- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

FreeAgent Training Session (1 Hour)

By Back Office Software Support Ltd T/A Boss

Remote training session for FreeAgent Accounting and Payroll software.

QuickBooks Training Session (1 Hour)

By Back Office Software Support Ltd T/A Boss

Remote training session for QuickBooks Accounting and Payroll software.

Sage Training Session (1 Hour)

By Back Office Software Support Ltd T/A Boss

Remote training session for Sage Accounting and Payroll software.

Xero Training Session (1 Hour)

By Back Office Software Support Ltd T/A Boss

Remote training session for Xero Accounting and Payroll software.

Internet of Things - IOT for leaders

By Mpi Learning - Professional Learning And Development Provider

The Internet of Things (IoT) promises a wide range of benefits for industry, energy and utility companies, municipalities, healthcare, and consumers. Data can be collected in extraordinary volume and detail regarding almost anything worth measuring, such as public health and safety, the environment, industrial and agricultural production, energy, and utilities.

Unlock Your Academic Potential with Assignment Help Online

By david hude

This article explores the advantages of Assignment Help Online, highlighting its importance for students dealing with time constraints, difficult topics, and balancing multiple responsibilities. It covers how these services provide professional assistance and tips on selecting the best platform for your academic needs. The FAQ section addresses common queries regarding the service.

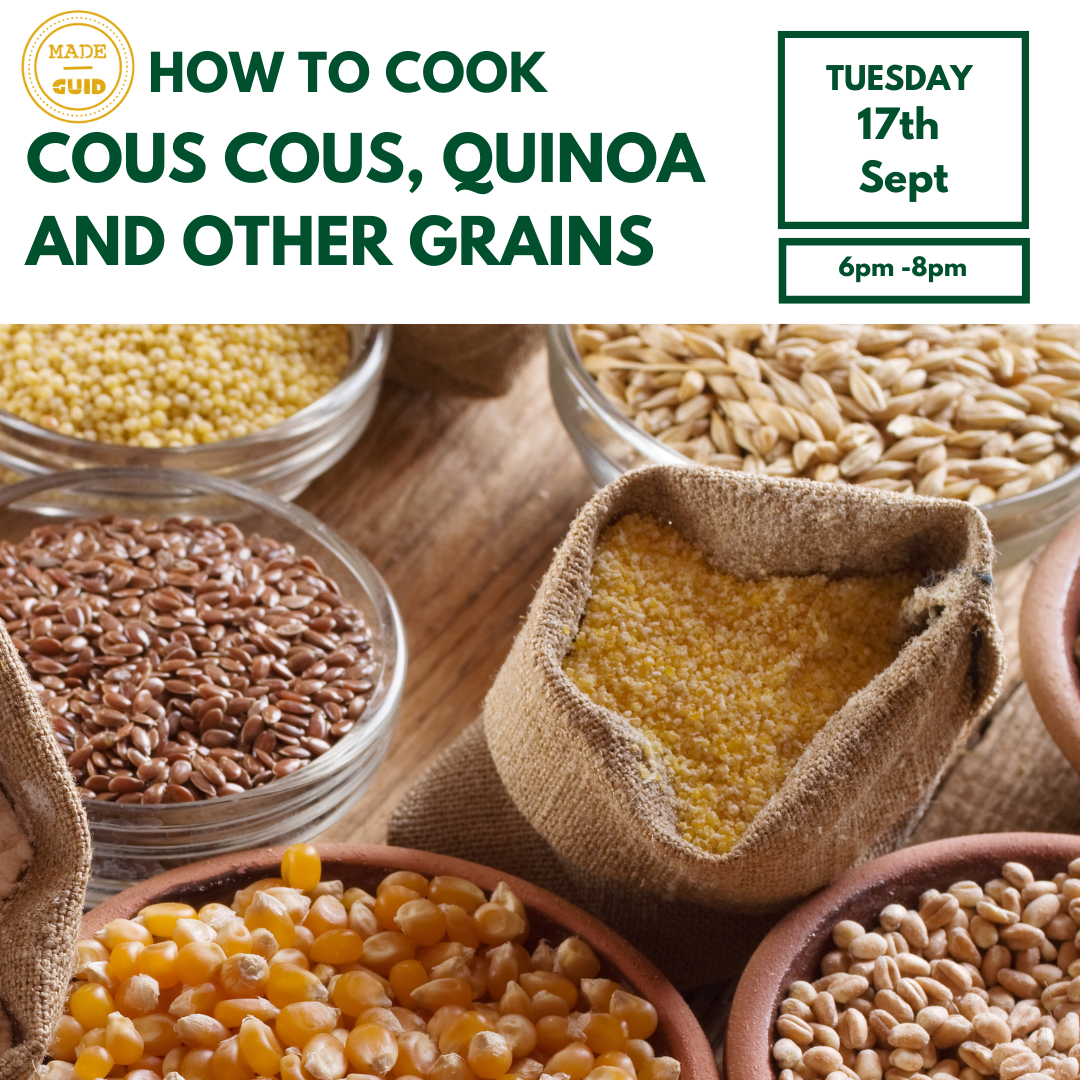

Add to your weekly recipe options by learning how to cook with Cous Cous, Quinoa and other grains such as buckwheat, freekah and millet. Simple quick recipes. The meals are based on a vegetarian diet which can be adapted at home and do contain allergens (soy, sesame). Please advise if you have a vegan diet or specific allergen. At the end of the cooking session we will eat together as a group This event includes full list of recipes for all meals and a free meal kit to cook at home. £10 per ticket

Overview This two-day intensive course is ideal for finance professionals seeking to deepen their expertise in options trading and volatility management. The course will cover option pricing and risk management techniques. Exploring differences between physical and cash-settled options European versus American/Bermudan options, and the implications of deferred premiums. Examining the role of volatility in option pricing & Managing First-Generation Exotics. Who the course is for Derivative traders Quants and research analysts Fund managers, fund of funds Structured product teams Financial and valuation controllers Risk managers and regulators Bank and corporate treasury managers IT Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Interest Rate Options are an essential part of the derivatives marketplace. This 3-Day programme will equip you to use, price, manage and evaluate interest rate options and related instruments. The course starts with a detailed review of option theory, from a practitioner’s viewpoint. Then we cover the key products in the rates world (caps/floors, swaptions, Bermudans) and their applications, plus the related products (such as CMS) that contain significant ’hidden’ optionality. We finish with a detailed look at the volatility surface in rates, and how we model vol dynamics (including a detailed examination of SABR). The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Search By Location

- opt Courses in London

- opt Courses in Birmingham

- opt Courses in Glasgow

- opt Courses in Liverpool

- opt Courses in Bristol

- opt Courses in Manchester

- opt Courses in Sheffield

- opt Courses in Leeds

- opt Courses in Edinburgh

- opt Courses in Leicester

- opt Courses in Coventry

- opt Courses in Bradford

- opt Courses in Cardiff

- opt Courses in Belfast

- opt Courses in Nottingham