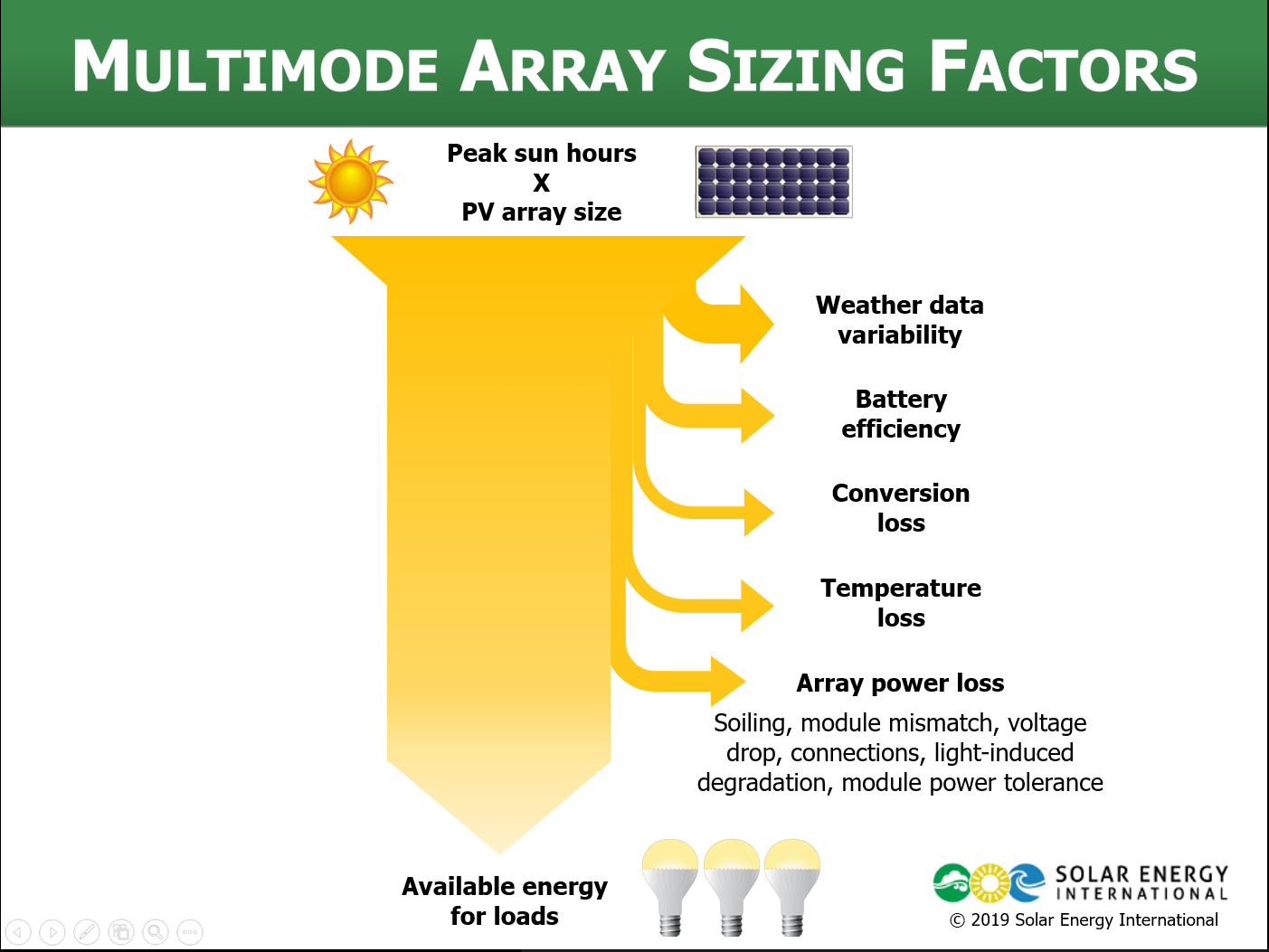

Define multimode system terminology Describe goals and applications of multimode systems Detail basic component layouts of multimode systems Define microgrid systems and diagram component layouts for microgrid applications List applications for multimode systems Distinguish between back-up and self-consumption use cases Examine daily and annual data to perform a load analysis Review battery bank sizing Identify PV array sizing methods and variables for multimode systems Calculate minimum PV array size to meet load requirements Calculate what percentage of overall annual consumption will be offset by selected PV array size Analyze data required to specify a multimode inverter Differentiate between sizing considerations for internal and external AC connections Describe various configurations for stacking and clustering multiple inverters Describe when and why advanced inverter functions are used Discuss the equipment and designs needed for advanced multimode functions Analyze each advanced multimode function List data needed to perform an accurate financial analysis of systems that use advanced multimode functions Describe factors that can affect the financial analysis of systems using advanced multimode functions Describe the National Electrical Code (NEC®) Articles that apply to the different parts of PV and energy storage systems (ESS) Identify specific requirements for ESS and systems interconnected with a primary power source List relevant building & fire codes Communicate specific requirements for workspace clearances, disconnects, & OCPD Describe PV system requirements that affect ESS installation List ESS labeling requirements Review DC coupled systems, including advantages and disadvantages Discuss MPPT charge controller operations and options Review charge controller sizing for grid-tied systems Design a DC coupled multimode PV system for a residential application Define operating modes of an AC coupled PV system while grid-connected or in island mode Explain charge regulation methods of grid-direct inverter output Review AC coupled PV system design strategies Evaluate equipment options for AC coupled multimode applications Design an AC coupled multimode PV system for a residential application Define Energy Storage System (ESS) Describe criteria for evaluating energy storage system configurations and applications Design ESS system for back-up power Describe large-scale energy storage system applications and functions; review use case examples Analyze equipment configuration options for large-scale AC and DC coupled systems Formulate questions to enable design optimization of large-scale energy storage systems Note: SEI recommends working closely with a qualified person and/or taking PV 202 for more information on conductor sizing, electrical panel specification, and grounding systems. These topics will be part of this course, but they are not the focus.

Tired of searching and accumulating all the relevant courses for this specific field? It takes a substantial amount of your time and, more importantly, costs you a fortune! Well, we have just come up with the ultimate solution for you by giving this all-inclusive Criminology and Criminal Law mega bundle. This 37 courses mega bundle keeps you up-to-date in this field and takes you one step ahead of others. Keeping in mind the latest advancements in this ever-emerging sector, the Criminology and Criminal Law bundle covers all the state-of-the-art tools and techniques required to become a competent worker in this area. You will encounter specific courses relevant to the sector. We take you from the most introductory fundamentals to advance knowledge in a step-by-step manner. In addition, the Criminology and Criminal Law bundle also consists of courses related to some soft skills that you will need to succeed in any industry or job sector. This Criminology and Criminal Law Bundle Consists of the following Premium courses: Course 01: Criminal Law Course 02: Paralegal Training Course 03: Cyber Security Law Course 04: GDPR Course 05: Criminal Intelligence Analyst Course 06: Forensic Science and Law Enforcement Criminal Profiling Course 07: Criminal Psychology and Profiling Course 08: Criminal Investigator Course 09: Crime Analysis Online Course Course 10: Criminal Psychology - Confession & Interrogation Course 11: Human Rights Course 12: English Law Course Course 13: Sexual Harassment in the Workplace (SHWT) Course 14: Legal Advisor Training Course 15: The Secrets of Body Language Course 16: Domestic Violence and Abuse Awareness Diploma Course 17: Emotional Intelligence and Human Behaviour Course 18: UK Employment Law Course 19: Preventing Radicalisation and Extremism Course 20: Verification of Death Course 21: Financial Crime Officer Course 22: Financial Crime Manager Course 23: Forensic Accounting Course Course 24: Finance: Financial Investigator Course 25: Anti-Money Laundering (AML) and Financial Crime Course 26: International Law and Human Rights Course 27: Forensic Science Course 28: Forensic Investigator Fundamentals Course 29: Private Detective Training Course 30: Accident investigation Moreover, this bundles include 7 career-focused courses: Course 01: Career Development Plan Fundamentals Course 02: CV Writing and Job Searching Course 03: Interview Skills: Ace the Interview Course 04: Video Job Interview for Job Seekers Course 05: Create a Professional LinkedIn Profile Course 06: Business English Perfection Course Course 07: Networking Skills for Personal Success Our cutting-edge learning package offers top-notch digital aid and first-rate tutor support. You will acquire the crucial hard and soft skills needed for career advancement because this bundle has been thoroughly examined and is career-friendly. So don't overthink! Enrol today. Learning Outcomes This unique Criminology and Criminal Law mega bundle will help you to- Quench your thirst for knowledge Be up-to-date about the latest advancements Achieve your dream career goal in this sector Know the applicable rules and regulations needed for a professional in this area Acquire some valuable knowledge related to Criminology and Criminal Law to uplift your morale The bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your expertise and essential knowledge, which will assist you in reaching your goal. Moreover, you can learn from any place in your own time without travelling for classes. Certificate: PDF Certificate: Free for all 37 courses Hard Copy Certificate: Free (For The Title Course: Previously it was £10) CPD 370 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Criminology and Criminal Law bundle is designed to assist anyone with a curious mind, anyone looking to boost their CVs or individuals looking to upgrade their career to the next level can also benefit from the learning materials. Requirements The courses in this bundle has been designed to be fully compatible with tablets and smartphones. Career path This Criminology and Criminal Law bundle will give you an edge over other competitors and will open the doors for you to a plethora of career opportunities. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Criminal Law) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

24 Hours Left! Don't Let Year-End Deals Slip Away - Enrol Now! Discover the keys to success in project management and advance your career with our comprehensive Cost Control & Project Scheduling course bundle. This bundle of 11 courses will provide you with the tools and knowledge you need to excel in your career, no matter your industry. The first course is QLS-endorsed, and you will receive a QLS hardcopy certificate for free with it. This certificate is a testament to your expertise and will help you stand out from the competition. Through this course bundle, you will learn how to manage projects effectively while keeping costs under control. You will also gain valuable skills in quality assurance, financial analysis, risk assessment, crisis management, people management, strategic planning, leadership, decision-making, and critical thinking. These skills are in high demand across various industries, and this course bundle will provide you with the competitive edge you need to succeed. Don't miss this opportunity to learn from industry experts and take your career to the next level. Enrol today and start your journey towards becoming a project management pro. This Cost Control & Project Scheduling Bundle Package includes: Course 01: Certificate in Cost Control & Project Scheduling at QLS Level 3 10 Premium Additional CPD QS Accredited Courses - Course 01: Business Fundamentals: Project Management Course 02: Quality Assurance (QA) Management Course 03: Cost Control Process and Management Course 04: Financial Analysis Course Course 05: Risk Assessment Course 06: Corporate Risk And Crisis Management Training Course 07: People Management Skills Course 08: Strategic Planning Process Course 09: Leadership Skills Course Course 10: Decision Making and Critical Thinking Training Why Prefer This Cost Control & Project Scheduling Bundle? You will receive a completely free certificate from the Quality Licence Scheme Option to purchase 10 additional certificates accredited by CPD Get a free Student ID Card - (£10 postal charges will be applicable for international delivery) Free assessments and immediate success results 24/7 Tutor Support After taking this Cost Control & Project Scheduling bundle courses, you will be able to learn: Effectively manage projects and budgets Ensure quality assurance in project deliverables Implement cost control processes and management techniques Conduct financial analysis and risk assessments Handle crisis situations and mitigate corporate risk Manage people effectively and develop leadership skills Create strategic plans and make sound business decisions ***Curriculum breakdown of Cost Control & Project Scheduling*** Chapter 1 Monitoring and Controlling Fundamentals Chapter 2 Schedule Control Chapter 3 Cost Control How is the Cost Control & Project SchedulingBundle Assessment Process? You have to complete the assignment questions given at the end of the course and score a minimum of 60% to pass each exam. Our expert trainers will assess your assignment and give you feedback after you submit the assignment. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you successfully pass the exams. CPD 220 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This course bundle is perfect for: Project managers looking to advance their careers Professionals seeking to improve their project management skills Individuals interested in learning about quality assurance, financial analysis, risk assessment, crisis management, people management, strategic planning, leadership, decision making, and critical thinking Career path This bundle will give you an edge in various professions, such as: Project Manager: £45,000 - £75,000 per year Quality Assurance Manager: £35,000 - £65,000 per year Financial Analyst: £35,000 - £55,000 per year Risk Assessment Specialist: £30,000 - £55,000 per year Crisis Management Coordinator: £25,000 - £45,000 per year Certificates Certificate in Cost Control & Project Scheduling at QLS Level 3 Hard copy certificate - Included CPD QS Accredited Certificate Digital certificate - Included Upon successfully completing the Bundle, you will need to place an order to receive a PDF Certificate for each course within the bundle. These certificates serve as proof of your newly acquired skills, accredited by CPD QS. Also, the certificates are recognised throughout the UK and internationally. CPD QS Accredited Certificate Hard copy certificate - Included International students are subject to a £10 delivery fee for their orders, based on their location.

24 Hour Flash Deal **25-in-1 SAP Techno-Functional Consultant Advanced Diploma Mega Bundle** SAP Techno-Functional Consultant Advanced Diploma Enrolment Gifts **FREE PDF Certificate**FREE PDF Transcript ** FREE Exam** FREE Student ID ** Lifetime Access **FREE Enrolment Letter ** Take the initial steps toward a successful long-term career by studying the SAP Techno-Functional Consultant Advanced Diploma package online with Studyhub through our online learning platform. The SAP Techno-Functional Consultant Advanced Diploma bundle can help you improve your CV, wow potential employers, and differentiate yourself from the mass. This SAP Techno-Functional Consultant Advanced Diploma course provides complete 360-degree training on SAP Techno-Functional Consultant Advanced Diploma. You'll get not one, not two, not three, but twenty-five SAP Techno-Functional Consultant Advanced Diploma courses included in this course. Plus Studyhub's signature Forever Access is given as always, meaning these SAP Techno-Functional Consultant Advanced Diploma courses are yours for as long as you want them once you enrol in this course This SAP Techno-Functional Consultant Advanced Diploma Bundle consists the following career oriented courses: Course 01: SAP S4HANA Controlling Course 02: SAP Controlling (CO) - Product Costing S4HANA Course 03: Transport Management and SAP Transportation Management Course 04: Enterprise Resource Planning (ERP) Course 05: Business Analysis Certification & Corporate Investigation Training Course 06: Financial Modelling Course 07: Quality Management and Strategic Training - ISO 9001 Course 08: Process Mapping Course 09: Supply Chain Management Course 10: Financial Planning Course 11: Understanding Financial Statements and Analysis Course 12: Financial Modeling Course for a Non-Finance Background Course 13: Investment Banking Operations Professional Course 14: Process Improvement Course 15: Lean Leadership, Culture and Management - Online Diploma Course 16: Operations Management Course 17: Logistic Management Course 18: Procurement, Logistic and Quality Management Course 19: Material Management Course 20: Production Manager Course 21: Customer Relationship Management Course 22: Business Strategy Planning Course 23: Information Governance and Data Management Training Course 24: Effective Communication Skills Diploma Course 25: Time Management The SAP Techno-Functional Consultant Advanced Diploma course has been prepared by focusing largely on SAP Techno-Functional Consultant Advanced Diploma career readiness. It has been designed by our SAP Techno-Functional Consultant Advanced Diploma specialists in a manner that you will be likely to find yourself head and shoulders above the others. For better learning, one to one assistance will also be provided if it's required by any learners. The SAP Techno-Functional Consultant Advanced Diploma Bundle is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This SAP Techno-Functional Consultant Advanced Diploma bundle course has been created with twenty-five premium courses to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This SAP Techno-Functional Consultant Advanced Diploma Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into SAP Techno-Functional Consultant Advanced Diploma Elementary modules, allowing our students to grasp each lesson quickly. The SAP Techno-Functional Consultant Advanced Diploma course is self-paced and can be taken from the comfort of your home, office, or on the go! With our Student ID card you will get discounts on things like music, food, travel and clothes etc. In this exclusive SAP Techno-Functional Consultant Advanced Diploma bundle, you really hit the jackpot. Here's what you get: Step by step SAP Techno-Functional Consultant Advanced Diploma lessons One to one assistance from SAP Techno-Functional Consultant Advanced Diplomaprofessionals if you need it Innovative exams to test your knowledge after the SAP Techno-Functional Consultant Advanced Diplomacourse 24/7 customer support should you encounter any hiccups Top-class learning portal Unlimited lifetime access to all twenty-five SAP Techno-Functional Consultant Advanced Diploma courses Digital Certificate, Transcript and student ID are all included in the price PDF certificate immediately after passing Original copies of your SAP Techno-Functional Consultant Advanced Diploma certificate and transcript on the next working day Easily learn the SAP Techno-Functional Consultant Advanced Diploma skills and knowledge you want from the comfort of your home CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This SAP Techno-Functional Consultant Advanced Diploma training is suitable for - Students Recent graduates Job Seekers Individuals who are already employed in the relevant sectors and wish to enhance their knowledge and expertise in SAP Techno-Functional Consultant Advanced Diploma Requirements To participate in this SAP Techno-Functional Consultant Advanced Diploma course, all you need is - A smart device A secure internet connection And a keen interest in SAP Techno-Functional Consultant Advanced Diploma Career path You will be able to kickstart your SAP Techno-Functional Consultant Advanced Diploma career because this course includes various courses as a bonus. This SAP Techno-Functional Consultant Advanced Diploma is an excellent opportunity for you to learn multiple skills from the convenience of your own home and explore SAP Techno-Functional Consultant Advanced Diploma career opportunities. Certificates CPD Accredited Certificate Digital certificate - Included CPD Accredited e-Certificate - Free CPD Accredited Hardcopy Certificate - Free Enrolment Letter - Free Student ID Card - Free

Taxation in the UK: Laws, Regulations, and Compliance

By Imperial Academy

QLS Level 5 Diploma | QLS Endorsed Certificate | 11 CPD Courses & PDF Certificates | 145 CPD Points | CPD Accredited

Search By Location

- Financial Courses in London

- Financial Courses in Birmingham

- Financial Courses in Glasgow

- Financial Courses in Liverpool

- Financial Courses in Bristol

- Financial Courses in Manchester

- Financial Courses in Sheffield

- Financial Courses in Leeds

- Financial Courses in Edinburgh

- Financial Courses in Leicester

- Financial Courses in Coventry

- Financial Courses in Bradford

- Financial Courses in Cardiff

- Financial Courses in Belfast

- Financial Courses in Nottingham