- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Description: QuickBooks 2008 is an accounting program which remains top notch for novices to expert users. It comes integrated and suitable for variety of industries. Intuit QuickBooks 2008 Foundation Training provides an overall outlook on the use of this software. In this course, you will learn about accounting basics which will help you get started with the software. After that, you will accustom yourself with lists, forms, registers which will help you with data entry. You will learn to add vendors, customers, sales receipts, setting up, tracking invoices, etc. This skills will build a foundation for mastering this program. Learning Outcomes: Performing basic transactions through setting up sales tax, opening check register, writing checks and much more Enter, view, search and pay bills; along with editing, deleting and voiding a bill Utilizing the loan manager by going through the preparation to add loans, viewing payment schedule and other relevant options Adding new inventory, checking inventory status, adjusting the quantity on hand and using build assemblies Customizing, creating, memorizing purchase orders and navigating through existing ones Finishing purchase orders by checking the spelling, using print preview, printing purchase order and using email options What to do when receiving inventory with or without bills, entering bills against inventory, backorders and closing purchase orders, and creating inventory worksheet Returning items to vendors, applying vendor credits, reimbursing expenses, and using vehicle mileage Creating new bank account in order to transfer funds, making non-customer deposits, and managing undeposited funds account Creating and funding petty cash, and tracking the expenses Understanding credit cards and QuickBooks, setting up credit card as liability account or as a vendor, entering charges, paying credit card, and reconciling them Utilizing online banking features by setting up online account in QuickBooks, and using it as a credit card merchant Using the report menu, opening report center and understanding it, choosing a category and opening pre-defined reports Choosing dates and columns, changing sort order, modifying the header and body for pre-defined reports Emailing, printing, exporting and memorizing the report Review some common reports such as trial balance, balance sheet, profit & loss and others Get report details through QuickZoom feature, accessing memorized reports, setting preferences, and using the learning center Assessment: At the end of the course, you will be required to sit for an online MCQ test. Your test will be assessed automatically and immediately. You will instantly know whether you have been successful or not. Before sitting for your final exam you will have the opportunity to test your proficiency with a mock exam. Certification: After completing and passing the course successfully, you will be able to obtain an Accredited Certificate of Achievement. Certificates can be obtained either in hard copy at a cost of £39 or in PDF format at a cost of £24. Who is this Course for? Intuit QuickBooks 2008 Foundation Training is certified by CPD Qualifications Standards and CiQ. This makes it perfect for anyone trying to learn potential professional skills. As there is no experience and qualification required for this course, it is available for all students from any academic background. Requirements Our Intuit QuickBooks 2008 Foundation Training is fully compatible with any kind of device. Whether you are using Windows computer, Mac, smartphones or tablets, you will get the same experience while learning. Besides that, you will be able to access the course with any kind of internet connection from anywhere at any time without any kind of limitation. Career Path After completing this course you will be able to build up accurate knowledge and skills with proper confidence to enrich yourself and brighten up your career in the relevant job market. Opening QuickBooks Pro 2008 01:00:00 Accounting Basics, Part One 01:00:00 Accounting Basics, Part Two 01:00:00 Getting Started with QuickBooks 01:00:00 Getting Help in QuickBooks 00:30:00 Lists, Forms, and Registers 00:30:00 Using the Chart of Accounts 00:30:00 Using the Journal 00:30:00 Adding Items and Services 01:00:00 Adding Vendors 00:30:00 Adding Customers 00:30:00 Adding Employees 00:30:00 Sales Receipts 00:30:00 Customer Payments 00:30:00 Finance Charges 01:00:00 Setting up Invoices 00:30:00 Finishing Invoices 00:30:00 Tracking Invoices 00:30:00 Issuing Credit Memos 01:00:00 Mock Exam Mock Exam- Intuit QuickBooks 2008 Foundation Training 00:20:00 Final Exam Final Exam- Intuit QuickBooks 2008 Foundation Training 00:20:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

CertNexus Certified CyberSec First Responder (CFR-410)

By Nexus Human

Duration 5 Days 30 CPD hours This course is intended for This course is designed primarily for cybersecurity practitioners preparing for or who currently perform job functions related to protecting information systems by ensuring their availability, integrity, authentication, confidentiality, and non-repudiation. It is ideal for those roles within federal contracting companies and private sector firms whose mission or strategic objectives require the execution of Defensive Cyber Operations (DCO) or DoD Information Network (DoDIN) operation and incident handling. This course focuses on the knowledge, ability, and skills necessary to provide for the defense of those information systems in a cybersecurity context, including protection, detection, analysis, investigation, and response processes. Overview In this course, you will identify, assess, respond to, and protect against security threats and operate a system and network security analysis platform. You will: Assess cybersecurity risks to the organization. Analyze the threat landscape. Analyze various reconnaissance threats to computing and network environments. Analyze various attacks on computing and network environments. Analyze various post-attack techniques. Assess the organization's security posture through auditing, vulnerability management, and penetration testing. Collect cybersecurity intelligence from various network-based and host-based sources. Analyze log data to reveal evidence of threats and incidents. Perform active asset and network analysis to detect incidents. Respond to cybersecurity incidents using containment, mitigation, and recovery tactics. Investigate cybersecurity incidents using forensic analysis techniques. This course covers network defense and incident response methods, tactics, and procedures that are in alignment with industry frameworks such as NIST 800-61r2 (Computer Security Incident Handling Guide), US-CERT's National Cyber Incident Response Plan (NCIRP), and Presidential Policy Directive (PPD)-41 on Cyber Incident Coordination. It is ideal for candidates who have been tasked with the responsibility of monitoring and detecting security incidents in information systems and networks, and for executing standardized responses to such incidents. The course introduces tools, tactics, and procedures to manage cybersecurity risks, defend cybersecurity assets, identify various types of common threats, evaluate the organization's security, collect and analyze cybersecurity intelligence, and remediate and report incidents as they occur. This course provides a comprehensive methodology for individuals responsible for defending the cybersecurity of their organization. This course is designed to assist students in preparing for the CertNexus CyberSec First Responder (Exam CFR-410) certification examination. What you learn and practice in this course can be a significant part of your preparation. In addition, this course and subsequent certification (CFR-410) meet all requirements for personnel requiring DoD directive 8570.01-M position certification baselines: CSSP Analyst CSSP Infrastructure Support CSSP Incident Responder CSSP Auditor The course and certification also meet all criteria for the following Cybersecurity Maturity Model Certification (CMMC) domains: Incident Response (IR) Audit and Accountability (AU) Risk Management (RM) Lesson 1: Assessing Cybersecurity Risk Topic A: Identify the Importance of Risk Management Topic B: Assess Risk Topic C: Mitigate Risk Topic D: Integrate Documentation into Risk Management Lesson 2: Analyzing the Threat Landscape Topic A: Classify Threats Topic B: Analyze Trends Affecting Security Posture Lesson 3: Analyzing Reconnaissance Threats to Computing and Network Environments Topic A: Implement Threat Modeling Topic B: Assess the Impact of Reconnaissance Topic C: Assess the Impact of Social Engineering Lesson 4: Analyzing Attacks on Computing and Network Environments Topic A: Assess the Impact of System Hacking Attacks Topic B: Assess the Impact of Web-Based Attacks Topic C: Assess the Impact of Malware Topic D: Assess the Impact of Hijacking and Impersonation Attacks Topic E: Assess the Impact of DoS Incidents Topic F: Assess the Impact of Threats to Mobile Security Topic G: Assess the Impact of Threats to Cloud Security Lesson 5: Analyzing Post-Attack Techniques Topic A: Assess Command and Control Techniques Topic B: Assess Persistence Techniques Topic C: Assess Lateral Movement and Pivoting Techniques Topic D: Assess Data Exfiltration Techniques Topic E: Assess Anti-Forensics Techniques Lesson 6: Assessing the Organization's Security Posture Topic A: Implement Cybersecurity Auditing Topic B: Implement a Vulnerability Management Plan Topic C: Assess Vulnerabilities Topic D: Conduct Penetration Testing Lesson 7: Collecting Cybersecurity Intelligence Topic A: Deploy a Security Intelligence Collection and Analysis Platform Topic B: Collect Data from Network-Based Intelligence Sources Topic C: Collect Data from Host-Based Intelligence Sources Lesson 8: Analyzing Log Data Topic A: Use Common Tools to Analyze Logs Topic B: Use SIEM Tools for Analysis Lesson 9: Performing Active Asset and Network Analysis Topic A: Analyze Incidents with Windows-Based Tools Topic B: Analyze Incidents with Linux-Based Tools Topic C: Analyze Indicators of Compromise Lesson 10: Responding to Cybersecurity Incidents Topic A: Deploy an Incident Handling and Response Architecture Topic B: Mitigate Incidents Topic C: Hand Over Incident Information to a Forensic Investigation Lesson 11: Investigating Cybersecurity Incidents Topic A: Apply a Forensic Investigation Plan Topic B: Securely Collect and Analyze Electronic Evidence Topic C: Follow Up on the Results of an Investigation Additional course details: Nexus Humans CertNexus Certified CyberSec First Responder (CFR-410) training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the CertNexus Certified CyberSec First Responder (CFR-410) course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

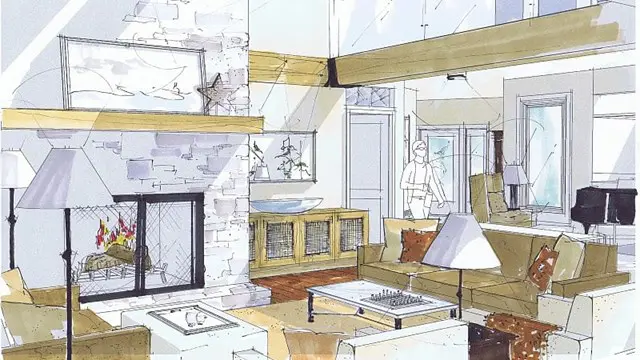

Vectorworks and Sketchup Help in Interior Design projects

By Real Animation Works

Vectorworks Course face to face One to one

An Introduction to Professional Scrum

By IIL Europe Ltd

An Introduction to Professional Scrum Although Scrum has been around for more than 25 years, it is still a new concept to many. Moreover, there are myths that arise. In this session, Eric Naiburg, Chief Operating Officer for Scrum.org, provides an overview of the Scrum framework. He'll discuss how Scrum enables agility, and how an empirical process can empower teams that use it. You'll learn about the empirical process in Scrum where decisions are made based on observation and experimentation rather than on detailed upfront planning. We will apply this learning using facts and real-world examples. This and other IIL Learning in Minutes presentations qualify for PDUs. Some titles, such as Agile-related topics may qualify for other continuing education credits such as SEUs, or CEUs. Each professional development activity yields one PDU for one hour spent engaged in the activity. Some limitations apply and can be found in the Ways to Earn PDUs section that discusses PDU activities and associated policies. Fractions of PDUs may also be reported. The smallest increment of a PDU that can be reported is 0.25. This means that if you spent 15 minutes participating in a qualifying PDU activity, you may report 0.25 PDU. If you spend 30 minutes in a qualifying PDU activity, you may report 0.50 PDU. What You Will Learn: Common myths and misconceptions about Scrum The 2020 Scrum Guide, Scrum Events, and Scrum Artefacts The Project Manager and Scrum Accountabilities in Scrum How Scrum can be used with other practices like Kanban, DevOps, Continuous Delivery, and more

Understanding Securities Financing Transaction Regulation - SFTR

5.0(4)By LGCA | London Governance and Compliance Academy

Course Overview SFTR is a major regulatory reporting requirement for anyone transacting repo and other securities financing transactions in the EU, no matter how limited their activity. In order to meet the regulator's demand for complete, accurate and timely data, firms are devoting considerable resources to the speedy remediation of rejected or unreconciled reports. Description This self-paced online course will offer delegates a grasp of what is required by SFTR in the EU and UK but will also provide a practical insight by looking at specific reporting rules and key data fields. Training Objectives By the end of the course, delegates should be able to: • Identify what trading activities are covered by SFTR, who has to report and by when; • Outline the role of trade repositories and recognise the reports sent to and sent out by these entities; • Distinguish the types of record to be sent to trade repositories and know in what order they should be sent; • Select and describe the data fields required for generic SFT structures, whether collateralized at transaction or portfolio level; • Complete a basic calculation of the estimated re-use of collateral. They should also: • Be aware of some of the practical issues that have arisen in reporting; • Know where to look for further guidance. Training Outline • Background which has brought the SFTR • What is Shadow Banking and how is it related to SFTR • Purpose of SFTR and key requirements for reporting parties • What SFTR covers: repos, securities/commodities lending, margin lending • Who is subject to SFTR, including mandatory delegation and branches • The role of trade repositories: who they are; what they do (validation and recon-ciliation); what you send them and what they send back and to others • Types of report (Action Types) and sequencing • Reporting deadlines. • Data sets, matching fields, cardinality rules (mandatory, conditional or optional) and conditionality links between fields • Counterparty data • Loan data: type, UTI, level of reporting, legal data, term, rate • Collateral data: type; level of reporting; classifications • CCP-cleared SFTs and margins • Collateral re-use reports: actual and estimated • Practical examples provided by ESMA Training Duration This course may take up to 3 hours to be completed. However, actual study time differs as each learner uses their own training pace. Participants This course is suitable for any professional involved with SFTR. Delegates would benefit from a familiarity with repos, securities lending and margin lending but this is not essential. The course is offered fully online using a self-paced approach. The learning units are based on reading material. Learners may start, stop and resume their training at any time. Accreditation and CPD Recognition This programme has been developed by the European Institute of Management and Finance (EIMF), a globally-recognised training institution. The syllabus is verified by external subject matter experts and can be accredited by regulators and other bodies for 3 CPD Units that require CPD training in financial regulation. The course may be also approved for CPD Units by institutions which approve general financial training, such as the CISI. Eligibility criteria and CPD Units are verified directly by your association, regulator or other bodies which you hold membership. Registration and Access To register to this course, click on the Get this course button to pay online and receive your access instantly. If you are purchasing this course on behalf of others, please be advised that you will need to create or use their personal profile before finalising your payment. Access to the course is valid for 365 days. If you wish to receive an invoice instead of paying online, please Contact us here. Talk to us for our special Corporate Group rates.

Insights Discovery Personalised Profile & Coaching

By Starling

A personalised resilience profile and 60 minute coaching and exploration session for those who want to develop their capacity to adapt positively in an ever changing world.

Hotel Financial Management: Income Statements and Balance Sheets

By Study Plex

Highlights of the Course Course Type: Online Learning Duration: 3 hours Tutor Support: Tutor support is included Customer Support: 24/7 customer support is available Quality Training: The course is designed by an industry expert Recognised Credential: Recognised and Valuable Certification Completion Certificate: Free Course Completion Certificate Included Instalment: 3 Installment Plan on checkout What you will learn from this course? Gain comprehensive knowledge about finance analysis and management Understand the core competencies and principles of finance analysis and management Explore the various areas of finance analysis and management Know how to apply the skills you acquired from this course in a real-life context Become a confident and expert financial manager or business manager Hotel Financial Management: Income Statements and Balance Sheets Course Master the skills you need to propel your career forward in finance analysis and management. This course will equip you with the essential knowledge and skillset that will make you a confident financial manager or business manager and take your career to the next level. This comprehensive hotel financial management course is designed to help you surpass your professional goals. The skills and knowledge that you will gain through studying this hotel financial management course will help you get one step closer to your professional aspirations and develop your skills for a rewarding career. This comprehensive course will teach you the theory of effective finance analysis and management practice and equip you with the essential skills, confidence and competence to assist you in the finance analysis and management industry. You'll gain a solid understanding of the core competencies required to drive a successful career in finance analysis and management. This course is designed by industry experts, so you'll gain knowledge and skills based on the latest expertise and best practices. This extensive course is designed for financial manager or business manager or for people who are aspiring to specialise in finance analysis and management. Enrol in this hotel financial management course today and take the next step towards your personal and professional goals. Earn industry-recognised credentials to demonstrate your new skills and add extra value to your CV that will help you outshine other candidates. Who is this Course for? This comprehensive hotel financial management course is ideal for anyone wishing to boost their career profile or advance their career in this field by gaining a thorough understanding of the subject. Anyone willing to gain extensive knowledge on this finance analysis and management can also take this course. Whether you are a complete beginner or an aspiring professional, this course will provide you with the necessary skills and professional competence, and open your doors to a wide number of professions within your chosen sector. Entry Requirements This hotel financial management course has no academic prerequisites and is open to students from all academic disciplines. You will, however, need a laptop, desktop, tablet, or smartphone, as well as a reliable internet connection. Assessment This hotel financial management course assesses learners through multiple-choice questions (MCQs). Upon successful completion of the modules, learners must answer MCQs to complete the assessment procedure. Through the MCQs, it is measured how much a learner could grasp from each section. In the assessment pass mark is 60%. Advance Your Career This hotel financial management course will provide you with a fresh opportunity to enter the relevant job market and choose your desired career path. Additionally, you will be able to advance your career, increase your level of competition in your chosen field, and highlight these skills on your resume. Recognised Accreditation This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. Course Curriculum Introduction & Fundamentals Introduction 00:02:00 Introduction to Hotel Operations 00:05:00 Fundamentals of Accounting Concepts 00:03:00 What is Allocation of Expenses 00:04:00 What are Prepayments 00:02:00 Key Terms Used In Hospitality Key Terms Used in Hospitality 00:01:00 Rooms Division Key Terms - Occupancy & Related Terms 00:07:00 Room Division Key Terms ADR and Related Terms 00:06:00 F&B Business - Key Quantity Drivers 00:08:00 Food & Beverage Division - Key Revenue Terms 00:07:00 What are various Revenue Segmentation - Transient Business 00:05:00 Hotel Revenue Segmentation - Group Business 00:05:00 F&B Revenue Segmentation Fundamentals 00:05:00 Standard Templates And Analysis Fundamentals Steps Standard Profit & Loss Templates Prescribed by USALI for Lodging Industries V11 00:11:00 Revenue Reports Analysis Fundamentals 00:05:00 Horizontal Analysis in practice through Room Segment Analysis 00:07:00 Vertical Analysis Explained via Room Segment Report 00:07:00 Combined Analsysis Simplified - Market Segment Report 00:04:00 Revenue Management & Analysis Reports Why You Should know The Business Source 00:05:00 Guest Nationality Report 00:04:00 Booking Lead Period and Booking Pace Concepts 00:04:00 Market Benchmark & Competitor Comparison Report 00:05:00 Upselling & Upgrades 00:03:00 Menu Engineering Report 00:08:00 Expenses & Expense Control Reports Labour Cost Basic Pay & Wages 00:05:00 Labour Cost - Service Charge 00:05:00 Labour Cost - Other Components 00:03:00 Labour Cost Analysis 00:05:00 Other Expenses and Control Reports 00:07:00 Cost Management Ideas Part 1 00:06:00 Cost Management Ideas - Part 2 00:05:00 Overall P&L Analysis Profit & Loss Analysis Steps 00:06:00 Room Division Profit & Loss 00:08:00 F&B Profit & Loss Statement 00:07:00 Certificate of Achievement Certificate of Achievement 00:00:00 Get Your Insurance Now Get Your Insurance Now 00:00:00 Feedback Feedback 00:00:00

The PMP in Lean Six Sigma

By IIL Europe Ltd

The PMP in Lean Six Sigma Because you are a Project Management Professional, you have been assigned to lead a Lean or Six Sigma project, or even to manage the company-wide Lean Six Sigma deployment. Now what? In this session, Dr. Richard Chua will help you navigate through the buzz and fog of Lean Six Sigma activities, project tracking and reporting. He will share his experience and best practices on how to lead and manage Lean Six Sigma projects and deployments successfully. This and other IIL Learning in Minutes presentations qualify for PDUs. Some titles, such as Agile-related topics may qualify for other continuing education credits such as SEUs, or CEUs. Each professional development activity yields one PDU for one hour spent engaged in the activity. Some limitations apply and can be found in the Ways to Earn PDUs section that discusses PDU activities and associated policies. Fractions of PDUs may also be reported. The smallest increment of a PDU that can be reported is 0.25. This means that if you spent 15 minutes participating in a qualifying PDU activity, you may report 0.25 PDU. If you spend 30 minutes in a qualifying PDU activity, you may report 0.50 PDU.

The PMP in Lean Six Sigma

By IIL Europe Ltd

The PMP in Lean Six Sigma Because you are a Project Management Professional, you have been assigned to lead a Lean or Six Sigma project, or even to manage the company-wide Lean Six Sigma deployment. Now what? In this session, Dr. Richard Chua will help you navigate through the buzz and fog of Lean Six Sigma activities, project tracking and reporting. He will share his experience and best practices on how to lead and manage Lean Six Sigma projects and deployments successfully. This and other IIL Learning in Minutes presentations qualify for PDUs. Some titles, such as Agile-related topics may qualify for other continuing education credits such as SEUs, or CEUs. Each professional development activity yields one PDU for one hour spent engaged in the activity. Some limitations apply and can be found in the Ways to Earn PDUs section that discusses PDU activities and associated policies. Fractions of PDUs may also be reported. The smallest increment of a PDU that can be reported is 0.25. This means that if you spent 15 minutes participating in a qualifying PDU activity, you may report 0.25 PDU. If you spend 30 minutes in a qualifying PDU activity, you may report 0.50 PDU.

Learning Agility as the New Differentiator for Managing Projects at Today's Pace of Change

By IIL Europe Ltd

Learning Agility as the New Differentiator for Managing Projects at Today's Pace of Change Levers of Project Agility: Effective Sponsorship You may be using agile processes in your projects, even have extended the use of agile management practices into other areas of business. However, lack of purposeful and appropriate sponsorship can stifle most projects. An under-engaged or over-enthusiastic sponsor can demotivate the team, slowdown decision making and disrupt even best agile processes. In this talk, we will examine the crucial role of the sponsor, their desired attributes and their relation with the project manager, product owner and scrum master to identify the risk factors and provide tips and tools for avoiding pitfalls and having effective sponsors. You may be agile, but a poor sponsor can still hamper project success. We'll examine this crucial role, ideal attributes, and provide tips to maximize sponsor effectiveness. This and other IIL Learning in Minutes presentations qualify for PDUs. Some titles, such as Agile-related topics may qualify for other continuing education credits such as SEUs, or CEUs. Each professional development activity yields one PDU for one hour spent engaged in the activity. Some limitations apply and can be found in the Ways to Earn PDUs section that discusses PDU activities and associated policies. Fractions of PDUs may also be reported. The smallest increment of a PDU that can be reported is 0.25. This means that if you spent 15 minutes participating in a qualifying PDU activity, you may report 0.25 PDU. If you spend 30 minutes in a qualifying PDU activity, you may report 0.50 PDU.