- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

48-Hour Knowledge Knockdown! Prices Reduced Like Never Before! Are you ready to take your career to the next level? Unlock new opportunities and become knowledgeable in internal auditing and financial investigation with our exclusive bundle of courses. Our Internal Auditor and Financial Investigator Training bundle includes 11 comprehensive courses that will equip you with the knowledge and expertise required to excel in the field. The first course in this bundle is QLS-endorsed, ensuring that you receive a QLS hardcopy certificate for free upon completion. This certificate is highly valued and will boost your credibility in the industry. The remaining 10 courses are CPD-QS accredited and cover a wide range of topics, including internal audit, corporate risk management, HR audit, financial analysis, and much more. Whether you're just starting your career or looking to advance to the next level, this bundle is the perfect choice for you. Each course is designed to provide you with a solid foundation in the subject matter, giving you the confidence to take on new challenges and responsibilities. Plus, with our flexible online learning platform, you can study at your own pace and on your own schedule. Don't miss out on this opportunity to enhance your skills and knowledge. Enrol in our Internal Auditor and Financial Investigator Training bundle today and take the first step towards a brighter future! This Internal Auditor and Financial Investigator Training Bundle Package includes: Course 01: Diploma in Internal Audit Skills at QLS Level 5 10 Premium Additional CPD QS Accredited Courses - Course 01: Internal Compliance Auditor Course 02: Corporate Risk And Crisis Management Course 03: HR Audit Advanced Certificate Course 04: Financial Investigator Course 05: Financial Analysis for Finance Reports Course 06: Finance: Financial Risk Management Course 07: Anti Money Laundering and Fraud Management Course 08: Diploma in Financial statement Analysis Course 09: Tax Accounting Course 10: GDPR Why Prefer This Internal Auditor and Financial Investigator Training Bundle? You will receive a completely free certificate from the Quality Licence Scheme Option to purchase 10 additional certificates accredited by CPD Get a free Student ID Card - (£10 postal charges will be applicable for international delivery) Free assessments and immediate success results 24/7 Tutor Support After taking this Internal Auditor and Financial Investigator Training bundle courses, you will be able to learn: Develop an in-depth understanding of internal auditing and financial investigation Learn how to assess and manage corporate risks and crises Gain expertise in HR audit and financial analysis Understand the principles of financial risk management and tax accounting Acquire knowledge of anti-money laundering and fraud management Master the GDPR principles and their implications for businesses Receive QLS and CPD-QS endorsed certificates upon completion of the courses ***Curriculum breakdown of Internal Audit*** Module 01: Auditing as a Form of Assurance Module 02: Internal Audit Procedures Module 03: Technology-based Internal Audit Module 04: Internal Control and Control Risk Module 05: Audit Interviews Module 06: Reporting Audit Outcome Module 07: UK Internal Audit Standards Module 08: Career as an Auditor How is the Internal Auditor and Financial Investigator TrainingBundle Assessment Process? You have to complete the assignment questions given at the end of the course and score a minimum of 60% to pass each exam. Our expert trainers will assess your assignment and give you feedback after you submit the assignment. You will be entitled to claim a certificate endorsed by the Quality Licence Scheme after you successfully pass the exams. CPD 220 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This bundle is suitable for: Aspiring internal auditors and financial investigators Professionals looking to enhance their skills and knowledge in the field Individuals seeking to enter the financial sector Anyone interested in learning about corporate risk management and compliance Career path This bundle will be beneficial for anyone looking to pursue a career as: Internal auditor: £27,000 - £65,000 per year Financial investigator: £27,000 - £60,000 per year Risk manager: £40,000 - £100,000 per year Compliance officer: £24,000 - £65,000 per year Financial analyst: £25,000 - £60,000 per year Tax accountant: £25,000 - £70,000 per year Certificates Diploma in Internal Audit Skills at QLS Level 5 Hard copy certificate - Included After successfully completing thecourse, you can order an original hardcopy Certificate of Achievement endorsed by the Quality Licence Scheme. This certificate will be delivered to your home, free of charge. To obtain the additional Quality Licence Scheme Endorsed Certificate, you will need to pay the corresponding fee based on the level of the courses: Level 1: £59 Level 2: £79 Level 3: £89 Level 4: £99 Level 5: £119 Level 6: £129 Level 7: £139 CPD QS Accredited Certificate Digital certificate - £10 Upon successfully completing the Bundle, you will need to place an order to receive a PDF Certificate for each course within the bundle. These certificates serve as proof of your newly acquired skills, accredited by CPD QS and will cost you £10 for each course. Also, the certificates are recognised throughout the UK and internationally. CPD QS Accredited Certificate Hard copy certificate - £29 International students are subject to a £10 delivery fee for their orders, based on their location.

Begin your journey in compliance management with practical knowledge of the laws and legislations that make up the regulatory field in the United Kingdom. Do you know that FCA sets an annual CPD requirement both for senior managers and employees of financial service firms? As per TC 2.1.15 & 2.1.16, the requirement is 35 hours in each 12 months, including 21 hours of structured CPD activities. Furthermore, TC 2.1.20G27/05/2022 defines structures CPD activities as follows: “Examples of structured continuing professional development activities include participating in courses, seminars, lectures, conferences, workshops, web-based seminars or e-learning.” Our FCA Compliance Essentials Bundle, fulfilling and even exceeding the FCA requirement in terms of CPD hours, is ideal for any professional within Financial Services. Study method Online, self-paced Course format Video with subtitles Duration 40 hours Qualification No formal qualification CPD 40 CPD hours / points Certificates Certificate of Completion - Free Description LGCA's FCA Compliance Essentials eLearning library currently includes the following courses (new courses are added on a regular basis): AML Risk Assessment AML Suspicious Activity Reports and Suspicious Transaction Reports (SAR/STRs) Anti-Bribery and Corruption Anti-Money Laundering and Counter Terrorist Finance Approved Persons Regime Assessing and Managing AML Risks Building an AML Risk-based Approach CASS Introduction Complaints Handling Compliance Introduction Compliance Monitoring and Testing Conduct Rules for All Staff Conflict of Interest (COI) Consumer Duty Establishing and Maintaining a Strong CDD Programme Ethics, Integrity and Fairness in Financial Services FCA: the Role and Approach Financial Promotions Regulation Fraud Detection and Prevention GDPR Awareness Introduction to Cybersecurity Introduction to Know Your Client (KYC) and Customer Due Diligence (CDD) Market Abuse (MAR) Operational Resilience Senior Managers and Certification Regime SM&CR – The Conduct Rules Suspicious Transactions/Activity Reporting The Value of Customer Due Diligence (CDD) Treating Customers Fairly Vulnerable Customer Management Whistleblowing Creating a Compliance Culture in Financial Services Who is this course for? Financial Services Providers Accounting Offices Financial Institutions Brokers Wealth & Fund Managers Investment Firms Insurance Companies Law Firms Compliance Consultants Payment Solutions Providers FinTech & RegTech Companies Fiduciary Services Firms

Trading & Investment (Stock Trading, Forex, Day Trading)

By Compliance Central

Get ready for an exceptional online learning experience with the Trading & Investment (Stock Trading, Forex, Day Trading) bundle! This carefully curated collection of 20 premium courses is designed to cater to a variety of interests and disciplines. Dive into a sea of knowledge and skills, tailoring your learning journey to suit your unique aspirations. The Stock Trading & Investment package is dynamic, blending the expertise of industry professionals with the flexibility of digital learning. It offers the perfect balance of foundational understanding and advanced insights. Whether you're looking to break into a new field or deepen your existing knowledge, the Stock Trading & Investment package has something for everyone. As part of the Stock Trading & Investment, you will receive complimentary PDF certificates for all courses in this bundle at no extra cost. Equip yourself with the Trading & Investment (Stock Trading, Forex, Day Trading) bundle to confidently navigate your career path or personal development journey. Enrol today and start your career growth! This Bundle Comprises the Following Trading & Investment (Stock Trading, Forex, Day Trading) CPD-accredited courses: Course 01: Stock Market Investing for Beginners Course 02: Forex Trading Diploma Course 03: Investment Course 04: Technical Analysis Masterclass for Trading & Investing Course 05: Complete Swing Trading Training Course 06: Trading - Gold Trading Course 07: Cryptocurrency: Wallets, Investing & Trading Course 08: Trading and Financing: Candlestick Pattern Course 09: Stock Trading Analysis with Volume Trading Course 10: Stock Market Day Trading Strategies Course 11: Penny Stocks Trading Course 12: Day Trade Stocks with Price Action and Tape Reading Strategy Course 13: Capital Budgeting & Investment Decision Rules Course 14: Investment Banking: Venture Capital Fundraising for Startups Course 15: Anti-Money Laundering (AML) Training Course 16: Risk Management Course 17: Financial Ratio Analysis for Business Decisions Course 18: Data Analysis and Forecasting in Excel Course 19: Microsoft Excel Complete Course 2019 Course 20: Decision-Making and Critical Thinking What will make you stand out? Upon completion of this online Trading & Investment (Stock Trading, Forex, Day Trading) bundle, you will gain the following: CPD QS Accredited Proficiency with this Stock Trading & Investment bundle After successfully completing the Stock Trading & Investment bundle, you will receive a FREE PDF Certificate from REED as evidence of your newly acquired abilities. Lifetime access to the whole collection of learning materials in this Stock Trading & Investment bundle The online test with immediate results You can study and complete the Stock Trading & Investment bundle at your own pace. Study for the Stock Trading & Investment bundle using any internet-connected device, such as a computer, tablet, or mobile device. Each course in this Trading & Investment (Stock Trading, Forex, Day Trading) bundle holds a prestigious CPD accreditation, symbolising exceptional quality. The materials, brimming with knowledge, are regularly updated, ensuring their relevance. This Stock Trading & Investment bundle promises not just education but an evolving learning experience. Engage with this extraordinary collection, and prepare to enrich your personal and professional development. Embrace the future of learning with Trading & Investment (Stock Trading, Forex, Day Trading), a rich anthology of 30 diverse courses. Our experts handpick each course in the Stock Trading & Investment bundle to ensure a wide spectrum of learning opportunities. This Stock Trading & Investment bundle will take you on a unique and enriching educational journey. The Trading & Investment (Stock Trading, Forex, Day Trading) bundle encapsulates our mission to provide quality, accessible education for all. Whether you are just starting your career, looking to switch industries, or hoping to enhance your professional skill set, the Stock Trading & Investment bundle offers you the flexibility and convenience to learn at your own pace. Make the Stock Trading & Investment package your trusted companion in your lifelong learning journey. CPD 200 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Trading & Investment (Stock Trading, Forex, Day Trading) bundle is perfect for: Aspiring Traders: Ideal for those looking to start a career in the financial markets with a focus on stock, forex, and day trading. Finance Students: University students or recent graduates who wish to enhance their practical knowledge and skills in trading and investments. Working Professionals: Individuals in finance or related fields seeking to upskill and explore additional revenue streams through trading. Entrepreneurs: Business owners interested in understanding market dynamics to better manage financial risk and investment. Personal Finance Enthusiasts: Individuals aiming to manage their own investments more effectively and learn the nuances of various market instruments. Requirements You are warmly invited to register for this Trading & Investment (Stock Trading, Forex, Day Tradi bundle. Please be aware that no formal entry requirements or qualifications are necessary. This curriculum has been crafted to be open to everyone, regardless of previous experience or educational attainment. Career path Upon Trading & Investment (Stock Trading, Forex, Day Trading) course completion, you can expect to: Stock Trader Forex Trader Day Trader Financial Analyst Risk Manager Portfolio Manager Trading Coach or Educator Market Research Analyst Proprietary Trader Investment Advisor Certificates CPD Certificates Digital certificate - Included

Investment Planning Strategies for Financial Advisors

By NextGen Learning

A client approaches a financial advisor seeking guidance on how to manage their wealth after inheriting a large sum of money. The advisor must assess the client's financial goals, develop a plan for managing their wealth, and provide ongoing support to ensure the plan is successful. Learning outcomes: Gain a thorough understanding of finance and financial planning. Develop essential skills necessary to succeed as a financial advisor. Learn how to create and analyse personal financial statements. Understand how to manage and mitigate financial risk. Learn how to develop investment plans that align with clients' goals. Acquire knowledge on the complexities of divorce planning. Gain expertise in using Google Analytics to improve financial advising. The Financial Advisor course is designed to provide students with a comprehensive understanding of finance and the skills necessary to succeed as a financial advisor. This theoretical course covers essential topics such as financial planning, wealth management, investment planning, and financial risk management. Students will also learn how to analyse personal financial statements and utilize Google Analytics to improve their advising. The course is suitable for individuals who are interested in pursuing a career in financial advising or those who wish to improve their existing skills in the field. It is also an excellent option for anyone seeking to improve their personal financial knowledge. Enrol today and gain the knowledge and skills necessary to succeed as a financial advisor. Certification Upon completion of the course, learners can obtain a certificate as proof of their achievement. You can receive a £4.99 PDF Certificate sent via email, a £9.99 Printed Hardcopy Certificate for delivery in the UK, or a £19.99 Printed Hardcopy Certificate for international delivery. Each option depends on individual preferences and locations. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals interested in pursuing a career in financial advising. Those who wish to improve their existing skills in the field. Anyone seeking to improve their personal financial knowledge. Career path Junior Financial Advisor: £22,000 - £35,000 Financial Advisor: £35,000 - £75,000 Senior Financial Advisor: £75,000 - £150,000 Wealth Management Advisor: £50,000 - £200,000 Investment Advisor: £40,000 - £100,000 Divorce Financial Planner: £40,000 - £100,000

Cash Flow Management and Acceleration Strategies

By NextGen Learning

Cash is king, master the art of managing cash flows with our Cash Flow Management course. Learn to accelerate cash inflows, budget for cash flow, and utilise company accounts to prevent cash shortages. With this course, you'll also gain valuable insights into how small businesses manage cash flow, and the reasons why companies often run into severe cash flow problems. According to recent research, cash flow problems are one of the leading causes of small business failure, with up to 82% of small businesses failing due to poor cash flow management. This highlights the critical importance of managing your finances effectively to ensure the success and sustainability of your business. Take control of your finances and learn the essential skills to manage your cash flow effectively. Our Cash Flow Management Basics course covers everything from budgeting to utilising company accounts, so you can avoid cash flow problems and take your business to the next level. Learning outcomes: Understand the fundamentals of cash flow management Learn techniques to accelerate cash inflows Develop budgeting skills for effective cash flow management Gain insight into how to utilise company accounts Understand the common cash flow problems faced by small businesses Learn to identify the warning signs of severe cash flow problems Cash flow management is essential for the survival of any business. Our Cash Flow Management Basics course is designed to give you a fundamental understanding of how to manage your business's cash flow effectively. This course covers everything from accelerating cash inflows to budgeting for cash flow and utilising company accounts. You'll also learn about the common cash flow problems faced by small businesses and the warning signs of severe cash flow problems. With our Cash Flow Management course, you will gain the skills and knowledge you need to take control of your finances and take your business to the next level. Whether you're a business owner, manager, or accountant, this course will equip you with the skills you need to manage your business's cash flow effectively. Our engaging and easy-to-follow course material is delivered online, making it convenient and accessible for anyone. So, Enrol now and start building a solid foundation for financial success. Certification Upon completion of the course, learners can obtain a certificate as proof of their achievement. You can receive a £4.99 PDF Certificate sent via email, a £9.99 Printed Hardcopy Certificate for delivery in the UK, or a £19.99 Printed Hardcopy Certificate for international delivery. Each option depends on individual preferences and locations. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Business owners Managers Accountants Finance professionals Career path Cash flow analyst (£20,000 - £45,000) Financial analyst (£25,000 - £60,000) Financial controller (£35,000 - £80,000) Chief Financial Officer (£75,000 - £200,000) Finance director (£80,000 - £250,000) Chief Executive Officer (£120,000 - £1,000,000+)

Overview If you know how to play the game, the stocks and bond investment can bring lucrative profits. Master the knowledge and skills required to thrive in the stock market with our Stock and Bond Investment Essentials course. Whether you are a seasoned player or new in the game, this course will come in handy. First this course will explain the basic fundamentals of stock and bond investment. Then you will learn about different investment types and effective techniques for successful investment. Through this course, you will get a clear understanding of the principles of finance and be able to develop the skills to win at stocks and bond markets. Furthermore, the course will help you develop essential skills for risk and portfolio management. So, if you are ready to embark on the journey of stock and bond investment, enrol now! Course Preview Learning Outcomes Familiarise yourself with the major concepts of stock and bond investment Learn about different types and techniques of investment Enhance your knowledge and understanding of finance Grasp effective strategies of stock and bond market Build your expertise in risk and portfolio management Why Take This Course From John Academy? Affordable, well-structured and high-quality e-learning study materials Meticulously crafted engaging and informative tutorial videos and materials Efficient exam systems for the assessment and instant result Earn UK & internationally recognised accredited qualification Easily access the course content on mobile, tablet, or desktop from anywhere, anytime Excellent career advancement opportunities Get 24/7 student support via email What Skills Will You Learn from This Course? Stock and bond investment Financial management Who Should Take this Stock and Bond Investment Essentials? Whether you're an existing practitioner or an aspiring professional, this course is an ideal training opportunity. It will elevate your expertise and boost your CV with key skills and a recognised qualification attesting to your knowledge. Are There Any Entry Requirements? This Stock and Bond Investment Essentials course is available to all learners of all academic backgrounds. But learners should be aged 16 or over to undertake the qualification. And a good understanding of the English language, numeracy, and ICT will be helpful. Stock and Bond Investment Essentials Certification After completing and passing the Stock and Bond Investment Essentials course successfully, you will be able to obtain a Recognised Certificate of Achievement. Learners can obtain the certificate in hard copy at £14.99 or PDF format at £11.99. Career Pathâ This exclusive Stock and Bond Investment Essentials course will equip you with effective skills and abilities and help you explore career paths such as Investment banker Finance manager Finance advisor Investment analyst Module 01: Introduction to Investment Introduction to Investment 00:07:00 Module 02: Types and Techniques Types and Techniques 00:10:00 Module 03: Key Concepts in Investment Key Concepts in Investment 00:09:00 Module 04: Understanding the Finance Understanding the Finance 00:10:00 Module 05: Stock Trading Basics Stock Trading Basics 00:18:00 Module 06: Investing in Bond Market Investing in Bond Market 00:08:00 Module 07: Investing in Stock Market Investing in Stock Market 00:10:00 Module 08: Risk and Portfolio Management Risk and Portfolio Management 00:10:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Financial Management - QLS Endorsed Certificate

By Imperial Academy

5 QLS Endorsed Course With Certificates | 5-in-1 Bundle | CPD Accredited | Career Guided Program | Lifetime Access

Exploration & Production (E&P) Cost Control, Budgeting & Cost Estimation

By EnergyEdge - Training for a Sustainable Energy Future

About this training course This 3-day training will provide a comprehensive understanding on the nature of costs and cost drivers in the E&P industry providing in-depth understanding on the budgeting process, proactive management, effective control and optimization of costs together with focused and relevant performance reporting. Training Objectives After the completion of this training course, participants will learn: Understand the nature of costs and cost drivers in the E&P industry through the Field Life Cycle Purpose of the Budget. Planning and Budgeting models. The Strategic and Medium-term plan Using budgets to make effective decisions. Prepare and understand costs in planning, budgeting & forecasting processes e.g. fixed / variable, capex / opex and routine / non-routine. Cost Accounting. Importance of timely cost capture and accurate recording e.g. VOWD / accruals, consistency of coding and clarity on accountability Strategic solutions in delivering cost optimization - 'do more for less' Management of costs in PSC and JV environments. Avoiding cost leakage and ensuring audit preparedness Cost Control Framework - budgets, AFEs, progress reports and variance analysis. Understanding key components and ensuring seamless interaction Cost Performance Reporting - use of KPI's, variance analysis and trend analysis. Tracking and monitoring cost optimization initiatives and targets Target Audience This training course is suitable and will greatly benefit the following specific groups: Finance staff with accounting and financial management responsibilities Those responsible for devising budgets, managing and controlling budgets Professionals engaged in planning, budgeting and management reporting Finance & Audit staff engaged on cost and financial controls Business unit managers and personnel whose responsibilities include cost management, controlling budgets and performance reporting Course Level Basic or Foundation Training Methods The training instructor relies on a highly interactive training method to enhance the learning process. This method ensures that all participants gain a complete understanding of all the topics covered. The training environment is highly stimulating, challenging, and effective because the participants will learn by case studies which will allow them to apply the material taught in their own organization. Course Duration: 3 days in total (21 hours). Training Schedule 0830 - Registration 0900 - Start of training 1030 - Morning Break 1045 - Training recommences 1230 - Lunch Break 1330 - Training recommences 1515 - Evening break 1530 - Training recommences 1700 - End of Training The maximum number of participants allowed for this training course is 25. This course is also available through our Virtual Instructor Led Training (VILT) format. Trainer Your expert course leader has more than 30 years of experience in the international oil and gas industry, covering all areas of Finance and Audit, including involvement in Commercial roles. During her 19 years with ENI she worked in Italy, Netherlands, Egypt and UK and was CFO for 2 major ENI subsidiaries. She has delivered training courses in Accounting, Audit, Economics and Commercial topics in many Countries. She has a Degree in Economics & Accounting and is a Certified Chartered Accountant. She is also a Chartered Auditor and an International Petroleum Negotiator. Outside of work, she is inspired by the beauty of nature and art, helping disadvantaged people, sports (football, golf) and her cat. Courses Delivered Internationally: E&P Accounting, Auditing in the Oil & Gas Industry Cost Control & Budgeting Introduction to the Oil & Gas Industry Petroleum Project Economics Contracts Strategy International O&G Exploitation Contracts POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

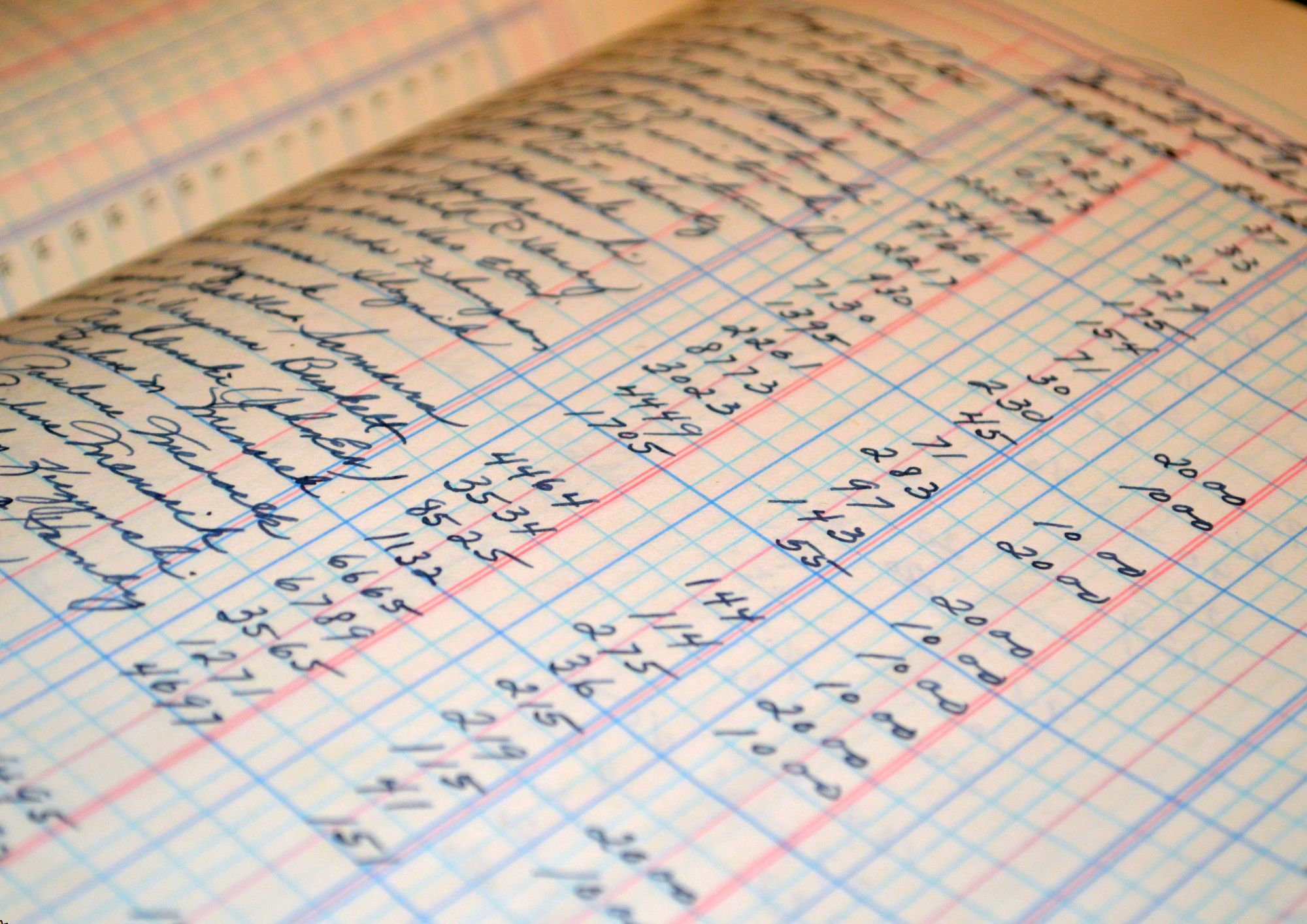

Household Ledger

By Compete High

ð¡ Master Your Household Finances with Household Ledger Course! ð Are you ready to take control of your household finances and achieve financial freedom? Introducing our Household Ledger course, a comprehensive text-based program designed to empower you with the skills and knowledge needed to manage your finances effectively. Say goodbye to financial stress and hello to financial empowerment with our easy-to-follow lessons and practical exercises. ð Benefits of Taking the Household Ledger Course: Financial Literacy: Gain a solid understanding of basic financial principles, including budgeting, tracking expenses, and managing debt. Improved Money Management: Learn how to create and maintain a household ledger to track income, expenses, and savings accurately. Debt Reduction: Discover strategies for reducing debt and building a solid financial foundation for you and your family. Budgeting Mastery: Develop effective budgeting techniques to allocate funds wisely, prioritize spending, and achieve your financial goals. Financial Planning: Learn how to set realistic financial goals, create a savings plan, and prepare for unexpected expenses or emergencies. Empowerment and Confidence: Gain the confidence to make informed financial decisions and take control of your financial future. Enhanced Communication: Improve communication with family members about financial matters, fostering teamwork and cooperation in managing household finances. ð¨âð©âð§âð¦ Who is this for? Individuals and families looking to gain control over their household finances. Those seeking to improve their financial literacy and money management skills. Anyone struggling with debt or financial stress and in need of practical solutions. Couples or families wanting to work together to achieve their financial goals. ð Career Path: While the Household Ledger course primarily focuses on personal finance management, the skills learned can also be valuable in various career paths, including: Financial Planning: Pursue a career as a financial planner or advisor, helping individuals and families create comprehensive financial plans to achieve their goals. Accounting and Bookkeeping: Apply your knowledge of budgeting and ledger management in roles such as accounting clerk, bookkeeper, or financial analyst. Financial Counseling: Become a financial counselor or coach, assisting clients in overcoming financial challenges, managing debt, and achieving financial wellness. Education: Share your expertise by teaching financial literacy courses in schools, community centers, or online platforms, empowering others to take control of their finances. Entrepreneurship: Use your financial management skills to start your own business or consultancy focused on personal finance education and coaching. ð FAQ: Q: Is this course suitable for beginners? A: Yes! The Household Ledger course is designed for individuals with varying levels of financial knowledge, including beginners. Our easy-to-follow lessons and practical exercises make it accessible to everyone. Q: Do I need any special software to take this course? A: No, you do not need any special software. The Household Ledger course utilizes simple and accessible methods for managing household finances, including manual ledger tracking techniques. Q: How long does it take to complete the course? A: The duration of the course depends on your learning pace and schedule. On average, students complete the course in 4-6 weeks, dedicating a few hours per week to study and practice. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the Household Ledger course, you will receive a certificate of achievement, showcasing your newfound skills in household finance management. Q: Can I apply the skills learned in this course to manage small business finances? A: While the focus of the course is on household finances, many of the principles and techniques taught can be applied to small business finance management as well. Q: Is there any support available if I have questions or need assistance during the course? A: Yes, our dedicated support team is available to assist you throughout your learning journey. You can reach out via email or through our online platform for prompt assistance. ð Ready to Take Control of Your Finances? Don't let financial stress hold you back from achieving your dreams. Enroll now in the Household Ledger course and embark on a journey to financial empowerment and security. Start building a brighter financial future for you and your loved ones today! ð°ð¡â¨ Course Curriculum Module 1 Introduction to Household Ledger Management Introduction to Household Ledger Management 00:00 Module 2 Mastering Budgeting and Financial Tracking Mastering Budgeting and Financial Tracking 00:00 Module 3 Frugal Living and Efficient Spending Frugal Living and Efficient Spending 00:00 Module 4 Building an Emergency Fund for Financial Security Building an Emergency Fund for Financial Security 00:00 Module 5 Mastering Debt Management and Achieving Financial Freedom Mastering Debt Management and Achieving Financial Freedom 00:00 Module 6 Introduction to Investing for Financial Growth Introduction to Investing for Financial Growth 00:00 Module 7 Secure Your Future_ Retirement Planning for a Comfortable Retirement Secure Your Future_ Retirement Planning for a Comfortable Retirement 00:00

Develop Your Career in Finance: Blue Ocean Strategy

By The Teachers Training

Overview Develop Your Career in Finance: Blue Ocean Strategy Course is yet another 'Teacher's Choice' course from Teachers Training for a complete understanding of the fundamental topics. You are also entitled to exclusive tutor support and a professional CPD-accredited certificate in addition to the special discounted price for a limited time. Just like all our courses, this Develop Your Career in Finance: Blue Ocean Strategy Course and its curriculum have also been designed by expert teachers so that teachers of tomorrow can learn from the best and equip themselves with all the necessary skills. Consisting of several modules, the course teaches you everything you need to succeed in this profession. The course can be studied part-time. You can become accredited within 05 Hours studying at your own pace. Your qualification will be recognised and can be checked for validity on our dedicated website. Why Choose Teachers Training Some of our website features are: This is a dedicated website for teaching 24/7 tutor support Interactive Content Affordable price Courses accredited by the UK's top awarding bodies 100% online Flexible deadline Entry Requirements No formal entry requirements. You need to have: Passion for learning A good understanding of the English language Be motivated and hard-working Over the age of 16. Certification CPD Certification from The Teachers Training Successfully completing the MCQ exam of this course qualifies you for a CPD-accredited certificate from The Teachers Training. You will be eligible for both PDF copy and hard copy of the certificate to showcase your achievement however you wish. You can get your digital certificate (PDF) for £4.99 only Hard copy certificates are also available, and you can get one for only £10.99 You can get both PDF and Hard copy certificates for just £12.99! The certificate will add significant weight to your CV and will give you a competitive advantage when applying for jobs. Develop Your Career in Finance: Blue Ocean Strategy Course Introduction 00:02:00 What Is The Blue Ocean Strategy 00:07:00 Methods Used In Blue Ocean Strategy - Value Innovation And Actions 00:05:00 Applying Blue Ocean Strategy For Career, Future Business Trends 00:08:00 How You Can Apply 4 Point Action For Career Planning 00:12:00 What Is Personal Brand And Step1 In Creating PB 00:06:00 Steps 2 To 8 In Personal Branding 00:14:00 Example Of A LinkedIn Profile For Personal Branding 00:08:00 Summarising The Way Forward In Career Development 00:04:00