- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

309 Courses in London

The Impact of Electric Vehicles (EVs) on the Grid

By EnergyEdge - Training for a Sustainable Energy Future

About this Virtual Instructor Led Training (VILT) Electrification of the transportation sector will impact the power system in several ways. Besides the additional load, local impact on the grid needs to be managed by the grid operators. Simultaneously charging of many electric vehicles (EVs) might exceed the limits in specific locations. On the other hand, EVs can provide flexibility and other ancillary services that will help grid operators. This 3 half-day VILT course will provide a complete overview of integrating electric vehicles (EVs) into the power grid. It will cover the whole value chain from grid operations to the car battery. This includes the control room, possible grid reinforcement, demand side management and power electronics. This course will demonstrate the impact on the grid and solutions for a safe & cost-effective grid plan and operation, with examples of successful integration of EVs. The course will also provide vital knowledge about technology used for EVs such as power electronics, demand side management, communication and batteries. In this context, the focus will be on power electronics as it has the highest impact on the grid. The grid planning tool, pandapower, is introduced as an open source tool for power system modelling. The set-up of the training course allows for discussion and questions. Questions can be formulated by the participants upfront or during the training. This course is delivered in partnership with Fraunhofer IEE. Training Objectives At the end of this course, the participants will: Understand the charging options for EVs and its impact on the grid and batteries Identify system services for EVs with regards to voltage quality at the point of common coupling Discover what are the 'grid friendly' and grid supporting functions in EVs Uncover the different applications, standards and data researched on EVs Examine the application of a grid planning tool (pandapower) for power system modelling Be able to develop code snippets with pandapower Apply and execute a code example for power system modelling with pandapower Target Audience EV and grid project developers and administrators Power grid operators and planners EPC organisations involved in grid development EV/ battery manufacturers and designers EV transport planners and designers Government regulators and policy makers Training Methods The VILT will be delivered online in 3 half-day sessions comprising 4 hours per day, with 2 x 10 minutes breaks per day, including time for lectures, discussion, quizzes and short interactive exercises. Additionally, some self-study will be requested. Participants are invited but not obliged to bring a short presentation (10 mins max) on a practical problem they encountered in their work. This will then be explained and discussed during the VILT. A short test or quiz will be held at the end of every session/day. Trainer Our first course expert is Head of Department Converters and Electrical Drive Systems at Fraunhofer IEE and Professor for Electromobility and Electrical Infrastructure at Bonn-Rhein-Sieg University of Applied Sciences. He received his engineering degree in automation in 2008 by the THM Technische Hochschule Mittelhessen (FH Giessen-Friedberg). Afterwards he studied power engineering at University of Kassel and received his diploma certificate in 2010. In 2016 he received the Ph.D. (Dr.-Ing.) from the University of Hannover. The title of his dissertation is Optimized multifunctional bi-directional charger for electric vehicles. He has been a researcher at the Fraunhofer IEE in Kassel since 2010 and deals with power converters for electric vehicles, photovoltaics and wind energy. His current research interests include the bidirectional inductive power transfer, battery charger and inverter as well as new power electronic components such as SiC MOSFETs and chokes. Additionally, our key expert is Chairman of the IEEE Joint IAS/PELS/IES German Chapter and a member of the International Scientific Committee of the EPE Association. Our second course expert is deputy head of energy storage department at Fraunhofer IEE. Prior to this he was the Director of Grid Integration department at SMA Solar Technology AG, one of the world's largest manufacturers of PV power converters. Before joining SMA, our course expert was manager of the Front Office System Planning at Amprion GmbH (formerly RWE TSO), one of the four German transmission system operators. He holds a degree of electrical engineering of the University of Kassel, Germany. In 2003 he finished his Ph.D. (Dr.-Ing.) on the topic of wind power forecasting at the 'Institute of Solar Energy Supply Technology' (now Fraunhofer IEE) in Kassel. In 2004 he started his career at RWE TSO with main focus on wind power integration and congestion management. Our course expert is chairman of the IEC SC 8A 'Grid Integration of Large-capacity Renewable Energy (RE) Generation' and has published several papers about grid integration of renewable energy source and forecasting systems on books, magazines, international conferences and workshops. Our third course expert is Research Associate at Fraunhofer IEE. He is actively working on different projects related to the integration of electric vehicle charging into the electric distribution grid. The focus of this work concerns time series based simulations for grid planning and operation in order to investigate the effect of a future rollout of electric vehicles and charging infrastructure on economics e.g. costs for grid reinforcement. He completed his master degree (MSc.) in Business Administration and Engineering: Electrical Power Engineering at RWTH Aachen University, Germany. Our trainers are experts from Fraunhofer Institute for Energy Economics and Energy System Technology (Fraunhofer, IEE), Germany. The Fraunhofer IEE researches for the national and international transformation of energy supply systems POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information about post training coaching support and fees applicable for this. Accreditions And Affliations

NPORS Lift Supervisor Training The aim of the NPORS Lift Supervisor Training is to Provide candidates with underpinning knowledge to allow them to understand the role and responsibility of the Lift Supervisor. As a result of the Lift Supervisor Course, and following successful completion of the NPORS Crane Supervisor training candidates will be able to understand and follow safe systems of work for lifting operations. This Lift supervisor course is for 3 days and can be completed at your site or ours. It is important that all delegates have a good understanding of spoken and written English for NPORS Crane Supervisor Training. NPORS Lift Supervisor Experienced Test Book with Confidence at Vally Plant Training At Vally Plant Training, we guarantee unbeatable value with our Lift Supervisor Experienced Test Price Match Promise. When you choose us, you can book with confidence, knowing that we will not be beaten on price. If you find a lower price for the same NPORS Lift Supervisor Experienced Worker Test, we’ll match it—ensuring you receive top-quality training at the best possible rate. Click for our terms and conditions Your skills, our commitment—always at the best price. NPORS Lift Supervisor Experienced Worker Test is for operators who have received some form of Lift Supervisor Course in the past or alternatively has been working with Lifting equipment, like cranes, Excavators or Telehandlers for a number of years. If you are unsure if you qualify to go down the Lift Supervisor experienced test route please contact our team to discuss this in more detail. Discounts are available for multiple Lift Supervisor Course bookings There are two parts to the lift supervisor test, a theory section comprised of 25 questions and a practical session, however Lift Supervisor training revision notes will be sent once the test has been booked. It is important that all delegates have a good understanding of spoken and written English for NPORS Crane Supervisor Training Crane Supervisor Course Summary: Leading Safe and Efficient Lifting Operations Introduction Ever wonder who keeps construction sites and warehouses running smoothly and safely? That’s where lift supervisors come in. They’re the unsung heroes ensuring everything moves like clockwork. And when it comes to proving you’re the best in the biz, NPORS certification is your golden ticket. It’s not just a piece of paper; it’s your passport to climbing the career ladder. Choose our Lifting Supervisor Course Today. Why Choose Our NPORS Lift Supervisor Training? What makes our training stand out with our Lifting Supervisor Course? Imagine learning from folks who’ve been in the trenches, in training grounds that feel like the real deal, and schedules that bend to your life, not the other way around. We’re not about boring lectures; we’re about getting your hands dirty. Who Should Attend Lift Supervisor Training? Are you the go-to person when things need to get done? Whether you’re starting out or looking to step up, if you’re in the world of construction or logistics, this Lifting Supervisor Course is for you. It’s tailored for those who like to keep things moving, safely and efficiently. Course Objectives: 1. Understanding Regulatory Requirements: Familiarise participants with relevant regulations and industry standards governing crane operations, LOLER. Ensure compliance with legal requirements and best practices for safe lifting operations, BS7121. 2. Roles and Responsibilities of a Crane Lift Supervisor: Define the roles and responsibilities of a Lift supervisor within the context of lifting operations. Highlight the importance of effective communication, leadership, and decision-making skills. 3. Crane Safety Procedures: Provide an overview of crane safety procedures, including pre-operational checks, equipment inspection, and maintenance. Emphasize the importance of hazard identification, risk assessment, and mitigation strategies. 4. Lifting Plan Development: Guide participants in the understanding of the lifting plans tailored to specific lifting tasks and site conditions created by the Appointed Person(AP). Address factors such as load weight, size, shape, centre of gravity, and environmental considerations. 5. Site Safety and Hazard Awareness: Enhance participants’ awareness of potential hazards in the lifting environment, such as overhead power lines, unstable ground, and confined spaces. Implement effective measures to mitigate risks and ensure a safe working environment. 6. Communication and Coordination: Stress the importance of clear and effective communication between crane operators, riggers, signallers, and other personnel involved in lifting operations. Provide guidance on establishing communication protocols, using standardized hand signals, and conducting pre-lift briefings. 7. Emergency Response and Crisis Management: Equip participants with the skills and knowledge to respond effectively to emergencies and crisis situations during lifting operations. Implement emergency procedures, evacuation protocols, and contingency plans to mitigate risks and ensure personnel safety. 8. Practical Exercises and Case Studies: Provide hands-on lift supervisor training opportunities for participants to apply theoretical knowledge in practical scenarios. Analyse real-life case studies to identify lessons learned, best practices, and areas for improvement in crane supervision. Learning Outcomes By the end, you’ll be a pro at keeping sites safe, managing lifts, and leading teams. You’ll walk away not just with knowledge, but with practical skills that meet and beat industry standards. It’s about making you the go to lift supervisor everyone wants on their team. Course Logistics Ready to jump in? We’ve got training spots across the UK, with dates and times that fit your life. Signing up is a breeze, and we’ll guide you through any paperwork or prerequisites. It’s all about making it easy for you to get started. Conclusion: A crane supervisor course aims to empower participants with the expertise and confidence to lead safe and efficient lifting operations on construction sites. By focusing on regulatory compliance, safety procedures, lifting plan development, hazard awareness, communication, and practical training, the course prepares crane supervisors to fulfil their roles effectively and ensure the well-being of all personnel involved in lifting activities. Investing in crane supervisor training is essential for promoting a culture of safety, minimising risks, and achieving excellence in crane operations management. Crane Supervisor Training Available 7 days a week to suit your business requirements. VPT have a team of friendly and approachable instructors, who importantly have a wealth of knowledge of lifting supervision and the construction industry We have our own training centre conveniently located close to the M5 junction 9, In Tewkesbury. With its own purpose-built practical training area to simulate an actual working environment for the supervisor course. Our Lift Supervisor training and test packages are priced to be competitive. Discounts are available for multiple bookings We can send a fully qualified NPORS supervisor Tester to your site nationwide, for instance to reduce the amount of time away from work More courses: Polish your abilities with our dedicated Lift Supervision Training, Slinger Signaller Training, Telehandler Training, Cat & Genny Training, Plant Loader Securer, Ride-On Road Roller, Abrasive Wheel Training, Lorry Loader Training and Scissor Lift Training sessions. Learn the safe and effective operation of these vital machines, crucial for construction and maintenance tasks. Elevate your skills and career prospects by enrolling in our comprehensive courses today. Frequently Asked Questions 1. What is Lift Supervisor Training? Lift Supervisor Training is a specialised course designed to equip individuals with the knowledge and skills required to supervise lifting operations safely and efficiently. This training typically covers topics such as planning lifts, managing lifting equipment, and ensuring compliance with safety regulations. 2. Who should attend The Lifting Supervisor Course? This training is ideal for individuals responsible for overseeing lifting operations on construction sites, in warehouses, or any environment where lifting equipment like cranes are used. It’s particularly beneficial for site supervisors, managers, and anyone involved in the planning and execution of lifting operations to attend the NPORS Lift supervisor Course. 3. What certifications are available through the Lift Supervisor Training? Participants can obtain several Lift Supervisor certifications, including: NPORS Traditional card: Valid for 5 years, widely accepted in various sectors. NPORS card with CSCS logo: Recognised by major building contractors, with an initial RED trained operator card that can be upgraded to a BLUE competent operator card after completing relevant Crane Supervisor NVQ. 4. Is a health and safety test required for the NPORS Crane Supervisor Red operator card with the CSCS logo? Yes, to qualify for this card, you must have completed the CSCS operatives health and safety test within the last two years. 5 . How long is the certification valid, and what is the renewal process? The NPORS Traditional card is valid for 5 years. The NPORS card with the CSCS logo’s RED trained operator card is valid for 2 years, after which it can be upgraded to a BLUE competent Crane Supervisor operator card upon completion of relevant NVQs. The renewal process typically involves undergoing a refresher course or assessment to ensure continued competence. For those looking for a “NPORS Crane Supervisor Training near me,” our widespread operations make it convenient for you to access Vally Plant Trainings top-quality training no matter where you are in the UK

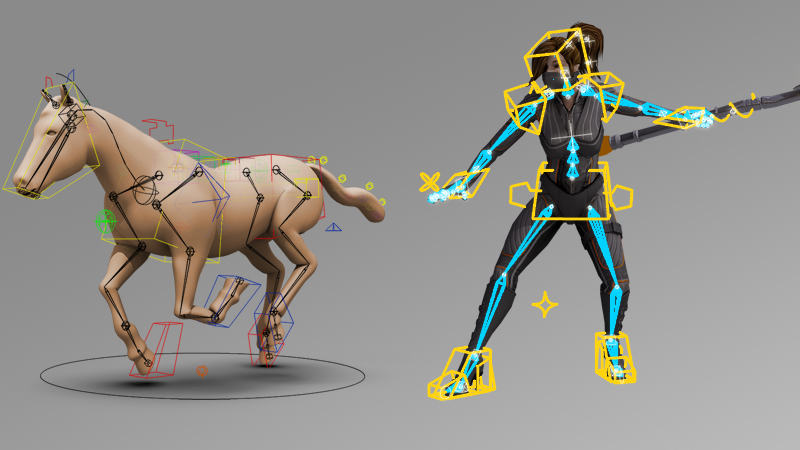

Character Animation in 3ds Max Training

By London Design Training Courses

Why Choose Character Animation in 3ds Max Training Course? Click here for more info. Top character animation course in 3ds Max, this course provides an accessible learning experience. Learning character animation enables you to create your own short films. It's not just a means of income; it evolves into a passion. Duration: 20 hrs Method: 1-on-1, Personalized attention. Schedule: Tailor your own hours of your choice, available from Monday to Saturday between 9 am and 7 pm. Enroll in our exclusive "Character Animation Fundamentals in 3ds Max" course at London Design Training, guided by experienced tutors Sitwat Ali, Qasim Ali, and Jess. Gain in-depth insights into animating 3D characters, covering essential techniques like character rigging, pose creation, and seamless pose-to-pose animation. 3ds Max Character Animation Course Duration: 20 hours Course Overview: Master the art of character animation in 3ds Max with our comprehensive course. Ideal for beginners and those with some 3D modeling and animation experience, this course covers everything you need to know to bring characters to life. Course Outline: Introduction to Character Animation Explore animation principles Get familiar with 3ds Max animation tools Learn to create character rigs and manage the timeline Basic Animation Principles Understand keyframes and animation cycles Apply the 12 principles of animation Work with the graph editor and ease-in/out techniques Advanced Animation Techniques Utilize the reaction manager for complex animations Master non-linear animation methods Animate with inverse kinematics, custom controllers, expressions, and scripts Creating Characters Craft a character model with proper topology Create UV maps and apply textures Prepare characters for rigging Facial Animation Learn facial animation principles Create blend shapes and morph targets Master lip syncing techniques Body Animation Animate walk cycles and character motion Achieve believable character poses Implement character physics Advanced Character Animation Work with motion capture data Use CAT and Biped tools Understand motion blur and create special effects Render and output animations Character Animation Projects Bring all skills together in practical projects Create basic and complex character animations Course Requirements: Computer with 3ds Max installed Basic computer operations knowledge Passion for character animation Course Goals: Upon completion, you'll have a thorough grasp of character animation in 3ds Max, capable of creating realistic and sophisticated character animations using advanced techniques. You'll be equipped with the skills to continue honing your character animation abilities independently.

AAT Level 3 Diploma in Accounting

By London School of Science and Technology

Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Course Overview This qualification covers a range of essential and higher-level accounting techniques and disciplines. Students will learn and develop skills needed for a range of financial processes, including maintaining cost accounting records, advanced bookkeeping and the preparation of financial reports and returns. Study the Level 3 Diploma to learn higher accounting techniques and disciplines and qualify for AAT bookkeeping membership (AATQB). The jobs it can lead to: • Accounts assistant • Accounts payable clerk • Audit trainee • Credit controller • Payroll administrator/supervisor • Practice bookkeeper • Finance assistant • Tax assistant • Accounts payable and expenses supervisor Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success we recommend that students begin their studies with a good standard of English and maths. Course Content: Business Awareness: This unit provides students with an understanding of the business, its environment and the influences that this has on an organisation’s structure, the role of its accounting function and its performance. Students will examine the purpose and types for businesses that exist and the rights and responsibilities of the key stakeholders, as well as gain an understanding of the importance of professional ethics and ethical management within the finance function. Learning outcomes: • Understand business types, structure and governance and the legal framework in which they operate. • Understand the impact of the external and internal environments on business, their performance and decisions. • Understand how businesses and accounts comply with principles of professional ethics. • Understand the impact of new technologies in accounting and the risks associated with data security. • Communicate information to stakeholders. Financial Accounting: Preparing Financial Statements: This unit provides students with the skills required to produce statements of profit or loss and statements for financial position for sole traders and partnerships, using a trial balance. Students will gain the double-entry bookkeeping skills needed to record financial transactions into an organisation’s accounts using a manual bookkeeping system. Learning outcomes: • Understand the accounting principles underlaying final accounts preparation. • Understand the principles of advanced double-entry bookkeeping. • Implement procedures for the acquisition and disposal of non-current assets. • Prepare and record depreciation calculations. • Record period end adjustments. • Produce and extend the trial balance. • Produce financial statements for sole traders and partnerships. • Interpret financial statements using profitability ratios. • Prepare accounting records from incomplete information. Management Accounting Techniques: This unit provides students with the knowledge and skills needed to understand the role of management accounting in an organisation, and how organisations use such information to aid decision making. Students will learn the principles that underpin management accounting methodology and techniques, how costs are handled in organisations and why organisations treat costs in different ways. Learning outcomes: • Understand the purpose and use of management accounting within organisations. • Use techniques required for dealing with costs. • Attribute costs according to organisational requirements. • Investigate deviations from budgets. • Use spreadsheet techniques to provide management accounting information. • Use management accounting techniques to support short-term decision making. • Understand principles of cash management. Tax Processes for Businesses: This unit explores tax processes that influence the daily operations of businesses and is designed to develop students’ skills in understanding, preparing and submitting Value Added Tax (VAT) returns to HM Revenue and Customs (HMRC). The unit provides students with the knowledge and skills that are needed to keep businesses, employers and clients compliant with laws and practices that apply to VAT and payroll. Learning outcomes: • Understand legislation requirements relating to VAT. • Calculate VAT. • Review and verify VAT returns. • Understand principles of payroll. • Report information within the organisation. DURATION 250-300 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Carbon Capture, Utilization & Storage (CCUS) Well Design & Monitoring

By EnergyEdge - Training for a Sustainable Energy Future

About this training course This 3-days training will provide a comprehensive review of integrity of wells exposed to carbon dioxide (CO2) in the context of Carbon Capture Utilization for enhanced oil recovery and Storage (CCUS). CO2 geological storage is a proven technology to reduce greenhouse gas emissions from sources such as coal power plants, cement kilns and steel mills. Wells are widely considered the most critical containment element, especially older wells that are not used to inject CO2 or monitor the plume evolution in the storage reservoir. The main reason for this perceived risk is the high corrosion rate of carbon steel when exposed to wet CO2, and the tendency of Portland cement to react with the gas. The training course advanced contents build on 15 years' experience in carbon storage, both in the development and deployment of technologies. First-hand, in-depth knowledge of the subject will allow us to debunk myths and focus on the real challenges of wells encountering CO2. Training Objectives After the completion of this training course, participants will be able to: Explain the CCUS market drivers Examine the behavior of CO2, on surface and in the reservoir Diagnose cement defects and design repairs Understand the limits of Portland cement Assess the benefits of different technologies and materials Realize why geology is a dominant factor in cement performance Critically choose the most appropriate monitoring techniques Classify aging processes of cement, steel, and rock when exposed to CO2 Assess the risk of existing wells if they encounter the CO2 plume Examine recent advances in real-time approaches to the production monitoring and lift management Target Audience This training course is suitable and will greatly benefit: All surface technical personnel such as process engineers & technologists Facility engineers, production engineers & technologists Drilling engineers and Well engineers Design engineers and Integrity engineers P&A engineers and Cementing engineers Geologists Senior management executives will benefit from this training as covers an overview of the technical and commercial details of CO2 capture technologies and risks involved. Course Level Intermediate Training Methods The training instructor relies on a highly interactive training method to enhance the learning process. This method ensures that all participants gain a complete understanding of all the topics covered. The training environment is highly stimulating, challenging, and effective because the participants will learn by case studies which will allow them to apply the material taught in their own organization. Course Duration: 3 days in total (21 hours). Training Schedule 0830 - Registration 0900 - Start of training 1030 - Morning Break 1045 - Training recommences 1230 - Lunch Break 1330 - Training recommences 1515 - Evening break 1530 - Training recommences 1700 - End of Training The maximum number of participants allowed for this training course is 20. This course is also available through our Virtual Instructor Led Training (VILT) format. Trainer Your expert course leader is an engineer with a passion for well integrity and possesses 28 years of international experience in field operations, technology development and management in the oil & gas and carbon storage sectors. Since 2018 he is program chair of the Well Integrity Technical Section of the Society of Petroleum Engineers (SPE). He is also author or co-author of 31 technical papers, a book chapter on CO2 geological storage and 7 patent applications. He delivers training on well integrity, plug and abandonment, asset integrity, risk management and QHSE across the Eastern Hemisphere, and carries out active research on harnessing geological barriers, modeling leaks through cement, and quantifying methane emissions from oil & gas wells. He has extensive expertise in: Well integrity, cementing, corrosion, upstream oil & gas (drilling, completion), carbon capture and storage, mathematical modeling, risk management, reliability, HSSE (health/safety/security/environment), asset integrity, management systems, sustainable development, project management, portfolio management, training, and technology development and innovation. He has personally worked on CCS projects in Europe (France, Germany, Netherlands, Norway), Algeria, Japan and USA. Partial list of companies that have benefited from the trainer's expertise: Vermilion Energy Geostock Aker BP Shell Statoil ENI TNO Geogreen Wintershall Archer INA and many more Recent CCS consulting track record: Schlumberger Total Oxand TNO THREE60 Energy and others POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable

NPORS Marine Knuckle Boom Crane (N014)

By Dynamic Training and Assessments Ltd

NPORS Marine Knuckle Boom Crane (N014)

AAT Level 2 Certificate in Accounting

By London School of Science and Technology

This qualification delivers a solid foundation in finance administration and core accounting skills, including double-entry bookkeeping, basic costing and an understanding of purchase, sales and general ledgers. Course Overview This qualification delivers a solid foundation in finance administration and core accounting skills, including double-entry bookkeeping, basic costing and an understanding of purchase, sales and general ledgers. Students will also learn about accountancy related business and personal skills and be introduced to the four key themes embedded in the qualification: ethics, technology, communications and sustainability. The jobs it can lead to: • Account administrator • Accounts assistant • Accounts payable clerk • Purchase/sales ledger clerk • Trainee accounting technician • Trainee finance assistant Entry requirements: Students can start with any qualification depending on existing skills and experience. For the best chance of success, we recommend that students begin their studies with a good standard of English and maths. Course Content: Introduction to Bookkeeping: This unit provides students with an understanding of manual and digital bookkeeping systems, including the associated documents and processes. Students will learn the basic principles that underpin double-entry bookkeeping systems. Learning outcomes: • Understand how to set up bookkeeping systems. • Process customer transactions. • Process supplier transactions. • Process receipts and payments. • Process transactions into the ledger accounts. Principles of Bookkeeping Controls: This unit builds on the knowledge and skills acquired from studying Introduction to Bookkeeping and explores control accounts, journals and reconciliations. Students will develop the ability to prepare the value added tax (VAT) control accounts as well as the receivables and payables ledger accounts. They’ll use the journal to record a variety of transactions, including the correction errors. Students will be able to redraft the initial trial balance, following adjustments. Learning outcomes: • Use control accounts. • Reconcile a bank statement with the cash book. • Use the journal. • Produce trial balances. Principles of Costing: This unit gives students an introduction to the principles of basic costing and builds a solid foundation in the knowledge and skills required for more complex costing and management accounting tasks. Students will learn the importance of the costing system as a source of information that allows management to plan, make decisions and control costs. Learning outcomes: • Understand the cost recording system within an organisation. • Use cost recording techniques. • Provide information on actual and budgeted cost and income. • Use tools and techniques to support cost calculations. The Business Environment: This unit provides knowledge and understanding of key business concepts and their practical application in the external and internal environment in which students will work. Students will gain an understanding of the legal system and principles of contract law and an appreciation of the legal implications of setting up a business and the consequences this may have. This unit will also give an understanding of how organisations are structured and where the finance function fits. Learning outcomes: • Understand the principles of contract law. • Understand the external business environment. • Understand the key principles of corporate social responsibility (CSR), ethics and sustainability. • Understand the impact of setting up different types of business entity. • Understand the finance function within an organisation. • Produce work in appropriate formats and communicate effectively. • Understand the importance of information to business operations. DURATION 170-190 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Achieving Outputs in a Complex World

By Mpi Learning - Professional Learning And Development Provider

Leadership is about 'getting stuff done'. This course concentrates on just that. In a complicated world, it helps leaders to ensure that the right stuff gets done at the right time and in the right way.

Layer of Protection Analysis (LOPA)

By EnergyEdge - Training for a Sustainable Energy Future

Take your knowledge to the next level with EnergyEdge course on Layer of Protection Analysis (LOPA). Enroll now to advance your career.

CAIA Level 2 Course

By London School of Science and Technology

The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. Course Overview The CAIA Association is a global professional body dedicated to creating greater alignment, transparency, and knowledge for all investors, with a specific emphasis on alternative investments. A Member-driven organization representing professionals in more than 100 countries, CAIA Association advocates for the highest ethical standards. Whether you need a deep, practical understanding of the world of alternative investments, a solid introduction, or data science skills for the future in finance, the CAIA Association offers a program for you. Why CAIA? Distinguish yourself with knowledge, expertise, and a clear career advantage – become a CAIA Charterholder. CAIA® is the globally recognized credential for professionals allocating, managing, analyzing, distributing, or regulating alternative investments. The Level II curriculum takes a top-down approach and provides Candidates with the skills and tools to conduct due diligence, monitor investments, and appropriately construct an investment portfolio. In addition, the Level II curriculum contains Emerging Topic readings; articles written by academics and practitioners designed to further inform and provoke the Candidate’s investment management process. After passing the Level II exam you are eligible, with relevant professional experience, to join the CAIA Association as a Member and receive the CAIA Charter. You will be part of an elite group of more than 13,000 professionals worldwide. Only after joining the Association, you are eligible to add the CAIA designation to your professional profiles. Who will benefit from enrolling in the CAIA program? Professionals who want to develop a deep level of knowledge and demonstrated expertise in alternative investments and their contribution to the diversified portfolio should pursue the CAIA Charter including: • Asset Allocators • Risk managers • Analysts • Portfolio managers • Traders • Consultants • Business development/marketing • Operations • Advisors Curriculum Topics: Topic 1: Emerging Topics • Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets • Technical Guide for Limited Partners: Responsible Investing in Private Equity • Channels for Exposure to Bitcoin • Assessing Long-Term Investor Performance: Principles, Policies and Metrics • Demystifying Illiquid Assets: Expected Returns for Private Equity • An Introduction to Portfolio Rebalancing Strategies • Longevity and Liabilities: Bridging the Gap • A Short Introduction to the World of Cryptocurrencies Topic 2: Ethics, Regulation and ESG • Asset Manager Code • Recommendations and Guidance • Global Regulation • ESG and Alternative Investments • ESG Analysis and Application Topic 3: Models • Modeling Overview and Interest Rate Models • Credit Risk Models • Multi-Factor Equity Pricing Models • Asset Allocation Processes and the Mean-Variance Model • Other Asset Allocation Approaches Topic 4: Institutional Asset Owners and Investment Policies • Types of Asset Owners and the Investment Policy Statement • Foundations and the Endowment Model • Pension Fund Portfolio Management • Sovereign Wealth Funds • Family Offices and the family office Model Topic 5: Risk and Risk Management • Cases in Tail Risk • Benchmarking and Performance Attribution • Liquidity and Funding Risks • Hedging, Rebalancing, and Monitoring • Risk Measurement, Risk Management, and Risk Systems Topic 6: Methods for Alternative Investing • Valuation and Hedging Using Binomial Trees • Directional Strategies and Methods • Multivariate Empirical Methods and Performance Persistence • Relative Value Methods • Valuation Methods for Private Assets: The Case of Real Estate Topic 7: Accessing Alternative Investments • Hedge Fund Replication • Diversified Access to Hedge Funds • Access to Real Estate and Commodities • Access through Private Structures • The Risk and Performance of Private and Listed Assets Topic 8: Due Diligence and Selecting Managers • Active Management and New Investments • Selection of a Fund Manager • Investment Process Due Diligence • Operational Due Diligence • Due Diligence of Terms and Business Activities Topic 9: Volatility and Complex Strategies • Volatility as a Factor Exposure • Volatility, Correlation, and Dispersion Products and Strategies • Complexity and Structured Products • Insurance-Linked and Hybrid Securities • Complexity and the Case of Cross-Border Real Estate Investing DURATION 200 Hours WHATS INCLUDED Course Material Case Study Experienced Lecturer Refreshments Certificate

Search By Location

- Operations Courses in London

- Operations Courses in Birmingham

- Operations Courses in Glasgow

- Operations Courses in Liverpool

- Operations Courses in Bristol

- Operations Courses in Manchester

- Operations Courses in Sheffield

- Operations Courses in Leeds

- Operations Courses in Edinburgh

- Operations Courses in Leicester

- Operations Courses in Coventry

- Operations Courses in Bradford

- Operations Courses in Cardiff

- Operations Courses in Belfast

- Operations Courses in Nottingham