- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Description: Retirement and succession planning is the management of filling the gap when a valuable employee retires. Retired workers or employers in your company can only be replaced with someone who has the same skills and knowledge. Companies and professionals who train their successor will not only help in filling the skills gap; it will also help in avoiding unstable future of business. If you want to know more about retirement and succession planning, then you don't have to worry about finding another source, this course will provide you everything you need to learn. Who is the course for? Professionals who help people decide their retirement plans. People who have an interest in their retirement plans. Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognized accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: The Retirement and Succession Planning Course is a useful qualification to possess, and would be beneficial for the following careers: Career Guide Counsellor Financial Adviser Financial Consultant Investment Planner Retirement Consultant. Retirement Planning Financial Planning And Planning For Retirement 00:15:00 Diversity Is Key In Retirement Planning 01:00:00 Financial Future And Planning For Retirement 00:15:00 IRA vs. 401 (k) 01:00:00 Long Term Retirement Planning 00:15:00 Planning Your Financial Retirement 01:00:00 Properly Planning For Financial Retirement 01:00:00 Property Investment For Retirement 01:00:00 Retirement Planning : How Long Do You Expect To Live 01:00:00 Keys Considerations When Planning For Financial Retirement 01:00:00 Types Of Retirement Plans 01:00:00 What Are Iras? 01:00:00 What Is A 401(K)? 01:00:00 Why A Financial Advisor? 01:00:00 Importance Of Planning For Retirement 00:30:00 A Financial Planner May Be Your Best Gift To Yourself 00:15:00 Common 401(k) Mistakes 00:30:00 Consolidation Or Multiple Accounts 00:30:00 Dealing With Alzheimer's 01:00:00 Find Senior Independent Living Peoples Near You 00:15:00 Importance Of Life Insurance For Financial Retirement Planning 00:30:00 Investing In Bonds 00:30:00 Long Term Care Options 00:30:00 Manage Your Money In Financial Retirement 00:15:00 Retirement Planning And Savings Plans 01:00:00 Retirement Isn't For Everybody 00:30:00 Roth Iras For Financial Retirement 00:30:00 The Future Of Senior Living And Assisted Living 01:00:00 Thinks To Consider When Considering A 401(K) 01:00:00 Perfect Time For Retirement 00:30:00 Succession Planning Module One - Getting Started 01:00:00 Module Two - Succession Planning Vs. Replacement Planning 01:00:00 Module Three - Preparing for the Planning Process 01:00:00 Module Four - Initiating Process 01:00:00 Module Five - The SWOT Analysis 01:00:00 Module Six - Developing the Succession Plan 01:00:00 Module Seven - Executing the Plan 01:00:00 Module Eight - Gaining Support 01:00:00 Module Nine - Managing the Change 01:00:00 Module Ten - Overcoming Roadblocks 01:00:00 Module Eleven - Reaching the End 01:00:00 Module Twelve - Wrapping Up 01:00:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents and interests with our special Improve your Financial Intelligence Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides professional training that employers are looking for in today's workplaces. The Improve your Financial Intelligence Course is one of the most prestigious training offered at StudyHub and is highly valued by employers for good reason. This Improve your Financial Intelligence Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Improve your Financial Intelligence Course, like every one of Study Hub's courses, is meticulously developed and well researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At StudyHub, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from StudyHub, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Improve your Financial Intelligence? Unlimited access to the course for forever Digital Certificate, Transcript, student ID all included in the price Absolutely no hidden fees Directly receive CPD accredited qualifications after course completion Receive one to one assistance on every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Improve your Financial Intelligence there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for £5.99. Original Hard Copy certificates need to be ordered at an additional cost of £9.60. Who is this course for? This Improve your Financial Intelligence course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skill. Prerequisites This Improve your Financial Intelligence does not require you to have any prior qualifications or experience. You can just enrol and start learning.This Improve your Financial Intelligence was made by professionals and it is compatible with all PC's, Mac's, tablets and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as bonus, you will be able to pursue multiple occupations. This Improve your Financial Intelligence is a great way for you to gain multiple skills from the comfort of your home. Course Curriculum Section 01: Introduction Introduction - Don't be Afraid 00:04:00 Section 02: The Three Key Financial Statements Key Financial Statements - Introduction 00:01:00 The Balance Sheet - Introduction 00:03:00 The Balance Sheet - Assets, Liabilities, Owners Equity 00:04:00 The Balance Sheet - How it relates to you 00:06:00 The Income Statement - Introduction 00:04:00 The Income Statement - How it relates to you 00:03:00 The Cashflow Statement - Introduction 00:04:00 The Cashflow Statement - How it relates to you 00:01:00 Key Financial Statements - Summary 00:01:00 Section 03: Ratio Analysis The Money Making Metrics 00:03:00 Ratio Analysis 00:02:00 Profitability Ratios 00:03:00 Operating Ratios 00:02:00 Liquidity and Leverage Ratios 00:03:00 How Ratio Analysis Impacts you 00:03:00 Section 04: Profit vs Cash Profit â Cash 00:03:00 Profit but No Cash 00:04:00 Cash but no Profit 00:05:00 Why understanding the Cashflow statement matters 00:04:00 Section 05: Managing Working Capital Managing Days Sales Outstanding 00:04:00 Managing Inventory 00:03:00 Working Capital - Case Study 00:05:00 Section 06: Return on Investments Return on Investments 00:04:00 Return on Investments - Calculations 00:04:00 Section 07: A broader Perspective Five Traps 00:04:00 Section 08: How much have you learned Course Completion 00:01:00

MB-800T00 Microsoft Dynamics 365 Business Central Functional Consultant

By Nexus Human

Duration 4 Days 24 CPD hours This course is intended for A Dynamics 365 Business Central core Functional Consultant is responsible for implementing core application setup processes for small and medium businesses. Overview Understand use cases for Business Central modules Set up Business Central Configure Financials Configure Sales and Purchasing Configure Operations Understand Integrationa nd Automation scenarios Built and optimized for small and medium businesses, Dynamics 365 Business Central is an application for companies that have outgrown their entry-level business applications. Growing businesses often outgrow their basic accounting software or legacy enterprise resource planning (ERP) systems that are unable to handle increased inventory and transactions, lack integration with other line-of-business systems, and have reporting limitations. Businesses are also challenged with the logistics of providing services that have more scalability, increased mobility, and availability in the cloud. With Business Central, you can manage your financials, automate and secure your supply chain, sell smarter, improve customer service and project performance, and optimize your operations. Introduction to Business Central Modules Introduction to Business Central Technology overview Navigate the user interface Master data for the Sales and Purchase process Application Setup Create and configure a new company Migrate data to Business Central Manage Security Set up core app functionality Set up dimensions Configure Financials Set up Finance Management Set up the Chart of Accounts Set up posting groups General Journals Set up Cash Management Set up Accounts Payables Set up Accounts Receivables Configure Sales and Purchasing Set up Inventory Configure prices and discounts Operations Purchase items Sell items Process financial transactions Inventory costing Integration and Automation Set up and use approvals with workflows Connect Power Apps Connect Power Automate Connect Power BI

Level 5 Diploma in Microsoft Excel Course for All (QLS Endorsed)

4.7(47)By Academy for Health and Fitness

24-Hour Knowledge Knockdown! Prices Reduced Like Never Before Did you know that in the UK, 80% of businesses use spreadsheets according to a recent study? Spreadsheets are a fundamental part of many businesses, but are you getting the most out of them? Proficiency in Excel is a highly sought-after skill in the UK. The average salary for an Excel expert can reach £50,000 and there's a consistent demand for qualified candidates across various industries.This comprehensive Microsoft Excel bundle can help you unlock the full potential of this powerful tool and take your career to the next level. With a single payment, you will gain access to Microsoft Excel course, including 10 premium courses, a QLS Endorsed Hardcopy certificate (for the title course) and 11 PDF certificates for Absolutely free. This Microsoft Excel Bundle Package includes: Main Course : Diploma in Complete Excel Course for All at QLS Level 5 10 Additional CPD Accredited Premium Courses related to Microsoft Excel: Course 01: Ultimate Microsoft Excel For Business Bootcamp Course 02: Business Data Analysis Course 03: Financial Modelling Using Excel Course 04: Microsoft Excel - Beginner, Intermediate & Advanced Course 05: Microsoft Excel Training: Depreciation Accounting Course 06: New Functions in Microsoft Excel Course 07: Excel: Top 50 Microsoft Excel Formulas in 50 Minutes! Course 08: Microsoft Excel - 25 Must-Know Formulas and Functions Course 09: Microsoft Excel: Automated Dashboard Using Advanced Formula, VBA, Power Query Course 10: Microsoft Excel: Excel Sheet Comparison with VBA This Microsoft Excel course bundle is designed to take you from complete beginner to advanced user. You'll learn all the essential skills you need to manage data effectively, create impactful charts and graphs, and use formulas and functions to automate complex tasks. Whether you're looking to improve your financial modelling skills, build dynamic dashboards, or simply become more efficient with everyday spreadsheet tasks, this bundle has a course for you. Learning Outcomes of Microsoft Excel Master essential formulas and functions for data manipulation and analysis. Create dynamic charts and graphs to present data insights effectively. Automate tasks and workflows using advanced Excel features. Build interactive dashboards to monitor key performance indicators (KPIs). Learn best practices for data cleaning, organisation, and presentation. Explore VBA programming to further customise your spreadsheets. Invest in your future and enrol now to unlock exciting career possibilities with the power of Microsoft Excel! Why Choose Our Microsoft Excel Bundle? Get a Free QLS Endorsed Certificate upon completion of Microsoft Excel Get a free student ID card with Microsoft Excel Training The Microsoft Excel is affordable and simple to understand The Microsoft Excel is an entirely online, interactive lesson with voiceover audio Lifetime access to the Microsoft Excel course materials The Microsoft Excel comes with 24/7 tutor support Start your learning journey straightaway! *** Course Curriculum *** Main Course : Diploma in Complete Excel Course for All at QLS Level 5 Section 01: Getting Started Section 02: Excel Basics Section 03: Excel Essential Functions Section 04: XLookup Only For Excel 2021 And Office 365 Section 05: Get Data And Tools Section 06: Formatting Data And Tables Section 07: Pivot Tables Section 08: Excel Charts Section 09: Advanced Excel Charts Section 10: Pivot Charts and much more... Course 01: Ultimate Microsoft Excel For Business Bootcamp Microsoft Excel 2019 New Features Getting Started With Microsoft Office Excel Performing Calculations Modifying A Worksheet Formatting A Worksheet Printing Workbooks Managing Workbooks Working With Functions Working With Lists Analyzing Data and much more... Course 02: Business Data Analysis Module 01: Introduction To Business Analysis Module 02: Business Environment Module 03: Business Processes Module 04: Business Analysis Planning And Monitoring Module 05: Strategic Analysis And Product Scope Module 06: Solution Evaluation Module 07: Investigation Techniques Module 08: Ratio Analysis Module 09: Stakeholder Analysis And Management Module 10: Process Improvement With Gap Analysis and much more... =========>>>>> And 8 More Courses <<<<<========= How will I get my Certificate? After successfully completing the course, you will be able to order your QLS Endorsed Certificates and CPD Accredited Certificates as proof of your achievement. PDF Certificate: Free (Previously it was £12.99*11 = £143) QLS Endorsed Hard Copy Certificate: Free (For The Title Course: Previously it was £119) CPD 255 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone interested in learning more about the topic is advised to take this Microsoft Excel Training course. This course is ideal for:. Beginners Intermediate Users Advanced Users Data Analysts Business Professionals Anyone who wants to excel in Excel! Requirements You will not need any prior background or expertise to enrol in this Microsoft Excel bundle. Career path After completing this Microsoft Excel bundle, you are to start your career or begin the next phase of your career. Data Analyst Business Analyst Financial Analyst Project Manager Accountant Entrepreneur Certificates CPD QS Accredited PDF Certificate Digital certificate - Included Diploma in Complete Excel Course for All at QLS Level 5 Hard copy certificate - Included

Explore endless possibilities and achieve tangible results with our wide range of online courses, prepared to suit every interest and skill level. Each course is thoughtfully designed for flexibility and useful application, ensuring you can learn and grow at your own pace from anywhere and transform your talents to accomplish your goals. Whether you're advancing your career, pursuing a passion, or seeking new opportunities, our courses will assist you in reaching your goals. Join us today and take the next step in your personal and professional journey with confidence and convenience. Start shaping your future now. This 20-in-1 Ultimate Excel Beginner to Advanced bundle consists of the following Courses: Course 01: MS Word Diploma Course 02: Proofreading & Copyediting Course 03: PowerPoint Diploma Course 04: Microsoft Excel Level 3 Course 05: New Functions in Microsoft Excel 2021 Course 06: Microsoft Excel: Automated Dashboard Using Advanced Formula, VBA, Power Query Course 07: Microsoft Excel: Excel Sheet Comparison with VBA Course 08: Microsoft Excel: Master Power Query in 120 Minutes! Course 09: Excel: Top 50 Microsoft Excel Formulas in 50 Minutes! Course 10: Excel Pivot Tables Course 11: Data Analysis in Microsoft Excel Complete Training Course 12: Excel Must Know Formulas and Functions Course 13: Excel spreadsheet for Beginner Course 14: Excel Data Analysis Course 15: Excel Vlookup, Xlookup, Match and Index Course 16: Excel Pivot Tables, Pivot Charts, Slicers, and Timelines Course 17: PowerBI Formulas Course 18: Outlook Tips and Tricks Course 19: Excel PowerQuery and PowerPivot Course 20: Complete Microsoft Power BI 2021 Additionally, you will get 5 other career-guided courses in this Excel Beginner to Advanced bundle: Course 01: Career Development Plan Fundamentals Course 02: CV Writing and Job Searching Course 03: Interview Skills: Ace the Interview Course 04: Video Job Interview for Job Seekers Course 05: Create a Professional LinkedIn Profile So, stop scrolling down and procure the skills and aptitude with Apex Learning to outshine all your peers by enrolling in this Excel Beginner to Advanced bundle. Learning Outcomes of Excel Beginner to Advanced Bundle This career-oriented bundle will help you to Gain the ability to excel in the role of Excel Beginner to Advanced Know your responsibilities as Excel Beginner to Advanced and convey your experience to others Gain excellent interpersonal and communication skills Know the pros and cons of working as Excel Beginner to Advanced Adhere to the regulations around this area Gain time and risk management skills to ensure efficiency Manipulate technological advancement to become more effective Maintain moral standards and set an example for your peers CPD 250 CPD hours/points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Excel Beginner to Advanced bundle. Requirements This Excel Beginner to Advanced course has been designed to be fully compatible with tablets and smartphones. Career path Having this expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the hard copy certificate for the title course (MS Word Diploma) for absolutely free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

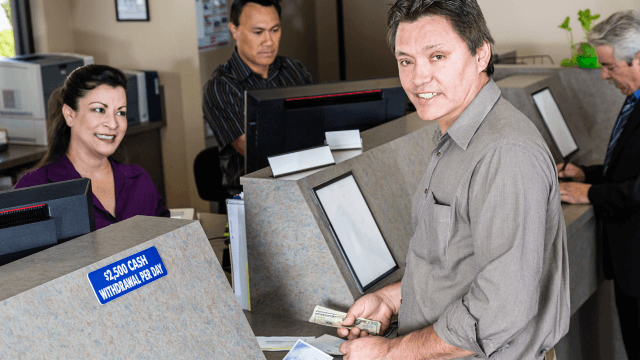

Bank Teller

By SkillWise

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents, and interests with our special Bank Teller Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides the professional training that employers are looking for in today's workplaces. The Bank Teller Course is one of the most prestigious training offered at Skillwise and is highly valued by employers for good reason. This Bank Teller Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Bank Teller Course, like every one of Study Hub's courses, is meticulously developed and well-researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At Skillwise, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from Skillwise, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Bank Teller? Unlimited access to the course forever Digital Certificate, Transcript, and student ID are all included in the price Absolutely no hidden fees Directly receive CPD-accredited qualifications after course completion Receive one-to-one assistance every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Bank Teller there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This Bank Teller course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skills. Prerequisites This Bank Teller does not require you to have any prior qualifications or experience. You can just enroll and start learning. This Bank Teller was made by professionals and it is compatible with all PCs, Macs, tablets, and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as a bonus, you will be able to pursue multiple occupations. This Bank Teller is a great way for you to gain multiple skills from the comfort of your home. Module 1 Introduction to a Bank Teller Introduction to a Bank Teller 00:09:00 Module 2 Skills and Abilities of a Bank Teller Skills and Abilities of a Bank Teller 00:10:00 Module 3 Types of Bank Accounts and Opening Them Types of Bank Accounts and Opening Them 00:16:00 Module 4 Mathematics Calculation for Bank Tellers Mathematics Calculation for Bank Tellers 00:12:00 Module 5 Bookkeeping Guideline and Payment Methods Bookkeeping Guideline and Payment Methods 00:17:00 Module 6 Cash Sorting in an Efficient Way Cash Sorting in an Efficient Way 00:08:00 Module 7 How to Identify Counterfeit How to Identify Counterfeit 00:08:00 Module 8 Function and Benefits of Currency Recyclers Function and Benefits of Currency Recyclers 00:10:00 Module 9 Dealing with Frauds Dealing with Frauds 00:15:00 Module 10 Safety Precautions for ATM (Automated Teller Machine) Safety Precautions for ATM (Automated Teller Machine) 00:16:00 Module 11 Customer Services a Bank Teller Can Offer Customer Services a Bank Teller Can Offer 00:14:00 Module 12 Rights and Obligations According to the UK Law Rights and Obligations According to the UK Law 00:07:00 Module 13 Ethical Issues for a Bank Teller Ethical Issues for a Bank Teller 00:07:00

Airport Management - Level 5

By Training Tale

**Airport Management - Level 5** Airport Managers are essential parts of any airport and are tasked with ensuring the maintenance of terminals, runways, and other buildings, as well as ensuring that everything within the airport is up to standard. The role of an airport manager is huge, and there is a high demand for airport managers. This Airport Management - Level 5 course will provide you with all of the essential skills to become an effective airport manager. Through this Airport Management - Level 5 course, you will learn about the latest international and national aviation law and regulations. The course teaches you how to meet the unique and dynamic demands of today's global airport management environment. You will learn how to respond quickly and decisively to an emergency and demonstrate the passenger boarding system procedures. The course also includes airport facilities, the importance of airport safety, how the airport plays an important role in the air transportation system, and other important airport related issues. This Airport Management - Level 5 can help you achieve your goals and prepare you for a rewarding career. So, enrol in our Level 5 Diploma in Airport Management course today and equip yourself with the essential skills to set yourself up for success! Learning Outcomes After completing this Airport Management - Level 5 course, learner will be able to: Gain a thorough understanding of Aviation Law and Regulation Gain a solid understanding of Aviation Economics and Forecasting Gain in-depth knowledge about Airfield Design, Configuration and Management Understand Airport Systems Planning and Design Understand Airport Management and Performance Understand Airport-Airline Relationship Understand Airline Business Models Understand Airline Pricing Strategies Understand Airline Scheduling and Disruption Management Understand Airline Passengers Understand Aviation Safety and Security Understand Airspace and Air Traffic Management Understand Air Cargo and Logistics Understand Airlines, Information Communication Technology and Social Media Understand Human Resource Management and Industrial Relations Understand Air Transport Marketing Understand Air Transport in Remote Regions Why Choose Airport Management - Level 5 Course from Us Self-paced course, access available from anywhere. Easy to understand, high-quality study materials. Airport Management Course developed by industry experts. MCQ quiz after each module to assess your learning. Automated and instant assessment results. 24/7 support via live chat, phone call or email. Free PDF certificate as soon as completing the course. ***Others Benefits of this Course Free One PDF Certificate Lifetime Access Unlimited Retake Exam Tutor Support [ Note: Free PDF certificate will provide as soon as completing the Airport Management - Level 5 course] Detailed Course Curriculum *** Airport Management - Level 5 *** Module 01: Aviation Law and Regulation Module 02: Aviation Economics and Forecasting Module 03: Airfield Design, Configuration and Management Module 04: Airport Systems Planning and Design Module 05: Airport Management and Performance Module 06: The Airport-Airline Relationship Module 07: Airline Business Models Module 08: Airline Pricing Strategies Module 09: Airline Passengers Module 10: Airline Scheduling and Disruption Management Module 11: Airline Finance Module 12: Aviation Safety and Security Module 13: Airspace and Air Traffic Management Module 14: Aircraft Manufacturing and Technology Module 15: Air Cargo and Logistics Module 16: Airlines, Information Communication Technology and Social Media Module 17: Environmental Impacts and Mitigation Module 18: Human Resource Management and Industrial Relations Module 19: Air Transport Marketing Module 20: Air Transport in Remote Regions Assessment Method After completing each module of the Manual Handling Course, you will find automated MCQ quizzes. To unlock the next module, you need to complete the quiz task and get at least 60% marks. Certification After completing the MCQ/Assignment assessment for this course, you will be entitled to a Certificate of Completion from Training Tale. The certificate is in PDF format, which is completely free to download. A printed version is also available upon request. It will also be sent to you through a courier for £13.99. Who is this course for? **Airport Management - Level 5** The Airport Management - Level 5 Course is ideal for anyone interested in pursuing a career in airport management. Requirements **Airport Management - Level 5** There are no specific requirements for Airport Management - Level 5 course because it does not require any advanced knowledge or skills. Career path **Airport Management - Level 5** With the help of Airport Management - Level 5 course, you will be able to seek several promising career opportunities, such as: Airport Manager Aviation Project Manager Air Traffic Services Manager Certificates Certificate of completion Digital certificate - Included

Level 3 Certificate in Quickbooks Online Bookkeeping

By Compliance Central

To succeed in today's competitive financial environment, you need more than just basic accounting skills. You need to be proficient in Quickbooks Online Bookkeeping, the leading cloud-based software for managing your finances. Whether you are a freelancer, a small business owner, or a corporate accountant, Quickbooks Online Bookkeeping can help you streamline your workflow and grow your business. Become a proficient Quickbooks Online Bookkeeper with our Level 3 Certificate course, where you'll learn how to master the key aspects of financial management. Gain confidence in bookkeeping best practices as you set up the system, manage nominal ledgers, handle customer and supplier accounts, and reconcile bank statements with ease. Learn how to perform accurate VAT calculations, simplify payroll processes, and generate useful reports to support informed decision-making. Enhance your skills in Quickbooks Online Bookkeeping and take your financial expertise to the next level. Elevate your financial management game - Enrol in our Level 3 Certificate in Quickbooks Online Bookkeeping course now! Course Learning Outcomes: Gain proficiency in setting up Quickbooks Online Bookkeeping system effectively. Master the nominal ledger and understand its crucial role in financial management. Develop skills to manage customers and suppliers efficiently within Quickbooks Online. Learn to navigate through sales and purchases ledgers seamlessly. Understand the nuances of VAT (Value Added Tax) and its application in Quickbooks Online Bookkeeping. Acquire the ability to perform bank reconciliation and manage payroll/wages effectively. Level 3 Certificate in Quickbooks Online Bookkeeping Module 1: Getting prepared - access the software and course materials Module 2: Getting started Module 3: Setting up the system Module 4: Nominal ledger Module 5: Customers Module 6: Suppliers Module 7: Sales ledger Module 8: Purchases ledger Module 9: Sundry payments Module 10: Sundry receipts Module 11: Petty cash Module 12: VAT - Value Added Tax Module 13: Bank reconciliation Module 14: Payroll / Wages Module 15: Reports Module 16: Tasks Module 17: Additional Resources Certificate of Achievement Endorsed Certificate of Achievement from the Quality Licence Scheme Learners will be able to achieve an endorsed certificate after completing the course as proof of their achievement. You can order the endorsed certificate for Free to be delivered to your home by post. For international students, there is an additional postage charge of £10. Endorsement The Quality Licence Scheme (QLS) has endorsed this course for its high-quality, non-regulated provision and training programmes. The QLS is a UK-based organisation that sets standards for non-regulated training and learning. This endorsement means that the course has been reviewed and approved by the QLS and meets the highest quality standards. Who is this course for? Level 3 Certificate in Quickbooks Online Bookkeeping Who is this course for: The Level 3 Certificate in Quickbooks Online Bookkeeping is designed for individuals seeking to enhance their skills and knowledge in the dynamic field of Quickbooks Online Bookkeeping, like - Bookkeeper Accounting Clerk Accounts Payable/Receivable Specialist Financial Administrator Tax Assistant Billing Coordinator Requirements Level 3 Certificate in Quickbooks Online Bookkeeping To enrol in this Level 5 Diploma in Functional Skills IT, Purchasing & Procurement course, all you need is a basic understanding of the English Language and an internet connection. Career path Level 3 Certificate in Quickbooks Online Bookkeeping Career Path: Bookkeeper Accounts Assistant Financial Administrator Payroll Administrator Accounts Payable/Receivable Clerk Small Business Owner/Entrepreneur Certificates CPD Accredited PDF Certificate Digital certificate - Included QLS Endorsed Hard Copy Certificate Hard copy certificate - Included CPD Accredited Hard Copy Certificate Hard copy certificate - £9.99 CPD Accredited Hard Copy Certificate Delivery Charge: Inside the UK: Free Outside of the UK: £9.99 each

Level 4, 5 KYC: AML & KYC

By Imperial Academy

Level 5 QLS Endorsed Course with FREE Certificate | CPD & CiQ Accredited | 150 CPD Points | Lifetime Access

Boost Your Career with Apex Learning and Get Noticed By Recruiters in this Hiring Season! Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £180 as a Gift - Enrol Now Give your career a boost and take it to the next level with the Bookkeeping Diploma for Accountants. This comprehensive program is designed to provide you with essential bookkeeping knowledge that will help you excel professionally. Whether you’re aiming to develop new skills for your next job or looking to enhance your expertise for a promotion, this diploma is your gateway to staying ahead of the competition. The Bookkeeping Diploma for Accountants covers everything from basic to advanced bookkeeping skills, offering in-depth training to illuminate your path and elevate your career. By strengthening your bookkeeping expertise, you’ll add significant value to your resume, making you stand out to potential employers. Throughout the program, you'll improve your competency in bookkeeping and gain valuable career insights that will help you see a clearer picture of your future growth. Enrol in the Bookkeeping Diploma for Accountants today and equip yourself with the critical bookkeeping skills needed to thrive in a competitive job market. Along with this course, you will get 10 premium courses, an originalHardcopy, 11 PDF Certificates (Main Course + Additional Courses) Student ID card as gifts. This Bundle Consists of the following Premium courses: Course 01: Diploma in Accounting and Bookkeeping Course 02: Diploma in Quickbooks Bookkeeping Course 03: Introduction to Accounting Course 04: Level 3 Tax Accounting Course 05: Level 3 Xero Training Course 06: Payroll Management - Diploma Course 07: Diploma in Sage 50 Accounts Course 08: Advanced Diploma in MS Excel Course 09: Microsoft Excel Training: Depreciation Accounting Course 10: Team Management Course 11: Document Control So, enrol now to advance your career! Key Features of the Course: FREE Bookkeeping Diploma for Accountants CPD-accredited certificate Get a free student ID card with Bookkeeping Diploma for Accountants training (£10 applicable for international delivery) Lifetime access to the Bookkeeping Diploma for Accountants course materials The Bookkeeping Diploma for Accountants program comes with 24/7 tutor support Get instant access to this Bookkeeping Diploma for Accountants course Learn Bookkeeping Diploma for Accountants training from anywhere in the world The Bookkeeping Diploma for Accountants training is affordable and simple to understand The Bookkeeping Diploma for Accountants training is entirely online Learning Outcomes: Upon completing the course, you will be able to: Understand and apply core bookkeeping systems and principles. Utilize basic accounting skills for effective financial record-keeping. Set up and manage QuickBooks software for bookkeeping tasks. Handle nominal ledger, sales ledger, and purchases ledger entries. Implement accounting policies and procedures in financial management. Apply accounting fundamentals to real-world scenarios and decision-making. Description Curriculum of the Bundle Course 01: Diploma in Accounting and Bookkeeping Introduction to the course Bookkeeping systems Basics Functionality On a personal note Accounting Skills Course 02: Diploma in Quickbooks Bookkeeping Getting prepared - access the software and course materials Getting started Setting up the system Nominal ledger Customers Suppliers Sales ledger Purchases ledger Sundry payments Course 03: Introduction to Accounting Accounting Fundamental Accounting Policies Course 04: Level 3 Tax Accounting Tax System and Administration in the UK Tax on Individuals National Insurance How to Submit a Self-Assessment Tax Return Fundamentals of Income Tax Advanced Income Tax Payee, Payroll and Wages Capital Gain Tax Value Added Tax Import and Export Corporation Tax Inheritance Tax Double Entry Accounting Management Accounting and Financial Analysis Career as a Tax Accountant in the UK Course 05: Level 3 Xero Training Introduction Getting Started Invoices and Sales Bills and Purchases Bank Accounts Products and Services Fixed Assets Payroll VAT Returns Course 06: Payroll Management - Diploma Sage 50 Payroll for Beginners Module 1: Payroll Basics Module 2: Company Settings Module 3: Legislation Settings Module 4: Pension Scheme Basics Module 5: Pay Elements Module 6: The Processing Date Module 7: Adding Existing Employees Module 8: Adding New Employees Module 9: Payroll Processing Basics Module 10: Entering Payments Module 11: Pre-Update Reports Module 12: Updating Records Module 13: e-Submissions Basics Module 14: Process Payroll (November) Module 15: Employee Records and Reports Module 16: Editing Employee Records Module 17: Process Payroll (December) Module 18: Resetting Payments Module 19: Quick SSP Module 20: An Employee Leaves Module 21: Final Payroll Run Module 22: Reports and Historical Data Module 23: Year-End Procedures Sage 50 Payroll Intermediate Level Module 1: The Outline View and Criteria Module 2: Global Changes Module 3: Timesheets Module 4: Departments and Analysis Module 5: Holiday Schemes Module 6: Recording Holidays Module 7: Absence Reasons Module 8: Statutory Sick Pay Module 9: Statutory Maternity Pay Module 10: Student Loans Module 11: Company Cars Module 12: Workplace Pensions Module 13: Holiday Funds Module 14: Roll Back Module 15: Passwords and Access Rights Module 16: Options and Links Module 17: Linking Payroll to Accounts Course 07: Diploma in Sage 50 Accounts Sage 50 Bookkeeper - Coursebook Introduction and TASK 1 TASK 2 Setting up the System TASK 3 a Setting up Customers and Suppliers TASK 3 b Creating Projects TASK 3 c Supplier Invoice and Credit Note TASK 3 d Customer Invoice and Credit Note TASK 4 Fixed Assets TASK 5 a and b Bank Payment and Transfer TASK 5 c and d Supplier and Customer Payments and DD STO TASK 6 Petty Cash TASK 7 a Bank Reconnciliation Current Account TASK 7 b Bank Reconciliation Petty Cash TASK 7 c Reconciliation of Credit Card Account TASK 8 Aged Reports TASK 9 a Payroll TASK 9 b Payroll TASK 10 Value Added Tax - Vat Return Task 11 Entering opening balances on Sage 50 TASK 12 a Year end journals - Depre journal TASK 12 b Prepayment and Deferred Income Journals TASK 13 a Budget TASK 13 b Intro to Cash flow and Sage Report Design TASK 13 c Preparation of Accountants Report & correcting Errors (1) Course 08: Advanced Diploma in MS Excel Microsoft Excel 2019 New Features Getting Started with Microsoft Office Excel Performing Calculations Modifying a Worksheet Formatting a Worksheet Printing Workbooks Managing Workbooks Working with Functions Working with Lists Analyzing Data Visualizing Data with Charts Using PivotTables and PivotCharts Working with Multiple Worksheets and Workbooks And many more... Course 09: Microsoft Excel Training: Depreciation Accounting Introduction Depreciation Amortization and Related Terms Various Methods of Depreciation and Depreciation Accounting Depreciation and Taxation Master Depreciation Model Conclusion Course 10: Presenting Financial Information Presenting Financial Information The Hierarchy of Performance Indicators The Principle of Effective Reports Guidelines for Designing Management Reports Methods of Presenting Performance Data The Control Chart: Highlighting the Variation in the Data And many more... Course 11: Document Control Introduction to Document Control Principles of Document Control and Elements of Document Control Environment Document Control Lifecycle Document Control Strategies and Instruments Document Management Quality Assurance and Controlling Quality of Documents Project Document Control Electronic Document Management Systems and Soft Copy Documentation How will I get my Certificate? After successfully completing the Bookkeeping course, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement. PDF Certificate: Free (Previously it was £10 * 11 = £110) Hard Copy Certificate: Free (For The Title Course) If you want to get hardcopy certificates for other courses, generally you have to pay £20 for each. But with this special offer, Apex Learning is offering a Flat 50% discount on hard copy certificates, and you can get each for just £10! PS The delivery charge inside the UK is £3.99, and the international students have to pay £9.99. CPD 120 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Anyone from any background can enrol in this Bookkeeping bundle. Persons with similar professions can also refresh or strengthen their skills by enrolling in this course. Students can take this course to gather professional knowledge besides their study or for the future. Requirements Our Bookkeeping Diploma is fully compatible with PC's, Mac's, laptops, tablets and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones, so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course; it can be studied in your own time at your own pace. Career path Having this various expertise will increase the value of your CV and open you up to multiple job sectors. Certificates Certificate of completion Digital certificate - Included