- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview This training course will give participants a developed knowledge of credit analysis. Through a mix of lectures and interactive case studies, participants will be able to perform detailed credit analysis, including analysing market and environment, computing key financial ratios, interpreting cash flows and analysing financing needs. Key Topics Financial needs and the business operating cycle Review of financial statements Financial ratio analysis Corporate cash flow analysis Cash flow projections for debt service Key lending policy guidelines

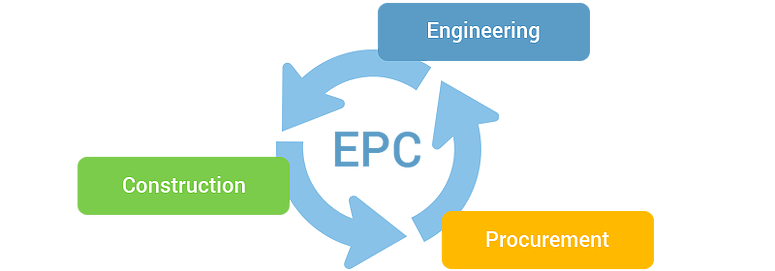

Overview EPC (Engineering, Procurement and Construction) is a very challenging area and is very competitive as well. Companies dealing with large and complex EPC projects are more often get involved in mitigation by complex contract laws and management that lead to huge financial losses. It is very important to Know-how EPC contract laws, and their commercial and financial aspects to gain skills and the ability to deal with complex contract laws and reduces the risk.

Overview In today's competitive business world firms are under unprecedented pressure to deliver value to their shareholders and other key stakeholders. Senior executives in all parts of the organisation are finding that they need some degree of financial know-how to cope with the responsibility placed on them as business managers and key decision-makers; monitoring and improving business performance, investing in capital projects, mergers and acquisitions and budgets. All require some degree of financial knowledge.

Overview Public Private Partnerships (PPPs) are arrangements typified by joined-up working between the public and private sectors. In the broadest sense, PPPs can cover all types of collaboration across the interface between the public and the private sector to deliver services. This course will equip participants with a basic understanding of PPPs and why they are needed. It will walk delegates through a typical PPP process, from the identification of potential PPP projects to risk appraisal, tendering, and implementation.

Overview A Strategic thinking and feasibility study is an effective way to safeguard against the wastage of investment or scarce resources. Organisations can reduce the risk of developing unpopular and impractical projects by conducting a feasibility study. A business plan can start only after a proposed business idea has been proven feasible. If feasible, we can proceed with a high level of confidence that the business plan will result in a profitable opportunity. It will provide a âroadmapâ that shows how a business may be created and developed.

Overview In order to determine if capital investment is beneficial to their organisation, Return on Investment Analysis will provide you with the tools and techniques. This course will teach you the basics of Return on Investment analysis such as estimating future revenues, ongoing expenses, and the initial investment. It will also explore more advanced aspects such as risk, changes in net working capital and the calculation of manufacturing overhead. It then assembles these projected expenses and revenues into a financial - the method experts agree is the best for evaluating capital investments.

Overview The development of effective and realistic business/financial models is a critical tool in today's value-driven organization. As shareholders are increasingly concerned with the value of their investments, organizations are continually driven to ensure the optimum use of resources. Using Excel®, the Business & Financial Modelling process provides an effective tool with which the potential outcomes of various strategic and tactical initiatives can be projected. This comprehensive five-day programme takes you through the modelling process from start to finish. It provides practical examples and applications of modelling for both strategic and tactical executives.

Overview Financial Analysis and Decision Making specifies a financial outline to support the life cycle approach of managing tedious projects over a long time scale. This course includes the advanced level of accounting structures which are required to insert knowledgable information in order to make decisions or to support the decision-making process where accounting and financial information overlaps other decision-making processes. In order to manage the growth of the organisation and measure the profitability it is very important to do a financial analysis. This course will take you through different models of accounting and finance which is helpful for the decision-making process thereby helping ensure sustainable growth and success.

Overview This course is designed to evaluate the financial statement, budget and making an effective decision. It will help to understand Discounted Cash Flow and its techniques, applications of financial statements and decision-making process. In this programme, you will challenge representatives to learn how to make use of financial statements to assess the strategic or financial performance of an organization. It will help to understand DCF Discounted Cash Flow techniques along with their apps for financial making decisions and making use of ratios in order to identify the major areas of concern. Find out the elements like weaker financial signals, major success factors, and robust financial signals within your own industry. It Projects future performance assuredly through real-world budgeting.

Overview This course will help our clients to assist not only in meeting the challenges of introducing IPSAS but also to secure the benefits of improved financial management to help secure the organisational objectives and goals of each public service organisation. We have developed this course starting with an introduction and then implementation of IPSAS. This course will help our clients to assist not only in meeting the challenges of introducing IPSAS but also to secure the benefits of improved financial management to help secure the organisational objectives and goals of each public service organisation. This enables multi-national organisations to make comparisons between projects wherever in the world they happen, irrespective of jurisdiction, culture, language and ethnicity. IPSAS is becoming and will become the World standard for Public Sector entities. We have developed this course starting with an introduction and then implementation of IPSAS. This allows clients to structure the move to IPSAS within its appropriate Framework. It is an approach that enables implementation to be done in a structured and well-managed way. In the course we will consider the main requirements of IPSAS and, by showing how they affect financial reports and published accounts, will help you to apply IPSAS. The course will assist both finance managers and general managers whose organisations and departments will be affected by IPSAS.

Search By Location

- project Courses in London

- project Courses in Birmingham

- project Courses in Glasgow

- project Courses in Liverpool

- project Courses in Bristol

- project Courses in Manchester

- project Courses in Sheffield

- project Courses in Leeds

- project Courses in Edinburgh

- project Courses in Leicester

- project Courses in Coventry

- project Courses in Bradford

- project Courses in Cardiff

- project Courses in Belfast

- project Courses in Nottingham