- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

13199 Courses

Changes in Accounting: Latest Trends Encountered by CFOs in 2022

By The Teachers Training

Overview Changes in Accounting: Latest Trends Encountered by CFOs in 2022 Course is yet another 'Teacher's Choice' course from Teachers Training for a complete understanding of the fundamental topics. You are also entitled to exclusive tutor support and a professional CPD-accredited certificate in addition to the special discounted price for a limited time. Just like all our courses, this Changes in Accounting: Latest Trends Encountered by CFOs in 2022 Course and its curriculum have also been designed by expert teachers so that teachers of tomorrow can learn from the best and equip themselves with all the necessary skills. Consisting of several modules, the course teaches you everything you need to succeed in this profession. The course can be studied part-time. You can become accredited within 05 Hours studying at your own pace. Your qualification will be recognised and can be checked for validity on our dedicated website. Why Choose Teachers Training Some of our website features are: This is a dedicated website for teaching 24/7 tutor support Interactive Content Affordable price Courses accredited by the UK's top awarding bodies 100% online Flexible deadline Entry Requirements No formal entry requirements. You need to have: Passion for learning A good understanding of the English language Be motivated and hard-working Over the age of 16. Certification CPD Certification from The Teachers Training Successfully completing the MCQ exam of this course qualifies you for a CPD-accredited certificate from The Teachers Training. You will be eligible for both PDF copy and hard copy of the certificate to showcase your achievement however you wish. You can get your digital certificate (PDF) for £4.99 only Hard copy certificates are also available, and you can get one for only £10.99 You can get both PDF and Hard copy certificates for just £12.99! The certificate will add significant weight to your CV and will give you a competitive advantage when applying for jobs. Introduction Introduction 00:01:00 Use Of AI In Accounting 00:07:00 Cloud-Based Accounting Software 00:06:00 Digital Transformation 00:10:00 Workplace Wellness 00:05:00 Online Collaboration And Remote Workforce 00:05:00 Evolution Of Accountant Role, Data Visualisation And Data Security 00:07:00 Outsourcing, Tax Compliances And Other Changes 00:05:00 CFO Trends 2022 And Beyond CFO Trends - Building Cash Resilience 00:13:00 CFO Trend - Creating An Effective Budget And Forecast During Uncertainties 00:09:00 CFO Trends - Using Automation And Digitalisation 00:08:00 CFO Trends - Aligning Business Model With Changing 00:05:00 CFO Trends - Hybrid Work Office And Culture 00:06:00 CFO Trends - Growth Through Innovation And Non-Finance Roles 00:07:00 Most Anticipated Changes In Accounting 00:52:00 The Trend For Focus By CFO 2022 00:59:00

Piggy Banking

By iStudy UK

Saving money isn't about math. The secret to saving money is the matter of priorities. The general rule of thought is, the earlier a person starts to put money aside towards savings, the more likely this said amount will eventually become a rather attractive number to facilitate some form of suitable retirement plans. This course will discuss in detail about the importance of starting to save as early as possible. You will also learn how ideal it is to start investing early. Investing will help you save or earn more money for an additional source of cash flow. Lastly, you will be provided with robust savings method that will surely make you save more and stop overspending. Course Highlights Piggy Banking is an award winning and the best selling course that has been given the CPD Certification & IAO accreditation. It is the most suitable course anyone looking to work in this or relevant sector. It is considered one of the perfect courses in the UK that can help students/learners to get familiar with the topic and gain necessary skills to perform well in this field. We have packed Piggy Banking into 7 modules for teaching you everything you need to become successful in this profession. To provide you ease of access, this course is designed for both part-time and full-time students. You can become accredited in just 4 hours, 45 minutes and it is also possible to study at your own pace. We have experienced tutors who will help you throughout the comprehensive syllabus of this course and answer all your queries through email. For further clarification, you will be able to recognize your qualification by checking the validity from our dedicated website. Why You Should Choose Piggy Banking Lifetime access to the course No hidden fees or exam charges CPD Accredited certification on successful completion Full Tutor support on weekdays (Monday - Friday) Efficient exam system, assessment and instant results Download Printable PDF certificate immediately after completion Obtain the original print copy of your certificate, dispatch the next working day for as little as £9. Improve your chance of gaining professional skills and better earning potential. Who is this Course for? Piggy Banking is CPD certified and IAO accredited. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic backgrounds. Requirements Our Piggy Banking is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path You will be ready to enter the relevant job market after completing this course. You will be able to gain necessary knowledge and skills required to succeed in this sector. All our Diplomas' are CPD and IAO accredited so you will be able to stand out in the crowd by adding our qualifications to your CV and Resume. Start Savings Early 00:30:00 Savings Is Never Enough: Invest Now 01:00:00 Powerful Savings Method: 401k & IRA 01:00:00 Jump Into Mutual Fund Investments 00:30:00 Save Big On Expenses: Frugal Living 01:00:00 Engage yourself to A Financial Adviser Now! 00:30:00 Wrapping Up 00:15:00 Mock Exam Final Exam

Diploma in Tax Accounting

By Compete High

Overview With the ever-increasing demand for Tax Accounting in personal & professional settings, this online training aims at educating, nurturing, and upskilling individuals to stay ahead of the curve - whatever their level of expertise in Tax Accounting may be. Learning about Tax Accounting or keeping up to date on it can be confusing at times, and maybe even daunting! But that's not the case with this course from Compete High. We understand the different requirements coming with a wide variety of demographics looking to get skilled in Tax Accounting. That's why we've developed this online training in a way that caters to learners with different goals in mind. The course materials are prepared with consultation from the experts of this field and all the information on Tax Accounting is kept up to date on a regular basis so that learners don't get left behind on the current trends/updates. The self-paced online learning methodology by Compete High in this Diploma in Tax Accounting course helps you learn whenever or however you wish, keeping in mind the busy schedule or possible inconveniences that come with physical classes. The easy-to-grasp, bite-sized lessons are proven to be most effective in memorising and learning the lessons by heart. On top of that, you have the opportunity to receive a certificate after successfully completing the course! Instead of searching for hours, enrol right away on this Diploma in Tax Accounting course from Compete High and accelerate your career in the right path with expert-outlined lessons and a guarantee of success in the long run. Who is this course for? While we refrain from discouraging anyone wanting to do this Diploma in Tax Accounting course or impose any sort of restrictions on doing this online training, people meeting any of the following criteria will benefit the most from it: Anyone looking for the basics of Tax Accounting, Jobseekers in the relevant domains, Anyone with ground knowledge/intermediate expertise in Tax Accounting, Anyone looking for a certificate of completion on doing an online training on this topic, Students of Tax Accounting, or anyone with an academic knowledge gap to bridge, Anyone with a general interest/curiosity Career Path This Diploma in Tax Accounting course smoothens the way up your career ladder with all the relevant information, skills, and online certificate of achievements. After successfully completing the course, you can expect to move one significant step closer to achieving your professional goals - whether it's securing that job you desire, getting the promotion you deserve, or setting up that business of your dreams. Course Curriculum Module 01 Introduction to Tax Accounting Introduction to Tax Accounting 00:00 Module 02 Income Statement and Balance Sheet Income Statement and Balance Sheet 01:00:00 Module 03 Tax System and Administration in the UK Tax System and Administration in the UK 01:00:00 Module 04 Tax on Individuals Tax on Individuals 00:00 Module 05 National Insurance National Insurance 00:00 Module 06 Self-Assessment Tax Return Submission Self-Assessment Tax Return Submission 00:00 Module 07 Fundamentals of Income Tax Fundamentals of Income Tax 00:00 Module 08 PAYE, Payroll and Wages PAYE, Payroll and Wages 00:00 Module 09 Double Entry Accounting Double Entry Accounting 00:00 Module 10 Career as a Tax Accountant in the UK Career as a Tax Accountant in the UK 00:00

Description: The Bookkeeping and Payroll USA Version - Video Training Course includes the essential issues related to Bookkeeping and Payroll. In the course, you will learn about the laws, rules, regulations, forms, records, and calculations of bookkeeping and payroll that a business owner or employee needs to run a business successfully. The course will help you to learn about the internal controls, subsidiary ledgers, reconciliations, sales tax, budgeting, accounting for merchandising and cash, partnerships and corporations, and cash flow. Apart from these, you will learn how to prepare a book for closing at the end of the years and the ways of developing interim statements. The course will teach you the complex payroll system simply so that you can apply your knowledge in the real world. Assessment: At the end of the course, you will be required to sit for an online MCQ test. Your test will be assessed automatically and immediately. You will instantly know whether you have been successful or not. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Bookkeeping and Payroll USA Version - Video Training Course is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Bookkeeping and Payroll USA Version - Video Training Course is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. Principles Introduction - GAAP FREE 00:15:00 Transactions 00:11:00 Overview of Internal Controls The Need for Internal Controls 00:24:00 Control Concepts 00:25:00 Subsidiary Ledgers and Special Journals Subsidiary Ledgers 00:16:00 Special Journals - Posting Sales Journal 00:18:00 Special Journals - Posting Cash Receipts 00:13:00 Reconciliations Purpose 00:14:00 Reconciliation 00:22:00 Who Should Perform the Reconciliation 00:12:00 Correcting Entries Correcting Entries 00:08:00 The Wrong Account 00:05:00 Sales Tax Sales Tax 00:13:00 Sales Tax Rules and Filing 00:13:00 Budgeting All Businesses Must Have a Strategic Plan 00:28:00 Types of Budgets 00:19:00 Accounting for Merchandising Merchandising Income Statement 00:17:00 Sales Discounts 00:15:00 Purchase Discounts 00:17:00 Accounting for Cash Defining Petty Cash 00:12:00 Accounting for Cash Over or Short 00:13:00 Cash Controls - The Bank Reconciliation 00:27:00 Payroll The Payroll Process 00:35:00 Payroll Process - Deduction Tables 00:21:00 Payroll Process - Earnings Record 00:24:00 Partnerships and Corporations The Partnership 00:19:00 Corporations 00:18:00 Preferred Stock 00:18:00 Accounts Receivable and Bad Debts Accounts Receivable 00:22:00 Bad Debts 00:17:00 Interim Profit or Loss Interim 00:09:00 Year End - Preparing to Close the Books Inventory 00:21:00 Inventory Obsolescence 00:20:00 Year End - Closing the Books Year End - Closing Journal Entries 00:14:00 Year End - Post Closing Trial Balance 00:18:00 Cash Flow What is Cash Flow 00:19:00 Cash Flow - The Indirect Method 00:23:00 The Direct Method 00:22:00 Mock Exam Mock Exam- Bookkeeping and Payroll USA Version - Video Training Course 00:20:00 Final Exam Final Exam- Bookkeeping and Payroll USA Version - Video Training Course 00:20:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

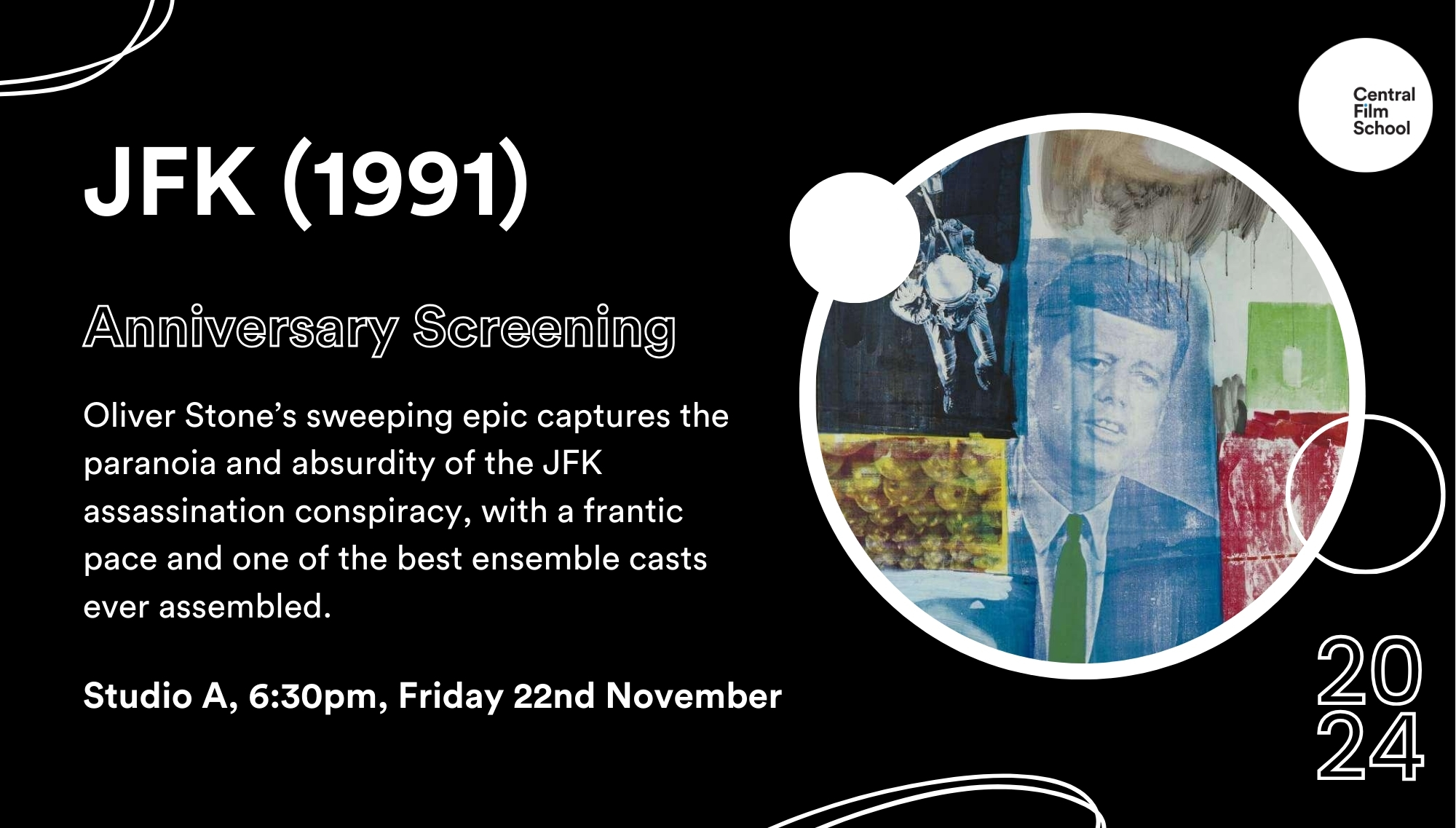

Join us for a special 61st anniversary screening of JFK (1991) by Oliver Stone Step back into one of the most tumultuous moments in American history with a powerful screening of the theatrical version of Oliver Stone’s gripping and controversial thriller that explores the assassination of President John F. Kennedy. Through dramatic storytelling and a deep dive into the era’s conspiracy theories, the film raises provocative questions that still stir debate today. Event Highlights Historical context: CFS welcomes Dr Mark de Valk, Course Leader of Practical Filmmaking at Central Film School, who will first deliver a pre-screening overview on Oliver Stone’s 1991 film JFK. Film screening: A special 61st anniversary screening of the theatrical version of JFK (1991) by Oliver Stone. There will also be a demonstration of a Bell & Howell 8mm film camera that captured the event on 22/11/63.

Master of Laws (LLM) Top-Up Inclusive of Level 7 Pathway Diploma

By School of Business and Technology London

Getting Started The University of Lancashire offers a comprehensive Master of Laws (LLM) programme meticulously designed to provide a deep and specialised legal education. Renowned for its rigorous curriculum and distinguished faculty, this programme is the preferred choice for experienced professionals and aspiring lawyers seeking to enhance their expertise. Law is a fast-changing and increasingly complex area impacting most professional, commercial and regulatory work aspects. You also don't need a legal background to study the (LLM) Master of Laws. The programme is designed for professionals seeking to expand their knowledge and advance their careers. You'll critically evaluate areas of law and the way they operate in the domestic, European, and international contexts. Through your dissertation, you'll develop critical analytical and research skills that will serve you well in any legal setting. The extensive e-law library facility of UCLAN offers you access to many legal and academic sources from within and outside the jurisdiction, providing you with the resources you need to succeed in your studies. Additionally, you'll be able to enhance your employability skills by gaining additional qualifications in alternative dispute resolution, specifically international arbitration and mediation. With a graduation ceremony held on campus grounds, you'll have the opportunity to celebrate your achievements with your peers, professors, and family members. Don't miss out on this exciting opportunity to take your legal career to the next level. The programme comprises two phases; the first is the Level 7 Diploma in International Business Law, awarded by Qualifi and delivered by the School of Business and Technology London. The second phase is the Master of Laws (LLM) Top-Up, awarded and delivered by the University of Central Lancashire through distance learning. School of Business and Technology London partners with Chestnut Education Group to promote this programme. About Awarding Body Founded in 1828, the University of Central Lancashire is a public university based in Preston, Lancashire, England. Today, UCLAN is one of the largest in the United Kingdom, with a student and staff community of nearly 38,000. At present, the University has academic partners in all regions of the globe, and it is on a world stage that the first-class quality of its education was first recognised. In 2010, UCLAN became the first UK modern Higher Education institution to appear in the QS World University Rankings. In 2018, the Centre for World University Rankings estimated Central Lancashire to be in the top 3.7 per cent of all global universities, highlighting the growth the University has made in offering students real-world learning experiences and reflecting the University's extensive pool of academic talent. Ranked in the top 7% of universities worldwide. Student Communities from more than 100 countries WES Recognised Qualifi is a UK Government (Ofqual.gov.uk) regulated awarding organisation and has developed a reputation for supporting relevant skills in a range of job roles and industries, including Leadership, Enterprise and Management, Hospitality and catering, Health and Social Care, Business Process Outsourcing and Public Services. Qualifi is also a signatory to BIS international commitments of quality. The following are the key facts about Qualifi. Regulated by Ofqual.gov.uk World Education Services (WES) Recognised Assessment Assignments and Project No examinations Entry Requirements Aspiring candidates who do not fulfil the above criterion but have sufficient managerial experience can undergo evaluation for an Advanced Entry. If English is not your first language, you will be expected to demonstrate a certificated level of proficiency of at least IELTS 6.5 (Academic level) or equivalent English Language qualification. Learners must request before enrolment to interchange unit(s) other than the preselected units shown in the SBTL website because we need to make sure the availability of learning materials for the requested unit(s). SBTL will reject an application if the learning materials for the requested interchange unit(s) are unavailable. Learners are not allowed to make any request to interchange unit(s) once enrolment is complete. Structure Phase 1 - QUALIFI Level 7 Diploma in International Business Law Programme Structure The QUALIFI Level 7 Diploma in International Business Law is made up of 120 credits, which equates to 1200 hours of TQT. Mandatory Units International Trade Law Unit Reference K/617/4822 TQT : 200 Credits : 20 In this unit, learners will be able to understand international sales transactions, environmental analysis while doing international trade, legal issues and financial forecasting processes. Commercial Trust Law Unit Reference M/617/4823 TQT : 200 Credits : 20 This unit explores the law of trusts internationally, comparing doctrine in different jurisdictions and exploring the theoretical implications of such differences. Industrial and Intellectual Property Law Unit Reference T/617/4824 TQT : 200 Credits : 20 This unit aims to introduce learners to knowledge, ability and critical understanding of regulatory and legislative requirements relating to industrial and Intellectual property laws. Law of Financial Crimes Unit Reference T/617/4824 TQT : 200 Credits : 20 Learners will be introduced to current debates, theories and legal practices in the law of financial crimes, such as statutory framework in the financial services regulations and capital market, fraud and theft act, and criminal law regulations. Company Law Unit Reference F/617/4826 TQT : 200 Credits : 20 This unit aims to inform learners about the English Law of registered companies, including private and public limited companies. Legal Research and Research Methods Unit Reference J/617/4827 TQT :100 Credits :10 Learners can cover key topics relating to research problems, conducting literature reviews, referencing, data collection and analysis techniques, and drawing conclusions from the analysed data. Optional Units Corporate Governance - Principles and Practices Unit Reference L/617/4828 TQT :100 Credits :10 This unit aims to develop learners' understanding, knowledge, and skills relating to the governing body's role, principles of corporate governance, various models and theories affecting corporate governance development, management functions, and development of governance codes, regulations and benefits of good governance. International Commercial Arbitration Unit Reference L/650/7069 TQT : 100 Credits :10 This unit aims for learners to explore the regulatory role of arbitration as a method of supra-national dispute resolution using comparative perspectives to explain contrasting regulation methods. Phase 2 - Master of Laws (LLM) Top-Up Programme Structure Dissertation Module Delivery Methods The programme comprises two phases; the first is the Level 7 Postgraduate Diploma in Law awarded by Qualifi and delivered by the School of Business and Technology London. The School of Business and Technology London offers flexible learning methods, including online and blended learning, allowing students to choose the mode of study that suits their preferences and schedules. The programme is self-paced and facilitated through an advanced Learning Management System. Students can easily interact with tutors through the SBTL Support Desk Portal System for course material discussions, guidance, assistance, and assessment feedback on assignments. School of Business and Technology London provides exceptional support and infrastructure for online and blended learning. Students benefit from dedicated tutors who guide and support them throughout their learning journey, ensuring a high level of assistance. The second phase is the Master of Laws (LLM) Top-Up, awarded and delivered by the University of Central Lancashire through distance learning. The University of Central Lancashire (UCLan) offers a range of distance learning options for students who require the flexibility to study remotely. These options include online courses, blended learning, and supported distance learning. UCLan's distance learning courses are designed to provide students with the same high-quality education as on-campus courses, with access to resources such as video lectures, online discussion forums, and interactive assessments. The University also provides a range of support services for distance learning students, including academic support, technical support, and access to the University's library and online resources. Resources and Support School of Business & Technology London is dedicated to offering excellent support on every step of your learning journey. School of Business & Technology London occupies a centralised tutor support desk portal. Our support team liaises with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receives a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and streamline all the support processes efficiently. Quality learning materials made by industry experts is a significant competitive edge of the School of Business & Technology London. Quality learning materials comprised of structured lecture notes, study guides, practical applications which includes real-world examples, and case studies that will enable you to apply your knowledge. Learning materials are provided in one of the three formats, such as PDF, PowerPoint, or Interactive Text Content on the learning portal. How does the Online Learning work at SBTL? We at SBTL follow a unique approach which differentiates us from other institutions. Indeed, we have taken distance education to a new phase where the support level is incredibly high.Now a days, convenience, flexibility and user-friendliness outweigh demands. Today, the transition from traditional classroom-based learning to online platforms is a significant result of these specifications. In this context, a crucial role played by online learning by leveraging the opportunities for convenience and easier access. It benefits the people who want to enhance their career, life and education in parallel streams. SBTL's simplified online learning facilitates an individual to progress towards the accomplishment of higher career growth without stress and dilemmas. How will you study online? With the School of Business & Technology London, you can study wherever you are. You finish your program with the utmost flexibility. You will be provided with comprehensive tutor support online through SBTL Support Desk portal. How will I get tutor support online? School of Business & Technology London occupies a centralised tutor support desk portal, through which our support team liaise with both tutors and learners to provide guidance, assessment feedback, and any other study support adequately and promptly. Once a learner raises a support request through the support desk portal (Be it for guidance, assessment feedback or any additional assistance), one of the support team members assign the relevant to request to an allocated tutor. As soon as the support receive a response from the allocated tutor, it will be made available to the learner in the portal. The support desk system is in place to assist the learners adequately and to streamline all the support process efficiently. Learners should expect to receive a response on queries like guidance and assistance within 1 - 2 working days. However, if the support request is for assessment feedback, learners will receive the reply with feedback as per the time frame outlined in the Assessment Feedback Policy.

NPORS Scissor Lift Training The aim of the NPORS Scissor lift training is to provide the candidate with the basic knowledge and practical skills involved in operating Mobile Elevated Working Platforms. NPORS Scissor lift training delegates will be enabled to: Book with Confidence at Vally Plant Training At Vally Plant Training, we guarantee unbeatable value with our Price Match Promise. When you choose us, you can book with confidence, knowing that we will not be beaten on price. If you find a lower price for the same NPORS Experienced Worker Test, we’ll match it—ensuring you receive top-quality training at the best possible rate. Your skills, our commitment—always at the best price. Boom Lift Training We at Vally Plant Training also offer the Boom Lift Training Course. The two can run at the same time so you are able to gain both qualifications to operate these MEWPS in the workplace Mobile Elevating Work Platform (MEWPS) Course Summary An Introduction to the Construction Industry. Provision and Use of Work Equipment Regulations. Lifting Operations and Lifting Equipment Regulations. Health and Safety at Work Order. Other current relevant regulations. Introduction to the machine. Pre – shift inspections. Controls and instruments. Operators Code of Safe Practice. Components and types of Mobile Elevating Work Platforms. Limitation of use. Moving and locating machine. Emergency controls. Servicing and Inspection Testing. Scissor Lift Training Available 7 days a week to suit your business requirements. VPT have a team of friendly and approachable instructors, who have a wealth of knowledge of the Scissor Lift and the construction industry We have our own training centre conveniently located close to the M5 junction 9, In Tewkesbury. With its own purpose-built MEWP practical training area to simulate an actual working environment. Our Scissor lift training and test packages are priced to be competitive. Discounts are available for multiple bookings We can send a fully qualified NPORS scissor lift Tester to your site nationwide, to reduce the amount of time away from work Frequently Asked Questions 1. Who should take the Scissor Lift Training? This training is ideal for individuals who need to operate Mobile Elevated Work Platforms (MEWPs), particularly scissor lifts, in various industries. 2. What does the Scissor Lift Training cover? The training includes site safety awareness, machine control familiarization, pre-start checks, safe operating techniques, recognizing hazards, and emergency procedures. 3. How long is the Scissor Lift Training? The course typically lasts 1 day and can accommodate up to 6 candidates. 4. What certification do I receive upon completion? Participants receive an NPORS card, either the traditional card valid for 5 years or the NPORS card with CSCS logo, initially valid for 2 years. 5. Are there any prerequisites for the Scissor Lift Training? Candidates must have a good understanding of English. For the NPORS card with CSCS logo, a CSCS Health & Safety test must have been completed within the last two years. Our more courses: Refine your expertise with our specialized Lift Supervision Training, Slinger Signaller Training, Ride-On Road Roller, Telehandler Training, Cat & Genny Training Slinger Signaller, Abrasive Wheels Training, Lorry Loader Training and Telehandler Training. Elevate your skills for safer and more efficient operations in construction and logistics. Enroll today to advance your career prospects. For those looking for a “NPORS Scissor Lift Training near me,” our widespread operations make it convenient for you to access Vally Plant Trainings top-quality training no matter where you are in the UK

Description: QuickBooks 2008 is an accounting program which remains top notch for novices to advanced users. It comes integrated and suitable for variety of industries. Intuit QuickBooks 2008 - Advanced provides an advanced overview on the use of this software. In this course, you will be able to learn about the to-do list, setting reminders, using class tracking, creating records NSF checks, etc. You will also learn about the aspects of estimation: creating, modifying, duplicating, printing, working on estimate reports, etc. Each section will be followed by a case study which will allow to get an overall view of the skill. Learning Outcomes: Using to do list, reminders, alerts manager and customized icons to daily tasks to star organized Viewing and generating history and reports for both A/P and A/R Understand class tracking, turning it on and setting it up, using it, and creating reports through it Creating items for NSF checks, recording NSF Fees, and handling bank charges for NSF checks Understanding, creating, customizing, finding old and viewing, modifying existing and duplicating estimates Putting the finishing touches on estimates by checking spelling, printing, emailing, creating and deactivating them Creating invoice, purchase orders and reports for estimates Opening the budget window, understanding and creating budgets, entering budget amounts, saving and reopening the budget Opening the forecast Wizard, creating, understanding, saving and reopening the forecast Opening the cash flow projector wizard, creating, understanding and saving or printing these projections Understanding payroll services, setting payroll preferences and employee defaults, and adding contractors Adding payroll items and accounts, and managing employee information and activity Tracking and paying payroll liabilities while also creating, voiding and deleting paychecks Assessment: At the end of the course, you will be required to sit for an online MCQ test. Your test will be assessed automatically and immediately. You will instantly know whether you have been successful or not. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Intuit QuickBooks 2008 - Advanced is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Intuit QuickBooks 2008 - Advanced is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. The Business of Doing Business Staying Organized 00:15:00 Managing A/P and A/R 00:15:00 Class Tracking 00:15:00 Handling NSF Payments 00:15:00 Estimates Creating Estimates 00:15:00 Finishing Estimates 00:15:00 Changing Estimates to Invoices 00:15:00 Budgets, Forecasts, and Projections Creating a Budget 00:15:00 Creating a Forecast 00:15:00 Creating a Cash Flow Projection 00:15:00 Payroll Configuring Payroll 00:15:00 Working with Payroll 00:30:00 Working with Paychecks and Payroll Liabilities 00:30:00 Mock Exam Mock Exam- Intuit QuickBooks 2008 - Advanced 00:20:00 Final Exam Final Exam- Intuit QuickBooks 2008 - Advanced 00:20:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Accredited Diploma in Business and Commercial Acumen

By iStudy UK

Having business and commercial acumen means having the ability to assess an external market and make effective decisions out of it. If you are someone who does not have such quality, then this course will help you with that. You will learn how to see the big picture and develop a management strategy for the business. You will understand how to practice financial literacy and develop your critical thinking. Finally, you will be able to practice management acumen and find the financial levers that will help you succeed in the business industry. Course Highlights Accredited Diploma in Business and Commercial Acumen is an award winning and the best selling course that has been given the CPD Certification & IAO accreditation. It is the most suitable course anyone looking to work in this or relevant sector. It is considered one of the perfect courses in the UK that can help students/learners to get familiar with the topic and gain necessary skills to perform well in this field. We have packed Accredited Diploma in Business and Commercial Acumen into 13 modules for teaching you everything you need to become successful in this profession. To provide you ease of access, this course is designed for both part-time and full-time students. You can become accredited in just 11 hours, 40 minutes and it is also possible to study at your own pace. We have experienced tutors who will help you throughout the comprehensive syllabus of this course and answer all your queries through email. For further clarification, you will be able to recognize your qualification by checking the validity from our dedicated website. Why You Should Choose Accredited Diploma in Business and Commercial Acumen Lifetime access to the course No hidden fees or exam charges CPD Accredited certification on successful completion Full Tutor support on weekdays (Monday - Friday) Efficient exam system, assessment and instant results Download Printable PDF certificate immediately after completion Obtain the original print copy of your certificate, dispatch the next working day for as little as £9. Improve your chance of gaining professional skills and better earning potential. Who is this Course for? Accredited Diploma in Business and Commercial Acumen is CPD certified and IAO accredited. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic backgrounds. Requirements Our Accredited Diploma in Business and Commercial Acumen is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path You will be ready to enter the relevant job market after completing this course. You will be able to gain necessary knowledge and skills required to succeed in this sector. All our Diplomas' are CPD and IAO accredited so you will be able to stand out in the crowd by adding our qualifications to your CV and Resume. Business and Commercial Acumen Module One - Getting Started 01:00:00 Module Two - Seeing the Big Picture 01:00:00 Module Three - KPIs (Key Performance Indicators) 01:00:00 Module Four - Risk Management Strategies 01:00:00 Module Five - Recognizing Learning Events 01:00:00 Module Six - You Need to Know These Answers and More 00:30:00 Module Seven - Financial Literacy (I) 01:00:00 Module Eight - Financial Literacy (II) 01:00:00 Module Nine - Business Acumen in Management 01:00:00 Module Ten - Critical Thinking in Business 01:00:00 Module Eleven - Key Financial Levers 01:00:00 Module Twelve - Wrapping Up 00:30:00 Activities Accredited Diploma in Business and Commercial Acumen- Activities 00:00:00 Mock Exam Mock Exam- Accredited Diploma in Business and Commercial Acumen 00:20:00 Final Exam Final Exam- Accredited Diploma in Business and Commercial Acumen 00:20:00

Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training Accounting is concerned with the daily flow of money into and out of a business or institution. Finance refers to the management of assets and liabilities as well as the planning of future growth. Accounting & Bookkeeping help companies measure, monitor, and plan their operations. Accounting & Bookkeeping help companies measure, monitor, and plan their operations. This Complete Accounting & Bookkeeping Training course is designed to provide a comprehensive introduction to business Accounting & Bookkeeping as an idea and a profession. If you're interested in becoming an account assistant or finance manager, other opportunities are available if you are passionate then this is the course for you. ThisComplete Accounting & Bookkeeping Training course will give you a solid understanding of accounting and financial processes, concepts, and responsibilities, preparing you for a career in the Accounting & Bookkeeping industry. Learning Outcomes After completing the Complete Accounting & Bookkeeping Training course, the learner will be able to - Learn the fundamentals of Accounting & Bookkeeping. Recognize the various types of cost data and cost analysis. Cost management and analysis reports. Understand how to handle accounts receivable and credit. Understand inventory management. Recognize the time value of money Identify accounting conventions and how to record financial data Improve managerial performance by understanding Special Offers of this Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training Course This Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training Course includes a FREE PDF Certificate. Lifetime access to this Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training Course Instant access to this Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training Course 24/7 Support Available to this Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training Course [ Note: Free PDF certificate as soon as completing the Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training Course] Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training Unlock the key to managing business finances with our Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training course! This program focuses on the daily flow of money and the management of assets and liabilities. Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training will equip you with the skills needed to measure, monitor, and plan financial operations effectively. Designed to offer a comprehensive introduction to both business Accounting & Bookkeeping, the Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training course is perfect for aspiring professionals. Start your journey today and master the essentials of Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training! Certificate of Completion You will receive a course completion certificate for free as soon as you complete the Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training Course. Who is this course for? Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training This Complete Accounting & Bookkeeping Training is for the ones who are interested in banking sector specially account and finance. Anyone who wants to advance their professional life. Requirements Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training To enrol in this Complete Accounting & Bookkeeping Training Course, students must fulfil the following requirements: Good Command over English language is mandatory to enrol in our Complete Accounting & Bookkeeping Training Course. Be energetic and self-motivated to complete our Complete Accounting & Bookkeeping Training Course. Basic computer Skill is required to complete our Complete Accounting & Bookkeeping Training Course. If you want to enrol in our Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training Course, you must be at least 15 years old. Career path Accounting & Bookkeeping: Complete Accounting & Bookkeeping Training After completing this Complete Accounting & Bookkeeping Training course, you may be able to pursue a variety of promising career opportunities, such as: Account manager Finance manager Administrative specialist and many more.

Search By Location

- Practical Courses in London

- Practical Courses in Birmingham

- Practical Courses in Glasgow

- Practical Courses in Liverpool

- Practical Courses in Bristol

- Practical Courses in Manchester

- Practical Courses in Sheffield

- Practical Courses in Leeds

- Practical Courses in Edinburgh

- Practical Courses in Leicester

- Practical Courses in Coventry

- Practical Courses in Bradford

- Practical Courses in Cardiff

- Practical Courses in Belfast

- Practical Courses in Nottingham