- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview 2 day applied course with comprehensive case studies covering both Standardized Approach (SA) and Internal Models Approach (IMA). This course is for anyone interested in understanding practical examples of how the sensitivities-based method is applied and how internal models for SES and DRC are built. Who the course is for Traders and heads of trading desks Market risk management and quant staff Regulators Capital management staff within ALM function Internal audit and finance staff Bank investors – shareholders and creditors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This is a 2 day course to learn ALM tools to achieve strong and market-resilient, actuarially-resilient Solvency 2 (S2) ratios at Group consolidated level and at key cash-remitting entities to ensure dividend stability. For those not fully familiar with Solvency 2, this course is best taken in conjunction with “Solvency 2” Who the course is for Capital management / ALM / risk management staff within insurance company Investors in insurance company securities – equity, subordinated bonds, insurance-linked securities Salespeople covering insurance companies Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Bite-sized sales training (In-House)

By The In House Training Company

If you're looking for a short, sharp high-impact intervention that will help motivate and inspire your sales team then a 'bite-sized' session could be just what you're looking for. We have a range of sessions that can be delivered on an 'off-the-shelf' basis, or they can be tailored to your specific requirements or, of course, we can develop something specifically for you on an entirely bespoke basis. And the length of the session is entirely up to you - 45-minutes, an hour, a half-day - whatever you prefer. Sessions can be run for small groups as part of your regular team meetings or they can be delivered for larger audiences, conference-style - the choice is yours. The session outlines below are just to give you an idea of the possibilities. If one of them whets your appetite please just give us a call on 01582 463463 to talk through what we can do for you - we're here to help!

Overview 1 day course on forensic accounting and analysis to unearth financial manipulation by companies Who the course is for Investors and analysts – equity and credit; public and private Bank loan officers M&A advisors Restructuring advisors Auditors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This two-day intensive course is ideal for finance professionals seeking to deepen their expertise in options trading and volatility management. The course will cover option pricing and risk management techniques. Exploring differences between physical and cash-settled options European versus American/Bermudan options, and the implications of deferred premiums. Examining the role of volatility in option pricing & Managing First-Generation Exotics. Who the course is for Derivative traders Quants and research analysts Fund managers, fund of funds Structured product teams Financial and valuation controllers Risk managers and regulators Bank and corporate treasury managers IT Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Train the trainer (In-House)

By The In House Training Company

At some point in your life you will have attended a training course or workshop, but what happens when you are asked to deliver one? Some people relish the opportunity while others are challenged by it. Whatever you feel about training others, it is a skill that is admired and can be studied and learned. With the trainer you will be learning the techniques, skills and understanding you need and you will have the chance to deliver a short training session to others, receive feedback and having the confidence to deliver it for real in your job. The training will comprise one day followed by a half day when all those able to attend will deliver and have feedback on a 20 minute training activity. To be able to create and maintain an environment conducive to learning and engagement To understand basic learning theory and practice and the difference between training, facilitating and learning To understand how adults learn and how to apply it as a trainer To be able to plan and deliver a training activity using the appropriate set of skills and behaviours To be able to review and evaluate learning and identify how outcomes are met To manage the learning process and the participant engagement in the training environment To be able to present effectively and appropriately to a variety of audiences To deliver and receive feedback on a short delivered training activity with peers To review and evaluate learning and have an action plan to take back and put into practice DAY ONE (full-day) 1 Welcome, housekeeping, how the day will be run Introductions (and making the most of them) Warm up - breaking the ice followed by review and feedback Creating an environment conducive to learning and engagement; managing expectations well as a trainer Group task with feedback and review in plenary 2 What is training and how do adults learn? Trainer input: David Kolb's Learning Cycle Group tasks 3 How to plan a session and what to include - trainer input Starting at the end and working backwards Linking outcomes to purposeful activities Practice task and planning time for day two using a template 4 The skills and behaviours of a brilliant trainer Modelling skills and behaviours Creative task and discussion 5 Mini reviewing task De-brief - using reviewing in training 6 How to manage the process Trainer input followed by practice Paying conscious attention to language (verbal and non verbal), feelings and responses in the room and managing yourself as a trainer 7 The trainer's toolkit #1 Key tools, materials and templates Choosing different tools and approaches with different audiences Know your audience 8 The trainer's toolkit #2 Key tools, materials and templates continued Addressing trainer good practice 9 Review, evaluation and action planning activities Why and what should we be evaluating and why it's important Action planning task Group review task DAY TWO (half-day) The day will comprise a series of 30 minute timed sessions where each delegate will present and deliver a training activity with the group. The training activity will be prepared and planned in advance and will take 20 minutes (+ or - 2 minutes) to deliver in real time. This will be followed by review and feedback from the trainer and peers to complete the total of 30 minutes as a time slot. Reiteration of the task and discussion can take place with the trainer if needed, and there is time included in Day One to support the training planning.

Overview 1 day course on IFRS 9 expected credit loss modelling, both for financial statement and capital stress testing purposes Who the course is for Credit risk management Quants ALM staff Finance Internal audit External auditors Bank investors – equity and credit investors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Credit Risk Capital Modelling Under Basel Internal Ratings Based Approach (IRB)

5.0(5)By Finex Learning

Overview 2 day applied course in modelling Basel IRB parameters and generating IRB Pillar 1 credit risk capital requirement for a mixed retail and corporate loan book Who the course is for Credit risk management, model validators and quants Loan officers / loan portfolio management ALM staff Bank investors – equity and credit investors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This 3-day course focuses on covering the foundations of equity markets, including practical experience with equity swaps and options. During this course you will learn: How to use equity swaps, dividend swaps, equity index options and single name options. Applications of these products are shown across a variety of strategies across volatility trading, corporate finance and investment management. Key issues in pricing and risk management. Who the course is for Equity and Derivative sales, traders, structurers, quants and relevant IT personnel Asset allocation managers and equity portfolio managers Company finance executives, corporate treasurers and investment bankers Risk managers, finance, IPV professionals, auditors and accountants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

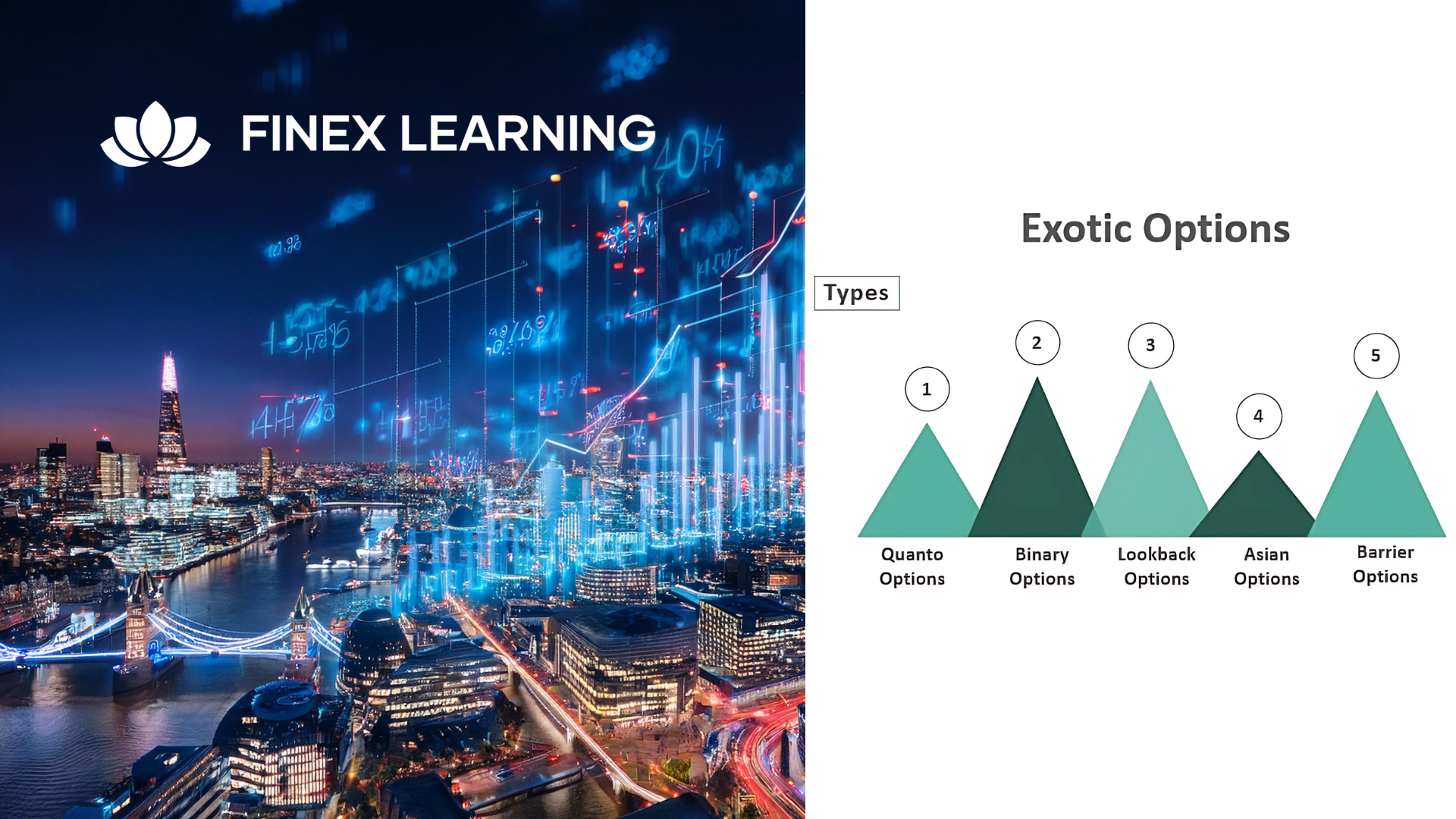

Overview This is a 1 Day Product course and as such is designed for participants who wish to improve the depth of their technical knowledge surrounding Exotic Options. Who the course is for Equity and Derivative sales Equity and Derivative traders Equity & Derivatives structurers Quants IT Equity portfolio managers Insurance Company investment managers Risk managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Search By Location

- course Courses in London

- course Courses in Birmingham

- course Courses in Glasgow

- course Courses in Liverpool

- course Courses in Bristol

- course Courses in Manchester

- course Courses in Sheffield

- course Courses in Leeds

- course Courses in Edinburgh

- course Courses in Leicester

- course Courses in Coventry

- course Courses in Bradford

- course Courses in Cardiff

- course Courses in Belfast

- course Courses in Nottingham