- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

3449 Courses delivered Online

Overview This comprehensive course on Excel Pivot Tables will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Excel Pivot Tables comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Excel Pivot Tables. It is available to all students, of all academic backgrounds. Requirements Our Excel Pivot Tables is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 7 sections • 18 lectures • 00:47:00 total length •Excel Pivot Tables: 00:03:00 •Overview about Store Dataset: 00:02:00 •Data Insights: 00:02:00 •Sales Profit Summary: 00:03:00 •Highlight the Data: 00:01:00 •Unprofitable Products: 00:02:00 •Create Crosstabs: 00:02:00 •Select Regions for Unprofitable Products: 00:04:00 •Real Time Analytics and Insights: 00:02:00 •Search Data for States with Slicers: 00:06:00 •Finding Trends: 00:02:00 •Find Data for Specific Date: 00:04:00 •Reporting Made Easy: 00:02:00 •Generate Reports with Pivot Tables: 00:04:00 •Marketing Analytics: 00:02:00 •Target Your Advertisements: 00:05:00 •Become Analyst: 00:01:00 •Assignment - Excel Pivot Tables: 00:00:00

Overview This comprehensive course on Financial Modeling Using Excel will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Financial Modeling Using Excel comes with accredited certification which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is this course for? There is no experience or previous qualifications required for enrolment on this Financial Modeling Using Excel. It is available to all students, of all academic backgrounds. Requirements Our Financial Modeling Using Excel is fully compatible with PC's, Mac's, Laptop,Tablet and Smartphone devices. This course has been designed to be fully compatible on tablets and smartphones so you can access your course on wifi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career path Having these various qualifications will increase the value in your CV and open you up to multiple sectors such as Business & Management, Admin, Accountancy & Finance, Secretarial & PA, Teaching & Mentoring etc. Course Curriculum 2 sections • 9 lectures • 01:31:00 total length •Welcome to the Course! Get the Overview of What You'll Learn: 00:04:00 •Planning your Financial Model: 00:09:00 •Building a Model Template: 00:12:00 •Projecting the Income Statement: 00:13:00 •Projecting the Balance Sheet: 00:17:00 •Projecting Cash Flows: 00:14:00 •Advanced Financial Modeling: 00:14:00 •BONUS LESSON: Top 5 Excel Features for Financial Modellers: 00:08:00 •Resources - Financial Modeling Using Excel: 00:00:00

Microsoft Excel 2016

By Course Cloud

Course Overview The comprehensive Microsoft Excel 2016 has been designed by industry experts to provide learners with everything they need to enhance their skills and knowledge in their chosen area of study. Enrol on the Microsoft Excel 2016 today, and learn from the very best the industry has to offer! This best selling Microsoft Excel 2016 has been developed by industry professionals and has already been completed by hundreds of satisfied students. This in-depth Microsoft Excel 2016 is suitable for anyone who wants to build their professional skill set and improve their expert knowledge. The Microsoft Excel 2016 is CPD-accredited, so you can be confident you're completing a quality training course will boost your CV and enhance your career potential. The Microsoft Excel 2016 is made up of several information-packed modules which break down each topic into bite-sized chunks to ensure you understand and retain everything you learn. After successfully completing the Microsoft Excel 2016, you will be awarded a certificate of completion as proof of your new skills. If you are looking to pursue a new career and want to build your professional skills to excel in your chosen field, the certificate of completion from the Microsoft Excel 2016 will help you stand out from the crowd. You can also validate your certification on our website. We know that you are busy and that time is precious, so we have designed the Microsoft Excel 2016 to be completed at your own pace, whether that's part-time or full-time. Get full course access upon registration and access the course materials from anywhere in the world, at any time, from any internet-enabled device. Our experienced tutors are here to support you through the entire learning process and answer any queries you may have via email.

Property Management: Development, Law, Lease & Mortgage - QLS Endorsed

4.7(47)By Academy for Health and Fitness

***Limited Time Offer*** Are you ready to dive into the exciting world of Property Management? As the real estate industry continues to boom, the demand for skilled Property Managers has skyrocketed. In fact, according to the Bureau of Labor Statistics, the employment of Property, Real Estate, and Community Association Managers is projected to grow 8% from 2020 to 2030, adding over 44,800 new jobs to the market. This comprehensive Property Management training bundle covers a wide array of topics, ensuring you gain a well-rounded understanding of the field. Dive into the fundamentals of Property Management, exploring property management principles, legal frameworks, and best practices. Expand your knowledge with courses on Property Development, Property Law and Legislation, Property & Estate Agency, Social Housing and Tenant Management, Wills and Probate Laws. Further, you'll delve into essential business concepts such as Capital Budgeting & Investment Decision Rules, Sales Psychology, Tax Accounting, and Customer Relationship Management, equipping you with the versatile skillset to excel in this dynamic industry. Courses Are Included in this Property Management Bundle: Course 01: Level 3 Diploma in Property Management (Property Manager) - QLS Endorsed Course 02: Property Development Diploma Course 05: Property Law and Legislation Course 03: Property & Estate Agent Course 04: Social Housing and Tenant Management Level 2 Course 06: Understanding Wills and Probate Laws - Level 2 Course 07: Construction Industry Scheme (CIS) Course 08: Capital Budgeting & Investment Decision Rules Course 09: Sales: Psychology of Customers Course 10: Level 3 Tax Accounting Course 11: Customer Relationship Management Learning Outcomes of Property Management Upon completion of the bundle, learners will: Understand the role and responsibilities of a property manager. Gain theoretical knowledge about UK Property laws and regulations. Learn about social housing management and property marketing skills. Understand residential property sales and surveying. Develop foundational knowledge about real estate operations. Understand the Construction Industry Scheme (CIS) and letting agent operations. Learn to write effective business proposals for property projects. Start your learning journey straightaway! Course Curriculum of Property Management 01 Introduction to Property Management 02 The Role and Responsibilities of a Property Manager 03 Listing Properties and Marketing 04 The Letting Process and Tenancy Agreement 05 The Property Management Process 06 Keeping Tenants Long Term 07 Regulations of Property Management 08 Changes in the UK Property Market: An Opportunity CPD 110 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This bundle is ideal for: Students seeking mastery in this field Professionals seeking to enhance their skills Anyone who is passionate about this topic Career path Property Manager (£22,000 - £45,000) Real Estate Agent (£18,000 - £50,000) Letting Agent (£17,000 - £30,000) Residential Surveyor (£22,000 - £60,000) Property Marketer (£20,000 - £35,000) Social Housing Manager (£26,000 - £40,000)

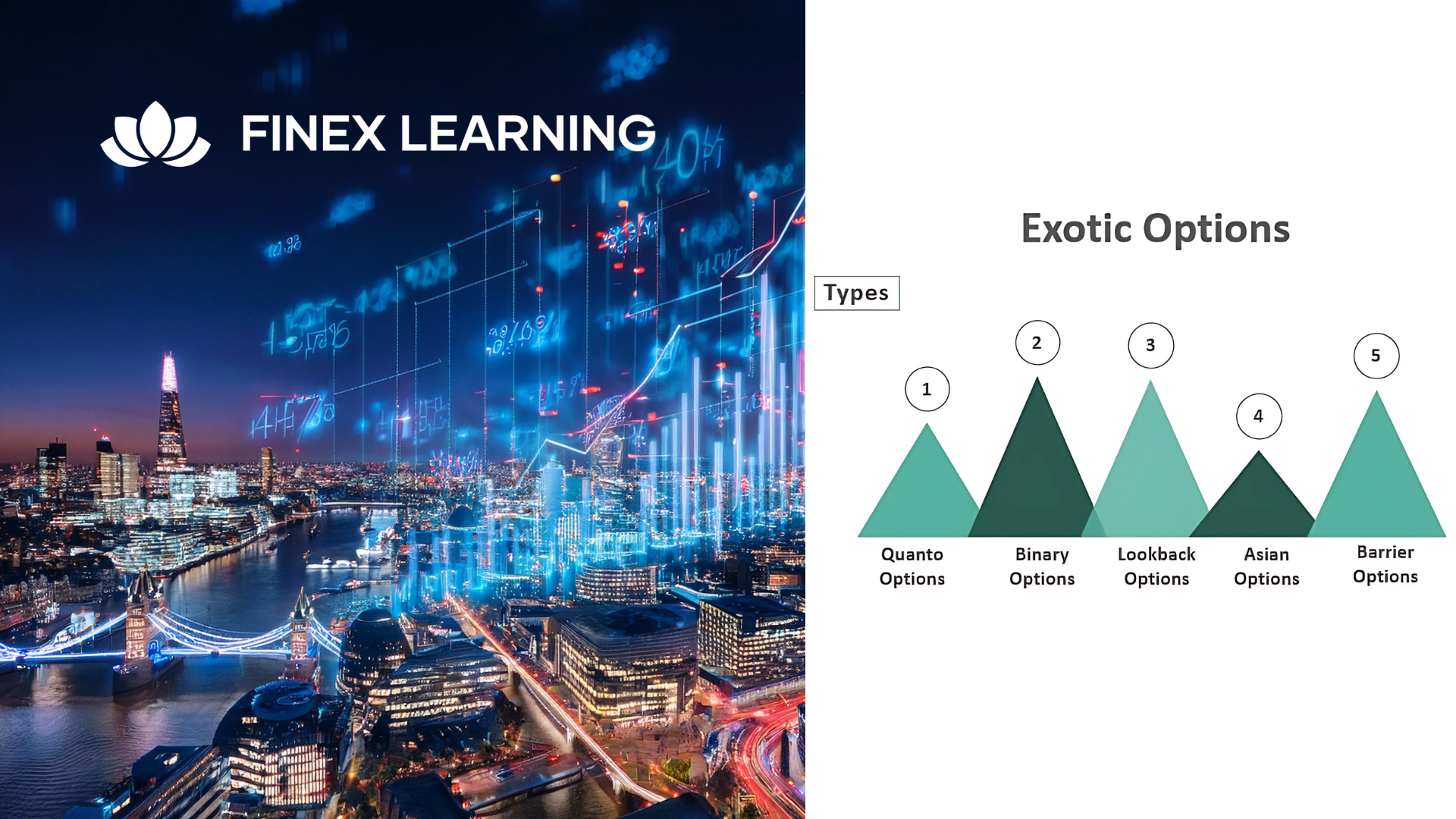

Overview This is a 1 Day Product course and as such is designed for participants who wish to improve the depth of their technical knowledge surrounding Exotic Options. Who the course is for Equity and Derivative sales Equity and Derivative traders Equity & Derivatives structurers Quants IT Equity portfolio managers Insurance Company investment managers Risk managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 1 day course to gain real insight into the Solvency 2 balance sheet dynamics, both under standard formula and our illustrative internal model Who the course is for Capital management / ALM / risk management staff within insurance company Investors in insurance company securities – equity, subordinated bonds, insurance-linked securities Salespeople covering insurance companies Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview 2 day applied course with comprehensive case studies covering both Standardized Approach (SA) and Internal Models Approach (IMA). This course is for anyone interested in understanding practical examples of how the sensitivities-based method is applied and how internal models for SES and DRC are built. Who the course is for Traders and heads of trading desks Market risk management and quant staff Regulators Capital management staff within ALM function Internal audit and finance staff Bank investors – shareholders and creditors Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview This 2-day programme covers the latest techniques used for fixed income attribution. This hands-on course enables participants to get a practical working experience of fixed income attribution, from planning to implementation and analysis. After completing the course you will have developed the skills to: Understand how attribution works and the value it adds to the investment process Interpret attribution reports from commercial systems Assess the strengths and weaknesses of commercially available attribution software Make informed decisions about the build vs. buy decision Present results in terms accessible to all parts of the business Who the course is for Performance analysts Fund and portfolio managers Investment officers Fixed Income professionals (marketing/sales) Auditors and compliance Quants and IT developers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Learn in detail about Exotic Options – Taxonomy, Barriers, and Baskets Who the course is for Fixed Income sales, traders, portfolio managers Bank Treasury Insurance Pension Fund ALM employees Central Bank and Government Funding managers Risk managers Auditors Accountants Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now

Overview Interest Rate Options are an essential part of the derivatives marketplace. This 3-Day programme will equip you to use, price, manage and evaluate interest rate options and related instruments. The course starts with a detailed review of option theory, from a practitioner’s viewpoint. Then we cover the key products in the rates world (caps/floors, swaptions, Bermudans) and their applications, plus the related products (such as CMS) that contain significant ’hidden’ optionality. We finish with a detailed look at the volatility surface in rates, and how we model vol dynamics (including a detailed examination of SABR). The programme includes extensive practical exercises using Excel spreadsheets for valuation and risk-management, which participants can take away for immediate implementation Who the course is for This course is designed for anyone who wishes to be able to price, use, market, manage or evaluate interest rate derivatives. Interest-rate sales / traders / structurers / quants IT Bank Treasury ALM Central Bank and Government Treasury Funding managers Insurance Investment managers Fixed Income portfolio managers Course Content To learn more about the day by day course content please click here To learn more about schedule, pricing & delivery options, book a meeting with a course specialist now