- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

PRINCE2 Agile Practitioner: In-House Training

By IIL Europe Ltd

PRINCE2 Agile® Practitioner: In-House Training PRINCE2 Agile® Practitioner is a solution combining the flexibility and responsiveness of Agile with the clearly defined framework of PRINCE2®. PRINCE2 Agile® framework covers a wide range of agile concepts, including SCRUM, Kanban, and Lean Startup. The PRINCE2 Agile® Practitioner certification teaches you to blend structure, governance, and control with agile methods, techniques, and approaches. The strength of PRINCE2® lies in the areas of project direction and project management, whereas Agile has a very strong focus on product delivery. When PRINCE2® and agile are combined, project direction, project management, and project delivery are optimized to create a complete project management solution. PRINCE2 Agile® is an extension module tailored for forward-thinking organizations and individuals already benefiting from PRINCE2®. It provides further guidance on how to apply agile methods to the world's most recognized project management method. The purpose of the Practitioner qualification is to demonstrate that you can apply and tailor PRINCE2 Agile® in a scenario situation. What you will Learn Understand the basic concepts of common agile ways of working Understand the purpose and context for combining PRINCE2® and the agile way of working Able to apply and evaluate the focus areas to a project in an agile context Able to fix and flex the aspects of a project in an agile context Apply the PRINCE2® principles and tailor the themes, processes, and management products to a project in an agile context To learn through the use of theory and practical exercises Prepare for the PRINCE2 Agile® Practitioner exam Benefits Agile methods allow organizations to realize the benefits of products and potentially an earlier return on investment while products are being developed and improved Improved communication through the use of common terminology across PRINCE2® and agile disciplines Develop a clear definition of how agile can govern a project's delivery, while PRINCE2® governs projects as a whole Seamless integration: PRINCE2 Agile® will complementPMBOK® GuideandAPM Body of Knowledge® just as PRINCE2® does currently. It will also be of interest for Program Managers with MSP® who need to understand how projects relate to the delivery mechanism. The most up-to-date and relevant view of Agile project management methodologies, PRINCE2 Agile® references the 'flow-based' working featured in Kanban in addition to other agile concepts not covered in other qualifications Agile Overview & Blending PRINCE2 and Agile Agile overview Blending PRINCE2 and Agile Fix and Flex, Agile and PRINCE2 Processes & Starting a Project Fix and Flex Agile and the PRINCE2 Processes; Starting up a project and Initiating a project Business case theme Change and Organization Themes& Principles Change theme Organization theme Agile and PRINCE2 Principles and the Agilometer Managing Product Delivery and Scrum & Plans and Progress Themes Managing product delivery and Scrum Plans Theme and Progress Theme Quality, Controlling & Managing a Stage and Directing Projects and Contracts Quality Theme Controlling a stage and Frequent Releases Managing a stage boundary Directing a project and contracts Closing a project Tailoring PRINCE2 Productsand Other Practices Tailoring PRINCE2 products and other practices

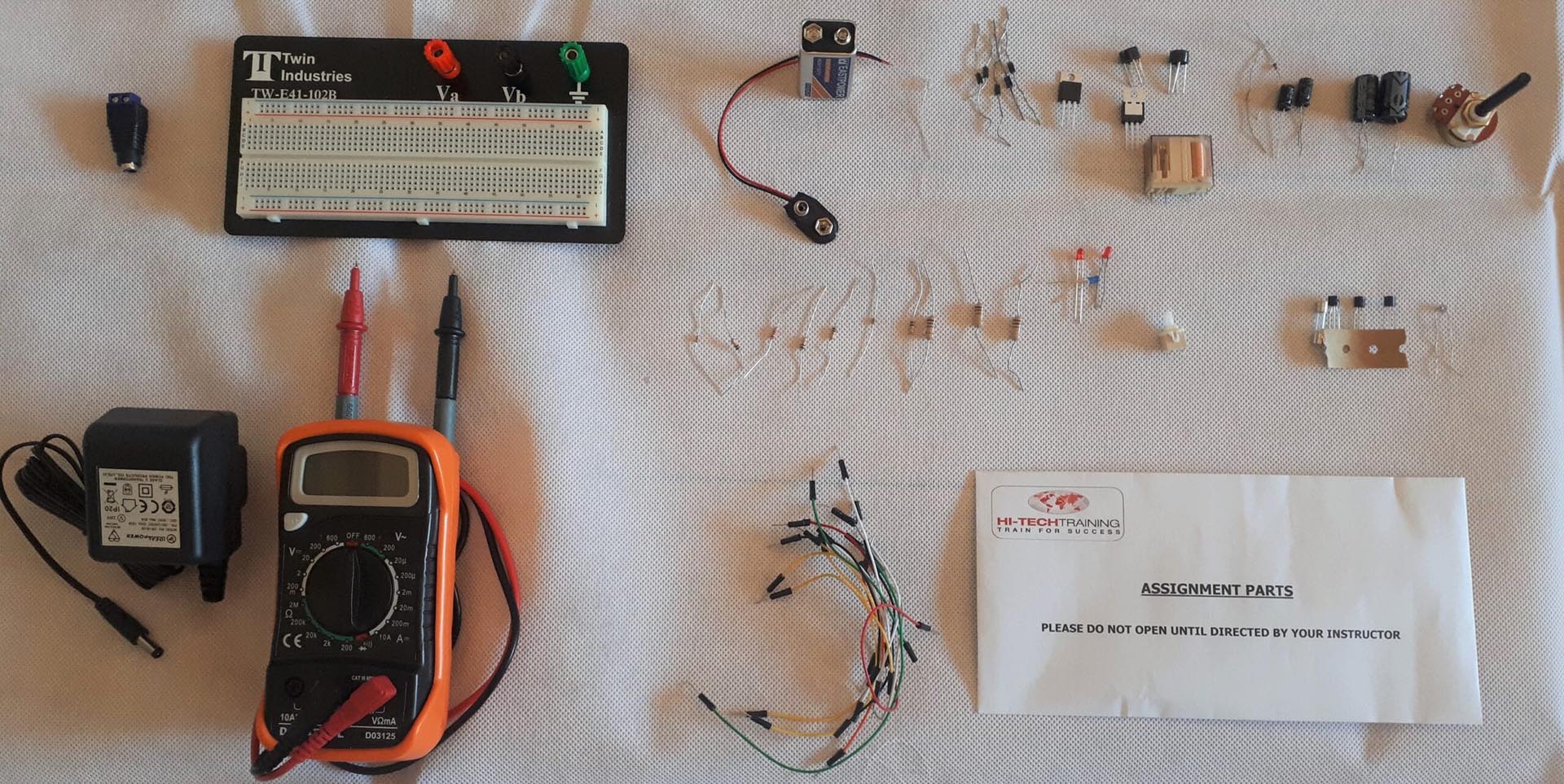

Electronics Repair 1 Course

By Hi-Tech Training

The Electronics Equipment Repair 1 equips participants with practical “Hands-On” skills relevant to the workplace and the theory required for certification. Participants on successful completion of the course will have the skills and knowledge to: Demonstrate the operation of a wide range of electronic components and circuits and their applications in modern electronic-based equipment such as amplifiers, Hi-Fi systems, stereos, and control systems Construct, test and fault-find the following popular basic circuits: Power supplies, amplifiers, timers, etc. Become competent in the correct use of electronic test and measurement equipment such as Analogue and Digital Multimeter and Oscilloscopes.

Lean Six Sigma Black Belt Certification Program: Virtual In-House Training

By IIL Europe Ltd

Lean Six Sigma Black Belt Certification Program: Virtual In-House Training This course is specifically for people wanting to become Lean Six Sigma Black Belts, who are already Lean Six Sigma practitioners. If advanced statistical analysis is needed to identify root causes and optimal process improvements, (Lean) Six Sigma Green Belts typically ask Black Belts or Master Black Belts to conduct these analyses. This course will change that. Green Belts wanting to advance their statistical abilities will have a considerable amount of hands-on practice in techniques such as Statistical Process Control, MSA, Hypothesis Testing, Correlation and Regression, Design of Experiments, and many others. Participants will also work throughout the course on a real-world improvement project from their own business environment. This provides participants with hands-on learning and provides the organization with an immediate ROI once the project is completed. IIL instructors will provide free project coaching throughout the course. What you Will Learn At the end of this program, you will be able to: Use Minitab for advanced data analysis Develop appropriate sampling strategies Analyze differences between samples using Hypothesis Tests Apply Statistical Process Control to differentiate common cause and special cause variation Explain and apply various process capability metrics Conduct Measurement System Analysis and Gage R&R studies for both discrete and continuous data Conduct and analyze simple and multiple regression analysis Plan, execute, and analyze designed experiments Drive sustainable change efforts through leadership, change management, and stakeholder management Successfully incorporate advanced analysis techniques while moving projects through the DMAIC steps Explain the main concepts of Design for Six Sigma including QFD Introduction: DMAIC Review IIL Black Belt Certification Requirements Review Project Selection Review Define Review Measure Review Analyze Review Improve Review Control Introduction: Minitab Tool Introduction to Minitab Minitab basic statistics and graphs Special features Overview of Minitab menus Introduction: Sampling The Central Limit Theorem Confidence Interval of the mean Sample size for continuous data (mean) Confidence Interval for proportions Sample size for discrete data (proportions) Sampling strategies (review) Appendix: CI and sample size for confidence levels other than 95% Hypothesis Testing: Introduction Why use advanced stat tools? What are hypothesis tests? The seven steps of hypothesis tests P value errors and hypothesis tests Hypothesis Testing: Tests for Averages 1 factor ANOVA and ANOM Main Effect Plots, Interaction Plots, and Multi-Vari Charts 2 factor ANOVA and ANOM Hypothesis Testing: Tests for Standard Deviations Testing for equal variance Testing for normality Choosing the right hypothesis test Hypothesis Testing: Chi Square and Other Hypothesis Test Chi-square test for 1 factor ANOM test for 1 factor Chi-square test for 2 factors Exercise hypothesis tests - shipping Non-parametric tests Analysis: Advanced Control Charts Review of Common Cause and Special Cause Variation Review of the Individuals Control Charts How to calculate Control Limits Four additional tests for Special Causes Control Limits after Process Change Discrete Data Control Charts Control Charts for Discrete Proportion Data Control Charts for Discrete Count Data Control Charts for High Volume Processes with Continuous Data Analysis: Non-Normal Data Test for normal distribution Box-Cox Transformation Box-Cox Transformation for Individuals Control Charts Analysis: Time Series Analysis Introduction to Time Series Analysis Decomposition Smoothing: Moving Average Smoothing: EWMA Analysis: Process Capability Process capability Discrete Data: Defect metrics Discrete Data: Yield metrics Process Capability for Continuous Data: Sigma Value Short- and long-term capabilities Cp, Cpk, Pp, Ppk capability indices Analysis: Measurement System Analysis What is Measurement System Analysis? What defines a good measurement system? Gage R&R Studies Attribute / Discrete Gage R&R Continuous Gage R&R Regression Analysis: Simple Correlation Correlation Coefficient Simple linear regression Checking the fit of the Regression Model Leverage and influence analysis Correlation and regression pitfalls Regression Analysis: Multiple Regression Analysis Introduction to Multiple Regression Multicollinearity Multiple Regression vs. Simple Linear Regression Regression Analysis: Multiple Regression Analysis with Discrete Xs Introduction Creating indicator variables Method 1: Going straight to the intercepts Method 2: Testing for differences in intercepts Logistic Regression: Logistic Regression Introduction to Logistic Regression Logistic Regression - Adding a Discrete X Design of Experiments: Introduction Design of Experiment OFAT experimentation Full factorial design Fractional factorial design DOE road map, hints, and suggestions Design of Experiments: Full Factorial Designs Creating 2k Full Factorial designs in Minitab Randomization Replicates and repetitions Analysis of results: Factorial plots Analysis of results: Factorial design Analysis of results: Fits and Residuals Analysis of results: Response Optimizer Analysis of results: Review Design of Experiments: Pragmatic Approaches Designs with no replication Fractional factorial designs Screening Design of Experiment Case Study Repair Time Blocking Closing: Organizational Change Management Organizational change management Assuring project sponsorship Emphasizing shared need for change Mobilizing stakeholder commitment Closing: Project Management for Lean Six Sigma Introduction to project management Project management for Lean Six Sigma The project baseline plan Work Breakdown Structure (WBS) Resource planning Project budget Project risk Project schedule Project executing Project monitoring and controlling and Closing Closing: Design for Lean Six Sigma Introduction to Design for Lean Six Sigma (DMADV) Introduction to Quality Function Deployment (QFD) Summary and Next Steps IIL's Lean Six Sigma Black Belt Certification Program also prepares you to pass the IASSC Certified Black Belt Exam (optional)

PRINCE2® Foundation and Practitioner

By Underscore Group

Learn the processes, practices and principles of project management described in the PRINCE2® approach and prepare for the Foundation and Practitioner examinations on this accredited programme. Duration: 5 days (32.5 hours) Our PRINCE2® Foundation and Practitioner Qualification course is designed to teach the processes, practices and principles of project management described in the PRINCE2® approach and to prepare delegates for the Foundation and Practitioner examinations, held as part of the course. This course is designed for existing and potential Project and Team Managers who would like to gain a comprehensive understanding of the PRINCE2® method of managing projects and will provide those responsible for planning and managing projects with a structure that will help, without imposing inflexible processes or stifling creative thinking. The PRINCE2® Foundation and Practitioner Course is based on the “Managing Successful Projects with PRINCE2® 7th Edition”, which describes the structured project management method. These are intensive modules and require delegates to undertake some evening work in their own time. Objectives By the end of the course you will be able to be: Describe the background, principles, structure and terminology used in the PRINCE2® 7th Edition project management method Prepare for and take both the PRINCE2® Foundation and Practitioner Exams Please note that examinations are the responsibility of the examination board, PEOPLECERT and must be organised separately by each person attending. Content Introduction Introduction to projects and project management Structure Of PRINCE2® 7th Edition The seven Principles –the basis of what defines a PRINCE2 project People – leading successful change, teams and communication The seven Practices – to be addressed throughout the project The seven Processes - the activities to direct, manage and deliver a project successfully Practices Business case – establishing mechanisms to decide whether project is desirable, viable and achievable Organizing – establishing accountabilities and responsibilities Quality – defining mechanisms to ensure that products are fit for purpose Plans – the product based approach to planning Risk – identifying, assessing and controlling uncertainty Issues – identifying, assessing and controlling changes to the baseline and other issues Progress – monitoring actual achievements against estimate and controlling deviations Processes Starting up a Project - is there a viable and worthwhile project Directing a Project – enabling key decision making by the Project Board Initiating a Project – establishing solid foundations Controlling a Stage –assigning and monitoring work and keeping within stage tolerance Managing Product Delivery – controlling the link between the Project Manager and Team Manager(s) Managing a Stage Boundary – current stage review and next stage planning Closing a Project – confirmation of acceptance and project review Tailoring PRINCE2® - to the project environment Foundation Examination and results Practitioner Workshop and Examination PRINCE2® Practitioner Examination Objectives and Guidance PRINCE2® Review PRINCE2® Practitioner Examination Workshops PRINCE2® Practitioner Examination PRINCE2® Foundation and Practitioner Examinations The PRINCE2® Foundation Exam is of 1 hour duration and consists of 60 multiple choice questions. A Pass is 36 correct answers, 60%. The PRINCE2® Practitioner Exam is a written paper of 2.5 hours duration. There are 70 Objective Test style questions to be answered in the 2.5 hours and the candidate may use an annotated manual. The candidate must score 42/70 to be successful, 60%. Presented in association with aims4change, a PEOPLECERT Accredited Training Organisation. PRINCE2® is a Registered Trade Mark of AXELOS Limited.

The Level 4 Diploma in Business Management programme has been created to develop and reward the business managers of today and the future, and to continue to bring recognition and professionalism to the management sectors. This diploma provides an introduction to the main facets and operations of organisations and the challenges faced by modern day businesses. Furthermore, through this Level 4 Diploma in Business Management we look to create learning that advances the thought leadership of organisations, offering conceptual and practical insights that are applicable in the companies of today and tomorrow Key Highlights of Level 4 Diploma In Business Management qualification are: Program Duration: 9 Months (Fast track mode available) Program Credits: 120 Designed for working Professionals Format: Online No Written Exam. The Assessment is done via Submission of Assignment Tutor Assist available Dedicated Student Success Manager Timely Doubt Resolution Regular Networking Events with Industry Professionals Become eligible to gain direct entry into relevant Undergraduate degree programme. Alumni Status No Cost EMI Option Requirements Diploma in Business Management - Level 4This Level 4 Diploma in Business Management (Accredited by Qualifi) qualifications has been designed to be accessible without artificial barriers that restrict access and progression. Learners will be expected to hold the following: Learners who have demonstrated some ability and possess Qualifications at Level 3 for example 'A' Levels or vocational awards; and/or OR work experience in a business environment and demonstrate ambition with clear career goals; Level 4 qualification in another discipline and want to develop their careers in management. Career path Learners completing the Level 4 Diploma in Business Management can progress to: The Second year of an Undergraduate Degree, or Level 5 Diploma qualifications (click here to view) Directly into employment in an associated profession. Certificates Certificate of Achievement Hard copy certificate - Included Once you complete the course, you would be receiving a Physical hard copy of your Diploma along with its Transcript which we would Courier to your address via DHL or Royal Mail without any additional charge

PRINCE2® Practitioner

By Career Smarter

PRINCE2 Practitioner certification is suitable for anyone managing projects. The Practitioner certification aims to confirm that you have sufficient knowledge and understanding to apply and tailor the method in a range of different project contexts. About this course £696.00 45 lessons Accredited training Certificate of completion included Exam included Course curriculum IntroductionCourse IntroductionPRINCE2 Practitioner SyllabusPRINCE2 Tutorbot Module 1Introduction Module 2PRINCE2 Process Walk Through Module 3PRINCE2 PrinciplesTest Your Knowledge Quiz Module 4PRINCE2 Organisation ThemeTest Your Knowledge Quiz Module 5PRINCE2 Starting up a Project ProcessTest Your Knowledge Quiz Module 6PRINCE2 Business Case ThemeTest Your Knowledge Quiz Module 7PRINCE2 Initiating a Project ProcessTest Your Knowledge Quiz Module 8PRINCE2 Directing a Project ProcessTest Your Knowledge Quiz Module 9PRINCE2 Progress ThemeTest Your Knowledge Quiz Module 10PRINCE2 Plans ThemeTest Your Knowledge Quiz Module 11PRINCE2 Quality ThemeTest Your Knowledge Quiz Module 12PRINCE2 Risk ThemeTest Your Knowledge Quiz Module 13PRINCE2 Change ThemeTest Your Knowledge Quiz Module 14PRINCE2 Controlling a Stage ProcessTest Your Knowledge Quiz Module 15PRINCE2 Managing Product Delivery ProcessTest Your Knowledge Quiz Module 16PRINCE2 Managing a Stage Boundary ProcessTest Your Knowledge Quiz Module 17PRINCE2 Closing a Project ProcessTest Your Knowledge Quiz Exam PreparationExam Preparation PRINCE2 Practitioner - Sample Examination PapersPRINCE2 Practitioner - Scenario BookletPRINCE2 Practioner Sample Examination 1 - Question BookletPRINCE2 Practioner Sample Examination 2 - Question BookletPRINCE2 Practioner Sample Examination 1 - RationalePRINCE2 Practioner Sample Examination 2 - Rationale Course DocumentsPRINCE2 Practitioner SyllabusPRINCE2 Glossary Internal Assessment TestInternal Assessment Test Course Feedback Course Feedback Form The PRINCE2® courses on this page are offered by ITonlinelearning ATO/Affiliate of AXELOS Limited. PRINCE2® is a registered trademark of AXELOS Limited. All rights reserved.

This Diploma in Business Management - Level 3 Qualification has been created to develop and reward those learners who are looking to or already have chosen a career in a business-related sector. The rationale of the programme is to provide a career path for learners who wish to develop their care capabilities within the business sector. The outcome of the Diploma in Business Management - Level 3, which is a recognised UK Qualification, is for learners to develop the skills required by organisations globally. Key Highlights of Level 3 Diploma in Business Management qualification are: Program Duration: 9 Months (Fast track mode available) Program Credits: 60 Designed for working Professionals Format: Online No Written Exam. The Assessment is done via Submission of Assignment Tutor Assist available Dedicated Student Success Manager Timely Doubt Resolution Regular Networking Events with Industry Professionals Become eligible to gain direct entry into relevant Undergraduate degree programme. Alumni Status No Cost EMI Option Requirements Diploma in Business Management - Level 3 This Level 3 Diploma in Business Management (Accredited by Qualifi) qualifications has been designed to be accessible without artificial barriers that restrict access and progression. Learners will be expected to hold the following: Learners who have demonstrated some ability and possess Qualifications at Level 2 and/or OR work experience in a business environment and demonstrate ambition with clear career goals; Level 3 qualification in another discipline and want to develop their careers in management. Career path Learners completing the Level 3 Diploma in Business Management can progress to: The First year of an Undergraduate Degree in Business and Management, or Level 4 Diploma qualifications (click here to view) Directly into employment in an associated profession. Certificates Certificate of Achievement Hard copy certificate - Included Once you complete the course, you would be receiving a Physical hard copy of your Diploma along with its Transcript which we would Courier to your address via DHL or Royal Mail without any additional charge

This Diploma in Entrepreneurship - Level 4 qualification (Accredited by Qualifi, UK) has been created to develop and reward the business managers of today and the future, and to continue to bring recognition and professionalism to the management sectors. It is envisaged that this Diploma in Entrepreneurship - Level 4 programme will encourage both academic and professional development so that you learners move forward to realise not just their own potential but also that of organisations across a broad range of sectors. Key Highlights of this Diploma in Entrepreneurship - Level 4 qualification are: Program Duration: 9 Months (Fast track 6 months duration mode Available) Program Credits: 120 Designed for working Professionals Format: Online No Written Exam. The Assessment is done via Submission of Assignment Tutor Assist available Dedicated Student Success Manager Timely Doubt Resolution Regular Networking Events with Industry Professionals Become eligible to gain direct entry into relevant Undergraduate degree programme. Alumni Status No Cost EMI Option Requirements This Diploma in Entrepreneurship - Level 4 (Accredited by Qualifi, UK) qualifications has been designed to be accessible without artificial barriers that restrict access and progression. Entry to the qualification will be through centre interview and learners will be expected to hold the following: Qualifications at Level 3 OR A Level 4 qualification in another discipline and want to develop their careers in business and entrepreneurship. Career path Learners completing this Course progress to: Level 5 Diploma in Business Management, or Level 5 Diploma in Business Enterprise, or Combined Level 5 + Level 6 Diploma in Business Management - 240 Credits Qualification, or BA (Hons) in Business Management Degree qualification, or The Second year of undergraduate study, or Directly into employment in an associated profession. Certificates Certificate of Achievement Hard copy certificate - Included Once you complete the course, you would be receiving a Physical hard copy of your Diploma along with its Transcript which we would Courier to your address via DHL or Royal Mail without any additional charge

Integrated Diploma in Business and Management - Level 3

4.0(2)By London School Of Business And Research

This Integrated Diploma in Business and Management - Level 3 qualification has been created to develop and reward those learners who are looking to or already have chosen a career in a business-related sector. We hope that learners take the opportunity to learn a great deal from this programme that will provide relevant new skills and qualities. It is envisaged that this Integrated Diploma in Business and Management - Level 3 programme will encourage both academic and professional development so that learners move forward to realise not just their own potential but also that of organisations across a broad range of sectors. Key Highlights of Level 3 Integrated Diploma in Business and Management qualification are: Program Duration: 9 Months (Fast track mode available) Program Credits: 120 Designed for working Professionals Format: Online No Written Exam. The Assessment is done via Submission of Assignment Tutor Assist available Dedicated Student Success Manager Timely Doubt Resolution Regular Networking Events with Industry Professionals Become eligible to gain direct entry into relevant Undergraduate degree programme. Alumni Status No Cost EMI Option Requirements This Level 3 Integrated Diploma in Business and Management (Accredited by Qualifi) qualifications has been designed to be accessible without artificial barriers that restrict access and progression. Learners will be expected to hold the following: Learners who have demonstrated some ability and possess Qualifications at Level 2 and/or OR work experience in a business environment and demonstrate ambition with clear career goals; Level 3 qualification in another discipline and want to develop their careers in management. Career path Learners completing the Level 3 Integrated Diploma in Business and Management can progress to: The First year of an Undergraduate Degree in Business and Management, or Level 4 Diploma qualifications (click here to view) Directly into employment in an associated profession. Certificates Certificatete of Achievement Hard copy certificate - Included Qualifi courses: Once you complete the course, you would be receiving a Physical hard copy of your Diploma along with its Transcript which we would Courier to your address via DHL or Royal Mail without any additional charge

Functional Skills Entry Level 1 Maths Course Online

By Lead Academy

This Functional Skills Maths Entry Level 1 course will assist you in displaying a solid understanding of the foundational concepts and basic principles of mathematics appropriate to the level, as well as the ability to use mathematical reasoning to solve routine issues in everyday contexts. Course Highlights: Course Type: Self-Paced Online Learning Total Qualification Time: 58 hours Guided Learning: 55 hours Accreditation: Pearson Edexcel Qualification: Nationally Recognised Qualification Study Materials: High-Quality E-Learning Study Materials Assessment: Internally graded and externally verified Access: 1 Year Access Certificate: Certificate upon completion of the official exam (hard copy) Tutor Support: Paid Tutor Support Customer Support: 24/7 live chat available Functional Skills Entry Level 1 Maths Course This Functional Skills Entry Level 1 Maths Course is regulated by Ofqual and accredited by Pearson Edexcel making it a nationally recognised qualification that will enhance your CV, helping you stand out from the rest of the candidates. You will acquire knowledge about the number system, common measures, geometry and handling data. Upon successful completion of this course, you will be able to apply your foundational mathematics knowledge in a range of practical scenarios. Why is this course right for you? This comprehensive Functional Skills Maths Entry Level 1 Course is suitable for: Anyone looking to secure a skill-oriented job People of all ages and academic backgrounds Anyone who wants to progress to functional skills level 1 or 2 Anyone who wants to take GCSE maths Anyone seeking to add a certified qualification to their university application Anyone aspiring to accelerate their career in this sector Anyone who wants to gain in-depth knowledge of functional skills in mathematics Whether you are a beginner into the field of functional maths or any professional seeking to reinforce your expertise in functional skills maths, this Functional Skills Maths Entry Level 1 Course will set you up with the advanced skills to boost your career profile. EXAM Booking & Results Details You can decide the exam date and place according to your convenience. Awarding Body Paper-Based Exam in Centre Results Pearson Edexcel Book within 15 days Get results in 20 working days *Offline examinations will be held at our Swindon and London centres. Please contact us for more information. Functional Skills Entry Level 1 Maths Qualification Purpose and Outcomes This Functional Skills Entry Level 1 Maths Qualification will help you to: Develop confidence in their application of basic mathematics concepts and abilities. Prove their understanding by using their abilities and expertise to complete easy tasks or simple mathematical equations. Acquire comprehensive problem-solving and underpinning skills to utilise mathematics in the course of everyday life. Course Curriculum Read, write, order and compare numbers up to 20 Use whole numbers to count up to 20 items, including zero Add numbers which total up to 20, and subtract numbers from numbers up to 20 Recognise and interpret the symbols +, – and = appropriately Recognise coins and notes and write them in numbers with the correct symbols (£ & p), where these involve numbers up to 20 Read 12-hour digital and analogue clocks in hours Know the number of days in a week, months and seasons in a year; be able to name and sequence Describe and make comparisons in words between measures of items including size, length, width, height, weight and capacity Identify and recognise common 2-D and 3-D shapes, including circles, cubes, rectangles (including squares) and triangle Use everyday positional vocabulary to describe position and direction, including left, right, in front, behind, under and above Read numerical information from lists Sort and classify objects using a single criterion Read and draw simple charts and diagrams, including a tally chart, block diagram/graph How This Course Will Work? This Functional Skills Entry Level 1 Maths course will help you build a solid foundation in mathematics. Throughout the course, it will provide you with various learning materials and activities to enhance your understanding of these subjects. Initial Assessment: To identify the current level of a student's abilities and recommend the appropriate course to enrol in upon completion. Diagnostic Assessment: Identifies skill gaps and produces an individual learning plan Learning Resources: Comprehensive video tutorials, practice quizzes & topic-based tests Progress Tracker: To record your progress in the course Free Mock Test: Access our free mock test facility for professional feedback and to prepare for the final exam. Entry Requirement This Functional Skills Entry Level 1 Maths qualification is available to all students of all academic backgrounds; no experience or previous qualifications are required. Exam Structure The Functional Skills Pearson Edexcel Qualification in Mathematics Level 1 consist of one externally assessed assessment that comprises two sections- a non-calculator section (calculator prohibited) and a calculator section (calculator permitted). The assessments are available as paper-based and onscreen, on-demand assessments. Section A (Non-calculator) Awarding Bod Exam Duration Total Marks Questions Cover Pearson Edexcel 2o minutes 6 25% Section B (Calculator) Awarding Body Exam Duration Total Marks Questions Cover Pearson Edexcel 1 hour 18 75% Each Maths assessment is designed to enable a minimally competent learner to achieve a pass mark of 36 out of 60. However, the awarding process will determine specifically where the pass mark sits for each assessment version. Therefore, the pass mark may vary between assessments. Recognised Accreditation This Functional Skills Maths Entry Level 1 has been independently accredited by Pearson Edexcel also regulated by Ofqual. The Office of Qualifications and Examinations Regulation (Ofqual) is responsible for regulating qualifications, assessments, and examinations in England. Pearson Edexcel is the most prestigious awarding body, for an academic and vocational qualifications. Pearson Edexcel qualifications are regulated by Ofqual and recognised by universities and employers across the world. Certification You will be rewarded with an Ofqual Regulated Pearson Edexcel Functional Skills Qualification in Mathematics at Entry Level 1 (depending on what you choose as an accreditation) upon successful completion of this Functional Skills Entry Level 1 Maths Course and passing the assessments. A certified hard copy of this qualification will be posted at your given address which is accepted by employers and universities across the globe. You can flaunt this qualification in your CV which will give you a competitive advantage over others in case of securing a job. FAQs The Functional Maths level 1 Course is equivalent to? The Level 1 course is a fundamental level of proficiency in English, Maths, and ICT that is equivalent to a GCSE grade 1 to 3 (formerly G to D grades). It is a nationally recognised qualification in the UK that provides an alternative to GCSEs for individuals who still need to pass these subjects during their secondary education. Why should I take the Functional Skills Maths instead of the GCSE Maths? The functional maths course is comparatively easier than the GCSE math and additionally the value of it is also more than the GCSE math course. However, you should select the course that suits your needs, as both courses provide different values at different places. Which one is more difficult between Functional and GCSE Maths courses? The functional skills Maths course is more flexible than the GCSE math course since you have to sit for the official exam in the GCSE courses. What is the Difference between Functional Skills and GCSE? A Functional skills course develops for the one who wants to learn Math, English and ICT for individual achievement in daily work place and on the other hand, GCSE focuses on theories and tests your academic ability. How will I access the functional skills Maths level 1 course after payment? A confirmation email will be sent to your registered email after payment. Hereafter anytime, you can start your learning journey with Lead Academy. Will I get access to the Course if my location is outside the UK? Yes, you can. Since it is an e-learning course, anyone from anywhere can enrol in our courses. What is an Accredited course? The professional body approves the procedures if any e-learning platform claims its courses are accredited. What is the benefit of doing an accredited course? You will only realize the benefit of having an accredited certificate once you face the corporate world. As employees, job places, and more value the accredited certificate, you must own this certificate by doing the course with us.