- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

4702 Courses delivered Online

Accounting and Finance

By NextGen Learning

Accounting and Finance Course Overview: This Accounting and Finance course offers a comprehensive understanding of the key principles and practices involved in accounting and finance. Learners will gain insights into essential financial concepts, from understanding the role of accountants to analysing financial statements. The course equips learners with the skills needed to navigate the world of financial management, preparing them for a wide range of opportunities in the finance industry. By completing this course, learners will be able to confidently approach financial tasks, from budgeting to risk management, and develop a clear understanding of the financial decision-making process. Course Description: This course covers the fundamentals of accounting and finance, offering in-depth insights into financial processes, accounting mechanics, and the preparation and analysis of financial statements. Learners will explore the role of accountants, budgeting and budgetary control, and financial markets, while also gaining a strong foundation in financial risk management and investment strategies. With a focus on analytical skills, the course will help learners develop a deeper understanding of financial operations and decision-making. By the end of the course, participants will be well-equipped to analyse financial data, manage risks, and apply their knowledge in a range of financial contexts. Accounting and Finance Curriculum: Module 01: Introduction to Accounting and Finance Module 02: The Role of an Accountant Module 03: Accounting Process and Mechanics Module 04: Introduction to Financial Statements Module 05: Financial Statement Analysis Module 06: Budgeting and Budgetary Control Module 07: Financial Markets Module 08: Financial Risk Management Module 09: Investment Management Module 10: Auditing (See full curriculum) Who is this course for? Individuals seeking to gain a solid understanding of accounting and finance. Professionals aiming to develop their financial management skills. Beginners with an interest in the finance or accounting industries. Those looking to transition into a finance-focused career. Career Path: Accountant Financial Analyst Budget Analyst Investment Advisor Risk Manager Auditor Finance Manager Banking and Financial Services

Pelvic Floor Confidence Course LIVE ONLINE

By For A Better You - Pilates & Pelvic Floor Health

Your Journey to Pelvic Floor Confidence starts here.. Are you ready to feel more confident in your pelvic floor when you cough, sneeze, laugh, run, jump or exercise? Then this course is for you!! I will show you in JUST 4 WEEKS how to improve your pelvic floor function & feel confident again! Pelvic Floor Confidence can be yours in just 4 weeks!!! Proven Results = A more confident you and a stronger pelvic floor The course has been designed to give you more information about the pelvic floor, how it works and what it does. You will learn how to work with your pelvic floor and increase it’s capacity to best serve your lifestyle and improve your pelvic floor confidence in a functional way. Week 1 – Understanding the pelvic floor and an introduction into the fundamentals of pelvic floor exercises, introduction to functional exercises Week 2 – Pelvic Floor first stage exercises, distraction techniques for urge incontinence and understanding our toilet patterns, with functional exercises Week 3 – Next Step Pelvic Floor Exercises, Pelvic Organ Prolapse and living with it, toilet habits and functional exercises Week 4 – Advanced Pelvic Floor Exercises, Bowel Issues and Irritants. Once you have completed the 4 weekly sessions you will have access to a 12 week follow on programme that will help you implement further what you have learned. This course has been designed to help you understand the importance of your pelvic floor and to help you support it in a functional way.

Business Finance: Business Finance Unlock your potential with our Business Finance course! Dive deep into Business Finance fundamentals, explore advanced Business Finance strategies, and master Business Finance principles. Our Business Finance course equips you with essential Business Finance skills, boosting your expertise in Business Finance analysis, Business Finance management, and Business Finance success. Enroll now in Business Finance! This Business Finance: Business Finance course will give you a solid understanding of accounting and financial processes, concepts, and responsibilities, preparing you for a career in the accounting and finance industry. Learning Outcomes After completing the Business Finance: Business Financecourse, the learner will be able to - Learn the fundamentals of accounting and finance. Recognize the various types of cost data and cost analysis. Cost management and analysis reports. Understand how to handle accounts receivable and credit. Understand inventory management. Recognize the time value of money Identify accounting conventions and how to record financial data Improve managerial performance by understanding Special Offers of this Business Finance Course: This Business Finance Course includes a FREE PDF Certificate. Lifetime access to this Business Finance Course Instant access to this Business Finance Course 24/7 Support Available to this Business Finance Course Business Finance: Business Finance Our Level 5 Business Finance course offers a thorough introduction to the essential concepts of business finance. You'll explore how Business Finance involves managing assets, liabilities, and planning for future growth. This course dives deep into the daily flow of money within a business, highlighting the critical role of Business Finance in measuring, monitoring, and planning operations. Designed for aspiring professionals, our Business Finance course equips you with the skills needed to succeed in the dynamic world of business finance. Enroll now to start mastering Business Finance! Who is this course for? Business Finance: Business Finance This Business Finance: Business Finance is for the ones who are interested in banking sector specially account and finance. Anyone who wants to advance their professional life. Requirements Business Finance: Business Finance To enrol in this Business Finance Course, students must fulfil the following requirements: Good Command over English language is mandatory to enrol in our Business Finance Course. Be energetic and self-motivated to complete our Business Finance Course. Basic computer Skill is required to complete our Business Finance Course. If you want to enrol in our Business Finance Course, you must be at least 15 years old. Career path Business Finance: Business Finance After completing this Business Finance: Business Finance course, you may be able to pursue a variety of promising career opportunities, such as: Account manager Finance manager Administrative specialist and many more.

November 2025 Fundamentals Organisation & Relationship Systems Coaching Training

By CRR UK

CRRUK equips professionals with the concepts, skills and tools to build conscious, intentional relationships, and to coach relationship systems of any size.

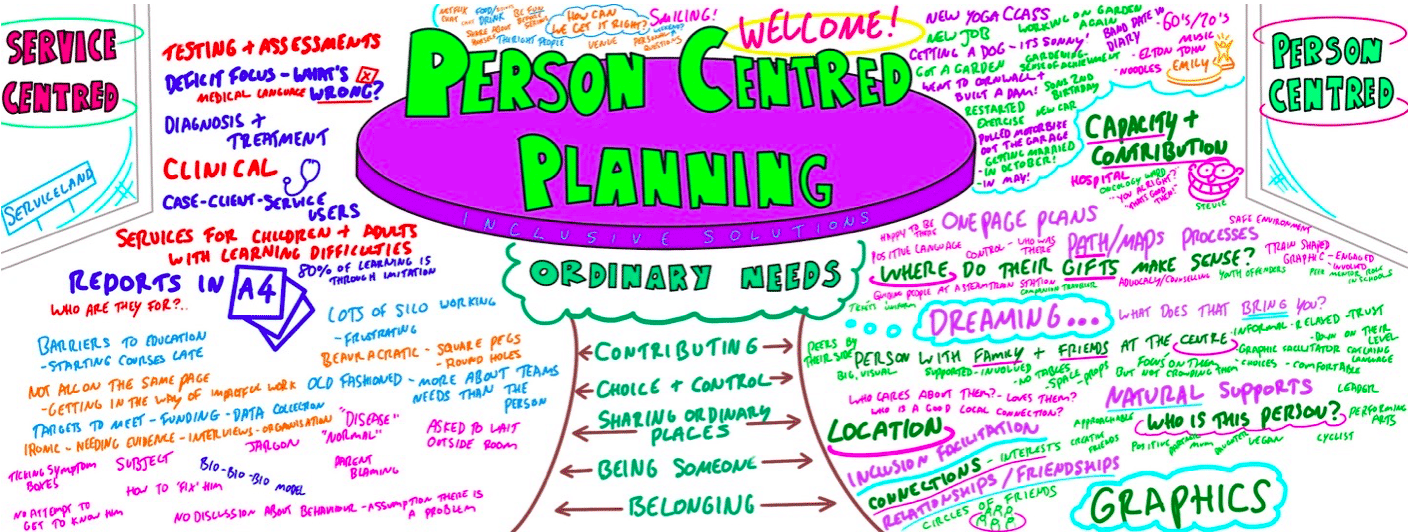

PERSON CENTRED PLANNING TRAINING

By Inclusive Solutions

Person Centred Planning (PCP) is a powerful tool for visioning, future planning and team building. It gets everyone on the same page and creates a progressive, constructive atmosphere so it is especially useful for people who are feeling ‘stuck’ or in a really desperate situation. The PCP processes we teach are called “PATH” and “MAPs”, and are both used for different situations. “To facilitate a group, family, team or organisation in thinking together around a given challenge or issue. Here is an opportunity to experience for real the person centred, futures planning tool – MAP/PATH” (Pearpoint, Forest, O’Brien. 1989). PCP can focus on an individual, with family and friends in the room supporting them, or focus on a group who want to set goals, and realise their potential as a team. PCP focuses on hopes and dreams, so is a very positive approach to planning, and utilises graphic facilitation, making it a very friendly way of working that is accessible to everyone. This unique, hands on PCP training course explores the difference between ‘person-centred thinking’ and ‘service-centred thinking’. Traditionally, we have not always listened deeply enough to the needs of those we are planning for. Often ‘medical model’ thinking dominates our planning for those with the most complex needs. Typically we plan ‘about’ rather than ‘with’ children and adults. We examine this ‘service centred’ approach that most professionals are used to, and question its limitations. This values based approach to inclusion will give participants the ‘theory’ behind why thinking and working in a person centred way is so important, and challenges people to strive for more for the people we are planning around. In addition to the knowledge and theory, this course empowers participants to facilitate their own Person Centred Plans using the PATH or MAPs process and provides the skills to do this effectively. Learning objectives Strengthen understanding of how to think in a person centred way Knowledge of the steps of PATH / MAPs process Ability to facilitate PATH/MAPs process Ability to graphically facilitate a PCP meeting Develop problem solving and planning skills Inclusive Solutions offer: We could provide training for a team of staff, or we could facilitate a PATH or MAP around a disabled person. We can also offer bespoke training packages, please enquire for more details. 1 day “Introduction to PCP” with up to 100 attendees focusing on ‘Person Centred Thinking’ – includes live demonstration of PATH or MAPs Process (for a member of the group / with a student and their family/friends). 2 day “PCP Skills training” – More skills focused, lots of practice. Includes Graphics academy, Process academy and Coaching (Best with under 30 attendees). 2 day “Introduction to PCP with Skills training” – includes live demonstration of PATH or MAPs process, Graphics academy, Process academy and Coaching (Best with under 30 attendees). Half day PATH or MAP for a disabled person, led by two experienced Inclusive Solutions facilitators. Full day PATH or MAP for a team, organisation or group such as a full school staff led by two experienced Inclusive Solutions facilitators. Typical Structure of 2-Day “Introduction to PCP with Skills” Training This course is most useful when delivered over 2 days so we have time to cover the ‘skills’ behind facilitating a PATH or a MAP. Here is an example of what usually happens. If you need us to, we can tailor any of our courses to suit your specific needs. Day 1 AM What makes a good welcome?Service centred thinking and working – what does it involve, how does it make people feel?Reflections on current practices – what is useful and what is harmful?Introduction to underpinning values of person centred thinking and working In depth exploration of the fundamentals of inclusion – encouraging identity, focusing on gifts and capacities Sharing success stories, and personal insight from experienced psychologistsShowcasing a number of practical PCP process in actionIntroduction to the “5 service accomplishments”, or “5 ordinary needs” PM Full PATH process demonstration, led by 2 experienced facilitators – one process facilitator and one graphic facilitatorVolunteers will make notes on what they see the facilitators doing and feedback at the end of the dayFeedback, Q&A Day 2 AM Graphics Academy – we will ease you into the world of graphic facilitation and show you how simple it really is – includes live coaching and graphics tutorial, then participants will practice on each other by facilitating the first 1 or 2 sections of the PATH Process Academy – we will give you some pointers about holding the group, and facilitating in an inclusive way, this is another chance to practice your new graphics skills PM The group is divided up, and volunteers are selected to facilitate PATH meetings The group then run the PATH’s simultaneously with an experienced coaches in the room to guide and to be available for questionsWe reconvene to feedback about the process and digest all we have learntBrief Q&A session and then final reflections

Overview The course begins by introducing credit risk, its components and its drivers. The course then dives into business risk assessment and group structure risks. After examining financial statements, including accounting concepts and principles, the course concludes with a review of financial analysis and its four main risk areas.

The Award in Accounting & Bookkeeping at QLS Level 2 is designed for anyone looking to understand the foundations of accounting and bookkeeping. This course provides a clear and structured approach to essential accounting practices, making it an ideal choice for beginners or those wishing to formalise their knowledge in these fields. With a focus on the key elements such as financial records, income, and expenses, learners can expect to gain a solid understanding of how to manage financial transactions and basic accounting processes. As an online course, it allows you to study at your own pace without the need to attend physical classes. The content is thoughtfully designed to provide clarity and ease of learning, ensuring you can follow along with ease while gaining valuable insights into accounting principles. Whether you're considering a career in finance or simply want to manage your personal finances better, this course provides the ideal starting point to build the skills you need for success. No need to worry about time constraints, as this course offers flexibility, allowing you to study when it suits you best. Learning Outcomes Decode essential accounting terms. Differentiate bookkeeping from accounting. Understand the accounting equation. Master the double-entry accounting system. Record transactions with precision. Grasp common business transactions. Key Features FREE QLS-endorsed certificate 4 Free CPD Accredited Courses with Free e-Certificates CPD Accredited Hard Copy Certificates Fully online, interactive courses Self-paced learning and laptop, tablet, smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Free Courses Microsoft Excel Microsoft Word, PowerPoint & Outlook Fundamentals of Financial Accounting Tax Accounting What Will You Learn from This Course? This course is your key to understanding the essential building blocks of accounting, from basic terms to mastering the art of bookkeeping. Whether you're a budding accountant or a small business owner looking to manage finances more effectively, this course provides the knowledge and skills you need to navigate the world of numbers with confidence. Section 01: Introduction Get acquainted with the world of accounting and bookkeeping. Section 02: Basic Accounting Terms Learn essential accounting terminology for a strong foundation. Difference between Bookkeeping and Accounting Distinguish between these crucial financial roles. Accounting Equation - Assets, Liabilities and Owners' Equity Understand the core equation that defines financial health. Expanded Accounting Equation - Revenues and Expenses Explore how revenues and expenses fit into the equation. Transactions Learn how to record financial transactions accurately. Accounts Understand the concept of accounts in accounting. Accrual Accounting System Discover the accrual method of accounting. Double-Entry Accounting System - General Journal and General Ledger Master the double-entry system and its components. Recording Transactions Acquire the skills to record transactions effectively. Section 03: Common Transactions Dive into everyday business transactions. Credit Purchases Understand the intricacies of credit-based purchases. Cash Purchases Learn how to handle cash-based purchases. Credit Sales Explore the world of credit-based sales. Cash Sales Master the art of handling cash sales. Unearned Revenues Understand unearned revenues and their impact. Prepaid Expenses Learn to account for prepaid expenses. Unrecorded Expenses Discover how to address unrecorded expenses. Unrecorded Revenue Explore the handling of unrecorded revenue. Depreciation Understand the concept of asset depreciation. Types of Discounts Learn about different types of discounts in transactions. Discount Allowed Understand the concept of discounts offered. Discount Received Explore the idea of discounts received. Section 04: Practice Apply your knowledge through practical exercises. Section 05: Assignment Complete assignments to reinforce your learning. Certificate Once you've successfully completed your course, you will immediately be sent a CPD Accredited PDF certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). After successfully completing the assignment, learners will be able to order a FREE QLS-endorsed certificate. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Aspiring accountants seeking foundational knowledge. Small business owners wanting to manage finances. Finance students starting their journey. Individuals exploring bookkeeping as a career. Entrepreneurs managing their own accounts. Office assistants responsible for basic accounting. Anyone curious about the world of finance. Bookkeepers looking to refine their skills. Requirements No prior degree or experience is required to enrol in this course. Career path Bookkeeper for Small Businesses. Accounting Assistant. Finance Clerk. Office Administrator. Small Business Owner/Manager. Financial Analyst in Entry-level Positions. Certificates CPD Accredited e-Certificate Digital certificate - Included CPD Accredited Hard Copy Certificate Hard copy certificate - Included You will get the hard copy certificates for Free! The delivery charge of the hard copy certificate inside the UK is £3.99 each. QLS Endorsed Certificate Hard copy certificate - Included

Winter Series 2025 - Organisation & Relationship Systems Coaching Training

By CRR UK

CRRUK equips professionals with the concepts, skills and tools to build conscious, intentional relationships, and to coach relationship systems of any size.

Overview This training course will empower you to recognize the root causes of fraud and white-collar crime in the current economy, understand the categories of fraud, equip you with methodologies of fraud detection and prevention, and heighten your ability to detect potential fraudulent situations. In addition to the fundamentals of fraud investigation and detection in a digital environment; profit-loss evaluation, analysis of accounting books, legal concepts, and quantification of financial damages are also examined in this course

It's no secret the world has been changing before our eyes !In order to confront the rapidly-evolving world around us, businesses need highly trained, adaptable and creative individuals to keep pace and stay innovative. BA (Hons) Business Management - 18 months course is designed to train you for the jobs of the future; you'll be taught the fundamentals of business management in the wider context of the contemporary business landscape, ensuring your skills will remain flexible and adaptable as the world changes. This BA (Hons.) Business Management - 18 Months programme aims to develop pro-active decision makers, managers and leaders for a variety of careers in business sectors in a global context. The course combines practical professional experience with creative approaches to enterprise and innovation that will develop your entrepreneurial spirit. Program Overview: BA (Hons) Business Management - 18 MonthsKey Highlights of BA (Hons) Business Management - 18 Months degree programme are: Program Duration: 18 Months (24 Months Option also available) Program Credits: 240 Designed for working Professionals 100% Online Global programme: Study anywhere, anytime on your laptop, phone or tablet. Study material: Comprehensive study materials and e-library support. No Written Exam. The Assessment is done via Submission of Assignment Online Lectures Timely Doubt Resolution Dedicated Student Success Manager Regular Networking Events with Industry Professionals LSBR Alumni Status Payment Plan: No Cost EMI Option