- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

125 Courses

Tax & VAT - Self-Assessment Tax Return

By Compliance Central

Are you looking forward to Along with the Tax & VAT Training, the most demanding skills, for the ongoing year and beyond? Then you are in the perfect place. Let's explore! Throughout this course, you will learn the essential skills and gain the knowledge needed to become a well versed in Along with the Tax & VAT. Each lesson of this course is intuitive and easy-to-understand. Our course starts with the basics of Along with The Tax & VAT and gradually progresses towards advanced topics. This Tax & VAT Bundle Includes- Course 01: UK Tax Return Course 02: UK Income Tax Course 03: Corporate Tax & VAT Course 04: Tax Accounting Learning Outcomes: Find out more about Value Added Tax (VAT) and how it functions. Recognize the laws and their application. Know the fundamentals of VAT and how it functions. Businesses have compliance and filing duties. With in-demand talents, you can advance your career. Key Features: CPD Accredited Course Unlimited Retake Exam & Tutor Support Easy Accessibility to the Course Materials 100% Learning Satisfaction Guarantee Lifetime Access & 24/7 Support Self-paced Course Modules Covers to Explore Multiple Job Positions So don't hesitate too long. You should enrol this course right away! The comprehensive learning resources for this course are available anytime, anywhere, so you can study at your own speed in the convenience of your own home. Industry experts break down the curricula into tiny, manageable units. And our professionals will respond to any of your questions. Curriculum Breakdown of the Tax Bundle Course 01: UK Tax Course Curriculum: Module 01: Tax System and Administration in the UK Module 02: Tax on Individuals Module 03: National Insurance Module 04: How to Submit a Self-Assessment Tax Return Course 02: UK Income Tax Course Curriculum: Module 01: Fundamental of Income Tax Module 02: Advanced Income Tax Module 03: Payee, Payroll and Wages Course 03: Corporate Tax & VAT Course Curriculum: Module 01: Value Added Tax Module 02: Corporation Tax Module 03: Inheritance Tax Course 04: Tax Accounting Course Curriculum: Module 01: Capital Gain Tax Module 02: Import and Export Module 03: Double Entry Accounting Module 04: Management Accounting and Financial Analysis Module 05: Career as a Tax Accountant in the UK Explore each of the roles available and how you can start your career in VAT & TAX field. CPD 40 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Tax & VAT bundle. Aspirants seeking a career in finance in the UK VAT accounting professionals in the UK who wish to succeed Requirements Students seeking to enrol for Along with the Tax & VAT course should meet the following requirements; Basic knowledge of English Language, which already you have Be age 16 years or above Basic Knowledge of Information & Communication Technologies for studying online or digital platform. Stable Internet or Data connection in your learning devices. Career path After completing this course, you can explore trendy and in-demand jobs related to Tax & VAT, such as- VAT and Tax Officer Indirect Tax/VAT Consultant Tax Analyst VAT Accountant VAT Assistant Manager Lead Financial Accountant Explore each of the roles available and how you can start your career in this course related platform. Certificates 4 CPD Accredited PDF Certificate Digital certificate - Included Each CPD Accredited Hard Copy Certificate Hard copy certificate - £10.79 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

Follow your dreams by enrolling on the Accountancy course today and develop the experience, skills and knowledge you need to enhance your professional development. Accountancy will help you arm yourself with the qualities you need to work towards your dream job. Study the Accountancy training course online with Janets through our online learning platform and take the first steps towards a successful long-term career. The Accountancy course will allow you to enhance your CV, impress potential employers, and stand out from the crowd. This Accountancy course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Study the Accountancy course through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the Accountancy course, to ensure you are supported every step of the way. Get a digital certificate as proof of your Accountancy course completion. Janets is one of the top online training course providers in the UK, and we want to make education accessible to everyone! Learn the essential skills you need to succeed and build a better future for yourself with the Accountancy course. The Accountancy course is designed by industry experts and is tailored to help you learn new skills with ease. The Accountancy is incredibly great value and allows you to study at your own pace. With full course access for one year, you can complete the Accountancy when it suits you. Access the Accountancy course modules from any internet-enabled device, including computers, tablets, and smartphones. The Accountancy course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the Accountancy now and start learning instantly! What You Get Out Of Studying Accountancy With Janets: Receive a digital Certificate upon successful completion of the Accountancy course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Description The Accountancy training course is delivered through Janets' online learning platform. Access the Accountancy content from any internet-enabled device whenever or wherever you want to. The Accountancy course has no formal teaching deadlines, meaning you are free to complete the course at your own pace. Method of Assessment To successfully complete the Accountancy course, students will have to take an automated multiple-choice exam. This exam will be online and you will need to score 60% or above to pass the Accountancy course. After successfully passing the Accountancy course exam, you will be able to apply for a CPD-accredited certificate as proof of your Accountancy qualification. Certificate of Achievement Endorsed Certificate of Achievement from the Quality Licence Scheme Once the course has been completed and the assessment has been passed, all students are entitled to receive an endorsed certificate. This will provide proof that you have completed your training objectives, and each endorsed certificate can be ordered and delivered to your address for only £69. Please note that overseas students may be charged an additional £10 for postage. CPD Certificate of Achievement from Janets After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for £9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for £15.99, which will reach your doorsteps by post. Who Is This Course For: The Accountancy is ideal for those who already work in this sector or are an aspiring professional. This Accountancy course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The Accountancy is open to all students and has no formal entry requirements. To study the Accountancy course, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Career Path: The Accountancy is ideal for anyone who wants to pursue their dream career in a relevant industry. Learn the skills you need to boost your CV and go after the job you want. Complete the Accountancy and gain an industry-recognised qualification that will help you excel in finding your ideal job.

Understanding the Association of Accounting Technicians

By Compete High

Unlock the Doors to a Successful Career with Understanding the Association of Accounting Technicians Text Course! Are you looking to embark on a rewarding journey in the world of finance and accounting? Do you aspire to become a proficient accounting technician, equipped with the knowledge and skills to excel in various financial settings? Look no further! Our comprehensive text course, 'Understanding the Association of Accounting Technicians,' is your key to unlocking a world of opportunities in the dynamic field of accounting. ð Why Choose Our Course? Our text course is meticulously designed to provide you with a solid foundation in the principles, practices, and regulations governing accounting and finance. Whether you're a beginner seeking to kickstart your career or a seasoned professional aiming to enhance your skills, our course offers something for everyone. Here are just a few reasons why our course stands out: Comprehensive Curriculum: Our course covers essential topics such as financial accounting, management accounting, taxation, and ethics, ensuring you gain a well-rounded understanding of accounting principles. Flexible Learning: Access the course material anytime, anywhere, at your own pace. Whether you're a full-time student, a working professional, or a busy parent, our flexible learning format allows you to study at your convenience. Expert Guidance: Learn from industry experts and experienced professionals who bring real-world insights and practical knowledge to the table. Benefit from their guidance and expertise as you navigate through the course material. Practical Assignments: Put your knowledge to the test with hands-on assignments and case studies designed to reinforce learning and enhance practical skills. Gain confidence in your abilities as you tackle real-world accounting scenarios. Recognized Certification: Upon successful completion of the course, receive a certification that validates your expertise and enhances your credibility in the eyes of employers and clients. ð Who is this for? Our course is ideal for: Aspiring accounting professionals seeking to kickstart their careers. Finance students looking to supplement their academic studies with practical knowledge. Working professionals aiming to enhance their accounting skills and advance their careers. Small business owners and entrepreneurs who want to gain a better understanding of financial management. No matter your background or experience level, our course is designed to accommodate learners of all profiles and help you achieve your career goals in the field of accounting. ð Career Path Upon completing our course, you'll be well-equipped to pursue a variety of exciting career opportunities in the accounting and finance sector. Some potential career paths include: Accounting Technician: As an accounting technician, you'll play a vital role in supporting the financial operations of organizations, handling tasks such as bookkeeping, payroll processing, and financial reporting. Tax Assistant: Specialize in taxation and assist individuals and businesses with tax planning, preparation, and compliance. Financial Analyst: Analyze financial data, trends, and performance metrics to provide insights and recommendations for strategic decision-making. Auditing Clerk: Conduct internal audits to ensure compliance with regulatory requirements and identify areas for improvement in financial processes and controls. Small Business Advisor: Provide financial advice and support to small businesses and startups, helping them navigate financial challenges and achieve their growth objectives. With the demand for skilled accounting professionals on the rise, the possibilities are endless for those who possess the knowledge and expertise gained from our course. ð FAQs Q: Is this course suitable for beginners with no prior accounting knowledge? A: Absolutely! Our course is designed to cater to learners of all levels, including beginners. We start with the fundamentals and gradually build upon them to ensure a comprehensive understanding of accounting principles. Q: How long does it take to complete the course? A: The duration of the course varies depending on your pace of learning and availability. On average, most learners complete the course within a few weeks to a few months. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the course and any associated assessments, you will receive a certificate of completion that can be showcased to employers and clients. Q: Can I access the course material on mobile devices? A: Yes, our platform is mobile-friendly, allowing you to access the course material on your smartphone or tablet for convenient learning on the go. Q: Is there any support available if I have questions or need assistance during the course? A: Absolutely! Our dedicated support team is here to assist you every step of the way. Whether you have questions about course content or technical issues, we're here to help. Don't miss out on this opportunity to take your accounting career to new heights! Enroll in our Understanding the Association of Accounting Technicians text course today and embark on a journey toward professional success and fulfillment. Unlock your potential and achieve your goals with us! Course Curriculum Module 1_ Introduction to Financial Accounting Introduction to Financial Accounting 00:00 Module 2_ Recording Financial Transactions Recording Financial Transactions 00:00 Module 3_ Accounting Standards and Principles Accounting Standards and Principles 00:00 Module 4_ Financial Analysis and Interpretation Financial Analysis and Interpretation 00:00 Module 5_ Budgeting and Financial Planning Budgeting and Financial Planning 00:00 Module 6_ Internal Controls and Risk Management. Internal Controls and Risk Management. 00:00

Diploma in Tax Accounting

By Compete High

Overview With the ever-increasing demand for Tax Accounting in personal & professional settings, this online training aims at educating, nurturing, and upskilling individuals to stay ahead of the curve - whatever their level of expertise in Tax Accounting may be. Learning about Tax Accounting or keeping up to date on it can be confusing at times, and maybe even daunting! But that's not the case with this course from Compete High. We understand the different requirements coming with a wide variety of demographics looking to get skilled in Tax Accounting. That's why we've developed this online training in a way that caters to learners with different goals in mind. The course materials are prepared with consultation from the experts of this field and all the information on Tax Accounting is kept up to date on a regular basis so that learners don't get left behind on the current trends/updates. The self-paced online learning methodology by Compete High in this Diploma in Tax Accounting course helps you learn whenever or however you wish, keeping in mind the busy schedule or possible inconveniences that come with physical classes. The easy-to-grasp, bite-sized lessons are proven to be most effective in memorising and learning the lessons by heart. On top of that, you have the opportunity to receive a certificate after successfully completing the course! Instead of searching for hours, enrol right away on this Diploma in Tax Accounting course from Compete High and accelerate your career in the right path with expert-outlined lessons and a guarantee of success in the long run. Who is this course for? While we refrain from discouraging anyone wanting to do this Diploma in Tax Accounting course or impose any sort of restrictions on doing this online training, people meeting any of the following criteria will benefit the most from it: Anyone looking for the basics of Tax Accounting, Jobseekers in the relevant domains, Anyone with ground knowledge/intermediate expertise in Tax Accounting, Anyone looking for a certificate of completion on doing an online training on this topic, Students of Tax Accounting, or anyone with an academic knowledge gap to bridge, Anyone with a general interest/curiosity Career Path This Diploma in Tax Accounting course smoothens the way up your career ladder with all the relevant information, skills, and online certificate of achievements. After successfully completing the course, you can expect to move one significant step closer to achieving your professional goals - whether it's securing that job you desire, getting the promotion you deserve, or setting up that business of your dreams. Course Curriculum Module 01 Introduction to Tax Accounting Introduction to Tax Accounting 00:00 Module 02 Income Statement and Balance Sheet Income Statement and Balance Sheet 01:00:00 Module 03 Tax System and Administration in the UK Tax System and Administration in the UK 01:00:00 Module 04 Tax on Individuals Tax on Individuals 00:00 Module 05 National Insurance National Insurance 00:00 Module 06 Self-Assessment Tax Return Submission Self-Assessment Tax Return Submission 00:00 Module 07 Fundamentals of Income Tax Fundamentals of Income Tax 00:00 Module 08 PAYE, Payroll and Wages PAYE, Payroll and Wages 00:00 Module 09 Double Entry Accounting Double Entry Accounting 00:00 Module 10 Career as a Tax Accountant in the UK Career as a Tax Accountant in the UK 00:00

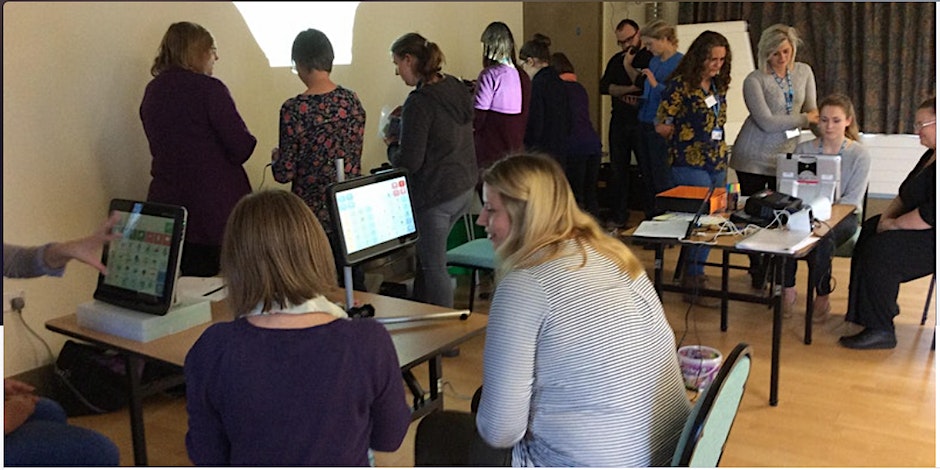

Introduction to AAC

By Electronic Assistive Technology Service (EATS), Lincoln

A hands-on introduction to various AAC devices for anyone with a personal or professional interest. This day introduces you to EATS and is a good foundation in Augmentative and Alternative Communication (AAC). You will learn different terminology used in the specialism; the difference between complexity of devices; key concepts related to implementing and making AAC work; how and when to refer to the specialist service and other essential knowledge needed to work in this area. The session is a good mix of theory and practical activities, and the day concludes with a generous interactive session for all to have a chance to have hands on experience with many devices and communication tools. The course is for anyone who wants information about AAC, whether you are a client, family member, paid carer, teacher, Speech & Language Therapist, other Allied Health Professional or anyone else who has an interest. If you are booking for a group, please supply details for each member of your party at checkout. This helps us to get an idea of who the course is helping, and in which manner. Thank you! This course is a requirement to attend our level 2 AAC awareness course. If you are interested in attending the level 2 course after you have completed this introduction, please contact us at eats.lincoln@nhs.net to book your place. If you have any questions about the event, please feel free to email us at eats.lincoln@nhs.net We hope to see you there!

Educators matching "AAT"

Show all 173Search By Location

- AAT Courses in London

- AAT Courses in Birmingham

- AAT Courses in Glasgow

- AAT Courses in Liverpool

- AAT Courses in Bristol

- AAT Courses in Manchester

- AAT Courses in Sheffield

- AAT Courses in Leeds

- AAT Courses in Edinburgh

- AAT Courses in Leicester

- AAT Courses in Coventry

- AAT Courses in Bradford

- AAT Courses in Cardiff

- AAT Courses in Belfast

- AAT Courses in Nottingham