- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

139 Courses delivered Online

Are you ready to excel in the vibrant world of hospitality? Our Hospitality Management Training course is designed to equip you with the skills and knowledge to thrive in this dynamic industry. Whether you're a newcomer or an industry professional looking to enhance your expertise, this course is your gateway to success. Key Features: CPD Certified Free Certificate Developed by Specialist Lifetime Access The Hospitality Management Training course provides a comprehensive introduction to the field of hospitality. Learners will gain a broad understanding of the hotel industry and learn how to manage front office operations, housekeeping, engineering, and security. They will explore how to effectively oversee food and beverage services and ensure high service quality. The course emphasizes customer satisfaction and covers the essential processes of hiring, training, and developing staff in the hospitality industry. Additionally, learners will delve into marketing strategies specific to travel and tourism, understand basic accounting principles relevant to hospitality, and learn about the latest technologies transforming the industry. This curriculum equips learners with practical skills and knowledge to excel in various hospitality management roles. Course Curriculum Module 01: Introduction to Hospitality Management Module 02: An Overview of the Hotel Industry Module 03: Management of Front Office Operations Module 04: Management of Housekeeping, Engineering and Security Operations Module 05: Management of Food and Beverages Operations Module 06: Management of Service Quality in the Hospitality Industry Module 07: Customer Satisfaction Module 08: The Process of Selection and Recruitment in Hospitality Industry Module 09: The Process of Development and Training in the Hospitality Industry Module 10: Marketing in Travel and Tourism Business Module 11: Accounting in Hospitality Module 12: E-Hospitality and Technology Learning Outcomes: Understand core principles in hospitality management and hotel industry operations. Master management techniques for front office and housekeeping operations. Oversee food and beverage management within hospitality environments. Enhance service quality management in hospitality industries. Implement effective customer satisfaction strategies. Utilise e-hospitality and technology in modern hospitality contexts. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Aspiring hotel managers seeking foundational knowledge. Hospitality staff aiming for career advancement. Individuals interested in the travel and tourism sector. Entrepreneurs entering the hospitality business. Recent graduates considering hospitality careers. Career path Hotel Manager Front Office Manager Housekeeping Manager Food and Beverage Manager Hospitality Marketing Coordinator E-Hospitality Specialist Certificates Digital certificate Digital certificate - Included Certificate of Completion Digital certificate - Included Will be downloadable when all lectures have been completed.

Advanced Diploma in Financial Planning & Financial Modelling - CPD Certified

4.7(47)By Academy for Health and Fitness

*** 24 Hour Limited Time Flash Sale *** Advanced Diploma in Financial Planning & Financial Modelling Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Do you dream of making smarter financial decisions, both personally and professionally? A recent study by the Money Advice Service found that a significant portion, 40% of UK adults lack confidence in managing their finances. Additionally, 20% of adults with no savings cushion struggle with debt. This comprehensive bundle offers the perfect solution. Are you ready to unlock your financial potential? Our Advanced Diploma in Financial Planning & Financial Modelling equips you with a powerful blend of financial planning and modelling expertise. Master the fundamentals of accounting and bookkeeping, before diving into financial analysis and risk management. Learn to craft strategic budgets and forecasts, navigate economic uncertainties, and make informed investment decisions. Build proficiency in industry-standard accounting software like Sage 50, QuickBooks, and Xero. Gain a competitive edge with in-depth training on financial modelling using Excel, a critical skill for business analysts and financial professionals. With this Advanced Financial Planning & Financial Modelling course you will get 30 CPD Accredited PDF Certificates, Hard Copy of Certificate and our exclusive student ID card absolutely free. Courses Are Included In This Advanced Financial Planning & Financial Modelling Bundle: Course 01: Secure Your Finance by Creating a Robust Financial Plan Course 02: Financial Reporting Course 03: Financial Modeling Using Excel Course 04: Online Financial Modelling Training Course 05: Accounting and Finance Course 06: Banking and Finance Accounting Statements Financial Analysis Course 07: Central Banking Monetary Policy Course 08: Corporate Finance: Profitability in a Financial Downturn Course 09: Debt Management - Online Course Course 10: Finance: Financial Risk Management Course 11: Financial Analysis Course Course 12: Financial Management Course 13: Making Budget & Forecast Course 14: Dealing With Uncertainty: Make Budgets and Forecasts Course 15: Understanding Financial Statements and Analysis Course 16: Learn to Read, Analyse and Understand Annual Reports Course 17: Accounting & Bookkeeping Masterclass Course 18: Accounting Basics Course 19: Bookkeeper Training Course Course 20: UK Tax Accounting Course 21: Sage 50 Accounts Course 22: Quickbooks Online Course 23: Xero Accounting and Bookkeeping Online Course 24: Business Law: Applied Fundamentals Course 25: Business Model Canvas for Business Plan Course 26: Capital Budgeting & Investment Decision Rules Course 27: Cost Control & Project Scheduling Course 28: Investment Course 29: Make Business Plans: Forecasting and Budgeting Course 30: Strategic Business Management Empower yourself with the expertise to achieve financial freedom and propel your career forward. Enrol today and unlock a world of financial possibilities! Learning Outcomes of Advanced Financial Planning & Financial Modelling Diploma Apply financial planning principles to personal and business scenarios. Master financial modelling techniques using Excel and specialized software. Analyze financial statements and assess business performance. Develop risk management strategies to mitigate financial uncertainty. Craft budgets and forecasts to predict future outcomes. Gain a comprehensive understanding of accounting principles and practices. Why Choose Us? Get a Free CPD Accredited Certificate upon completion of Financial Planning & Financial Modelling Get a free student ID card with Financial Planning & Financial Modelling Training program (£10 postal charge will be applicable for international delivery) The Financial Planning & Financial Modelling is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Get Lifetime access to the Financial Planning & Financial Modelling course materials The Financial Planning & Financial Modelling comes with 24/7 tutor support Start your learning journey straight away! Curriculum Breakdown Course 01: Secure Your Finance by Creating a Robust Financial Plan Section 01: The Fundamentals Section 02: Revenue Models Section 03: Staffing And Expense Models Section 04: Financial Statements Course 02: Financial Reporting Module 01: Financial Reporting Module 02: The Cash Flow Statement Module 03: Credit Analysis Module 04: The Balance Sheet Module 05: Equity Analysis Module 06: Ratio Analysis Module 07: The Applications And Limitations Of EBITDA Module 08: Tax System And Administration In The UK Course 03: Financial Modeling Using Excel Welcome to the Course! Get the Overview of What You'll Learn Planning your Financial Model Building a Model Template Projecting the Income Statement Projecting the Balance Sheet Projecting Cash Flows Advanced Financial Modeling BONUS LESSON: Top 5 Excel Features for Financial Modellers =========>>>>> And 27 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*30= £389) CPD Hard Copy Certificate: Free ( For The First Course: Previously it was £29.99) CPD 300 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This bundle is ideal for: Students seeking mastery in this field Professionals seeking to enhance their skills Anyone who is passionate about this topic Requirements This Advanced Financial Planning & Financial Modelling doesn't require prior experience and is suitable for diverse learners. Career path This Advanced Financial Planning & Financial Modelling bundle will allow you to kickstart or take your career in the related sector to the next stage. Financial Analyst Investment Banker Financial Planner Risk Manager Business Consultant Finance Manager Certificates CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free. CPD Accredited Hard Copy Certificate Hard copy certificate - Included Please note that International students have to pay an additional £10 as a shipment fee.

"An investment in knowledge pays the best interest." - Benjamin Franklin. So invest in your financial future with our comprehensive Payroll Tax & Personal Finance bundle course. This carefully crafted curriculum covers various vital subjects, including Payroll Management, Pension UK, and Sage 50 Accounts, providing a solid foundation for a successful career in finance. Empower yourself with in-depth knowledge of tax accounting, personal finance, and financial analysis, all while mastering essential business administration wisdom. Our Level 3 Tax Accounting, Professional Personal Finance Course, and Financial Analysis modules will equip you with the expertise needed to excel in the ever-changing financial landscape. Stay ahead of the curve with our Xero Projects & Job Costing, Employment Law Level 3, and GDPR Data Protection courses. These modules will enhance your understanding of financial software and legal aspects and ensure your readiness for the challenges of the finance and business administration industries. Enrol in our Payroll Tax & Personal Finance bundle course today and secure your future in finance. This Payroll Tax & Personal Finance Consists of the following Premium courses: Course 01: Payroll Management Course Course 02: Pension UK Course 03: Sage 50 Accounts Course 04: Level 3 Tax Accounting Course 05: Professional Personal Finance Course Course 06: Accounting and Finance Diploma Course 07: Financial Analysis Course 08: Business Administration Level 3 Course 09: Xero Projects & Job Costing Course 10: Employment Law Level 3 Course 11: GDPR Data Protection Learning outcomes: Master the intricacies of payroll management and pension schemes. Develop proficiency in using Sage 50 Accounts software. Understand the tax accounting principles at Level 3. Gain insights into personal finance management. Enhance your knowledge of accounting and finance. Hone your wisdom in financial analysis and business administration. Learn about Xero Projects and job costing techniques. Comprehend employment law and GDPR data protection regulations. Our Payroll Tax & Personal Finance bundle course provides a diverse and comprehensive exploration of essential financial topics, from payroll management to tax accounting. Designed to prepare you for a successful career in finance, this multifaceted course covers a wide range of subjects to strengthen your understanding of financial principles and tools. Whether you aspire to excel in payroll management, enhance your personal finance knowledge, or dive into the world of tax accounting, this versatile course has you covered. Equip yourself with the expertise to thrive in the dynamic financial sector and secure a rewarding career. Payroll Management Course Module 01: Payroll System in the UK Module 02: Payroll Basics Module 03: Company Settings Module 04: Legislation Settings Module 05: Pension Scheme Basics Module 06: Pay Elements Module 07: The Processing Date Module 08: Adding Existing Employees Module 09: Adding New Employees Module 10: Payroll Processing Basics Module 11: Entering Payments Module 12: Pre-Update Reports Module 13: Updating Records Module 14: e-Submissions Basics Module 15: Process Payroll (November) Module 16: Employee Records and Reports Module 17: Editing Employee Records Module 18: Process Payroll (December) Module 19: Resetting Payments Module 20: Quick SSP Module 21: An Employee Leaves Module 22: Final Payroll Run Module 23: Reports and Historical Data Module 24: Year-End Procedures CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Individuals pursuing a career in payroll management. Aspiring tax accountants and financial analysts. Professionals seeking expertise in personal finance management. Those looking to enhance their accounting and finance wisdom. Individuals aiming to work in business administration. Professionals interested in understanding employment law and GDPR data protection. Requirements This Payroll Tax & Personal Finance course has been designed to be fully compatible with tablets and smartphones. Career path Payroll Manager (Salary range: £25,000 - £45,000) Pension Administrator (Salary range: £18,000 - £35,000) Tax Accountant (Salary range: £25,000 - £50,000) Personal Finance Advisor (Salary range: £30,000 - £60,000) Financial Analyst (Salary range: £25,000 - £55,000) Business Administrator (Salary range: £18,000 - £35,000) GDPR Data Protection Officer (Salary range: £30,000 - £60,000) Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - £10 You will get the Hard Copy certificate for the Payroll Management Course course absolutely Free! Other Hard Copy certificates are available for £10 each.

Explore the intricacies of tax strategy and financial planning for beginners in this comprehensive course. From income tax to VAT, gain insights into key topics like accounting, capital gains tax, and self-assessment. Master tax compliance and optimize your financial decisions with expert guidance. Start planning your financial future today!

Xero Accounting & Bookkeeping + Tax, Finance & Financial Management

By Compliance Central

***Small Businesses FEAR This Simple Financial Secret!** (Learn it with the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management Course!)*** Did you know that according to a recent Federation of Small Businesses report, 72% of small business owners in the UK believe strong financial management is crucial for success? The Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course equips you with the theoretical knowledge and understanding to excel in this critical area. This Xero Accounting & Bookkeeping + Tax, Finance & Financial Management comprehensive course is designed to provide a solid foundation in Xero accounting software, tax accounting principles, and financial management strategies. Throughout the course, you'll gain the theoretical knowledge needed to navigate the financial world with confidence, helping you make informed decisions for your business or future career. 3 CPD Accredited Courses Are: Course 01: Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7 Course 02: Tax Accounting Course 03: Financial Management Learning Outcome: Going through our interactive modules of Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course , you will be able to - Gain a working knowledge of Xero Accounting & Bookkeeping software. Master essential tasks like creating invoices, managing bills, and reconciling bank accounts in Xero. Understand core accounting principles like double-entry accounting and VAT returns. Develop strong financial management skills, including budgeting, analyzing financial statements, and interpreting financial data. Gain a theoretical grounding in tax accounting, including capital gains tax and import/export considerations. Confidently navigate the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management landscape. Key Highlights of Xero Accounting & Bookkeeping + Tax, Finance & Financial Management: CPD Accredited Xero Accounting & Bookkeeping + Tax, Finance & Financial Management Course Unlimited Retake Exam & 24/7 Tutor Support Easy Accessibility to the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management Course Materials 100% Learning Satisfaction Guarantee Lifetime Access Self-paced online Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course Modules Covers to Explore Multiple Job Positions Curriculum Topics: Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7e Xero Accounting & Bookkeeping + Tax, Finance & Financial Management begins with a deep dive into Xero accounting software. This course equips you with the theoretical knowledge to navigate Xero's functionalities for various bookkeeping tasks. You'll learn how to set up your Xero account, manage contacts, create invoices and bills, reconcile bank statements, and track inventory. Xero Accounting & Bookkeeping + Tax, Finance & Financial Management also covers essential bookkeeping principles like double-entry accounting and chart of accounts. Section 01: Introduction Introduction Section 02: Getting Started Introduction - Getting Started Signing up Quick Tour Initial Settings Chart of Accounts Adding a Bank Account Demo Company Tracking Categories Contacts Section 03: Invoices and Sales Introduction - Invoices and Sales Sales Screens Invoice Settings Creating an Invoice Repeating Invoices Credit Notes-03 Quotes Settings Creating Quotes Other Invoicing Tasks Sending Statements Sales Reporting Section 04: Bills and Purchases Introduction - Bills and Purchases Purchases Screens Bill Settings Creating a Bill Repeating Bills Credit Notes-04 Purchase Order Settings Purchase Orders Batch Payments Other Billing Tasks Sending Remittances Purchases Reporting Section 05: Bank Accounts Introduction - Bank Accounts Bank Accounts Screens Automatic Matching Reconciling Invoices Reconciling Bills Reconciling Spend Money Reconciling Receive Money Find and Match Bank Rules Cash Coding Remove and Redo vs Unreconcile Uploading Bank Transactions Automatic Bank Feeds Section 06: Products and Services Introduction - Products and Services Products and Services Screen Adding Services Adding Untracked Products Adding Tracked Products Section 07: Fixed Assets Introduction - Fixed Assets Fixed Assets Settings Adding Assets from Bank Transactions Adding Assets from Spend Money Adding Assets from Bills Depreciation Section 08: Payroll Introduction - Payroll Payroll Settings Adding Employees Paying Employees Payroll Filing Section 09: VAT Returns Introduction - VAT Returns VAT Settings VAT Returns - Manual Filing VAT Returns - Digital Filing Free Course 01: Tax Accounting Xero Accounting & Bookkeeping + Tax, Finance & Financial Management delves into the world of tax accounting. This course provides a theoretical understanding of tax principles, regulations, and calculations relevant to businesses. You'll explore topics like income tax, corporation tax, value added tax (VAT), and payroll taxes. Xero Accounting & Bookkeeping+ Tax, Finance & Financial Management equips you with the knowledge to identify tax implications for business transactions and ensure compliance with tax authorities. Module 01: Capital Gain Tax Module 02: Import and Export Module 03: Double Entry Accounting Module 04: Management Accounting and Financial Analysis Module 05: Career as a Tax Accountant in the UK Free Course 02: Financial Management Xero Accounting & Bookkeeping + Tax, Finance & Financial Management concludes with a focus on financial management. This course explores the theoretical underpinnings of financial decision-making. You'll learn how to create financial statements, analyze financial data, develop budgets and forecasts, and manage cash flow effectively. Xero Accounting & Bookkeeping+ Tax, Finance & Financial Management empowers you to make informed financial decisions that contribute to the overall success of a business. Module 01: Introduction to Financial Management Module 02: Fundamentals of Budgeting Module 03: The Balance Sheet Module 04: The Income Statement Module 05: The Cash Flow Statement Module 06: Statement of Stockholders' Equity Module 07: Analysing and Interpreting Financial Statements Module 08: Inter-Relationship Between all the Financial Statements Module 09: International Aspects of Financial Management Each topic has been designed to deliver more information in a shorter amount of time. This makes it simple for the learners to understand the fundamental idea and apply it to diverse situations through Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course. Certification Free CPD Accredited (CPD QS) Certificate. Quality Licence Scheme Endorsed Certificate of Achievement: Upon successful completion of the course, you will be eligible to order an original hardcopy certificate of achievement. This prestigious certificate, endorsed by the Quality Licence Scheme, will be titled 'Advanced Diploma in Xero Accounting and Bookkeeping at QLS Level 7'. Your certificate will be delivered directly to your home. The pricing scheme for the certificate is as follows: £129 GBP for addresses within the UK. Please note that delivery within the UK is free of charge. Disclaimer This Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course will teach you about Xero accounting software and help you improve your skills using it. It's created by an independent company, & not affiliated with Xero Limited. Upon completion, you will earn a CPD accredited certificate, it's not an official Xero certification. CPD 30 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course. Besides, this Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course particularly recommended for- Anyone interested in learning Xero can progress from a beginner to a knowledgeable user in just one day. Small business owners that want to handle their own accounting in Xero Xero Practice Manager Bookkeepers who wish to learn Xero rapidly Requirements Students seeking to enrol for Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course should meet the following requirements; Basic knowledge of English Language is needed for Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course, which already you have. Basic Knowledge of Information & Communication Technologies for studying Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course in online or digital platform. Stable Internet or Data connection in your learning devices to complete the Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course easily. Career path The Xero Accounting & Bookkeeping + Tax, Finance & Financial Management course will enable you to explore in Xero related trendy and demanding jobs, such as: Bookkeeping Specialist Client Experience Specialist Accounting Advisory Apprentice Cloud Accountant Education Specialist Management Accountant Finance Manager Tax Implementation Specialist Xero Practice Manager Certificates CPD QS Certificate of completion Digital certificate - Included After successfully completing this course, you can get CPD accredited digital PDF certificate for free.

Training for Non Profit Organisations (for Staff, Boards, and Volunteers) Course

5.0(14)By Training Express

Running a successful non-profit organisation requires more than just goodwill – it demands structure, strategy, and a solid grasp of key operations. This online training package brings together 26 essential topics tailored for those involved in charity work – from frontline volunteers and support staff to senior board members. Whether you're dealing with donors, managing teams, overseeing budgets or writing grant proposals, this course offers a clear and engaging pathway to sharpen your understanding of non-profit essentials. Covering everything from fundraising and digital marketing to charity accounting, public speaking, and crisis management, the programme is designed to address the many layers of organisational life within the non-profit sector. The content is delivered online with flexibility in mind, allowing participants to build confidence and grow their knowledge at their own pace. Ideal for those seeking to strengthen operational awareness, improve communication, and navigate the specific demands of running or supporting charitable initiatives. Key Features: CPD Certified FREE Instant e-certificate Fully online, interactive course with audio voiceover Developed by qualified professionals in the field Self-paced learning and laptop, tablet, smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Training for Non Profit OrganisationsIncludes: Course 01: Fundraising Course 02: How to Fundraise: A Guide to Fundraising for Non-Fundraisers Course 03: Charity Accounting Course 04: Public Speaking Course 05: Leadership and Management Diploma Course 06: Marketing Course 07: Equality, Diversity and Discrimination Course 08: Team Management Course 09: Remote Team Management Course 10: People Management Skills Course 11: Event Planning Course 12: Grant Writing for Non-Profits Course 13: Public Relations Course 14: Financial Analysis Course 15: Financial Management Course 16: Crisis Management Course 17: Event Crowd Control Course 18: Budgeting Course 19: Digital Marketing Course 20: Equality, Diversity & Inclusion Course 21: Cross Cultural Awareness Course 22: Document Control Course 23: Project Management Diploma Course 24: Resilience Training Course 25: Strategic Planning and Analysis for Marketing Course 26: Conflict Resolution Training Learning Outcomes: Fundraising techniques Charity accounting principles Financial management practices Public speaking and PR strategies Leadership and management Employ digital marketing Crisis management and conflict resolution techniques Accreditation All of our courses, including this course are fully accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certification Once you've successfully completed your Course, you will immediately be sent your digital certificates. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our certifications have no expiry dates, although we recommend renewing them every 12 months. CPD 260 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Non-profit staff, boards, and volunteers Career path Charity Fundraiser Non-profit Manager Grant Writer Public Relations Officer Event Coordinator Project Manager Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

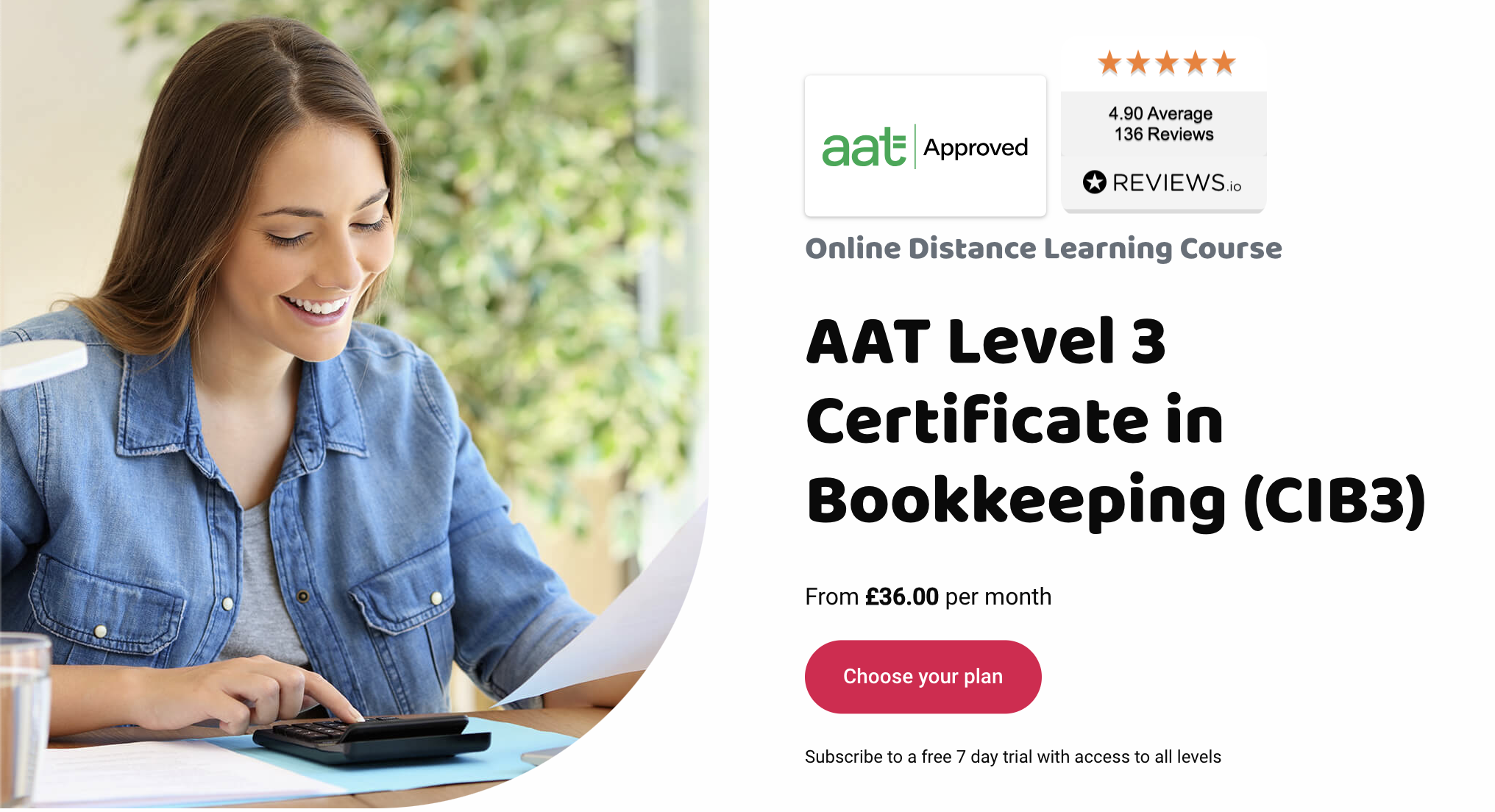

Have you already got some bookkeeping experience and want to build on it? Or have you done Level 2 and now need to cement your learning? Level 3 Bookkeeping is the qualification for you. AAT Level 3 in Bookkeeping is suited for those who want to continue learning more advanced bookkeeping skills, and are looking to work in roles such as accounts manager, professional bookkeeper, or ledger manager. The course is made up of two units: Financial Accounting: Preparing Financial Statements (FAPS), and Tax Processes for Businesses (TPFB). Recommended study time: 6 to 8 hours per week Estimated completion time: 3 – 5 months About AAT Level 3 Certificate in Bookkeeping Entry requirementsAnyone can start at Level 3, but we recommend that you have done Level 2 first, as the qualification builds on existing knowledge.Syllabus By the end of the AAT Level 3 Bookkeeping course, you will be able to confidently apply the principles of double-entry bookkeeping, be able to prepare final accounts, and understand VAT legislation, VAT returns, and the implications of errors. There are three areas to study, made up of various subjects. It usually takes 3-5 months to complete if you spend 6-8 hours a week studying. Topics covered:Financial Accounting: Preparing Financial Statements (FAPS) The accounting principles underlying financial accounts preparation The principles of advanced double-entry bookkeeping How to implement procedures for the acquisition and disposal of non-current assets How to prepare and record depreciation calculations How to record period end adjustments How to produce and extend the trial balance How to produce financial statements for sole traders and partnerships How to interpret financial statements using profitability ratios How to prepare accounting records from incomplete information Tax Processes for Businesses (TPFB) The legislation requirements relating to VAT How to calculate VAT How to review and verify VAT returns The principles of payroll How to report information within the organisation How is this course assessed? This Level 3 course is assessed with unit assessments. Unit assessment A unit assessment tests knowledge and skills taught in that unit. At Level 3 they are: Available on demand Scheduled by and sat at AAT approved assessment venues Marked by the computer Getting your results Assessment results are available in your MyAAT account within 24 hours for computer marked assessments. AAT approved venues You can search for your nearest venue via the AAT website launch. What’s included, and what support will I get? Partnering with the best, you’ll always have access to market leading tutor led online learning modules and content developed by Kaplan and Osborne books. All day, every day for as long as you subscribe Unlimited access to the AAT Level 3 content with the use of all other levels. Empowering you to progress when you’re ready at no extra cost Instant access to our unique comprehensive Study Buddy learning guide Access to Consolidation and Progress Tests and computer and self marked Mock Exams You’re fully supported with access to expert tutors, seven days a week, responding via email within four working hours You’ll be assigned a mentor to help and guide you through the order of subjects to study in, and check that the level you’re starting at is right for you Your subscription includes all the online content you need to succeed, but if you want to supplement your learning with books, Eagle students get 50% off hard copy study materials What could I do next? You can now work as a qualified bookkeeper. Alternatively, if you want to continue studying, your Eagle subscription gives you unlimited access to all AAT levels, meaning you can move onto the full AAT qualification at no extra cost. Additional costs If you would like to, you can become a member of the Association of Accounting Technicians (AAT) launch. Fees associated with admission, and exam fees are in addition to the cost of the course. Admission and membership fees are payable direct to AAT. Exam fees are paid to the exam centre. AAT one-off Level 3 Certificate in Bookkeeping Registration Fee: £90 AAT Assessment Fees: £70 to £80 per unit Please be aware that these are subject to change.

Forex Training at QLS Level 5 Diploma

By Imperial Academy

FREE Level 5 QLS Certificate | FREE 11 CPD Courses & PDF Certificates | 200 CPD Points | Lifetime Access

Course overview If you wish to gain the relevant skills in corporate finance, take the proper steps with this Introduction to Corporate Finance course and maximize your business's value. This course educates you on the fundamental areas of corporate finance to balance capital funding between investments. In this Introduction to Corporate Finance course, you will develop a comprehensive understanding of corporate finance, including its accounting principles and financial analysis. You will learn how to boost business value by effective planning and implementation of various strategies. It will educate you on essential topics like cash forecast, present value, future value, rate of return, and adding debt. You will also discover the risk management strategies to balance risk and profitability. Learning outcome Deepen your understanding of financial analysis Learn about the cash forecasting method Be able to calculate present value and future value Have a solid grasp of rate of return and adding debt Strengthen your knowledge of risk management Who Is This Course For? This Introduction to Corporate Finance course is highly beneficial for anyone interested in learning the fundamentals of corporate finance to maximize their business value. In addition, the skills gained from this training will provide excellent opportunities to work in Corporate Finance. Entry Requirement This course is available to all learners of all academic backgrounds. Learners should be aged 16 or over. Good understanding of English language, numeracy and ICT skills are required to take this course. Certification After you have successfully completed the course, you will obtain an Accredited Certificate of Achievement. And, you will also receive a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hardcopy for £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why Choose Us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos and materials from the industry-leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; United Kingdom & internationally recognized accredited qualification; Access to course content on mobile, tablet and desktop from anywhere, anytime; Substantial career advancement opportunities; 24/7 student support via email. Career Path The Introduction to Corporate Finance Course provides essential skills that will make you more effective in your role. It would be beneficial for any related profession in the industry, such as: Executive Assistant Finance Manager Account Executive Account Manager Junior Accountant Introduction to Corporate Finance Learn More About This Course! 00:06:00 Financial Analysis 00:09:00 Cash Forecast 00:03:00 Present Value 00:13:00 Future Value 00:07:00 Rate of Return and Adding Debt 00:14:00 Risk Management 00:13:00 Finance in Practice 00:07:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00