- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

22698 Courses

The Master of Business Administration (MBA) is a prestigious postgraduate qualification that is highly valued by leading employers. It can boost your salary, increase your professional reputation and expand your networking opportunities. If you're a graduate with some business experience and ambitions for a high-flying career, studying for an MBA could be just what you need to make the next step. Our MBA 12 months programme equips you to think logically, laterally and independently through 2 stage intensive, immersive, and challenging programme. With the advantage of studying on the job, anytime and anywhere, you get Cost Advantage and same degree which is given to full time students at the University Campus. The programme is not just an academic course. By exploring and examining real-life business problems to work on and solve, you enhance your own understanding of how a business works. We take a strategic perspective on business and management that helps you develop the skills to contribute to the major business decisions organisations have to make about their future. Program Overview: Master of Business Administration (MBA) - 12 Months Key Highlights of Master of Business Administration (MBA) - 12 Months qualification are: Fully Recognized and Globally Accepted Degree Program Duration: 12 Months (18 months / 24 months duration programme also available) Program Credits: 180 Designed for working Professionals Format: Online Student to faculty ratio of just 15:1 No Written Exam. The Assessment is done via Submission of Assignment and University Dissertation Project Same Degree which is given to Full Time students at the University Campus. Study material: Comprehensive study material and e-library support available at no additional cost. Tutor Assist available Dedicated Student Success Manager Timely Doubt Resolution Regular Networking Events with Industry Professionals Become eligible to gain direct entry into relevant Doctorate / PhD programme. LSBR Alumni Status No Cost EMI Option Top Skills You Will Learn MBA 12 months is widely seen as a passport to a successful career. It demonstrates the breadth and depth of your functional competence, strategic knowledge and problem-solving ability. Course Structure: MBA 12 MonthsThe MBA 12 months programme consists of 2 Stages.Stage 1: This stage is delivered by London School of Business and Research. The programme involves delivery through on-line Learning Management System (LMS). This stage leads to award of Level 7 Diploma in Strategic Management and Leadership. Credits earned at this stage - 120 credits (60 ECTS). Mandatory unitsStrategic Management (20 Credits)Strategic Leadership (20 Credits)Strategic Human Resource Management (20 Credits)Advanced Business Research Methods (20 Credits) Optional units(Choose any 2units to make 120 credits)Strategic Financial Management (20 Credits)Supply Chain and Operations Management (20 Credits)Entrepreneurship and Innovation (20 Credits)Globalisation and Corporate Governance (20 Credits)Strategic Change Management (20 Credits)Strategic Marketing (20 Credits) Successful completion of Stage 1 leads to Progression to Stage 2Stage 2: Delivered by the University / awarding body. On completion of the diploma programme you progress / Top up with Degree through a UK University for progression to the MBA degree. The stage 2 is delivered via distance learning by faculties from the University / awarding body. Credits earned at this stage - 60 credits (30 ECTS). Completion of Stage 2 leads to award of MBA Degree Dissertation Project Successful completion of Stage 2 leads to award of Degree by the university. Who is this course for? MBA in 12 Months programme is ideal for working professionals, successful managers, executives and professionals who want to take their career to a new level and Ambitious people who want to fast track their chosen career or start a new enterprise

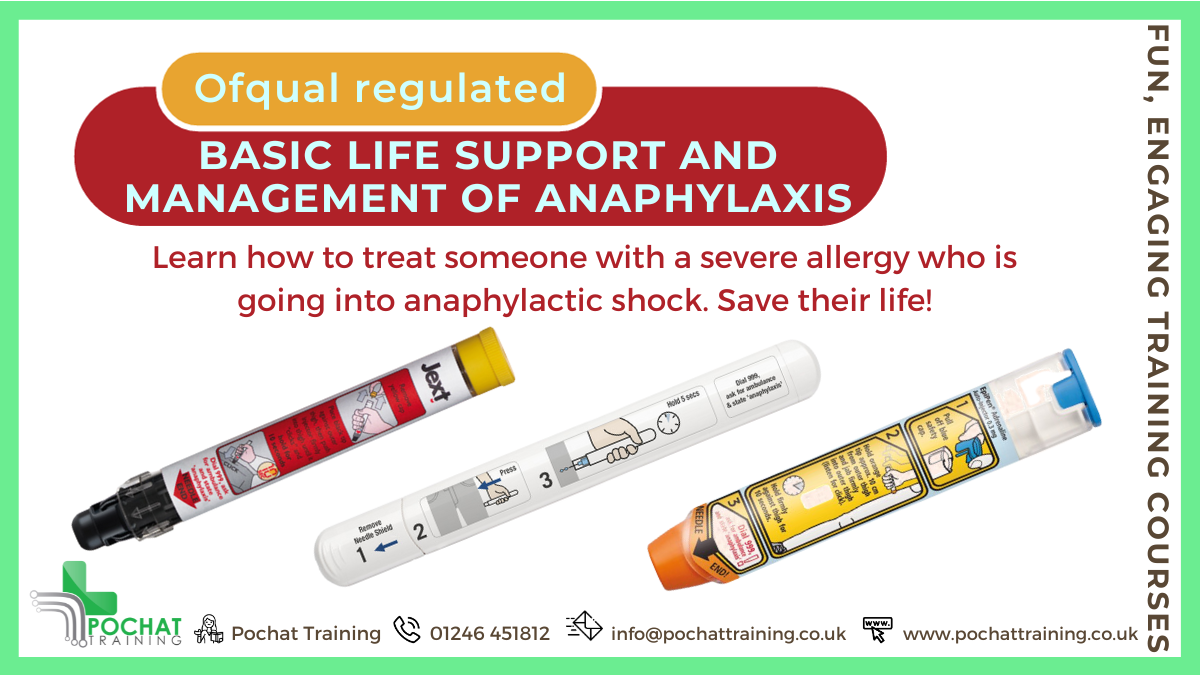

QA Level 2 Award In Basic Life Support And Management Of Anaphylaxis (RQF) Half day course Gives learners the knowledge and skills to save someone who is in anaphylactic shock Also covers how to prevent this happening in the first place Also available as a bolt-on to certain other courses Course Contents: Incident and Casualty Management Managing an Unresponsive Casualty Recovery Position The Chain of Survival CPR Signs and Symptoms of Anaphylaxis Treatment of Anaphylaxis Medication Use of Adrenaline Auto-Injectors Benefits of this course: Anaphylaxis is a severe and life-threatening allergic reaction, which requires immediate medical attention Did you know that in 2014 there were over 4,000 hospital admissions for anaphylactic shock in England? Every year, the number of those suffering from anaphylaxis is increasing. This makes it very important for people to know what to do when encountering someone who is having an anaphylactic shock This QA Level 2 Award in Basic Life Support and Management of Anaphylaxis (RQF) course has been designed for those who have a specific responsibility at work, at home or as a volunteer, to provide basic life support and manage anaphylaxis when dealing with an emergency Successful applicants will be able to recognise the signs and symptoms of anaphylaxis and will be equipped with the vital skills needed to administer safe, prompt and effective treatment. This includes practising with adrenaline auto-injectors. Accredited, Ofqual regulated qualification: Our Basic Life Support and Management of Anaphylaxis training course is a nationally recognised, Ofqual regulated qualification accredited by Qualsafe Awards.This means that you can be rest assured that your Basic Life Support and Management of Anaphylaxis Certificate fulfils the legal requirements and is a very good way to make sure you and your employees are trained in Management of Anaphylaxis..The Ofqual Register number for this course is 603/2548/3

Cost Engineering, Financing and Risk Management for Upstream and Downstream Oil & Gas Projects

5.0(10)By GBA Corporate

Overview This 5-day course is developed to make the delegates walk through the engineering formulas and equations to become a professional in managing estimates, projections, risks, and uncertainties and secure financing for high-value, high-risk projects, from both Onshore and Offshore Oil & Gas industry segments.

Overview This course will help you manage project risk effectively by identifying, analyzing, and communicating inevitable changes to project scope and objectives. You will understand and practice the elements needed to measure and report on project scope, schedule, and cost performance. You will be equipped with the tools to manage change in the least disruptive way possible for your team and other project stakeholders.

Overview This course can offer you a transparent understanding of the credit management method and increase your confidence when handling credit management matters. This course will equip delegates with a range of enhanced communication skills to enable them to effectively collect debt by phone. These skills can be used to make sure that they are not only more effective at collecting money from customers but also maintain positive working relationships.

Overview Public Private Partnerships (PPPs) are arrangements typified by joined-up working between the public and private sectors. In the broadest sense, PPPs can cover all types of collaboration across the interface between the public and the private sector to deliver services. This course will equip participants with a basic understanding of PPPs and why they are needed. It will walk delegates through a typical PPP process, from the identification of potential PPP projects to risk appraisal, tendering, and implementation.

Overview The valuation of corporates is a fundamental skill required of a wide range of finance professionals including equity analysts, strategists, corporate finance executives, fund managers, PE/VC executives, and general bankers. The recent volatility of corporate valuations, combined with the emergence of new sectors, makes understanding the theory and practice of valuation essential. This practical course is taught using inter-active sessions that comprise lectures followed by short, practical, and interactive case studies and exercises to reinforce the concepts covered in each teaching session. Emphasis is placed on delegates gaining hands-on experience with various valuation techniques.

Overview Objectives Define brands and understand the opportunities and challenges facing them in highly competitive business landscapes Plan and craft a powerful brand positioning statement that reflects the brand's promise and the expectations of their most valued customers Build a strategic brand and track its growth and sustainability using researched processes Explore the elements of brand equity and the constituents of brand identity to build consistent and sustainable brands Identify various brand strategies to come up with sound actions aligned with the status of existing and new markets and products Master the process for conducting a full brand audit to evaluate brand performance and take remedial actions

Overview This Compliance and Risk Management Course is designed for anyone looking for a pathway into this profession and wanting to develop their industry knowledge and skills. It covers the role of the Compliance Officer and compliance department in detail, with step-by-step training in compliance auditing and risk management. This Compliance and Risk Management Training Course will equip you with the fundamental skills needed to identify and manage regulatory risk in your organization, taking you through key topics such as how to implement an efficient Compliance Management System, ethics and compliance, risk types and classifications, and how to design a solid risk management strategy. By the end of this Compliance and Risk Management Training Course, you'll have an excellent understanding of core compliance issues, as well as how to promote a positive compliance culture for your organization, which will give you a head start when it comes to standing out in the relevant job market.

Overview Corporate frauds have the inherent power to bring large organizations to their knees, cause huge monetary loss, prompt lawsuits followed by significant legal expenses, lead to the imprisonment of employees and deteriorate confidence in the market, governments, and institutions. In response, corporations and governments across the globe have stepped up their effort to inspect, prevent and penalize fraudulent practices; resulting in a greater emphasis on the domains of forensic auditing and accounting in the current economy. This training course will empower you to recognize the root causes of fraud and white-collar crime in the current economy, understand the categories of fraud, equip you with methodologies of fraud detection and prevention, and heighten your ability to detect potential fraudulent situations. In addition to the fundamentals of fraud investigation and detection in a digital environment; profit-loss evaluation, analysis of accounting books, legal concepts, and quantification of financial damages are also examined in this course

Search By Location

- EQ Courses in London

- EQ Courses in Birmingham

- EQ Courses in Glasgow

- EQ Courses in Liverpool

- EQ Courses in Bristol

- EQ Courses in Manchester

- EQ Courses in Sheffield

- EQ Courses in Leeds

- EQ Courses in Edinburgh

- EQ Courses in Leicester

- EQ Courses in Coventry

- EQ Courses in Bradford

- EQ Courses in Cardiff

- EQ Courses in Belfast

- EQ Courses in Nottingham