- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

The “ISO 14298:2021 Lead Implementer Course” is designed to provide participants with the knowledge and skills necessary to lead the implementation of a Security Printing Management System based on ISO 14298:2021. This comprehensive course covers the key principles, requirements, and best practices for establishing and maintaining an effective security printing management system. Participants will learn how to develop, implement, and manage processes that comply with the ISO 14298 standard.

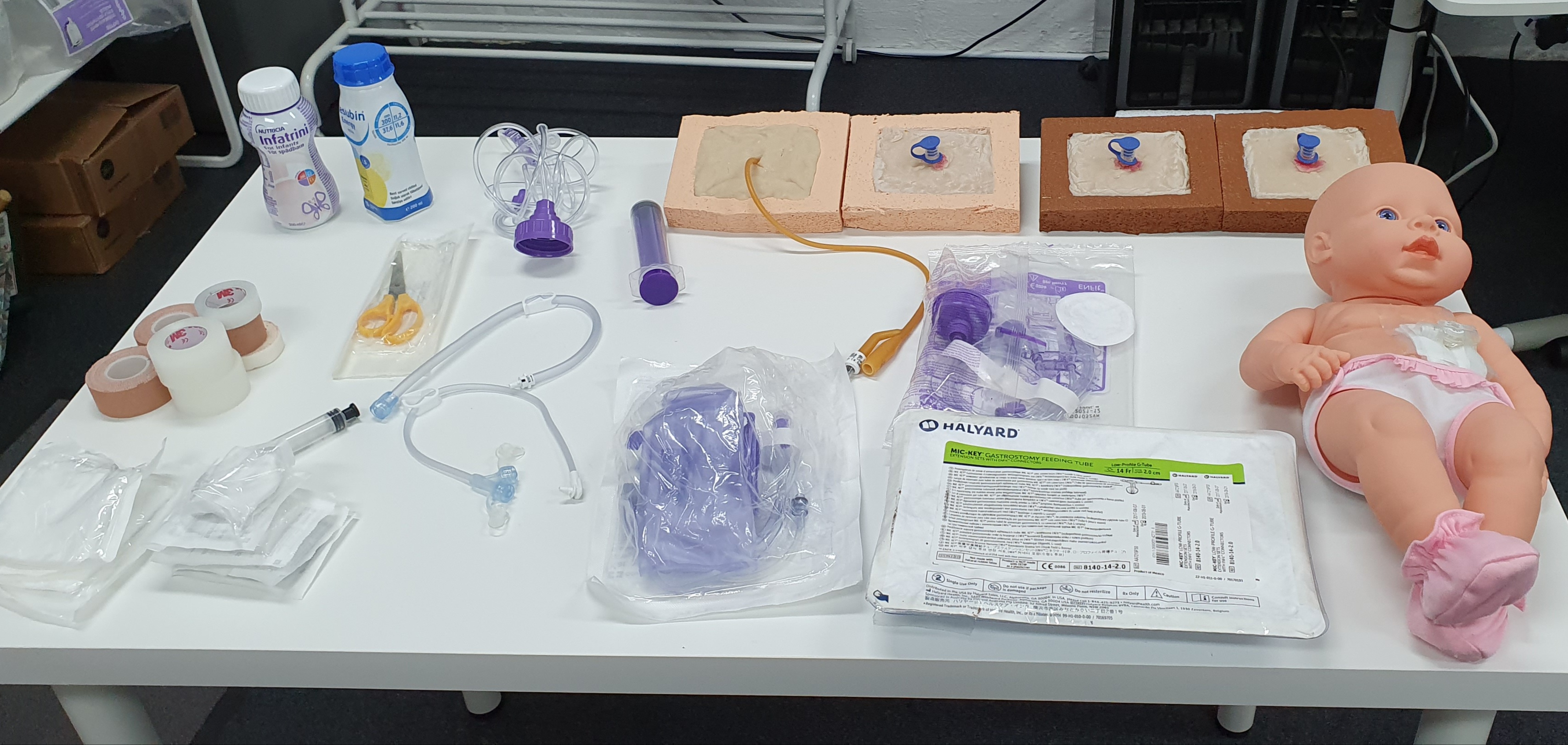

Gastrostomy tube care Gastrostomy tube management Gastrostomy tube training Enteral feeding care Gastrostomy tube complications Gastrostomy site care Gastrostomy tube insertion Gastrostomy tube feeding techniques Gastrostomy tube nursing Gastrostomy care for healthcare professionals Gastrostomy tube education CPD accredited course Nursing revalidation hours Practical gastrostomy care training Hands-on gastrostomy tube practice Patient education in gastrostomy care Ethical considerations in gastrostomy tube care Cultural sensitivity in gastrostomy care Gastrostomy tube complications prevention High-quality gastrostomy care certification PEG

Agile Business Consortium Scrum Master Course

By IIL Europe Ltd

Agile Business Consortium Scrum Master® Course This two-day course covers the principles and theory of the Scrum framework and the role of the Scrum Master. IIL is an accredited training organization (ATO) and the course is delivered by accredited trainers. APMG's accreditation processes are respected globally and accredited by UKAS. A Scrum Master is responsible for promoting and supporting Scrum as defined in The Scrum Guide, and also is the leader who serves the Product Owner, the Development Team, and the Organization. Why APMG - Agile Business Consortium Scrum Master® Course and Certification? The course, syllabus, and learning objectives are based on The Scrum Guide - The Definitive Guide to Scrum: The Rules of the Game - created and maintained by Scrum's creators Ken Schwaber and Jeff Sutherland Increased business (non-IT) focus of course and exercises Developed in partnership with Agile Business Consortium - leaders in promoting and enabling business agility Course is highly interactive to encourage collaboration and reinforce learning objectives Candidates can sit the examination at the end of the training course No recertification requirements. APMG Scrum Master certification does not expire. Successful candidates are entitled to free 1-year membership with the Agile Business Consortium Successful candidates can claim a digital badge and share their success online What You Will Learn At the end of this program, you will be able to: Gain a deep understanding of the Scrum Framework - the theory, practices, roles, rules, and values - as defined in The Scrum Guide Understand, in detail, the role of Scrum Master, and how the role interacts with different members of the Scrum Team and other stakeholders Master the Scrum principles to better understand their application when returning to the workplace Understand how to construct an effective development team with an appropriate mix of skills and experience Know how to act as a servant-leader for the Scrum Team, promoting and enabling self-organization to create high-value products. Learn how to facilitate Scrum Events and remove impediments to the Scrum Team's progress Help Scrum Product Owners shape and refine product backlogs to guide early and incremental delivery of valuable products Drive adoption of the Scrum framework for more effective product and solution development, working with stakeholders and other Scrum Masters to improve its effectiveness Day One Scrum Overview Self-Organization Agile Principles Empirical Product Development Scrum Events The Development Team Scrum Roles Day Two The Product Backlog Sprint Planning and Done Sprint Progress Scrum Simulation Growing as a Scrum Master

Nail Technician Course Level 2

By Penelope Academy

This 3 day practical course (taken in professional beauty salon) designed to show You how to carry out manicures. This course is designed for complete beginners, who wish to learn from basic to professional most popular nail art techniques to start Your career as nail technicians. It is also good to refresh knowledge and learn new techniques for those of You that are already in business.

Level 2 NVQ Diploma in Barbering – inc. Wet Shaving

By Alan d Hairdressing Education

This Beginners Barbering Course is aimed at those looking to be work-ready upon completion and working towards an internationally recognised Barbering qualification. After an initial induction, on day 2 you will learn to cut & style utilising the 5 Alan d Foundation haircuts before moving on to the practical elements of Barbering, incorporating all the latest techniques using scissors, scissor-over-comb, clippers & trimmers and learning beard and moustache trimming and wet shaving.

Wet Shaving - Advanced Course

By Alan d Hairdressing Education

Learn the classic Wet Shaving in our Advanced Wet Shaving Course. Ideal for qualified barbers looking to learn a new skill and add to their services. In this 2-day course, you’ll learn shaving theory along with skin tensioning and lathering techniques.

Photoshop Training Course Basics to Advanced

By ATL Autocad Training London

Photoshop Training Course Basics to Advanced designed for individuals of every skill level, ranging from beginners to advanced image editing professionals. Immerse yourself in the realm of potent image manipulation tools at our school in London. Personalized Photoshop courses either at our facility or directly at your location. Click here for more info: Website Duration: 20 hours. Method: Personalized 1-on-1. Schedule: Customize your learning with pre-booked sessions available Monday to Saturday, from 9 am to 7 pm. Course Title: Mastering Photoshop: From Basics to Advanced Proficiency Course Duration: 20 hours Module 1: Introduction to Photoshop (2 hours) Understanding the Photoshop interface Navigating tools and panels Basic keyboard shortcuts for efficient workflow Introduction to different file formats and their uses Module 2: Essential Tools and Techniques (3 hours) Selection tools and techniques for precise editing Working with layers: management and blending modes Understanding brushes, gradients, and patterns Introduction to basic filters and their applications Module 3: Image Editing and Retouching (4 hours) Color correction and adjustment layers Advanced retouching techniques: Healing Brush, Clone Stamp, and Content-Aware tools Removing backgrounds and unwanted elements Restoring old or damaged photographs Module 4: Advanced Photo Manipulation (3 hours) Compositing multiple images seamlessly Advanced blending modes and layer effects Creative use of masks and clipping paths Special effects: lighting, shadows, and reflections Module 5: Text and Typography (2 hours) Working with text layers and formatting options Creating custom typography and text effects Utilizing layer styles for creative text designs Text manipulation along paths and shapes Module 6: Web and UI Design (3 hours) Designing web banners, buttons, and interfaces Slicing and optimizing images for the web Creating interactive prototypes and mockups Exporting assets for web and app development Module 7: Print Design and Prepress (2 hours) Understanding color modes: CMYK vs. RGB Setting up documents for print: bleed, margins, and resolution Designing print materials: brochures, business cards, and posters Preparing files for professional printing Module 8: Project-Based Learning (1 hour) Applying learned techniques to real-world projects Instructor-led project: creating a digital artwork or advertisement Feedback and critique session for skill refinement Final presentation of completed projects Upon completion, you will: Master Photoshop Skills: Gain proficiency in fundamental and advanced Photoshop techniques, enabling professional-level image editing and creative design. Enhance Creativity: Develop creative problem-solving abilities, enabling innovative and visually appealing design solutions. Job Opportunities: Graphic Designer: Craft compelling visual content for ads, websites, and marketing materials. Photo Retoucher: Edit and enhance photographs to meet professional standards. Digital Artist: Create digital artwork and illustrations for various purposes. Web/UI/UX Designer: Design user-friendly interfaces and engaging online experiences. Marketing Content Creator: Generate eye-catching promotional visuals and social media content. Video Editor: Enhance video footage and create engaging video content for online platforms. Professional Adobe Photoshop Training in London - On-Site & Live Virtual Classes Being the industry-leading image editing software, Photoshop empowers users to manipulate images, enhance colors, and create visually striking designs. Its extensive toolkit allows for intricate adjustments, retouching, and even editing videos, graphic design, and 3D imagery. Enroll in our Photoshop course to establish a strong foundation in creative visuals, focusing on essential skills like image adjustment, composition, and common troubleshooting. For a more in-depth understanding, our Advanced course delves into advanced techniques such as color fills, text and layer styling, and creating web-ready artwork. Explore our masterclass options for advanced training and deeper insights. Both beginner courses are available in physical classrooms and online, providing flexible learning opportunities. Holistic Design Education: Comprehensive training across diverse design fields. Industry-Experienced Instructors: Learn from seasoned professionals in the field. Flexible Learning: Accommodating schedules for busy professionals and students. Practical Projects: Hands-on projects for real-world design experience. Career-Focused Skills: Acquire industry-relevant skills for professional growth. Cutting-Edge Facilities: Access state-of-the-art technology and facilities. Personalized Training: Tailored programs to suit individual learning needs. Networking Opportunities: Connect with design professionals for valuable connections. Innovation Exploration: Explore creative trends and emerging technologies. Ongoing Support: Continuous assistance and post-course guidance.

Advance Dry Needling Course (London, England) May 2025

By CPD Today

Dry needling course part 2, course is designed for all manual therapists including osteopaths, chiropractors, physiotherapist and sports therapists. To attend part 2 of the course you must have completed part 1.

Search By Location

- Course Courses in London

- Course Courses in Birmingham

- Course Courses in Glasgow

- Course Courses in Liverpool

- Course Courses in Bristol

- Course Courses in Manchester

- Course Courses in Sheffield

- Course Courses in Leeds

- Course Courses in Edinburgh

- Course Courses in Leicester

- Course Courses in Coventry

- Course Courses in Bradford

- Course Courses in Cardiff

- Course Courses in Belfast

- Course Courses in Nottingham