- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

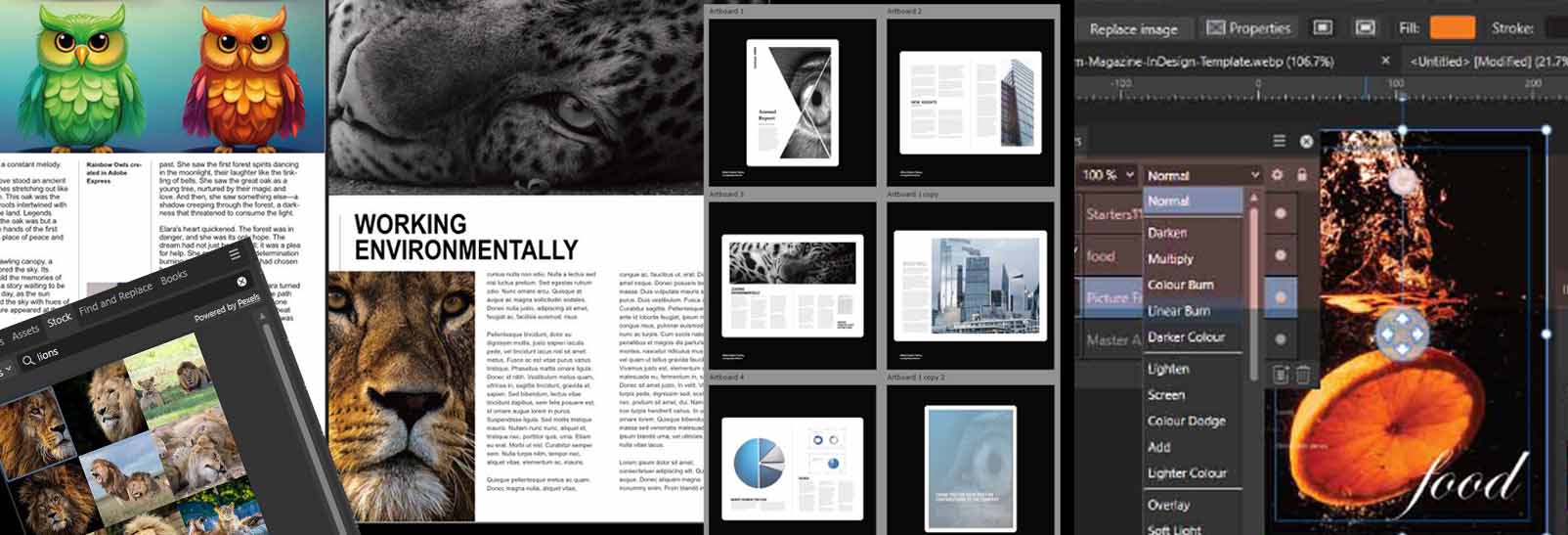

Affinity Publisher Training

By Greta Powell Training

Affinity Publisher Training Course for Beginners. Online Affinity Training with live instructors or face to face onsite. Learn to create and design layouts for flyers, brochures, newsletters, marketing documents and business stationery.

Power BI - introduction (2 day) (In-House)

By The In House Training Company

There is a lot to learn in Power BI, this course takes a comprehensive look at the fundamentals of analysing data and includes a balanced look at the four main components that make up Power BI Desktop: Report view, Data view, Model view, and the Power Query Editor. It also demonstrates how to utilise the online Power BI service. It looks at authoring tools that enable you to connect to and transform data from a variety of sources, allowing you to produce detailed reports through a range of visualisations, in an interactive and dynamic way. It also includes a detailed look at formulas by writing both M functions in Power Query, and DAX functions in Desktop view. This knowledge will allow you to take your reports to the next level. The aim of this course is to provide a complete introduction to understanding the Power BI analysis process, by working hands-on with examples that will equip you with the necessary skills to start applying your learning straight away. 1 Getting Started The Power BI ecosystem Opening Power BI Desktop Power BI's four views Introduction to Dashboards 2 Importing Files Importing data sources Importing an Excel file Importing a CSV file Importing a database Connect to an SQL Server Database Import vs. Direct Query Importing from the web Importing a folder of files Managing file connections 3 Shape Data in the Query Editor The process of shaping data Managing data types Keeping and removing rows Add a custom column Appending tables together Hiding queries in reports Fixing error issues Basic maths operations 4 The Data Model Table relationships Relationship properties 5 Merge Queries Table join kinds Merging tables 6 Inserting Dashboard Visuals Things to keep in mind Inserting maps Formatting Maps Inserting charts Formatting Charts Inserting a tree map Inserting a table, matrix, and card Controlling number formats About report themes Highlighting key points Filter reports with slicers Sync slicers across dashboards Custom web visuals 7 Publish and share Reports Publishing to Power BI service Editing online reports Pinning visuals to a dashboard What is Q&A? Sharing dashboards Exporting reports to PowerPoint Exporting reports as PDF files 8 The Power Query Editor Fill data up and down Split column by delimiter Add a conditional column More custom columns Merging columns 9 The M Functions Inserting text functions Insert an IF function Create a query group 10 Pivoting Tables Pivot a table Pivot and append tables Pivot but don't aggregate Unpivot tables Append mismatched headers 11 Data Modelling Expanded Understanding relationships Mark a date table 12 DAX New Columns New columns and measures New column calculations Insert a SWITCH function 13 Introduction to DAX Measures Common measure functions Insert a SUM function Insert a COUNTROWS function Insert a DISTINCTCOUNT function Insert a DIVIDE function DAX rules 14 The CALCULATE Measure The syntax of CALCULATE Insert a CALCULATE function Control field summarisation Things of note 15 The SUMX measure X iterator functions Anatomy of SUMX Insert a SUMX function When to use X functions 16 Time Intelligence Measures Importance of a calendar table Insert a TOTALYTD function Change financial year end date Comparing historical data Insert a DATEADD function 17 Hierarchies and Groups Mine data using hierarchies Compare data in groups

Power BI - dashboards (1 day) (In-House)

By The In House Training Company

Power BI is a powerful data visualisation program that allows businesses to monitor data, analyse trends, and make decisions. This course is designed to provide a solid understanding of the reporting side of Power BI, the dashboards, where administrators, and end users can interact with dynamic visuals that communicates information. This course focuses entirely on the creation and design of visualisations in dashboards, including a range of chart types, engaging maps, and different types of tables. Designing dashboards with KPI's (key performance indicators), heatmaps, flowcharts, sparklines, and compare multiple variables with trendlines. This one-day programme focuses entirely on creating dashboards, by using the many visualisation tools available in Power BI. You will learn to build dynamic, user-friendly interfaces in both Power BI Desktop and Power BI Service. 1 Introduction Power BI ecosystem Things to keep in mind Selecting dashboard colours Importing visuals into Power BI Data sources for your analysis Joining tables in Power BI 2 Working with data Utilising a report theme Table visuals Matrix visuals Drilling into hierarchies Applying static filters Group numbers with lists Group numbers with bins 3 Creating visuals Heatmaps in Power BI Visualising time-intelligence trends Ranking categorical totals Comparing proportions View trends with sparklines 4 Comparing variables Insert key performance indicators (KPI) Visualising trendlines as KPI Forecasting with trendlines Visualising flows with Sankey diagrams Creating a scatter plot 5 Mapping options Map visuals Using a filled map Mapping with latitude and longitude Mapping with ArcGIS or ESRI 6 Creating dashboards High-level dashboard Migration analysis dashboard Adding slicers for filtering Promote interaction with nudge prompts Searching the dashboard with a slicer Creating dynamic labels Highlighting key points on the dashboard Customised visualisation tooltips Syncing slicers across pages 7 Sharing dashboards Setting up and formatting phone views Exporting data Creating PDF files Uploading to the cloud Share dashboards in SharePoint online

Outlook - advanced (In-House)

By The In House Training Company

This one-day workshop is intended for participants who have a basic understanding of Outlook but who want to know how to use its advanced features to manage their email communications, calendar events, contact information and other communication tasks. This course will help participants: Gain confidence using Outlook and its advanced features Organise and prioritise email messages Archive messages for safe-keeping Use rules to process received or sent messages automatically Manage scheduled meetings with others Give others permission to view and manage their folders and items Use contacts and commands to find out more about a person or company Prioritise work-flow using tasks and assigning tasks to others 1 Email messages Combining multiple clicks with quick steps Following up flag options Saving multiple attachments Attaching a folder of files Recalling and replacing a message Categorising messages with conditional formatting 2 Message options Adding options to messages Marking a message as private Receiving quick responses with voting buttons Directing replies to specific users Delaying sent messages Inserting links in messages 3 Stay organised with rules Using rules to automate message flow Moving messages with rules Using the rules wizard Setting up rules with conditions Using rules that work whilst you are away 4 Message clean-up Using conversation clean-up Using mailbox clean-up Moving messages to the archive folder Archiving folder properties Auto-archiving properties 5 Managing calendars Creating calendar groups Sharing calendars with permissions Setting up working days and times Managing time zones Categorise appointments with conditional formatting Publishing a calendar 6 Schedule meetings Scheduling a meeting Managing meeting responses Proposing new meeting times Adding attendees to a meeting Viewing multiple appointments 7 Using contacts Merging contacts to letters Merging contacts to labels Mail merging contacts in Word Exporting contacts to Excel 8 Managing tasks Organising your workload with tasks Categorising tasks Assigning tasks to others Sending a task status report Allocating time for tasks Regenerating a new task Viewing your tasks in the calendar 9 Adding message items Adding calendars to messages Adding business cards to messages 10 Email accounts Adding multiple user accounts Adding account permissions

Fraud (In-House)

By The In House Training Company

Fraud should not happen, but it does. It can happen at the highest to lowest levels in an organisation. Recent surveys show that incidents of fraud are not decreasing. Fraud costs companies money and, perhaps even more importantly, reputational damage. The losers are not just the shareholders, suppliers, customers, etc, but society as a whole. This programme shows why frauds happen, how organisations put themselves at risk and what they can do to prevent it. This programme will help directors and others understand: The motives for committing fraud Directors' responsibilities for identifying and reporting fraud What types of frauds there are How frauds are perpetrated How they can be prevented How regulators deal with fraud Above all, the principal objective of this programme is to help make your organisation as secure as possible from the threat of fraud. 1 Motives for committing fraud - drivers of fraud Session objective: to understand why people might commit fraud Drivers of fraudulent behaviourAmbitionGreedTheftConceit? And more! 2 Accounting mechanisms that allow fraud Session objective: to review the elements of the accounting, internal control and management processes that allow creative accounting Income or liability? Asset or expense? Coding errors and misclassification Netting off and grossing up Off-balance sheet items 3 Structures that allow fraud Session objective: to consider company and trading structures that allow frauds to be perpetrated Group structures Trading structures Tax havens Importing and exporting 4 Interpretations and other non-compliance that allow fraud Session objective: to look at how creative interpretations of law and accounting practice may permit fraud The place of accounting standards Accounting policies Trading methods The place of auditing standards 5 Money laundering Session objective: to review what constitutes money laundering Types of money laundering Identifying laundering Preventing laundering 6 Preventing fraud - proper management structures Session objective: to review the place of proper corporate governance Corporate governance Company management structure Audit committees The place of internal audit 7 Preventing fraud - proper accounting Session objective: to review best accounting and auditing practice Accounting standards Internal accounting policies Adequacy of internal controls Internal audit 8 Preventing fraud - regulation Session objective: to look at how regulators aim to prevent fraud The regulatory environment Financial services regulation 9 Conclusion Course review Open forum Close 10 Course summary - developing your own cost action plan Group and individual action plans will be prepared with a view to participants identifying their cost risks areas and the techniques which can be immediately applied to improve costing and reduce costs

Credit control training 'menu' (In-House)

By The In House Training Company

This is not a single course but a set of menu options from which you can 'pick and mix' to create a draft programme yourself, as a discussion document which we can then fine-tune with you. For a day's training course, simply consider your objectives, select six hours' worth of modules and let us do the fine-tuning so that you get the best possible training result. Consider your objectives carefully for maximum benefit from the course. Is the training for new or experienced credit control staff? Are there specific issues to be addressed within your particular sector (eg, housing, education, utilities, etc)? Do your staff need to know more about the legal issues? Or would a practical demonstration of effective telephone tactics be more useful to them? Menu Rather than a generic course outline, the expert trainer has prepared a training 'menu' from which you can select those topics of most relevance to your organisation. We can then work with you to tailor a programme that will meet your specific objectives. Advanced credit control skills for supervisors - 1â2 day Basic legal overview: do's and don'ts of debt recovery - 2 hours Body language in the credit and debt sphere - 1â2 day County Court suing and enforcement - 1â2 day Credit checking and assessment - 1 hour Customer visits and 'face to face' debt recovery skills - 1â2 day Data Protection Act explained - 1â2 day Dealing with 'Caring Agencies' and third parties - 1 hour Debt counselling skills - 2 hours Elementary credit control skills for new staff - 1â2 day Granting credit and collecting debt in Europe - 1â2 day Identifying debtors by 'type' to handle them accurately - 1 hour Insolvency: Understanding bankruptcy / receivership / administration / winding-up / liquidation / CVAs and IVAs - 2 hours Late Payment of Commercial Debts Interest Act explained - 2 hours Liaison with sales and other departments for maximum credit effectiveness - 1 hour Suing in Scottish Courts (Small Claims and Summary Cause) - 1â2 day Telephone techniques for successful debt collection - 11â2 hours Terms and conditions of business with regard to credit and debt - 2 hours Tracing 'gone away' debtors (both corporate and individual) - 11â2 hours What to do if you/your organisation are sued - 1â2 day Other topics you might wish to consider could include: Assessment of new customers as debtor risks Attachment of Earnings Orders Bailiffs and how to make them work for you Benefit overpayments and how to recover them Cash flow problems (business) Charging Orders over property/assets Credit policy: how to write one Council and Local Authority debt recovery Consumer Credit Act debt issues Using debt collection agencies Director's or personal guarantees Domestic debt collection by telephone Exports (world-wide) and payment for Emergency debt recovery measures Education Sector debt recovery Forms used in credit control Factoring of sales invoices Finance Sector debt recovery needs Third Party Debt Orders (Enforcement) Government departments (collection from) Harassment (what it is - and what it is not) Health sector debt recovery skills Hardship (members of the public) Insolvency and the Insolvency Act In-house collection agency (how to set up) Instalments: getting offers which are kept Judgment (explanation of types) Keeping customers while collecting the debt Late payment penalties and sanctions Letter writing for debt recovery Major companies as debtors Members of the public as debtors Monitoring of major debtors and risks Negotiation skills for debt recovery Old debts and how to collect them Out of hours telephone calls and visits Office of Fair Trading and collections Oral Examination (Enforcement) Pro-active telephone collection Parents of young debtors Partnerships as debtors Positive language in debt recovery Pre-litigation checking skills Power listening skills Questions to solicit information Retention of title and 'Romalpa' clauses Sale of Goods Act explained Salesmen and debt recovery Sheriffs to enforce your judgment Students as debtors Statutory demands for payment Small companies (collection from) Sundry debts (collection of) Terms and Conditions of Contract Tracing 'gone away' debtors The telephone bureau and credit control Taking away reasons not to pay Train the trainer skills Utility collection needs Visits for collection and recovery Warrant of execution (enforcement)

Search By Location

- export Courses in London

- export Courses in Birmingham

- export Courses in Glasgow

- export Courses in Liverpool

- export Courses in Bristol

- export Courses in Manchester

- export Courses in Sheffield

- export Courses in Leeds

- export Courses in Edinburgh

- export Courses in Leicester

- export Courses in Coventry

- export Courses in Bradford

- export Courses in Cardiff

- export Courses in Belfast

- export Courses in Nottingham