- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview This course will help our clients to assist not only in meeting the challenges of introducing IPSAS but also to secure the benefits of improved financial management to help secure the organisational objectives and goals of each public service organisation. This enables multi-national organisations to make comparisons between projects wherever in the world they happen, irrespective of jurisdiction, culture, language and ethnicity. IPSAS is becoming and will become the World standard for Public Sector entities. We have developed this course starting with an introduction and then implementation of IPSAS. This allows clients to structure the move to IPSAS within its appropriate Framework. It is an approach that enables implementation to be done in a structured and well-managed way. In the course we will consider the main requirements of IPSAS and, by showing how they affect financial reports and published accounts, will help you to apply IPSAS. The course will assist both finance managers and general managers whose organisations and departments will be affected by IPSAS. The consequences of managing the finances of public organisations will be examined, together with potential unintended consequences. How to implement IPSAS effectively and economically, is probably the most important aspect. The approach will be to understand the advantages to the organisation from IPSAS implementation and how benefits realisation can be ensured both internally and for stakeholders. The course will deal with practical issues for public sector organisations, including strategic management and the medium-term financial framework

Overview This course will provide participants with an introduction to the key elements to consider in analysing financial institutions for example factors used in the assessment of the operational performance of financial institutions including but not limited to solvency, liquidity, earnings, management and systems/controls. The program will primarily cover banking institutions but there will also be some sessions devoted to risks associated with insurance companies.

Overview This course is designed to evaluate the financial statement, budget and making an effective decision. It will help to understand Discounted Cash Flow and its techniques, applications of financial statements and decision-making process. In this programme, you will challenge representatives to learn how to make use of financial statements to assess the strategic or financial performance of an organization. It will help to understand DCF Discounted Cash Flow techniques along with their apps for financial making decisions and making use of ratios in order to identify the major areas of concern. Find out the elements like weaker financial signals, major success factors, and robust financial signals within your own industry. It Projects future performance assuredly through real-world budgeting.

Overview This course is designed to give me comprehensive knowledge of the credit control process. This comprehensive and practical course concentrates on the credit control process and effective credit management assessing the risk and the process of credit management. It will enable delegates to get complete pictures and improve their skills at recognizing the warning signs through the use of exercises, discussions, and case studies.

Overview With the change in the density of enterprise risk, new risks have emerged, and managing it has become everyone's responsibility. The new Enterprise Risk Management course offers you the exclusive opportunity to learn the concepts and principles of the newly updated ERM framework and to integrate the framework into your organisation's strategy. The course is designed with all the modules to provide you with the knowledge necessary to understand and apply Enterprise Risk Management - Integrating with Strategy and Performance. The ERM framework assists management and boards of directors with their respective duties for managing risk.

Overview Financial analysis gives you a wide understanding of a company's financial information which further helps you to analyse risks in the future and improve business prospects. It plays a vital role in calculating business profit. Professionals with the necessary skills help you to know how your business and forecast the future of the business. It helps to analyse financial statements and also to appraise the present and future prospects of the business. This course is specially designed to enhance the skills of financial professionals, in financial analytics by having in-depth knowledge of fundamentals of financial statement analysis thereby empowering their analytical skills in measuring the risk business investors are dealing with and also asking the appropriate questions. It will enhance the skills of the participant and will boost their confidence uplifting their ability to comment on business activities and analyse financial health for management. These skills and the required technical knowledge will be put into practice throughout the course using interactive examples and case studies.

Overview EDMS Electronic Document Management System is basically a kind of IT-based system which is developed to manage the creation, tracking, storage and disposal of all physical and digital documents and records. Through this, we can easily keep track of various documents modified by different users. With the access of one application, many different tasks can be completed that revolve around document management. It enhances the security system where we can easily define whom to have access to what part of the documents. EDRMS is known by many other different names like Enterprise content management systems or digital asset management, document mapping and so on. This course shows participants how to deal with documents in an electronic way to get rid of the paper's hard copy which takes a lot of space and time. It will also update you with the EDRMS system and changes that happen to take place with the passage of time. The advanced technology leads to Advance EDRMS systems with enhanced features.

Overview EDRMS Electronic Document and Record Management System is basically a kind of IT-based system which is developed to manage the creation, tracking, storage and disposal of all physical and digital documents and records. Through this, we can easily keep track of various documents modified by different users. With the access of one application, many different tasks can be completed that revolve around document management. It enhances the security system where we can easily define whom to have access to what part of the documents. EDRMS is known by many other different names like Enterprise content management systems or digital asset management, document mapping and so on. This course shows participants how to deal with documents in an electronic way to get rid of the paper's hard copy which takes a lot of space and time. It will also update you with the EDRMS system and changes that happen to take place with the passage of time. The advanced technology leads to Advance EDRMS systems with enhanced features.

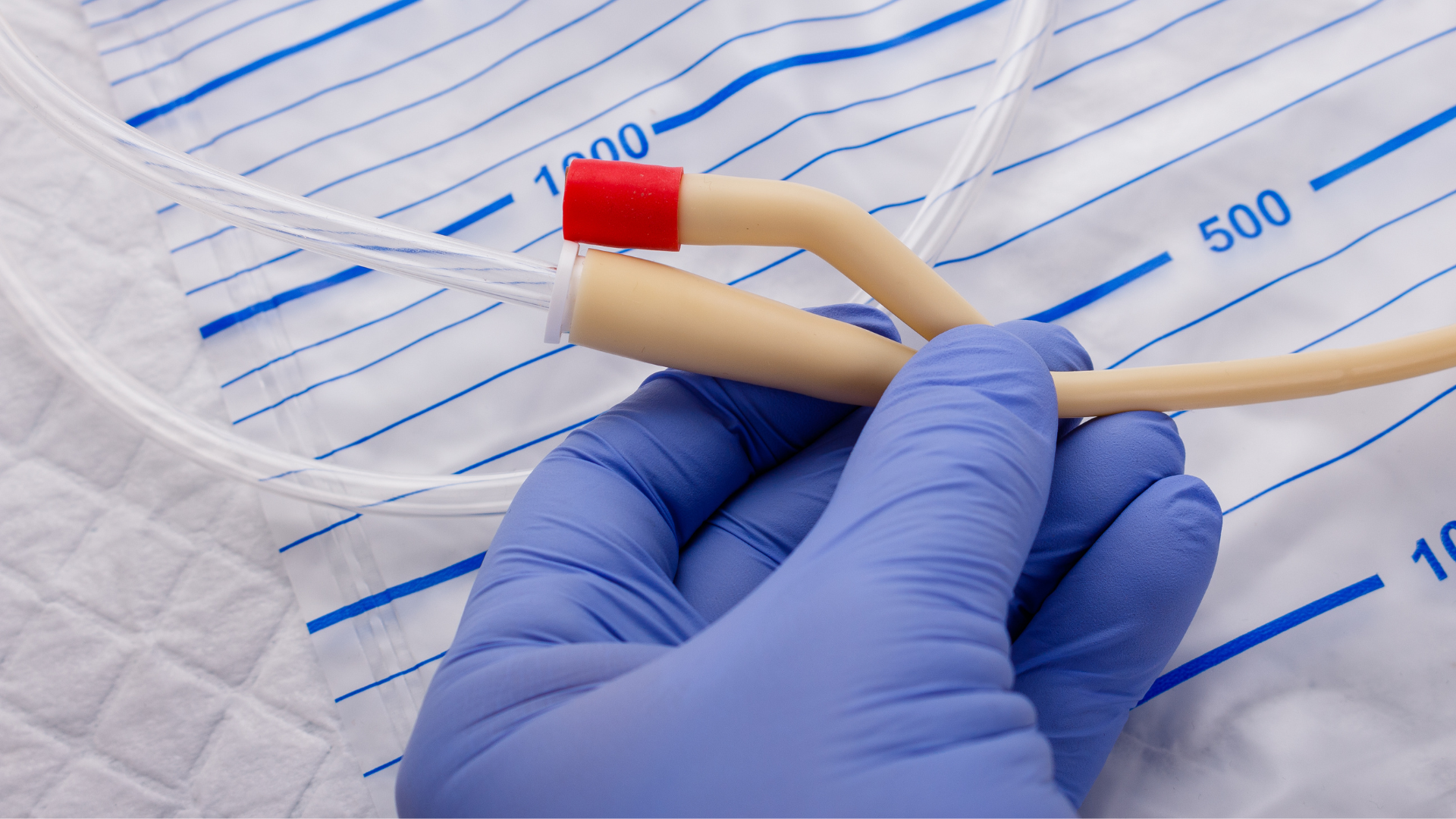

An overview of catheter care as an effective intervention in infection prevention and controlled continence care. Allowing participants to demonstrate theoretical and practical competencies within a classroom environment.

Portfolio, Programs, and Project Offices Foundation: In-House

By IIL Europe Ltd

Portfolio, Programme, and Project Offices (P3O®) Foundation: In-House Training P3O® is the AXELOS standard for the design of decision-making processes regarding changes in organizations. P3O provides a guideline for the design of portfolio, programme, and project offices in organizations. The P3O Foundation course is an interactive learning experience. The P3O Foundation-level content provides you with sufficient knowledge and understanding of the P3O guidance to interact effectively with, or act as an informed member of, an office within a P3O model. It enables you to successfully complete the associated P30 Foundation exam and achieve the qualification. In this course, you will be prepared to successfully attempt the P3O Foundation exam and learn how to implement or re-energize a P3O model in their own organization. What you will Learn Individuals certified at the P3O Foundation level will be able to: Define a high-level P3O model and its component offices List the component offices in a P3O model Differentiate between Portfolio, Programme, and Project Management List the key functions and services of a P3O List the reasons for establishing a P3O model Compare different types of P3O models List the factors that influence selection of the most appropriate P3O model for an organization Define the processes to implement or re-energize a P3O Benefits: Fast-track programme for those who want to achieve P3O Foundation qualification Practical case study and scenarios Attractive slides and course book Introduction to P3O What is the purpose of P3O? Definitions What are P3Os? Portfolio, programme, and project lifecycles Governance and the P3O Designing a P3O Model Factors that affect the design Design considerations What functions and services should the P3O offer? Roles and responsibilities Sizing and tailoring of the P3O model Introduction to P3O What is the purpose of P3O? Definitions What are P3Os? Portfolio, programme, and project lifecycles Governance and the P3O Designing a P3O Model Factors that affect the design Design considerations What functions and services should the P3O offer? Roles and responsibilities Sizing and tailoring of the P3O model Why Have a P3O? How a P3O adds value Maximizing that value Getting investment for the P3O Overcoming common barriers Timescales How to Implement or Re-Energize a P3O Implementation lifecycle for a permanent P3O Identify Define Deliver Close Implementation lifecycle for a temporary programme or project office Organizational context Definition and implementation Running Closing Recycling How to Operate a P3O Overview of tools and techniques Benefits of using standard tools and techniques Critical success factors P3O tools P3O techniques

Search By Location

- AS Courses in London

- AS Courses in Birmingham

- AS Courses in Glasgow

- AS Courses in Liverpool

- AS Courses in Bristol

- AS Courses in Manchester

- AS Courses in Sheffield

- AS Courses in Leeds

- AS Courses in Edinburgh

- AS Courses in Leicester

- AS Courses in Coventry

- AS Courses in Bradford

- AS Courses in Cardiff

- AS Courses in Belfast

- AS Courses in Nottingham