- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

HR Management Diploma and UK Employment Law With Complete Career Guide Course

5.0(2)By Training Express

The HR Management Diploma and UK Employment Law course provides an essential foundation in understanding the complexities of managing human resources in the modern workplace. This course delves into the key areas of HR management, including recruitment, employee relations, performance management, and compensation, while offering a deep dive into the specifics of UK employment law. Whether you're new to HR or looking to expand your knowledge, this course will help you navigate the ever-changing landscape of employee management and legal frameworks in the UK. In addition to core HR practices, the course offers a detailed exploration of UK Employment Law, covering topics such as employee rights, contracts, dismissal procedures, and health and safety regulations. By the end of the course, you will gain a clear understanding of how to manage HR operations effectively while ensuring your practices align with the law. Designed for those eager to build a career in human resources or enhance their existing expertise, this course equips you with the tools needed to manage people and policies with confidence. ________________________________________________________________________ Key Features: CPD Certified HR Management Diploma and UK Employment Law With Complete Career Guide 10 Instant e-certificate and hard copy dispatch by next working day Fully online, interactive course with audio voiceover Developed by qualified professionals in the field Self-paced learning and laptop, tablet, smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum: Module 01: Introduction to Human Resource Module 02: Employee Recruitment and Selection Procedure Module 03: Employee Training and Development Process Module 04: Performance Appraisal Management Module 05: Employee Relations Module 06: Motivation and Counselling Module 07: Ensuring Health and safety at the Workplace Module 08: Employee Termination Module 09: Employer Record and Statistics Module 10: Essential UK Employment Law ________________________________________________________________________ Complete Career Guide for HR Management Diploma and UK Employment Law (A to Z) This isn't just a course; it's your ticket to thriving in the sector and your roadmap to the HR Management. In addition to mastering the essentials of HR Management, you'll also gain valuable skills in CV writing, job searching, communication, leadership, and project management. These 9 complementary courses are designed to empower you at every stage of your journey. Stand out in your career, from crafting a winning CV to excelling in interviews. Develop the leadership skills to inspire your team and efficiently manage projects. This holistic approach ensures you're not just job-ready but career-ready. Enrol today, and let's build your success story together in HR Management. Your dream career starts here! List of career guide courses included in HR Management Diploma and UK Employment Law With Complete Career Guide: Course 01: Professional CV Writing and Job Searching Course 02: Communication Skills Training Course 03: Career Development Training Course 04: Time Management Course 05: Returning to Work Training Course 06: Level 3 Diploma in Project Management Course 07: Leadership Skills Course 08: Body Language Course 09: Interview and Recruitment ________________________________________________________________________ Learning Outcomes: Understand the fundamentals of Human Resource Management. Apply effective recruitment and selection procedures in organisations. Implement employee training and development processes for workforce enhancement. Evaluate and manage performance appraisal effectively. Develop skills in employee relations, motivation, and counselling. Ensure workplace health and safety and handle employee termination proficiently. ________________________________________________________________________ Accreditation All of our courses, including the HR Management Diploma and UK Employment Law With Complete Career Guide course, are fully accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certification Once you've successfully completed your HR Management Diploma and UK Employment Law With Complete Career Guide, you will immediately be sent your digital certificates. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our certifications have no expiry dates, although we recommend renewing them every 12 months. Assessment At the end of the HR Management Diploma and UK Employment Law With Complete Career Guide courses, there will be an online assessment, which you will need to pass to complete the HR Management Diploma and UK Employment Law With Complete Career Guide course. Answers are marked instantly and automatically, allowing you to know straight away whether you have passed. If you haven't, there's no limit on the number of times you can take the final exam. All this is included in the one-time fee you paid for the course itself. CPD 100 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This HR Management Diploma and UK Employment Law With Complete Career Guide Course can be taken by anyone who wants to understand more about the topic. With the aid of this course, you will be able to grasp the fundamental knowledge and ideas. Additionally, this HR Management Diploma and UK Employment Law With Complete Career Guide Course is ideal for: Individuals aspiring to enter the field of HR management. Professionals seeking a comprehensive UK employment law understanding. HR personnel aiming to enhance their knowledge and skills. Managers responsible for employee relations and performance. Anyone interested in maintaining workplace health and safety standards. Requirements Learners do not require any prior qualifications to enrol on this HR Management Diploma and UK Employment Law With Complete Career Guide Course. You just need to have an interest in HR Management Diploma and UK Employment Law With Complete Career Guide Course. Career path After completing this HR Management Diploma and UK Employment Law With Complete Career Guide Course you will have a variety of careers to choose from. HR Manager - £30K to 50K/year. Recruitment Specialist - £25K to 40K/year. Training and Development Coordinator - £28K to 45K/year. Employee Relations Advisor - £27K to 42K/year. Health and Safety Officer - £26K to 40K/year. Certificates 10 CPD Accredited e-Certificates Digital certificate - Included 10 CPD Accredited Hard Copy Certificates Hard copy certificate - Included

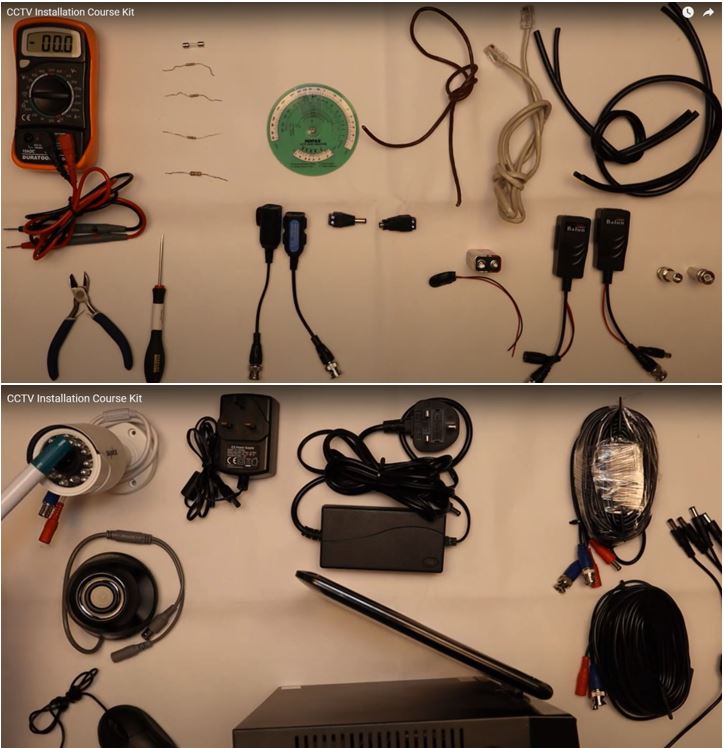

CCTV Installation Course

By Hi-Tech Training

Hi-Tech Training Closed Circuit Television (CCTV) Installation Course is designed to give participants a practical knowledge of the operation and installation of CCTV systems at a foundation level.

The UK Corporate Tax Returns Insight Course is designed to provide a deep understanding of the UK corporate tax system and the key principles behind submitting corporate tax returns. This online course caters to professionals and individuals seeking a thorough understanding of the tax process, from preparing accurate returns to understanding the financial implications for businesses. Through a structured approach, learners will gain insights into the essential components that make up corporate tax returns and the critical steps involved in their preparation. The course is ideal for those looking to expand their knowledge of corporate tax obligations in the UK, focusing on the accurate submission of tax returns and understanding the intricacies of UK tax law. It covers various topics, including tax computation, allowances, exemptions, and reliefs available to businesses. With this course, learners will become well-versed in the essential processes and best practices involved in corporate tax compliance. This course aims to provide you with the expertise needed to navigate the complexities of UK corporate tax, ensuring that you are well-prepared to manage tax returns with confidence. Key Features CPD Accredited FREE PDF + Hardcopy certificate Fully online, interactive course Self-paced learning and laptop, tablet and smartphone-friendly 24/7 Learning Assistance Discounts on bulk purchases Course Curriculum Module 1: Introduction to Corporate Tax Return in the UK Module 2: Income and Expenses in Corporate Tax Returns Module 3: Tax Reliefs, Credits, and Special Schemes Module 4: Compliance and Reporting Obligations Module 5: International Tax Considerations Module 6: Tax Investigation and Dispute Resolution Module 7: Emerging Trends and Updates in Corporate Taxation Module 8: Corporate Tax Calculation Learning Outcomes Analyse corporate financial data for accurate tax reporting. Implement tax strategies leveraging reliefs and credits effectively. Navigate international tax regulations for cross-border transactions. Ensure compliance with reporting obligations in corporate tax. Resolve tax investigations with strategic dispute management. Stay updated with emerging trends, adapting corporate tax strategies. Accreditation This course is CPD Quality Standards (CPD QS) accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field. Certificate After completing this course, you will get a FREE Digital Certificate from Training Express. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Financial professionals seeking in-depth corporate tax knowledge. Accountants aiming to enhance their expertise in tax calculations. Business owners and managers keen on optimising tax strategies. Tax consultants looking to stay abreast of international tax norms. Aspiring tax advisors seeking a comprehensive understanding. Legal professionals wanting to specialise in corporate taxation. Finance students preparing for a career in corporate tax. Individuals aiming to excel in financial management with a focus on taxation. Career path Corporate Tax Advisor Tax Consultant Financial Analyst (Tax) Tax Compliance Manager International Tax Specialist Corporate Finance Manager Certificates Digital certificate Digital certificate - Included Once you've successfully completed your course, you will immediately be sent a FREE digital certificate. Hard copy certificate Hard copy certificate - Included Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK). For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10. Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Overview Know your employment law with our UK Employment Law and Employee Rights Diploma course. This UK Employment Law and Employee Rights Diploma course will help you gain a comprehensive understanding of the law for both employers and employees. It will give you an understanding of the law aspects and how to tackle employment law issues with confidence. Upon completing the course, you will have an invaluable outline of UK employment law's essential concepts that you need to know to take up your dream job in the law industry. This UK Employment Law course is designed to cover all aspects of employment law. From understanding basic law principles to exploring complex employment law cases, this course provides an in-depth look at how law is applied in the workplace. With this law knowledge, you will be well-equipped to navigate the law requirements of your job and handle any law challenges that may arise. Enrol now to take the first step toward becoming an expert in employment law. Your future in the law sector starts here with the knowledge and qualifications that only a specialized law course like this can offer. By investing in your law education, you are opening the door to a fulfilling and successful career in law. Learning Outcomes of this Employment Law Bundle: Understand the key principles and regulations of UK employment law. Analyse employee rights and employer obligations under UK employment law. Gain insights into the legal frameworks governing workplace discrimination law. Learn how to apply employment law in handling workplace disputes effectively. Explore the procedures for legal compliance within UK employment law. Develop skills to interpret and implement changes in UK employment law. Key Features of the Employment Law Course: FREE UK Employment Law CPD-accredited certificate Get a free student ID card with UK Employment Law training (£10 applicable for international delivery) Lifetime access to the UK Employment Law course materials The UK Employment Law program comes with 24/7 tutor support Get instant access to this UK Employment Law course Learn UK Employment Law training from anywhere in the world The UK Employment Law training is affordable and simple to understand The UK Employment Law training is an entirely online How will I get my certificate? At the end of the law course, there will be an online law MCQ test which you can take either during or after the UK Employment Law course. After successfully completing the law test, you will be able to order your law certificate. These law certificates are included in the price and serve as a testament to your law expertise. Who is this Employment Law course for? There is no experience or previous law qualifications required for enrollment in this UK Employment Law and Employee Rights Diploma. It is available to all students, regardless of their academic backgrounds, who wish to gain expertise in employment law. Requirements Our UK Employment Law and Employee Rights Diploma is fully compatible with PCs, Macs, laptops, tablets, and smartphones, making it easy to study law wherever you are. This course has been designed to be fully accessible on tablets and smartphones so you can access your law course on Wi-Fi, 3G, or 4G. There is no time limit for completing this law course, so you can study law at your own pace and in your own time. Career Path Having these various law qualifications will increase the value of your CV and open you up to multiple sectors such as Business & Management, Admin, Accountancy & Finance, Secretarial & PA, Teaching & Mentoring, and many others. Mastering employment law will make you a sought-after professional in industries where understanding law is crucial. This diploma will set you apart in the competitive job market by showcasing your comprehensive knowledge of law. Course Curriculum 3 sections • 13 lectures • 05:59:00 total length •Module 01: Basic of Employment Law: 00:24:00 •Module 02: Legal Recruitment Process: 00:43:00 •Module 03: Employment Contracts: 00:25:00 •Module 04: Employee Handbook: 00:23:00 •Module 05: Disciplinary Procedure: 00:15:00 •Module 06: National Minimum Wage & National Living Wage: 00:37:00 •Module 07: Parental Right, Sick Pay & Pension Scheme: 00:43:00 •Module 08: Discrimination in the Workplace: 00:39:00 •Module 09: Health & Safety at Work: 00:19:00 •Module 10: Dismissal, Grievances and Employment Tribunals: 00:36:00 •Module 11: Workplace Monitoring & Data Protection: 00:15:00 •Mock Exam - UK Employment Law and Employee Rights Diploma: 00:20:00 •Final Exam - UK Employment Law and Employee Rights Diploma: 00:20:00

UK Employment Law For HR Online Training Course

By Study Plex

Highlights of the Course Course Type: Online Learning Duration: 3 Hours Tutor Support: Tutor support is included Customer Support: 24/7 customer support is available Quality Training: The course is designed by an industry expert Recognised Credential: Recognised and Valuable Certification Completion Certificate: Free Course Completion Certificate Included Instalment: 3 Installment Plan on checkout What you will learn from this course? Gain comprehensive knowledge about employment law UK Understand the core competencies and principles of employment law UK Explore the various areas of employment law UK Know how to apply the skills you acquired from this course in a real-life context Become a confident and expert human resources manager or HR manager UK Employment Law For HR Online Training Course Course Master the skills you need to propel your career forward in employment law UK. This course will equip you with the essential knowledge and skillset that will make you a confident human resources manager or HR manager and take your career to the next level. This comprehensive law for HR course is designed to help you surpass your professional goals. The skills and knowledge that you will gain through studying this law for HR course will help you get one step closer to your professional aspirations and develop your skills for a rewarding career. This comprehensive course will teach you the theory of effective employment law UK practice and equip you with the essential skills, confidence and competence to assist you in the employment law UK industry. You'll gain a solid understanding of the core competencies required to drive a successful career in employment law UK. This course is designed by industry experts, so you'll gain knowledge and skills based on the latest expertise and best practices. This extensive course is designed for human resources manager or HR manager or for people who are aspiring to specialise in employment law UK. Enrol in this law for HR course today and take the next step towards your personal and professional goals. Earn industry-recognised credentials to demonstrate your new skills and add extra value to your CV that will help you outshine other candidates. Who is this Course for? This comprehensive law for HR course is ideal for anyone wishing to boost their career profile or advance their career in this field by gaining a thorough understanding of the subject. Anyone willing to gain extensive knowledge on this employment law UK can also take this course. Whether you are a complete beginner or an aspiring professional, this course will provide you with the necessary skills and professional competence, and open your doors to a wide number of professions within your chosen sector. Entry Requirements This law for HR course has no academic prerequisites and is open to students from all academic disciplines. You will, however, need a laptop, desktop, tablet, or smartphone, as well as a reliable internet connection. Assessment This law for HR course assesses learners through multiple-choice questions (MCQs). Upon successful completion of the modules, learners must answer MCQs to complete the assessment procedure. Through the MCQs, it is measured how much a learner could grasp from each section. In the assessment pass mark is 60%. Recognised Accreditation This course is accredited by continuing professional development (CPD). CPD UK is globally recognised by employers, professional organisations, and academic institutions, thus a certificate from CPD Certification Service creates value towards your professional goal and achievement. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. What is CPD? Employers, professional organisations, and academic institutions all recognise CPD, therefore a credential from CPD Certification Service adds value to your professional goals and achievements. Benefits of CPD Improve your employment prospects Boost your job satisfaction Promotes career advancement Enhances your CV Provides you with a competitive edge in the job market Demonstrate your dedication Showcases your professional capabilities What is IPHM? The IPHM is an Accreditation Board that provides Training Providers with international and global accreditation. The Practitioners of Holistic Medicine (IPHM) accreditation is a guarantee of quality and skill. Benefits of IPHM It will help you establish a positive reputation in your chosen field You can join a network and community of successful therapists that are dedicated to providing excellent care to their client You can flaunt this accreditation in your CV It is a worldwide recognised accreditation What is Quality Licence Scheme? This course is endorsed by the Quality Licence Scheme for its high-quality, non-regulated provision and training programmes. The Quality Licence Scheme is a brand of the Skills and Education Group, a leading national awarding organisation for providing high-quality vocational qualifications across a wide range of industries. Benefits of Quality License Scheme Certificate is valuable Provides a competitive edge in your career It will make your CV stand out Course Curriculum Module 1: Fundamentals of the Employment Law Fundamentals of the Employment Law 00:25:00 Module 2: Laws Governing Employment in the UK Laws Governing Employment in the UK 00:15:00 Module 3: The Recruitment Process The Recruitment Process 00:20:00 Module 4: Employment Contracts Employment Contracts 00:10:00 Module 5: Employment Rights & Benefits Employment Rights & Benefits 00:20:00 Module 6: Health and Safety Health and Safety 00:20:00 Module 7: Training and Development Opportunities Training and Development Opportunities 00:15:00 Module 8: Discrimination at Workplace Discrimination at Workplace 00:20:00 Module 9: Handling Grievances Handling Grievances 00:15:00 Module 10: Managing Absenteeism Managing Absenteeism 00:25:00 Module 11: Dismissal at Workplace Dismissal at Workplace 00:15:00 Module 12: Developing a Social Media Policy at Workplace Developing a Social Media Policy at Workplace 00:10:00 Module 13: Disciplinary Guidelines against Drug & Alcohol Misuse Disciplinary Guidelines against Drug & Alcohol Misuse 00:15:00 Conclusion UK Employment Law Conclusion UK Employment Law 00:20:00 Final Assessment Assessment - UK Employment Law For HR Online Training Course 00:10:00 Obtain Your Certificate Order Your Certificate of Achievement 00:00:00 Get Your Insurance Now Get Your Insurance Now 00:00:00 Feedback Feedback 00:00:00

The UK Employment Law: Legal Recruitment Process is a wonderful learning opportunity for anyone who has a passion for this topic and is interested in enjoying a long career in the relevant industry. It's also for anyone who is already working in this field and looking to brush up their knowledge and boost their career with a recognised certification. This UK Employment Law: Legal Recruitment Process consists of several modules that take around 1 hour to complete. The course is accompanied by instructional videos, helpful illustrations, how-to instructions and advice. The course is offered online at a very affordable price. That gives you the ability to study at your own pace in the comfort of your home. You can access the modules from anywhere and from any device. Why choose this course Earn an e-certificate upon successful completion. Accessible, informative modules taught by expert instructors Study in your own time, at your own pace, through your computer tablet or mobile device Benefit from instant feedback through mock exams and multiple-choice assessments Get 24/7 help or advice from our email and live chat teams Full Tutor Support on Weekdays Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Mock exams Multiple-choice assessment Certification After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for £9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for £15.99, which will reach your doorsteps by post. Course Content UK Employment Law: Legal Recruitment Process Legal Recruitment Process 00:45:00 Order your Certificates & Transcripts Order your Certificates & Transcripts 00:00:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Unlock the complexities of property law and taxation in the UK with our comprehensive course. Whether you're a legal professional, accountant, or property enthusiast, this program delves into crucial aspects that shape the industry today. Key Features: CPD Certified Developed by Specialist Lifetime Access In the "UK Property Law, VAT, and Taxation" course, learners will gain comprehensive knowledge about the legal aspects and financial considerations involved in UK property transactions. They will understand how the UK property market operates and how ownership and possession of properties are legally managed. The course covers co-ownership arrangements, detailing the rights and responsibilities of joint property owners. Learners will also explore the practical applications of property law, learning about legal procedures and practices essential in real estate transactions. Additionally, the course delves into property taxation, focusing on capital gains tax and VAT implications specific to properties. This knowledge equips learners with insights crucial for accountants and lawyers dealing with property-related taxation issues, providing practical tips to navigate and optimize tax strategies within legal frameworks. Course Curriculum Module 01: Changes in the UK Property Market Module 02: Ownership and Possession of the Property Module 03: Co-Ownership in Property Module 04: The Property Law and Practice Module 05: Property Taxation on Capital Gains Module 06: VAT on Property Taxation Module 07: Property Taxation Tips for Accountants and Lawyers Learning Outcomes: Understand recent UK Property Market changes affecting legal practices. Identify legal principles governing Ownership and Possession in property transactions. Analyze the concept of Co-Ownership and its implications in property law. Apply Property Law principles to real-life scenarios in practice. Evaluate the impact of Capital Gains Tax on property transactions. Explain the application of VAT in property transactions for taxation purposes. CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Law students interested in property law. Accountants specializing in property taxation. Legal professionals seeking property law expertise. Tax advisors focusing on property transactions. Real estate agents needing legal knowledge. Career path Property Lawyer Tax Consultant Real Estate Solicitor Accountant specializing in property tax Legal Advisor in property transactions Certificates Digital certificate Digital certificate - Included Will be downloadable when all lectures have been completed.

Overview This comprehensive course on Self Assessment Tax Return Filing UK will deepen your understanding on this topic. After successful completion of this course you can acquire the required skills in this sector. This Self Assessment Tax Return Filing UK comes with accredited certification from CPD, which will enhance your CV and make you worthy in the job market. So enrol in this course today to fast track your career ladder. How will I get my certificate? You may have to take a quiz or a written test online during or after the course. After successfully completing the course, you will be eligible for the certificate. Who is This course for? There is no experience or previous qualifications required for enrolment on this Self Assessment Tax Return Filing UK. It is available to all students, of all academic backgrounds. Requirements Our Self Assessment Tax Return Filing UK is fully compatible with PC's, Mac's, Laptop, Tablet and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones so you can access your course on Wi-Fi, 3G or 4G. There is no time limit for completing this course, it can be studied in your own time at your own pace. Career Path Learning this new skill will help you to advance in your career. It will diversify your job options and help you develop new techniques to keep up with the fast-changing world. This skillset will help you to- Open doors of opportunities Increase your adaptability Keep you relevant Boost confidence And much more! Course Curriculum 2 sections • 6 lectures • 00:28:00 total length •Introduction to Self Assessment: 00:06:00 •Logging into the HMRC System: 00:06:00 •Fill in the Self Assessment Return: 00:06:00 •Viewing the Calculation: 00:03:00 •Submitting the Assessment: 00:02:00 •Conclusion: 00:05:00

The UK Employment Law: Wages & Benefits Certification is a wonderful learning opportunity for anyone who has a passion for this topic and is interested in enjoying a long career in the relevant industry. It's also for anyone who is already working in this field and looking to brush up their knowledge and boost their career with a recognised certification. This UK Employment Law: Wages & Benefits Certification consists of several modules that take around 2 hours to complete. The course is accompanied by instructional videos, helpful illustrations, how-to instructions and advice. The course is offered online at a very affordable price. That gives you the ability to study at your own pace in the comfort of your home. You can access the modules from anywhere and from any device. Why choose this course Earn an e-certificate upon successful completion. Accessible, informative modules taught by expert instructors Study in your own time, at your own pace, through your computer tablet or mobile device Benefit from instant feedback through mock exams and multiple-choice assessments Get 24/7 help or advice from our email and live chat teams Full Tutor Support on Weekdays Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Mock exams Multiple-choice assessment Certification After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for £9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for £15.99, which will reach your doorsteps by post. Course Content UK Employment Law: Wages & Benefits Certification Basics of Employment Law 00:17:00 National Minimum Wage & National Living Wage 00:33:00 Parental Rights, Sick Pay, & Pension Scheme 00:44:00 Health & Safety at Work 00:16:00 Order your Certificates & Transcripts Order your Certificates & Transcripts 00:00:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.