- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Courses delivered Online

We couldn't find any listings for your search. Explore our online options and related educators below to see if they help you.

Know someone teaching this? Help them become an Educator on Cademy.

Online Options

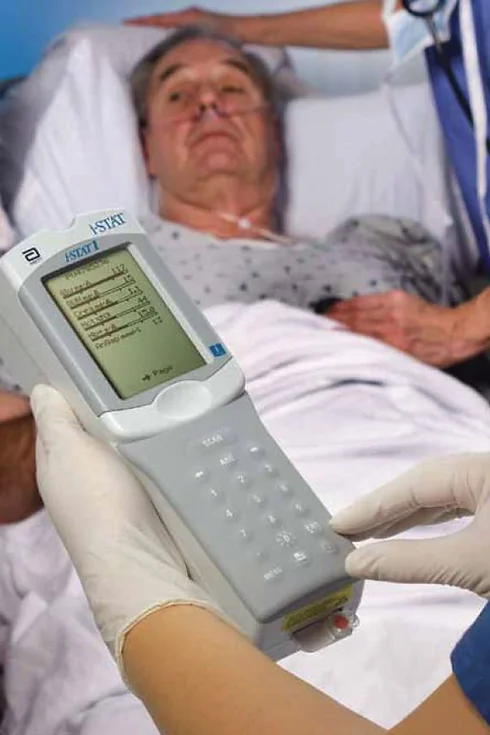

Show all 8596The UK's first and only Level 4 qualification in Phlebotomy (equivalent to Ireland Level 6) FDSc (Foundation Degree Level) qualification Nationally Recognised certificate Dually accredited: Open College Network and CPD Covers both aspirated and evacuated systems Covers specialised blood collection systems & methods Classroom or Virtual Classroom learning options Comprehensive Training Kit is provided when booking our Virtual Classroom option (yours to keep) Complete your training from beginner to advanced level This course either follows on from our Introduction to Phlebotomy Course or can be combined with our introductory course as part of a course package (see below) Available to candidates who have completed (or are currently enrolled to complete) our Introduction to Phlebotomy Course or have previous phlebotomy practical experience.

Take your phlebotomy qualifications to the next level ... Nationally Recognised Qualification OCN Accredited - Level 3 (advanced) CPD Accredited Covers specialised and advanced phlebotomy techniques and practices Comprehensively covers Peripheral IV Cannulation Advanced qualification - additional credits Download a digital certificate on completion Basic understanding of English language required LOOKING TO ADD PRACTICAL TRAINING? ALSO AVAILABLE AS SEPARATE CLASSROOM OR VIRTUAL CLASSROOM COURSES: 1: Advanced Phlebotomy Course - Level 4 2: Peripheral IV Cannulation Course - Level 3 COMPLETION OF INTRODUCTION TO PHLEBOTOMY COURSE RECOMMENDED BUT NOT ESSENTIAL

2year Masters program with Experience certificate and Chartered Engineering status

By JP Jacobs International University

Mep Design Engineering

Project Team Leadership

By Nexus Human

Duration 2 Days 12 CPD hours This course is intended for This course is designed for all project managers and project team leaders. This class is intended for PMP?s looking to earn PDU's, or for Project Managers looking to learn more about Project Team Leadership techniques. Project success depends on choosing, motivating, and leading the project team. This course focuses on improving the project manager?s human resource expertise, from initial planning through project closure. Participants will apply all course principles to a work-related case study taken directly from their work environment. At course completion, students will be able to develop a human resource plan, acquire optimal team members, develop and motivate team members, and manage team members to accomplish project goals. NOTE: This course will earn you 14 PDUs. 1 - Project Teams Overview Project Human Resource Management Project Human Resources Management Processes Case Study Selection 2 - Develop Human Resource Plan Plan Human Resource Management Roles and Responsibilities Project Organizational Chart Staffing Management Plan Resource Histogram 3 - Acquire Project Team Acquire Project Team Overview Multi-Criteria Decision Analysis Acquire Contract Resources Optimize Virtual Teams Best Practices Social Identity Theory Virtual Teams and Social Identity Theory Team Building Activities for Virtual Teams Cultural Diversity Individualism and Communitarianism Perspectives of Time and Space Fate and Personal Responsibility Face and Saving Face Body Language Create Resource Calendars 4 - Develop Project Team Develop Project Team Overview Ground Rules Form, Storm, Norm, Perform, Adjourn Team Building Team Building ? Personality Profiles Collaborative, Delphi, Majority and Plurality Decision Making Recognition and Rewards Expectancy Theory Maslow?s Hierarchy Of Needs Operant Conditioning Team Performance Assessment 5 - Manage Project Team Manage Project Team Overview Performance Problems Challenging Stakeholders Stress Management Conflict Management and Resolution Views of Conflict Sources of Project Management Conflict Conflict Resolution Survey Conflict Resolution Techniques Additional course details: Nexus Humans Project Team Leadership training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Project Team Leadership course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

Project Management X

By IIL Europe Ltd

Project management is a fast-growing profession, as well as an evolving profession. Project Management X (PMX) offers a fresh perspective on the essential knowledge and skills required to deliver intended project outcomes. This course starts with the concept that the purpose of projects is to deliver value. Value can be created in various ways depending on whether you have known or evolving scope. PMX teaches a variety of ways to begin a project including a project proposal, charter, and roadmap. You will learn how to organize and deliver scope using a mixture of methods, such as a WBS, backlog, and releases. PMX provides you with the opportunity to tailor the functions needed to lead a project so you can balance management needs and support self-organizing teams. It helps you honor the need for flexibility while aligning with best practices. The X in Project Management X represents how you can think differently about determining a tailored approach to your projects in order to meet the needs of your organization. This robust experience, designed to enable on-the-job skill transfer, leverages collaborative technology, videos, polls, self-assessments, and rigorous case study practices.

Project Management for Non-Project Managers (Virtual)

By IIL Europe Ltd

Project Management for Non-Project Managers (Virtual) Individuals who are involved in projects (commissioning, supporting, sponsoring, etc.) may often be unfamiliar with project management. A basic understanding of project management is essential for non-project managers, who are critical stakeholders contributing to project success. This awareness course usesA Guide to the Project Management Body of Knowledge (PMBOK® Guide) and other sources to introduce you to project management vocabulary, concepts, and techniques. It also provides insights into the realities of being a project manager, and opportunities to explore how you can positively impact projects in your own role. Getting Started Introductions Course structure Course goals and objectives Foundation Concepts Project management overview Strategic value of project management Defining project success Project life-cycle models and governance Project roles and responsibilities Project Initiating and Planning Initiating the project Defining project requirements and scope Developing the project schedule and budget Project Risk Management, Executing, Monitoring, and Closing Understanding, evaluating, and adjusting for risk Honoring the baseline and executing the project Monitoring and controlling the project Closing the project Project Interpersonal Processes Project communication Project team development Conflict management

Project Management for Non-Project Managers: In-House Training

By IIL Europe Ltd

Project Management for Non-Project Managers: In-House Training Individuals who are involved in projects (commissioning, supporting, sponsoring, etc.) may often be unfamiliar with project management. A basic understanding of project management is essential for non-project managers, who are critical stakeholders contributing to project success. This awareness course uses A Guide to the Project Management Body of Knowledge (PMBOK® Guide) and other sources to introduce you to project management vocabulary, concepts, and techniques. It also provides insights into the realities of being a project manager, and opportunities to explore how you can positively impact projects in your own role. What You Will Learn At the end of this program, you will be able to: Identify the benefits of project management Use standard project management terminology Describe characteristics of successful projects, project managers, and high-performing teams Explain various project stakeholder roles, their responsibilities, and the fundamental project management processes Recognize how agile / adaptive practices are useful for certain project life cycles Create a personal action plan for how to support real-world projects within a non-PM role Getting Started Introductions Course structure Course goals and objectives Foundation Concepts Project management overview Strategic value of project management Defining project success Project life-cycle models and governance Project roles and responsibilities Project Initiating and Planning Initiating the project Defining project requirements and scope Developing the project schedule and budget Project Risk Management, Executing, Monitoring, and Closing Understanding, evaluating, and adjusting for risk Honoring the baseline and executing the project Monitoring and controlling the project Closing the project Project Interpersonal Processes Project communication Project team development Conflict management