- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

211 Courses in Birmingham

Overview 2 day applied course with comprehensive case studies covering both Standardised Approach (SA) and Internal Models Approach (IMA). This course is for anyone interested in understanding practical examples of how the sensitivities-based method is applied and how internal models for SES and DRC are built. Who the course is for Traders and heads of trading desks Market risk management and quant staff Regulators Capital management staff within ALM function Internal audit and finance staff Bank investors – shareholders and creditors Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Learn in detail about Exotic Options – Taxonomy, Barriers, and Baskets Who the course is for Fixed Income sales, traders, portfolio managers Bank Treasury Insurance Pension Fund ALM employees Central Bank and Government Funding managers Risk managers Auditors Accountants Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Tableau Desktop Training - Analyst

By Tableau Training Uk

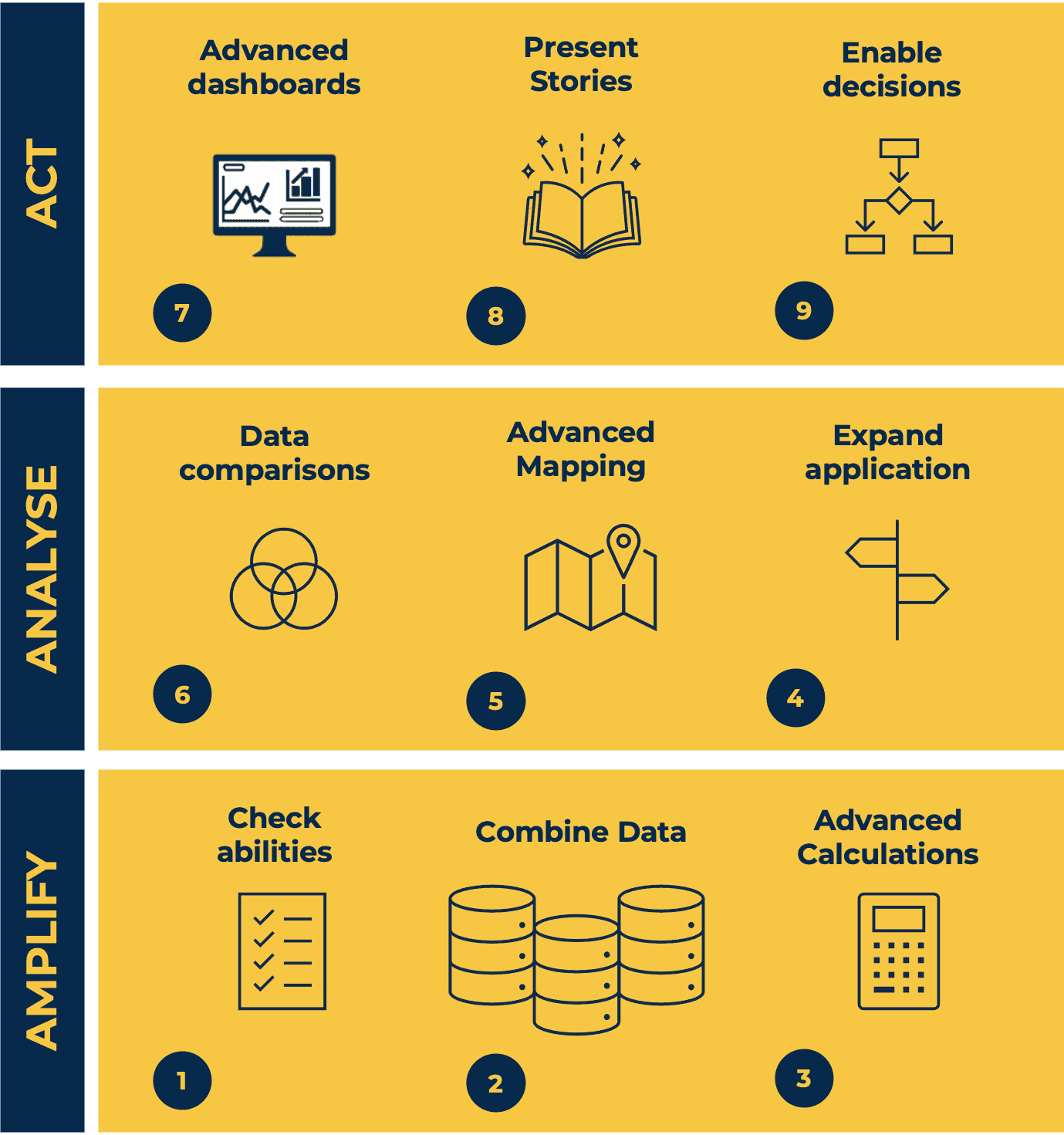

This Tableau Desktop Training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course is split into 3 phases and 9 modules: Phase 1: AMPLIFY MODULE 1: CHECK ABILITIES Revision – What I Should Know What is possibleHow does Tableau deal with dataKnow your way aroundHow do we format chartsHow Tableau deals with datesCharts that compare multiple measuresCreating Tables MODULE 2: COMBINE DATA Relationships Joining Tables – Join Types, Joining tables within the same database, cross database joins, join calculations Blending – How to create a blend with common fields, Custom defined Field relationships and mismatched element names, Calculated fields in blended data sources Unions – Manual Unions and mismatched columns, Wildcard unions Data Extracts – Creating & Editing Data extracts MODULE 3: ADVANCED CALCULATIONS Row Level v Aggregations Aggregating dimensions in calculations Changing the Level of Detail (LOD) of calculations – What, Why, How Adding Table Calculations Phase 2: ANALYSE MODULE 4: EXPAND APPLICATION Making things dynamic with parameters Sets Trend Lines How do we format charts Forecasting MODULE 5: ADVANCED MAPPING Using your own images for spatial analysis Mapping with Spatial files MODULE 6: DATA COMPARISONS Advanced Charts Bar in Bar charts Bullet graphs Creating Bins and Histograms Creating a Box & Whisker plot Phase 3: ACT MODULE 7: ADVANCED DASHBOARDS Using the dashboard interface and Device layout Dashboard Actions and Viz In tooltips Horizontal & Vertical containers Navigate between dashboards MODULE 8: PRESENT STORIES Telling data driven stories MODULE 9: ENABLE DECISIONS What is Tableau Server Publishing & Permissions How can your users engage with content This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must bring their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium “Steve not only provided a comprehensive explanation of the content of the course, but also allowed time for discussing particular business issues that participants may be facing. That was really useful as part of my learning process.”Juan C., Financial Conduct Authority “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium

Overview Learn about contract triggers, including European vs. American style, and variations like one-touch, no-touch, and double no-touch options. Who the course is for Risk managers IT System developers Traders and derivatives teams Consultants and brokers Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 2 day course on key interest rate derivative products, covering both theory (product mechanics, market conventions and valuation) and practice (wide range of applications for wide range of market participants showcased) Who the course is for Interest rate traders, salespeople and quants Asset-liability management staff with banks and insurance companies Fixed income and credit asset managers / hedge funds / pension funds / insurance companies Corporate treasurers Risk management Anyone using interest rate derivatives Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Tableau Desktop Training - Foundation

By Tableau Training Uk

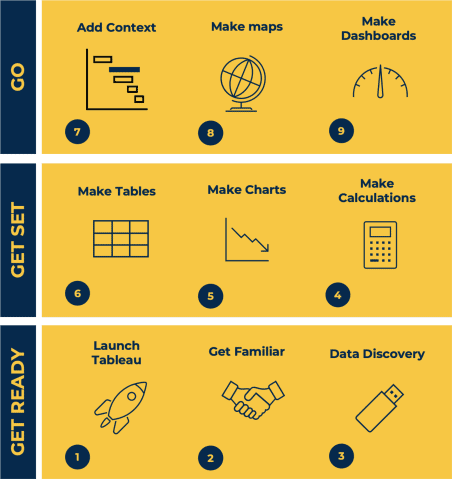

This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop Training course is a jumpstart to getting report writers and analysts with little or no previous knowledge to being productive. It covers everything from connecting to data, through to creating interactive dashboards with a range of visualisations in two days of your time. Having a quick turnaround from starting to use Tableau, to getting real, actionable insights means that you get a swift return on your investment of time and money. This accelerated approach is key to getting engagement from within your organisation so everyone can immediately see and feel the impact of the data and insights you create. This course is aimed at someone who has not used Tableau in earnest and may be in a functional role, eg. in sales, marketing, finance, operations, business intelligence etc. The course is split into 3 phases and 9 modules: PHASE 1: GET READY MODULE 1: LAUNCH TABLEAU Check Install & Setup Why is Visual Analytics Important MODULE 2: GET FAMILIAR What is possible How does Tableau deal with data Know your way around How do we format charts Dashboard Basics – My First Dashboard MODULE 3: DATA DISCOVERY Connecting to and setting up data in Tableau How Do I Explore my Data – Filters & Sorting How Do I Structure my Data – Groups & Hierarchies, Visual Groups How Tableau Deals with Dates – Using Discrete and Continuous Dates, Custom Dates Phase 2: GET SET MODULE 4: MAKE CALCULATIONS How Do I Create Calculated Fields & Why MODULE 5: MAKE CHARTS Charts that Compare Multiple Measures – Measure Names and Measure Values, Shared Axis Charts, Dual Axis Charts, Scatter Plots Showing Relational & Proportional Data – Pie Charts, Donut Charts, Tree Maps MODULE 6: MAKE TABLES Creating Tables – Creating Tables, Highlight Tables, Heat Maps Phase 3: GO MODULE 7: ADD CONTEXT Reference Lines and Bands MODULE 8: MAKE MAPS Answering Spatial Questions – Mapping, Creating a Choropleth (Filled) Map MODULE 9: MAKE DASHBOARDS Using the Dashboard Interface Dashboard Actions This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must use their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Excellent Trainer – knows his stuff, has done it all in the real world, not just the class room.”Richard L., Intelliflo “Tableau is a complicated and powerful tool. After taking this course, I am confident in what I can do, and how it can help improve my work.”Trevor B., Morrison Utility Services “I would highly recommend this course for Tableau beginners, really easy to follow and keep up with as you are hands on during the course. Trainer really helpful too.”Chelsey H., QVC “He is a natural trainer, patient and very good at explaining in simple terms. He has an excellent knowledge base of the system and an obvious enthusiasm for Tableau, data analysis and the best way to convey results. We had been having difficulties in the business in building financial reports from a data cube and he had solutions for these which have proved to be very useful.”Matthew H., ISS Group

Overview This 1 day course focus on comprehensive review of the current state of the art in quantifying and pricing counterparty credit risk. Learn how to calculate each xVA through real-world, practical examples Understand essential metrics such as Expected Exposure (EE), Potential Future Exposure (PFE), and Expected Positive Exposure (EPE) Explore the ISDA Master Agreement, Credit Support Annexes (CSAs), and collateral management. Gain insights into hedging strategies for CVA. Gain a comprehensive understanding of other valuation adjustments such as Funding Valuation Adjustment (FVA), Capital Valuation Adjustment (KVA), and Margin Valuation Adjustment (MVA). Who the course is for Derivatives traders, structurers and salespeople xVA desks Treasury Regulatory capital and reporting Risk managers (market and credit) IT, product control and legal Quantitative researchers Portfolio managers Operations / Collateral management Consultants, software providers and other third parties Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This 2 day course focuses on best practice bank ALM in today’s environment of a multiplicity of regulatory constraints on the balance sheet Who the course is for Asset Liability Committee (ALCO) members Treasury Risk Finance and internal audit capital management Funding management Liquidity buffer investment team Derivative structurers and salespeople; IT software providers Regulators Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Project management 'masterclasses' (In-House)

By The In House Training Company

Masterclasses? Refreshers? Introductions? It depends what you're looking for and where you want to pitch them, but here are six tried-and-tested highly focused sessions that organisations can take individually or as a series, to help develop their teams' project management capabilities one topic at a time. Objectives for each individual session are set out below, as part of the session outlines. Taken together, as a series, however, these modules are an ideal opportunity to develop your team's levels of project management capability maturity, whether that's by introducing them to the basic principles, refreshing them on best practice, or giving them the opportunity to really drill down into a specific area of challenge in your particular operating environment. Session outlines 1 Stakeholder management Session objectives This session will help participants: Understand why stakeholders matter to projects Be able to identify and engage stakeholders Be able to categorise stakeholders by their significance 1 Key principles What does 'stakeholder' mean - in theory? What does this mean in practice? Why stakeholders matter Consequences of missing stakeholders The stakeholder management process:IdentifyAssessPlanEngage 2 Identifying stakeholders Rapid listing CPIG analysis PESTLE analysis Drawing on the knowledge and experience of others Other ways to identify stakeholders 3 Assessing stakeholders Which stakeholders are significant? Stakeholder radar Power-interest maps Power-attitude maps 4 Planning The adoption curve Dealing with obstacles Who should engage which stakeholder? How should the project's organisation be structured? How will communication happen? 5 Engaging Seven principles of stakeholder engagement 2 Requirements and prioritisation Session objectives This session will help participants: Understand how clarity of requirements contributes to project success Use different techniques for prioritising requirements Agree requirements with stakeholders Manage changes to requirements 1 Understanding and managing stakeholder needs and expectations What are 'requirements'? What is 'requirements management'? Sources of requirements - and the role of stakeholders Are stakeholders sufficiently expert to specify their needs? Do they understand the detail of what they want, or do they need help to tease that out? What do stakeholders want to achieve? Working within constraints Prioritising requirements - three techniques 2 MoSCoW prioritisation 'Must have', should have', 'could have, 'won't have this time' When to use MoSCoW 3 The Kano Model Customer satisfaction - 'attractive' and 'must-be' qualities When to use Kano 4 Value-based prioritisation Understanding risk v value Using risk v value to prioritise features and schedules 5 Agreeing requirements Perfect v 'good enough' Establishing acceptance criteria Requirements traceability Agreeing project scope 6 Changing requirements Why requirements change Why change control matters Impact on projects A formal change control process Paying for change - managing change for different types of project 3 Estimating Session objectives This session will help participants: Understand the different purposes estimates satisfy Be able to use different estimating techniques Understand how to achieve different levels of accuracy 1 Key principles What's an estimate? Informed guesswork What needs to be estimated? Costs, resources, effort, duration Tolerances Precision v accuracy 2 Estimating through the lifecycle Start Plan Do 3 Early estimates Comparative ('analogous') estimating Parametric estimating Using multiple estimating techniques 4 Bottom-up estimating Bottom-up ('analytical') estimating Pros Cons 5 Three-point estimating Three-point ('PERT': Programme Evaluation and Review Technique) estimating Uncertainty and the range of estimates Calculating a weighted average Three-point with bottom-up 4 Scheduling Session objectives This session will help participants: Understand how to create a viable schedule Be able to use different forms of schedule Understand the concept of the critical path 1 Key principles The planning horizon Rolling wave planning Release planning 2 Viable scheduling Creating a viable schedule Define the scope Sequence the work Identify the risks and build in mitigations Identify the resources Estimate the effort and durations Check resource availability Refine until a workable schedule is produced 3 Critical path analysis The critical path Network diagrams Sequence logic Practical application:Network diagram with estimated durationsThe 'forward pass'The 'backward pass'Calculating total floatIdentifying the critical pathCalculating free float Gantt charts 5 Risk and issue management Session objectives This session will help participants: Understand the difference between risks and issues Be able to identify and assess risks Understand ways of mitigating risks Manage issues 1 Key principles Understanding risk Threats and opportunities The risk management processPreparation - proactive risk managementThe process - identify, assess, plan, implementStakeholder communication Roles and responsibilities Risk management strategy The risk register Risk appetite 2 Risk identification Brainstorming Interviews Assumption analysis Checklists 3 Risk assessment and prioritisation Probability, impact and proximity Triggers Qualitative risk assessment Qualitative impact assessment Qualitative probability assessment Probability / impact grid Bubble charts Risk tolerance 4 Planning countermeasures To mitigate or not to mitigate? Categories of risk response Avoid and exploit Reduce and enhance Transfer Share Accept Contingency Secondary risks 5 Issue management What is an issue? Tolerances Issues and tolerances The PRINCE2 view of issues Ownership of issues An issue management process Issue register 6 Budgeting and cost control Session objectives This session will help participants: Understand what to include in a budget - and why Choose - and use - the appropriate estimating technique Align the budget with the schedule Understand how to monitor spend and control costs Trouble-shoot effectively to get projects back within budget Session format Flexible. The session can be tailored to the participants' average level of project management maturity - a 60-minute session (delivered virtually) is an effective introduction. A 90-minute session allows for more in-depth treatment. A half-day session (face-to-face or virtual) gives time for a more challenging workshop, particularly to discuss specific cost control issues with any of the participants' current projects. 1 Where is the money coming from? Can we pay from revenue? Do we need to borrow? How long will the project take to pay back? The lifecycle of the budget Through-life costs Stakeholder involvement 2 Estimating costs Reminder: the relationship between estimates Reminder: possible estimating techniques What do we need to estimate?PeopleEquipmentMaterialsFacilities and operating costsWork package estimateEstimated project costs Estimating agile projects 3 Aligning budget and schedule Scheduling and financial periods Spreading the budget 4 Reserves and agreeing the budget Contingency reserve Management reserve Agreeing the budget 5 Cost control Planned spend over time Actual spend over time Work completed over time Evaluating different scenarios: delivery v spend 6 Trouble-shooting Why are we where we are? What has caused the project to spend at the rate it is? Why is it delivering at the rate it is? What are the root causes? What can we do about it?

Credit Risk Capital Modelling Under Basel Internal Ratings Based Approach (IRB)

5.0(5)By Finex Learning

Overview 2 day applied course in modelling Basel IRB parameters and generating IRB Pillar 1 credit risk capital requirement for a mixed retail and corporate loan book Who the course is for Credit risk management, model validators and quants Loan officers / loan portfolio management ALM staff Bank investors – equity and credit investors Course Content To learn more about the day by day course content please request a brochure To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Search By Location

- Financial Courses in London

- Financial Courses in Birmingham

- Financial Courses in Glasgow

- Financial Courses in Liverpool

- Financial Courses in Bristol

- Financial Courses in Manchester

- Financial Courses in Sheffield

- Financial Courses in Leeds

- Financial Courses in Edinburgh

- Financial Courses in Leicester

- Financial Courses in Coventry

- Financial Courses in Bradford

- Financial Courses in Cardiff

- Financial Courses in Belfast

- Financial Courses in Nottingham