- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview This course will help our clients to assist not only in meeting the challenges of introducing IPSAS but also to secure the benefits of improved financial management to help secure the organisational objectives and goals of each public service organisation. We have developed this course starting with an introduction and then implementation of IPSAS. This course will help our clients to assist not only in meeting the challenges of introducing IPSAS but also to secure the benefits of improved financial management to help secure the organisational objectives and goals of each public service organisation. This enables multi-national organisations to make comparisons between projects wherever in the world they happen, irrespective of jurisdiction, culture, language and ethnicity. IPSAS is becoming and will become the World standard for Public Sector entities. We have developed this course starting with an introduction and then implementation of IPSAS. This allows clients to structure the move to IPSAS within its appropriate Framework. It is an approach that enables implementation to be done in a structured and well-managed way. In the course we will consider the main requirements of IPSAS and, by showing how they affect financial reports and published accounts, will help you to apply IPSAS. The course will assist both finance managers and general managers whose organisations and departments will be affected by IPSAS.

Overview This course in Public Sector Accounting and Budgeting training seminar is designed to provide a comprehensive briefing on the fundamental principles and key functions in the continuously developing sphere of public sector finance. Non-financial public sector employees and managers are regularly required to both provide input to the budget process and respond to information presented in departmental financial reports.

Overview This course will give you in-depth knowledge of contract management by covering contract creation, executing contracts and evaluating its operational and financial performance. The course will detail how to reduce financial risks. Every business is facing the problem of cost-cutting and enhancing the company's performance. The contract Management Course is very effective and facilitates the requirement for an automated contract management system.

Overview This course will help our clients to assist not only in meeting the challenges of introducing IPSAS but also to secure the benefits of improved financial management to help secure the organisational objectives and goals of each public service organisation. This enables multi-national organisations to make comparisons between projects wherever in the world they happen, irrespective of jurisdiction, culture, language and ethnicity. IPSAS is becoming and will become the World standard for Public Sector entities. We have developed this course starting with an introduction and then implementation of IPSAS. This allows clients to structure the move to IPSAS within its appropriate Framework. It is an approach that enables implementation to be done in a structured and well-managed way. In the course we will consider the main requirements of IPSAS and, by showing how they affect financial reports and published accounts, will help you to apply IPSAS. The course will assist both finance managers and general managers whose organisations and departments will be affected by IPSAS. The consequences of managing the finances of public organisations will be examined, together with potential unintended consequences. How to implement IPSAS effectively and economically, is probably the most important aspect. The approach will be to understand the advantages to the organisation from IPSAS implementation and how benefits realisation can be ensured both internally and for stakeholders. The course will deal with practical issues for public sector organisations, including strategic management and the medium-term financial framework

Overview Objectives Analysis of current market practices and what products and structures are utilized, and why Developing new products for your clients and markets Entering the crypto and fintech space to serve the Islamic market Structuring products from the building block of theory (Islamic law) through to the final end product Impact on each group of stakeholders (Scholars, structurers, legal, marketing, operations, risk, execution etc)

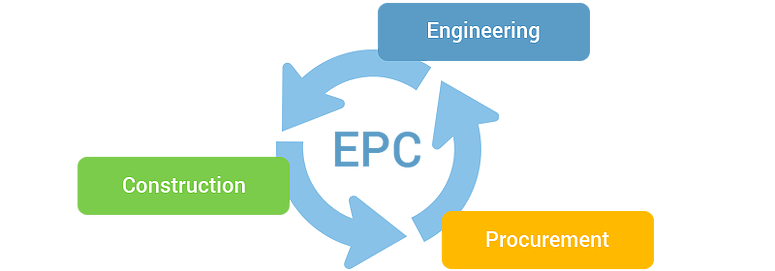

Overview EPC (Engineering, Procurement and Construction) is a very challenging area and is very competitive as well. Companies dealing with large and complex EPC projects are more often get involved in mitigation by complex contract laws and management that lead to huge financial losses. It is very important to Know-how EPC contract laws, and their commercial and financial aspects to gain skills and the ability to deal with complex contract laws and reduces the risk.

Overview Internal control, as defined by accounting and auditing, is a process for assuring an organization's objectives in operational effectiveness and efficiency, reliable financial reporting, and compliance with laws, regulations and policies. It is very important for the organisation to have a smooth flow of accounting as it plays a very important role in the development of the organisation. Financial Managers or any person who deals with Accounts need to see that the company accounts are very updated and are free from any risks that can become a problem during the time of Auditing. This course will feed you with all the skills required to have a good Internal Management process it is important to analyse Risk Management to see if the process is working efficiently and measures the effectiveness of controls put in place to alleviate risks.

Organisation Programme - Bribery and corruption risk assessment

By Global Risk Alliance Ltd

Our training programme will provide those involved at any stage of the process for procuring goods and/or services within their organisations with the knowledge and skillset to identify and mitigate the threat posed by the breadth and multi-layered complexity of procurement fraud, corruption and associated financial crime and money laundering.

Finance for Non-Finance Professionals in Oil & Gas Petroleum Fiscal Regimes & Applied Finance for Non-Finance Oil & Gas Professionals

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course This separately bookable 3 full-day course is not designed to skill Oil & Gas engineers to be accountants, but to give the participants the confidence and ability to communicate with accountants and finance managers and to improve their own financial decision making. For technical professionals, a high level of single subject matter expertise is no longer sufficient for superior management performance. Oil & Gas technical professionals who wish to succeed in the resources industry are required to develop skills beyond their core functional knowledge. An understanding of financial information and management, and an awareness of the economic theory that drives value creation, are an integral part of the managers required suite of skills. This course can also be offered through Virtual Instructor Led Training (VILT) format. Training Objectives Workshop A: Finance for Non-Finance for Oil & Gas Professionals Attend this industry specific course and benefit from the following: Demystify financial jargon and fully interpret financial statements Understand Balance Sheets and Profit & Loss statements of Oil & Gas companies Discover the crucial distinction between cash flow and profit Understand how to make correct investment decisions using Net present Value and Internal Rate of Return Interpret oil and gas company financial reports using ratio analysis Learn the difference between cash costs and full costing of energy products Learn how to manage working capital for increased shareholder value Workshop B: Petroleum Fiscal Regimes and Applied Finance for Oil & Gas Industry Professionals Attend this advanced Training course to enhance your financial acumen from the following: Build and compare cash flow based models of both production sharing contract projects and royalty regime projects Gain an awareness of the different valuation methods for producing properties and undeveloped acreage Learn the industry specific accounting issues that apply when interpreting oil and gas company financial statements Understand how the physical characteristics of energy assets (e.g. reserves, reservoir quality) are translated into project valuations Learn how the investment analysts value oil and gas stocks and make buy/sell recommendations Target Audience This course is specifically designed for those with a non-finance background training from the Oil & Gas sector and requires only basic mathematical ability as a pre-requisite. It is presented in a manner that reduces the jargon to basic principles and applies them to numerous real-life examples. This course has been researched and developed for Managers, Superintendents, Supervisors, Engineers, Planners, Lawyers, Marketers, Team Leaders and Project Coordinators in the technical and non-technical departments in the Oil and Gas industry. Course Level Basic or Foundation Trainer Your expert course leader has presented over 300 courses and seminars in financial management. He began his career as a graduate in the Corporate Treasury of WMC Ltd having completed a degree in Applied Mathematics and Geology at Monash University. After five years with WMC, he pursued an MBA in finance and accounting at Cornell University in New York. He later gained a PhD in energy policy from the University of Melbourne. He worked for WMC Ltd in Perth as a Senior Financial Analyst in the Minerals Division and subsequently as an Energy Analyst in the Petroleum Division. In April 1997, he established an independent consultancy business providing advice to companies such as Woodside, Shell and Japan Australia LNG (MIMI). He spent many years as a consultant and commercial manager in the North West Shelf Gas project in Western Australia. Since 2006, he has been an Adjunct Fellow at the Macquarie University Applied Finance Centre where he teaches courses in valuation, financial statement modelling, and resources industry investment analysis. His background in geology and mathematics allows him to empathise with those who seek an understanding of finance but are approaching the learning experience with a technical mind. He receives consistently high ratings for his breadth of knowledge of the subject matter. He presents in a lively interactive style using real life examples and cases. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Exploration & Production (E&P) Accounting Level 3

By EnergyEdge - Training for a Sustainable Energy Future

About this training course This highly interactive 5-day training is aimed at those who wish to take their E&P accounting skills to a more advanced level than our introductory course, E&P Accounting - Level 1, and our intermediate course, E&P Accounting - Level 2. It will help equip you for more demanding analytical roles within your organisation. Training Objectives After the completion of this training course, participants will be able to: Carry out and manage the day-to-day financial accounting activities associated with participation in E&P joint ventures Prepare, analyse and present information for effective financial reporting Understand the impact of a comprehensive range of activities on the financial statements of an upstream oil and gas company Practically apply IFRS in accounting for a wide range of typical oil and gas industry activities Target Audience This is an advanced level course designed for: those who have already attended E&P Accounting - Level 1 and E&P Accounting - Level 2, or those who can demonstrate, by a combination of relevant experience and previous study, sufficient prior knowledge to contribute and benefit from attending this workshop Course Level Advanced Training Methods Training Method - Scenario Based Learning Learning centers around highly realistic E&P company scenarios. A computer-based simulation is used to plan, record and report the progress of your company through several years of international E&P activities. Teams of 2 - 3 people participate in the financial management of these activities, including Operator and Non-operator accounting, recording of transactions, updating of financial statements and analysis of results. The highly interactive laptop-based scenario approach will enable you to follow the impact of each activity from initiation through to final results and analysis of company performance. You will need to bring with you to the course your own laptop PC with MS Excel⢠pre-installed. Prior knowledge of spreadsheet techniques is assumed. Trainer will provide various Excel files which participants may retain at the end of the course. Course Duration: 5 days in total (35 hours). Training Schedule 0830 - Registration 0900 - Start of training 1030 - Morning Break 1045 - Training recommences 1230 - Lunch Break 1330 - Training recommences 1515 - Evening break 1530 - Training recommences 1700 - End of Training The maximum number of participants allowed for this training course is 25. Trainer Your expert course leader has more than 30 years of experience in the international oil and gas industry, covering all areas of Finance and Audit, including involvement in Commercial roles. During her 19 years with ENI she worked in Italy, Netherlands, Egypt and UK and was CFO for 2 major ENI subsidiaries. She has delivered training courses in Accounting, Audit, Economics and Commercial topics in many Countries. She has a Degree in Economics & Accounting and is a Certified Chartered Accountant. She is also a Chartered Auditor and an International Petroleum Negotiator. Outside of work, she is inspired by the beauty of nature and art, helping disadvantaged people, sports (football, golf) and her cat. Courses Delivered Internationally: E&P Accounting, Auditing in the Oil & Gas Industry Cost Control & Budgeting Introduction to the Oil & Gas Industry Petroleum Project Economics Contracts Strategy International O&G Exploitation Contracts POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Search By Location

- Financial Courses in London

- Financial Courses in Birmingham

- Financial Courses in Glasgow

- Financial Courses in Liverpool

- Financial Courses in Bristol

- Financial Courses in Manchester

- Financial Courses in Sheffield

- Financial Courses in Leeds

- Financial Courses in Edinburgh

- Financial Courses in Leicester

- Financial Courses in Coventry

- Financial Courses in Bradford

- Financial Courses in Cardiff

- Financial Courses in Belfast

- Financial Courses in Nottingham