- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

207 Courses in Nottingham

Overview This 1 day course focus on comprehensive review of the current state of the art in quantifying and pricing counterparty credit risk. Learn how to calculate each xVA through real-world, practical examples Understand essential metrics such as Expected Exposure (EE), Potential Future Exposure (PFE), and Expected Positive Exposure (EPE) Explore the ISDA Master Agreement, Credit Support Annexes (CSAs), and collateral management. Gain insights into hedging strategies for CVA. Gain a comprehensive understanding of other valuation adjustments such as Funding Valuation Adjustment (FVA), Capital Valuation Adjustment (KVA), and Margin Valuation Adjustment (MVA). Who the course is for Derivatives traders, structurers and salespeople xVA desks Treasury Regulatory capital and reporting Risk managers (market and credit) IT, product control and legal Quantitative researchers Portfolio managers Operations / Collateral management Consultants, software providers and other third parties Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This 2 day course focuses on best practice bank ALM in today’s environment of a multiplicity of regulatory constraints on the balance sheet Who the course is for Asset Liability Committee (ALCO) members Treasury Risk Finance and internal audit capital management Funding management Liquidity buffer investment team Derivative structurers and salespeople; IT software providers Regulators Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Tableau Desktop Training - Analyst

By Tableau Training Uk

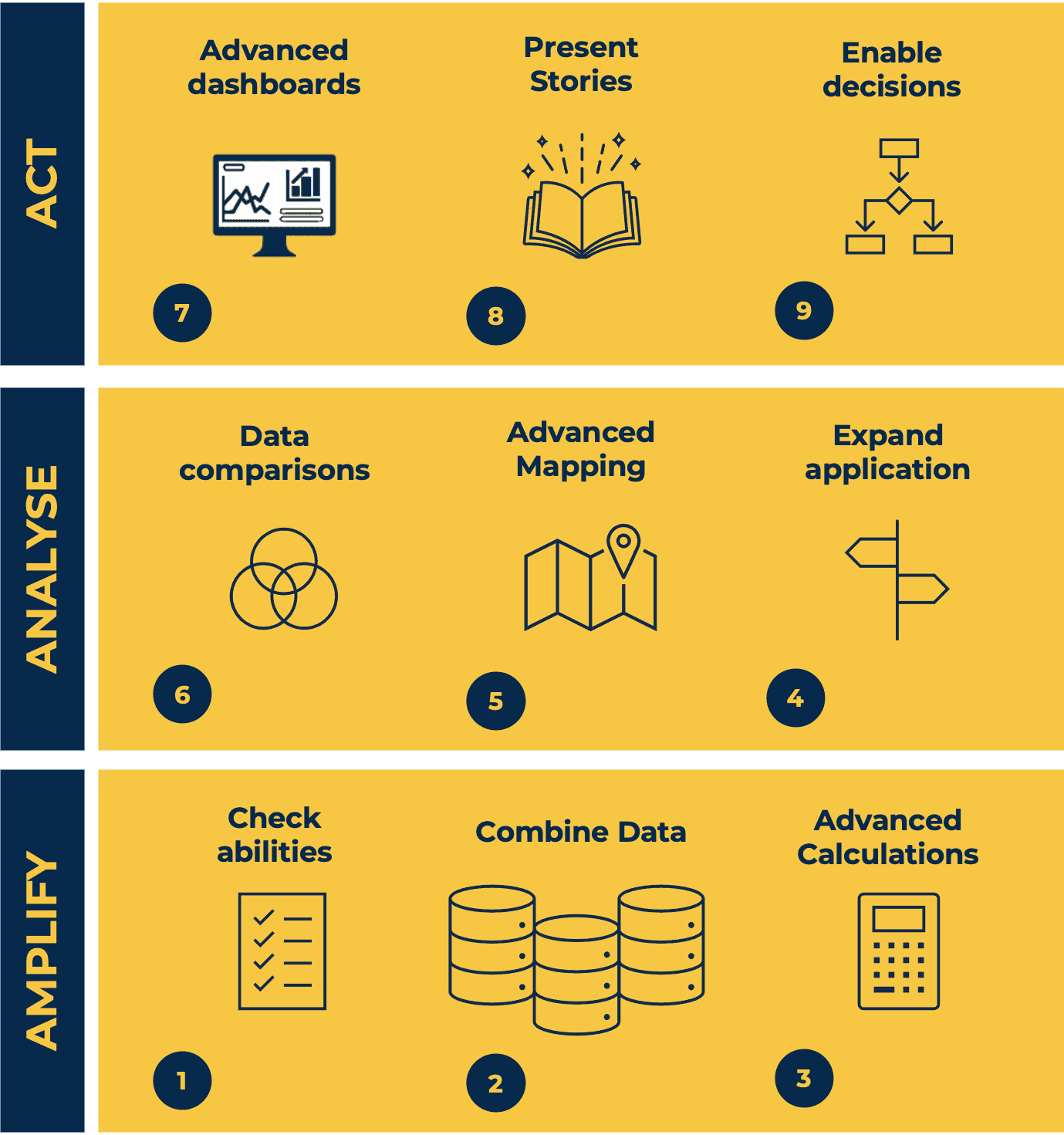

This Tableau Desktop Training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course is split into 3 phases and 9 modules: Phase 1: AMPLIFY MODULE 1: CHECK ABILITIES Revision – What I Should Know What is possibleHow does Tableau deal with dataKnow your way aroundHow do we format chartsHow Tableau deals with datesCharts that compare multiple measuresCreating Tables MODULE 2: COMBINE DATA Relationships Joining Tables – Join Types, Joining tables within the same database, cross database joins, join calculations Blending – How to create a blend with common fields, Custom defined Field relationships and mismatched element names, Calculated fields in blended data sources Unions – Manual Unions and mismatched columns, Wildcard unions Data Extracts – Creating & Editing Data extracts MODULE 3: ADVANCED CALCULATIONS Row Level v Aggregations Aggregating dimensions in calculations Changing the Level of Detail (LOD) of calculations – What, Why, How Adding Table Calculations Phase 2: ANALYSE MODULE 4: EXPAND APPLICATION Making things dynamic with parameters Sets Trend Lines How do we format charts Forecasting MODULE 5: ADVANCED MAPPING Using your own images for spatial analysis Mapping with Spatial files MODULE 6: DATA COMPARISONS Advanced Charts Bar in Bar charts Bullet graphs Creating Bins and Histograms Creating a Box & Whisker plot Phase 3: ACT MODULE 7: ADVANCED DASHBOARDS Using the dashboard interface and Device layout Dashboard Actions and Viz In tooltips Horizontal & Vertical containers Navigate between dashboards MODULE 8: PRESENT STORIES Telling data driven stories MODULE 9: ENABLE DECISIONS What is Tableau Server Publishing & Permissions How can your users engage with content This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must bring their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium “Steve not only provided a comprehensive explanation of the content of the course, but also allowed time for discussing particular business issues that participants may be facing. That was really useful as part of my learning process.”Juan C., Financial Conduct Authority “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium

Project management 'masterclasses' (In-House)

By The In House Training Company

Masterclasses? Refreshers? Introductions? It depends what you're looking for and where you want to pitch them, but here are six tried-and-tested highly focused sessions that organisations can take individually or as a series, to help develop their teams' project management capabilities one topic at a time. Objectives for each individual session are set out below, as part of the session outlines. Taken together, as a series, however, these modules are an ideal opportunity to develop your team's levels of project management capability maturity, whether that's by introducing them to the basic principles, refreshing them on best practice, or giving them the opportunity to really drill down into a specific area of challenge in your particular operating environment. Session outlines 1 Stakeholder management Session objectives This session will help participants: Understand why stakeholders matter to projects Be able to identify and engage stakeholders Be able to categorise stakeholders by their significance 1 Key principles What does 'stakeholder' mean - in theory? What does this mean in practice? Why stakeholders matter Consequences of missing stakeholders The stakeholder management process:IdentifyAssessPlanEngage 2 Identifying stakeholders Rapid listing CPIG analysis PESTLE analysis Drawing on the knowledge and experience of others Other ways to identify stakeholders 3 Assessing stakeholders Which stakeholders are significant? Stakeholder radar Power-interest maps Power-attitude maps 4 Planning The adoption curve Dealing with obstacles Who should engage which stakeholder? How should the project's organisation be structured? How will communication happen? 5 Engaging Seven principles of stakeholder engagement 2 Requirements and prioritisation Session objectives This session will help participants: Understand how clarity of requirements contributes to project success Use different techniques for prioritising requirements Agree requirements with stakeholders Manage changes to requirements 1 Understanding and managing stakeholder needs and expectations What are 'requirements'? What is 'requirements management'? Sources of requirements - and the role of stakeholders Are stakeholders sufficiently expert to specify their needs? Do they understand the detail of what they want, or do they need help to tease that out? What do stakeholders want to achieve? Working within constraints Prioritising requirements - three techniques 2 MoSCoW prioritisation 'Must have', should have', 'could have, 'won't have this time' When to use MoSCoW 3 The Kano Model Customer satisfaction - 'attractive' and 'must-be' qualities When to use Kano 4 Value-based prioritisation Understanding risk v value Using risk v value to prioritise features and schedules 5 Agreeing requirements Perfect v 'good enough' Establishing acceptance criteria Requirements traceability Agreeing project scope 6 Changing requirements Why requirements change Why change control matters Impact on projects A formal change control process Paying for change - managing change for different types of project 3 Estimating Session objectives This session will help participants: Understand the different purposes estimates satisfy Be able to use different estimating techniques Understand how to achieve different levels of accuracy 1 Key principles What's an estimate? Informed guesswork What needs to be estimated? Costs, resources, effort, duration Tolerances Precision v accuracy 2 Estimating through the lifecycle Start Plan Do 3 Early estimates Comparative ('analogous') estimating Parametric estimating Using multiple estimating techniques 4 Bottom-up estimating Bottom-up ('analytical') estimating Pros Cons 5 Three-point estimating Three-point ('PERT': Programme Evaluation and Review Technique) estimating Uncertainty and the range of estimates Calculating a weighted average Three-point with bottom-up 4 Scheduling Session objectives This session will help participants: Understand how to create a viable schedule Be able to use different forms of schedule Understand the concept of the critical path 1 Key principles The planning horizon Rolling wave planning Release planning 2 Viable scheduling Creating a viable schedule Define the scope Sequence the work Identify the risks and build in mitigations Identify the resources Estimate the effort and durations Check resource availability Refine until a workable schedule is produced 3 Critical path analysis The critical path Network diagrams Sequence logic Practical application:Network diagram with estimated durationsThe 'forward pass'The 'backward pass'Calculating total floatIdentifying the critical pathCalculating free float Gantt charts 5 Risk and issue management Session objectives This session will help participants: Understand the difference between risks and issues Be able to identify and assess risks Understand ways of mitigating risks Manage issues 1 Key principles Understanding risk Threats and opportunities The risk management processPreparation - proactive risk managementThe process - identify, assess, plan, implementStakeholder communication Roles and responsibilities Risk management strategy The risk register Risk appetite 2 Risk identification Brainstorming Interviews Assumption analysis Checklists 3 Risk assessment and prioritisation Probability, impact and proximity Triggers Qualitative risk assessment Qualitative impact assessment Qualitative probability assessment Probability / impact grid Bubble charts Risk tolerance 4 Planning countermeasures To mitigate or not to mitigate? Categories of risk response Avoid and exploit Reduce and enhance Transfer Share Accept Contingency Secondary risks 5 Issue management What is an issue? Tolerances Issues and tolerances The PRINCE2 view of issues Ownership of issues An issue management process Issue register 6 Budgeting and cost control Session objectives This session will help participants: Understand what to include in a budget - and why Choose - and use - the appropriate estimating technique Align the budget with the schedule Understand how to monitor spend and control costs Trouble-shoot effectively to get projects back within budget Session format Flexible. The session can be tailored to the participants' average level of project management maturity - a 60-minute session (delivered virtually) is an effective introduction. A 90-minute session allows for more in-depth treatment. A half-day session (face-to-face or virtual) gives time for a more challenging workshop, particularly to discuss specific cost control issues with any of the participants' current projects. 1 Where is the money coming from? Can we pay from revenue? Do we need to borrow? How long will the project take to pay back? The lifecycle of the budget Through-life costs Stakeholder involvement 2 Estimating costs Reminder: the relationship between estimates Reminder: possible estimating techniques What do we need to estimate?PeopleEquipmentMaterialsFacilities and operating costsWork package estimateEstimated project costs Estimating agile projects 3 Aligning budget and schedule Scheduling and financial periods Spreading the budget 4 Reserves and agreeing the budget Contingency reserve Management reserve Agreeing the budget 5 Cost control Planned spend over time Actual spend over time Work completed over time Evaluating different scenarios: delivery v spend 6 Trouble-shooting Why are we where we are? What has caused the project to spend at the rate it is? Why is it delivering at the rate it is? What are the root causes? What can we do about it?

Credit Risk Capital Modelling Under Basel Internal Ratings Based Approach (IRB)

5.0(5)By Finex Learning

Overview 2 day applied course in modelling Basel IRB parameters and generating IRB Pillar 1 credit risk capital requirement for a mixed retail and corporate loan book Who the course is for Credit risk management, model validators and quants Loan officers / loan portfolio management ALM staff Bank investors – equity and credit investors Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Tableau Desktop Training - Foundation

By Tableau Training Uk

This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. Having a quick turnaround from starting to use Tableau, to getting real, actionable insights means that you get a swift return on your investment of time and money. This accelerated approach is key to getting engagement from within your organisation so everyone can immediately see and feel the impact of the data and insights you create. This course is aimed at someone who has not used Tableau in earnest and may be in a functional role, eg. in sales, marketing, finance, operations, business intelligence etc. The course is split into 3 phases and 9 modules: PHASE 1: GET READY MODULE 1: LAUNCH TABLEAU Check Install & Setup Why is Visual Analytics Important MODULE 2: GET FAMILIAR What is possible How does Tableau deal with data Know your way around How do we format charts Dashboard Basics – My First Dashboard MODULE 3: DATA DISCOVERY Connecting to and setting up data in Tableau How Do I Explore my Data – Filters & Sorting How Do I Structure my Data – Groups & Hierarchies, Visual Groups How Tableau Deals with Dates – Using Discrete and Continuous Dates, Custom Dates Phase 2: GET SET MODULE 4: MAKE CALCULATIONS How Do I Create Calculated Fields & Why MODULE 5: MAKE CHARTS Charts that Compare Multiple Measures – Measure Names and Measure Values, Shared Axis Charts, Dual Axis Charts, Scatter Plots Showing Relational & Proportional Data – Pie Charts, Donut Charts, Tree Maps MODULE 6: MAKE TABLES Creating Tables – Creating Tables, Highlight Tables, Heat Maps Phase 3: GO MODULE 7: ADD CONTEXT Reference Lines and Bands MODULE 8: MAKE MAPS Answering Spatial Questions – Mapping, Creating a Choropleth (Filled) Map MODULE 9: MAKE DASHBOARDS Using the Dashboard Interface Dashboard Actions This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must use their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Excellent Trainer – knows his stuff, has done it all in the real world, not just the class room.”Richard L., Intelliflo “Tableau is a complicated and powerful tool. After taking this course, I am confident in what I can do, and how it can help improve my work.”Trevor B., Morrison Utility Services “I would highly recommend this course for Tableau beginners, really easy to follow and keep up with as you are hands on during the course. Trainer really helpful too.”Chelsey H., QVC “He is a natural trainer, patient and very good at explaining in simple terms. He has an excellent knowledge base of the system and an obvious enthusiasm for Tableau, data analysis and the best way to convey results. We had been having difficulties in the business in building financial reports from a data cube and he had solutions for these which have proved to be very useful.”Matthew H., ISS Group

How to start a small business and set it up for success

By Accountant Calgary

Starting a small business can be a rewarding journey, but it requires careful planning and the right strategies to succeed. From creating a solid business plan to organizing finances and finding the right support, this guide will help you establish a foundation for a thriving business. For entrepreneurs in Calgary, key resources like reliable bookkeeping services can make a significant difference. Here’s how to start a small business and set it up for lasting success. Developing a business plan A clear, well-researched business plan serves as a roadmap for your business. It outlines your goals, target market, competitive advantage, and financial projections. This plan will also help attract investors or secure loans. To create an effective business plan: Define your mission and vision: Explain why your business exists and what you aim to achieve. Identify your target audience: Determine who your customers are and what problems your business will solve for them. Analyze competitors: Study your competitors to understand what they offer and find ways to differentiate your business. Set realistic financial projections: Estimate costs, revenue, and profits. This will give potential investors confidence in your business. Choosing a business structure Selecting the right business structure is essential, as it affects your taxes, liability, and daily operations. Common options include: Sole proprietorship: Simple to set up, with minimal paperwork, but offers no separation of personal and business liability. Partnership: Ideal for two or more owners, allowing shared responsibilities, but partners share liabilities. Corporation: Provides liability protection, but involves more paperwork and regulatory requirements. LLC (Limited Liability Company): Offers liability protection without the complexity of a corporation. Choose a structure that best suits your needs, and consult a legal professional to ensure compliance with Calgary’s business regulations. Securing funding Most small businesses require some level of funding to get started. Consider various financing options to find the best fit: Personal savings or family support: Often the first source of funding for many entrepreneurs. Business loans: Many banks offer small business loans with varying interest rates. Grants and government programs: Explore government grants and programs specifically designed to support small businesses in Calgary. Angel investors or venture capital: For businesses with high growth potential, attracting investors may be an option. Registering your business To operate legally, you’ll need to register your business. This process involves choosing a unique name, filing the necessary documents, and obtaining a business license in Calgary. You may also need specific permits depending on your industry. Completing these steps ensures that your business complies with all local regulations. Organizing your finances Managing finances effectively is crucial for any small business. Accurate bookkeeping keeps your business organized, tracks income and expenses, and prepares you for tax season. Many small businesses in Calgary choose to hire a bookkeeper in Calgary to handle these responsibilities, allowing owners to focus on growth. Working with one of the best bookkeeping services in Calgary can provide: Accurate financial records: Professional bookkeepers help maintain up-to-date records, which is essential for financial health. Compliance with tax laws: Calgary’s best bookkeeping services are familiar with local tax regulations, ensuring that you file correctly and on time. Insights for decision-making: With accurate records, you can make informed decisions on budgeting, spending, and investments. Creating a strong brand identity Building a brand that resonates with your target audience is essential. Your brand identity includes your business name, logo, colors, and messaging, as well as the experience you offer customers. Developing a consistent brand identity sets you apart from competitors and builds trust with customers. Here are some steps to create a strong brand identity: Design a logo and visual theme: Choose a professional logo, color scheme, and design elements that reflect your brand’s personality. Develop a unique brand voice: Whether it’s friendly, professional, or playful, keep your brand voice consistent in all communications. Focus on customer experience: Aim to provide exceptional service that keeps customers coming back and sharing their positive experiences. Building an online presence In today’s digital world, an online presence is crucial for reaching potential customers. Start by creating a professional website where customers can learn more about your products or services. Next, consider establishing a presence on social media platforms that suit your audience. Key components of a strong online presence include: User-friendly website: Make sure your website is easy to navigate, mobile-friendly, and includes essential information about your business. Social media profiles: Engage with customers and share updates on platforms like Facebook, Instagram, or LinkedIn. Google My Business: Setting up a Google My Business profile helps customers in Calgary find you more easily. Building a support network Running a small business can be challenging, and having a network of support is invaluable. Surround yourself with people who can provide advice, resources, and encouragement. Consider these ways to build a support network: Join local business associations: Groups like the Calgary Chamber of Commerce offer networking opportunities, resources, and workshops. Seek mentorship: Experienced business owners can offer guidance and insights that help you avoid common pitfalls. Hire professionals for specialized tasks: For financial and legal matters, work with professionals like accountants, lawyers, and bookkeepers. Tracking progress and making adjustments As your business grows, it’s essential to review your progress and adjust your strategies. Regularly assessing financial performance, customer feedback, and market trends can help you refine your approach and stay competitive. Working with one of the best bookkeeping services in Calgary can make tracking your financial performance much easier, giving you insight into profit margins, cash flow, and budgeting. Consider these strategies for tracking progress: Set measurable goals: Establish specific goals for growth, such as revenue targets or customer acquisition numbers. Analyze performance data: Use financial statements, sales reports, and customer feedback to assess performance. Stay flexible: Be willing to make changes to products, services, or marketing strategies if they aren’t meeting customer needs. Conclusion Starting a small business takes effort, planning, and ongoing management. By creating a solid business plan, organizing your finances, and developing a strong brand, you can set your business up for success. In Calgary, many new business owners choose to hire a bookkeeper in Calgary to ensure accurate financial management and stay compliant with local regulations. Taking advantage of the best bookkeeping services in Calgary can free up your time, allowing you to focus on growing your business and achieving long-term success. With dedication and the right strategies, your small business can thrive in today’s competitive market.

Overview This is a 2 day course on understanding credit markets converting credit derivatives, from plain vanilla credit default swaps through to structured credit derivatives involving correlation products such as nth to default baskets, index tranches, synthetic collateralized debt obligations and more. Gain insights into the corporate credit market dynamics, including the role of ratings agencies and the ratings process. Delve into the credit triangle, relating credit spreads to default probability (PD), exposure (EAD), and expected recovery (LGD). Learn about CDS indices (iTRAXX and CDX), their mechanics, sub-indices, tranching, correlation, and the motivation for tranched products. The course also includes counterparty risk in derivatives market where you learn how to managed and price Counterparty Credit Risk using real-world, practical examples Understand key definitions of exposure, including Mark-to-Market (MTM), Expected Exposure (EE), Expected Positive Exposure (EPE), Potential Future Exposure (PFE), Exposure at Default (EAD), and Expected Loss (EL) Explore the role of collateral and netting in managing counterparty risk, including the key features and mechanics of the Credit Support Annex (CSA) Briefly touch upon other XVA adjustments, including Margin Valuation Adjustment (MVA), Capital Valuation Adjustment (KVA), and Collateral Valuation Adjustment (CollVA). Who the course is for Credit traders and salespeople Structurers Asset managers ALM and treasury (Banks and Insurance Companies) Loan portfolio managers Product control, finance and internal audit Risk managers Risk controllers xVA desk IT Regulatory capital and reporting Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Interest Rate Options are an essential part of the derivatives marketplace. This 3-Day programme will equip you to use, price, manage and evaluate interest rate options and related instruments. The course starts with a detailed review of option theory, from a practitioner’s viewpoint. Then we cover the key products in the rates world (caps/floors, swaptions, Bermudans) and their applications, plus the related products (such as CMS) that contain significant ’hidden’ optionality. We finish with a detailed look at the volatility surface in rates, and how we model vol dynamics (including a detailed examination of SABR). The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Budgeting and control (In-House)

By The In House Training Company

Budgeting is more than mere vague oversight. Budgeting should deliver the corporate strategy, add shareholder value and lead to a well-run business - for the benefit of all involved in it. Effective budgeting leads to real control - effective day-to-day operational control and more. This course demonstrates what proper budgeting and operational control can do. This course will help ensure that participants: Appreciate the importance of the budgeting process Take ownership of it Use it as a daily working tool - not an annual exercise - to help run their part of the operation Improve their reporting against budget Ensure their delivery against budget 1 Objectives of budgets The budget process Stages - what is the prime aim of a budget? What is forecasting? ObjectivesPlanningImplementation 2 Budget and cost control focus Choosing objectives Links with corporate strategy Links with resource management Can the accounting systems cope? 3 Traditional budgeting and control Benefits and drawbacks The process Control and feedback Reporting - what can be expected? 4 Advanced budgeting and control Understanding the business process Taking out costs Cost awareness ZBB - as valid as ever 5 Reports Reports for action The purpose of a report Content - deliverables and feedback Culture is so important

Search By Location

- Financial Courses in London

- Financial Courses in Birmingham

- Financial Courses in Glasgow

- Financial Courses in Liverpool

- Financial Courses in Bristol

- Financial Courses in Manchester

- Financial Courses in Sheffield

- Financial Courses in Leeds

- Financial Courses in Edinburgh

- Financial Courses in Leicester

- Financial Courses in Coventry

- Financial Courses in Bradford

- Financial Courses in Cardiff

- Financial Courses in Belfast

- Financial Courses in Nottingham