- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Data Analysts' Toolbox - Excel, Python, Power BI, Alteryx, Qlik Sense, R, Tableau

By Packt

This course explains how huge chunks of data can be analyzed and visualized using the power of the data analyst toolbox. You will learn Python programming, advanced pivot tables' concepts, the magic of Power BI, perform analysis with Alteryx, master Qlik Sense, R Programming using R and R Studio, and create stunning visualizations in Tableau Desktop.

Port Management - Level 5 Diploma (QLS Endorsed)

By Kingston Open College

QLS Endorsed + CPD QS Accredited - Dual Certification | Instant Access | 24/7 Tutor Support | All-Inclusive Cost

Transport Manager: Learn Successful Transport Management - CPD Certified

4.7(47)By Academy for Health and Fitness

***24 Hour Limited Time Flash Sale*** Transport Manager Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Are you a professional feeling stuck in your career, struggling to keep up with the ever-changing demands of the industry? Or perhaps you're a beginner, unsure of where to start or how to break into your desired field. Whichever stage you're in, our exclusive Transport Manager: Successful Transport Management Bundle provides unique insights and tools that can help you achieve your goals. Designed to cater to the needs of both seasoned professionals and aspiring newcomers, our Transport Manager: Successful Transport Management bundle is a comprehensive program that will equip you with the essential skills and knowledge you need to succeed. Whether you're looking to advance in your current role or embark on a new career journey, this bundle has everything you need to take your professional life to the next level. But that's not all. When you enrol in Transport Manager: Successful Transport Management Online Training, you'll receive 30 CPD-Accredited PDF Certificates, Hard Copy Certificates, and our exclusive student ID card, all absolutely free. Courses Are Included In this Transport Manager: Successful Transport Management Career Bundle: Course 01: Transport Manager: Successful Transport Management Course 02: Transport Planning Course 03: Logistics Management Course 04: Import/Export Processing Course 05: Supply Chain Management Course 06: Delivery Manager Course 07: Quality Management and Strategic Training - ISO 9001 Course 08: Material Management Course 09: Inventory Management Course 10: Operations and Warehouse Management with Transport Management Course 11: Freight Consultant Master Class Course 12: Driving Instructor Level 3 Diploma Course 13: Driving Theory Test Preparation Course 14: Driver Safety Awareness Certificate Course 15: Delivery Driver Training Course 16: Safeguarding for Taxi Drivers Course 17: Forklift Training Course 18: Introduction to Manual Handling Course 19: Engine Lubricant System Training - Level 4 Course 20: Electric Vehicle Battery Management System Course 21: Rail Training Essentials Course 22: Trainee Train Driver Course Course 23: Port Management Diploma Course 24: Hybrid Vehicle Expert Training Course 25: Large Goods Vehicle (LGV) Course 26: Vehicle Maintenance Course 27: Car Mechanic Interactive Online Training Course 28: Car Mechanic and Repair Training Course 29: Car Restoration Course 30: MET Technician With Transport Manager: Successful Transport Management, you'll embark on an immersive learning experience that combines interactive lessons with voice-over audio, ensuring that you can learn from anywhere in the world, at your own pace. And with 24/7 tutor support, you'll never feel alone in your journey, whether you're a seasoned professional or a beginner. Don't let this opportunity pass you by. Enrol in Transport Manager: Successful Transport Management today and take the first step towards achieving your goals and dreams. Why Choose Our Transport Manager Bundle? Get a Free CPD Accredited Certificate upon completion of Transport Manager Get a free student ID card with Transport Manager Training The Transport Manager is affordable and simple to understand This course is entirely online, interactive lesson with voiceover audio Lifetime access to the Transport Manager course materials The Transport Manager comes with 24/7 tutor support Start your learning journey straightaway! Transport Manager: Successful Transport Management premium bundle consists of 30 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of this course is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification You have to complete the assignment given at the end of the course. After passing the Transport Manager: Successful Transport Management exam You will be entitled to claim a PDF & Hardcopy certificate accredited by CPD Quality standards completely free. CPD 300 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This bundle is ideal for: Students seeking mastery in this field Professionals seeking to enhance their skills Anyone who is passionate about this topic Requirements This bundle doesn't require prior experience and is suitable for diverse learners. Career path This Transport Manager: Successful Transport Management bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates CPD Accredited Digital certificate Digital certificate - Included CPD Accredited Hard copy certificate Hard copy certificate - Included If you are an international student, then you have to pay an additional 10 GBP for each certificate as an international delivery charge.

Professional Certificate Course in International Business Environment in London 2024

4.9(261)By Metropolitan School of Business & Management UK

The aim of the "International Business Environment" course is to provide students with the knowledge and skills necessary to develop and implement effective global business strategies. The course aims to equip students with a strategic mindset that enables them to analyze global business environments, identify opportunities and threats, and develop strategies to manage complex cross-border operations.After the successful completion of the course, you will be able to learn about the following, Understand the Internationalisation of business. Analyze the International business environment. Evaluating the country's attractiveness. Analyse the business environment of the host country. Explore Liberalisation Vs. Deregulation. Understand Modes of Conducting International Business. Analyze Revolutionary economic trends. This course focuses on developing a strategic perspective on conducting business in a global context. The course covers a range of topics, including global strategy development, strategic alliance formation, risk management, and cultural intelligence. Students in this course will learn how to analyze global market trends and develop effective strategies for managing cross-border business operations. They will also gain a deeper understanding of the cultural and institutional differences that shape international business environments, and learn how to apply this knowledge to make strategic decisions in a global context. By the end of the course, students will have developed a strategic mindset that will enable them to excel in international business. This course will explore the complexities of managing a business in a global context. The course covers a wide range of topics, including cross-cultural communication, international trade and investment, global marketing, supply chain management, and strategic planning for global expansion. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. International Business Environment Self-paced pre-recorded learning content on this topic. International Business Environment Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. CEO, Director, Manager, Supervisor International Business Manager Export/Import Manager Global Supply Chain Manager International Marketing Manager International Trade Compliance Manager International Trade Analyst Foreign Affairs Specialist International Economist Global Business Development Manager International Financial Analyst. Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

Overview Enter the world of UK accountancy and finance and start a dynamic new career with endless possibilities. This Accounting and Tax course offers you a masterclass in financial management skills, regardless of your current abilities or qualifications. The learning modules will allow you to learn all the fundamental processes of basic Accounting quickly and understand the current processes and standards needed to excel in financial administration. You will attain the capabilities and confidence to produce first-class reports, budgeting analysis, fiscal projections, create company journals, and so much more. The course provides an excellent way to enable an entry-point in any thriving financial organisation. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is this course for? There is no experience or previous qualifications required for enrolment on this Accounting and Tax. It is available to all students, of all academic backgrounds. Requirements Our Accounting and Tax is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible on tablets and smartphones so you can access your course on wifi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career path Having these various qualifications will increase the value in your CV and open you up to multiple sectors such as Business & Management , Admin, Accountancy & Finance, Secretarial & PA, Teaching & Mentoring etc. Course Curriculum 2 sections • 16 lectures • 05:53:00 total length •Module 01: Tax System and Administration in the UK: 00:26:00 •Module 02: Tax on Individuals: 00:24:00 •Module 03: National Insurance: 00:17:00 •Module 04: How to Submit a Self-Assessment Tax Return: 00:15:00 •Module 05: Fundamentals of Income Tax: 00:32:00 •Module 06: Advanced Income Tax: 00:42:00 •Module 07: Payee, Payroll and Wages: 00:22:00 •Module 08: Capital Gain Tax: 00:29:00 •Module 09: Value Added Tax: 00:28:00 •Module 10: Import and Export: 00:21:00 •Module 11: Corporation Tax: 00:19:00 •Module 12: Inheritance Tax: 00:31:00 •Module 13: Double Entry Accounting: 00:15:00 •Module 14: Management Accounting and Financial Analysis: 00:15:00 •Module 15: Career as a Tax Accountant in the UK: 00:17:00 •Assignment - Accounting and Tax: 00:00:00

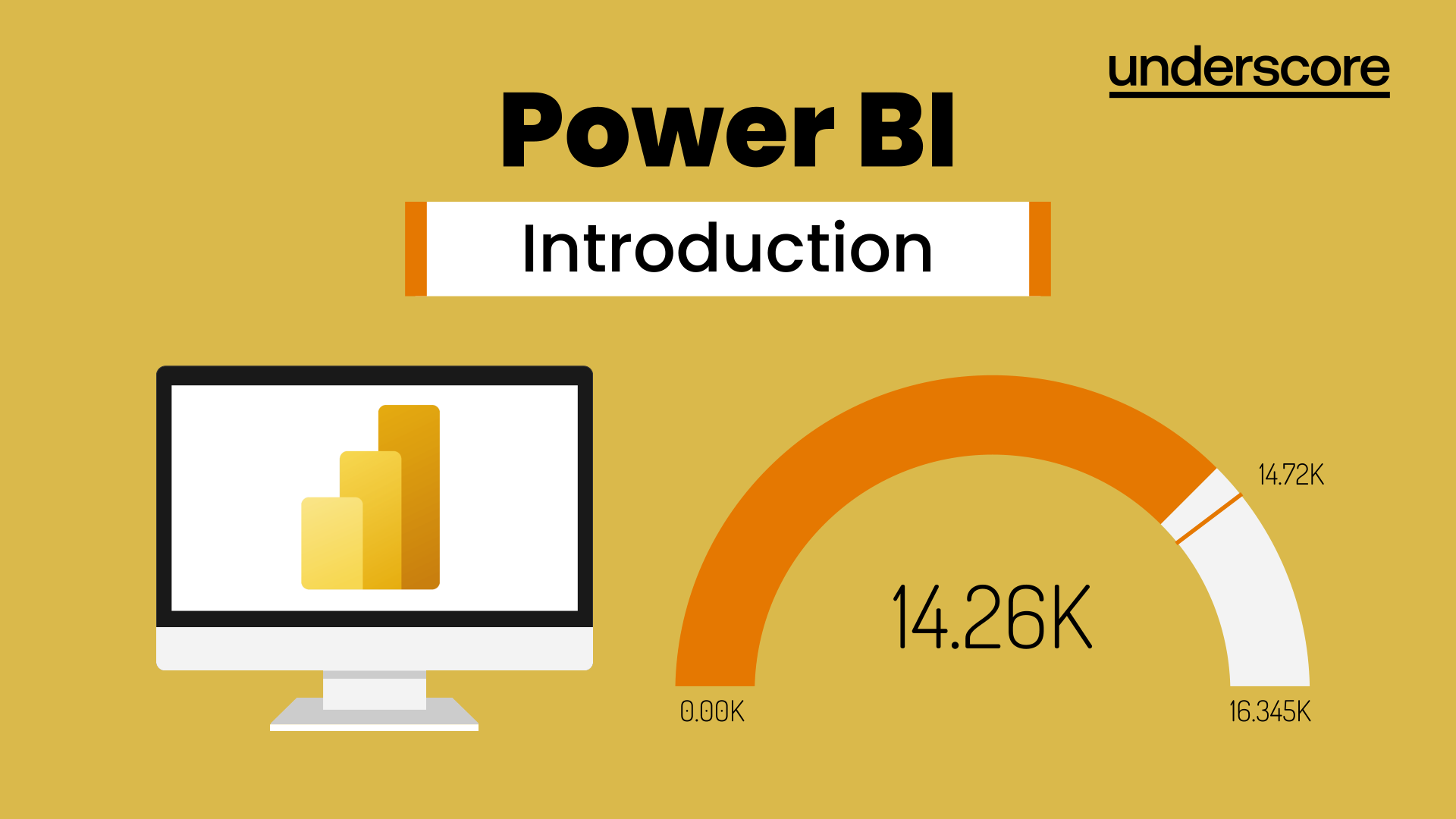

Power BI Introduction

By Underscore Group

Learn how to use this powerful tool to import and clean data and create some amazing visuals. Course overview Duration: 2 days (13 hours) Power BI Desktop is a powerful tool for working with your data. It enables you to import multiple data sources and create effective visualisations and reports. This course is an introduction to Power BI to get you started on creating a powerful reporting capability. You should have a good working knowledge of Excel and managing data before attending. Objectives By the end of the course you will be able to: Import data from multiple data sources Edit and transform data before importing Create reports Create different visualisations Create data models Build data relationships Use the drill down features Create measures Use the Power BI Service Build dashboards Use the mobile app Content Essentials Importing Data Power BI Overview Data sources Importing data Transforming Your Data Editing your data Setting data types Removing columns/rows Choosing columns to keep Setting header rows Splitting columns Creating Reports Creating and saving reports Adding pages Renaming pages Interactivity Refreshing your data Adding Columns Columns from example Custom columns Conditional columns Append Queries Importing folders Setting up and using append queries Creating Chart Visualisations Adding chart elements Choosing chart types Setting properties Setting values, axis and legends Using tooltips Visual filters Setting page and report filters Creating Tables, Cards, Gauges and Maps Adding table elements Adding maps Working with cards Working with matrices KPIs and Gauges Conditional Formatting Setting rules Removing conditional formatting Working with Data Models Merge Queries Setting up and using merge queries Merging in columns of data Creating a Data Model The data model Multiple data tables Connecting tables Building relationships Relationship types Building visuals from multiple tables Unpivoting Data Working with summary data Unpivoting data Using Hierarchies Using built in hierarchies Drill down Drill up See next level Expand a hierarchy Create a new hierarchy Grouping Grouping text fields Grouping date and number fields Creating Measures DAX functions DAX syntax Creating a new measure Using quick measures Using the PowerBI Service Shared workspaces My workspace Dashboards Reports Datasets Drill down in dashboards Focus mode Using Q&A Refreshing data Using Quick Insights Power BI Mobile App Using the Power BI Mobile App

Overview This comprehensive course on Tax Accounting Assistant will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Tax Accounting Assistant comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast-track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Tax Accounting Assistant. It is available to all students, of all academic backgrounds. Requirements Our Tax Accounting Assistant is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 1 sections • 15 lectures • 05:07:00 total length •Module 01: Tax System and Administration in the UK: 00:25:00 •Module 02: Tax on Individuals: 00:23:00 •Module 03: National Insurance: 00:13:00 •Module 04: How to Submit a Self-Assessment Tax Return: 00:12:00 •Module 05: Fundamentals of Income Tax: 00:22:00 •Module 06: Advanced Income Tax: 00:39:00 •Module 07: Payee, Payroll and Wages: 00:18:00 •Module 08: Capital Gain Tax: 00:24:00 •Module 09: Value Added Tax: 00:24:00 •Module 10: Import and Export: 00:20:00 •Module 11: Corporation Tax: 00:17:00 •Module 12: Inheritance Tax: 00:29:00 •Module 13: Double Entry Accounting: 00:11:00 •Module 14: Management Accounting and Financial Analysis: 00:14:00 •Module 15: Career as a Tax Accountant in the UK: 00:16:00

Boost Your Career By Enrolling In This Commercial Law - CPD Certified Bundle To Overcome Your Challenges! X in 1 Commercial Law - CPD Certified Bundle Improve your knowledge and enhance your skills to succeed with this Commercial Law - CPD Certified bundle. This Commercial Law - CPD Certified bundle is designed to build your competent skill set and enable the best possible outcome for your future. Our bundle is ideal for those who aim to be the best in their fields and are always looking to grow. This Commercial Law - CPD Certified Bundle Contains X of Our Premium Courses for One Discounted Price: Course 01: Commercial Law Course 02: Business Studies Course 03: Intermediate Economics Level 6 Course 04: UK Tax Accounting Course 05: Online Entrepreneurship Training Course 06: Investment Course 07: Import/Export Processing Course 08: Stakeholder Management Course 09: Ultimate Microsoft Excel For Business Bootcamp All the courses under this Commercial Law - CPD Certified bundle are split into a number of expertly created modules to provide you with an in-depth and comprehensive learning experience. Upon successful completion of the Commercial Law - CPD Certified bundle, an instant e-certificate will be exhibited in your profile that you can order as proof of your new skills and knowledge. Stand out from the crowd and get trained for the job you want. With this comprehensive Commercial Law - CPD Certified bundle, you can achieve your dreams and train for your ideal career. This Commercial Law - CPD Certified bundle covers essential aspects in order to progress in your chosen career. Why Prefer Us? All-in-one package of X premium courses' Commercial Law - CPD Certified bundle Earn a certificate accredited by CPDQS. Get a free student ID card! (£10 postal charge will be applicable for international delivery) Globally Accepted Standard Lesson Planning Free Assessments 24/7 Tutor Support. Start your learning journey straightaway! *** Course Curriculum *** Our Commercial Law - CPD Certified bundle courses consist of the following learning modules: Course 01: Commercial Law Module 1: Introduction to Commercial law Module 2: Business Organisations Module 3: International Trade: the Theory, the Institutions, and the Law Module 4: Sales of Goods Law Module 5: Consumer Law and Protection Module 6: E-Commerce Law Module 7: Competition Law Assessment Process Once you have completed all the courses in the Commercial Law - CPD Certified bundle, you can assess your skills and knowledge with an optional assignment. Our expert trainers will assess your assignment and give you feedback afterward. CPD 95 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This Commercial Law - CPD Certified bundle is suitable for everyone. Requirements You will not need any prior background or expertise. Career path This Commercial Law - CPD Certified bundle will allow you to kickstart or take your career in the related sector to the next stage. Certificates CPDQS Accredited Certificate Digital certificate - £10 Upon passing the Bundle, you need to order to receive a Digital Certificate for each of the courses inside this bundle as proof of your new skills that are accredited by CPDQS. CPDQS Accredited Certificate Hard copy certificate - £29 Upon passing the Bundle, you need to order to receive a Hard copy Certificate for each of the courses inside this bundle. If you are an international student, then you have to pay an additional 10 GBP as an international delivery charge.

Professional Certificate Course in International Marketing Distribution in London 2024

4.9(261)By Metropolitan School of Business & Management UK

The aim of the course on international marketing distribution is to equip students with the knowledge and skills necessary to develop and implement effective distribution strategies in foreign markets. The course is designed to help students understand the complexities of international distribution, including cultural differences, legal regulations, and logistical challenges. After the successful completion of the course, you will be able to learn about the following. Identify different types of distribution channels and their role in international marketing. Explain the importance of physical distribution and documentation in international trade. Develop a basic understanding of the documentation requirements for international trade. Understand the factors involved in developing an effective international marketing program. Apply marketing concepts and principles to create an effective international marketing strategy. This course provides an in-depth analysis of international marketing distribution and its role in global business. Students will learn about the different types of distribution channels, including direct and indirect channels, and the advantages and disadvantages of each. The course also covers physical distribution and documentation requirements for international trade, as well as the factors involved in developing an effective international marketing program. This course provides an in-depth analysis of international marketing distribution and its role in global business. Students will learn about the different types of distribution channels, including direct and indirect channels, and the advantages and disadvantages of each. The course also covers physical distribution and documentation requirements for international trade, as well as the factors involved in developing an effective international marketing program. VIDEO - Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. International Marketing Distribution Self-paced pre-recorded learning content on this topic. International Marketing Distribution Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. Global Marketing Manager International Sales Manager Export Manager Distribution Channel Manager Supply Chain Manager Logistics Coordinator International Trade Specialist Import/Export Compliance Manager Channel Development Manager Distribution Network Analyst Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.