- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

13090 Courses

Embark on a captivating journey into the Italian language with our comprehensive beginner's course. Master the fundamentals, build a solid foundation, and unlock the beauty of Italian communication. Learn essential vocabulary, grammar, and practical conversational skills in this expertly crafted Italian language course. Start your linguistic adventure today!

Tableau Desktop Training - Analyst

By Tableau Training Uk

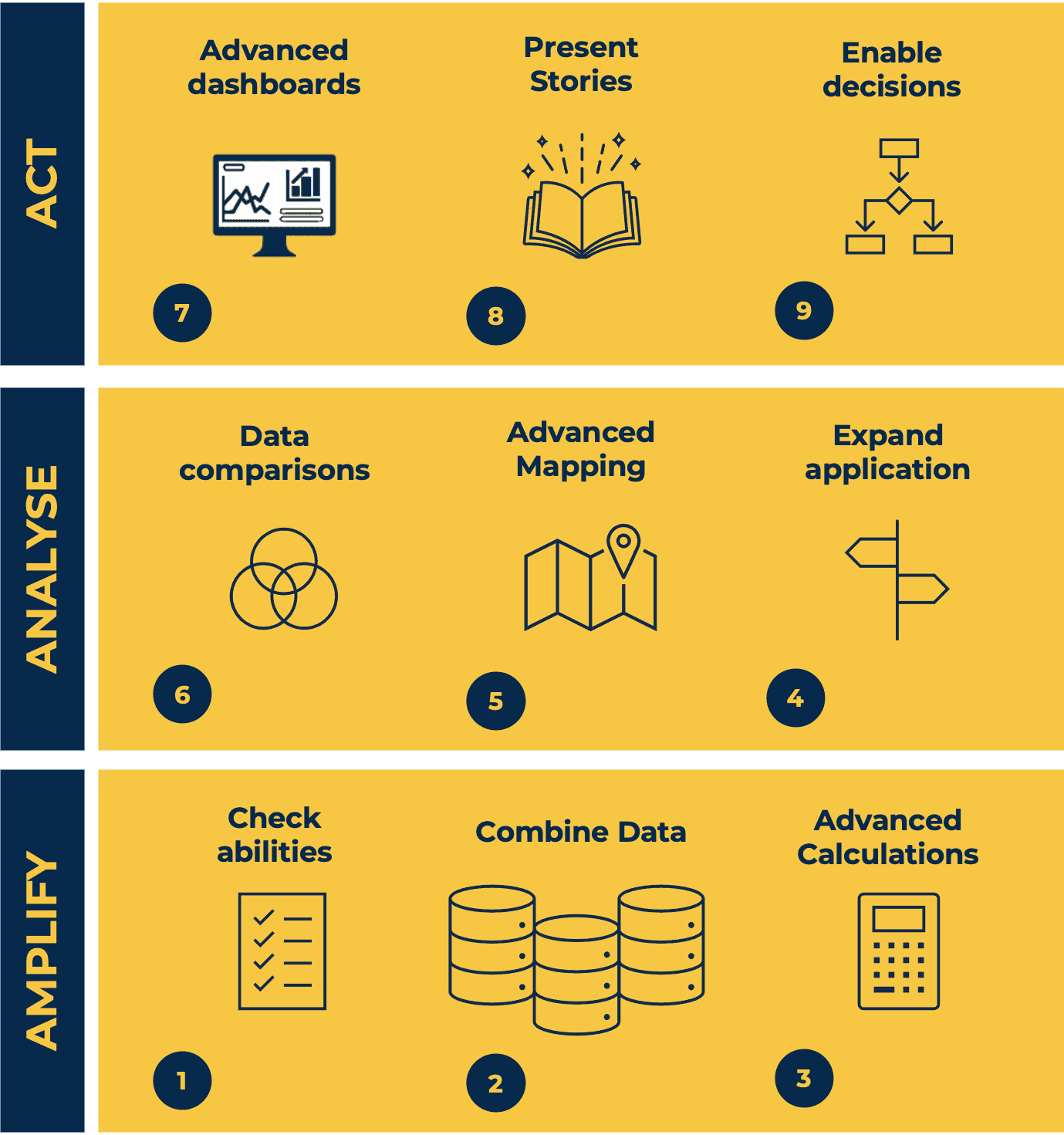

This Tableau Desktop Training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course is split into 3 phases and 9 modules: Phase 1: AMPLIFY MODULE 1: CHECK ABILITIES Revision – What I Should Know What is possibleHow does Tableau deal with dataKnow your way aroundHow do we format chartsHow Tableau deals with datesCharts that compare multiple measuresCreating Tables MODULE 2: COMBINE DATA Relationships Joining Tables – Join Types, Joining tables within the same database, cross database joins, join calculations Blending – How to create a blend with common fields, Custom defined Field relationships and mismatched element names, Calculated fields in blended data sources Unions – Manual Unions and mismatched columns, Wildcard unions Data Extracts – Creating & Editing Data extracts MODULE 3: ADVANCED CALCULATIONS Row Level v Aggregations Aggregating dimensions in calculations Changing the Level of Detail (LOD) of calculations – What, Why, How Adding Table Calculations Phase 2: ANALYSE MODULE 4: EXPAND APPLICATION Making things dynamic with parameters Sets Trend Lines How do we format charts Forecasting MODULE 5: ADVANCED MAPPING Using your own images for spatial analysis Mapping with Spatial files MODULE 6: DATA COMPARISONS Advanced Charts Bar in Bar charts Bullet graphs Creating Bins and Histograms Creating a Box & Whisker plot Phase 3: ACT MODULE 7: ADVANCED DASHBOARDS Using the dashboard interface and Device layout Dashboard Actions and Viz In tooltips Horizontal & Vertical containers Navigate between dashboards MODULE 8: PRESENT STORIES Telling data driven stories MODULE 9: ENABLE DECISIONS What is Tableau Server Publishing & Permissions How can your users engage with content This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must bring their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium “Steve not only provided a comprehensive explanation of the content of the course, but also allowed time for discussing particular business issues that participants may be facing. That was really useful as part of my learning process.”Juan C., Financial Conduct Authority “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium

Description: Business Accounting refers to the systematic recording, analysing, interpreting and presenting financial information. An Introduction to Business Accounting - Complete Video Course course provides you with the basic knowledge of Business Accounting for the betterment of your business. In the course, you will learn the accounting equation and different types of financial statements and the ways of analysing transactions using the double-entry system, and by journalizing transactions. The course will also teach you how to post entries, the trial balance, and find errors using horizontal analysis. The Business Accounting course will also teach you the ways of adjusting process, adjusting entries, preparing a worksheet, and creating financial statements. Areas of concentration also include accounting cycles, temporary vs permanent accounting basics, the accounting cycle illustrated steps, the fiscal year, and working capital and current ratio. To sum up, the course will help you to know the basic usage of Business Accounting. Assessment: At the end of the course, you will be required to sit for an online MCQ test. Your test will be assessed automatically and immediately. You will instantly know whether you have been successful or not. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? An Introduction to Business Accounting - Complete Video Course is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our An Introduction to Business Accounting - Complete Video Course is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. Professional Bookkeeper Introduction Professional Bookkeeper FREE 00:09:00 Introduction to Accounting and Business Defining a Business 00:07:00 Ethics in Accounting 00:05:00 Generally Accepted Accounting Principles (GAAP) 00:10:00 The Accounting Equation The Accounting Equation 00:07:00 Transactions 00:11:00 Financial Statements 00:13:00 Analyzing Transactions The Accounting Equation and Transactions 00:16:00 Double-Entry System 00:11:00 Transactions - Journalizing 00:17:00 Journal Entries 00:38:00 Entering Information - Posting Entries Posting Entries 00:10:00 The Trial Balance 00:10:00 Finding Errors Using Horizontal Analysis 00:09:00 Horizontal Trend : Balance Sheet 00:21:00 Horizontal Trend: Income Statement 00:36:00 Adjusting Process The Purpose of the Adjusting Process 00:15:00 Adjusting Entries Adjusting Entries - Prepaid Expenses 00:13:00 Adjusting Entries - Accrued Revenues 00:10:00 Adjusting Entries - Depreciation Expense 00:09:00 Adjustment Summary Adjustment Summary - Review 00:13:00 Vertical Analysis 00:33:00 Preparing a Worksheet Preparing a Worksheet 00:06:00 Financial Statements The Income Statement 00:11:00 Financial Statements - Definitions 00:12:00 Completing the Accounting Cycle Temporary vs. Permanent Accounts 00:19:00 The Accounting Cycle Illustrated Accounting Cycle Illustrated - Steps 1-5 00:11:00 Accounting Cycle Illustrated - Steps 6-10 00:12:00 Fiscal Year Fiscal Year 00:09:00 Spreadsheet Exercise Spreadsheet Exercise - Steps 1-4 00:11:00 Spreadsheet Exercise - Steps 5-7 00:37:00 Mock Exam Mock Exam- An Introduction to Business Accounting - Complete Video Course 00:20:00 Final Exam Final Exam- An Introduction to Business Accounting - Complete Video Course 00:20:00 Order Your Certificates and Transcripts Order Your Certificates and Transcripts 00:00:00

Whether it is a small local business or a multinational company, there is always a spot open for accountants and bookkeepers. This line of profession provides a secure job with a good salary and other additional benefits. The Accounting, Bookkeeping & Payroll - Complete Video Course(US) is here to equip you with the vital skills to establish a promising career in the accounting and bookkeeping sector. In this Accounting, Bookkeeping & Payroll - Complete Video Course(US), you will first receive a detailed introduction to accounting. Then the course will educate you on accounting equations, transactions and financial statements. You will be able to develop the ability to prepare worksheets, complete the accounting cycle, and post and adjust entries. The second section of the course will educate you on the principles of bookkeeping. You will learn how to manage the budget and sales tax. This valuable course will also ensure that you have the essential skills for payroll management. After completing the Accounting, Bookkeeping & Payroll - Complete Video Course(US), you will receive a valuable certificate to enrich your resume. Enrol in this excellent course today to boost your skills and your career. Learning Outcomes Enrich your knowledge of accounting equations, transaction and financial statements Develop the skills for posting and adjusting entries Understand the process of preparing a worksheet Learn about the steps of the accounting cycle Familiarise yourself with the principles of bookkeeping Grasp the skills for budgeting and managing sales tax Acquire the essential skills and abilities for payroll management Who is this Course for? Accounting, Bookkeeping & Payroll - Complete Video Course(US) is certified by CPD Quality Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Accounting, Bookkeeping & Payroll - Complete Video Course(US) is fully compatible with any kind of device. Whether you are using Windows computers, Mac, smartphones or tablets, you will get the same experience while learning. You will be able to access the course with any internet connection from anywhere at any time without any kind of limitation. Assessment At the end of the course, you will be required to sit for an online MCQ test. Your test will be assessed automatically and immediately. You will instantly know whether you have been successful or not. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Why Choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry-leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognised accredited qualification; Access to course content on mobile, tablet, or desktop from anywhere, anytime; The benefit of career advancement opportunities; 24/7 student support via email. Certification After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at the cost of £39 or in PDF format at the cost of £24. Career Path After completing this Accounting, Bookkeeping & Payroll - Complete Video Course(US), you will be able to build up accurate knowledge and skills with proper confidence to enrich your career in the following professions Accountant Bookkeeper Finance Officer Payroll Supervisor Accounts Assistant Module 01 : Business Accounting Professional Bookkeeper Introduction Professional Bookkeeper FREE 00:09:00 Introduction to Accounting and Business Defining a Business 00:07:00 Ethics in Accounting 00:05:00 Generally Accepted Accounting Principles (GAAP) 00:10:00 The Accounting Equation The Accounting Equation 00:07:00 Transactions 00:11:00 Financial Statements 00:13:00 Analyzing Transactions The Accounting Equation and Transactions 00:16:00 Double-Entry System 00:11:00 Transactions - Journalizing 00:17:00 Entering Information - Posting Entries Posting Entries 00:10:00 The Trial Balance 00:10:00 Finding Errors Using Horizontal Analysis 00:09:00 Adjusting Process The Purpose of the Adjusting Process 00:15:00 Adjusting Entries Adjusting Entries - Prepaid Expenses 00:13:00 Adjusting Entries - Accrued Revenues 00:10:00 Adjusting Entries - Depreciation Expense 00:09:00 Adjustment Summary Adjustment Summary - Review 00:13:00 Vertical Analysis 00:33:00 Preparing a Worksheet Preparing a Worksheet 00:06:00 Financial Statements The Income Statement 00:11:00 Financial Statements - Definitions 00:12:00 Completing the Accounting Cycle Temporary vs. Permanent Accounts 00:19:00 The Accounting Cycle Illustrated Accounting Cycle Illustrated - Steps 1-5 00:11:00 Accounting Cycle Illustrated - Steps 6-10 00:12:00 Fiscal Year Fiscal Year 00:09:00 Spreadsheet Exercise Spreadsheet Exercise - Steps 1-4 00:11:00 Spreadsheet Exercise - Steps 5-7 00:37:00 Module 02 : Bookkeeping and Payroll Principles Introduction - GAAP FREE 00:15:00 Transactions 00:11:00 Overview of Internal Controls The Need for Internal Controls 00:24:00 Control Concepts 00:25:00 Subsidiary Ledgers and Special Journals Subsidiary Ledgers 00:16:00 Special Journals - Posting Sales Journal 00:18:00 Special Journals - Posting Cash Receipts 00:13:00 Reconciliations Purpose 00:14:00 Reconciliation 00:22:00 Who Should Perform the Reconciliation 00:12:00 Correcting Entries Correcting Entries 00:08:00 The Wrong Account 00:05:00 Sales Tax Sales Tax 00:13:00 Sales Tax Rules and Filing 00:13:00 Budgeting All Businesses Must Have a Strategic Plan 00:28:00 Types of Budgets 00:19:00 Accounting for Merchandising Merchandising Income Statement 00:17:00 Sales Discounts 00:15:00 Purchase Discounts 00:17:00 Accounting for Cash Defining Petty Cash 00:12:00 Accounting for Cash Over or Short 00:13:00 Cash Controls - The Bank Reconciliation 00:27:00 Payroll The Payroll Process 00:35:00 Payroll Process - Deduction Tables 00:21:00 Payroll Process - Earnings Record 00:24:00 Partnerships and Corporations The Partnership 00:19:00 Corporations 00:09:00 Preferred Stock 00:18:00 Accounts Receivable and Bad Debts Accounts Receivable 00:22:00 Bad Debts 00:17:00 Interim Profit or Loss Interim 00:09:00 Year End - Preparing to Close the Books Inventory 00:21:00 Inventory Obsolescence 00:20:00 Year End - Closing the Books Year End - Closing Journal Entries 00:14:00 Year End - Post Closing Trial Balance 00:18:00 Cash Flow What is Cash Flow 00:19:00 Cash Flow - The Indirect Method 00:23:00 The Direct Method 00:22:00 Order Your Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Accounts Assistant

By Compete High

Course Curriculum Module 1 Introduction to Financial Management Introduction to Financial Management 00:00 Module 2 Financial Statements and Analysis Financial Statements and Analysis 00:00 Module 3 Time Value of Money and Investment Appraisal Time Value of Money and Investment Appraisal 00:00 Module 4 Capital Budgeting and Project Evaluation Capital Budgeting and Project Evaluation 00:00 Module 5 Working Capital Management Working Capital Management 00:00 Module 6 Cash Flow Statement and Liquidity Management Cash Flow Statement and Liquidity Management 00:00 Module 7 Financial Analysis and Ratios Financial Analysis and Ratios 00:00 Module 8 Budgeting and Forecasting_ Planning for Success Budgeting and Forecasting_ Planning for Success 00:00 Module 9 Internal Controls and Risk Management Internal Controls and Risk Management 00:00

Advanced Tax Accounting Part - 3

By iStudy UK

Course Description Get instant knowledge from this bite-sized Advanced Tax Accounting Part - 3 course. This course is very short and you can complete it within a very short time. In this Advanced Tax Accounting Part - 3 course you will get ideas of advanced tax accounting, the key understanding of double-entry accounting, management accounting and so on. Enrol in this course today and start your instant first step towards learning about inheritance tax. Learn faster for instant implementation. Learning Outcome Familiarise with inheritance tax Understand import and export Gain in-depth knowledge of the double-entry accounting Deepen your understanding of management accounting and financial analysis Learn about your career as a tax accountant in the UK How Much Do Tax Accountants Earn? Senior - £48,000 (Apprx.) Average - £28,000 (Apprx.) Starting - £17,000 (Apprx.) Requirement Our Advanced Tax Accounting Part - 3 is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Advanced Tax Accounting Part - 3 Inheritance Tax 00:29:00 Import and Export 00:20:00 Double Entry Accounting 00:11:00 Management Accounting and Financial Analysis 00:14:00 Career as a Tax Accountant in the UK 00:16:00 Assignment Assignment - Advanced Tax Accounting Part - 3 00:00:00

Essentials of UK VAT

By iStudy UK

Essentials of UK VAT Overview Feeling overwhelmed by VAT? You're not alone! Value Added Tax can be a tricky subject for businesses in the UK. But worry no more! This 'Essentials of UK VAT' course is your clear and concise guide to understanding VAT and keeping your taxes in order. We'll break down VAT into simple steps, starting with the basics. You'll learn key terms and how to calculate VAT amounts yourself. We'll cover who needs to register for VAT and the different rates that apply to various products and services. From creating proper invoices to understanding how VAT applies to things like car purchases, this course gives you all you need to know. By the end, you'll be a whiz at filing your VAT returns and keeping your business compliant. We'll also cover situations where you don't need to pay VAT, and any penalties you want to avoid. As a bonus, the course explores Making Tax Digital (MTD), a new government initiative that affects how you submit your VAT information. This course is perfect for anyone who deals with UK VAT, from business owners to accountants and even those just starting out. Learning Outcomes Gain a solid understanding of Value Added Tax (VAT) in the UK. Master key VAT terminology and confidently perform VAT calculations. Understand who is required to register for VAT and navigate the registration process. Apply VAT accurately to different business transactions, including goods, services, and vehicles. Learn how to create compliant VAT invoices and maintain proper records. Navigate VAT return submissions and ensure compliance with Making Tax Digital (MTD). Why You Should Choose Essentials of UK VAT Lifetime access to the course No hidden fees or exam charges CPD Accredited certification on successful completion Full Tutor support on weekdays (Monday - Friday) Efficient exam system, assessment and instant results Download Printable PDF certificate immediately after completion Obtain the original print copy of your certificate, dispatch the next working day for as little as £9. Improve your chance of gaining professional skills and better earning potential. Who is this Course for? Essentials of UK VAT is CPD certified and IAO accredited. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic backgrounds. Requirements Our Essentials of UK VAT is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path You will be ready to enter the relevant job market after completing this course. You will be able to gain necessary knowledge and skills required to succeed in this sector. All our Diplomas' are CPD and IAO accredited so you will be able to stand out in the crowd by adding our qualifications to your CV and Resume. Essentials of UK VAT Module 01: Understanding VAT Understanding VAT 00:36:00 Module 02: VAT Terminology And Calculation VAT Terminology and Calculation 00:35:00 Module 03: VAT Taxable Persons VAT Taxable Persons 00:46:00 Module 04: VAT Registration VAT Registration 00:40:00 Module 05: VAT Rates VAT Rates 00:32:00 Module 06: Invoicing And Records Invoicing and Records 00:27:00 Module 07: VAT Application In Goods, Services And Vehicles VAT Application in Goods, Services and Vehicles 00:31:00 Module 08: Supply Supply 00:43:00 Module 09: The VAT Return The VAT Return 00:25:00 Module 10: Tips On VAT Compliance Tips on VAT Compliance 00:21:00 Module 11: VAT Exemptions And Zero-Rated VAT VAT Exemptions and Zero-Rated VAT 00:39:00 Module 12: Miscellaneous VAT Issues And Penalties Miscellaneous VAT Issues and Penalties 00:41:00 Module 13: Making Tax Digital Making Tax Digital 00:26:00

Basic Fire Safety Awareness Course for Care Homes Training

By Lead Academy

This Course at a Glance Define the common causes of fire and understand how to reduce the risks its possess Acquire knowledge about the Fire triangle that shows how a fire can start Recognise elements of combustion and ways in which fires can spread Learn about the most common causes of fire such as electricity, smoking, arson etc Understand the chemistry of fire and its ability to spread through four specified methods Identify the health risk caused by smoke and know how to control it Recognise the fire safety features in buildings and understand their role in fire prevention, management, and evacuation Understand how to respond upon the discovery of a fire Demonstrate the use of fire drills to test the practicality of fire evacuation plans Recognise the different types of Fire Extinguishers and when to use them Recognise the different types of Fire Extinguishers and when to use them Basic Fire Safety Awareness Course for Care Homes Training Overview The Regulatory Reform (Fire Safety) Order 2005 applies to all workplaces, regardless of their size, and mandates employers to offer adequate fire awareness training for all employees. Companies, therefore, have a legal obligation to follow government-issued fire safety laws and legislation. Maintaining proper fire safety in care homes is indeed a crucial concern as it is a matter of life and death because of the vulnerable people residing there. During any emergency relating to fire, it is extremely difficult to evacuate the vulnerable residents safely as most of them are very old or completely bedridden. This course is designed to equip you with basic fire safety awareness with additional safety measures tailored specifically for anyone who owns or works in a care home. This course will train you to respond quickly and efficiently if a fire breaks out in care homes and ensure the vulnerable occupants are evacuated safely out of the danger zone. The London Fire Brigade upon investigation came to the conclusion that 29% of the care homes had failures relating to fire doors within their premises, 10% had inadequate training for staff and managers and 14% had evidence of poor emergency planning or a potential lack of staff to implement emergency plans. Hence, it is significantly important for care homes to train their staff with the essential knowledge and skills to tackle any unfortunate fire events that may occur within the premises and implement emergency plans to mitigate the potential risks associated with fire. Upon successful completion of this Fire Safety Awareness Training Course, you will be able to work out effective evacuations and risk assessment plans to avoid injuries or even fatalities that can result in tragic incidents such as death. Who should take this course? This Fire Safety Awareness Training Course is suitable for: Any employee working in care homes Owners of any care home Anyone responsible for supervising fire safety Any designated fire marshall in their workplace Anyone interested to learn about fire safety protocols Whether you are the owner of any care home or an employee looking to ensure the safety of the vulnerable residents residing there, by implementing property safety protocols, this course will set you up with the appropriate skills and knowledge to design an effective fire safety evacuation plan to protect them by all means. Entry Requirements There are no academic entry requirements for this Basic Fire Safety Awareness Course for Care Homes Training course, and it is open to students of all academic backgrounds. However, you are required to have a laptop/desktop/tablet or smartphone and a good internet connection. Assessment Method This Fire Safety Awareness Training Course assesses learners through multiple-choice questions (MCQs). Upon successful completion of each module, learners must answer MCQs to step into the next module. Through the MCQs, it is measured how much a learner could grasp from each section. In the assessment pass mark is 75%. Course Curriculum Module 1: Chemistry of Fire Module 2: Common Causes of Fire Module 3: Basic Safety Features in Buildings Module 4: Introduction to Fire Extinguishers Module 5: What to do in Cases of Fire Recognised Accreditation CPD Certification Service This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Many organisations look for employees with CPD requirements, which means, that by doing this course, you would be a potential candidate in your respective field. Quality Licence Scheme Endorsed The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. It will give you a competitive advantage in your career, making you stand out from all other applicants and employees. Certificate of Achievement Endorsed Certificate from Quality Licence Scheme After successfully passing the MCQ exam you will be eligible to order the Endorsed Certificate by Quality Licence Scheme. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. It will give you a competitive advantage in your career, making you stand out from all other applicants and employees. There is a Quality Licence Scheme endorsement fee to obtain an endorsed certificate which is £65. Certificate of Achievement from Lead Academy After successfully passing the MCQ exam you will be eligible to order your certificate of achievement as proof of your new skill. The certificate of achievement is an official credential that confirms that you successfully finished a course with Lead Academy. Certificate can be obtained in PDF version at a cost of £12, and there is an additional fee to obtain a printed copy certificate which is £35. FAQs Is CPD a recognised qualification in the UK? CPD is globally recognised by employers, professional organisations and academic intuitions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. CPD-certified certificates are accepted by thousands of professional bodies and government regulators here in the UK and around the world. Are QLS courses recognised? Although QLS courses are not subject to Ofqual regulation, they must adhere to an extremely high level that is set and regulated independently across the globe. A course that has been approved by the Quality Licence Scheme simply indicates that it has been examined and evaluated in terms of quality and fulfils the predetermined quality standards. When will I receive my certificate? For CPD accredited PDF certificate it will take 24 hours, however for the hardcopy CPD certificate takes 5-7 business days and for the Quality License Scheme certificate it will take 7-9 business days. Can I pay by invoice? Yes, you can pay via Invoice or Purchase Order, please contact us at info@lead-academy.org for invoice payment. Can I pay via instalment? Yes, you can pay via instalments at checkout. How to take online classes from home? Our platform provides easy and comfortable access for all learners; all you need is a stable internet connection and a device such as a laptop, desktop PC, tablet, or mobile phone. The learning site is accessible 24/7, allowing you to take the course at your own pace while relaxing in the privacy of your home or workplace. Does age matter in online learning? No, there is no age limit for online learning. Online learning is accessible to people of all ages and requires no age-specific criteria to pursue a course of interest. As opposed to degrees pursued at university, online courses are designed to break the barriers of age limitation that aim to limit the learner's ability to learn new things, diversify their skills, and expand their horizons. When I will get the login details for my course? After successfully purchasing the course, you will receive an email within 24 hours with the login details of your course. Kindly check your inbox, junk or spam folder, or you can contact our client success team via info@lead-academy.org

Interview Skills for Accountants

By The Teachers Training

Overview Interview Skills for Accountants Course is yet another 'Teacher's Choice' course from Teachers Training for a complete understanding of the fundamental topics. You are also entitled to exclusive tutor support and a professional CPD-accredited certificate in addition to the special discounted price for a limited time. Just like all our courses, this Interview Skills for Accountants Course and its curriculum have also been designed by expert teachers so that teachers of tomorrow can learn from the best and equip themselves with all the necessary skills. Consisting of several modules, the course teaches you everything you need to succeed in this profession. The course can be studied part-time. You can become accredited within 05 Hours studying at your own pace. Your qualification will be recognised and can be checked for validity on our dedicated website. Why Choose Teachers Training Some of our website features are: This is a dedicated website for teaching 24/7 tutor support Interactive Content Affordable price Courses accredited by the UK's top awarding bodies 100% online Flexible deadline Entry Requirements No formal entry requirements. You need to have: Passion for learning A good understanding of the English language Be motivated and hard-working Over the age of 16. Certification CPD Certification from The Teachers Training Successfully completing the MCQ exam of this course qualifies you for a CPD-accredited certificate from The Teachers Training. You will be eligible for both PDF copy and hard copy of the certificate to showcase your achievement however you wish. You can get your digital certificate (PDF) for £4.99 only Hard copy certificates are also available, and you can get one for only £10.99 You can get both PDF and Hard copy certificates for just £12.99! The certificate will add significant weight to your CV and will give you a competitive advantage when applying for jobs. Interview Skills for Accountants Module 01: Welcome to Interview Skills for Accountants 00:01:00 Module 02: Introduction and Agenda 00:03:00 Module 03: The Interview Skills Balance Sheet 00:06:00 Module 04: Preparing for your Interview 00:09:00 Module 05: The Interview 00:11:00 Module 06: Other Types of Interview 00:03:00 Module 07: What if you don't get the job? 00:01:00 Module 08: After the Interview 00:05:00 Module 09: What can you do now? 00:02:00 Module 10: Key Learning Points 00:05:00 Module 11: Sample Accountancy Interview Questions 00:14:00 Module 12: Final thoughts on Interview Skills for Accountants 00:02:00 Assignment Assignment - Interview Skills for Accountants 00:00:00

Safe and Efficient Driving Practices

By Compete High

Sales Overview: Safe and Efficient Driving Practices Are you ready to take your driving skills to the next level? Introducing 'Safe and Efficient Driving Practices,' an all-inclusive program designed to equip drivers with the knowledge and techniques necessary to navigate roads safely and confidently. With modules meticulously crafted by industry experts, this comprehensive package covers everything from defensive driving to handling emergencies on the road. Module 1: Introduction to Safe and Efficient Driving Practices Get started on the right foot with a solid foundation in safe driving principles. Learn the importance of proactive decision-making, situational awareness, and maintaining focus behind the wheel. This module sets the stage for a mindset geared towards safety and efficiency. Module 2: Defensive Driving Techniques Arm yourself with the skills needed to anticipate and respond to potential hazards on the road. Explore defensive driving strategies that empower you to avoid collisions, mitigate risks, and stay in control of any driving situation. From scanning the road ahead to maintaining a safe following distance, master the art of defensive driving. Module 3: Driving in Adverse Weather Conditions Rain, snow, or fog-weather conditions can pose significant challenges for drivers. In this module, learn how to adapt your driving style to adverse weather conditions, including techniques for maintaining traction, adjusting speed, and navigating slippery roads safely. Don't let inclement weather catch you off guard-be prepared to handle any forecast with confidence. Module 4: Sharing the Road with Others Driving isn't just about you-it's about sharing the road with fellow motorists, cyclists, and pedestrians. Discover the importance of courtesy, communication, and cooperation in creating a safer driving environment for everyone. Learn how to navigate traffic, interact with other road users, and promote mutual respect on the roadways. Module 5: Handling Emergencies on the Road When the unexpected happens, be prepared to spring into action. This module equips you with essential skills for managing emergencies such as vehicle malfunctions, accidents, and medical crises. From knowing how to safely pull over to administering first aid, learn how to stay calm, focused, and effective in high-pressure situations. With 'Safe and Efficient Driving Practices,' you'll not only enhance your own safety but also contribute to the well-being of others on the road. Whether you're a seasoned driver looking to brush up on your skills or a novice eager to learn, this program offers invaluable insights that can save lives and make every journey a smoother, more enjoyable experience. Don't wait-invest in your safety and start driving with confidence today! Course Curriculum Module 1: Introduction to Safe and Efficient Driving Practices Introduction to Safe and Efficient Driving Practices 00:00 Module 2: Defensive Driving Techniques Defensive Driving Techniques 00:00 Module 3: Driving in Adverse Weather Conditions Driving in Adverse Weather Conditions 00:00 Module 4: Defensive Driving Defensive Driving 00:00 Module 5: Sharing the Road with Others Sharing the Road with Others 00:00 Module 6: Handling Emergencies on the Road Handling Emergencies on the Road 00:00

Search By Location

- Practical Courses in London

- Practical Courses in Birmingham

- Practical Courses in Glasgow

- Practical Courses in Liverpool

- Practical Courses in Bristol

- Practical Courses in Manchester

- Practical Courses in Sheffield

- Practical Courses in Leeds

- Practical Courses in Edinburgh

- Practical Courses in Leicester

- Practical Courses in Coventry

- Practical Courses in Bradford

- Practical Courses in Cardiff

- Practical Courses in Belfast

- Practical Courses in Nottingham