- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Healthcare Management: Healthcare Management Course Online Healthcare Management: Healthcare Management Course is more than just patient care. The most successful healthcare professionals of today are also well-versed in important business and management concepts. Whether you manage your own practice or manage others in a clinic, department, or nursing floor, you must be able to successfully lead those around you, understand the financial situation, develop budgets, and navigate the regulatory environment. This Healthcare Management: Healthcare Management Course will provide you with the basic concepts of Healthcare Management, and you will gain a thorough understanding of the role of the healthcare manager. You will also develop knowledge of management topics such as finance and business management by completing our Healthcare Management: Healthcare Management course. Main Course: Healthcare Management Training Course Free Courses included with Healthcare Management: Healthcare Management course. Course 01: Level 3 Diploma in Healthcare Support Course 02: Mental Health Support Worker [ Note: Free PDF certificate as soon as completing the Healthcare Management: Healthcare Management Course] Healthcare Management: Healthcare Management Course Online Industry Experts designed this Healthcare Management: Healthcare Management Course into 07 detailed modules. Course Curriculum of Healthcare Management: Healthcare Management Course Module 01: Healthcare Management Module 02: Role of the Healthcare Manager Module 03: Organisational Behaviour and Management Thinking Module 04: Quality Improvement Basics Module 05: The UK Health Systems Module 06: The Health and Care of Older People in England Module 07: Child Health Care Assessment Method of Healthcare Management: Healthcare Management Course After completing Healthcare Management: Healthcare Management Course, you will get quizzes to assess your learning. You will do the later modules upon getting 60% marks on the quiz test. Certification of Healthcare Management: Healthcare Management Course After completing the Healthcare Management: Healthcare Management Course, you can instantly download your certificate for FREE. Who is this course for? Healthcare Management: Healthcare Management Course Online This Healthcare Management: Healthcare Management Course is ideal for a wide range of health and social care practitioners working in statutory, private, voluntary and charitable organisations within the Health & Social care sector. Requirements Healthcare Management: Healthcare Management Course Online To enrol in this Healthcare Management: Healthcare Management Course, students must fulfil the following requirements: Good Command over English language is mandatory to enrol in our Healthcare Management: Healthcare Management Course. Be energetic and self-motivated to complete our Healthcare Management: Healthcare Management Course. Basic computer Skill is required to complete our Healthcare Management: Healthcare Management Course. If you want to enrol in our Healthcare Management: Healthcare Management Course, you must be at least 15 years old. Career path Healthcare Management: Healthcare Management Course Online Completing this Healthcare Management: Healthcare Management Course boosts one’s ability to obtain gainful employment within the health care and medical fields.

Healthcare Management: Healthcare Management Course Online Unlock the Power of Healthcare Management: Healthcare Management Course: Enrol Now! Healthcare is more than just patient care. The most successful healthcare professionals of today are also well-versed in important business and management concepts. Whether you manage your own practice or manage others in a clinic, department, or nursing floor, you must be able to successfully lead those around you, understand the financial situation, develop budgets, and navigate the regulatory environment. This Healthcare Management: Healthcare Management Course will provide you with the basic concepts of Healthcare Management, and you will gain a thorough understanding of the role of the healthcare manager. You will also develop knowledge of management topics such as finance and business management by completing our Healthcare Management: Healthcare Management course. Main Course: Healthcare Management Training Free Courses included with Healthcare Management: Healthcare Management course. Course 01: Healthcare Assistant Course Course 03: Healthcare Support Course [ Note: Free PDF certificate as soon as completing the Healthcare Management: Healthcare Management Course] Healthcare Management: Healthcare Management Course Online Industry Experts designed this Healthcare Management: Healthcare Management Course into 07 detailed modules. Course Curriculum of Healthcare Management: Healthcare Management Course Module 01: Healthcare Management Module 02: Role of the Healthcare Manager Module 03: Organisational Behaviour and Management Thinking Module 04: Quality Improvement Basics Module 05: The UK Health Systems Module 06: The Health and Care of Older People in England Module 07: Child Health Care Assessment Method of Healthcare Management: Healthcare Management Course After completing Healthcare Management: Healthcare Management Course, you will get quizzes to assess your learning. You will do the later modules upon getting 60% marks on the quiz test. Certification of Healthcare Management: Healthcare Management Course After completing the Healthcare Management: Healthcare Management Course, you can instantly download your certificate for FREE. Who is this course for? Healthcare Management: Healthcare Management Course Online This Healthcare Management: Healthcare Management Course is ideal for a wide range of health and social care practitioners working in statutory, private, voluntary and charitable organisations within the Health & Social care sector. Requirements Healthcare Management: Healthcare Management Course Online To enrol in this Healthcare Management: Healthcare Management Course, students must fulfil the following requirements: Good Command over English language is mandatory to enrol in our Healthcare Management: Healthcare Management Course. Be energetic and self-motivated to complete our Healthcare Management: Healthcare Management Course. Basic computer Skill is required to complete our Healthcare Management: Healthcare Management Course. If you want to enrol in our Healthcare Management: Healthcare Management Course, you must be at least 15 years old. Career path Healthcare Management: Healthcare Management Course Online Completing this Healthcare Management: Healthcare Management Course boosts one’s ability to obtain gainful employment within the health care and medical fields.

24-Hour Flash Sale! Prices Reduced Like Never Before!! Do you dream of a career where you build relationships, solve problems, and ensure customer satisfaction? In the UK alone, the customer service industry employs over 5 million people, with a projected growth of 10% by 2026. The "Customer Service, KYC & CRM Training" course bundle is carefully designed to meet this demand, offering a comprehensive curriculum that equips learners with the skills to excel in these crucial areas. This comprehensive course bundle covers six key areas, beginning with foundational training in Customer Service Co-ordination. It advances into specialised KYC compliance for fraud prevention, then dives into CRM for optimising customer relationships, and highlights the significance of a Customer-friendly Environment. Further, it offers expertise in Customer Analytics for behavioural insights and equips learners to combat fraud as Customer Service Fraud Officers. This Customer Service, KYC & CRM Training Bundle Contains 6 of Our Premium Courses for One Discounted Price: Course 01: Diploma in Customer Services Course 02: Diploma in Know Your Customer (KYC) Course 03: Diploma in Customer Relationship Management (CRM) Course 04: Customer Service & Environment Course 05: Customer Analytics Training Taking this course will not only improve your understanding and skills in customer service, KYC, and CRM but also significantly enhance your career prospects. As businesses increasingly recognise the value of customer-centric service models and compliance with regulatory standards, the demand for qualified professionals in these areas is soaring. So enrol now on this training and position yourself as a valuable asset in any customer-focused industry! Why Choose Our Customer Service, KYC & CRM Training Course? Get a chance to order a QLS Endorsed Certificate upon completion of the course Get a Free Student ID Card with this training course The course is Affordable and Simple to understand Lifetime Access to the course materials The course comes with 24/7 Tutor Support So enrol now in this Customer Service, KYC & CRM Training Today to advance your career! Assessment Process of the Customer Service, KYC & CRM Training Once you have completed all the modules on the course, you can assess your computer skills and knowledge with an optional assignment. Our expert will assess your assignment and give you feedback afterwards. Course 01: Customer Services Co-ordinator Training Introduction to Customer Service What's Different about Good Customer Service? Customer Relationship Management Customer Service Communication Strategies Data Analysis in CRM Deepening Customer Relationship Handling Customer Complaints Aspects of Phone Etiquette Know Your Customer (KYC) Customer Due Diligence - CDD Course 02: Know Your Customer (KYC) Introduction to KYC Customer Due Diligence AML (Anti-Money Laundering) KYC, AML and Data Privacy Regulations for Businesses Operations in the United Kingdom Regulations to be Complied by Industries Methods for carrying out KYC and AML and the Future of KYC Compliance Course 03: Customer Relationship Management CRM Fundamentals CRM Strategies Data Analysis in CRM CRM Databases Deepening Customer Relationship Handling Customer Complaints Future of CRM =========>>>>> And 2 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*6 = £78) CPD 170 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this bundle. This bundle is ideal for: Customer Service Executives Compliance officers CRM managers Marketing professionals Fraud analysts Requirements You will not need any prior background or expertise to enrol in this Customer Service, KYC & CRM Training Course. Career path After completing this bundle, you are to start your career or begin the next phase of your career. Customer Service Manager - £30,000 to £50,000 KYC Analyst - £25,000 to £40,000 CRM Specialist - £30,000 to £45,000 Customer Insights Analyst - £35,000 to £55,000 Fraud Prevention Specialist - £28,000 to £45,000 Customer Experience Manager - £32,000 to £60,000 Certificates CPD Accredited Digital Certificate Digital certificate - Included Upon passing the Course, you need to order a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPD QS for Free CPD Accredited Hard Copy Certificate Hard copy certificate - £29 CPD Accredited Certificate 29 GBP for Printed Hardcopy Certificate inside the UK 39 GBP for Printed Hardcopy Certificate outside the UK (international delivery) Customer Services Co-ordinator Training at QLS Level 4 Hard copy certificate - £99 After successfully completing the Diploma in Customer Services Co-ordinator Training at QLS Level 4 course, you can order an original hardcopy certificate of achievement endorsed by the Quality Licence Scheme. The certificate will be home-delivered, with a pricing scheme of - 99 GBP inside the UK 109 GBP (including postal fees) for international delivery

Start learning Forex Trading Course: Basic Analysis of Trade that will give you enough knowledge and skills to build your dream career. About this course This Forex Trading Course: Basic Analysis of Trade helps to grow your skills faster through the power of relevant content and world-class tutors. In this industry-leading bite-sized course, you will learn up-to-date knowledge in the relevant field within a few hours and get certified immediately. The modules of this course are very easy to understand and all of the topics are split into different sections. You will easily grasp and use the knowledge gained from this course in your career and go one step ahead of your competitors. The course is designed to improve your employability and provide you with the tools you need to succeed. Enrol today and start learning your essential skills. Why choose this course Earn a digital Certificate upon successful completion. Accessible, informative modules taught by expert instructors Study in your own time, at your own pace, through your computer tablet or mobile device Get 24/7 help or advice from our email and live chat teams Get full tutor support on weekdays (Monday to Friday) Course Design The Forex Trading Course: Basic Analysis of Trade is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Who Is This Course For:â This Forex Trading Course: Basic Analysis of Trade is ideal for those who want to be skilled in this field or who wish to learn a new skill to build their dream career. If you want to gain extensive knowledge, potential experience, and be an expert in the related field then this is a great course for you to grow your career. Requirements This course is for anyone who would like to learn Forex Trading Course: Basic Analysis of Trade related skills to aid his/her career path. No formal entry prerequisites are required Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Course Content Module 01: An Overview of Forex Trading Module 02: Major Exchange and Currencies Module 03: The Different Types of Foreign Exchange Markets Module 04: Forex Trading Fundamental Analysis Course Content Forex Trading Fundamentals Module 01: An Overview of Forex Trading 00:11:00 Module 02: Major Exchange and Currencies 00:10:00 Module 03: The Different Types of Foreign Exchange Markets 00:11:00 Module 04: Forex Trading Fundamental Analysis 00:17:00 Order your Certificates & Transcripts Order your Certificates & Transcripts 00:00:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

The Import Officer Essentials Course is designed to equip you with the fundamental knowledge and understanding required to confidently manage import and export operations. Covering everything from the basics of international trade to the complexities of logistics and supply chain management, this course provides a clear roadmap for handling the critical elements of importing goods. You will explore topics such as sourcing and procurement, marketing strategies, and documentation procedures, all crucial for a smooth and efficient import process. This course also delves into pricing, payment methods, and shipping procedures, ensuring you grasp the financial and operational aspects involved. Additionally, it covers key areas like supplier relationship management and negotiation techniques to enhance your ability to maintain strong partnerships and secure favourable terms. Perfectly tailored for those aiming to understand the import sector without the need for physical attendance, this course delivers valuable insights through a fully online format, making it an excellent choice for busy professionals and newcomers alike. Key Benefits Accredited by CPD Instant e-certificate Fully online, interactive course Self-paced learning and laptop, tablet, smartphone-friendly 24/7 Learning Assistance Curriculum Module 01: Introduction to Import Export Module 02: Organising the Import Export Operation Module 03: Products for Your Import Export Business Module 04: Sourcing, Purchasing, and Procurement Module 05: Target the Marketing and Find Your Customers Module 06: Introduction to Logistic Management Module 07: Planning Framework for Logistics Module 08: Searching, Marketing, and Distribution Module 09: Documentation and Supply Chain Management Module 10: Pricing, Payment and Shipping Procedure Module 11: Necessary Tools for Trading Module 12: Channels of Distribution Module 13: Supplier Relationship Management Module 14: Negotiation Techniques Course Assessment You will immediately be given access to a specifically crafted MCQ test upon completing an online module. For each test, the pass mark will be set to 60%. Certificate Once you've successfully completed your course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our certifications have no expiry dates, although we do recommend that you renew them every 12 months. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Import Officer Essentials training is ideal for highly motivated individuals or teams who want to enhance their skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Learn the essential skills and knowledge you need to excel in your professional life with the help & guidance from our Import Officer Essentials training. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included

The Commercial Manager Training Course offers a detailed exploration of the essential principles and practices that underpin effective commercial management. Designed to provide a solid foundation, this course covers critical areas such as managing commercial relationships, partnerships, budget and cash flow oversight, and negotiation techniques. Each module is crafted to enhance understanding of how to navigate the complexities of commercial projects, from risk management to customer lifecycle strategies, ensuring participants gain a well-rounded perspective on managing commercial operations successfully. This course also delves into the roles of shareholders, loans and debt management, and the key legislations influencing commercial activities. With a focus on strategic thinking and decision-making, the training equips learners with the knowledge to foster productive business relationships and optimise financial performance. Ideal for professionals aiming to deepen their commercial acumen, this course provides valuable insights through a structured and engaging curriculum, all delivered in an accessible online format. Whether you are looking to refine your skills or broaden your understanding, this course is tailored to support your professional growth in the commercial sector. Key Benefits Accredited by CPD Instant e-certificate Fully online, interactive course Self-paced learning and laptop, tablet, smartphone-friendly 24/7 Learning Assistance Curriculum Module 01: Introduction to Commercial Management Module 02: Commercial Relationship Part-1 Module 03: Commercial Relationship Part-2 Module 04: Partnership and Agreements Module 05: Budget Management Module 06: Cash Flow Management Part- 1 Module 07: Cash Flow Management Part- 2 Module 08: Negotiation Module 09: Commercial Risk Management Module 10: Commercial Project Management Module 11: Customer Relationship Management (CRM) Part-1 Module 12: Customer Relationship Management (CRM) Part-2 Module 13: Managing Customer Lifecycle Module 14: Roles of Shareholders in Commercial Management Module 15: Loans and Debts Management Module 16: Commercial Legislations Course Assessment You will immediately be given access to a specifically crafted MCQ test upon completing an online module. For each test, the pass mark will be set to 60%. Certificate Once you've successfully completed your course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our certifications have no expiry dates, although we do recommend that you renew them every 12 months. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Commercial Manager training is ideal for highly motivated individuals or teams who want to enhance their skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Learn the essential skills and knowledge you need to excel in your professional life with the help & guidance from our Commercial Manager training. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included

Master the art of private investigation with the Private Investigator Level 3 Diploma. This comprehensive course equips you with crucial skills such as interviewing, criminal psychology, surveillance, and business management, ensuring you have the expertise for a successful career in the field.

Tableau Desktop Training - Analyst

By Tableau Training Uk

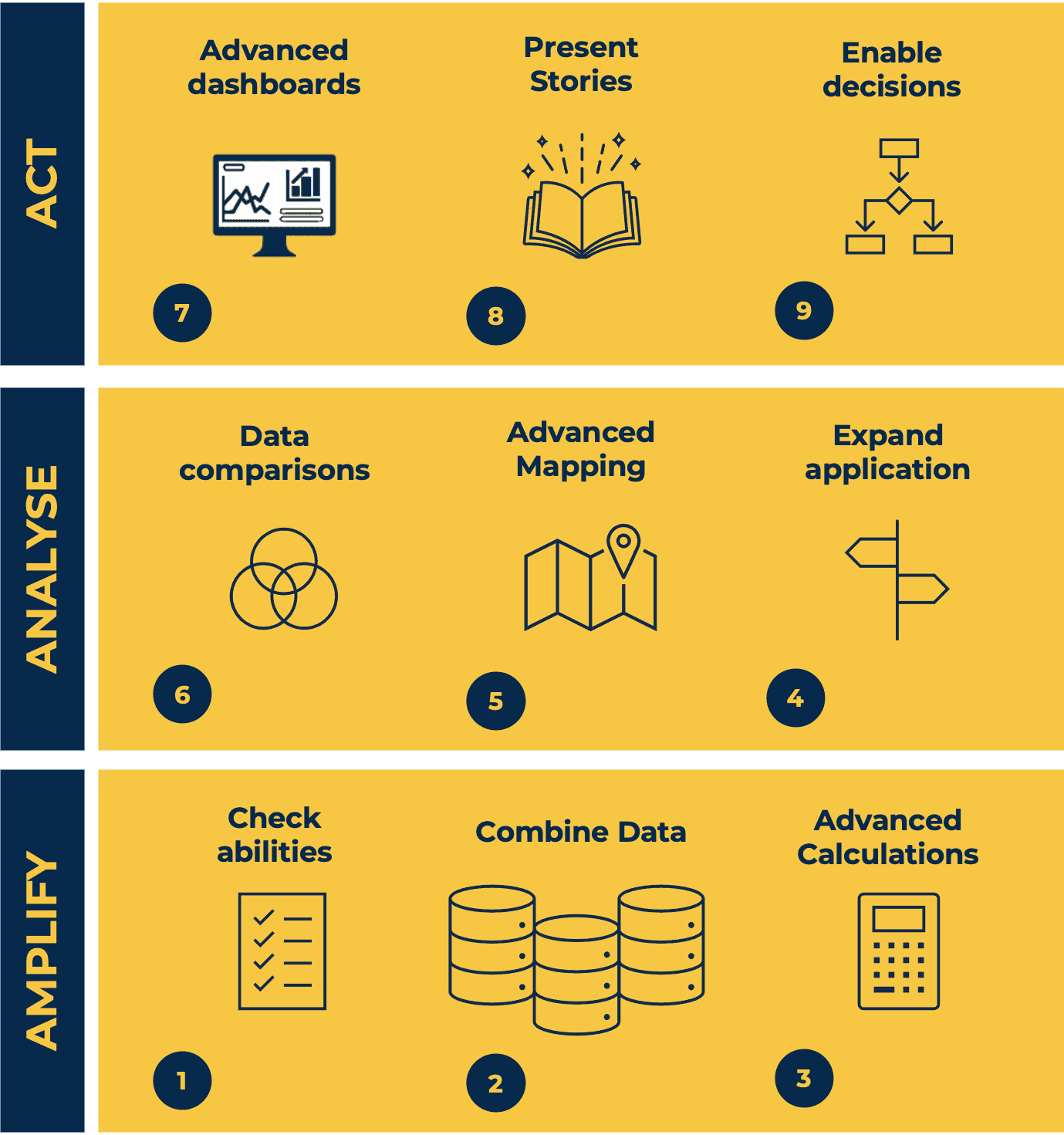

This Tableau Desktop Training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. For Private options, online or in-person, please send us details of your requirements: This Tableau Desktop training intermediate course is designed for the professional who has a solid foundation with Tableau and is looking to take it to the next level. Attendees should have a good understanding of the fundamental concepts of building Tableau worksheets and dashboards typically achieved from having attended our Tableau Desktop Foundation Course. At the end of this course you will be able to communicate insights more effectively, enabling your organisation to make better decisions, quickly. The Tableau Desktop Analyst training course is aimed at people who are used to working with MS Excel or other Business Intelligence tools and who have preferably been using Tableau already for basic reporting. The course is split into 3 phases and 9 modules: Phase 1: AMPLIFY MODULE 1: CHECK ABILITIES Revision – What I Should Know What is possibleHow does Tableau deal with dataKnow your way aroundHow do we format chartsHow Tableau deals with datesCharts that compare multiple measuresCreating Tables MODULE 2: COMBINE DATA Relationships Joining Tables – Join Types, Joining tables within the same database, cross database joins, join calculations Blending – How to create a blend with common fields, Custom defined Field relationships and mismatched element names, Calculated fields in blended data sources Unions – Manual Unions and mismatched columns, Wildcard unions Data Extracts – Creating & Editing Data extracts MODULE 3: ADVANCED CALCULATIONS Row Level v Aggregations Aggregating dimensions in calculations Changing the Level of Detail (LOD) of calculations – What, Why, How Adding Table Calculations Phase 2: ANALYSE MODULE 4: EXPAND APPLICATION Making things dynamic with parameters Sets Trend Lines How do we format charts Forecasting MODULE 5: ADVANCED MAPPING Using your own images for spatial analysis Mapping with Spatial files MODULE 6: DATA COMPARISONS Advanced Charts Bar in Bar charts Bullet graphs Creating Bins and Histograms Creating a Box & Whisker plot Phase 3: ACT MODULE 7: ADVANCED DASHBOARDS Using the dashboard interface and Device layout Dashboard Actions and Viz In tooltips Horizontal & Vertical containers Navigate between dashboards MODULE 8: PRESENT STORIES Telling data driven stories MODULE 9: ENABLE DECISIONS What is Tableau Server Publishing & Permissions How can your users engage with content This training course includes over 25 hands-on exercises and quizzes to help participants “learn by doing” and to assist group discussions around real-life use cases. Each attendee receives a login to our extensive training portal which covers the theory, practical applications and use cases, exercises, solutions and quizzes in both written and video format. Students must bring their own laptop with an active version of Tableau Desktop 2018.2 (or later) pre-installed. What People Are Saying About This Course “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium “Steve not only provided a comprehensive explanation of the content of the course, but also allowed time for discussing particular business issues that participants may be facing. That was really useful as part of my learning process.”Juan C., Financial Conduct Authority “Course was fantastic, and completely relevant to the work I am doing with Tableau. I particularly liked Steve’s method of teaching and how he applied the course material to ‘real-life’ use-cases.”Richard W., Dashboard Consulting Ltd “This course was extremely useful and excellent value. It helped me formalise my learning and I have taken a lot of useful tips away which will help me in everyday work.” Lauren M., Baillie Gifford “I would definitely recommend taking this course if you have a working knowledge of Tableau. Even the little tips Steve explains will make using Tableau a lot easier. Looking forward to putting what I’ve learned into practice.”Aron F., Grove & Dean “Steve is an excellent teacher and has a vast knowledge of Tableau. I learned a huge amount over the two days that I can immediately apply at work.”John B., Mporium

Overview This comprehensive course on Know Your Customer will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Know Your Customer comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Know Your Customer. It is available to all students, of all academic backgrounds. Requirements Our Know Your Customer is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 5 sections • 5 lectures • 01:28:00 total length •Introduction to KYC: 00:20:00 •AML (Anti-Money Laundering): 00:16:00 •KYC, AML, and Data Privacy Regulations in the United Kingdom: 00:16:00 •Industry Regulations: 00:19:00 •KYC and AML Methods and the Future of KYC Compliance: 00:17:00

Overview This comprehensive course on Know Your Customer (KYC) will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Know Your Customer (KYC) comes with accredited certification which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is this course for? There is no experience or previous qualifications required for enrolment on this Know Your Customer (KYC). It is available to all students, of all academic backgrounds. Requirements Our Know Your Customer (KYC) is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible on tablets and smartphones so you can access your course on wifi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career path Having these various qualifications will increase the value in your CV and open you up to multiple sectors such as Business & Management, Admin, Accountancy & Finance, Secretarial & PA, Teaching & Mentoring etc. Course Curriculum 7 sections • 7 lectures • 02:17:00 total length •Introduction to KYC: 00:31:00 •Customer Due Diligence: 00:21:00 •AML (Anti-Money Laundering): 00:31:00 •KYC, AML, and Data Privacy Regulations for Businesses Operation in the UK: 00:21:00 •Regulations to Be Complied by Industries: 00:20:00 •Methods for Carrying out KYC and AML and the Future of KYC Compliance: 00:13:00 •Assignment - Know Your Customer (KYC): 2 days