- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Overview This 2-day programme covers the latest techniques used for fixed income attribution. This hands-on course enables participants to get a practical working experience of fixed income attribution, from planning to implementation and analysis. After completing the course you will have developed the skills to: Understand how attribution works and the value it adds to the investment process Interpret attribution reports from commercial systems Assess the strengths and weaknesses of commercially available attribution software Make informed decisions about the build vs. buy decision Present results in terms accessible to all parts of the business Who the course is for Performance analysts Fund and portfolio managers Investment officers Fixed Income professionals (marketing/sales) Auditors and compliance Quants and IT developers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview A review of the most enduringly popular structured equity-linked products. This 1 day hands-on programme will help you gain familiarity with 1st generation & 2nd generation structured products convexity – and their applications. Discover techniques for maximising the participation rate to enhance returns for investors. Explore the trade-offs between coupon payments and gearing, and how they affect the risk-return profile of the notes. Explore ladder structures, their relationship to lookbacks, and the benefits they offer to investors. Learn about accumulators, their structuring, and the reasons behind their controversy in the market. Who the course is for Structured Products Desks, Financial Engineers, Product Controllers Traders, Dealing Room Staff and Sales People Risk Managers, Quantitative Analysts and Middle Office Managers Fund Managers, Investors, Senior Managers Researchers and Systems Developers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Telephone Training - Live On-Site and Remote Training Sessions

By Telephone Trainers Ltd

Our telephone training takes place in your normal working situation, using the actual telephones and software, and the programming software clients that trainees will use when fully trained. Our trainers will travel anywhere in the world to train you face to face, or if you prefer, we can offer our whole training catalogue remotely using Teams or Zoom. On-site and live remote telecoms training sessions have a general reputation as most effective for trainees to continue to efficiently carry out their telecoms usage, programming and own in-house training of future new employees. On-site training involves employees training at their place of work while they are doing their actual job, or in pre-organised classroom training sessions, based around hands-on interaction, trainer Q&A and all carried out using your own site telephone system. Our telephone trainers also offer consultations on your new or current telephone systems: looking into how you currently use your system, making suggestions on how programming could be tweaked and changed to improve your current usage, how to improve on call handling methods, and informing you of additional products which may be available on your system that you may not be aware of. This could help improve the level of communication across your company and interactions with your customers. We believe telephone handset and voicemail training sessions are essential to the smooth and efficient running of your company, making sure your staff are aware of all the features and benefits that the telephone handsets can offer, and ensuring calls are dealt with quickly and effectively. System administration training is available to teach new administrators how to manage and control a variety of system features. This type of training is especially important when new administrators have little or no previous telecom knowledge or experience, but it is equally important at all levels to ensure the new system is utilised to its maximum capability. Administration days or Call Centre Software training days take one full day to complete. Full Day Example: 9:30 - 16:00 Day Structure 09:30 - 10:45 Handset & VM session for up to 8 people 10:45 - 12:00 Handset & VM session for up to 8 people 12:00 - 12:45 Lunch 12:45 - 14:00 Handset & VM session for up to 8 people 14:00 - 15:15 Handset & VM session for up to 8 people 15:15 - 16:30 Handset & VM session for up to 8 people Half Day Example: 9:30 - 13:00 Switchboard training takes half a day (3-4 hours for up to 3 people). If you want to train more than 3 people, you may need to extend the day to a full day, to ensure everyone gets to have hands-on training on the switchboard. Super Users and Train the Trainer Sessions Super User sessions can also be organised to show advanced system features in order to provide an ongoing training service to their colleagues, once the trainers have left the site.

Alcohol Personal Licence Holder

By Twig Services Ltd

Alcohol Personal Licence Holder Online Training Course

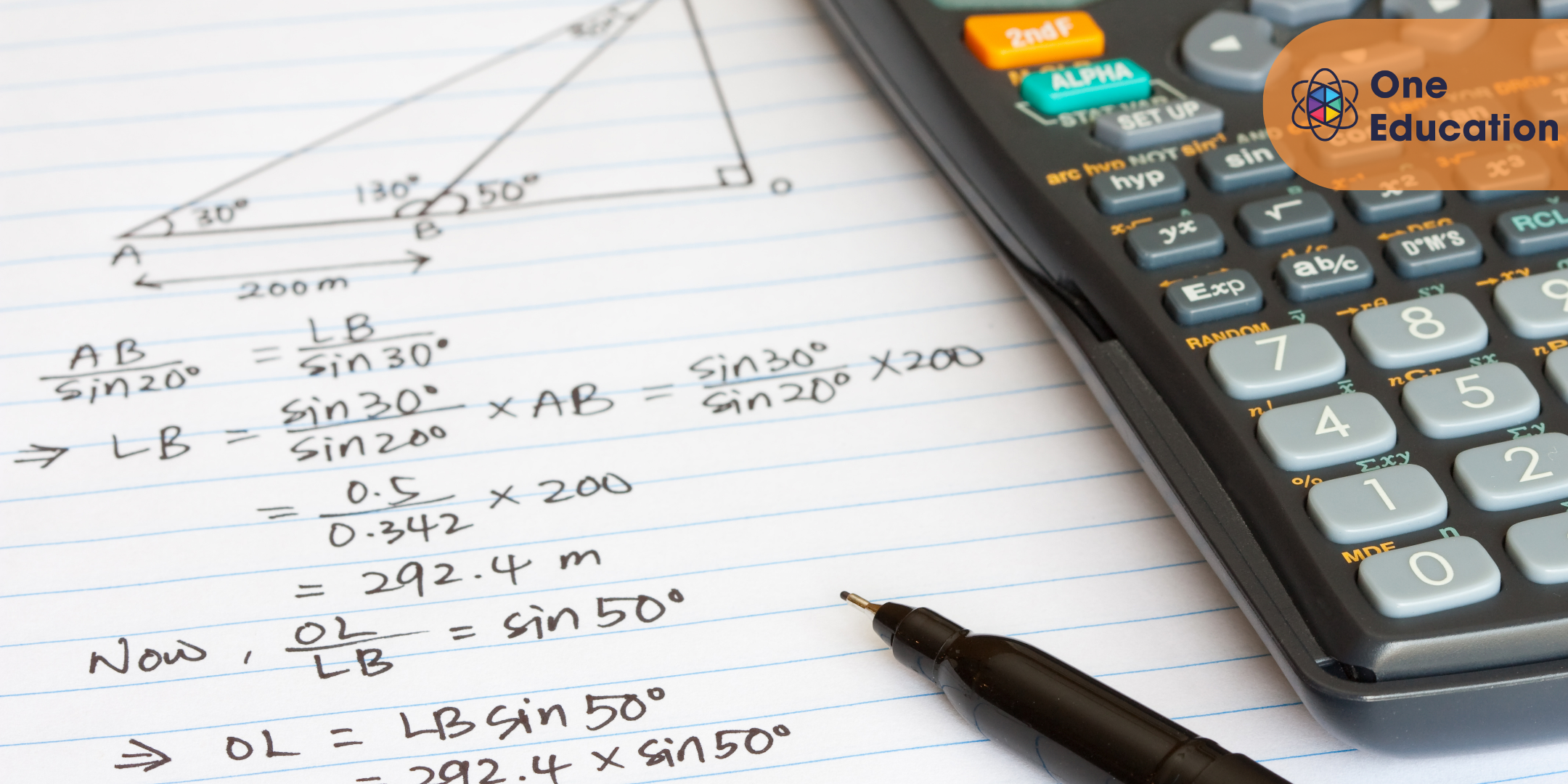

Mathematics Fundamentals - Percentages Course

By One Education

Percentages play a silent yet powerful role in our everyday decisions—whether it’s sorting out discounts, understanding interest rates, or figuring out proportions. The Mathematics Fundamentals - Percentages Course is tailored to help learners grasp the core principles of percentages without any complicated jargon or overwhelming equations. Clear, engaging, and neatly structured, this course takes the mystery out of percentage calculations and turns confusion into confidence. Designed for learners of all levels, this course breaks down the essentials into bite-sized, logical steps—making each concept stick with ease. Whether you're brushing up for exams, sharpening your skills for work, or just trying to finally make sense of supermarket sales, you’ll find this course refreshingly clear. From calculating increase and decrease to working through percentage change and reverse percentages, everything you need is right here—well explained and easy to follow. Learning Outcomes: Develop a foundational understanding of percentages and their applications in math Learn how to calculate percentages of numbers, increase or decrease numbers by percentages, and calculate compound interest Gain confidence in solving percentage problems and applying mathematical concepts Expand your understanding of practical applications of percentages in real-world scenarios Prepare for more advanced math courses or exams that involve percentages The Mathematics Fundamentals - Percentages course is designed to provide learners with a comprehensive understanding of percentages and their applications in math. Through engaging lessons, expert guidance, and a proven curriculum, learners will gain the skills and confidence they need to solve percentage problems. Upon completing this course, learners will have a solid foundation in percentages and be prepared for more advanced math courses or exams. With a focus on developing practical skills in calculating percentages, increasing or decreasing numbers by percentages, and calculating compound interest, this course is the key to unlocking your potential and achieving success in math. Mathematics Fundamentals - Percentages Course Curriculum Introduction Introduction Percentages Lesson 1 - Finding 10% by dividing by 10 Lesson 2 - Dividing by 10 with numbers that don't end in a zero Lesson 3 - Dividing decimals by 10 Lesson 4 - Dividing by 10 with decimals less than 10 Lesson 5 - Dividing by 10 with whole numbers less than 10 Lesson 6 - Dividing pennies by 10 Lesson 7 - Finding 20% of a number Lesson 8 - Practise finding 20% of a number Lesson 9 - Finding 5% of a number Lesson 10 - Practise finding 5% of a number Lesson 11 - Finding 1% of a number Lesson 12 - Practise finding 1% of a number Lesson 13 - Finding 2% of a number Lesson 14 - Finding 50% of a number Lesson 15 - Practise finding 50% of a number Lesson 16 - Finding 25% of a number Lesson 17 - Finding any percentage of any number Lesson 18 - Ways to find different percentages Lesson 19 - Practise finding any percentage of any number Lesson 20 - Practise finding any percentage of any number Lesson 21 - Using a calculator Lesson 22 - Practise using a calculator to find percentages of numbers Lesson 23 - Let's practise Lesson 24 - Let's practise Lesson 25 - Let's practise Lesson 26 - Let's practise Lesson 27 - Let's practise Lesson 28 - Let's practise Lesson 29 - Let's practise Lesson 30 - Let's practise Lesson 31 - Let's practise Lesson 32 - Let's practise Lesson 33 - Increasing a number by a percentage Lesson 34 - Increasing a number by a percentage Lesson 35 - Increasing a number by a percentage Lesson 36 - Increasing a number by a percentage on a calculator Lesson 37 - Increasing a number by a percentage on a calculator Lesson 38 - Increasing a number by a percentage on a calculator Lesson 39 - Decreasing a number by a percentage Lesson 40 - Decreasing a number by a percentage Lesson 41 - Decreasing a number by a percentage Lesson 42 - Decreasing a number by a percentage on a calculator Lesson 43 - Decreasing a number by a percentage on a calculator Lesson 44 - Simple interest and compound interest Lesson 45 - Simple interest and compound interest Lesson 46 - Compound interest formula Lesson 47 - Interest questions Lesson 48 - Interest questions Lesson 49 - Reverse percentages Lesson 50 - Reverse percentages Lesson 51 - Reverse percentages How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of __ GBP. £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK ( An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Students struggling with percentages in their math classes Individuals seeking to improve their math skills for personal or professional reasons Professionals seeking to enhance their math skills in their careers Anyone interested in expanding their understanding of percentages and their applications in math Students preparing for math exams or courses that involve percentages Career path Accountant Financial analyst Statistician Data analyst Economist £20,000 - £70,000+ (depending on career path and experience) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

Microsoft Excel Course for Everyone - Complete Excel Course

By The Teachers Training

Unlock the full potential of Microsoft Excel with our course for everyone. Learn essential skills and advanced techniques to excel in any data-driven role.

Overview The first half of the course will cover all the essential tools of the currency markets – spot FX, forwards, FX swaps and NDFs. We look both at the pricing of these products and also how customers use them. The afternoon session will cover a range of important topics beyond the scope of an elementary course on currency options. We start with a quick review of the key concepts and terminology, and then we look at the key exotics (barriers and digitals) and how they are used to create the most popular customer combinations. We move on to look at the currently most-popular 2nd generation exotics, such as Accumulators, Faders and Target Redemption structures. Who the course is for FX Sales, traders, structurers, quants Financial engineers Risk Managers IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Regulators Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview A 1-day course on inflation-linked bonds and derivatives, focusing on the UK market in particular. We examine how inflation is defined and quantified, the choice of index (RPI vs. CPI), and the most common cash flow structures for index-linked securities. We look in detail at Index-linked Gilts, distinguishing between the old-style and new-style quotation conventions, and how to calculate the implied breakeven rate. Corporate bond market in the UK, and in particular the role of LPI in driving pension fund activity. Inflation swaps and other derivatives, looking at the mechanics, applications and pricing of inflation swaps and caps/floors. The convexity adjustment for Y-o-Y swaps is derived intuitively. Who the course is for Front-office sales Product control Research Traders Risk managers Fund managers Project finance and structured finance practitioners Accountants, auditors, consultants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Unpuzzling finance (In-House)

By The In House Training Company

Finance doesn't have to be a puzzle. And if you want to get anywhere with your career, it had better not be! Whatever your role, you have an impact on the financial wellbeing of the organisation you work for, whether you've got specific financial responsibilities or not. This thoroughly practical, fun and enjoyable one-day workshop will help unpuzzle finance for you. It's an ideal opportunity to master the terminology, get to grips with the concepts, learn how 'the finance department' works and understand the part you play. This course will help participants: Appreciate the role and importance of Finance within organisations Be able to recognise and describe some of the common items and jargon used Identify the elements of the Profit & Loss and the Balance Sheet Understand cashflow Make better decisions Manage budgets 1 Introduction Expectations Terminology Key financial principlesAccrualsConsistencyPrudenceGoing concern 2 The three main financial statements Profit & Loss accountIncomeCost of salesGross profitAdministrative expenses ('overheads')Net profit/(loss) for the financial year (the 'bottom line')P&L format Balance SheetTerminologyFixed AssetsCurrent AssetsCurrent LiabilitiesLong-term LiabilitiesCapitalB/S format Cashflow Statement Financial and management information systems 3 Budgets and forecasts Why budget? Types of budget - incremental or zero-based Budgeting for costs - fixed and variable Budgeting for income An eight point plan for budgeting for your department Case study: Small Brother Ltd Problems and solutions 4 Accruals Accruals - what and why? Prepayments 5 Open forum

Overview A comprehensive and practical 3 days workshop on pricing, using and managing structured interest rate derivatives. What used to be called exotic interest rate derivatives are now commonplace and an essential part of the financial marketplace either as legacy transactions or embedded in new structures. This intensive course is for anyone who wishes to be able to use, price, manage, market or evaluate standard interest rate derivatives such as Constant Maturity Swaps, Range Accruals and Quantos. We also look in detail at such important products as CMS spread-linked structures and volatility/variance swaps, always from a pragmatic practitioner’s perspective. Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers IPV professionals Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now