- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

881 Courses in Birmingham

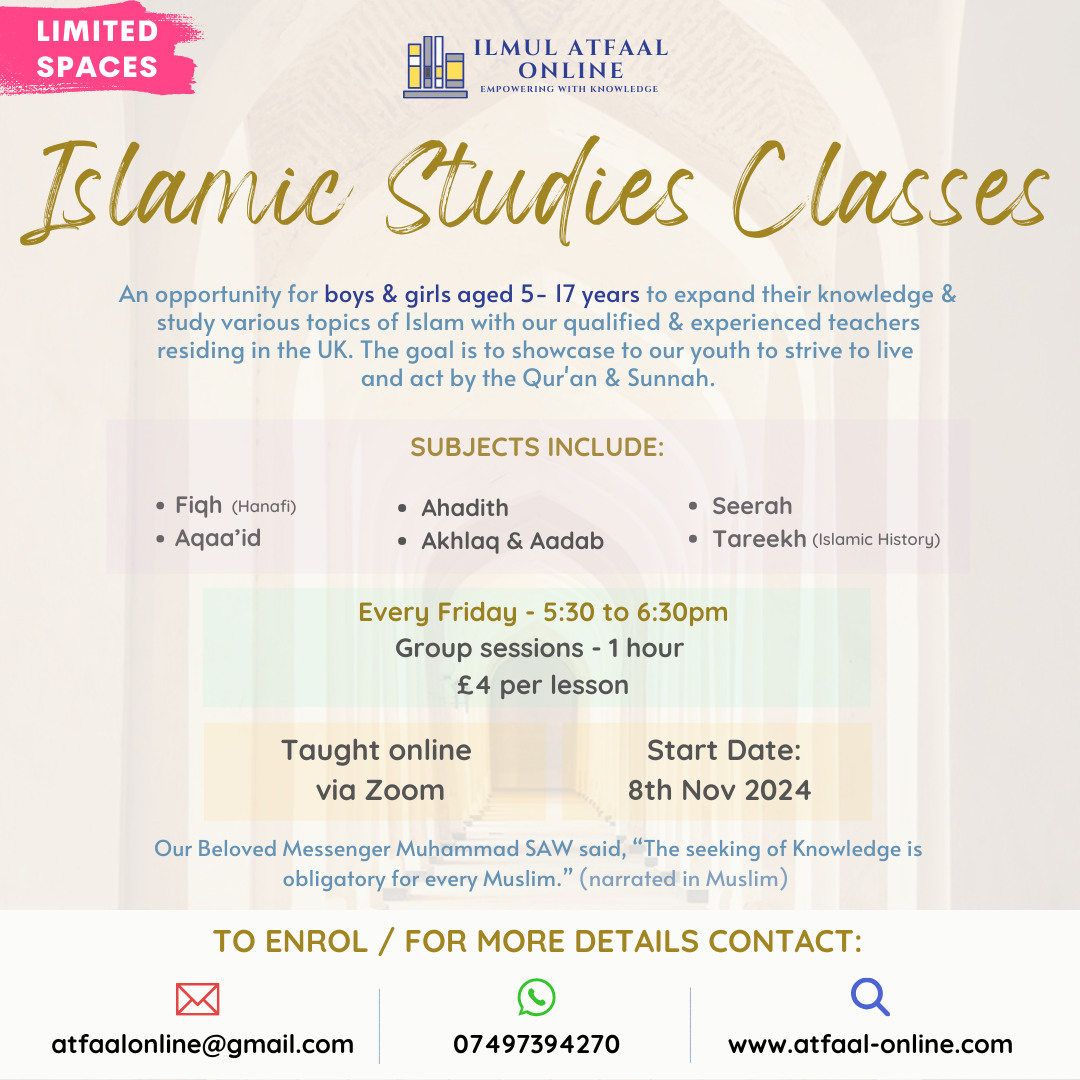

Islamic Studies Classes

By Ilmul Atfaal Online

Islamic Studies Classes

End of Life Awareness

By Prima Cura Training

This course will help you to gain a better knowledge of the policy which underpins end of life care. It will help you to learn about the delivery of great end of life care and improve your communication skills to strengthen working relationships during this period. You will also feel you have a better understanding on how to support the friends and family of the person that you are caring for.

Bowel Care & Management

By Prima Cura Training

Our Bowel Care training will enable learners to deliver effective and thorough support to individuals who have difficulty managing their bowel habits due to immobility or illness. Bowel Care training is aimed at support workers with no experience of bowel care and can also be attended by nurses who may like to update their knowledge.

1 Day First Aid for Mental Health

By Prima Cura Training

First Aid for Mental Health 1-day course stands at the forefront of addressing the crucial aspect of mental well-being. Designed to equip individuals with essential skills and knowledge, this course offers a comprehensive exploration of mental health first aid.

Person-Cenred Care

By Prima Cura Training

Person-centred approaches are a core skills framework that articulates what it means to be person-centred and how to develop and support the workforce to work in this way. Developed in partnership with Skills for Health and Skills for Care, the Framework aims to distil best practices and to set out core, transferable behaviours, knowledge and skills. It is applicable across services and sectors and across different types of organisations. Person-centred approaches underpins existing dementia, learning disabilities, mental health and end of life care core skills frameworks. This subject forms standard 5 in The Care Certificate.

Dignity in Care

By Prima Cura Training

This course is aimed at anyone working in the Care Sector to improve awareness and knowledge of dignity and how workers can help protect it. Learners will understand their roles and responsibilities, a clear understanding of the 7 principles of dignity, and show an increased understanding of best practice for communicating with service users. Explore how dignity starts at the very top of the organisation with the manager and owner taking responsibility for ensuring their staff provide a dignified service. It will describe how care staff provide and the way they provide it, are the standard by which service users will measure whether they have been treated with dignity and respect.

Fire Safety Awareness

By Prima Cura Training

A fire, or similar emergency can happen at any time in your workplace. Fire safety awareness refers to the knowledge and understanding of the precautions and measures that individuals can take to prevent fires from occurring and to minimize the damage caused by fires. This course will ensure that your staff and their managers all know what to do to maximize safety in the event of a fire or a gas leak.

Learning Disability Awareness

By Prima Cura Training

It is estimated that more than 1.2 million people in the UK are living with a learning disability. Healthcare and social care workers must have an adequate understanding of the needs of people with learning disabilities. It is also essential that they listen to the needs, hopes and aspirations of those living with learning disabilities, their careers, friends, and families. An improved knowledge, together with current guidance and best practice recommendations help to improve the care provided to people who have learning disabilities.

AAT Advanced Diploma | AAT Level 3 | AAT Courses Online

By Osborne Training

AAT Level 3 is an Advanced or Intermediate level of AAT qualification in accounting. This course gives successful students the skills and knowledge to work competently in finance, accountancy, or bookkeeping role. Moreover, the students also have the opportunity to progress their studies with the AAT Level 4 Diploma in Accounting and acquire full membership of the AAT. Duration You can expect this qualification to take 1-1.5 year to complete for most students. Tutors Tutors are highly qualified with extensive knowledge of accountancy. Study Options Online Live - Live Interactive Online Classes are offered through the State of The Art Virtual Learning Campus. Classes are recorded to catch up later. In-Campus - Study at our London campus for AAT level 3. Daytime, weekend and evening courses for AAT available. AAT Distance Learning- Self-Study at home at your own pace with Study Material and access to Online study Material through Virtual Learning Campus (VLC). AAT Qualification Once you finish AAT qualification and pass all exams successfully, you will be awarded globally recognised AAT Certificate in Accounting from AAT. AAT Level 3 Course Syllabus Advanced Bookkeeping Final Accounts Preparation Indirect Tax Management Accounting: Costing Ethics for Accountants Spreadsheets for Accounting

Just Pass

By Just Pass

Just Pass School of Motoring, with a premier driving instructor in Birmingham, is committed to excellence in driver education. Our certified instructors provide personalised, comprehensive lessons tailored to fit each student's unique learning style and pace. With a focus on safety, confidence, and skill-building, we equip learners with the knowledge and practice needed to navigate the roads adeptly. Whether you're a beginner or looking to polish your driving abilities, Just Pass offers a supportive, encouraging environment to ensure you succeed. Choose Just Pass School of Motoring, your expert driving instructor in Birmingham, for a journey towards driving mastery. Phone No. :- 0800 073 0789 Email Id :- admin@justpass.co.uk

Search By Location

- knowledge Courses in London

- knowledge Courses in Birmingham

- knowledge Courses in Glasgow

- knowledge Courses in Liverpool

- knowledge Courses in Bristol

- knowledge Courses in Manchester

- knowledge Courses in Sheffield

- knowledge Courses in Leeds

- knowledge Courses in Edinburgh

- knowledge Courses in Leicester

- knowledge Courses in Coventry

- knowledge Courses in Bradford

- knowledge Courses in Cardiff

- knowledge Courses in Belfast

- knowledge Courses in Nottingham