- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

LED Light Therapy Course in person

By KBH Training Academy

LED Light Therapy Course What is LED Therapy? LED light therapy are a popular non-invasive skin treatment for acne, sun damage, wounds, and other skin problems Course content * Health and safety * Sterilisation and disinfection * Appearance of the therapist * Ergonomics * Handwashing * What is LED light therapy * Skin ageing and turning back time * Free radicals, radicals and anti-oxidants * How does LEAD work * The consultation process * Key points of LED * Benefits of LED * The treatment explained * Other benefits to LED therapy * The wound healing process * Important reminders and treatment tips * Treatment protocols Training kit if purchased -Facial kit -cleanser -Led bridge -Sponges 2x How does the course work? The course is divided into 2 parts, the first part is theoretical which you have to complete before you come for your practical training, and the second one is a practical assignment. The practical assignment is done on the day which will be agreed upon course purchase. You will spend around 2-3 hours practising on a model in our venue in London E106RA. Will I require a model? Yes, usually 1 model is required Do I Need Experience Before Booking a Course? We’re pleased to offer courses to people with lots of different experiences. However, previous experience nor qualifications are not necessary if you would like to enrol on our Course. Certificate You will receive an end of course certificate which is accredited by the cpd group and allows you to work on public Payment By paying for the course you agree to our terms and conditions.

This Skills for Care Endorsed & CPD accredited training has been designed for existing Social care Staff in line with CQC requirements. Delivered by experienced and professional tutors and trainers with over 25 years of combined experience.

Skills for Care Endorsed Practical Mandatory Refresher Care Training

4.0(1)By Transit Smart Skills & Consult

This Skills for Care Endorsed & CPD accredited training has been designed for existing Social care Staff in line with CQC requirements . Delivered by experienced and professional tutors and trainers with over 25 years of combined experience.

Total Accounting Training Course Package - With Guaranteed Job Placement

By Osborne Training

Total Accounting Training Course Package - With Guaranteed Job Placement It is a comprehensive practical accounting training program designed to build the bridge between knowledge and practical aspects of accounting and tax. With this accounting courses many modules of tax and accounting are covered as well as Computerised Accounting & Payroll. Moreover, After completing the modules you will have the chance to get hands on experience which will open the door for lucrative Accounting, Tax & Payroll sector. CompletOsborne Trainingion of this training program will earn you valuable verified CPD points. As an accountant, it is vital to gain CPD points to retain your accounting membership and to comply with Professional Accounting Bodies (such as ACCA, AAT, CIMA, ICAEW etc.) requirements. Advanced Excel Bookkeeping VAT Training - Preparation and Submission Personal Tax Return Training Company Accounting and Tax Training Sage 50 Accounting Training Sage Payroll Training

CHILD PROTECTION ADVANCED ONE DAY COURSE

By Child Protection Training Uk

Everyone shares responsibility for safeguarding and promoting the welfare of children and young people, irrespective of individual roles. This course is for those who have already completed a Level 1 course and need to gain an advanced knowledge of Child Protection, including working towards becoming a Designated Safeguarding Lead (DSL), manager or policy writer. This course is designed for individuals who work with children in either a paid or voluntary capacity. It relates to the issues surrounding safeguarding children by exploring the concepts of "child vulnerability", "child protection" and "significant harm"; coupled with the individual and organisational responsibilities of protecting children from abuse.

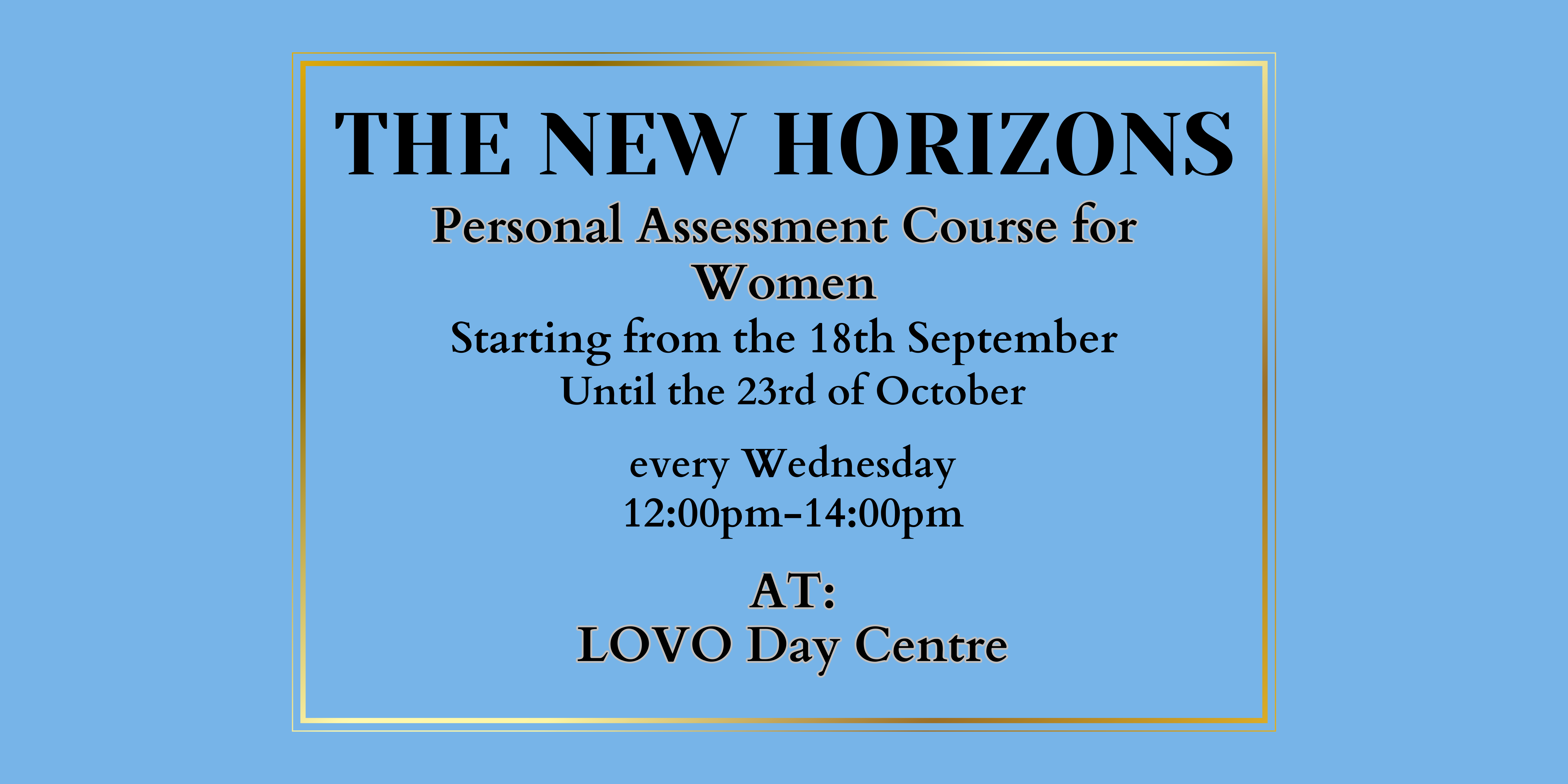

-New Horizons- Personal Assessment Course (women only)

By LOVO CIC

A six-module course over 6 weeks of 2h per week. Interactive training and coaching to take you on a journey of self-discovery. Start on a path of self-evaluation to realise your full potential, build confidence, and set suitable career and personal goals. Learners will receive CPD accredited certification when they successfully complete the course.

Miss Date Doctor workplace counselling services will provide services for your employees and support them with their relationship and life problems. We have a team of highly experienced and qualified professionals. The team is CPD, ICF, UKCP and BACP accredited. The M.D.D team consists of life coaches, counsellors and therapists. We offer three different packages for employers dependant on the size of your workforce. We are the most modern coaching and counselling platform in the UK. The workplace counselling services we offer have been tailored specifically to modern times and are very objective-driven and problem-solving based. We aim to give your employees the support they need whenever they need it. Call 03333443853 or email:enquiries@relationshipsmdd.com to get the solutions you need for your employees today. https://relationshipsmdd.com/workplace-counselling-services/

CHILD PROTECTION AWARENESS ONE DAY COURSE

By Child Protection Training Uk

Formally Safeguarding Children Level 1: One Day Course 10am - 3.30pm Working Together to Safeguard Children 2018 & Keeping Children Safe in Education (2022) Updated This Course can also be run within your organisation for your staff group at a reduced cost contact us for a quote or if you have any other questions about this course talk to an adviser now online.

Level 4 Award in Immediate Life Support (ILS) Course

By NR Medical Training

The Level 4 Award in Immediate Life Support (RQF) is ideal for a wide range of healthcare professionals. This includes doctors, dental professionals, medical students, nurses, midwives, and physiotherapists who need an ILS qualification for their registration with regulatory bodies like the GMC, GDC, NMC, and HCPC. It's also perfect for those looking to advance in their careers or needing an ILS certification for new job opportunities.

Total SAGE Training (Sage 50 Accounts + Sage Payroll Training)

By Osborne Training

Total SAGE Training (Sage 50 Accounts + Sage Payroll Training) Want to open the door to working in Finance and Accountancy Industry? Starting our Total Sage Training courses will enhance your career potentials and give you the skills and knowledge you need to get started in Finance and Accountancy Industry. Total Sage Training courses are combined with Sage 50 Accounts and Sage Payroll Training. You will receive a CPD Completion Certificate from Osborne Training once you finish the course. You also have an Option to attain Certificate from SAGE(UK) subject to passing the exams. What qualification will I gain for Sage Training Courses? CERTIFICATION FROM SAGE (UK) As Osborne Training is a Sage (UK) Approved training provider, you could gain the following qualifications provided that you book and register for exams and pass the exams successfully: Sage 50c Computerised Accounting Course (Level 1) Sage 50c Computerised Accounting Course (Level 2) Sage 50c Computerised Accounting Course (Level 3) Sage 50c Computerised Payroll Course (Level 1) Sage 50c Computerised Payroll Course (Level 2) Sage 50c Computerised Payroll Course (Level 3) Level 1 Working with Sage 50 Accounts Program Basics. Creating Account names, Numbers & Bank Payments Financials Bank Reconciliations Generating Customers Invoices Monitoring Customer Activity Generating Product Invoices & Credit Notes Compiling & Sending Customer Statements Creating Customer Receipts & Purchase Invoices Supplier Payments Managing Recurring Entries Generating Reports & Information The Active Set-Up Wizard VAT Changes. Level 2 An overview of the Sage program Entering opening balances, preparing and printing a trial balance Creating customer records Creating supplier records Setting up opening assets, liabilities and capital balances, Producing routine reports Checking data, Entering supplier invoices Posting error corrections, amending records Invoicing, generating customer letters, entering new products, checking communication history Banking and payments, producing statements, petty cash Audit trails, correcting basic entry errors, reconciling debtors and creditors Creating sales credit notes, Processing purchase credit notes Preparing journals Verifying Audit Trail Purchase orders, processing sales orders Processing Trial Balance Creating Backups Restoring data Writing-off bad debts Level 3 Creating a Chart of Accounts to Suit Company Requirements Sole Trader Accounts preparation The Trial Balance preparation Errors in the Trial Balance Disputed Items Use of the Journal Prepare and Process Month End Routine Contra Entries The Government Gateway and VAT Returns Bad Debts and Provision for Doubtful Debts Prepare and Produce Final Accounts Management Information Reports Making Decisions with Reports Using Sage The Fixed Asset Register and Depreciation Accruals and Prepayments Cash Flow and Forecast Reports Advanced Credit Control

Search By Location

- cpd Courses in London

- cpd Courses in Birmingham

- cpd Courses in Glasgow

- cpd Courses in Liverpool

- cpd Courses in Bristol

- cpd Courses in Manchester

- cpd Courses in Sheffield

- cpd Courses in Leeds

- cpd Courses in Edinburgh

- cpd Courses in Leicester

- cpd Courses in Coventry

- cpd Courses in Bradford

- cpd Courses in Cardiff

- cpd Courses in Belfast

- cpd Courses in Nottingham