- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

This Excel Introduction course is a very good introduction to essential fundamental programming concepts using Excel as programming language. These concepts are daily used by professionals and are essential in most jobs. By the end, you'll be comfortable with Excel concepts, ribbons, formulas, and the Functions Wizard. You will gain hands-on practical experience creating a spreadsheet from scratch on your own.

Excel Intermediate Course, 1-Day. This course covers the essential Excel Intermediate, in our interactive, instructor led Live Virtual Classroom. You already know your way around Excel e.g. you understand some of the functionality on the Home Ribbons, can move around and format cells. etc. In the Excel intermediate course we cover in-depth functions and Formulae so that you will be able to create fantastic spreadsheets like budgets, forecasts, and more. You will be able to understand and unravel the complicated formulae created by your colleagues. During the course you will excellent spreadsheets so that you have examples to take away. Location: Instructor-led, Online. Our Style: Hands-on, Practical Course. Group Size: Max 4 people per group. Qualification: PCWorkshops Excel Intermediate Certification Hours: 1 Day, 10am-5pm Excel Intermediate Course, Course Outline. Working with Functions and Formulas The Function Wizard Using Functions in Excel: The 5 Popular functions If-else function Working with Names and Ranges Copying formulae Creating Formulae in Excel, general calculations. Lookups: Vlookup, Hlookup, Index, Match. Formatting a Range as a Table: Properties and behaviour of a table. Managing Tables: Working with Tables. Working with Tables: Working with Records and Fields. Filters and Sorting, Freeze panes, split, protecting and unprotecting. Using Excel as a Database: Advanced filter: copy only specified rows and columns from a large data set, auto mate this selective copy. Pivot-tables: Create Pivot Table, Refresh Data. Amend, Filter, Sort, Format Pivot Tables, Add additional Pivot formulae. Pivot Charts: Excel Pivot Charts and Sparklines. Examples and exercises with Pivot Charts and Sparklines. Other Excel Courses Inlcuded with the Excel Intermediate Course PCWorkshops Excel Intermediate Certificate on completion Excel Intermediate Notes Excel Code Examples Practical Excel Intermediate exercises Personal attention in a small group of up to 4 delegates Book the Excel Intermediate Course About us Our experienced trainers are award winners. More about us FAQ's Client Comments

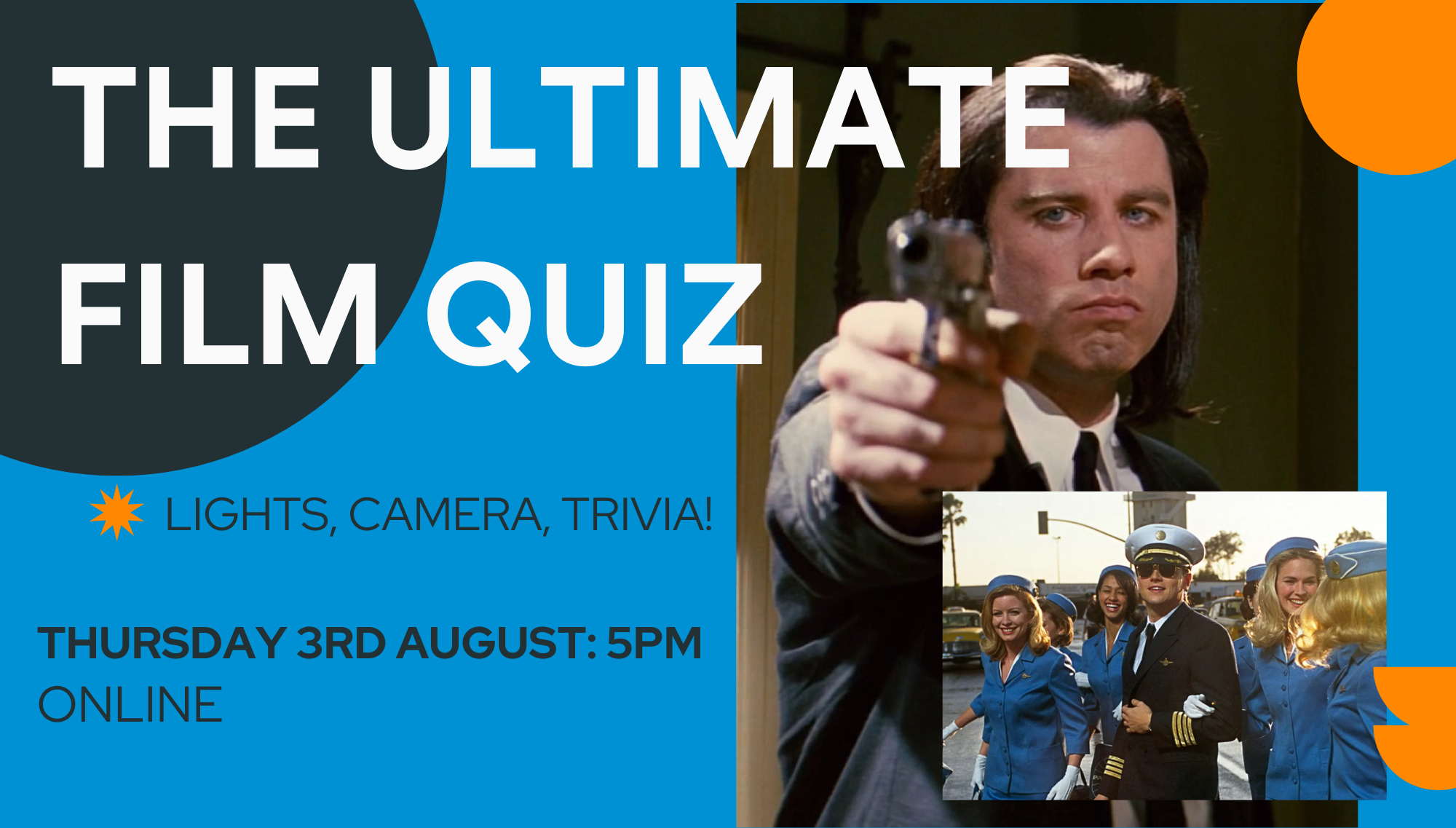

Date: Thursday 3rd August Time: 5pm Location: Online Come and meet your future classmates while you showcase your cinematic wisdom at our Ultimate Film Quiz! Event Details:Whether you're an aspiring filmmaker, actor or screenwriter, this quiz will test even our most cinema-savvy students! We'll be testing your knowledge on the timeless classics, heartwarming dramas and pulse pounding action masterpieces.So grab your popcorn and get ready to showcase your movie knowledge next Thursday, August 3rd at 5pm. The deadline to book this event is Monday 31st July 2023.

Sage Accounting Courses

By Osborne Training

Sage Accounting Courses Every business, no matter how large or small, is required legally to 'keep books'. Bookkeepers play a vital role in organisations. Thus, they ensure accurate records of individual financial transactions in an orderly, up to date and comprehensive method. Sage 50 Accounts software is widely used in various business sectors in the UK and internationally. If you are organised and like working through documents and enjoy seeing a set of figures add up properly, then bookkeeping or accountancy with Sage 50 Accounts is the career for you. If you're looking to gain competency in the world's most popular bookkeeping software, the Sage 50 Computerised Accounts course will teach everything you need to know, while helping you gain a recognised qualification. At the end of the training you have the option to gain some practical experience in accounting by joining the optional job placement with our sister company, Osborne certified accountants.

Advanced Microsoft Excel Training Course on Bookkeeping

By Osborne Training

Advanced Microsoft Excel Training Course on Bookkeeping Microsoft Excel is the world's most popular spreadsheet program, learning how to use the software with Osborne Training shows that you've taken one of the best Excel training courses available. Comprehensive excel courses come with up to date material to practice at home and during your class. Excel Course Content Creating worksheets, formatting text Simple and complex formulas Handling rows and columns Average, max and min functions and using charts. Use of IF Formula Summing Techniques Cell References Formula Linking Tables and Bordering Look up References (Vlookup, Hlookup,etc) Data Validation Conditional Formatting Date & Time Formulas Charts & Graphs Protection & Security Creating Pivot Table Pivot Table Analysis

Advanced Bookkeeping Excel Courses online | Excel Training in Campus

By Osborne Training

Microsoft Excel is the world's most popular spreadsheet program, learning how to use the software with Osborne Training shows that you've taken one of the best Excel training courses available. A comprehensive training course with up to date material to practice at home and during your class. You will also be provided a step by step manual of all the tricks you can do using Excel spreadsheets to gain better management reporting and budgeting skills. It is a fundamental programme for professional Accountants. Excel spread sheets are the most powerful tool, extensively used for reporting and analysis. Having advanced skills on excel can excel your career and help you to stand ahead of the competitive job market. Advanced skills on excel is a must for any potential professional accountants. You will receive an attendance certificate once you complete the course successfully. Excel Course Content Creating worksheets, formatting text Simple and complex formulas Handling rows and columns Autocomplete, using styles, headers and footers, Average, max and min functions and using charts. Use of IF Formula Summing Techniques Cell References Formula Linking Sumifs Tables and Bordering Look up References (Vlookup, Hlookup,etc) Data Validation Conditional Formatting Date & Time Formulas Charts & Graphs Protection & Security Creating Pivot Table Pivot Table Analysis

Sage Line 50 Accounting / Bookkeeping Training - Fast Track

By Osborne Training

Sage Line 50 Accounting / Bookkeeping Training - Fast Track If you're looking to gain competency in the world's most popular bookkeeping software, the Sage 50 Computerised Accounting course will teach everything you need to know, while helping you gain a recognised qualification. This Course is designed to provide individuals from beginner to advanced knowledge of bookkeeping and Sage 50 accounts. It is intended for individuals who aim to improve career prospects and to be able to better financial management and control of business. This course covers Level 1-3 of Sage 50 Bookkeeping/Accounting Training. Every business, no matter how large or small, is required by law to 'keep books'. Therefore, Bookkeepers play a vital role within organisations; ensuring records of individual financial transactions are accurate, orderly, up to date and comprehensive. If you are organised and methodical, like working through documents and enjoy seeing a set of figures add up properly, then bookkeeping is the career for you. What qualification will I gain? You have the choice to gain certification from one of the following awarding bodies. CERTIFICATION FROM SAGE (UK) As Osborne Training is a Sage (UK) Approved training provider, you could gain the following qualifications provided that you book and register for exams and pass the exams successfully: Sage 50c Computerised Accounting Course (Level 1) Sage 50c Computerised Accounting Course (Level 2) Sage 50c Computerised Accounting Course (Level 3) Level 1 Working with Sage 50 Accounts Program Basics. Creating Account names, Numbers & Bank Payments Financials Bank Reconciliations Generating Customers Invoices Monitoring Customer Activity Generating Product Invoices & Credit Notes Compiling & Sending Customer Statements Creating Customer Receipts & Purchase Invoices Supplier Payments Managing Recurring Entries Generating Reports & Information The Active Set-Up Wizard VAT Changes. Level 2 An overview of the Sage program Entering opening balances, preparing and printing a trial balance Creating customer records Creating supplier records Setting up opening assets, liabilities and capital balances, Producing routine reports Checking data, Entering supplier invoices Posting error corrections, amending records Invoicing, generating customer letters, entering new products, checking communication history Banking and payments, producing statements, petty cash Audit trails, correcting basic entry errors, reconciling debtors and creditors Creating sales credit notes, Processing purchase credit notes Preparing journals Verifying Audit Trail Purchase orders, processing sales orders Processing Trial Balance Creating Backups Restoring data Writing-off bad debts Level 3 Creating a Chart of Accounts to Suit Company Requirements Sole Trader Accounts preparation The Trial Balance preparation Errors in the Trial Balance Disputed Items Use of the Journal Prepare and Process Month End Routine Contra Entries The Government Gateway and VAT Returns Bad Debts and Provision for Doubtful Debts Prepare and Produce Final Accounts Management Information Reports Making Decisions with Reports Using Sage The Fixed Asset Register and Depreciation Accruals and Prepayments Cash Flow and Forecast Reports Advanced Credit Control

Access to Payroll | Sage Payroll Courses

By Osborne Training

Payroll courses in London | Online Courses | Distance Learning Course Overview: Broken down into practical modules this course is a very popular and well-received introduction to moving from manual payroll to computerised payroll, and it incorporates all the new government requirements for RTI reporting Payroll is a vital role within any organisation. A career in payroll means specialising in a niche field with excellent progression opportunities. What support is available? Free high-quality course materials Tutorial support Highly equipped IT lab Student Discount with NUS card Exam fees and exam booking service Personalised individual study plan Specialist Career Management service State of the Art Virtual Learning Campus Free Sage Payroll Software Duration 6 Weeks Study Options Classroom Based - Osborne Training offers Daytime and Weekend sessions for Payroll Training Course from London campus. Online Live - Osborne Training offers Live Online sessions for Sage Payroll Training Classes through the Virtual Learning Campus. Distance Learning - Self Study with Study Material and access to Online study Material through Virtual Learning Campus. Benefits for Trainees Sage Payroll Qualifications open new doors to exciting careers, as well as extending payroll skills if you are currently employed. State of the Art Virtual Learning Campus Start your own payroll bureau Work in small businesses A payroll career can lead to great things Update your knowledge of Sage payroll Improve your employability prospects A career path into payroll Ideal Continuing Professional Development course Gain a qualification to boost your CV Option to gain IAB accredited qualification Start your training immediately without having to wait for the new term to begin Certification You will receive a certificate from Osborne Training once you finish the course. You have an option to get an IAB Certificate subject to passing the IAB exam or Sage certified exam. Syllabus Advanced processing of the payroll for employees Preparation and use of period end HMRC forms and returns preparation of internal reports Maintaining accuracy, security and data integrity in performing payroll tasks. Deductions - Pension schemes and pension contributions Processing the payroll -complex income tax issues Processing Payroll Giving Scheme Processing Statutory Adoption Pay (SAP) Advanced Income tax implications for company pension schemes Student Loan repayments Processing Holiday Payments Processing Car Benefit on to the Payroll System Attachment of Earnings Orders & Deductions from Earnings Orders Leavers with complex issues Advanced processing of statutory additions and deductions Recovery of statutory additions payments - from HMRC Completing the processing of the payroll Complex Reports and payments due to HMRC Introduction to Auto-enrolment Cost Centre Analysis Advanced, routine and complex payroll tasks Calculation of complex gross pay

Managing Safely - IOSH Award (In-House)

By The In House Training Company

This is a very popular, comprehensive, practical and experiential programme, covering: Assessing risks: Defines and demystifies risk and risk assessment. Risk assessments and a simple scoring system are introduced, and participants carry out assessments. Controlling risks: Cutting risks down, concentrating on the best techniques to control key risks and how to choose the right methods. Understanding your responsibilities: The legal framework; health & safety management systems. Identifying hazards: The main issues any organisation has to deal with: entrances and exits, work traffic, fire, chemicals, electricity, physical and verbal abuse, bullying, stress, noise, housekeeping and the working environment, slips, trips and falls, working at height, computers and manual handling. Investigating accidents and incidents: Why accidents should be investigated, why things go wrong and how to carry out an investigation when they do. Measuring performance: How checking performance can help to improve health & safety. How to develop basic performance indicators. Auditing and proactive and reactive measuring. Protecting the environment: Introduction to waste and pollution. How organisations and individual managers can get involved in cutting down their environmental impacts. The programme enables participants to: Assess and control risks and hazards Understand their own responsibilities for safety and health Investigate incidents Measure their own performance Reflect on good practice and plan how to ensure the safety of the staff for whom they are responsible

Team Building & Team Development

By Dickson Training Ltd

Our Team Building Programmes are 'simply excellent' (quote from Unilever). They always deliver much greater energy' motivation and efficiently accelerates to a galvanised, integrated team for their Manager/Team Leader. They're great fun and very commercially orientated - the best of both key elements to a successful and long-lasting high performance team. A successful company is always made up of successful teams. Teams that can work autonomously with a clearly defined set of goals, roles, vision, responsibility and culture will always reach for and achieve far greater success than a team that works just as a group of individuals. Our team building solutions are individually built and geared towards teams at any level within an organisation, providing an independent and objective perspective to promote a common purpose such as the creation of a 'high performance team'. Out With The Old Traditionally, team building events have been restricted to certain levels of management where they head off site for a bit of archery, quad biking and paintballing or something along those lines. Then over some coffee and cocktails, business plans and more efficient ways to work are casually discussed. Whilst being out having fun instead of being at work may improve an individual person's mood, the effect will only be short-term, and will not go far in creating permanent and cohesive teams who are able to overcome challenges together and drive the business forward when back in the workplace. In With The New Today's business thinking is more strategic and certainly has to look for returns on the investment. That is why Dickson Training Ltd's team building programmes are bespoke and built to your requirements through research, understanding your business and, most importantly, what results and achievements you are looking to get out of the programme. Once "what success looks like" has been established, we create tasks and activities that will test your leadership, problem solving, communication and team work skills. When the tasks have been completed, the learning - both practical and theory - is debriefed to the group as well as how it will translate back in your business. Not only are our events great fun, but they provide participants with learning points they can act upon to improve or enhance the working practices/environment. Team Building That Gets Results We have a highly innovative team who design team builds to suit all budgets and time or space restrictions. Large or small, we will develop the perfect event to meet your commercial objectives, keeping in line with your values and company culture. More recently we have combined team galvanising events with ways to engage the participants with and support their local communities. This solution has proved extremely popular with our clients and we are continuing to develop more and more programmes doing exactly this. " Phil did everything in a very professional and focused manner, without losing sight of the overall aims or having 'fun'. When I moved to Airbus UK and subsequently European Aeronautic Defense and Space Company (EADS), I had no hesitation in recommending Phil and the team to deliver the required training and team events. Without doubt Phil and his team are excellent providers of training, to suit even bespoke requirements, and I would not hesitate in recommending the team to any business in the future. " Glenn Brown, Systems & Expertise Manager, Airbus Personnel Service Augmented Skills – an Essay by Phil Dickson All of you, who are reading this, and all the people you meet and work with will have – ‘Augmented Skills’. So – if you are an IT Engineer or a Pharmacist; perhaps you are, or know, a Departmental Leader and you work with a Logistics Project Manager; these roles will demand core skills, whether they be technical know-how or qualifications in the discipline. But to be that bit better; more reliable; more effective & productive and therefore more valuable and, frankly, marketable – capitalizing on ‘Augment Skills’ comes into play. The I T Engineer who was a Chess Champion at Uni, which would indicate that they possess some key ‘Augmented skills’ including how they plan 3 steps ahead and are always prepared for the unexpected. The Pharmacist, who is a keen sportsperson in their private life, will likely be tenacious, team-orientated and disciplined – again these are superb qualities to have in this – or any – role. Your colleagues, as well as yourself, will have ‘Augmented Skills’ that will be an asset if only they are explored and applied to their role and indeed, career. Everyone has their own 'Super-power' If they love gardening, they are probably strategic, patient and inclined to research; if they cook or bake, they are usually well organized and comfortable with multi-tasking. A big reader will tend to be considered and possess good critical thinking faculties, and an amateur mechanic or keen DIY person will often be practical, resourceful and very determined. I have observed that many new Parents discover they have ‘Augmented Skills’ they didn’t know they had... such as getting order out of chaos and displaying industrial amounts of patience and good grace when they really do not feel like it. They very often become far more compassionate and empathetic. Most people have their very own ‘Superpower’. Invite your team members to offer their ‘Augmented Skills’ to your work-place – and just watch as it elevates the motivation levels and improves results. It’ll be very rewarding for all concerned – and for meeting the Team’s objectives, to encourage the person who is a talented artist to be a sounding board on some of the marketing imagery and layouts; for the team member who is great at Maths or resolving crosswords to be asked for their input to solving a problem that is causing logistical or operational headaches. Never exploit a Team member’s unique special skills at their expense I would like to stress, however, that it must never be an area where a team member gets exploited by harvesting their unique special skills to coerce them into taking on greater responsibilities and tasks without providing them with the commensurate salary and status. To do so would be immoral and, ultimately, counter-productive as it would lead to resentment and disenfranchisement. This is about encouraging people’s capability and inviting their input to boost confidence and enhance the team’s capability. Often, we need to be more than what our Job Description says It is also important to highlight that whatever a person’s role or function is – they will definitely need to have additional capabilities to be effective. The best example of this is when we designed and delivered a range of ‘Advanced Customer Care skills’ training sessions for the Met Office a few years ago…we met so many remarkably super-bright Meteorologists, many of whom were having to make significant adjustments to answering questions from Customers that seemed to be illogical and often, obtuse. It wasn’t enough for these Meteorologists to be highly skilled at interpreting data and identifying patterns – they needed ‘Augmented skills’ to make that information accessible to members of the public (and Council workers and Air Traffic controllers and Shipping agents) and many other people, as to what that particular weather system was going to be like in their area and at what time. They have to know how to ‘de-jargonise’ the material and provide succinct, clear, and yet temperate, descriptions without ever appearing exasperated, impatient or judgmental in response to sometimes quite silly questions. For a highly trained scientist – that can be counter-intuitive. Being Philosophical... and a wee bit pretentious At the risk of being a little Philosophical (and probably a wee bit pretentious) – in my own role of Trainer – my core skills have to include – being a very good communicator, an active listener and have innovative and engaging ways to convert an idea, or a model, into practical application that my Delegates and Clients gain tangible benefits from. This is how it applies to me... I really enjoy composing short, light classical-style piano pieces. Now, to do this well, you need to be able to find a transition from one chord or melody to a different theme or key. It has to be worked out very carefully to have incremental transitions and pleasant-sounding developments as the piece unfolds. I think I have become better at this as I have honed my skills as a composer. But I have realized that these very same skills have ‘Augmented’ my ability to help a Manager, or a Team, move from a state of conflict; tension; disfunction; disenfranchisement; lack of confidence to a place that is more harmonious with far greater productivity. The very same process of careful listening, considering options, taking well-considered steps, having a creative, sometimes brave, move towards a resolution are at play in both Training and Piano Compositions! Scheduled Courses Unfortunately this course is not one that is currently scheduled as an open course, and is only available on an in-house basis. Please contact us for more information.

Search By Location

- Pop Courses in London

- Pop Courses in Birmingham

- Pop Courses in Glasgow

- Pop Courses in Liverpool

- Pop Courses in Bristol

- Pop Courses in Manchester

- Pop Courses in Sheffield

- Pop Courses in Leeds

- Pop Courses in Edinburgh

- Pop Courses in Leicester

- Pop Courses in Coventry

- Pop Courses in Bradford

- Pop Courses in Cardiff

- Pop Courses in Belfast

- Pop Courses in Nottingham