- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Technical Report Writing and Presentation Skills for Oil & Gas Engineers and Technical Professionals

By EnergyEdge - Training for a Sustainable Energy Future

Develop your technical report writing and presentation skills with EnergyEdge's course designed for oil & gas professionals. Sign up now!

PRINCIPLES OF INTERNATIONAL TAXATION

By Mojitax

MojiTax Principles of International Taxation is a comprehensive self-paced program designed to provide students with an in-depth understanding of international taxation. The training covers all essential concepts, principles, and skills needed to succeed in the Advanced Diploma in International Taxation (ADIT) professional exam. It includes engaging presentations, funny stories to illustrate key topics, multiple-choice questions, and additional study resources such as an E-textbook and interactive quizzes. It is divided into five parts, each covering a section of the ADIT syllabus on Principles of International Taxation. Students can choose to take the ADIT professional exam or MojiTax exam upon completing the course, and our team is always available to assist with any questions or concerns. . Learning: Self Paced Mode of assessment: 50 MCQs (80% Pass mark) Award : MOJITAX certificate of knowledge, and ADIT Module 1 (exam preparation). Author: MojiTax Start date : NA Duration: Self Paced ADIT/MOJITAX Blended Syllabus The curriculum of the course encompasses the syllabus of the Chartered Institute of Taxation's Advanced Diploma in International Taxation, Module 1. Additionally, practical concerns for tax practitioners are also covered. Upon completion of the module, participants are expected to have a solid understanding of international taxation principles and confidently pass the ADIT Module 1, Principles of International Taxation exam in either June or December. Professional Exam Focused At MojiTax, we understand that our students want to be well-prepared for their Advanced Diploma in International Taxation (ADIT) professional exam. That's why our Banking training is exam-focused. Our course is structured to cover all the topics and concepts needed for success on the exam. We also align our training with the ADIT syllabus, ensuring that each section of our program corresponds to the exam's content. How we support our students MojiTax supports students on the course in several ways. Firstly, the course is self-paced, meaning students can work through the material at their own pace and have access to it 24/7. Secondly, the course is designed to be exam-focused, ensuring that students are well-prepared to take the ADIT professional exam. Finally, MojiTax aims to respond to all inquiries from students within 24 working hours, ensuring that students receive prompt support and assistance when needed. Our resources Our students have access to a range of training materials and assessments designed to support their learning and progress. These include: Presentations: E-Textbook: Intergovernmental Materials: Access to relevant intergovernmental materials, such as tax treaties, OECD guidelines, and other relevant publications. Multiple-Choice Questions: ADIT Revision Questions: MojiTax Exam: 01 Introduction Introduction to MojiTax PITIntroduction to MojiTax PITADIT/CIOT websiteADIT Syllabus: Principles of International Taxation 02 Part 1: Basic principles of international taxation - 20% Presentation: Basic Principles of International TaxationChapter 1: Basic Principles of International TaxationQuiz 1: Test your knowledgeADIT Revision Questions, Chapter 1 03 Part 2: Double taxation conventions (DTCs), focusing on the current version of the OECD Model Tax Convention (MTC) - 30% Presentation: Double Tax ConventionsChapter 2: Double taxation conventions (DTCs), focusing on the current version of the OECD Model Tax Convention (MTC)Quiz 2: Test your knowledgeADIT Revision Questions, Chapter 2OECD Model Tax Convention and commentariesUN Model Tax Convention 04 Part 3: Transfer pricing and restrictions on interest deductibility - 20% Presentation: Transfer Pricing & Restrictions on interest deductibilityChapter 3: Transfer pricing and restrictions on interest deductibilityQuiz 3: Test your knowledgeADIT Revision Questions, Chapter 3 05 Part 4: International tax avoidance - 25% Presentation: International Tax AvoidanceChapter 4: International tax avoidanceQuiz 4: Test your knowledgeADIT Revision Questions, Chapter 4BEPS Report - Summary 06 Part 5: Miscellaneous topics - 5% Presentation: Miscellaneous topicsChapter 5: Miscellaneous topicsQuiz 5: Test your knowledgeADIT Revision Questions, Chapter 5 07 Examination & Certificate Assessment GuidanceAssessment & Certificate PortalModule Feedback

CT03d - Clinical trial sponsor’s GCP responsibilities

By Zenosis

The sponsor of a clinical trial takes responsibility for its initiation, management, and/or financing. A sponsor may transfer any or all of the sponsor’s trial-related duties and functions to a contract research organisation, but the ultimate responsibility for the quality and integrity of the trial data always resides with the sponsor. Duties and functions discussed in this short course include trial design, selection of investigators, QA and QC, data handling and record keeping, finance and compensation, regulatory submissions, management of investigational product(s), safety reporting, monitoring, audit, dealing with noncompliance, and clinical trial reports. ICH guideline E6 (revision 2) encourages sponsors to adopt a risk-based approach to managing the quality of trials. We discuss this approach in general, and aspects such as risk-based monitoring in particular.

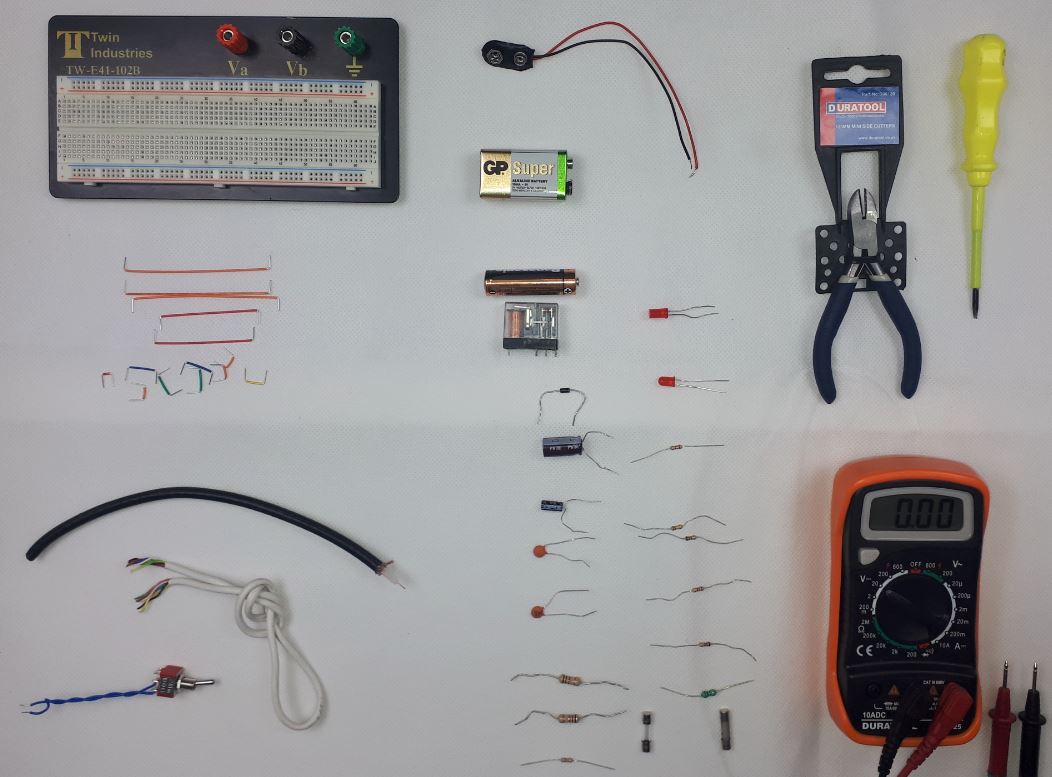

Preliminary Electronic Security Course

By Hi-Tech Training

The Preliminary Electronic Security Course is an introductory (or revision) course designed to provide participants who have no previous Electrical or Electronics experience with the background skills required to attend the CCTV Installation Course, Access Control Course or Fire Alarm Foundation Course. The course gives both an introduction to electronics and electronic security and shows how the two fields merge together. Ideal for a beginner wishing to learn more about this fascinating area. A large practical content is guaranteed. The day will be an excellent learning experience with a skilled instructor. It is a great introduction to the other courses we provide.

At this Oracle SQL Fundamentals course, we cover SQL queries, group by's , aggregates, joins, date-functions, String Functions, Random Functions, Math Functions, Insert, update and delete, Creating and changing tables, sub-queries in detail, views, stored procedures, custom functions, and table variables. Course level is beginners to intermediate.

Foundation & Practitioner Diploma in Clinical Hypnotherapy

5.0(26)By The Northern College Of Clinical Hypnotherapy

Our Practitioner Diploma in Clinical Hypnotherapy is a blend of eLearning at your own pace, weekly video conferencing, Masterclasses, and Peer Supervision sessions with interactive and synchronised learning.

Top up tuition

By Wessex Tutors & Exam Centre

A level one-to-one tuition

Writing for the Business Professional

By Nexus Human

Duration 2 Days 12 CPD hours This course is intended for Professionals desiring to be able to communicate clearly and concisely in their writing will benefit from this course. Overview Awareness of common spelling and grammar issues in business writing. Basic concepts in sentence and paragraph construction. Basic structure of agendas, email messages, business letters, business proposals, and business reports. Collaborative writing techniques, tools and best practices Tips and techniques to use when deciding the most appropriate format to use for agendas, email messages, business letters, business proposals, and business reports In this course, you will learn the essential skills needed to organize your thoughts and select the best words and phrases to clearly convey them in writing. Private classes on this topic are available. We can address your organization?s issues, time constraints, and save you money, too. Contact us to find out how. 1. Working With Words Monitoring Spelling, Grammar, and Verb Tense Creating a Reference Sheet 2. Constructing Sentences Recognizing Sentence Parts Classifying Sentence Type Increasing Readability with Punctuation 3. Creating Paragraphs The Three Basic Components Organization Methods 4. Finding Facts Identifying and Using Key Resources Fact-Finding and Information Gathering 5. Collaborative Writing Clarifying the Objective Collaborative Writing Strategies and Patterns 6. Types of Collaborative Business Writing Applying Different Construction Techniques Cut & Paste, Puzzle, Sequential Summative Integrating Construction 7. Collaborative Tools and Processes Planning and Revision Creating Outlines and Storyboards Building Team Cohesion 8. Writing Meeting Agendas Choosing an Agenda Format Structuring and Writing the Agenda 9. Writing E-Mails, Reports and Proposals Addressing Your Message Using Proper Grammar and Defining Acronyms Structuring, Formatting, and Writing Your Report Additional course details: Nexus Humans Writing for the Business Professional training program is a workshop that presents an invigorating mix of sessions, lessons, and masterclasses meticulously crafted to propel your learning expedition forward. This immersive bootcamp-style experience boasts interactive lectures, hands-on labs, and collaborative hackathons, all strategically designed to fortify fundamental concepts. Guided by seasoned coaches, each session offers priceless insights and practical skills crucial for honing your expertise. Whether you're stepping into the realm of professional skills or a seasoned professional, this comprehensive course ensures you're equipped with the knowledge and prowess necessary for success. While we feel this is the best course for the Writing for the Business Professional course and one of our Top 10 we encourage you to read the course outline to make sure it is the right content for you. Additionally, private sessions, closed classes or dedicated events are available both live online and at our training centres in Dublin and London, as well as at your offices anywhere in the UK, Ireland or across EMEA.

CT03: ICH Good Clinical Practice

By Zenosis

Good Clinical Practice (GCP) is a set of internationally recognised ethical and scientific quality requirements for designing, conducting, recording and reporting clinical trials. Compliance with GCP principles is required by regulatory authorities in many countries for the authorisation of clinical trials and the acceptance of their data. The International Council for Harmonisation’s guideline E6, often referred to as ICH GCP, is the international standard specification for Good Clinical Practice.