- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

VTCT Levels 2, 3 & 4 Training Package: Your Journey to a Successful Career in Beauty Therapy

By Cosmetic College

Unlock your potential in the beauty industry with our Ultimate Value Training Package! This all-inclusive training package combines our highly sought-after VTCT Level 2 Facial & Skincare, VTCT NVQ Level 3 in Beauty Therapy, and VTCT Level 4 Laser Hair Removal & Skin Rejuvenation training courses. Invest in your future with this comprehensive package that will empower you with the knowledge and skills needed for a successful career in beauty therapy. What's Included: VTCT Level 2 Facial & Skincare Course Standalone Cost: 1,350 Learn the fundamentals of facial treatments and skincare Master techniques for various skin types and conditions Gain hands-on experience with industry-standard products and equipment VTCT NVQ Level 3 in Beauty Therapy Standalone Cost: 2,550 Expand your skills in advanced beauty treatments Delve into specialised techniques such as microdermabrasion and electrical treatments Enhance your client consultation and communication skills VTCT Level 4 Laser Hair Removal & Skin Rejuvenation Standalone Cost: 1,350 Master advanced techniques and cutting-edge beauty treatments Qualify in laser hair removal, light therapies, as well as aesthetic treatments Develop skills in managing a beauty therapy business Your Investment Ultimate Value Training Package - 4,230 (30% saving of 2,450!) Why Choose Our Ultimate Value Training Package? Comprehensive training: Our package covers a wide range of beauty therapy techniques, from foundational to advanced, ensuring a well-rounded education in the field. Expert instructors: Learn from experienced professionals who are passionate about sharing their knowledge and expertise. Flexible scheduling: Our courses are designed to accommodate your busy schedule with a variety of learning options, including full time, part-time and weekend classes. Hands-on experience: Gain valuable practical experience in our state-of-the-art training facilities. Industry-leading qualifications: Our courses are accredited by VTCT, ensuring you receive high-quality training that meets industry standards and is internationally recognised. Take the First Step Towards a Rewarding Career in Beauty Therapy Ready to embark on your journey to success in the beauty therapy industry? Our Ultimate Value Training Package is the perfect investment in your future. With comprehensive training, hands-on experience, and expert guidance, you'll be well on your way to a fulfilling and lucrative career. Don't miss out on this incredible offer! Enrol today and start building the foundation for a successful career in beauty therapy.

VTCT Level 4 Award in the Internal Quality Assurance of Assessment Processes and Practice

By Cosmetic College

If you're interested in advancing your career in the education and training industry, this course is perfect for you. The course covers the essential skills and knowledge required to internally assure the quality of assessment in the education and training sector. Upon completion, you'll be able to conduct internal quality assurance activities and assess the competence of assessors. This certification is ideal for those who aspire to become internal quality assurers, lead internal quality assurance teams, or wish to enhance their career prospects in the education and training industry. Our course is available at a competitive price of 499 and is delivered online through our e-learning platform. You'll be able to complete the course at your own pace and convenience, with support from our experienced instructors. This course is ideal for those who want to advance their career in the education and training industry. Become a certified internal quality assurer with our VTCT Level 4 Award in the Internal Quality Assurance of Assessment Processes and Practice course.

BWY Yoga Teacher Training

By Rose School Of Transformational Yoga

If you have a regular practice and are interested in becoming a Yoga Teacher than this course is for you.

This Level 4 City and Guilds 2396-01 Design and Verification of Electrical Installations course has been designed to help develop the skills and up date the knowledge of the requirements to enable you to professionally design, erect and then verify an electrical installation. This course is aimed at those who will have responsibility for designing, supervising, installing and testing electrical installations. Further information can be found here: C&G 2396 Electrical Design Course — Optima Electrical Training (optima-ect.com)

Understanding Safe Clinical Practice Professional Development and Competence/Resilience/Mental Health and Wellbeing Interprofessional Communication Reflective Practice Health Promotion and Motivational Interviewing Clinical Skills and Chronic Disease-Asthma COPD/B12/Wound Care/Diabetes/Cardiovsacular/ECG's

AAT Level 4 Diploma in Professional Accounting

By London School of Science and Technology

This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Course Overview This qualification covers complex accounting and finance topics and tasks leading to students becoming confident with a wide range of financial management skills and applications. Students will gain competencies in drafting financial statements for limited companies, recommending accounting systems strategies and constructing and presenting complex management accounting reports. Study the Level 4 Diploma in Professional Accounting to master complex accounting tasks and qualify for senior finance roles, as well as AAT full membership. The jobs it can lead to: • Accounts payable and expenses supervisor • Assistant financial accountant • Commercial analyst • Cost accountant • Fixed asset accountant • Indirect tax manager • Payroll manager • Payments and billing manager • Senior bookkeeper • Senior finance officer • Senior fund accountant • Senior insolvency administrator • Tax supervisor • VAT accountant Entry Requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Applied Management Accounting (mandatory): This unit allows students to understand how the budgetary process is undertaken. Students will be able to construct budgets and then identify and report on both areas of success and on areas that should be of concern to key stakeholders. Students will also gain the skills required to critically evaluate organisational performance. Learning outcomes: • Understand and implement the organisational planning process. • Use internal processes to enhance operational control. • Use techniques to aid short-term and long-term decision making. • Analyse and report on business performance. Drafting and Interpreting Financial Statements (mandatory): This unit provides students with the skills and knowledge for drafting the financial statements of single limited companies and consolidated financial statements for groups of companies. It ensures that students will have a proficient level of knowledge and understanding of international accounting standards, which will then be applied when drafting the financial statements. Students will also have a sound appreciation of the regulatory and conceptual frameworks that underpin the preparation of limited company financial statements. Learning outcomes: • Understand the reporting frameworks that underpin financial reporting. • Draft statutory financial statements for limited companies. • Draft consolidated financial statements. • Interpret financial statements using ratio analysis. Internal Accounting Systems and Controls (mandatory): This unit teaches students to consider the role and responsibilities of the accounting function, including the needs of key stakeholders who use financial reports to make decisions. Students will review accounting systems to identify weaknesses and will make recommendations to mitigate identified weaknesses in future operations. Students will apply several analytical methods to evaluate the implications of any changes to operating procedures. Learning outcomes: • Understand the role and responsibilities of the accounting function within an organisation. • Evaluate internal control systems. • Evaluate an organisation’s accounting system and underpinning procedures. • Understand the impact of technology on accounting systems. • Recommend improvements to an organisation’s accounting systems. Business Tax (optional): This unit introduces students to UK taxation relevant to businesses. Students will understand how to compute business taxes for sole traders, partnerships and limited companies. They will also be able to identify tax planning opportunities while understanding the importance of maintaining ethical standards. Learning outcomes: • Prepare tax computations for sole traders and partnerships. • Prepare tax computations for limited companies. • Prepare tax computations for the sale of capital assets by limited companies. • Understand administrative requirements of the UK’s tax regime. • Understand the tax implications of business disposals. • Understand tax relief, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs. Personal Tax (optional): This unit provides students with the fundamental knowledge of the three most common taxes that affect taxpayers in the UK: Income Tax, Capital Gains Tax and Inheritance Tax. With this knowledge students will be equipped to not only prepare the computational aspects of taxes, where appropriate, but also appreciate how taxpayers can legally minimise their overall taxation liability. Learning outcomes: • Understand principles and rules that underpin taxation systems. • Calculate UK taxpayers’ total income. • Calculate Income Tax and National Insurance contributions (NICs) payable by UK taxpayers. • Calculate Capital Gains Tax payable by UK taxpayers. • Understand the principles of Inheritance Tax. Audit and Assurance (optional): This unit aims to give a wider understanding of the principles and concepts, including legal and professional rules of audit and assurance services. The unit will provide students with an awareness of the audit process from planning and risk assessment to the final completion and production of the audit report. Students will also get a practical perspective on audit and assurance, with an emphasis on the application of audit and assurance techniques to current systems. Learning outcomes: • Demonstrate an understanding of the audit and assurance framework. • Demonstrate the importance of professional ethics. • Evaluate the planning process for audit and assurance. • Review and report findings. Cash and Financial Management (optional): This unit focuses on the important of managing cash within organisations and covers the knowledge and skills to make informed decision on financing and investment in accordance with organisational policies and external regulations. Students will identify current and future cash transactions from a range of sources, learn how to eliminate non-cash items and use various techniques to prepare cash budgets. Learning outcomes: • Prepare forecasts for cash receipts and payments. • Prepare cash budgets and monitor cash flows. • Understand the importance of managing finance and liquidity. • Understand the way of raising finance and investing funds. • Understand regulations and organisational policies that influence decisions in managing cash and finance. Credit and Debt Management (optional): This unit provides an understanding and application of the principles of effective credit control systems, including appropriate debt management systems. Students will be introduced to techniques that can be used to assess credit risks in line with policies, relevant legislation and ethical principles. Learning outcomes: • Understand relevant legislation and contract law that impacts the credit control environment. • Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures. • Understand the organisation’s credit control processes for managing and collecting debts. • Understand different techniques available to collect debts. DURATION 420-440 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Digital Brows Training | Fundamental Beginners PMU Training - 1-2-1 Private Training

By ID Liner | Permanent Makeup Training & Supplies

students learn a variety of different brow tattooing techniques, so we will spend two days learning the shaded brow effects possible with a digital device and three days focused on our most-requested Hairstroke Brows.

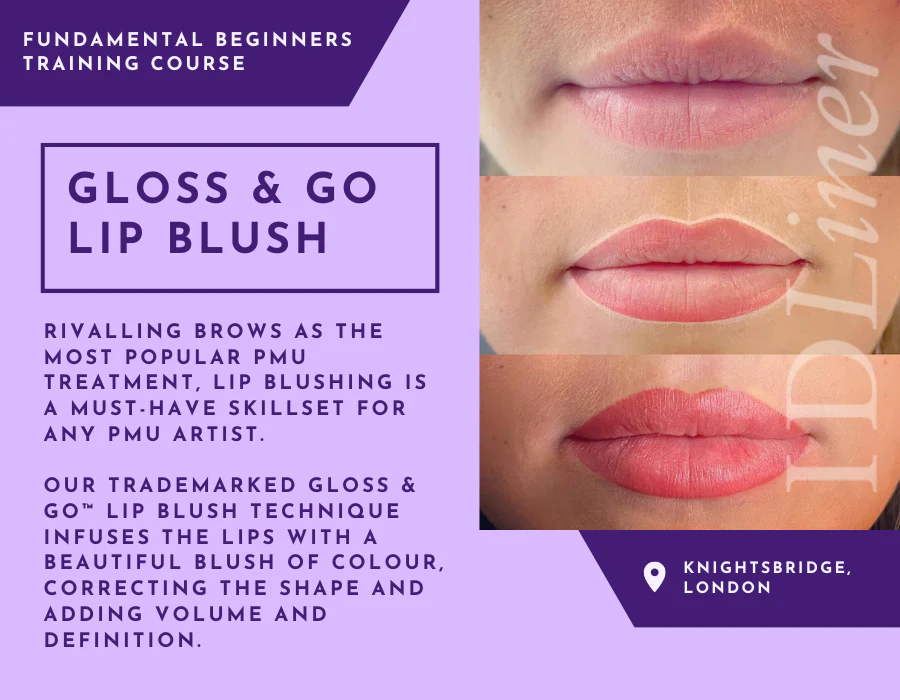

GLOSS & GO™ Lip Blush Training | Fundamental Beginners PMU Training - 1-2-1 Private Training

By ID Liner | Permanent Makeup Training & Supplies

On successful completion of the ID Liner Gloss & Go™ Lip Blush training course, students will not only be given the skills and tools to offer this incredibly popular treatment to their clients but will also be permitted to advertise the trademark, giving them an edge in a competitive market.

Permanent Eyeliner | Fundamental Beginners PMU Training - 1-2-1 Private Training

By ID Liner | Permanent Makeup Training & Supplies

The objective of the ID Liner Permanent Eyeliner fundamental course is to teach you how to achieve this look for your clients. It is the perfect solution for clients who struggle to draw on their own eyeliner or who just want an expertly enhanced look 24/7

Search By Location

- Level 4 Courses in London

- Level 4 Courses in Birmingham

- Level 4 Courses in Glasgow

- Level 4 Courses in Liverpool

- Level 4 Courses in Bristol

- Level 4 Courses in Manchester

- Level 4 Courses in Sheffield

- Level 4 Courses in Leeds

- Level 4 Courses in Edinburgh

- Level 4 Courses in Leicester

- Level 4 Courses in Coventry

- Level 4 Courses in Bradford

- Level 4 Courses in Cardiff

- Level 4 Courses in Belfast

- Level 4 Courses in Nottingham