- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Management of Portfolios (MoP) Practitioner: In-House Training

By IIL Europe Ltd

Management of Portfolios (MoP®) Practitioner: In-House Training In this MoP® Practitioner course, participants will have sufficient knowledge and understanding of how to apply and tailor the MoP guidance and to analyze portfolio data, documentation, and roles in relation to a given situation. MoP helps organizations ensure if the investments are done in the right, change initiatives, and implementing them correctly. This is achieved by: Prioritizing the programs and projects in terms of their contribution to the organization's strategic objectives and overall level of risk Managing the programs and projects consistently to ensure efficient and effective delivery Maximizing the benefit by providing the greatest return from the investment made What you will Learn Define the business case to get senior management approval for portfolio management Plan the implementation of portfolio management Select and adapt MoP principles, practices, and techniques to suit different organizational environments Evaluate examples of MoP information including documents and role descriptions Analyze the solutions adopted in relation to a given scenario Introduction Overview MoP Portfolio Definition Portfolio Management Roles Portfolio Management Documents MoP Practitioner Assignments Portfolio Management Documents Portfolio Delivery How to Implement Practice Exam MoP Practitioner Exam (taken online, after the class has ended)

Better Business Cases Foundation: In-House Training

By IIL Europe Ltd

Better Business Cases™ Foundation: In-House Training: In-House Training Better Business Cases™ is based on the Five Case Model - which is the UK government's best practice approach to structuring spending proposals and making effective business decisions. Using this best practice approach will allow organizations to reduce unnecessary spending and improve the decision-making process which gives you a greater chance of securing necessary funding and support for initiatives. The goal of the foundation course is to enable participants to work effectively with a team to develop a strong business case in their work environment. What You Will Learn At the end of this program, you will be able to: Describe the philosophy and the underlying rationale of the Five Case Model Identify different types of business case, their purpose, who is responsible for them Recognize when the different types are required in the development of a spending proposal Develop the business case in relation to other recognized and recommended best practices for programme and project management Overview of the Five Case Model Five key components of a business case and the order in which they are presented Three key stages in the development of a spending proposal Definition of a programme / project and the key differences between programmes and projects Purpose of a Business Justification Case (BJC) and in what circumstances it should be considered Purpose of a Strategic Outline Case (SOC) Purpose of an Outline Business Case (OBC) Purpose of a Full Business Case (FBC) Relationship between policies, strategies, programmes, and projects and their deliverables Developing the Strategic Case Purpose and core content of a Strategic Case Purpose of SMART robust spending objectives and the key objectives for spend: economy, efficiency, effectiveness, re-procurement, and statutory or regulatory compliance Four main categories of benefits criteria and the parties involved in their development Three key categories of risk Purpose of identifying constraints and dependencies Difference between direct and indirect benefits Developing the Economic Case Purpose and core content of an Economic Case Purpose of critical success factors and the key critical success factors based upon the Five Case Model Purpose of the long list options and how to generate options and undertake SWOT analysis Minimum of four short-list options, how they are derived, and what they should include (Reference Project / Public Sector Comparator [PSC]) Difference between the preferred way forward and the preferred option Purpose, objectives, key participants, and outputs of Workshop Stage 2 - identifying and assessing the options Rules that should be followed for the treatment of costs and benefits Key differences between economic appraisals and financial appraisals Factors considered when selecting the preferred option Developing the Commercial Case Purpose and core content of a Commercial Case Guiding principles when apportioning risk between the contractual parties Purpose of payment mechanisms Purpose of Step 9 in the development framework: Contracting for the deal Developing the Financial Case Purpose and core content of a Financial Case The financial statements required for all projects The possible impacts to consider Developing the Management Case Purpose and core content of a Management Case Purpose of a programme / project management strategy, framework, and plan Purpose of a change management strategy, framework, and plan Purpose of a benefits realization strategy, framework, and register / plan Purpose of a risk management strategy, framework and register / plan Purpose of a post programme / project evaluation strategy, framework, and plan

Better Business Cases Practitioner: In-House Training

By IIL Europe Ltd

Better Business Cases™ Practitioner: In-House Training: In-House Training Better Business Cases™ is based on the Five Case Model - which is the UK government's best practice approach to structuring spending proposals and making effective business decisions. Using this best-practice approach will allow organizations to reduce unnecessary spending and improve the decision-making process which gives you a greater chance of securing necessary funding and support for initiatives. The goal of the practitioner course is to develop a candidate's ability to deliver a comprehensive business case, through encouraging expanded knowledge to guide the practical application of theoretical foundations. Upon the completion of this Practitioner course, a candidate will be able to start applying the model to a real business case development project. What You Will Learn At the end of this program, you will be able to: Develop the lifecycle of a business case and to establish the relationships between the five cases Apply the steps in the business case development framework, in order to support the production of a business case, using the Five Case Model, for a given scenario Overview of Better Business Cases Alignment with the strategic planning process Importance of the Business Case using the Five Case Model Overview of the Five Case Model Purpose of the key stages in the development of a spending proposal Purpose of a Business Justification Case Business Case Development Process Purpose of project / programme assurance and assurance reviews Responsibility for producing the Business Case Determining the Strategic Context and Undertaking the Strategic Assessment Scoping the Scheme and Preparing the Strategic Outline Case Planning the Scheme and Preparing the Outline Business Case Procuring the Solution and Preparing the Full Business Case Implementation and monitoring Evaluation and feedback Making the Case for Change Agree on the strategic context Determine spending objectives, existing arrangements, and business needs Determine potential business scope and key service requirements Determine benefits, risks, constraint, and dependencies Exploring the Preferred Way Forward Agree on critical success factors Determine long list options and SWOT analysis Recommend a preferred way forward Determining Potential Value for Money Revisit the short list Prepare the economic appraisal for short-listed options Undertake benefits appraisal Undertake risk appraisal Select preferred option and undertake sensitivity analysis Preparing for the Potential Deal Determine the procurement strategy Determine service streams and required outputs Outline potential risk apportionment Outline potential payment mechanisms Ascertain contractual issues and accountancy treatment Ascertaining Affordability and Funding Requirement Prepare the financial model Prepare the financial appraisals Planning for Successful Delivery Plan programme / project management Plan change and contract management Plan benefits realization Plan risk management Plan programme / project assurance and post project evaluation Procuring the Value for Money Solution Revisit the case for change Revisit the OBC options Detail procurement process and evaluation of best and final offers (BAFOs) Contracting for the Deal Set out the negotiated deal and contractual arrangements Set out the financial implications of the deal Ensuring Successful Delivery Finalize project management arrangements and plans Finalize change management arrangements and plans Finalize benefits realization arrangements and plans Finalize risk management arrangements and plans Finalize contract management arrangements and plans Finalize post-project evaluation arrangements and plans

Project Management Fundamentals: In-House Training

By IIL Europe Ltd

Project Management Fundamentals: In-House Training Many projects are performed by highly competent and effective people who have little or no project management training. They perform projects like process improvement, marketing campaign development, new product development, event planning and production, and other 'tasks' which are projects. Project Management Fundamentals (PMF) is designed to support those people who need a solid foundation in project management, without being unnecessarily burdened to learn it while on the job. The course offers practical skills, concepts, and principles that can be taken back to the workplace, along with insights needed to adapt them to specific project environments. In today's environment, that means possibly adapting to Agile / Iterative methods. So, we have recently added key Agile concepts to provide a basic understanding of shifting towards agility. Since PMF's course goal is to achieve quality performance by learning effective planning and control, the focus is on a process orientation and an analytical, systems-oriented approach. Together, these frameworks promote project-related problem solving and decision-making skills necessary for real world projects. They honor project needs for collaboration, clear communications among people, and interpersonal and relationship skills. Recognition of these needs are woven throughout PMF, but are highlighted in two specific areas: Module 2 - People and Projects Module 8 - Executing, Communicating, and Developing the Team What You Will Learn At the end of this program, you will be able to: Describe the value of strong project management Identify characteristics of a successful project and project manager Recognize how current agile / adaptive practices fit within project management Explore project management processes, including Initiating, Planning, Execution, Monitoring & Controlling, and Closing Utilize project management processes and tools, based on case studies and real-world situations Create an initial project plan Use standard project management terminology Foundation Concepts Project management and definitions Value and focus of PM Competing constraints and project success Project life cycles People and Projects People and projects overview The project manager The project team People and projects in organizations Initiating and Defining Requirements Initiating the project Developing the project charter Conducting stakeholder assessments Defining requirements Using the Work Breakdown Structure Defining the Work Breakdown Structure (WBS) Developing a usable WBS Using the WBS Managing Project Risk Making the case for risk management Overview to planning for risk Identifying risks Analyzing risks Planning responses to risks Implementing response and monitoring risks Considerations for adaptive environments Estimating Defining an estimate Estimating approaches Estimating practices Estimating cost Validating an estimate Scheduling Defining the scheduling process and related terminology Sequencing and defining dependencies Determining the critical path Considering schedule risks and optimizing the schedule Executing, Communicating, and Developing the Team From baseline to execution Project communications and stakeholder relationships High-performing teams Monitoring and Controlling Defining monitoring and controlling Viewing control through the competing demands lens Variance Analysis and corrective action (Earned Value) Considerations in adaptive environments Closing the Project Closing projects Focusing on project transition Focusing on post-project evaluations

Portfolio, Programs, and Project Offices Foundation: In-House

By IIL Europe Ltd

Portfolio, Programme, and Project Offices (P3O®) Foundation: In-House Training P3O® is the AXELOS standard for the design of decision-making processes regarding changes in organizations. P3O provides a guideline for the design of portfolio, programme, and project offices in organizations. The P3O Foundation course is an interactive learning experience. The P3O Foundation-level content provides you with sufficient knowledge and understanding of the P3O guidance to interact effectively with, or act as an informed member of, an office within a P3O model. It enables you to successfully complete the associated P30 Foundation exam and achieve the qualification. In this course, you will be prepared to successfully attempt the P3O Foundation exam and learn how to implement or re-energize a P3O model in their own organization. What you will Learn Individuals certified at the P3O Foundation level will be able to: Define a high-level P3O model and its component offices List the component offices in a P3O model Differentiate between Portfolio, Programme, and Project Management List the key functions and services of a P3O List the reasons for establishing a P3O model Compare different types of P3O models List the factors that influence selection of the most appropriate P3O model for an organization Define the processes to implement or re-energize a P3O Benefits: Fast-track programme for those who want to achieve P3O Foundation qualification Practical case study and scenarios Attractive slides and course book Introduction to P3O What is the purpose of P3O? Definitions What are P3Os? Portfolio, programme, and project lifecycles Governance and the P3O Designing a P3O Model Factors that affect the design Design considerations What functions and services should the P3O offer? Roles and responsibilities Sizing and tailoring of the P3O model Introduction to P3O What is the purpose of P3O? Definitions What are P3Os? Portfolio, programme, and project lifecycles Governance and the P3O Designing a P3O Model Factors that affect the design Design considerations What functions and services should the P3O offer? Roles and responsibilities Sizing and tailoring of the P3O model Why Have a P3O? How a P3O adds value Maximizing that value Getting investment for the P3O Overcoming common barriers Timescales How to Implement or Re-Energize a P3O Implementation lifecycle for a permanent P3O Identify Define Deliver Close Implementation lifecycle for a temporary programme or project office Organizational context Definition and implementation Running Closing Recycling How to Operate a P3O Overview of tools and techniques Benefits of using standard tools and techniques Critical success factors P3O tools P3O techniques

Work Breakdown Structures: In-House Training

By IIL Europe Ltd

Work Breakdown Structures: In-House Training It's amazing how often project managers begin the project planning process by making an outlined list of every task they believe will be required to complete a project and then proclaim they have created the work breakdown structure (WBS) for the project. The result is a list of hundreds, or even thousands of tasks, many of them having durations of a few days or a few hours. Essentially, what they have done is create a 'to do' list, which they then use as a 'checklist' to measure progress. This approach leads to, and even encourages, micromanagement of the resources working on the project without consideration of more critical aspects of project management such as: requirements management, risk management, procurement management, estimating, scheduling, executing, and controlling. Further, it makes it impossible to see the big picture, at levels of detail, in keeping with the needs of sponsors, clients, project and functional managers, team leaders, and project performers. Join us for this exciting program and learn how to use the WBS to make better-informed business decisions. What You Will Learn You will learn how to: Describe the need for a project WBS Describe the WBS role in the project Gain practical experience in the development, decomposition, and use of the WBS Determine the appropriate level of detail in the WBS. Explain how the WBS integrates with project requirements, risk, procurement, estimating, scheduling, and overall project execution. Provide the basic tools to enhance efficient re-use of key information in your future projects Foundation Concepts Key definitions History of the WBS Importance of the WBS Overall structure Terminology Other breakdown structures WBS tools WBS & Scope Project scope management processes Specification of the project objectives WBS design based on project deliverable WBS decomposition process and 'The 100% rule' Work Packages and Control Accounts WBS & Risk Risk management planning and WBS Risk identification to enhance the WBS Risk analysis and the WBS Risk responses and updating the WBS Implementing risk response and Monitoring risks and the WBS WBS & Estimating Use of WBS in the estimating process Components and work packages Sizing and algorithmic estimates WBS & Scheduling Component Scheduling - High-Level Milestones WBS activity decomposition WBS elements dependencies Work Package Level Schedules Responsibility assignment matrix WBS & Execution and Control Earned Value Management and tracking of work performance Progress reports, forecasts, and corrective and preventive actions used to manage work performance Necessary information to close out a project

Managing Benefits Foundation: In-House Training

By IIL Europe Ltd

Managing Benefits™ Foundation: In-House Training The APMG International Managing Benefits and Swirl Device logo is a trademark of The APM Group Limited, used under permission of The APM Group Limited. All rights reserved. Benefits are not simply just one aspect of project and programme management (PPM) - rather, they are the rationale for the investment of taxpayers' and shareholders' funds in change initiatives. Managing Benefits is designed to complement existing best practices in portfolio, programme and project management (such as PRINCE2®, MSP®, P3O® & MoP®), and consolidates existing guidance while expanding on the specific practices and techniques aimed at optimizing benefits realization. The purpose of the Managing Benefits guidance and certification scheme is to provide you with generally applicable guidance encompassing benefits management principles, practices, and techniques, and to prepare you to take and pass the Foundation exam on the last day. Managing Benefits provides: An overview of benefits management - what it is, the case for doing it, and some common misconceptions that can limit its effectiveness in practice Descriptions of the seven principles upon which successful approaches to benefits management are built, and examples of how they have been applied in practice Guidance on how to apply benefits management at a portfolio level, as well as at an individual project or programme level Details of the five practices in the Benefits Management Cycle and examples of how they have been applied in practice Advice on how to get started in implementing effective benefits management practices and sustain progress What You Will Learn You'll learn how to: Define benefits, benefits management and related terms, and the objectives of benefits management Explain the principles upon which successful approaches to benefits management are based Define the practices contained within the Benefits Management Cycle and relevant techniques applicable to each practice Describe key elements of portfolio-based benefits management, as well as the scope of key roles and responsibilities for benefits management and the typical contents of the main benefits management documentation Identify barriers to effective benefits management and strategies to overcome them, including the key success characteristics of benefits management Improve your ability to pass the APMG Managing Benefits Foundation Certification exam Getting Started Introductions Course structure Course goals and objectives Overview of Managing Benefits The Benefits Management Model Key Benefits Management Practices What is Benefits Management? Definitions Value and Value Management Why do we need benefits management? Objectives Benefits Management Principles Align benefits with strategy Start with the end in mind Utilize successful delivery methods Integrate benefits with performance management Manage benefits from a portfolio perspective Apply effective governance Develop a value culture The Benefits Management Cycle Barriers to effective and efficient benefits management and overcoming them Key success characteristics of effective benefits management Key roles, responsibilities, and documentation Benefits Management Practice 1 - Identify and Quantify Benefits Management Practice 2 - Value and Appraise Benefits Management Practice 3 - Plan Benefits Management Practice 4 - Realize Benefits Management Practice 5 - Review Portfolio-based Benefits Management Implementing and Sustaining Progress APMG Managing Benefits Foundation Exam

Risk Management for IT Projects: In-House Training

By IIL Europe Ltd

Risk Management for IT Projects: In-House Training IT projects may have direct bottom-line impact on the organization, cost millions of dollars, cause organizational change and change the way the organization is perceived by clients. Many IT projects are notoriously hard to predict and are filled with risk. IT Risk Management takes a comprehensive look at IT project risk management using PMI's PMBOK® Guide Risk Management Model in the context of IT Project Life Cycle phases. The goal of this course is to arm the practitioner with a rigorous, common-sense approach to addressing uncertainty in projects. This approach includes the ability to influence project outcomes, avoid many potential project risks, and be ready to calmly and efficiently respond to unavoidable challenges. What you will Learn You'll learn how to: Describe the risk management process, using the PMBOK® Guide's standard models and terminology Discuss the potential barriers to managing risk effectively in IT project organizations Develop an effective risk management plan for IT projects Identify project risks using IT-specific, practical tools Analyze individual risk events and overall project risk using IT-specific, practical approaches Plan effective responses to IT-specific risk based on the results of risk analysis and integrate risk responses into project schedules and cost estimates Manage and control risk throughout the IT project life cycle Implement selected elements of IT project risk management on your next project Foundation Concepts Basic concepts and purpose Risk and project constraints Risk and corporate cultures Risk management and IT PLC standards Plan Risk Management for IT Projects Plan Risk management process Plan Risk management activities Design a standard template Assess the project-specific needs Tailor the template Produce a project-specific risk management plan Gain consensus and submit as part of overall project plan A risk management plan of IT projects Identify Risks for IT Projects Identify risk process overview Risk categories and examples Risk identification tools Risk events by project life-cycle phases Perform Risk Analysis for IT Projects Perform qualitative risk analysis overview Core qualitative tools for IT projects Auxiliary qualitative tools for cost and schedule estimates When to use quantitative analysis for IT projects Plan Risk Response for IT Projects Plan risk response overview Active risk response strategies for IT projects (Threat and Opportunity) Acceptance and contingency reserves Contingency planning for IT projects Plan risk responses for IT projects Implement Risk Response for IT Projects Implement Risk Responses Executing Risk Response Plans Techniques and Tools Used Continuous Risk Management Monitor Risks for IT Projects Monitor risks overview Monitor risks tips for IT projects Technical performance measurement systems Risk management implementation for IT projects

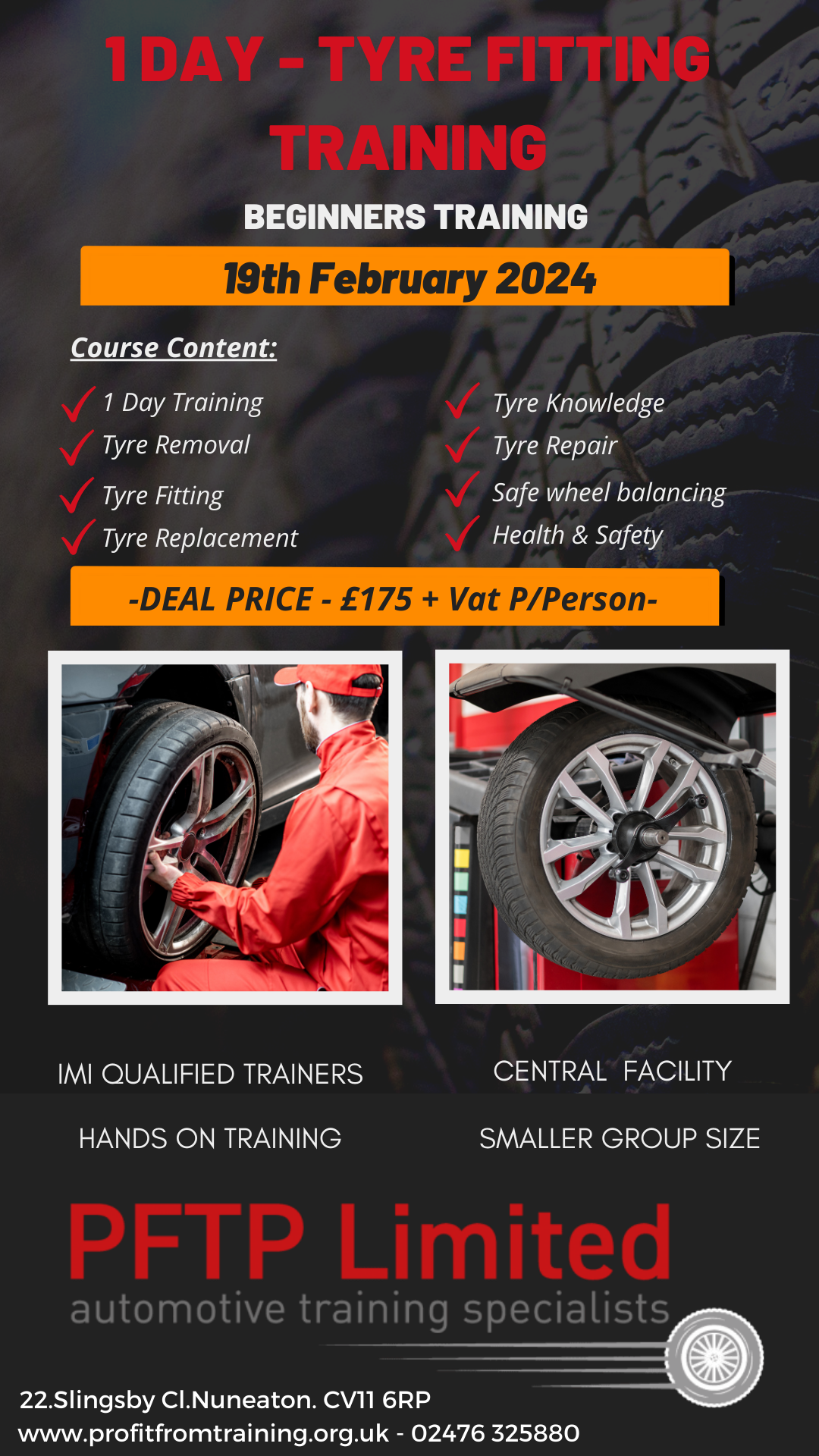

Introduction To Tyre Fitting Training

By PFTP Ltd

Basic Course 1 Day- Tyre Removal, Tyre Fitting, Tyre Replacement, Wheel Balancing, Jacking (plus a little tyre knowledge) It is mainly a day covering the practical elements and working with steel wheels

The Level 3 International Foundation Diploma for Higher Education Studies (L3IFDHES) is usually a one-year pre-university qualification that provides students with an entry route to an overseas university. The L3IFDHES prepares students with the essential English language skills, key transferable study skills, cultural knowledge, and chosen specialisms that universities feel bridges the gap between high school and undergraduate study. In January 2023 we offer pathways in business and higher finance. With agreements in place with over 70 universities across the globe, students’ can progress with confidence to a higher education course for further study. Entry Requirements For entry onto the NCC Education Level 3 International Foundation Diploma for Higher Education Studies (L3IFDHES) qualification students must have successfully completed secondary school education. Students must also meet the English language entry requirements of: • IELTS minimum score of 4.5 or above OR • GCE ‘O’ Level English D7 or above Alternatively, a student can take the free NCC Education Higher English Placement Test which is administered by our Accredited Partner Centre’s.

Search By Location

- knowledge Courses in London

- knowledge Courses in Birmingham

- knowledge Courses in Glasgow

- knowledge Courses in Liverpool

- knowledge Courses in Bristol

- knowledge Courses in Manchester

- knowledge Courses in Sheffield

- knowledge Courses in Leeds

- knowledge Courses in Edinburgh

- knowledge Courses in Leicester

- knowledge Courses in Coventry

- knowledge Courses in Bradford

- knowledge Courses in Cardiff

- knowledge Courses in Belfast

- knowledge Courses in Nottingham