- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Power BI - advanced (1 day) (In-House)

By The In House Training Company

This course starts with data transformation strategies, exploring capabilities in the Power Query Editor, and data-cleansing practices. It looks at the Advanced Query Editor to view the M language code. This course focuses on advanced DAX measures that include filtering conditions, with a deep dive into time intelligence measures. Like the M query language, DAX is a rich functional language that supports variables and expression references. This course also looks at the creation of dynamic dashboards and incorporates a range of visualisations available in Power BI Desktop and online in the AppSource. The course finishes with a look at setting up end user level security in tables. 1 The query editor Split by row delimiter AddDays to determine deadlines Advanced query editor 2 Fuzzy matching joins Matching inconsistencies by percentage Matching with transformation table 3 Logical column functions Logical functions IF, AND, OR Using multiple conditions Including FIND in functions 4 Editing DAX measures Make DAX easier to read Add comments to a measure Using quick measures 5 The anatomy of CALCULATE Understanding CALCULATE context filters Adding context to CALCULATE with FILTER Using CALCULATE with a threshold 6 The ALL measure Anatomy of ALL Create an ALL measure Using ALL as a filter Use ALL for percentage 7 DAX iterators Anatomy of iterators A closer look at SUMX Using RELATED in SUMX Create a RANKX RANKX with ALL 8 Date and time functions Overview of functions Create a DATEDIFF function 9 Time intelligent measures Compare historical monthly data Create a DATEADD measure Creating cumulative totals Creating cumulative measures Visualising cumulative totals 10 Visualisations in-depth Utilising report themes Create a heatmap Comparing proportions View trends with sparklines Group numbers using bins Setting up a histogram 11 Comparing variables Visualising trendlines as KPI Forecasting with trendlines Creating a scatter plot Creating dynamic labels Customised visualisation tooltips Export reports to SharePoint 12 User level security Setting up row level security Testing user security

Tableau Desktop Training - Foundation

By Tableau Training Uk

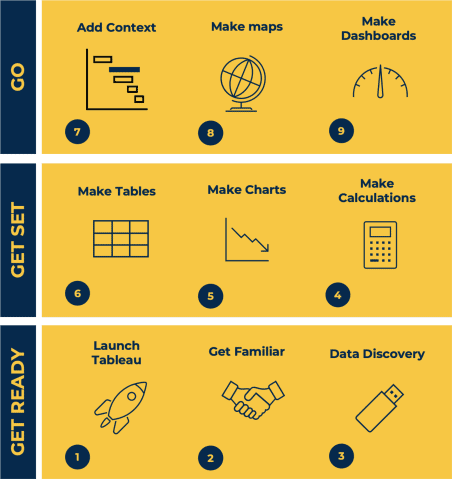

This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. Having a quick turnaround from starting to use Tableau, to getting real, actionable insights means that you get a swift return on your investment of time and money. This accelerated approach is key to getting engagement from within your organisation so everyone can immediately see and feel the impact of the data and insights you create. This course is aimed at someone who has not used Tableau in earnest and may be in a functional role, eg. in sales, marketing, finance, operations, business intelligence etc. The course is split into 3 phases and 9 modules: PHASE 1: GET READY MODULE 1: LAUNCH TABLEAU Check Install & Setup Why is Visual Analytics Important MODULE 2: GET FAMILIAR What is possible How does Tableau deal with data Know your way around How do we format charts Dashboard Basics – My First Dashboard MODULE 3: DATA DISCOVERY Connecting to and setting up data in Tableau How Do I Explore my Data – Filters & Sorting How Do I Structure my Data – Groups & Hierarchies, Visual Groups How Tableau Deals with Dates – Using Discrete and Continuous Dates, Custom Dates Phase 2: GET SET MODULE 4: MAKE CALCULATIONS How Do I Create Calculated Fields & Why MODULE 5: MAKE CHARTS Charts that Compare Multiple Measures – Measure Names and Measure Values, Shared Axis Charts, Dual Axis Charts, Scatter Plots Showing Relational & Proportional Data – Pie Charts, Donut Charts, Tree Maps MODULE 6: MAKE TABLES Creating Tables – Creating Tables, Highlight Tables, Heat Maps Phase 3: GO MODULE 7: ADD CONTEXT Reference Lines and Bands MODULE 8: MAKE MAPS Answering Spatial Questions – Mapping, Creating a Choropleth (Filled) Map MODULE 9: MAKE DASHBOARDS Using the Dashboard Interface Dashboard Actions This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must use their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Excellent Trainer – knows his stuff, has done it all in the real world, not just the class room.”Richard L., Intelliflo “Tableau is a complicated and powerful tool. After taking this course, I am confident in what I can do, and how it can help improve my work.”Trevor B., Morrison Utility Services “I would highly recommend this course for Tableau beginners, really easy to follow and keep up with as you are hands on during the course. Trainer really helpful too.”Chelsey H., QVC “He is a natural trainer, patient and very good at explaining in simple terms. He has an excellent knowledge base of the system and an obvious enthusiasm for Tableau, data analysis and the best way to convey results. We had been having difficulties in the business in building financial reports from a data cube and he had solutions for these which have proved to be very useful.”Matthew H., ISS Group

Influencing for Leadership and Management

By Dickson Training Ltd

We often find ourselves working in fast-paced matrix environments, working in/with virtual teams or simply trying to get something done by someone in another part of the business. This common aspect of our working lives has a common challenge: how to influence other people to help us or do something for us, when they don't report to us. Pulling rank or strong nudging might work once, but we need to build a supportive and collaborative relationship over the long term. What Does This Course Offer? Fortunately, there are really effective tips for influencing, and our program offers an influencing model in detail. Through activity and discussion we explore how you can apply these principles and use it when you need help from other people. Even when we are not in a leadership position it can sometimes be extremely difficult to get people's help, especially when we have no authority over them. This is where an approach and an influencing model can help us identify what we and other people value in a given influencing situation. We can then explore that information so that everyone can view and pursue a common purpose. This course will enhance and promote the skill set necessary for any leader or manager, allowing our in-depth influencing knowledge to be applied into your working environment. From an employer's perspective this award can be a significant long-term return on investment by developing your leaders and managers. Our learning experiences are successful because the outcomes are quickly embedded and demonstrate an immediate visible impact on the day-to-day working environment. Our engaging learning inspires employees to want to personally add value to the companies they work for. We also offer our Paradigm Trait-Map™ online assessment and report as a frame of reference for your own influencing styles and that of others. This assessment should be completed before attending the program, and will be expanded upon during the program delivery. Course Content The Influencing for Leadership and Management course covers the following topics: Two key influencing models that you can apply back in your daily work Different types of influencing How to create the right environment for influencing Barriers you may face and how to overcome these barriers Accreditation Activity Our accredited tutors deliver training that encourages delegates to confidently and practically apply all they have learnt as soon as they get back into the business. To achieve this award, delegates need to prepare and deliver a 3 minute presentation* on the highlights of their learning and immediate application avenues when back in their working environment. *Participants will be given 30 minutes during the program to prepare for their 3 min presentation at the end of the program. Scheduled Course Dates Unfortunately this course is not currently scheduled as an open course as it is primarily run as an in-house programme. For more information, please contact us. In-House Courses This is our own management training course which has been developed and refined over the many years we have been providing it to delegates from organisations in virtually every industry. This means that the course syllabus is extremely flexible and can be tailored to your specific requirements. If you would like to discuss how we can tailor this management training course for you and/or run it at your premises, please contact us.

Occupational Health and Safety (Level 3) CIEH Intermediate Certificate (In-House)

By The In House Training Company

This course aims to provide managers and supervisors with a thorough understanding of the different aspects of health and safety in the workplace. With a focus on the role of supervision, learners on this course will develop the essential knowledge and understanding to enable them to discharge their health and safety responsibilities and ensure the safety of their workplace colleagues. The programme has a particular focus on:

Project planning and risk management (In-House)

By The In House Training Company

Many organisations find that project teams struggle to create and maintain effective plans. Estimates are often overly optimistic and risks go unmanaged until the inevitable happens. Resource managers also find it hard to forecast the likely loading on their departments and requests for support are not provided in a consistent format. This programme has been developed to address these needs in a very practical, hands-on format. Case study work can be based on simulations or on the organisation's current projects for maximum benefit to participants. The aim of this training is to develop and enhance participants' planning and risk management skills in order to maximise the success of project work undertaken by the organisation. The principal training objectives for this programme are to: Provide a structured, integrated approach to planning and risk management Demonstrate practical tools and techniques for each stage of planning Show how to organise and involve relevant people in the planning process Explain how to use the plan for forecasting and pro-active project control Identify ways to improve planning, both individually and corporately The course will emphasise the importance of participative planning techniques that improve the quality of plans whilst reducing overall time and cost of planning. The course will encourage discussion of internal procedures and practices and may be customised to include them if required. DAY ONE 1 Introduction (Course sponsor) Why this programme has been developed Review of participants' needs and objectives 2 Projects and planning Why plan? The benefits of good planning / penalties of poor planning Planning in the project lifecycle; the need for a 'living' plan The interaction between target setting and the planning process Team exercise: planning the project 3 Planning the plan Defining the application and structure of the plan Impact of planning decisions during the project lifecycle Using available time to create an effective plan 4 Defining deliverables Assessing the context; reviewing the goals and stakeholders Developing the scope and defining deliverables; scope mapping Understanding customer priorities; delivering value for money Case study: defining the project deliverables 5 Creating the work breakdown Building the work breakdown structure Detailing the tasks and sub-tasks; structured brainstorming Defining task ownership; the task responsibility matrix 6 Creating and using a logical network Developing the logical network; task boarding Determining the critical path and calculating float Accelerating the plan; concurrent programming and risk Individual and group exercises DAY TWO 7 Developing resource schedules Deriving the Gantt chart from the network Developing the detailed resource schedules Calculating the expenditure profile ('S' curve) 8 Estimating task durations and costs Understanding estimates: effort, availability and duration Estimating tools and techniques Application of estimating techniques during the project lifecycle 9 Case study Developing the project plan Refining the project plan Team presentations and discussion 10 Managing risks and refining the plan Awareness of contractual issues associated with risk Identifying and evaluating risks; deciding ownership Managing risks: determining levels of provision and contingency Controlling risks: maintaining an up-to date risk register 11 Planning for pro-active control The earned value analysis (EVA) concept and its predictive value Deriving the measures needed for cost and delivery performance Practical issues associated with implementing EVA 12 Using and maintaining the plan Tracking progress and updating the plan Publishing and controlling the plan 13 Course review and transfer planning (Course sponsor present) Identify ways of implementing the techniques learnt Sponsor-led review and discussion of proposals Conclusion

Occupational Health and Safety (Level 2) CIEH Foundation Certificate (In-House)

By The In House Training Company

The CIEH Foundation Certificate in Occupational Health and Safety supports businesses in their legal obligations to ensure employees are protected from harm. This course is ideal for those who want to develop their knowledge of health and safety issues in the workplace and of the regulations for maintaining a healthy and safe working environment. This course will focus on common hazards and how to control them. It will help you work more safely and be more aware of how your own actions can affect the health and safety of others.

Utility Tracing Including use of Precision Locators

By Vp ESS Training

Focussing on utility tracing products and established safe systems of works the course aims to provide delegates with sufficient information, knowledge and confidence to conduct a utility survey and mark up. CITB grant may be available for organisations registered with the Construction Industry Training Board Book via our website @ https://www.vp-ess.com/training/utility-detection/utility-tracing-including-use-of-precision-locators/ or via email at: esstrainingsales@vpplc.com or phone on: 0800 000 346

Bespoke Management Training

By Dickson Training Ltd

One of our greatest strengths is our ability to tailor any of our open management courses to the needs and requirements of different businesses in different industries. We understand that whilst our open management training courses provide a wealth of knowledge in their particular area of focus, not all of it may be relevant for your business and the particular industry you operate in.Rather than making delegates sit through management training that is irrelevant to their job role, we offer bespoke management training where we tailor the course to cover the specific needs of your organisation, ultimately relieving the inevitable boredom and "switching off" that would come with having to sit through training that a person knew they would not need. Why choose us for your bespoke management training needs? We have provided tailored, bespoke management training courses to some of the largest organisations in the UK. Using our acquired experience and knowledge of running these courses, we will be able to work with you to create a bepoke management training programme that delivers a significant return on investment, both in terms of tangible and intangible results. ILM accredited management training courses Because we charge a daily training rate rather than a per delegate fee, if you have a number of delegates requiring management training, a bespoke management training course can often be less expensive than putting them all on an open course. A number of courses have been accredited by the ILM, which means you can be assured as to the standard of the course content and delivery. For more information on these, please see our page on ILM Management Training. All of our ILM Programmes are provided in partnership with BCF Group Limited, which is the ILM Approved Centre we deliver under. Interested in finding out more about bespoke management training? Between us, we can come up with a training plan which will provide relevant, bespoke management training for your delegates which will maximise the return on both your time and cost. We are happy to come to your premises or arrange training facilities nearer to your location if this would be more convenient. Feedback Below is a small selection of past feedback for our management training and development courses and programmes: "Excellent instructor. I looked forward to our monthly lectures knowing that I would have a good laugh but also that I would learn more about the subject and myself. He has been very helpful to me and the rest of the students, not just during the lectures but often in his own time. His enthusiasm for all of the subjects covered during the course was evident throughout, which again helped me to enjoy and understand the subjects and lectures. If I get the chance in future to attend a further course with you, I would jump at the chance."Senior Acquisitions SurveyorGalliford Try "A very accomplished trainer and someone who I would very much like to be involved in our business training going forward. The feedback I have had from all levels of our team structure is excellent."Group HR OperationsEADS Personnel Services UK "Phil has a lot of energy which he throws into the course. This visably broke down resistance and attendees entered into the exercises wholeheartedly."Senior QSBullock Construction Scheduled Courses Unfortunately this course is not one that is currently scheduled as an open course, and is only available on an in-house basis. Please contact us for more information.

PowerPoint - intermediate (In-House)

By The In House Training Company

This one-day workshop is designed to enhance your PowerPoint skills to achieve dynamic presentations that work with you, making it easier to deliver a polished, professional presentation. You will learn advanced PowerPoint skills that will save you time and elevate your presentations. This course will help participants: Create custom shows to personalise presentations for individual clients Make the Slide Master work collectively with slide layouts and themes Seamlessly interact with external content using links Work with advanced animations and transitions, and video/audio tools 1 Themes and Masters Add a Design theme to a presentation Make changes to the Slide Master Delete layouts from the slide master Saving a slide master with themes as a template 2 Advanced graphics and diagrams Drawing, duplicating and resizing shapes Grouping, aligning and stacking shapes and graphics Using SmartArt for diagrams and organisation charts 3 Graphs and charts Inserting and formatting a chart Linking an Excel chart to a slide Linking Excel tables to a slide Animating charts 4 Video, Custom animation and Hyperlinks Adding and editing video Animating pictures and drawings Hyperlink to another Slide or Website Compressing and optimising media 5 Presenting Reuse slides Hide slides Rehearsing timings Enabling a presentation to run continuously

Appraisal skills (In-House)

By The In House Training Company

Many managers question the value of appraisal programmes and many line managers believe appraisals are unduly time-consuming and bureaucratic. Yet the appraisal is a vital starting point when it comes to managing performance effectively and it is vital that managers appreciate this. Handled well, the benefits of formal appraisals are enormous. This thoroughly practical workshop has been designed to give line managers the knowledge, skills and confidence to deliver a well-structured appraisal - even in the most challenging circumstances. This course will help participants: Appreciate the benefits of the appraisal process Assess standards of performance objectively Plan and prepare for appraisals effectively Conduct a well-structured appraisal meeting Acquire the essential skills required for effective appraisals Improve their ability to discuss difficult issues more confidently Identify training and development requirements Agree clear and measurable development objectives Complete essential paperwork Understand the need to facilitate continual informal dialogue between appraisals 1 Introduction and course objectives 2 The appraisal process The aim of the appraisal process Understanding the bigger picture - the appraisal process as part of the employee development process The benefits of the appraisal process Common pitfalls Five steps to an effective performance appraisal 3 Step 1 - Assessment Using job standards as the basis for objective assessment Assessment of previous objectives 4 Step 2 - Preparation Documentation required Data on each appraisee Planning the meeting 5 Step 3 - The meeting The skills of appraisal interviewing The structure of the appraisal interview Dealing with poor performance and difficult situations Taking notes and completing documentation 6 Step 4 - Planning ahead and objective setting Identifying action to improve performance and enhance skills Establishing relevant training needs Agreeing SMART performance objectives Formulating a personal development plan 7 Step 5 - Action after the interview Essential paperwork Follow-up and action required between appraisal interviews Continuing informal dialogue 8 Video case study Bullets 9 Conclusion Course review / discussion Preparation of action plans for building on the skills learnt Close

Search By Location

- Course Courses in London

- Course Courses in Birmingham

- Course Courses in Glasgow

- Course Courses in Liverpool

- Course Courses in Bristol

- Course Courses in Manchester

- Course Courses in Sheffield

- Course Courses in Leeds

- Course Courses in Edinburgh

- Course Courses in Leicester

- Course Courses in Coventry

- Course Courses in Bradford

- Course Courses in Cardiff

- Course Courses in Belfast

- Course Courses in Nottingham