- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

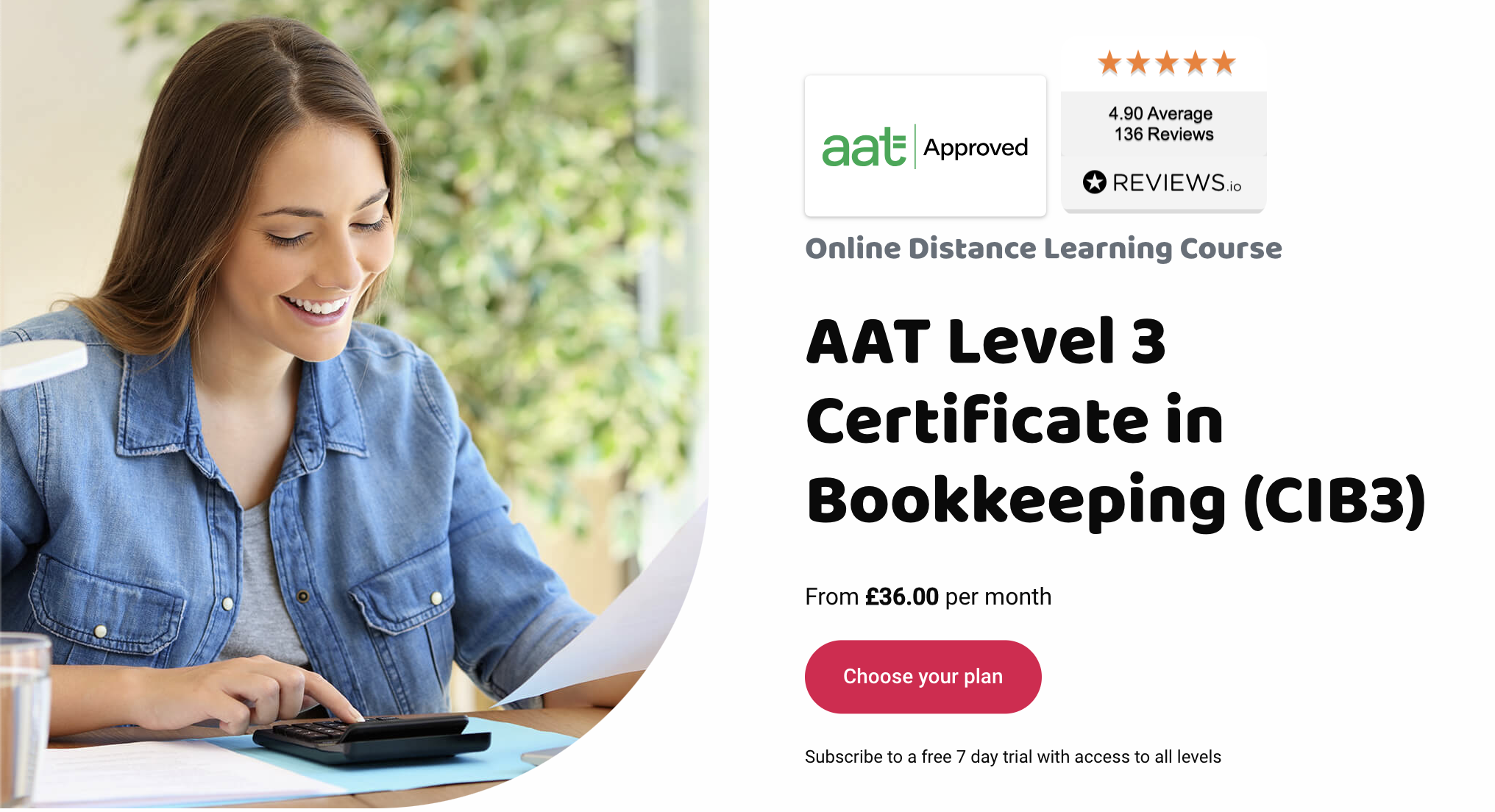

Have you already got some bookkeeping experience and want to build on it? Or have you done Level 2 and now need to cement your learning? Level 3 Bookkeeping is the qualification for you. AAT Level 3 in Bookkeeping is suited for those who want to continue learning more advanced bookkeeping skills, and are looking to work in roles such as accounts manager, professional bookkeeper, or ledger manager. The course is made up of two units: Financial Accounting: Preparing Financial Statements (FAPS), and Tax Processes for Businesses (TPFB). Recommended study time: 6 to 8 hours per week Estimated completion time: 3 – 5 months About AAT Level 3 Certificate in Bookkeeping Entry requirementsAnyone can start at Level 3, but we recommend that you have done Level 2 first, as the qualification builds on existing knowledge.Syllabus By the end of the AAT Level 3 Bookkeeping course, you will be able to confidently apply the principles of double-entry bookkeeping, be able to prepare final accounts, and understand VAT legislation, VAT returns, and the implications of errors. There are three areas to study, made up of various subjects. It usually takes 3-5 months to complete if you spend 6-8 hours a week studying. Topics covered:Financial Accounting: Preparing Financial Statements (FAPS) The accounting principles underlying financial accounts preparation The principles of advanced double-entry bookkeeping How to implement procedures for the acquisition and disposal of non-current assets How to prepare and record depreciation calculations How to record period end adjustments How to produce and extend the trial balance How to produce financial statements for sole traders and partnerships How to interpret financial statements using profitability ratios How to prepare accounting records from incomplete information Tax Processes for Businesses (TPFB) The legislation requirements relating to VAT How to calculate VAT How to review and verify VAT returns The principles of payroll How to report information within the organisation How is this course assessed? This Level 3 course is assessed with unit assessments. Unit assessment A unit assessment tests knowledge and skills taught in that unit. At Level 3 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the computer Getting your results Assessment results are available in your MyAAT account within 24 hours for computer marked assessments. AAT approved venues You can search for your nearest venue via the AAT website launch. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe Unlimited access to the AAT Level 3 content with the use of all other levels. Empowering you to progress when you’re ready at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials What could I do next? You can now work as a qualified bookkeeper. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can move onto the full AAT qualification at no extra cost. Additional costs If you would like to, you can become a member of the Association of Accounting Technicians (AAT) launch. Fees associated with admission, and exam fees are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT one-off Level 3 Certificate in Bookkeeping Registration Fee: £90 AAT Assessment Fees: £70 to £80 per unit Please be aware that these are subject to change.

This course will show you how dangerous noise can be in the workplace, and the main safety issues you should be aware of. It will take you through some of the simple science, the main laws that apply and introduce you to noise level limits. It also covers some of the specific health risks and how to avoid them by producing risk assessments, action plans and through the provision of appropriate Personal Protective Equipment.

This course will start by introducing the learning outcomes and role of the lockdown officer, then discuss some of the likely reasons for a lockdown, go over some of the steps you can take to prepare your school for lockdown as well as what to do in the event of a lockdown taking place.

This course is intended to give you an overview of how the National Food Hygiene Rating Scheme works, what the scoring criteria are and how these are assessed by the inspectors, the appeals process, the Safer Food Better Business management system, E-Coli and concludes with some practical advice for ensuring your premises gets the best score possible.

Food safety combines a number of practices to reduce health hazards. These include premises hygiene, personal hygiene, risk control, pest control and waste management. This level 2 course is about minimising the level of potential hazards in a food manufacturing setting.

Food safety combines a number of practices to reduce health hazards. These include premises hygiene, personal hygiene, risk control, pest control and waste management. This level 2 course is about minimising the level of potential hazards in a food catering setting.

This course is aimed at anyone who undertakes work at height, or who employs people who regularly work at height. It covers what constitutes work at height, the safety issues, and how to assess and reduce some of the risks. Important note: Please note that this is an awareness course only, if your duties include working at height you will also need further practical training, you can get in touch with us to arrange this.

Learn how to identify the different types of fire extinguishers that might be installed within your workplace and what situations they might be used in. At the end of the final module you will be presented with a simulation that will test what you’ve learnt.

This course will introduce you to some of the statistics relating to slips, trips and falls and dispel some of the myths surrounding them. It also touches on the law as it relates to slips, trips and falls. It contains real examples of where things have gone wrong and some practical steps that could have been taken to prevent these incidents. The course also covers some of the straightforward changes that can be made in most businesses to significantly reduce the risk of a slip, trip or fall incident occurring.