- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

SIA Door Supervisor Course + First Aid

By London Construction College

Take The SIA Door Supervisor Course + First Aid, This Will Take You 6 Days To Complete. Enrol Now On To The Course! What Is SIA Door Supervisor Course? The SIA (Security Industry Authority) Door Supervisor Training is a comprehensive training program designed to prepare individuals for roles as door supervisors within the security industry in the United Kingdom. Door supervisors play a critical role in ensuring safety and security at licensed premises, including bars, clubs, and events. This SIA Door Supervisor Course + First Aid is 6 days, this is a compulsory course in order to attain the Door Supervisor Licence. Furthermore, this will allow you to work as a doorman, nightclub security, retail security, corporate security, construction security and many other security sectors. Enrol now or contact us for any further details. Course Overview: 6 Days Course | 09:00 – 18:30 | Mon – Sat Every Week SIA Door Supervisor Course Road Map 1. Book Course Book your SIA Door Supervisor Training and First Aid Course in London (6 Days) 2. Attend Course Attend a 6-day course, and successfully pass all your SIA Door Supervisor exams. 3. Apply SIA Register for an account with SIA, and apply for your SIA Door Supervisor Licence. Course Information Why Choose SIA Door Supervisor Course? Expert Instructors Learn from seasoned professionals who bring real-world insights to the classroom. Our instructors are dedicated to your success, offering guidance and support throughout the training. Practical Training Gain hands-on experience in simulated security scenarios, preparing you for the challenges you’ll face in the field. Our practical sessions enhance your problem-solving skills and decision-making abilities SIA Compliance Stay ahead in the security industry by understanding and complying with SIA regulations. Our course covers the latest guidelines, ensuring you are well-versed in the legal and ethical aspects of security operations Job Placement Assistance We go beyond training by offering job placement assistance. Our network of industry connections helps you kickstart your security career with confidence. Ready To Begi Your SIA Journey? Your journey toward a rewarding and responsible career as a Door Supervisor starts here. Contact us today to enrol in our Door Supervisor Training at London Construction College, and take the first step towards an exciting and impactful career in security. Your future awaits! SIA Door Supervisor Course Content Unit 1 : Working In The Private Security Industry Legal Considerations in the Private Security Industry. Ensuring Health and Safety for Private Security Operatives . Awareness of Fire Safety. Procedures for Emergency Situations. Effective Communication Skills and Customer Care. Unit 2: Working As A Door Supervisor Adherence to Behavioral Standards. Understanding Civil and Criminal Law. Procedures for Search Operations. Protocols for Arrest Situations. Awareness of Drugs and Their Impact. Documentation of Incidents and Preservation of Crime Scenes. Compliance with Licensing Laws. Emergency Procedures. Unit 3: Conflict Management For The Private Security Industry Conflict Avoidance and Personal Risk Mitigation. De-escalation of Conflicts. Resolution and Lessons from Conflicts . Application of Communication and Conflict Management Skills for Door Supervisors. Unit 4: Physical Intervention Skills For The Private Security Industry Overview of Physical Intervention Skills. Essential Legislation Awareness . Fun Fact: The persuasive Communication and Conflict Management skills acquired in this course are applicable both professionally and personally in conflict situations. This standalone component alone holds a value exceeding the course price. SIA Door Supervisor Exam On the last day of the course, you’ll encounter four multiple-choice exams along with a practical assessment. We acknowledge that exams can be intimidating, but rest assured, there’s no cause for concern. The Door Supervisor course comprehensively covers all exam topics, and your skilled instructor will thoroughly equip you for success in these assessments. Embarking on an exciting career in the security industry as a Door Supervisor or Security Guard starts with the initial step of acquiring the right training. Throughout your Door Supervisor training, we guide you through the entire process, offering essential training and providing the necessary materials to assist you in obtaining your SIA Door Supervisor license. Document Checks Proof Of Identity You will need to provide documents that prove you are who you say you are. Address history You need to provide two proofs of address. Bank or building society statement issued within the last three months. Utility bill issued within the last three months. A credit card statement was sent to your current address within the last three months. Council Tax statement issued in the last 12 months. Mortgage statement issued in the last 12 months. Age You must be 18 or over to hold an SIA licence. Criminal record Please be aware, that even if you pass the SIA door supervisor, you will still need to pass SIA criminal record checks. If you live outside the UK, or you have spent 6 continuous months or more outside the UK in the last 5 years, you need to provide evidence of overseas criminal record checks to the SIA. SIA will only issue a licence after completing background checks. Right to work in the UK You must have the right to work in the UK to get a front-line or non-front-line licence. Important Things You Should Know FAQ SIA Door Supervisor Training What is the SIA Door Supervisor course, and why do I need it? The SIA Door Supervisor course is a training program designed for individuals seeking employment in the security industry, specifically in roles such as door supervision. The Security Industry Authority (SIA) requires this qualification for those working in designated roles to ensure a standard level of competence and professionalism. What does the SIA Door Supervisor Course cover? The SIA course covers a range of topics essential for door supervisors, including conflict management, physical intervention, emergency procedures, legal responsibilities, and customer service. It provides a comprehensive skill set needed to excel in the role. Can I take the course in London? Yes, the SIA Door Supervisor course is available in London. How long does the course take to complete? The SIA Door Supervisor and First Aid is completed over 6 days of training. Is there an age requirement for taking the SIA Door Supervisor course? Yes, you must be at least 18 years old to take the SIA Door Supervisor course as it is a legal requirement for working in the security industry. What are the job prospects after completing the course? Successfully completing the SIA Door Supervisor course enhances your employability in the security industry. Door supervisors are in demand in various establishments, including nightclubs, bars, and events, and having the SIA qualification opens up job opportunities in these sectors. Do I need any prior experience in security to enrol in the course? No, prior experience in security is not a prerequisite for enrolling in the SIA Door Supervisor course. The course is designed to provide comprehensive training for individuals at various levels, including those new to the security industry. Can I take the SIA Door Supervisor course if I’m not a UK citizen? Yes, the SIA Door Supervisor course is open to individuals regardless of nationality. However, it’s essential to ensure that you meet the legal requirements for working in the UK, including visa regulations.

Sketchup Courses London 1 on 1

By Real Animation Works

SketchUp Course With Layout and V-Ray

Introduction to Sketchup Course 1-2-1

By Real Animation Works

Sketchup face to face training customised and bespoke.

Interior Design Tutor one to one

By Real Animation Works

Interior design tutor one to one open 7 days 9 am to 9 pm

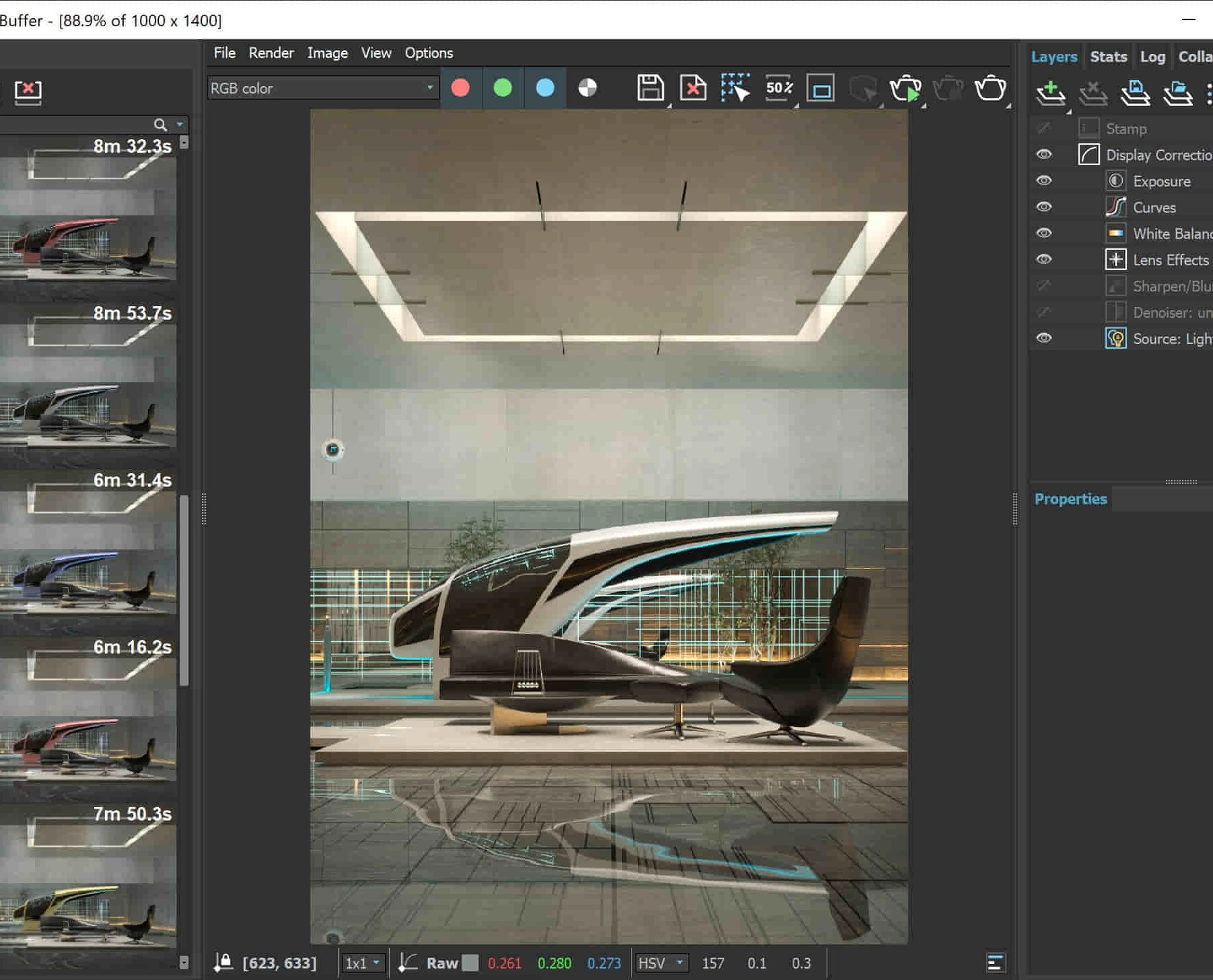

3ds Max and Vray Training

By London Design Training Courses

Why Choose 3ds Max and Vray Training Course? Click here for more info 3ds Max a valuable tool for architectural modeling, product design, and manufacturing across numerous industries. While widely utilized, mastering the software requires effort. Engaging in 3ds Max tutorials proves particularly advantageous for game designers, aiding in their career advancement. Duration: 10 hrs Method: 1-on-1, Personalized attention Schedule: Tailor your own hours, available from Mon to Sat between 9 am and 7 pm Our 3ds Max course consists of two main sections, covering architectural visualizations for both interior and exterior scenes. By the end of the training, you'll have the expertise to create professional projects independently. We begin with fundamental and advanced 3D modeling, starting from simple objects and progressing to complex buildings, interiors, and products. 3ds Max and Vray Comprehensive Course Course Duration: 10 hours Course Overview: This course is designed to offer a comprehensive introduction to 3ds Max and Vray. Throughout this program, you will acquire the knowledge necessary to proficiently create 3D models, apply materials and textures, configure lighting and camera systems, and produce high-quality Vray renders. This course is suitable for individuals with various levels of experience, from beginners to those with some prior exposure to 3D modeling and rendering. Course Outline: Module 1: Introduction to 3ds Max and Vray Familiarization with the 3ds Max interface Configuring the workspace Navigating within 3ds Max Introduction to Vray and its user interface Module 2: 3D Modeling Creating fundamental shapes Employing modifiers Crafting intricate shapes through advanced 3D modeling techniques Grasping the fundamentals of polygonal modeling Crafting both organic and inorganic models Module 3: Materials and Textures Application and modification of textures Understanding UVW mapping Utilizing the material editor Developing custom materials Leveraging Vray materials Module 4: Lighting Introduction to various lighting techniques Exploring different types of lights Comprehending light properties Configuring lights for a scene Employing Vray lights Module 5: Cameras Familiarization with camera systems Understanding camera properties Setting up camera views Creating animations using cameras Utilizing Vray cameras Module 6: Rendering Introduction to rendering Exploring Vray Global Illumination Utilizing Vray Physical Cameras Harnessing Vray HDRI Lighting Implementing the Vray Rendering Workflow Module 7: Projects Integrating all acquired knowledge Crafting a simple interior scene Constructing a basic exterior scene Developing a complex scene featuring multiple objects and materials Course Requirements: To participate in this course, you will need: A computer with 3ds Max and Vray installed (trial versions can be obtained from Autodesk and Chaos Group websites) Basic computer operation skills An interest in 3D modeling and animation Course Goals: Upon completing this course, you will have gained a comprehensive understanding of 3ds Max and Vray. You will possess the skills required to create realistic and visually captivating 3D scenes using Vray. Furthermore, you will be well-equipped to continue honing your 3D modeling and rendering abilities. Resources: Vray Trial Download: https://www.chaosgroup.com/vray/sketchup/free-trial Materials:https://www.vray-materials.de/ Textures: https://textures.com/ By completing the 3ds Max and Vray Training Course, participants will acquire proficiency in 3D modeling and rendering using 3ds Max. They will establish a solid foundation and essential skills, enabling them to create captivating visualizations. This expertise opens doors to various job opportunities in fields such as architectural visualization, game design, film production, and product modeling.

InDesign Evening Training

By London Design Training Courses

Why Choose InDesign Evening Training Course? Course Link. If you aim to enhance your design abilities, acquire proficiency in a new software, or pursue a career in graphic design, an InDesign course is highly beneficial. Tailored for individuals with foundational knowledge of Adobe InDesign, this training is designed to further develop your existing skills. Duration: 10 hrs Method: 1-on-1, Personalized attention Schedule: Tailor your own hours of your choice, available from Mon to Sat between 9 am and 7 pm InDesign Evening Course Outline (10 hours) Introduction Getting Started with Adobe InDesign CC Advanced Course Adjusting Workspace for Maximum Efficiency Customizing Default Font Size for New Documents Utilizing Special Features for Typekit & Open Type Fonts Exploring Sources for Free Fonts in InDesign Mastering Fonts in Adobe InDesign CC Identifying Fonts with Font Guess Selecting Beautiful Font Pairings Incorporating Free Icons from Adobe Market Using the Color Theme Tool Understanding Colour Modes Importing and Setting Default Colors Finding Great Colors with Adobe Color Managing Appearance of Black & Proofing Colors Creating Multiple Shapes with Gridify Live Distribute Drawing Arrows in InDesign CC Designing Complex Flowers in InDesign CC Utilizing Auto Size for Auto-Expanding Text Boxes Exploring Placeholder Text Alternatives Adding Paragraph Borders & Shading Understanding Paragraph vs Single Line Composer Making Paragraphs Span 2 Columns Mastering Justification & Hyphenation Options Aligning Optical Margins Harnessing the Power of Keep Options Working with Advanced Anchored Objects Using Conditional Text Creating Pie Charts & Bar Graphs Pros & Cons of Interactive Types Creating Interactive PDFs Adding Interactive Page Transitions Adding Navigation to Interactive PDFs Understanding Publish Online in InDesign CC Publishing Adobe InDesign Documents Online Adding Video to InDesign Documents Creating Button-Triggered Animations Making Multi-State Objects Incorporating Adobe Animate CC to InDesign Files Adding Maps & Calendars to Interactive Documents Generating QR Codes in InDesign CC Exploring Essential Keyboard Shortcuts Automatically Placing Text on Multiple Pages Creating Cross References & Index Adding Document Name Automatically with Text Variables Utilizing Adobe InDesign CC Book Feature Changing Preferences for Advanced Users Speeding Up Workflow for Advanced Users Using Character Styles Advanced Paragraph Styles Mapping Word Styles with InDesign Styles Creating Nested Styles & Grep Styles Using Next Style Mastering Object Styles Best Practices for Working Across Multiple Documents Utilizing Adobe Stock with InDesign CC Cropping Images Inside Text Making InDesign Layouts with Adobe Comp CC Advanced Use of CC Libraries Integrating Photoshop & Illustrator in InDesign CC Creating PDF Forms in InDesign CC Advanced Use of the Pages Panel Placing InDesign Documents Inside Each Other Installing and Using Scripts in InDesign CC Improving InDesign Performance Advanced Exporting & Printing Tricks Bonus: Software Updates Adobe InDesign https://adobe.com › indesign › get-started Installing for the first time or on a new computer? Click Get InDesign below to begin downloading. Follow the onscreen instructions to sign-in and install.

The Therapeutic Power of Language

By Human Givens College

– a psychotherapy skills masterclass The language we use has a huge impact on others – on this practical, inspiring course you will learn how to combine solution-focused techniques and effective language skills to help relieve distress and improve outcomes, as quickly as possible… Accredited CPD Certificate : 12 hours Length 2 days (9:30am - 4:00pm) Excellent course! I’ve learnt so much and been inspired so much. Gareth has a wonderful style of delivery...MARY FLYNN This course is suitable for anyone working with adults, teens or children – the knowledge and skills you will gain have a wide range of applications in addition to therapy and counselling, including coaching, healthcare, teaching, motivation, overcoming resistance, emotional turmoil and much more. You will leave with a powerful toolkit of precisely-targeted and creative therapeutic language skills, as well as a range of effective brief therapy strategies. These can be easily tailored to any individual and used to successfully help people resolve a wide range of conditions and problems as quickly as possible. If you want to be more effective in what you do, these are core skills to have… Denise Winn previously taught this course, it is now delivered by Gareth Hughes Why take this course Language is key to everything we do – being aware of the power of language to help or do harm is essential when we’re trying to help people. Knowing how to use it well can make all the difference to a successful therapeutic outcome. Paying attention to the language we use is central to the human givens approach to therapy and counselling: our choice of words is crucial in building rapport with people, learning more about someone – their unique qualities and abilities – in listening and responding, in providing motivation and in collaborating to agree goals and strategies for the effective resolution of their problems. The careful use of language is essential for other areas of life too: at work, home, with family and friends – and this 2-day course is accessible to all. It can be taken as part of the Human Givens Diploma or as a stand-alone course. You will gain a solid foundation in the most effective brief solution-focused strategies and language skills that are essential if you want to be able to help people as quickly as possible. By distilling the essence of proven brief therapy approaches and working in tune with the givens of human nature, outcomes can be dramatically improved and suffering successfully reduced. You will also learn how any team of professional healthcare workers can safely incorporate brief therapy techniques into their work with patients suffering from depression, anxiety, panic attacks, PTSD, anger, OCD, eating disorders, addiction and relationship/marital/family problems, thereby improving outcomes and reducing suffering on an even wider scale. Good to know This course gives you essential skills that are used in the successful treatment of a wide range of conditions, such as anxiety disorders, depression, addictions, self-harm, OCD and the rewind technique for treating trauma and phobias. They are also fundamental skills to have when using guided imagery and visualisation. This course is an essential component of Part 1 of the HG Diploma. I feel very excited and energised. I can't wait to start using these techniques...OCCUPATIONAL THERAPIST What will you learn The essential skills needed for successful brief therapy New information about the APET™ model – why it is so important to construct therapy that is in tune with our how brains work (our emotional reactions come first) – this speeds up therapy and explains why purely cognitive and behavioural approaches can take so long An ability to get to the root of the matter quickly by establishing which innate needs are not being met and why (the essence of effective brief therapy) Quick rapport building skills How to use the RIGAAR™ structure to improve therapy outcomes Reflective listening and reflective reframing How to use therapeutic language skills directly and indirectly to initiate change Ways to use solution-focused questioning to create a framework for change How to identify and use your client’s own life resources An understanding of why the human givens approach dramatically increases the likelihood of therapy being brief, regardless of the presenting problem A range of psychological interventions to use with common psychiatric problems: anxiety, panic attacks, depression, intrusive thoughts, relationship difficulties and so on Promoting cooperation by developing realistic and achievable goals How to identify exceptions (when the problem doesn’t occur) and get the patient to take credit for them How to generate motivation for change in your patients Separating the patient’s core identity from their problem How to minimise or overcome resistance How not to be drawn in to a client’s negative self-view Great use of case histories to illustrate the skills covered How to use the psychological laws of positive expectancy and concentrated attention An understanding of why taking this collaborative human givens stance, reduces stress and pressure on you Plenty of opportunity to consolidate what you are learning by practising the skills yourself How is the course structured? Held over two consecutive days, this skills-based practical workshop combines a blend of talks, demonstrations and exercises. Each day starts at 9.30pm and finishes at 4.00pm, with 2 breaks for networking and refreshment and 45 minutes for lunch. Course notes, refreshments and lunch are included on both days. Who is this course suitable for? You and your patients will benefit enormously from you attending these two days. If you are a counsellor, psychotherapist, clinical psychologist, mental health nurse, GP, doctor, nurse, OT, physiotherapist, youth worker, social worker, health visitor, support worker or any other caring professional, and wish to be more effective in what you do, this course gives you the perfect opportunity to discover new, subtle but highly effective skills with plenty of time to practise to help you assimilate them into your own work. Many other professions – such as educational and business professionals – also find the skills and information covered highly applicable to and beneficial for their own work. It is also suitable for anyone who is thinking of a career in this field as these are core skills needed for successful brief, solution-focused psychotherapy. This course has been independently accredited by the internationally recognised CPD Standards Office for 12 hours of CPD training. On completion of this training you’ll receive CPD certificates from the College and the CPD Standards Office.

ABT/NVQ Level 3 Upgrade Electrolysis Course

By The Angel Academy Of Teaching & Training

What Does The Course Include? When choosing a course ensure that it includes both theory and a wide variety of practical content. Every course should include: Anatomy and Physiology Types & structure of the hair Skin, blood and lymphatic circulation Reproductive and endocrine system Theory of Electric Currents Consultations & Record Cards Contra-indications & contra-actions Aftercare advice Choice of needles / probes Accurate probing techniques Legislation, Hygiene and Sterilisation Performing the correct stretch Short-wave Diathermy Galvanic/Blend The Heating Pattern Correct Insertion Techniques The Target Area Unusual Hair Growth FAQ’s Health and Safety Areas Treated This informal and structured weekend will teach all the required techniques necessary to perform successful hair removal treatments. Performed on massage couches, each student will receive guidance on how to effectively perform a full electrolysis treatment on the following areas: Leg Bikini Underarm Nape of Neck Brow Lip Chin Chest The Angel Academy prides itself on always a 100% pass rate for all of its courses since 2003. Classes are kept relatively small so that the tuition can always be of the highest standard. Over the years, all manner of student has come to the Angel Academy from Celebrity to Supermodel to Housewife to Career person looking for a way to relax from the every-day stress and strains that life presents them with.

3ds Max Basics Training Course

By ATL Autocad Training London

Who is this course for? 3ds Max Basics Training Course. This course is designed for beginners and enthusiasts looking to learn the fundamentals of 3ds Max. Whether you're a budding 3D artist, designer, or hobbyist, this training course provides a comprehensive introduction to the basics of 3ds Max. Click here for more info: Website Duration: 10 hrs Method: 1-on-1 and Personalized attention. Schedule: Tailor your own schedule by pre-booking a convenient hour of your choice, available from Mon to Sat between 9 am and 7 pm. Course Outline: 3D Modeling and Animation with 3ds Max I. Introduction to 3ds Max - Course overview and objectives - Navigating the user interface - Basic settings and preferences II. Creating 3D Objects - Building simple shapes with primitive objects - Craft complex designs using Editable Poly - Enhancing objects with modifiers - Applying materials and textures for realistic effects III. Lighting Techniques - Illuminating scenes with different light sources - Exploring various types of lighting - Adjusting light properties for desired effects - Casting shadows to enhance realism IV. Camera Control - Creating and configuring camera views - Fine-tuning camera settings for optimal shots - Animating cameras for dynamic scenes V. Animation Fundamentals - Mastering keyframe animation techniques - Utilizing the time slider and track view - Animating object transformations - Adding movement to materials and textures VI. Rendering Process - Configuring render settings for high-quality output - Selecting appropriate output formats - Streamlining rendering with batch processing - Enhancing final renders with post-processing effects VII. Project-Based Learning - Applying acquired skills to complete a final project - Exercising creativity and problem-solving abilities - Integrating modeling, animation, lighting, and rendering into the project In-Depth Course Outline: 1. Modeling - Edit Poly Modeling: Extrude, Chamfer, Cut, and Slices - Symmetry Mirror Modeling - Designing a Table and Chair - Creating a Basic House Model - Working with Lines and Shapes - Importing Plans from AutoCAD/Vectorworks - Crafting Interior Spaces - Adding Doors, Windows, Railings, and Trees - Implementing Stairs 2. Modifiers - Exploring Compound Objects - Utilizing Connect, Scatter, Pro Boolean, Loft, and Terrain Modifiers - Manipulating Bend, Taper, Twist, Stretch, Skew, FFD, Wave, Ripple, and Lattice - Employing the Lathe Modifier for Curved Objects 3. 3ds Max Basic Lights - Mastering Omni, Spot, and Direct Lights for Illumination 4. 3ds Max Camera - Understanding Free and Target Cameras for Optimal Shots 5. Texturing and Rendering - Applying Diffuse and Bump Mapping Techniques - Integrating Environment and Background Images - Configuring Render Settings for High-Quality Images - Lighting and Rendering Scenes in 3ds Max Upon completing our 3ds Max Basic Training Course, participants will: Master Fundamental 3D Modeling: Acquire proficiency in basic 3D modeling techniques, including object creation and manipulation. Texturing and Material Application: Learn the art of texturing and applying materials to 3D models for realistic rendering. Essential Lighting and Rendering Skills: Understand fundamental lighting principles and rendering techniques to create visually appealing scenes. Basic Animation Knowledge: Grasp the basics of animation, including keyframe animation and movement principles. Scene Composition and Camera Setup: Learn how to compose scenes effectively and set up cameras for different perspectives. Recommended Resources: Official Autodesk Documentation: Explore Autodesk's official website for 3ds Max documentation, including tutorials, user guides, and forums for troubleshooting. Books: Consider essential reads like '3ds Max For Dummies' by Kelly L. Murdock or '3ds Max 2022 Essentials' by Randi L. Derakhshani and Dariush Derakhshani for detailed guides on mastering the software. By utilizing these resources, participants can further enhance their 3ds Max skills and stay updated with the latest industry trends and techniques." Skills Acquired: Fundamental 3D Modeling Techniques in 3ds Max Texturing and Material Application Skills Lighting and Rendering Fundamentals Animation Basics and Keyframe Animation Introduction to Scene Composition and Camera Setup Career Opportunities: Entry-Level 3D Modeler Junior 3D Animator Texturing and Lighting Assistant CAD Designer in Architectural Firms Product Visualization Artist in Marketing Agencies Upon completing our 3ds Max Basic Training Course, students will acquire foundational 3D modeling and animation skills, opening doors to entry-level positions in various industries, including animation studios, architectural firms, and marketing agencies." Step into Personalized Learning with Us! Why Choose Us? Our Exclusive Benefits: Tailored One-on-One Training: Experience personalized coaching from skilled architects and designers, either face-to-face at (SW96DE) or via live online sessions. Sessions are available Monday to Saturday, 9 am to 7 pm. Customized Tutorials: Take home unique video tutorials crafted to elevate your learning experience. Comprehensive Learning Resources: Access a digital reference book for thorough revision, ensuring you grasp every concept effectively. Free Ongoing Support: Enjoy continuous post-course assistance via phone or email, ensuring your success extends beyond the class. Flexible Syllabus: We adapt syllabus and projects to match your specific needs, ensuring you learn exactly what matters most to you. Official Certificate: Certificate upon completing the course. Why Us? Personalized Learning Support: Our courses, ranging from 10 hours to 120 hrs Diploma training Courses, provide unwavering support at every stage. With personalized homework assignments and free after-course assistance, we pave the way to mastering software with unparalleled guidance. Individual Attention, No Crowded Classrooms: Bid farewell to overcrowded classrooms. Experience the intimacy of one-on-one learning. This ensures you receive the undivided attention you deserve, creating a confident and comfortable learning environment. Financial Flexibility: Embarking on your educational journey shouldn't be a financial burden. We offer a range of payment plans tailored to your needs. Explore the available options and embark on your learning adventure today. Expert Instructors, Real-world Expertise: Our instructors are meticulously chosen experts, renowned for their extensive industry knowledge and passion for teaching. They are dedicated to imparting invaluable skills to anyone eager to learn. Download 3ds max. Autodesk Download a free 30 day trial of 3ds Max

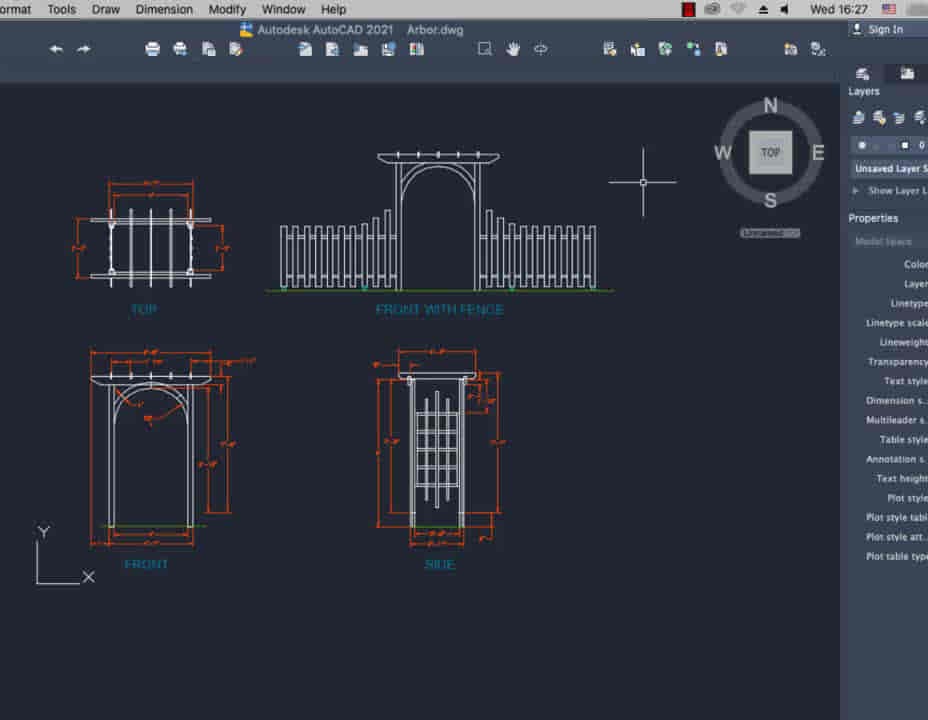

Bespoke AutoCAD Mac Basic-Intermediate Course

By ATL Autocad Training London

Why Learn Bespoke AutoCAD Mac Basic-Intermediate Course? Learn AutoCAD using your projects and learn how to use powerful tools and techniques for drawing, dimensioning, and printing 2D drawings with our Intermediate AutoCAD course. Check our Website How long is the training? 10 hours, Choose and split 10 hrs Mon to Sat 9 am to 7 pm. Book online or call 02077202581 or 07970325184. Method? 1-on-1, available in both in-person and Live Online. Course Topics Include: Building Fundamental Shapes Working with Lines, Arcs, and Polylines Utilizing Grip Tools Precision Object Alignment Data Management and Backups Exploring File Formats Ensuring Disaster Recovery Mastering Object Creation Handling Measurement Units Dynamic Input Techniques Inquiring Commands and Measurement Tools Effective Object Viewing Navigating Zoom and Pan Object Manipulation Strategies Object Selection Methods Swift Object Management Object Transformation Techniques Scaling and Altering Objects Trim, Extend, and Offset Functions Creating Geometric Variations Object Joining and Editing Corner Filleting and Chamfering Stretching Objects Organizing Your Drawings Layer Management Customizing Object Properties Applying Linetypes Layout Design and Setup Efficient Page Configurations Scaling Drawing Views Adding Annotations Multiline and Single-Line Text Creation Text Styling and Editing Dimensioning Concepts Customizing Dimension Styles Dimension Editing Implementing Multileaders Object Hatching Hatching Editing Reusable Content Management Blocks and Symbols Tool Palette Usage Working with Groups Model Space and Paper Space Understanding Layout Creation and Viewports Viewport Scaling Plotting and PDF Output Managing Multiple Sheet Drawings Utilizing Plotstyles Crafting Custom Drawing Templates Download AutoCAD Mac https://www.autodesk.co.uk After completing the AutoCAD for Mac course, learners can expect the following learning outcomes: Proficiency in AutoCAD: Participants will acquire the skills and knowledge needed to confidently use AutoCAD for Mac, including creating and editing drawings, managing objects, and applying precision techniques. Effective Design Skills: They will gain the ability to produce accurate 2D drawings, making them valuable assets in design-related professions. Jobs that individuals can pursue after completing this course include: Draftsperson: Working in architectural, engineering, or construction firms to create technical drawings and plans. CAD Technician: Assisting in the development of designs for various projects, such as product design or urban planning. Interior Designer: Using AutoCAD for space planning and layout design in the interior design industry. Architectural Designer: Collaborating on architectural projects, including creating floor plans and elevations. Mechanical Designer: Participating in the design and development of mechanical components and systems. Civil Engineering Technician: Supporting civil engineers in designing infrastructure projects, such as roads and bridges. Electrical or Electronics Designer: Assisting in the creation of electrical schematics and electronic circuit diagrams. Landscape Designer: Planning and visualizing outdoor spaces, gardens, and landscapes. Completing this AutoCAD course opens doors to various industries where precise and detailed 2D drawing skills are highly valued. The AutoCAD Mac Bespoke 1 on 1 Basics to Intermediate Level Training Course provides participants with a comprehensive skill set, enabling them to attain proficiency in using AutoCAD Mac. This course covers a wide range of functionalities and caters to individuals at all skill levels, whether they are beginners or experienced users. Participants will begin by learning fundamental features such as drawing, editing, annotations, and dimensioning. As they progress, they will delve into more advanced topics like object manipulation, customizing workspaces, and streamlining workflows. Key Benefits of the Course: Mastery of Mac-AutoCAD: Acquire expertise in both essential and advanced techniques for creating precise 2D drawings. Enhanced Productivity: Increase efficiency by implementing time-saving tips and optimizing your work processes. Versatile Design Abilities: Develop the skills to undertake diverse projects in fields such as architecture, engineering, and more. Industry-Relevant Competencies: Elevate your career prospects across various industries by gaining in-demand AutoCAD skills. Access to Recorded Lessons: Review and reinforce your learning at your convenience with access to recorded lesson sessions. Ongoing Email Support: Receive continuous assistance and guidance via email even after completing the course. Enroll today to benefit from interactive learning experiences guided by experienced instructors. Choose between flexible in-person or online sessions, gain access to lesson recordings, and enjoy a lifetime of email support. Tailored Guidance: Get personalized coaching and instruction tailored to your unique learning needs and objectives. Convenient Scheduling: Choose from flexible training slots available Monday to Saturday from 9 am to 7 pm, accommodating your busy schedule. Versatile Learning Options: Select between in-person training at our location, conveniently situated just 5 minutes away from Oval Tube Station, or participate in live online sessions from anywhere. Engaging Interactions: Participate in interactive sessions designed for questions, discussions, and problem-solving, creating an immersive learning experience. Effective Progression: Accelerate your learning with focused guidance, allowing you to advance at your own pace while mastering the material. Tailored Curriculum: Customize the course content to align with your prior knowledge and specific areas of interest, ensuring a relevant and engaging learning experience. Real-Time Guidance: Receive immediate feedback from the instructor, enhancing your comprehension and skill development. Comprehensive Support: Enjoy ongoing assistance and clarification opportunities through email or additional sessions beyond the course for an in-depth learning experience.

Search By Location

- career Courses in London

- career Courses in Birmingham

- career Courses in Glasgow

- career Courses in Liverpool

- career Courses in Bristol

- career Courses in Manchester

- career Courses in Sheffield

- career Courses in Leeds

- career Courses in Edinburgh

- career Courses in Leicester

- career Courses in Coventry

- career Courses in Bradford

- career Courses in Cardiff

- career Courses in Belfast

- career Courses in Nottingham