- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

1685 Courses in London

Building Better Careers with Soft Skills: 1-Day Workshop in London

By Mangates

10 Soft Skills You Need 1 Day Training in London

Practical Sales Skills 1 Day Workshop in London

By Mangates

Practical Sales Skills 1 Day Workshop in London

Venepuncture and cannulation course Venepuncture training for healthcare professionals Cannulation skills development Intravenous access techniques Blood sample collection training Infection control in venepuncture Hands-on venepuncture practice Cannula insertion training Nursing revalidation hours CPD accredited course Healthcare professional skills development Venepuncture and cannulation procedures Venepuncture certification program Intravenous catheter insertion Best practices in venepuncture Patient assessment for venepuncture Troubleshooting venepuncture complications Venepuncture and cannulation simulation Real-life venepuncture scenarios Healthcare career advancement with venepuncture skills

Communication Skills 1 Day Training in London

By Mangates

Communication Skills 1 Day Training in London

Non-Invasive Ventilation Course CPAP and BiPAP Training Respiratory Support Course NIV Techniques for Nurses Cough Assist and High Flow Training CPAP and BiPAP Certification Non-Invasive Ventilation for HCAs/Carers Home and Hospital NIV Training CPAP and BiPAP Online Course The CPD Standard Office Accredited NIV Course Revalidation

The "ISO 14298:2021 Lead Auditor Course" integrates the principles of ISO 14298:2021, the International Standard for Security Printing Management, with the methodologies outlined in ISO 19011:2018, the Guidelines for Auditing Management Systems. The course equips participants with the skills and knowledge required to lead security printing audits effectively, ensuring compliance with ISO 14298:2021, and applies the principles of ISO 17011:2017 for conformity assessment bodies. It covers audit planning, execution, and reporting while emphasizing risk management and continual improvement.

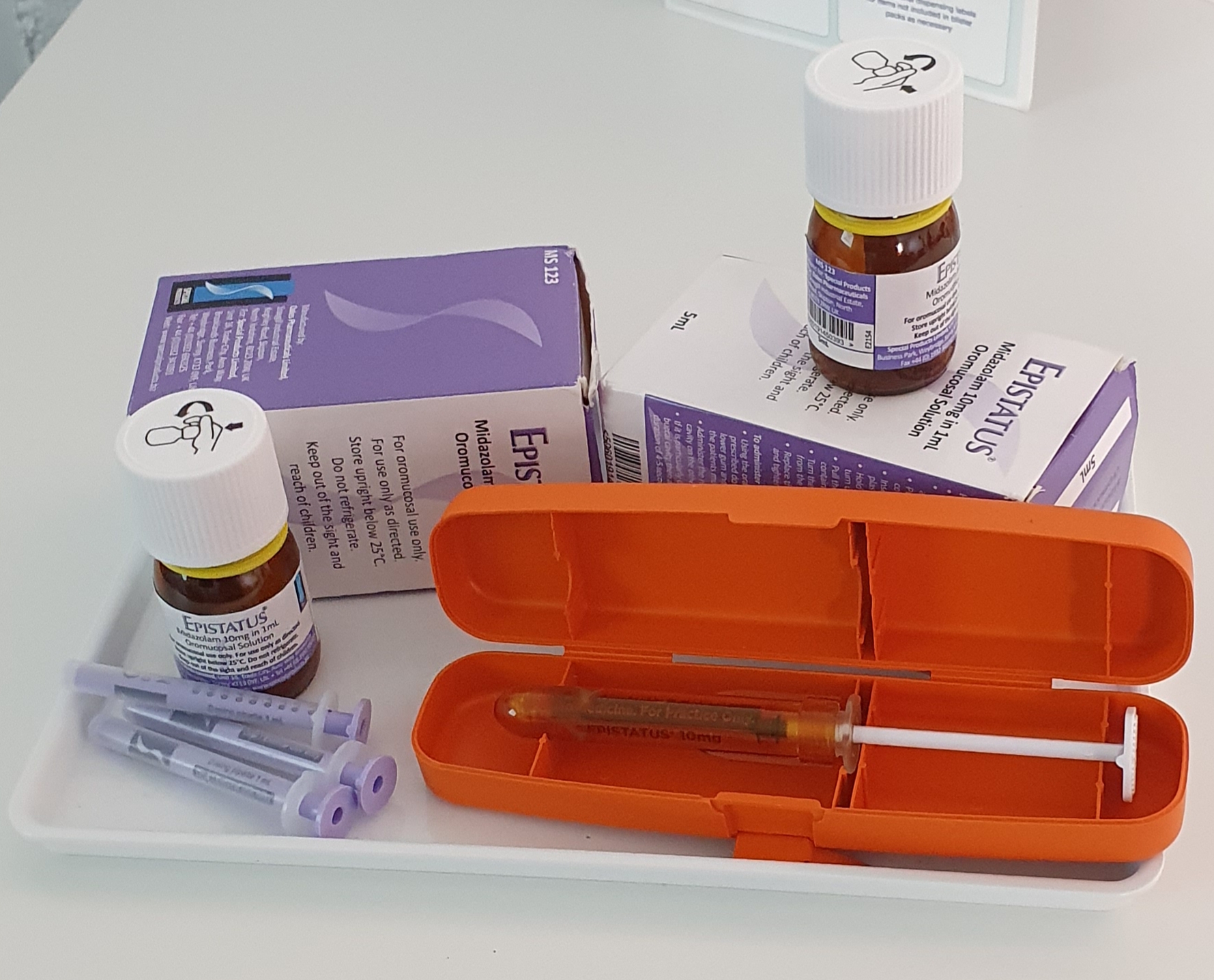

Epilepsy awareness Buccal medication training Seizure management course Epilepsy education program Neurological disorder training Emergency response to seizures Epilepsy care for healthcare professionals CPD accredited epilepsy course Nursing revalidation hours Healthcare professional seizure training Hands-on buccal administration practice Seizure recognition techniques Epilepsy management for caregivers Practical skills in epilepsy care Interactive epilepsy training sessions Expert instructors in epilepsy awareness Epilepsy impact on patients and families Effective communication in epilepsy care Real-life scenarios in epilepsy training High-quality epilepsy care certification

Safeguarding Protection Safeguarding and protection Child protection Vulnerable adults Abuse prevention Neglect prevention Exploitation prevention Identifying abuse Reporting abuse Case studies on safeguarding Safeguarding training Recognizing signs of abuse Preventing abuse and neglect Safeguarding course with case studies

Search By Location

- Professional Courses in London

- Professional Courses in Birmingham

- Professional Courses in Glasgow

- Professional Courses in Liverpool

- Professional Courses in Bristol

- Professional Courses in Manchester

- Professional Courses in Sheffield

- Professional Courses in Leeds

- Professional Courses in Edinburgh

- Professional Courses in Leicester

- Professional Courses in Coventry

- Professional Courses in Bradford

- Professional Courses in Cardiff

- Professional Courses in Belfast

- Professional Courses in Nottingham