- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Tableau Desktop Training - Advanced Analyst

By Tableau Training Uk

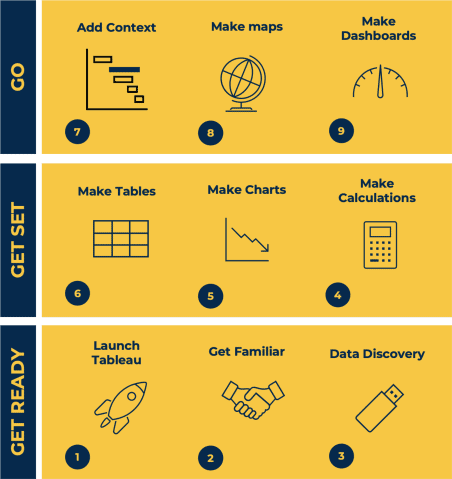

This 3 day Tableau Desktop Advanced Training course is designed for professionals who have been working with Tableau for some time and are looking to dive deeper and learn analytical use cases that utilise Tableaus advanced features. It is also a perfect refresher course if you want to upgrade your skills to the latest features. Public Course Options EXTEND YOUR KNOWLEDGE OF TABLEAU IN THIS HANDS-ON COURSE TRAINING £1,200 per person + VAT 3 Day live virtual course 12 Months access to online course This 3 day Tableau Desktop Advanced Training course is designed for the professional who has been working with Tableau for some time and is looking to dive deeper. You will review all calculation types and apply Table Calculations and Level of Detail Expressions in multiple use cases. You will also learn advanced techniques for analysing time series data, cohorts and survey data. You will learn advanced mapping and dashboard techniques to help improve the insights gained for your target audience. You will be introduced to the latest features together with practical use cases for getting the most benefit from them. Attendees should have a deep understanding of the fundamental concepts of building Tableau worksheets and dashboards and be comfortable with the techniques learnt in the Foundation and Analyst courses. At the end of this course you will be able to apply and combine some of the more complex capabilities and techniques that Tableau has to offer. In addition to our regular 2 day syllabus we have added an additional day so that we can add learning for many new features introduced into Tableau over the last couple of years. Live Coaching and Q&A Access In addition to the 3 day live and interactive course, delegates also receive 6 weeks live access to our Coaching and Q&A calls that take place 3 times each week. Delegates have found these to be highly beneficial to enhance their learning experience as well as assisting with applying the learning from the course to practical working deliverables on their own data. The course includes the following topics: RECAP: CALCULATIONS Review of Number Functions Review of String Functions Review of Date Functions Review of Type Conversions Review of Logical Functions Review of Aggregate Functions Alternatives to Calculations 2 Hands-on exercises GETTING THE MOST FROM TABLE CALCULATIONS What are and when to use Table Calculations What Table Calculation Types are there? Defining the Scope and Direction of calculations Using Table Calculations in Calculated Fields How do Filters work with Table Calculations? 7 Hands-on exercises LODS - LEVEL OF DETAIL EXPRESSIONS Overview FIXED LOD How do Filters work with LODs? INCLUDE LOD EXCLUDE LOD Nesting LODs Comparing the various Calculation Types 5 Hands-on exercises ADVANCED TECHNIQUES FOR ANALYSING TIME-BASED DATA Creating Sparklines Creating Slope Charts Creating Control Charts Creating Bump Charts 4 Hands-on exercises ANALYSING BEHAVIOURS IN DATA Creating Cohort Analysis Analysing Survey Data 2 Hands-on exercises ADVANCED TECHNIQUES FOR MAPPING Mapping Distance from a point Normalising map areas with Hexbins Combining Spatial & Data Files 3 Hands-on exercises ADVANCED CONSIDERATIONS FOR DASHBOARDS Identifying your Audience Using Containers and Layout Considerations for Dashboard Elements Sheet swapping Adding Dashboard Actions to Context 2 Hands-on exercises In addition to the regular syllabus we will also cover the following New Features : Viz in Tooltips Set Actions Parameter Actions Show/Hide Containers Animations Dashboard Navigation Button Replace Worksheet in a Dashboard (DB) Show/Hide Sort Controls Vector Maps Customisable reference line tooltips Automatic dashboard phone layouts Export to PowerPoint Transparent worksheet backgrounds Density Mark Type (New Heatmap) Dashboard Extensions Step and Jump Lines Dashboard Grids Nested sorting improvements Ask Data Explain Data Spatial Calculations Negative values on log axis Additional clustering functionality Enhanced cross-database join control This training course includes over 35 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. A comprehensive training manual is provided together with all the data, starter and solution Tableau Workbooks required for the training. Students must use their own laptop with an active version of Tableau Desktop 2020.1 (or later) pre-installed. What People Are Saying About This Course "Course was fantastic and completely relevant to the work I am doing with Tableau. I particularly liked Steve's method of teaching and how he applied the course material to 'real-life' use-cases."Richard W., Dashboard Consulting Ltd "This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work."Lauren M., Baillie Gifford "I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I've learned into practice."Aron F., Grove & Dean "Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work."John B., Mporium

Estate Management Level 7

By Imperial Academy

Level 7 Diploma (FREE QLS Endorsed Certificate) | 10 CPD Courses + 10 Certificates | CPD Accredited | Lifetime Access

This course will start by covering some of the key terms you will need to understand before moving on to identifying critical control points and analysing some of the key hazards. It’ll show you how to determine control points and how to avoid cross-contamination in the food chain. It will also cover some of the control measures that can be taken along with how to address a problem if a critical limit is breached.

This course explores the risk to workers caused by the Covid-19 virus and covers actions that can be taken by employers and employees to protect themselves and each other as they return to work. The content of this course is based on the latest information from the UK government and the NHS. It covers information about the virus, risk assessments and personal safety, along with how to make changes to the daily work environment to address these risks.

At the end of this course, candidates will have an understanding of what a risk assessment is and how to complete one. To achieve this the course will define important terms, provide some basic background information to explain how important risk assessments are and discuss some of the legislation that applies. It will then go on to provide practical advice on how to identify hazards and analyse risk before finishing off by explaining the responsibilities of both employers and employees with regards to risk assessment.

This course is aimed at users of display screen equipment, or DSE as it’s often called. DSE is a term that covers a wide range of equipment. If DSE equipment like this is not set up correctly, users are at increased risk from certain disorders. As an employee, you share the responsibility to keep people safe at work. That means undergoing relevant training and ensuring that rules are followed.

24 Hour Flash Deal **25-in-1 Diploma in Skills for Business: Finance Mega Bundle** Diploma in Skills for Business: Finance Enrolment Gifts **FREE PDF Certificate**FREE PDF Transcript ** FREE Exam** FREE Student ID ** Lifetime Access **FREE Enrolment Letter ** Take the initial steps toward a successful long-term career by studying the Diploma in Skills for Business: Finance package online with Studyhub through our online learning platform. The Diploma in Skills for Business: Finance bundle can help you improve your CV, wow potential employers, and differentiate yourself from the mass. This Diploma in Skills for Business: Finance course provides complete 360-degree training on Diploma in Skills for Business: Finance. You'll get not one, not two, not three, but twenty-five Diploma in Skills for Business: Finance courses included in this course. Plus Studyhub's signature Forever Access is given as always, meaning these Diploma in Skills for Business: Finance courses are yours for as long as you want them once you enrol in this course This Diploma in Skills for Business: Finance Bundle consists the following career oriented courses: Course 01: Business Finance Course 02: Business Management and Finance Course Course 03: Capital Budgeting & Investment Decision Rules Course 04: Cashflow Management and Forecasting Course 05: Corporate Finance Course 06: Cost Control Process and Management Course 07: Debt Management, Assessment, Financing & Counselling Course 08: Essentials of UK VAT Course 09: Financial Analysis Methods Course 10: Financial Modelling for Decision Making and Business plan Course 11: Financial Planning Course 12: Financial Reporting Course 13: Financial Risk Management Course 14: Financial Statements Fraud Detection Training Course 15: FinTech Course 16: Forex Trading Course 17: Improve your Financial Intelligence Course 18: Investment Banking Operations Professional Course 19: Level 3 Diploma in Business Administration Course 20: Personal Financial Management & Wellness Course 21: Raising Money & Valuations Course 22: Retail Customer Service & Effective Customer Targeting Course 23: Sage 50 Accounts Training Course 24: Understanding Financial Statements and Analysis Course 25: Operations Management In this exclusive Diploma in Skills for Business: Finance bundle, you really hit the jackpot. Here's what you get: Step by step Diploma in Skills for Business: Finance lessons One to one assistance from Diploma in Skills for Business: Finance professionals if you need it Innovative exams to test your knowledge after the Diploma in Skills for Business: Finance course 24/7 customer support should you encounter any hiccups Top-class learning portal Unlimited lifetime access to all twenty-five Diploma in Skills for Business: Finance courses Digital Certificate, Transcript and student ID are all included in the price PDF certificate immediately after passing Original copies of your Diploma in Skills for Business: Finance certificate and transcript on the next working day Easily learn the Diploma in Skills for Business: Finance skills and knowledge you want from the comfort of your home The Diploma in Skills for Business: Finance course has been prepared by focusing largely on Diploma in Skills for Business: Finance career readiness. It has been designed by our Diploma in Skills for Business: Finance specialists in a manner that you will be likely to find yourself head and shoulders above the others. For better learning, one to one assistance will also be provided if it's required by any learners. The Diploma in Skills for Business: Finance Bundle is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Diploma in Skills for Business: Finance bundle course has been created with twenty-five premium courses to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Diploma in Skills for Business: Finance Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into Diploma in Skills for Business: Finance Elementary modules, allowing our students to grasp each lesson quickly. The Diploma in Skills for Business: Finance course is self-paced and can be taken from the comfort of your home, office, or on the go! With our Student ID card you will get discounts on things like music, food, travel and clothes etc. CPD 250 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Diploma in Skills for Business: Finance training is suitable for - Students Recent graduates Job Seekers Individuals who are already employed in the relevant sectors and wish to enhance their knowledge and expertise in Diploma in Skills for Business: Finance After completing the Tax Accounting course later, you can enrol in these courses: Association of Chartered Certified Accountants (ACCA) AAT Level 2 Certificate in Accounting BCS Foundation Certificate in Business Analysis AAT Level 3 Diploma in Accounting AAT Level 1 Award in Bookkeeping A-level Accounting Certificate in Business Accounting (CBA) IGCSE Accounting Foundation in Bookkeeping Diploma Level 7 Diploma in Accounting and Finance Association of Accounting Technicians certificate in business accounting CBA AAT Level 2 Certificate in Accounting AAT Foundation Certificate in Bookkeeping Level 2 ACCA Diploma in Accounting and Business (RQF Level 4) CIMA Certificate in Business and Accounting CIMA Diploma in Management Accounting AAT Advanced Diploma in Accounting Level 3 Official Xero Certification Level 6 Diploma in Professional Accountancy (RQF) AAT Level 4 Diploma in Professional Accounting Level 3 Diploma Foundation Diploma in Accountancy AAT Advanced Certificate in Bookkeeping Level 3 Association of Chartered Certified Accountants (ACCA) AAT Level 2 Certificate in Bookkeeping Chartered Institute of Management Accountants Institute of Financial Accountants Membership of the Chartered Institute of Management Accountants Level 4 Diploma Accounting and Business Finance NCFE Level 3 Diploma in Skills for Business: Finance Please Note: Studyhub is a Compliance Central approved resale partner for Quality Licence Scheme Endorsed courses. Requirements To participate in this Diploma in Skills for Business: Finance course, all you need is - A smart device A secure internet connection And a keen interest in Diploma in Skills for Business: Finance Career path You will be able to kickstart your Diploma in Skills for Business: Finance career because this course includes various courses as a bonus. This Diploma in Skills for Business: Finance is an excellent opportunity for you to learn multiple skills from the convenience of your own home and explore Diploma in Skills for Business: Finance career opportunities. Certificates CPD Accredited Certificate Digital certificate - Included CPD Accredited e-Certificate - Free CPD Accredited Hardcopy Certificate - Free Enrolment Letter - Free Student ID Card - Free

Data Analysis and Visualization with Microsoft Excel

By Mpi Learning - Professional Learning And Development Provider

This course is designed for students who already have foundational knowledge and skills in Excel and who wish to perform robust and advanced data and statistical analysis with Microsoft Excel using PivotTables, use tools such as Power Pivot and the Data Analysis ToolPak to analyze data and visualize data and insights using advanced visualizations in charts and dashboards in Excel.

Payroll Diploma Payroll professionals are a crucial part of the business world. Working in Payroll requires various skills and knowledge, including accounting, data entry, and customer service. In addition, Payroll professionals manage employee wages and benefits, process Payroll taxes, and ensure compliance with local, state, and federal labour laws. A career in Payroll can be a rewarding and lucrative opportunity. Payroll professionals are in high demand due to the complexity of payroll regulations and the need for accuracy and efficiency. Payroll professionals are also often in charge of maintaining employee records, which can be challenging but rewarding. If you want to become a well-established Payroll Manager, Supervisor, or Administrator, this Payroll Diploma course will provide you with a solid foundation to build confidence and more advanced skills. This course has been designed to assist learners in gaining a strong command of instruction in the Payroll Management System, providing them with a solid reservoir of knowledge to help them succeed in their professional careers. So enrol in the course right now! Furthermore, to help you showcase your expertise in Payroll, we have prepared a special gift of 1 hardcopy certificate and 1 PDF certificate for the title course completely free of cost. These certificates will enhance your credibility and encourage possible employers to pick you over the rest. This Payroll Bundle Consists of the following Premium courses: Course 01: Payroll Management Course Course 02: Diploma in Sage 50 Accounts Course 03: Pension UK Course 04: Employment Law Level 3 Course 05: Law and Contracts - Level 2 Course 06: Recruitment Consultant - Level 4 Course 07: Virtual Interviewing for HR Course 08: Introduction to VAT Course 09: Level 3 Tax Accounting Course 10: Level 3 Xero Training Course 11: Professional Bookkeeping Course Course 12: Microsoft Excel Level 3 Course 13: Stress Management Training Course 14: Time Management Learning Outcome of this Payroll course Learn about Payroll and its fundamentals. Understand the UK payroll system. Learn everything there is to know about the processes involved in managing and processing a company's Payroll. Learn how to hire full-time, part-time, and casual workers. Learn how to make and manage timesheets for your employees. Learn about overtime calculations. Learn more about Paye, Tax, and National Insurance. Understand the payroll process Discover how to submit payroll reports on a quarterly and annual basis Curriculum Payroll Management Course Payroll System in the UK Payroll Basics Company Settings Legislation Settings Pension Scheme Basics Pay Elements The Processing Date Adding Existing Employees Adding New Employees Payroll Processing Basics Entering Payments Pre-Update Reports Updating Records e-Submissions Basics Process Payroll (November) Employee Records and Reports Editing Employee Records Resetting Payments Quick SSP An Employee Leaves Reports and Historical Data Year-End Procedures And Much More... How will I get my Certificate? After successfully completing the course, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (For The Title Course) Hard Copy Certificate: Free (For The Title Course) CPD 140 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Accounting students Business owner Anyone who wants to learn to account Bookkeepers and Accountants who need to have an understanding of the UK payroll system Students who are going for jobs where the requirement is working knowledge of how UK payroll works Those who have studied accounting but want practical knowledge of Payroll Requirements This course has been designed to be fully compatible with tablets and smartphones. Career path Enrolling in this bundle can lead to the following career opportunities: Payroll Administrator Business Analyst Payroll Manager HR Manager CIS specialist Apprentice Payroll Officer Payroll Clerk Payroll Data Analyst The typical annual income for these professionals ranges from £20,000 to £70,000 in the UK. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Payroll Management Course) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.