- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

5150 Courses delivered Online

Gain a solid foundation in financial management with our comprehensive Accounting and Finance Level 1 & 2 course. Explore key concepts and principles essential for success in accounting and finance. Develop valuable skills and knowledge applicable across various industries, and emerge with the expertise to confidently navigate financial challenges and make informed decisions.

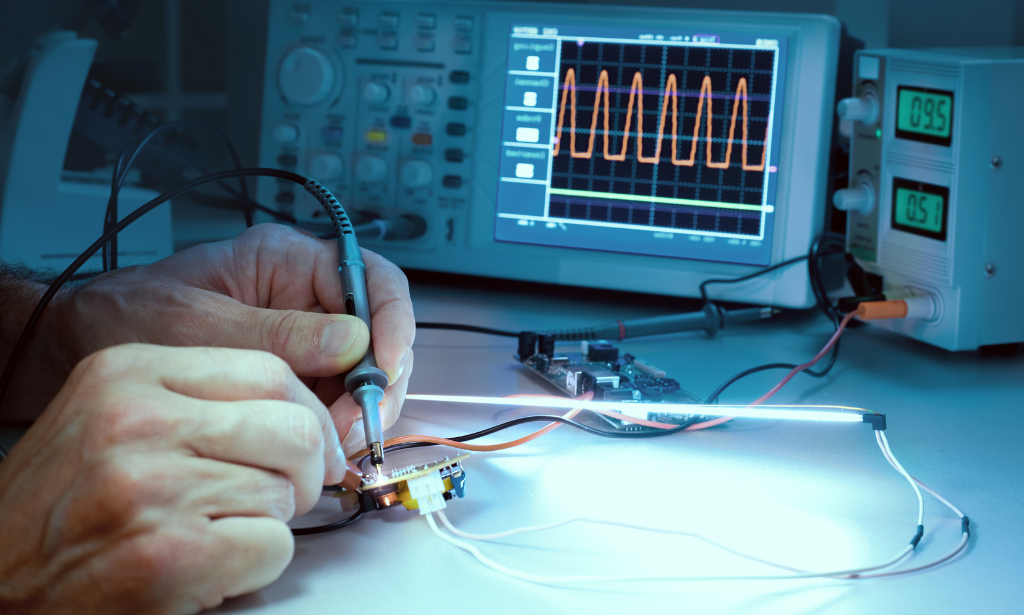

Explore the lucrative career of a PAT tester by enhancing your skills with our PAT Testing - Portable Appliance Testing Training course. Gain valuable insights into risk reduction and control, conduct visual inspections, and master the testing of PAT equipment.

Enroll in our Waxing Online Course to master the art of achieving flawless skin. Gain essential skills in waxing techniques, safety protocols, and client care practices. Start your journey towards a rewarding career in the beauty industry today!

Fire Marshal Training - Level 3 offers comprehensive instruction in fire safety, prevention, and emergency response. Gain certification in workplace safety and evacuation procedures. Ideal for fire wardens, health and safety officers, and those seeking to enhance their understanding of fire hazards and regulations. Enrol now for expert-led instruction and practical skills development

Feeling overwhelmed by the complexities of UK corporate tax returns? Our UK Corporate Tax Return Fundamentals course empowers you to navigate the process with confidence. Gain the essential knowledge to reduce your company's tax burden and ensure compliance with HMRC regulations.

With the complete skill set this Gel Nail Diploma provides, you'll be ready to start a profitable and rewarding career doing what you love. Don't miss this opportunity to turn your passion into a thriving business. Enroll today and let your creativity shine!

Our complete Certified Nursing Assistant Diploma course is expertly designed and features interactive lessons, real-world scenarios, and assessments to ensure you master all essential medical procedures and responsibilities with confidence.