- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

705 Courses delivered Online

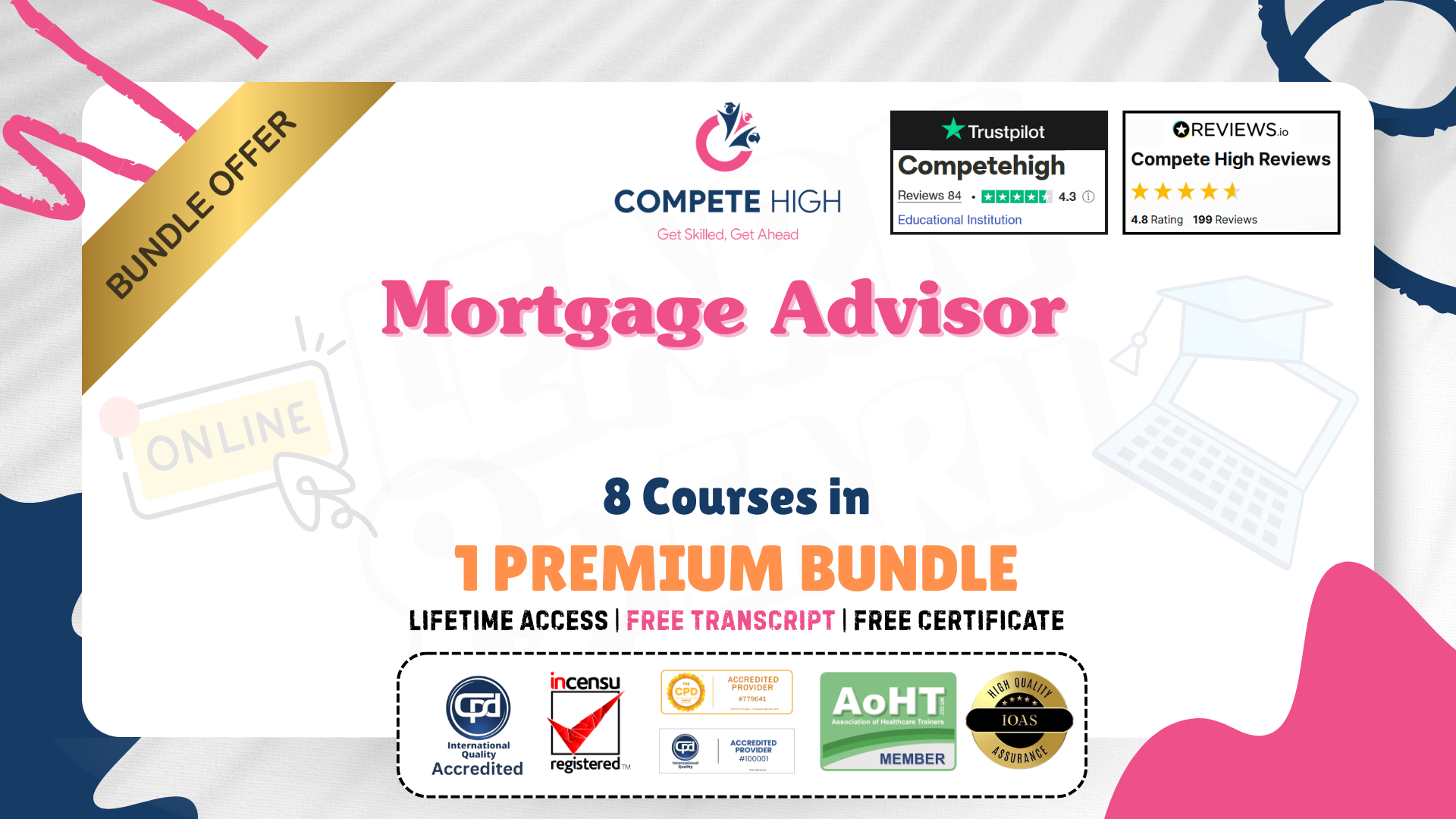

Mortgage Advisor: 8 in 1 Premium Courses Bundle

By Compete High

This Mortgage Advisor bundle provides a no-nonsense route through the key areas of financial services, including property law, client identity checks (KYC), anti-money laundering, and regulatory standards. You’ll also get a working grasp of financial tools like Sage and Xero, which keep things organised on the numbers front. Designed for learners aiming for advisory or support roles in finance and property, this bundle offers insight into the industry expectations without burying you in buzzwords. GDPR, financial analysis, and client data protection are covered in a way that makes the rules clear—and the spreadsheets less daunting. Learning Outcomes: Learn principles of mortgage advice and financial regulations. Understand key property law topics relevant to advising. Explore GDPR and data protection responsibilities. Understand AML and KYC procedures and documentation. Build basic skills in Sage and Xero accounting software. Analyse financial data with structured thinking techniques. Who is this Course For: Future mortgage advisors and financial support staff. Finance students preparing for industry-based knowledge. Property managers improving financial literacy. Bank staff seeking advancement in mortgage services. Insurance and loan officers expanding advisory skills. Small business owners managing client finances. Bookkeepers wanting additional finance qualifications. Anyone interested in financial regulations and tools. Career Path: Mortgage Advisor – £37,000/year Financial Assistant – £28,000/year Compliance Officer – £39,000/year Property Manager – £35,000/year Finance Administrator – £26,000/year Bookkeeper – £27,000/year

Diploma in Sage Payroll

By Course Cloud

Diploma in Sage Payroll Course Overview Master the essentials of payroll management and accounting with our Diploma in Sage Payroll course. Whether you're a beginner or an accounting professional looking to upgrade your skills, this course provides practical, hands-on training using Sage 50 Accounts. You’ll learn how to efficiently manage payroll tasks, bank reconciliations, VAT returns, year-end journals, and much more. Through clear step-by-step lessons, you'll build the confidence to run financial operations smoothly and support any business's accounting needs. Get ready to fast-track your career in bookkeeping, payroll, or finance management with a recognised set of in-demand skills. Extra Included: Free Course Included: Accounting Masterclass Lifetime Access Free Student ID Card Learning Outcome Understand how to set up and navigate Sage 50 Accounts. Manage customer and supplier accounts effectively. Handle fixed assets, petty cash, and bank reconciliations. Process payroll transactions and payroll journals. Complete VAT returns and generate essential financial reports. Enter opening balances and perform year-end accounting tasks. Set budgets and gain an introduction to cash flow and report designing. Who is this Diploma in Sage Payroll Course for? This course is ideal for individuals aiming to pursue a career in bookkeeping, accounting, or payroll administration. It is also perfectly suited for small business owners managing their own finances, freelance accountants, and professionals wishing to enhance their Sage 50 Accounts knowledge for better career prospects. Entry Requirements There are no formal entry requirements for this course. It is open to anyone who is interested in learning Sage Payroll and bookkeeping. Accredited Certification After successfully completing the course, you can get a UK and internationally accepted certificate to share your achievement with potential employers or include it in your CV. For the PDF certificate, you’ll need to pay £9.99. You can get the hard copy for 15.99, which will reach your doorstep by post.

Achieving Email Excellence Strategies for Successful Email Marketing

5.0(1)By Let’s Do Business Group

Email Marketing remains a cornerstone of digital communication, which when used effectively can elevate your brand, foster customer loyalty, and drive remarkable results.

Step into the captivating world of Functional Skills Maths Level 2, a course that transcends mere numbers. It's not just about equations; it's about empowering you to conquer challenges and infuse confidence into your every step. Imagine a world where percentages aren't daunting but doors opening to financial empowerment. Functional Skills Maths Level 2 equips learners with essential mathematical competencies. This course addresses real-world challenges, empowering individuals to navigate daily life, business, and further education with confidence. Proficiency in BODMAS, decimals, ratios, and more provides tangible benefits, fostering problem-solving and decision-making skills. Students gain a competitive edge in personal and professional spheres, improving their prospects and contributing to a numerically literate society. By mastering concepts like percentages and unitary methods, learners enhance their financial acumen, crucial for managing personal finances or pursuing business ventures. This course is a gateway to unlocking opportunities, and fostering a deeper understanding of mathematical applications in diverse contexts. The practical skills acquired are invaluable for achieving academic success, career advancement, and overall personal development. Learning Outcomes Apply rules of BODMAS for accurate mathematical simplification. Demonstrate proficiency in working with integers and directed numbers. Master calculations involving decimals, percentages, and scientific notation. Analyse and solve problems related to profit, loss, discount, and tax. Utilise unitary methods in practical applications and problem-solving scenarios. Understand and apply concepts of ratio, proportion, and fractions effectively. Successfully estimate and approximate numerical values in real-world situations. Comprehend the principles of factors, multiples, and their mathematical relationships. Apply mathematical skills to solve mock and final exam questions effectively. Who is this Award in Functional Skills Maths at QLS Level 2 Course For? Individuals seeking practical math skills for daily life. Students aiming for academic success and confidence in mathematics. Professionals looking to enhance their financial literacy. Entrepreneurs and business enthusiasts want sound mathematical foundations. Anyone wanting to improve problem-solving abilities through practical math. Why Choose This Award in Functional Skills Maths at QLS Level 2 Course Unlimited access to the course for a lifetime. Opportunity to earn a certificate accredited by the CPD Quality Standards and CIQ after completing this course. Structured lesson planning in line with industry standards. Immerse yourself in innovative and captivating course materials and activities. Assessments designed to evaluate advanced cognitive abilities and skill proficiency. Flexibility to complete the Course at your own pace, on your own schedule. Receive full tutor support throughout the week, from Monday to Friday, to enhance your learning experience. Unlock career resources for CV improvement, interview readiness, and job success. Career Path Administrative roles: Administrative Assistant (£18,000 - £25,000 per year) Retail positions: Retail Manager (£20,000 - £45,000 per year) Finance sector: Junior Accountant (£20,000 - £30,000 per year) Business ownership: Small Business Owner (Earnings vary widely) Further studies: Access to higher-level math courses for specialised careers. Prerequisites This Functional Skills Maths - Level 2 is open to all, irrespective of prior qualifications. Enrolling is simple, and the course, created by experts, functions seamlessly on PCs, Macs, tablets, and smartphones. With accessibility from any location with a reliable internet connection, this course provides convenient learning options. Certification After finishing the course content, you'll encounter a written assignment test. Upon successful completion, you can acquire a PDF certificate for a fee of £4.99. If you prefer a physical copy, you can order an original hard copy for an extra £8. Endorsed Certificate of Achievement from the Quality Licence Scheme Learners will be able to achieve an endorsed certificate after completing the course as proof of their achievement. You can order the endorsed certificate for only £75 to be delivered to your home by post. For international students, there is an additional postage charge of £10. Endorsement The Quality Licence Scheme (QLS) has endorsed this course for its high-quality, non-regulated provision and training programmes. The QLS is a UK-based organisation that sets standards for non-regulated training and learning. This endorsement means that the course has been reviewed and approved by the QLS and meets the highest quality standards. Please Note: Studyhub is a Compliance Central approved resale partner for Quality Licence Scheme Endorsed courses. Course Curriculum Integers ( Directed Numbers) Lecture 1 Introduction 00:02:00 Lecture 2 Multiplying any digit number by 11, 22, and 33 00:09:00 Lecture 3 Integers and ordering of integers 00:06:00 Lecture 4 Addition and Subtractions of Integers 00:07:00 Lecture 5 Operations on Integers 00:04:00 Lecture 6 Multiplication and Division of Integers 00:04:00 Lecture 7 Powers of Integers (Exponents) 00:04:00 Factors and Multiples Lecture 8 Complete knowledge about factors and multiples 00:06:00 Lecture 9 Divisibility tests for 2,3,4,5,6 00:07:00 Lecture 10 Divisibility rules 7,8,9,10,11 00:06:00 Lecture 11 Prime Factorization 00:06:00 Lecture 12 Highest Common Factor HCF 00:10:00 Lecture 13 Least Common Multiple LCM 00:16:00 Lecture 14 Relation between LCM and HCF 00:04:00 Fractions Lecture 15 Classification of Fractions 00:04:00 Lecture 16 Convert mixed to improper and improper to mixed fractions 00:03:00 Lecture 17 Equivalent Fractions 00:04:00 Lecture 18 Comparing Fractions after converting to like fractions 00:09:00 Lecture 19 Reducing a fraction to lowest term 00:04:00 Lecture 20 Addition and subtraction OF fractions 00:08:00 Lecture 21 Multiplication and division of fractions 00:11:00 Lecture 22 Word problems on fractions 00:16:00 Simplification Rule : BODMAS Lecture 23 BODMAS and rules to remove brackets 00:03:00 Lecture 24 Simplify expressions using BODMAS rules 00:05:00 Lecture 25 Simplify expressions involving fractions using BODMAS 00:07:00 Decimal numbers Lecture 26 Decimal numbers in relation to fractions 00:08:00 Lecture 27 Like and unlike Decimals 00:05:00 Lecture 28 Ordering of Decimal numbers 00:10:00 Lecture 29 Addition and subtraction of Decimal 00:07:00 Lecture 30 Multiplication of Decimal 00:03:00 Lecture 31 Division of Decimal 00:05:00 Rational Numbers Lecture 32 Rational number 00:02:00 Lecture 33 Representation of Rational Numbers on Number line 00:04:00 Lecture 34 Determining which fraction is terminating or non terminating 00:05:00 Lecture 35 shortcut method of writing decimal expansion of fraction to decimal 00:08:00 Approximation Lecture 36 Rounding to whole number 00:06:00 Lecture 37 Rounding to required number of decimals (1 d.p. ) 00:05:00 Lecture 38 rounding to significant digits 00:07:00 Lecture 39 Practice question on three methods of approximation 1 00:05:00 Estimation and Scientific Notation or Standard form Lecture 40 Estimation 00:05:00 Lecture 41 Scientific Notation 00:07:00 Lecture 42 Operation on numbers when they are in scientific notation 00:06:00 Percentage Lecture 43 Percentage to fraction and fraction to percentage 00:06:00 Lecture 44 Percentage of a quantity and conversation to decimal 00:06:00 Lecture 45 Expressing one quantity as percentage of another quantity 00:06:00 Lecture 46 Finding increase decrease percent 00:05:00 Lecture 47 Uses of percentages-Word Problems 00:09:00 Ratio and Proportion Lecture 48 Ratio- How to express as simple ratio 00:09:00 Lecture 49 How to compare Ratios 00:04:00 Lecture 50 Word problems on finding ratios 00:07:00 Lecture 51 To divide a given quantity into a given Ratio 00:11:00 Lecture 52 Proportion 00:04:00 Lecture 53 Practice problems on Proportion 00:06:00 Lecture 54 Continued proportion 00:06:00 Unitary Method and its Applications Lecture 55 Direct Variation ( or proportion) 00:04:00 Lecture 56 Problems based on Direct proportion 00:10:00 Lecture 57 Inverse Variation ( or proportion) 00:10:00 Lecture 58 Multiple Ratios 00:10:00 Profit , Loss, discount and Tax Lecture 59 Basics - Profit and Loss 00:04:00 Lecture 60 More practice problems on Profit & Loss 00:06:00 Lecture 61 Selling price formula and Problems 00:04:00 Lecture 62 Cost price formula and Problems 00:03:00 Lecture 63 Higher problems on Profit and Loss 00:08:00 Lecture 64 Basics - Discount.mp4 00:05:00 Lecture 65 Practice problems on Discount 00:04:00 Lecture 66 Tax 00:06:00 Mock Exam Mock Exam - Award in Functional Skills Maths at QLS Level 2 00:20:00 Final Exam Final Exam - Award in Functional Skills Maths at QLS Level 2 00:20:00 Order your QLS Endorsed Certificate Order your QLS Endorsed Certificate 00:00:00

VAT Mini Bundle

By Compete High

Nothing says “grown-up” quite like understanding your VAT. The VAT Mini Bundle walks you through Value Added Tax, essential tax knowledge, business law basics, structured report writing, and—because life gets messy—some self-organisation tactics to keep your numbers (and nerves) in check. Whether you’re chasing receipts or wrangling legalese, this bundle puts logic back into numbers. Perfect for early-career finance workers, small business enthusiasts, or anyone tired of pretending to know what ‘input tax’ means. Numbers don’t bite—especially when presented like this. Learning Outcomes: Understand key concepts behind VAT and its applications. Learn tax fundamentals relevant to business and self-employment. Explore basic business law for financial process understanding. Develop structured report writing for financial clarity. Organise documents and tasks using simple organisational methods. Apply structured thinking to legal and financial topics. Who is this Course For: Bookkeeping assistants learning VAT and tax rules. Entrepreneurs managing business records and reports. Finance support staff handling admin for accountants. Tax return helpers needing structured refresher knowledge. Self-employed individuals tracking invoices and taxes. Admin workers supporting financial documentation. Legal secretaries touching on business and tax law. Beginners interested in structured financial writing. Career Path: VAT Administrator – £26,000/year Tax Assistant – £27,500/year Accounts Support Officer – £25,000/year Finance Administrator – £24,000/year Junior Report Writer (Finance Focus) – £23,500/year Business Law Clerk (Entry-Level) – £28,000/year

Microsoft Office Specialist (MOS): 8 in 1 Premium Courses Bundle

By Compete High

Whether you’re updating a spreadsheet, writing a formal letter, or creating a PowerPoint worthy of applause, this Microsoft Office Specialist (MOS) bundle has your digital desk drawer sorted. From MS Word to SQL, each module is designed to sharpen your command of the Office suite and its closely linked technologies. You'll learn to glide through Excel formulas, structure Access databases, interpret dashboards with Power BI, and manage projects with confidence in MS Project. It's not about just knowing where the buttons are—it’s about knowing what to do with them. Learning Outcomes: Navigate Microsoft Office tools with confidence and accuracy. Build and analyse data using Excel and Power BI. Create structured databases using MS Access. Write, edit and format documents professionally in Word. Prepare and present slides with clarity in PowerPoint. Organise communication and schedules using Outlook effectively. Who is this Course For: Office workers looking to improve everyday digital workflow. Admin assistants needing structured Microsoft Office training. Professionals handling reports, data, and communications. Beginners aiming to develop foundational Microsoft Office skills. Jobseekers wanting up-to-date tech proficiency. Small business owners managing documents and communication. Team leaders coordinating tasks via Outlook or MS Project. Anyone curious about Power BI and data presentation. Career Path: Administrative Assistant – £21,000–£28,000 per year Data Entry Clerk – £20,000–£25,000 per year Office Manager – £28,000–£40,000 per year Project Administrator – £25,000–£32,000 per year Business Analyst (with Power BI) – £38,000–£52,000 per year IT Support Assistant – £22,000–£30,000 per year

Payroll Administrator: 8 in 1 Premium Courses Bundle

By Compete High

The Payroll Administrator: 8 in 1 Premium Courses Bundle blends finance and organisation into one tidy package. This bundle includes payroll, bookkeeping, accounting, and financial analysis modules alongside Sage, Xero, and admin-focused learning — perfect for those managing both people and payments. Whether you're calculating overtime or double-checking data in a spreadsheet, this content will help keep the wheels turning smoothly. It’s designed for those who handle everything from payslips to purchase orders and like their numbers to behave. With administrative tasks and payroll combined, it’s the well-balanced knowledge set that every multitasking office hero deserves. Learning Outcomes: Understand payroll cycles, employee payments, and recordkeeping procedures Learn data entry methods and office organisation standards Study bookkeeping and accounting theory for payroll efficiency Gain understanding of Sage and Xero financial software Explore financial analysis and employee pay structures Understand administrative responsibilities in payroll environments Who is this Course For: Payroll assistants aiming to strengthen software and admin skills Office staff involved in basic payroll or financial duties Administrative professionals needing payroll-related training Bookkeepers transitioning into payroll administration roles Small business owners managing employee payment processes Data entry clerks handling financial recordkeeping and input Accountancy students adding payroll modules to their knowledge HR staff with added responsibility for timesheets and wages Career Path (UK Average Salaries): Payroll Administrator – £28,000/year Administrative Assistant – £24,000/year Bookkeeper – £28,000/year HR Payroll Coordinator – £30,000/year Accounts Assistant – £26,500/year Xero/Sage Officer – £27,000/year

Operations Management: 8 in 1 Premium Courses Bundle

By Compete High

Operations management is the unseen engine behind every efficient business. This 8-in-1 bundle unpacks vital areas like supply chain, procurement, and business analysis, alongside leadership and project oversight. It’s designed to give learners clarity on how organisations keep their wheels turning smoothly. With a mix of people management, business law, and quality assurance, the course provides a well-rounded understanding of managing processes, teams, and legal considerations. Whether you manage a small team or work in large-scale operations, this course sharpens your grasp of the essentials that keep business running on schedule and within budget. 🎯 Learning Outcomes: Understand key principles of operations and supply chain management. Learn procurement techniques to optimise purchasing decisions. Gain insight into business analysis and process improvement. Develop skills in managing teams effectively and efficiently. Explore basics of business law related to operations. Understand quality assurance methods to maintain standards. 👤 Who is this Course For: Aspiring operations managers wanting foundational knowledge. Procurement officers seeking clearer supply chain understanding. Team leaders managing operational workflows and staff. Business analysts aiming to broaden process knowledge. Small business owners overseeing daily operations. Project coordinators involved in cross-functional tasks. Legal advisors interested in business law fundamentals. Quality control officers looking to enhance their skills. 💼 Career Path (UK Average Salaries): Operations Manager – £42,000 per year Supply Chain Coordinator – £35,000 per year Procurement Specialist – £38,000 per year Business Analyst – £40,000 per year Quality Assurance Officer – £33,000 per year Team Leader – £31,000 per year

Investment Banking Mini Bundle

By Compete High

You don’t need a pinstripe suit to make sense of the numbers. The Investment Banking Mini Bundle focuses on core concepts in banking, finance, business analysis, financial analysis, and the Sage software suite—all explained without the need for financial jargon translations. If your goal is clarity, this bundle keeps it simple. Whether you're peeking into spreadsheets or analysing business health, you’ll move from finance basics to structured analysis with calm precision. Think of it as your numbers-first toolkit—minus the financial drama. Learning Outcomes: Understand core banking structures and financial institution processes. Learn essential finance principles relevant to financial operations. Explore techniques used in financial analysis and review. Study business analysis methods used for internal decisions. Use Sage for financial tracking and basic reporting operations. Connect finance concepts across banking and business analysis. Who is this Course For: Aspiring finance professionals learning early-stage industry concepts. Students preparing for roles in banking or business finance. Business support staff managing data and reporting operations. Administrative workers using Sage for accounts-based tasks. Analysts seeking to develop structured financial thinking. Small business staff working across finance and planning. Beginners exploring banking without the financial jargon flood. Those supporting decision-makers with financial reports or analysis. Career Path: Investment Banking Assistant – £34,000/year Financial Analyst (Junior) – £35,000/year Business Analyst (Entry-Level) – £33,000/year Sage Accounts Administrator – £27,000/year Banking Operations Coordinator – £30,500/year Finance Assistant (Corporate Sector) – £29,000/year