- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Teacher Training for ECTs & Student Teachers - In Person Tuition - London, Lambeth, Wandsworth, Merton, Southwark, Kensington & Chelsea

5.0(8)By GLA Tutors Home or Online

A pioneering provider of independent mentoring services For adults who are training to be teachers and Early Career Teachers (ECTs), our mission is to support and empower aspiring educators as they navigate their journey towards becoming skilled and confident professionals in the teaching profession. As a mentorship program tailored specifically for adults pursuing a teaching career, we understand the unique challenges and expectations placed upon trainees in the profession. We are committed to providing comprehensive and personalised support to help trainees meet the teaching standards set by the Department for Education in England. The teaching standards and expectations in England Our experienced mentors are well-versed in the teaching standards and expectations in England. We provide guidance and practical assistance to trainees in areas such as lesson planning, classroom management, assessment strategies, and creating inclusive learning environments. Our aim is to help trainees develop a deep understanding of the curriculum, pedagogical approaches, and effective teaching techniques. Planning Planning is a crucial aspect of a teacher's role, and we offer specialised support to trainees in this area. Our mentors work closely with trainees to develop effective lesson plans that align with curriculum requirements and engage students in meaningful learning experiences. We provide guidance on designing differentiated instruction to meet the diverse needs of students, fostering a supportive and inclusive classroom environment. Confidence Confidence is essential for success in the teaching profession, and we are dedicated to helping trainees build their self-assurance. Our mentors provide individualised coaching and feedback, helping trainees develop their teaching skills, classroom presence, communication abilities, and interpersonal skills with other staff. We create a safe and supportive environment where trainees can explore their strengths, identify areas for growth, and gain the confidence needed to deliver impactful lessons and engage with students and the wider school community effectively. High quality resources In addition to planning and confidence-building, GLA Tutorsoffers a range of other support services to trainees. We provide resources and guidance on effective behavior management strategies, assessment and feedback techniques, and effective use of technology in the classroom. Our mentors also offer guidance on professional development opportunities, helping trainees stay updated with the latest educational research and best practices in teaching. A collaborative and ongoing process At GLA Tutors, we believe that mentorship is a collaborative and ongoing process. Our mentors build strong relationships with trainees, offering ongoing support, guidance, and encouragement throughout their training and early career stages. We understand the challenges and triumphs that trainees may encounter, and we are dedicated to helping them navigate their journey towards becoming successful and impactful teachers. ChooseGLA Tutorsas your trusted partner in your teaching journey. With our experienced mentors, personalised support, and comprehensive resources, we are committed to helping you meet the teaching standards, develop as a confident educator, and make a positive impact in the lives of your students. Invest in your future as a teacher and join us at GLA Tutors today.

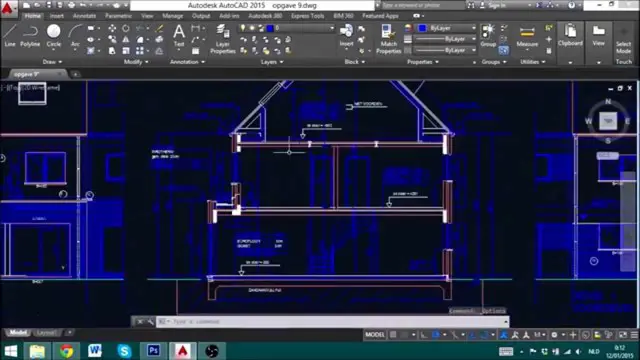

AutoCAD On Demand One to One Courses

By Real Animation Works

AutoCad Pay per Hour Training Course

3ds max on Demand One to one Training Course

By Real Animation Works

3ds max on One to one Training Course pay as you go

We deliver Workplace PAT Testing Courses across most of the UK to assist businesses with Compliance. We also work with Bridges into Work and ReACT in association with Careers Wales and the Welsh Government to offer work based skills which some Candidates could be eligible for Government funding.

Essential Adobe InDesign Training Course

By ATL Autocad Training London

Who is this for? Essential Adobe InDesign Training Course. Acquire Adobe InDesign basics from certified instructors. Master layout design, typography, and core design concepts. Opt for in-person or live online sessions. Receive a Certificate of Completion and lifelong email assistance. Lean desktop publishing skills and quality layouts. Click here for more info: Website Duration: 5 hours Approach: Individualized 1-on-1 training with customized content. Schedule: Flexible sessions, available Monday to Saturday from 9 am to 7 pm. Course Outline: Module 1: Introduction to Adobe InDesign (1 hour) Familiarize with workspace and tools Create new documents with appropriate page size and margins Effectively format text and images Customize the interface for efficient workflow Module 2: Text Formatting and Styles (1 hour) Apply consistent character and paragraph styles Manage text flow using frames Organize lists with bullets and numbering Master special characters for precise typography Module 3: Working with Images (1 hour) Import and position images in documents Adjust image size and alignment within frames Create professional layouts with text wrapping around images Enhance visuals with image frames and effects Module 4: Layout Design (1 hour) Create precise grids and guides for alignment Arrange objects for balanced layouts Streamline work with layers Maintain consistency using master pages and templates Module 5: Printing and Exporting (1 hour) Understand color modes and print principles Export to PDF and other formats for diverse outputs Ensure print readiness through preflighting Efficiently archive and manage InDesign files Through practical exercises, solidify your grasp of each module, enabling you to design visually appealing layouts, craft documents for various purposes, and manage InDesign projects adeptly. Adobe InDesign's potential is vast, and this fundamentals course opens doors for you to explore diverse design projects. Seize this opportunity to unleash your creative prowess with InDesign! Upon completing the Adobe InDesign Fundamentals course, participants will be able to: Master InDesign Tools: Demonstrate proficiency in utilizing InDesign's essential tools, workspace, and interface for effective design workflows. Layout Design Skills: Create visually appealing layouts using grids, guides, and balanced object arrangements, ensuring professional-quality design. Text Formatting Mastery: Apply consistent character and paragraph styles, manage text flow, and enhance typography with special characters. Image Manipulation Expertise: Import, position, and enhance images within frames, integrating them seamlessly into layouts. Printing and Exporting Proficiency: Understand color modes, print principles, and export documents to various formats, ensuring print readiness and diverse output options. Efficient Project Management: Utilize layers, master pages, and templates for streamlined project organization and management in InDesign. Book Recommendations: "InDesign CC Classroom in a Book" by Kelly Kordes Anton and John Cruise: This official Adobe guide provides hands-on lessons and practical techniques for mastering InDesign's core features. "InDesign Type: Professional Typography with Adobe InDesign" by Nigel French: Explore advanced typography techniques, layout principles, and typographic finesse specific to Adobe InDesign. "Real World Adobe InDesign CC" by Olav Martin Kvern, David Blatner, and Bob Bringhurst: A comprehensive guide offering practical insights, tips, and real-world techniques for InDesign users of all levels. "The Adobe InDesign CS6 Book for Digital Photographers" by Scott Kelby: Focused on integrating photography with InDesign, this book provides valuable insights into creating visually stunning layouts with images. "InDesign Secrets" by David Blatner and Anne-Marie Concepción: This book is packed with expert tips, tricks, and techniques that can significantly enhance your efficiency and creativity in InDesign. 1-on-1 InDesign Courses: Personalized Learning: Tailored 1-on-1 courses designed to meet your specific learning needs and goals. Expert Instructors: Learn from industry professionals with extensive experience in animation and design. Flexible Scheduling: Schedule sessions at your convenience, allowing you to balance learning with your busy lifestyle. Comprehensive Curriculum: Dive deep into animation techniques, software mastery, and creative skills through our comprehensive courses. Hands-On Training: Get practical, hands-on experience with real-world animation projects, enhancing your skills effectively. Individual Attention: Benefit from personalized attention and detailed feedback from instructors, ensuring your progress and understanding. Professional Development: Acquire skills relevant to the industry, empowering you for career advancement in animation and related fields. Portfolio Enhancement: Develop a strong portfolio with the guidance of experts, showcasing your newfound skills and creativity. Post-Course Support: Enjoy continued support even after the course completion, ensuring you have resources for ongoing learning and growth. Certification: Receive a certificate upon course completion, validating your expertise and enhancing your professional credentials. Course Highlights: Master Adobe InDesign's key features for layout, text, images, and graphics. Learn design principles and typography techniques for visually appealing documents. Efficiently handle multi-page projects like magazines and brochures. Utilize styles, templates, and libraries for streamlined design and consistency. Explore advanced techniques for interactive PDFs and digital publishing. Earn a Certificate of Completion for your Adobe InDesign proficiency. Flexible learning options: in-person or live online sessions. Lifetime email support for ongoing assistance after the course. Adobe InDesign Learn & Support https://helpx.adobe.com ⺠support ⺠indesign Get started with Adobe InDesign. Find tutorials, the user guide, answers to common questions, and help from the community forum.

Autodesk AutoCAD Course 1-2-1 Evening and Weekends.

By Real Animation Works

Autocad face to face training customised and bespoke. Online or Face to Face

A pioneering provider of independent mentoring services For adults who are training to be teachers and Early Career Teachers (ECTs), our mission is to support and empower aspiring educators as they navigate their journey towards becoming skilled and confident professionals in the teaching profession. As a mentorship program tailored specifically for adults pursuing a teaching career, we understand the unique challenges and expectations placed upon trainees in the profession. We are committed to providing comprehensive and personalised support to help trainees meet the teaching standards set by the Department for Education in England. The teaching standards and expectations in England Our experienced mentors are well-versed in the teaching standards and expectations in England. We provide guidance and practical assistance to trainees in areas such as lesson planning, classroom management, assessment strategies, and creating inclusive learning environments. Our aim is to help trainees develop a deep understanding of the curriculum, pedagogical approaches, and effective teaching techniques. Planning Planning is a crucial aspect of a teacher's role, and we offer specialised support to trainees in this area. Our mentors work closely with trainees to develop effective lesson plans that align with curriculum requirements and engage students in meaningful learning experiences. We provide guidance on designing differentiated instruction to meet the diverse needs of students, fostering a supportive and inclusive classroom environment. Confidence Confidence is essential for success in the teaching profession, and we are dedicated to helping trainees build their self-assurance. Our mentors provide individualised coaching and feedback, helping trainees develop their teaching skills, classroom presence, communication abilities, and interpersonal skills with other staff. We create a safe and supportive environment where trainees can explore their strengths, identify areas for growth, and gain the confidence needed to deliver impactful lessons and engage with students and the wider school community effectively. High quality resources In addition to planning and confidence-building, GLA Tutorsoffers a range of other support services to trainees. We provide resources and guidance on effective behavior management strategies, assessment and feedback techniques, and effective use of technology in the classroom. Our mentors also offer guidance on professional development opportunities, helping trainees stay updated with the latest educational research and best practices in teaching. A collaborative and ongoing process At GLA Tutors, we believe that mentorship is a collaborative and ongoing process. Our mentors build strong relationships with trainees, offering ongoing support, guidance, and encouragement throughout their training and early career stages. We understand the challenges and triumphs that trainees may encounter, and we are dedicated to helping them navigate their journey towards becoming successful and impactful teachers. ChooseGLA Tutorsas your trusted partner in your teaching journey. With our experienced mentors, personalised support, and comprehensive resources, we are committed to helping you meet the teaching standards, develop as a confident educator, and make a positive impact in the lives of your students. Invest in your future as a teacher and join us at GLA Tutors today.

On-Demand SketchUp Training Course: Enhance Your 3D Design Skills

By Real Animation Works

Personalized SketchUp Training: Pay-As-You-Go One-to-One Sessions

Maya Evening Learning Sessions

By ATL Autocad Training London

Maya Evening Learning Sessions. Maya Evening Learning Sessions offer flexibility for professionals, interactive classes, supportive community, and skill enhancement in a convenient after-work schedule. Perfect for work-life balance and continued education. Click here for more info: Website Tailored Learning: Custom curriculum catering to your skill level. Course Duration: 10 hours. Approach: 1-to-1 Schedule: Craft your learning path by pre-booking hours from Mon to Sat, 9 am to 7 pm, accommodating your convenience. Maya 10-Hour Course Key Details: Duration: 10 hours of intensive training. Approach: Hands-on, interactive sessions focusing on essential Maya concepts and techniques. Curriculum Highlights: Introduction to Maya: Understanding the software interface and basic tools. 3D Modeling: Mastering polygon modeling techniques and object manipulation. Texturing and Materials: Learning to apply textures, materials, and UV mapping. Lighting and Rendering: Exploring lighting setups, camera compositions, and rendering methods. Animation Fundamentals: Grasping keyframe animation, editing clips, and basic character rigging. Special Effects and Dynamics: Creating particle systems, fluid simulations, and basic special effects. Who Should Attend: Beginners: Individuals new to 3D modeling and animation. Aspiring 3D Artists: Those aiming to pursue careers in animation, gaming, or visual effects. Creative Professionals: Designers and artists looking to expand their skill set into 3D graphics. Job Opportunities: Completing this Maya course equips participants with the skills necessary for various roles, including: 3D Modeler: Creating detailed 3D models for games, movies, or simulations. Animator: Bringing characters and scenes to life through animation. Texture Artist: Designing textures and materials to enhance 3D models. Lighting Artist: Illuminating scenes to evoke specific moods and atmospheres. Visual Effects Artist: Specializing in creating stunning visual effects for films and games. Participants completing the Maya 10-Hour Course will: Master Maya basics including modeling, texturing, lighting, and animation. Create 3D models, apply textures, and understand lighting and rendering principles. Develop essential skills in animation and special effects. Troubleshoot common issues in 3D projects. Recommended Books: "Introducing Autodesk Maya 2022" by Derakhshani: Comprehensive guide with hands-on tutorials. "Maya Character Creation" by Maraffi: Focuses on character modeling and animation techniques. "The Animator's Survival Kit" by Williams: Timeless principles applicable to any animation software. Maya 10-Hour Course Key Details: Duration: 10 hours of intensive training. Approach: Hands-on, interactive sessions focusing on essential Maya concepts and techniques. Curriculum Highlights: Introduction to Maya: Understanding the software interface and basic tools. 3D Modeling: Mastering polygon modeling techniques and object manipulation. Texturing and Materials: Learning to apply textures, materials, and UV mapping. Lighting and Rendering: Exploring lighting setups, camera compositions, and rendering methods. Animation Fundamentals: Grasping keyframe animation, editing clips, and basic character rigging. Special Effects and Dynamics: Creating particle systems, fluid simulations, and basic special effects. Who Should Attend: Beginners: Individuals new to 3D modeling and animation. Aspiring 3D Artists: Those aiming to pursue careers in animation, gaming, or visual effects. Creative Professionals: Designers and artists looking to expand their skill set into 3D graphics. Job Opportunities: Completing this Maya course equips participants with the skills necessary for various roles, including: 3D Modeler: Creating detailed 3D models for games, movies, or simulations. Animator: Bringing characters and scenes to life through animation. Texture Artist: Designing textures and materials to enhance 3D models. Lighting Artist: Illuminating scenes to evoke specific moods and atmospheres. Visual Effects Artist: Specializing in creating stunning visual effects for films and games. Adaptable Evening Maya Classes In-Depth 10-Hour Maya Program Hands-On Maya Projects Professional Maya Expertise Diverse Maya Applications Guidance from Experts Tailored Learning Experience Ongoing Email Assistance Access to Maya Trial and Resources Ignite Your Creative Potential!

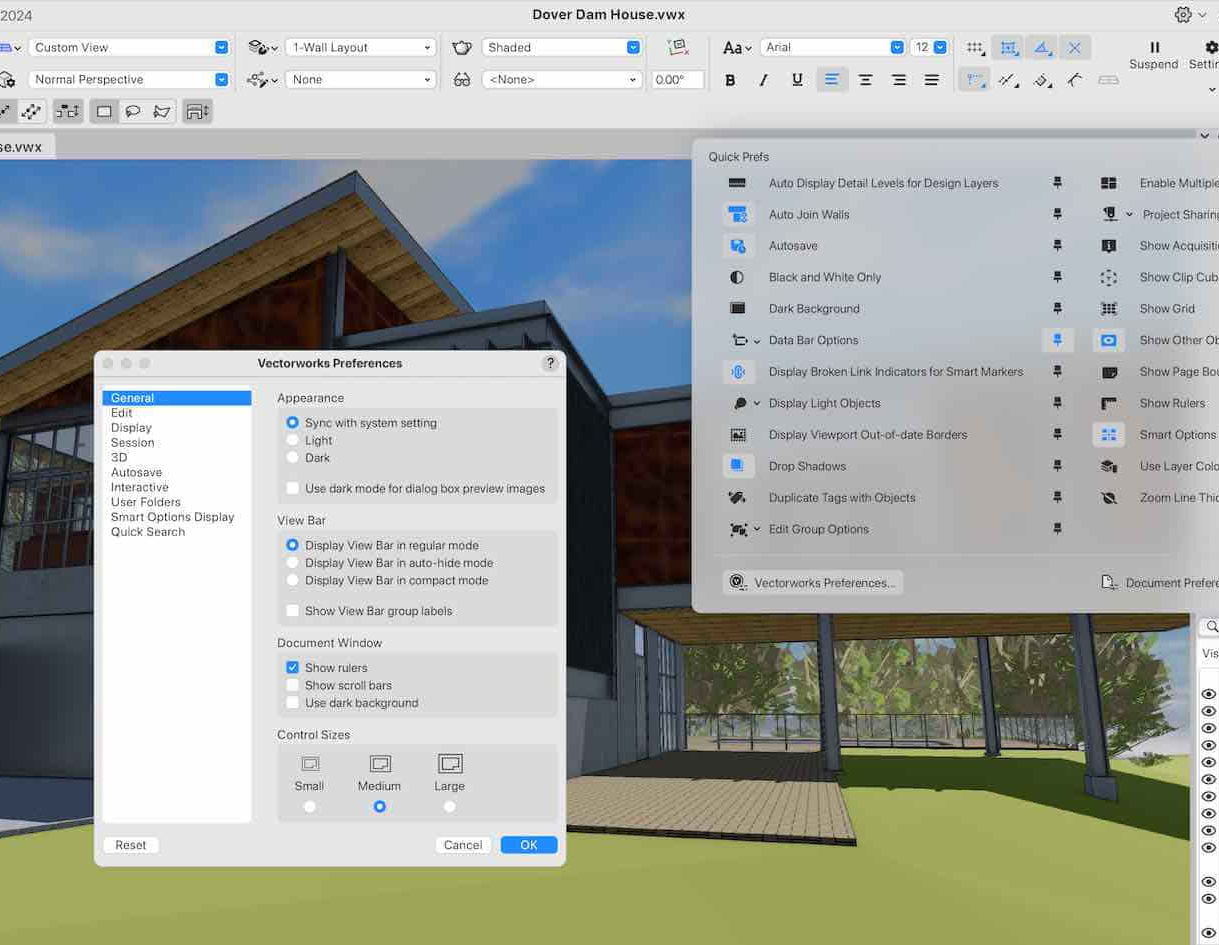

Vectorworks 2D Basics Level Training Course

By ATL Autocad Training London

Why Vectorworks 2D Basics Level Training Course? Vectorworks excels in 2D design, delivering exceptional results and serving as a robust 2D design tool. The Fundamentals course provides customizable tools for precise 2D drawings, while VectorWorks Architect streamlines the process with user-friendly, easy-to-learn tools. Click here for more info: Website Course Details: 10 hrs, Flexible 1-on-1 sessions, in-person or online. 9 am and 7 pm (Mon-Sat).10 hours, split as needed for your schedule. Module 1: Understanding CAD and Vectorworks The Role of CAD in Design Introduction to Vectorworks Software Module 2: Setting Up Your Workspace Workspace Configuration Basic Options and Preferences Module 3: Foundational Drawing Skills Drawing Techniques Selecting Objects Module 4: Advanced Object Editing Combining Shapes Mirroring Objects Rotating Objects Grouping Objects Module 5: Precision Drawing and Scaling Working with Scale Setting Preferences Saving Templates Module 6: Accurate Object Placement Drawing Precision Moving Objects Precisely Module 7: Advanced Editing Techniques Using Fillet Employing Offset Module 8: Introduction to Object Attributes and Groups Basic Attributes Editing Object Groups Module 9: Duplicating Objects Linear Duplicates Rectangular Duplicates Circular Duplicates Module 10: Creating Room Plans Designing Walls Incorporating Windows and Doors Module 11: Room Plan Development Room Plan Drawing Methods Module 12: Utilizing Additional Attributes Hatch Patterns Gradients Image Fills Module 13: Drawing Elevations Elevation Techniques Effective Methods Module 14: Importing Images for Graphics Graphic Illustration Image Integration Module 15: Symbols and Resource Management Creating Symbols Introduction to Resource Browser Module 16: Organizing Drawings with Design Layers Design Layer Usage Module 17: Labeling Drawings and Title Blocks Drawing Labels Title Block Text Module 18: Plotting and Printing User Interface and Terminology Printing Techniques Module 19: Creating Drawing Sheets A1, A2, and A3 Sheets Module 20: Utilizing Viewports Multiple Views Module 21: Professional Model Presentation Paper Space Presentation Converting to PDFs Module 22: Managing Files and Projects Module 23: Displaying Objects and Terminology Module 24: Objects and Data Management Module 25: Precise Object Placement Object Snaps Quick Select Module 26: Dividing and Measuring Objects Module 27: Dimensioning and Annotation Module 28: Working with Text Module 29: Custom Tool Palettes Module 30: Organizing Tool Palettes Module 31: Effective Tool Palette Usage Module 32: Standard Views and Drawing Techniques Module 33: Drawing Curves Arcs, Donuts, and Ellipses Module 34: Real-World Units and Measurements Module 35: Object Manipulation Changing Object Angles Module 36: File Management Saving, Exiting, and Opening Projects Module 37: Creating Mirror Images Module 38: Introduction to 3D Modeling Creating Extrusions Basic 3D Concepts Outcomes and Vectorworks Jobs: Vectorworks Proficiency: Gain expertise in using Vectorworks software for design tasks. 2D Design Skills: Create accurate 2D drawings and architectural plans. Advanced Editing: Efficiently manipulate and edit objects in your designs. Precision Drawing: Develop skills for precise scaling and drawing. These skills open doors to careers in design, architecture, engineering, entertainment, and more. Potential Jobs: Architectural Drafter Interior Designer Landscape Designer AD Technician Graphic Designer Construction Estimator Product Designer Set Designer Event Planner Urban Planner Vectorworks 2D Training Course Our Vectorworks training is thoughtfully designed to educate and inspire designers at every skill level. Whether you're just starting or a seasoned pro, our courses will furnish you with fresh skills, streamline your workflows, and unleash the full potential of your Vectorworks software. Online Training Choices Tailored Online Sessions: Customized training sessions tailored to your specific requirements and skill level. Virtual Classroom: Participate in interactive virtual classes from the convenience of your workspace. Getting Started Guides: Comprehensive guides to assist you in navigating the fundamentals of Vectorworks. In-Person Training Opportunities Customized On-Site Sessions: Hands-on training delivered directly to your office or at regional events. One-to-One: Engage in interactive learning at our training locations. Download Vectorworks https://www.vectorworks.net Personalized One-on-One Training: Get individualized attention and customized instruction. Flexible Scheduling: Choose your preferred training time and day to suit your schedule. Post-Course Assistance: Access free online support after course completion. Comprehensive Learning Materials: Receive PDF notes and handouts to enhance your learning. Certificate of Completion: Earn a recognition certificate upon successfully finishing the course. Affordable Rates: Enjoy cost-effective training rates. Software Setup Assistance: Receive help setting up the software on your computer. Referral Benefits: Recommend a friend and receive discounts on future courses. Group Training Discounts: Special discounts available for group training sessions. Convenient Availability: Access training sessions from Monday to Sunday, with extended hours. Tailored Training: Receive customized, bespoke training tailored to your specific requirements.

Search By Location

- career Courses in London

- career Courses in Birmingham

- career Courses in Glasgow

- career Courses in Liverpool

- career Courses in Bristol

- career Courses in Manchester

- career Courses in Sheffield

- career Courses in Leeds

- career Courses in Edinburgh

- career Courses in Leicester

- career Courses in Coventry

- career Courses in Bradford

- career Courses in Cardiff

- career Courses in Belfast

- career Courses in Nottingham