- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Credit control training 'menu' (In-House)

By The In House Training Company

This is not a single course but a set of menu options from which you can 'pick and mix' to create a draft programme yourself, as a discussion document which we can then fine-tune with you. For a day's training course, simply consider your objectives, select six hours' worth of modules and let us do the fine-tuning so that you get the best possible training result. Consider your objectives carefully for maximum benefit from the course. Is the training for new or experienced credit control staff? Are there specific issues to be addressed within your particular sector (eg, housing, education, utilities, etc)? Do your staff need to know more about the legal issues? Or would a practical demonstration of effective telephone tactics be more useful to them? Menu Rather than a generic course outline, the expert trainer has prepared a training 'menu' from which you can select those topics of most relevance to your organisation. We can then work with you to tailor a programme that will meet your specific objectives. Advanced credit control skills for supervisors - 1â2 day Basic legal overview: do's and don'ts of debt recovery - 2 hours Body language in the credit and debt sphere - 1â2 day County Court suing and enforcement - 1â2 day Credit checking and assessment - 1 hour Customer visits and 'face to face' debt recovery skills - 1â2 day Data Protection Act explained - 1â2 day Dealing with 'Caring Agencies' and third parties - 1 hour Debt counselling skills - 2 hours Elementary credit control skills for new staff - 1â2 day Granting credit and collecting debt in Europe - 1â2 day Identifying debtors by 'type' to handle them accurately - 1 hour Insolvency: Understanding bankruptcy / receivership / administration / winding-up / liquidation / CVAs and IVAs - 2 hours Late Payment of Commercial Debts Interest Act explained - 2 hours Liaison with sales and other departments for maximum credit effectiveness - 1 hour Suing in Scottish Courts (Small Claims and Summary Cause) - 1â2 day Telephone techniques for successful debt collection - 11â2 hours Terms and conditions of business with regard to credit and debt - 2 hours Tracing 'gone away' debtors (both corporate and individual) - 11â2 hours What to do if you/your organisation are sued - 1â2 day Other topics you might wish to consider could include: Assessment of new customers as debtor risks Attachment of Earnings Orders Bailiffs and how to make them work for you Benefit overpayments and how to recover them Cash flow problems (business) Charging Orders over property/assets Credit policy: how to write one Council and Local Authority debt recovery Consumer Credit Act debt issues Using debt collection agencies Director's or personal guarantees Domestic debt collection by telephone Exports (world-wide) and payment for Emergency debt recovery measures Education Sector debt recovery Forms used in credit control Factoring of sales invoices Finance Sector debt recovery needs Third Party Debt Orders (Enforcement) Government departments (collection from) Harassment (what it is - and what it is not) Health sector debt recovery skills Hardship (members of the public) Insolvency and the Insolvency Act In-house collection agency (how to set up) Instalments: getting offers which are kept Judgment (explanation of types) Keeping customers while collecting the debt Late payment penalties and sanctions Letter writing for debt recovery Major companies as debtors Members of the public as debtors Monitoring of major debtors and risks Negotiation skills for debt recovery Old debts and how to collect them Out of hours telephone calls and visits Office of Fair Trading and collections Oral Examination (Enforcement) Pro-active telephone collection Parents of young debtors Partnerships as debtors Positive language in debt recovery Pre-litigation checking skills Power listening skills Questions to solicit information Retention of title and 'Romalpa' clauses Sale of Goods Act explained Salesmen and debt recovery Sheriffs to enforce your judgment Students as debtors Statutory demands for payment Small companies (collection from) Sundry debts (collection of) Terms and Conditions of Contract Tracing 'gone away' debtors The telephone bureau and credit control Taking away reasons not to pay Train the trainer skills Utility collection needs Visits for collection and recovery Warrant of execution (enforcement)

Learning Disability Awareness

By Prima Cura Training

What are the aims of this course? What learning disability is and isn't The facts of learning disabilities What barriers people with learning disabilities face Medical barriers Societal barriers How to support people with learning disabilities

Smartphone video production

By Rough House Media

Do you use video as a tool to promote your charity, business, organisation or campaigns? And if you don’t, do you feel as if you ought to? Videos account for more than 80% of all consumer internet traffic. So the pressure to use video as a marketing and PR tool has increased enormously. But the cost can be prohibitive. Using a video production company, such as ours, might be ideal, but for many it is out of reach – particularly if, like many of our clients, you’re a charity. However, there is an alternative, which more and more organisations are choosing, especially those which need to produce regular digital content. That is to produce the video yourself. Nowadays, you do not even need to invest in a video camera. All you need is your smart phone, some simple equipment you can buy on Amazon for as little as £80, plus your laptop or PC. This is why we have developed a new smartphone video training course, Smart Video. Our smartphone video training course covers: Equipment – including setting up your phone, microphones, tripods and editing programmes Planning your video Techniques to give your films broadcast-quality polish Getting the perfect shot – including shot sizes, positioning the camera, framing, lighting, sound, sequences and backgrounds Filming interviews An introduction to editing Producing videos for social media Bespoke training The course can be tailored to the type of videos you need to make. If most of your videos will be interviews, we’ll focus on presenting your interviewee in the best possible light – literally. If, on the other hand, you need to film buildings, events or products, we’ll tailor the course accordingly. If your video needs a script, we’ll give you tips and techniques on how to “write to pictures”, so your messages comes across well. And on all our courses, we’ll give you a guide to the best equipment and apps to use to enhance your filming and editing. The smartphone video course will be led by Paul Curran who has many years experience producing, filming and editing films and videos, for the BBC and corporate clients.

Managing with NLP (In-House)

By The In House Training Company

Self-understanding is a prerequisite for leading and managing others responsibly and honourably. The field of Neuro Linguistic Programming has helped us to gain a better insight into how we all think and behave. Upon completion of this course participants will be able to: Gain an insight into the purpose and functions of the unconscious mind Develop flexibility to increase their for behaviours in different circumstances Appreciate how different people experience the world Create and set effective goals and direction Understand the NLP Model of Communication Adapt their communication style to maximise effectiveness Influence and persuade others by connecting with people Understand how empowerment can make life easier Appreciate how creativity works Learn creativity techniques to tap into the power of the team 1 Self-awareness Autopilot - your unconscious mind Developing flexibility How identify, values & beliefs shape our behaviour Models of the world 2 Creating direction Describing present and desired state Designing your direction Making it happen Self-mastery 3 Communication The NLP Model of Communication Insights to the way people think Understanding representation systems Reframing the way people think about negative experiences Using metaphor 4 Influence and persuasion Building trust Connecting with people Purpose intention and outcomes The difference empowerment makes 5 Creativity and innovation Hindrances to creativity and innovation Your natural state of creativity Getting unblocked Creativity techniques 6 Action plan Course summary and presentation of action plans

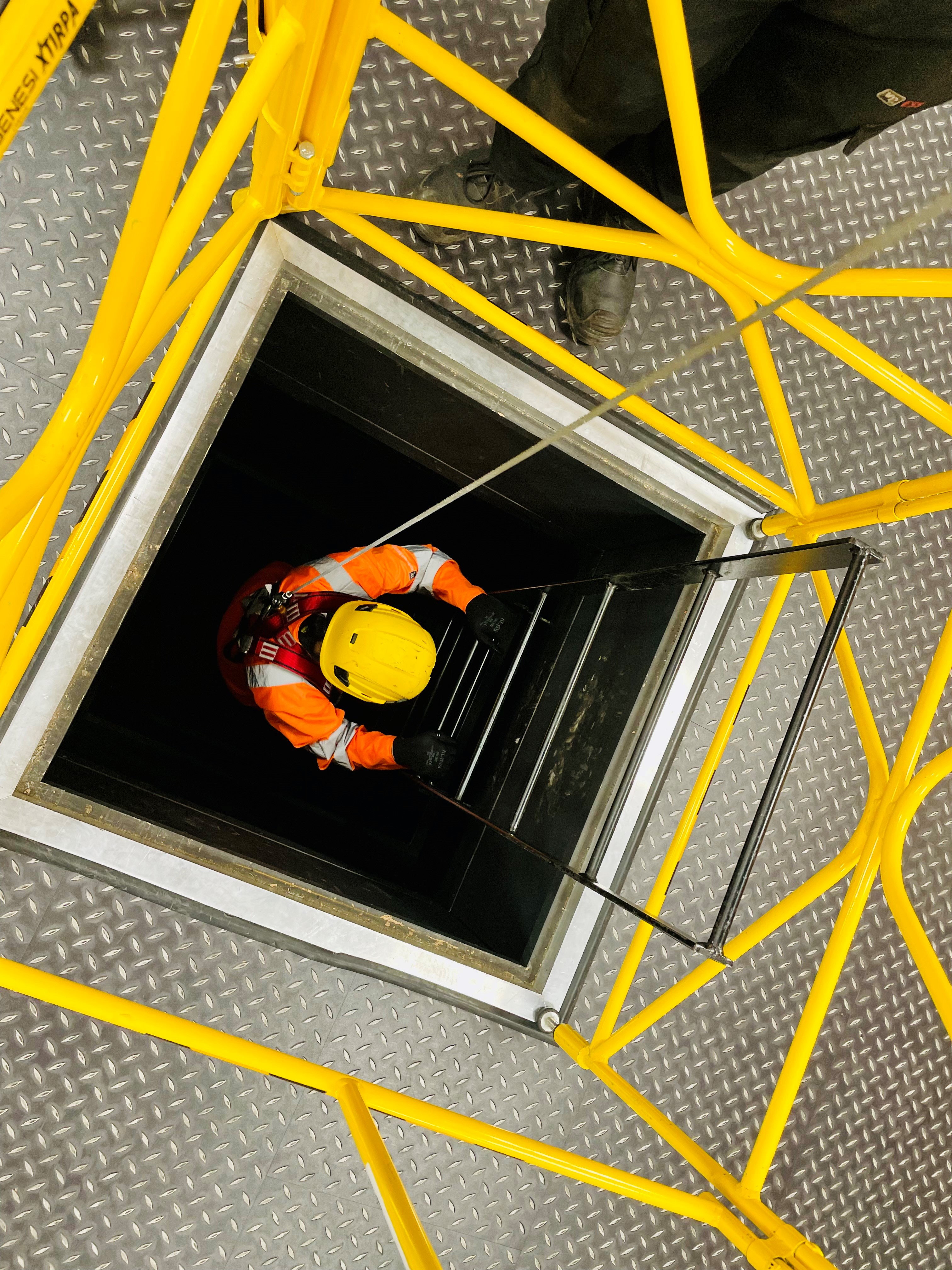

City & Guilds Level 3 Award in Supervising Teams Undertaking Work in Confined Spaces - 6160-05

By Vp ESS Training

City & Guilds Level 3 Award in Supervising Teams Undertaking Work in Confined Spaces - 6160-05 - This course is designed to provide delegates with enough understanding of Safe Systems of Work to be able to authorise works and issue permits. It identifies the employer’s responsibilities within their own policies to allocate duties to competent employees. To achieve this qualification the delegate must hold the level 2 qualification relevant to their own work environment including the use confined space equipment. Book via our website @ https://www.vp-ess.com/training/confined-spaces/6160-05-city-guilds-level-3-award-in-supervising-teams-undertaking-work-in-confined-spaces/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Bid writing (In-House)

By The In House Training Company

This workshop is very practical in its nature and aims to give delegates an opportunity to not only learn about the key aspects of successful bid writing, but to also put them into practice. The workshop helps delegates understand what is most important to buyers and how to successfully convey they proposition to them. 1 Welcome and introductions 2 The mindset of successful bid writing The mindset needed for successful bid writing Thinking from the buyer's perspective and not your own 3 Decision making The way buyers make decisions - rational and emotional Understanding buying motives Looking at how to present ideas against those motives The idea of cognitive fluency How to pitch an idea in a way that leads to a positive decision 4 To bid or not to bid? Writing a bid is a big commitment; a clear understanding of the chances of winning is required Understanding of the implications of winning and the impact it will have on the organisation 5 Understanding your value proposition Framework to help identify unique proposition and how that fits in with the requirements of the bid 6 The tender process Understanding the process to enable a successful chance of winning the bid Different types of tender processes Evaluation of criteria and the impact on bid writing 7 Writing skills Different ways of writing and structuring bids to ensure their messages gets across well in a way that will be looked on favourably by the buyer 8 Summarise 9 Close

Memory skills and mind-mapping (In-House)

By The In House Training Company

This is an incredibly practical programme which has been developed to enable participants to improve their memory skills. The session focuses on specific techniques that can be used to improve retention of information. It also introduces the principles of mind-mapping By the end of this programme participants will be able to: Explain how our brain processes and stores information Describe the difference between short-term and long-term memory Use specific techniques to improve retention Explain the principles of mind mapping Be able to use mind maps to plan and order information Each participant, no matter how poor they believe their memory to be, will by the close of the session have learnt techniques that enable them to memorise 53 items in a prescriptive order - a massive boost to their confidence in their memory skills. 1 An introduction to the brain's functions Introductory brain-training How the brain works Left / right brain function Short-term and long-term memory Barriers to a good memory 2 Memory techniques Tips and techniques for improving memory Basic word association Chaining and linking Touchstone techniques Use of mnemonics Memory hooks Remembering names 3 Maximising memory Minimising barriers The importance of sleep and diet Supplements which may affect memory 4 Mind-mapping Purpose and principles Creating a mind map Use of colour to delight the eye and tickle the brain How to use the output from a map

Sage Line 50 Accounting / Bookkeeping Training - Fast Track

By Osborne Training

Sage Line 50 Accounting / Bookkeeping Training - Fast Track If you're looking to gain competency in the world's most popular bookkeeping software, the Sage 50 Computerised Accounting course will teach everything you need to know, while helping you gain a recognised qualification. This Course is designed to provide individuals from beginner to advanced knowledge of bookkeeping and Sage 50 accounts. It is intended for individuals who aim to improve career prospects and to be able to better financial management and control of business. This course covers Level 1-3 of Sage 50 Bookkeeping/Accounting Training. Every business, no matter how large or small, is required by law to 'keep books'. Therefore, Bookkeepers play a vital role within organisations; ensuring records of individual financial transactions are accurate, orderly, up to date and comprehensive. If you are organised and methodical, like working through documents and enjoy seeing a set of figures add up properly, then bookkeeping is the career for you. What qualification will I gain? You have the choice to gain certification from one of the following awarding bodies. CERTIFICATION FROM SAGE (UK) As Osborne Training is a Sage (UK) Approved training provider, you could gain the following qualifications provided that you book and register for exams and pass the exams successfully: Sage 50c Computerised Accounting Course (Level 1) Sage 50c Computerised Accounting Course (Level 2) Sage 50c Computerised Accounting Course (Level 3) Level 1 Working with Sage 50 Accounts Program Basics. Creating Account names, Numbers & Bank Payments Financials Bank Reconciliations Generating Customers Invoices Monitoring Customer Activity Generating Product Invoices & Credit Notes Compiling & Sending Customer Statements Creating Customer Receipts & Purchase Invoices Supplier Payments Managing Recurring Entries Generating Reports & Information The Active Set-Up Wizard VAT Changes. Level 2 An overview of the Sage program Entering opening balances, preparing and printing a trial balance Creating customer records Creating supplier records Setting up opening assets, liabilities and capital balances, Producing routine reports Checking data, Entering supplier invoices Posting error corrections, amending records Invoicing, generating customer letters, entering new products, checking communication history Banking and payments, producing statements, petty cash Audit trails, correcting basic entry errors, reconciling debtors and creditors Creating sales credit notes, Processing purchase credit notes Preparing journals Verifying Audit Trail Purchase orders, processing sales orders Processing Trial Balance Creating Backups Restoring data Writing-off bad debts Level 3 Creating a Chart of Accounts to Suit Company Requirements Sole Trader Accounts preparation The Trial Balance preparation Errors in the Trial Balance Disputed Items Use of the Journal Prepare and Process Month End Routine Contra Entries The Government Gateway and VAT Returns Bad Debts and Provision for Doubtful Debts Prepare and Produce Final Accounts Management Information Reports Making Decisions with Reports Using Sage The Fixed Asset Register and Depreciation Accruals and Prepayments Cash Flow and Forecast Reports Advanced Credit Control

Unpuzzling finance (In-House)

By The In House Training Company

Finance doesn't have to be a puzzle. And if you want to get anywhere with your career, it had better not be! Whatever your role, you have an impact on the financial wellbeing of the organisation you work for, whether you've got specific financial responsibilities or not. This thoroughly practical, fun and enjoyable one-day workshop will help unpuzzle finance for you. It's an ideal opportunity to master the terminology, get to grips with the concepts, learn how 'the finance department' works and understand the part you play. This course will help participants: Appreciate the role and importance of Finance within organisations Be able to recognise and describe some of the common items and jargon used Identify the elements of the Profit & Loss and the Balance Sheet Understand cashflow Make better decisions Manage budgets 1 Introduction Expectations Terminology Key financial principlesAccrualsConsistencyPrudenceGoing concern 2 The three main financial statements Profit & Loss accountIncomeCost of salesGross profitAdministrative expenses ('overheads')Net profit/(loss) for the financial year (the 'bottom line')P&L format Balance SheetTerminologyFixed AssetsCurrent AssetsCurrent LiabilitiesLong-term LiabilitiesCapitalB/S format Cashflow Statement Financial and management information systems 3 Budgets and forecasts Why budget? Types of budget - incremental or zero-based Budgeting for costs - fixed and variable Budgeting for income An eight point plan for budgeting for your department Case study: Small Brother Ltd Problems and solutions 4 Accruals Accruals - what and why? Prepayments 5 Open forum

Search By Location

- IT Courses in London

- IT Courses in Birmingham

- IT Courses in Glasgow

- IT Courses in Liverpool

- IT Courses in Bristol

- IT Courses in Manchester

- IT Courses in Sheffield

- IT Courses in Leeds

- IT Courses in Edinburgh

- IT Courses in Leicester

- IT Courses in Coventry

- IT Courses in Bradford

- IT Courses in Cardiff

- IT Courses in Belfast

- IT Courses in Nottingham