- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

51 Courses in London

This CPD course meets the criteria for the General Dental Council’s development outcomes C. This course includes medical emergencies as set out by the GDC in the dental practice. Immediate Life Support (ILS) Level 3 (VTQ) course is designed to meet the requirements of ILS courses laid down by UK Resus Council guidelines and is certified by ProTrainings. This CPD course meets the criteria for the General Dental Council’s development outcomes C. This course includes medical emergencies as set out by the GDC in the dental practice. This course includes the latest CPR and Coronavirus recommendations. The aim is to train healthcare personnel in cardiopulmonary resuscitation, simple airway management and safe defibrillation by enabling them to manage patients in cardiac arrest until the arrival of a cardiac arrest team and to participate as members of that team. The course is run over one day and consists of lectures and practical sessions. The course looks at how to identify the causes and promote the prevention of cardiopulmonary arrest. Recognise and treat the deteriorating patient using the ABCDE approach and undertake the skills of quality CPR and defibrillation. It also covers simple airway manoeuvres and utilises non-technical skills to facilitate initial leadership and effective team membership. Dates for 2024 (please choose one for your course): 21 August, 18 November Duration : 6 hours (1 day) Time: 9:30am to 5pm Fee: £195.00 Location – The Foundry, 156 Blackfriars Rd, London SE1 8EN (Southwark Station (2-3 min walk) and Waterloo/Blackfriars Station (10 min walk)) Two Certificates on completion (available for collection from the Academy in between 5 to 7 days) Regulated Certificate – valid for 1 year Verifiable CPD Certificate – 6 hours

CIPD Foundation Certificate in People Practice Level 3

By London School of Science and Technology

This is the firmest foundation for your career in the people profession, incorporating both HR and L&D. Develop your skills by facing real-life challenges. Course Overview This is the firmest foundation for your career in the people profession, incorporating both HR and L&D. Develop your skills by facing real-life challenges. You’ll develop the knowledge and skills needed to deliver tasks that benefit your organisation at an operational level. An ideal starting point if you are new to the people profession or are working in a support role. Is this qualification right for me? This qualification is perfect for you if you’re ready to make your mark on the profession. It won’t just help you get started – it’ll give you a head start, too. This is ideal for anyone embarking on a career in the people practice, or for those already in a support role and looking to take the next step on the ladder. What will I learn? The Level 3 Foundation Certificate in People Practice is awarded by the Chartered Institute of Personnel and Development, the leading human resources professional body. The qualification introduces you to areas such as: • Business, culture and change in context • Principles of analytics • Core behaviours for people professionals • Essentials of people practice What may it lead to? This course will enable you to develop your career towards more senior roles and/or progress to level 5. The Level 3 Foundation Certificate in People Practice can lead to foundation membership of the CIPD. Upon starting your qualification, you will join the CIPD as a student member. Qualification level: The Foundation Certificate in People Practice is Regulated Qualifications Framework (RQF) Level 3 in England and Northern Ireland. Perfect for: HR and L&D beginners starting their career Typical job titles: • HR Assistant • HR Administrator • Organisational Development Officer • Learning Administrator DURATION 6-8 Months WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

AAT Level 3 Diploma in Accounting

By London School of Science and Technology

Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Course Overview This qualification covers a range of essential and higher-level accounting techniques and disciplines. Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Study the Level 3 Diploma to learn higher accounting techniques and disciplines and qualify for AAT bookkeeping membership (AATQB). The jobs it can lead to: • Accounts assistant • Accounts payable clerk • Audit trainee • Credit controller • Payroll administrator/supervisor • Practice bookkeeper • Finance assistant • Tax assistant • Accounts payable and expenses supervisor Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success we recommend that students begin their studies with a good standard of English and maths. Course Content: Business Awareness: This unit provides students with an understanding of the business, its environment and the influences that this has on an organisation’s structure, the role of its accounting function and its performance. Students will examine the purpose and types for businesses that exist and the rights and responsibilities of the key stakeholders, as well as gain an understanding of the importance of professional ethics and ethical management within the finance function. Learning outcomes: • Understand business types, structure and governance and the legal framework in which they operate. • Understand the impact of the external and internal environments on business, their performance and decisions. • Understand how businesses and accounts comply with principles of professional ethics. • Understand the impact of new technologies in accounting and the risks associated with data security. • Communicate information to stakeholders. Financial Accounting: Preparing Financial Statements: This unit provides students with the skills required to produce statements of profit or loss and statements for financial position for sole traders and partnerships, using a trial balance. Students will gain the double-entry bookkeeping skills needed to record financial transactions into an organisation’s accounts using a manual bookkeeping system. Learning outcomes: • Understand the accounting principles underlaying final accounts preparation. • Understand the principles of advanced double-entry bookkeeping. • Implement procedures for the acquisition and disposal of non-current assets. • Prepare and record depreciation calculations. • Record period end adjustments. • Produce and extend the trial balance. • Produce financial statements for sole traders and partnerships. • Interpret financial statements using profitability ratios. • Prepare accounting records from incomplete information. Management Accounting Techniques: This unit provides students with the knowledge and skills needed to understand the role of management accounting in an organisation, and how organisations use such information to aid decision making. Students will learn the principles that underpin management accounting methodology and techniques, how costs are handled in organisations and why organisations treat costs in different ways. Learning outcomes: • Understand the purpose and use of management accounting within organisations. • Use techniques required for dealing with costs. • Attribute costs according to organisational requirements. • Investigate deviations from budgets. • Use spreadsheet techniques to provide management accounting information. • Use management accounting techniques to support short-term decision making. • Understand principles of cash management. Tax Processes for Businesses: This unit explores tax processes that influence the daily operations of businesses and is designed to develop students’ skills in understanding, preparing and submitting Value Added Tax (VAT) returns to HM Revenue and Customs (HMRC). The unit provides students with the knowledge and skills that are needed to keep businesses, employers and clients compliant with laws and practices that apply to VAT and payroll. Learning outcomes: • Understand legislation requirements relating to VAT. • Calculate VAT. • Review and verify VAT returns. • Understand principles of payroll. • Report information within the organisation. DURATION 250-300 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Hypnotherapy Practitioner Diploma Course : Feb - March 2025

By Hypnotic Solutions Training

Hypnotherapy Training Course

Total Accounting Training Course Package - With Guaranteed Job Placement

By Osborne Training

Total Accounting Training Course Package - With Guaranteed Job Placement It is a comprehensive practical accounting training program designed to build the bridge between knowledge and practical aspects of accounting and tax. With this accounting courses many modules of tax and accounting are covered as well as Computerised Accounting & Payroll. Moreover, After completing the modules you will have the chance to get hands on experience which will open the door for lucrative Accounting, Tax & Payroll sector. CompletOsborne Trainingion of this training program will earn you valuable verified CPD points. As an accountant, it is vital to gain CPD points to retain your accounting membership and to comply with Professional Accounting Bodies (such as ACCA, AAT, CIMA, ICAEW etc.) requirements. Advanced Excel Bookkeeping VAT Training - Preparation and Submission Personal Tax Return Training Company Accounting and Tax Training Sage 50 Accounting Training Sage Payroll Training

Hypnotherapy Practitioner Diploma Course : Oct-Dec 2024

By Hypnotic Solutions Training

Hypnotherapy Training Course

AAT Level 4 Diploma in Professional Accounting

By London School of Science and Technology

This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Course Overview This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Students will gain competencies in drafting financial statements for limited companies, recommending accounting systems strategies and constructing and presenting complex management accounting reports. Study the Level 4 Diploma in Professional Accounting to master complex accounting tasks and qualify for senior finance roles, as well as AAT full membership. The jobs it can lead to: • Accounts payable and expenses supervisor • Assistant financial accountant • Commercial analyst • Cost accountant • Fixed asset accountant • Indirect tax manager • Payroll manager • Payments and billing manager • Senior bookkeeper • Senior finance officer • Senior fund accountant • Senior insolvency administrator • Tax supervisor • VAT accountant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Applied Management Accounting (mandatory): This unit allows students to understand how the budgetary process is undertaken. Students will be able to construct budgets and then identify and report on both areas of success and on areas that should be of concern to key stakeholders. Students will also gain the skills required to critically evaluate organisational performance. Learning outcomes: • Understand and implement the organisational planning process. • Use internal processes to enhance operational control. • Use techniques to aid short-term and long-term decision making. • Analyse and report on business performance. Drafting and Interpreting Financial Statements (mandatory): This unit provides students with the skills and knowledge for drafting the financial statements of single limited companies and consolidated financial statements for groups of companies. It ensures that students will have a proficient level of knowledge and understanding of international accounting standards, which will then be applied when drafting the financial statements. Students will also have a sound appreciation of the regulatory and conceptual frameworks that underpin the preparation of limited company financial statements. Learning outcomes: • Understand the reporting frameworks that underpin financial reporting. • Draft statutory financial statements for limited companies. • Draft consolidated financial statements. • Interpret financial statements using ratio analysis. Internal Accounting Systems and Controls (mandatory): This unit teaches students to consider the role and responsibilities of the accounting function, including the needs of key stakeholders who use financial reports to make decisions. Students will review accounting systems to identify weaknesses and will make recommendations to mitigate identified weaknesses in future operations. Students will apply several analytical methods to evaluate the implications of any changes to operating procedures. Learning outcomes: • Understand the role and responsibilities of the accounting function within an organisation. • Evaluate internal control systems. • Evaluate an organisation’s accounting system and underpinning procedures. • Understand the impact of technology on accounting systems. • Recommend improvements to an organisation’s accounting systems. Business Tax (optional): This unit introduces students to UK taxation relevant to businesses. Students will understand how to compute business taxes for sole traders, partnerships and limited companies. They will also be able to identify tax planning opportunities while understanding the importance of maintaining ethical standards. Learning outcomes: • Prepare tax computations for sole traders and partnerships. • Prepare tax computations for limited companies. • Prepare tax computations for the sale of capital assets by limited companies. • Understand administrative requirements of the UK’s tax regime. • Understand the tax implications of business disposals. • Understand tax relief, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs. Personal Tax (optional): This unit provides students with the fundamental knowledge of the three most common taxes that affect taxpayers in the UK: Income Tax, Capital Gains Tax and Inheritance Tax. With this knowledge students will be equipped to not only prepare the computational aspects of taxes, where appropriate, but also appreciate how taxpayers can legally minimise their overall taxation liability. Learning outcomes: • Understand principles and rules that underpin taxation systems. • Calculate UK taxpayers’ total income. • Calculate Income Tax and National Insurance contributions (NICs) payable by UK taxpayers. • Calculate Capital Gains Tax payable by UK taxpayers. • Understand the principles of Inheritance Tax. Audit and Assurance (optional): This unit aims to give a wider understanding of the principles and concepts, including legal and professional rules of audit and assurance services. The unit will provide students with an awareness of the audit process from planning and risk assessment to the final completion and production of the audit report. Students will also get a practical perspective on audit and assurance, with an emphasis on the application of audit and assurance techniques to current systems. Learning outcomes: • Demonstrate an understanding of the audit and assurance framework. • Demonstrate the importance of professional ethics. • Evaluate the planning process for audit and assurance. • Review and report findings. Cash and Financial Management (optional): This unit focuses on the important of managing cash within organisations and covers the knowledge and skills to make informed decision on financing and investment in accordance with organisational policies and external regulations. Students will identify current and future cash transactions from a range of sources, learn how to eliminate non-cash items and use various techniques to prepare cash budgets. Learning outcomes: • Prepare forecasts for cash receipts and payments. • Prepare cash budgets and monitor cash flows. • Understand the importance of managing finance and liquidity. • Understand the way of raising finance and investing funds. • Understand regulations and organisational policies that influence decisions in managing cash and finance. Credit and Debt Management (optional): This unit provides an understanding and application of the principles of effective credit control systems, including appropriate debt management systems. Students will be introduced to techniques that can be used to assess credit risks in line with policies, relevant legislation and ethical principles. Learning outcomes: • Understand relevant legislation and contract law that impacts the credit control environment. • Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures. • Understand the organisation’s credit control processes for managing and collecting debts. • Understand different techniques available to collect debts. DURATION 420-440 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Successfully managing smaller projects (In-House)

By The In House Training Company

The aim of this course is to provide an overview of the principles and practice for leading and managing a portfolio of smaller projects in a multi-project / multi-task environment. It presents a range of practical methods and techniques relevant to the smaller project scenario, using exercises and case studies to show how these can be applied. The scope of the programme includes: The course also emphasises the importance of the leadership and team-working skills needed by project managers and team members in carrying out their roles. The principal training objectives for this programme are to: Explain and demonstrate the key principles of successful project management Demonstrate a range of useful project management tools and techniques Define the role, and help participants understand the skills required by, the project leader Provide a structured framework to help participants manage multiple projects Identify opportunities to improve project management within the organisation DAY ONE 1 Introduction (Course sponsor) Why this programme has been developed Review of participants' needs and objectives 2 Managing smaller projects Projects and project management Lessons from past projects; the essential requirements for success Differences between projects; characteristic project life cycles Key issues and challenges of smaller projects The multi-project world; project portfolio management 3 Project exercise Syndicate teams plan and manage a small project Review of the project exercise: What are the keys to successful management of small projects? 4 Setting up the project Getting organised Managing the definition process Identifying and managing project stakeholders Working with the customer to define the scope and agree deliverables 5 Case study 1 Defining the project scope and deliverables Syndicate teams define the scope and deliverables for a typical project 6 Project planning The importance and cost benefit of effective planning Planning the plan; deciding how detailed a plan to create Packaging the work and estimating timescales and costs Developing project / resource schedules; setting milestones for control v Identifying and managing critical path activities 7 Case study 2 Creating the project plan Syndicate teams develop and analyse the project plan DAY TWO 8 Managing project risks Identifying risks to the project outcome, timescale and cost Evaluating risks and adopting an appropriate risk strategy Defining risk ownership; keeping a simple risk log Keeping risk management up to date; staying pro-active Integrating planning and risk management 9 Project control Managing change, minimising scope creep Selecting the data needed to provide early warning of problems Monitoring performance easily with 'S' curves and slip charts Using trend forecasting to assess true project status Running project review meetings 10 Managing a multi-project portfolio Understanding the world of multiple projects Establishing ownership of project / programme management Classifying projects and creating the 'master schedule' Defining and applying project lifecycle management Resource management: essential pre-requisites and mechanisms Project prioritisation criteria and techniques; pain / gain analysis 11 Managing the multi-project team Characteristics of small project teams / part-time team membership Clarifying line and project management responsibilities Implementing effective manpower planning Establishing professional working practices in the team Developing project management competences in the team Establishing team roles and integrating team members 12 Course review and transfer planning (Course sponsor present) Identify actions to be implemented individually Identify corporate opportunities for improving project management Sponsor-led review and discussion of proposals Conclusion

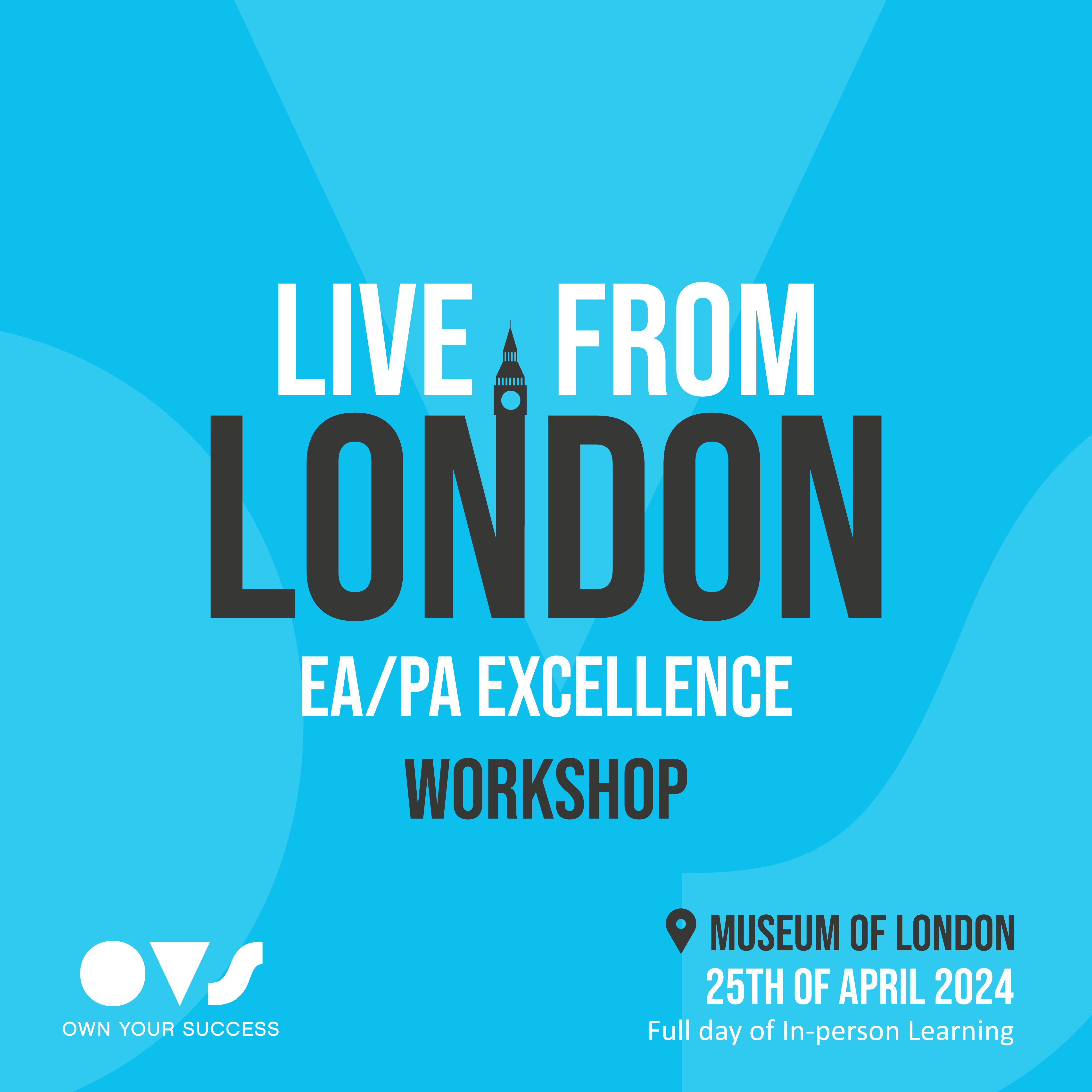

EA/PA Excellence Workshop Live from London on the 25th of April 2024. Featuring Keynote speaker Reggie Love, former Special Assistant to 44th President of the USA, Barrack Obama. Panel featuring Sophie Chapman, assistant to Steven Bartlett entrepreneur, author, host of the diary of a CEO and youngest ever dragon on BBC's Dragon's Den, Victoria Wratten, CEO of the Executive & Personal Assistants Association. The workshop contains, panel talk, keynote talk and facilitation over key topics from Kate Wood over the course of the day.

Contract and commercial management for practitioners (In-House)

By The In House Training Company

This five-day programme empowers participants with the skills and knowledge to understand and effectively apply best practice commercial and contracting principles and techniques, ensuring better contractor performance and greater value add. This is an assessed programme, leading to the International Association for Contracts & Commercial Management (IACCM)'s coveted Contract and Commercial Management Practitioner (CCMP) qualification. By the end of this comprehensive programme the participants will be able to: Develop robust contracting plans, including scopes of work and award strategies Undertake early market engagements to maximise competition Conduct effective contracting and commercial management activities, including ITT, RFP, negotiated outcomes Understand the legalities of contract and commercial management Negotiate effectively with key stakeholders and clients, making use of the key skills of persuading and influencing to optimise outcomes Undertake effective Supplier Relationship Management Appreciate the implications of national and organisational culture on contracting and commercial activities Appreciate professional contract management standards Set up and maintain contract and commercial management governance systems Take a proactive, collaborative, and agile approach to managing commercial contracts Develop and monitor appropriate and robust KPIs and SLAs to manage the contractor and facilitate improved contractor performance Appreciate the cross-functional nature of contract management Collaborate with clients to deliver sustainable performance and to manage and exceed client expectations Understand the roles and responsibilities of contract and commercial managers Use effective contractor selection and award methods and models (including the 10Cs model) and use these models to prepare robust propositions to clients Make effective use of lessons learned to promote improvements from less than optimal outcomes, using appropriate templates Effectively manage the process of change, claims, variations, and dispute resolution Develop and present robust propositions Make appropriate use of best practice contract and commercial management tools, techniques, and templates DAY ONE 1 Introduction Aims Objectives KPIs Learning strategies Plan for the programme 2 The contracting context Key objectives of contract management Importance and impact on the business 3 Critical success factors Essential features of professional commercial and contract management and administration The 6-step model 4 Putting the 'management' into commercial and contract management Traditional v 'new age' models The need for a commercial approach The added value generated 5 Definitions 'Commercial management' 'Contract management' 'Contracting' ... and why have formal contracts? 6 Stakeholders Stakeholder mapping and analysis The 'shared vision' concept Engaging with key functions, eg, HSE, finance, operations 7 Roles and responsibilities Contract administrators Stakeholders 8 Strategy and planning Developing effective contracting plans and strategies DAY TWO 1 Contract control Tools and techniques, including CPA and Gantt charts A project management approach Developing effective contract programmes 2 The contracting context Key objectives of contract management Importance and impact on the business 3 Tendering Overview of the contracting cycle Requirement to tender Methods Rationale Exceptions Steps Gateways Controls One and two package bids 4 Tender assessment and contract award I - framework Tender board procedures Role of the tender board (including minor and major tender boards) Membership Administration Developing robust contract award strategies and presentations DAY THREE 1 Tender assessment and contract award II - processes Pre-qualification processes CRS Vendor registration rules and processes Creating bidder lists Disqualification criteria Short-listing Using the 10Cs model Contract award and contract execution processes 2 Minor works orders Process Need for competition Role and purpose Controls Risks 3 Contract strategy Types of contract Call-offs Framework agreements Price agreements Supply agreements 4 Contract terms I: Pricing structures Lump sum Unit price Cost plus Time and materials Alternative methods Target cost Gain share contracts Advance payments Price escalation clauses 5 Contract terms II: Other financial clauses Insurance Currencies Parent body guarantees Tender bonds Performance bonds Retentions Sub-contracting Termination Invoicing 6 Contract terms III: Risk and reward Incentive contracts Management and mitigation of contractual risk DAY FOUR 1 Contract terms IV: Jurisdiction and related matters Applicable laws and regulations Registration Commercial registry Commercial agencies 2 Managing the client-contractor relationship Types of relationship Driving forces Link between type of contract and style of relationships Motivation - use of incentives and remedies 3 Disputes Types of dispute Conflict resolution strategies Negotiation Mediation Arbitration DAY FIVE 1 Performance measurement KPIs Benchmarking Cost controls Validity of savings Balanced scorecards Using the KPI template 2 Personal qualities of the contract manager Negotiation Communication Persuasion and influencing Working in a matrix environment 3 Contract terms V: Drafting skills Drafting special terms 4 Variations Contract and works variation orders Causes of variations Risk management Controls Prevention Negotiation with contractors 5 Claims Claims management processes Controls Risk mitigation Schedules of rates 6 Close-out Contract close-out and acceptance / completion HSE Final payments Performance evaluation Capturing the learning 7 Close Review Final assessment Next steps

Search By Location

- Membership Courses in London

- Membership Courses in Birmingham

- Membership Courses in Glasgow

- Membership Courses in Liverpool

- Membership Courses in Bristol

- Membership Courses in Manchester

- Membership Courses in Sheffield

- Membership Courses in Leeds

- Membership Courses in Edinburgh

- Membership Courses in Leicester

- Membership Courses in Coventry

- Membership Courses in Bradford

- Membership Courses in Cardiff

- Membership Courses in Belfast

- Membership Courses in Nottingham