- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

Total NetFlow training course description A comprehensive hands on course covering NetFlow. The course starts with the basics of flows moving swiftly onto configuring NetFlow and studying the information it provides. What will you learn Describe NetFlow. Configure generators and collectors. Recognise how NetFlow can be used. Describe the issues in using NetFlow. Compare NetFlow with SNMP, RMON and sflow. Total NetFlow training course details Who will benefit: Technical staff working with NetFlow. Prerequisites: TCP/IP Foundation Duration 2 days Total NetFlow for engineers What is NetFlow? Flows. Where to monitor traffic. Hands on Wireshark flow analysis. Getting started with NetFlow NetFlow configuration. Hands on Accessing NetFlow data using the CLI. NetFlow architecture Generators and collectors. When flows are exported. NetFlow reporting products. SolarWinds. Hands on Collector software. NetFlow features and benefits Real time segment statistics, real time top talkers, traffic matrices. Hands on Traffic analysis with NetFlow. NetFlow issues NetFlow impact, agent resources, server resources, comparing NetFlow with SNMP, RMON and sflow. Hands on Advanced NetFlow configuration. Export formats Flow aging timers, NetFlow versions, export formats, templates, IPFIX. Hands on NetFlow packet analysis. NetFlow MIBs The NetFlow MIB, configuration, retrieving NetFlow statistics. Hands on Integrating NetFlow with SNMP.

Professional Certificate Course in Blockchain Platforms and Use Cases in Trade and Finance in London 2024

4.9(261)By Metropolitan School of Business & Management UK

The course on Blockchain Platforms and Use Cases in Trade and Finance is designed to provide participants with an in-depth understanding of the we.trade platform. Participants will delve into foundational concepts, identify key consortium members and participating banks, analyze platform features and functionalities, explore diverse use cases in trade finance, and recognize the specific benefits that we.trade offers to SMEs, emphasizing its role in facilitating seamless cross-border transactions. After the successful completion of the course, you will be able to learn about the following,⦠Understand the foundational concepts of the we.trade platform in trade finance.⦠Identify key consortium members and participating banks in the we.trade ecosystem.⦠Analyze the features and functionalities of the we.trade platform.⦠Explore use cases and applications of we.trade in trade finance.⦠Recognize the benefits of we.trade for SMEs and its role in cross-border transactions.⦠Analyze real-world examples of successful we.trade implementations. Participants will gain comprehensive insights into the foundational concepts of the we.trade platform, ensuring a solid understanding of its operational framework. Identification of key consortium members and participating banks will provide a holistic view of the platform's ecosystem. The course will delve into the features and functionalities of we.trade, offering a detailed analysis of its use cases in trade finance. Special attention will be given to recognizing how we.trade benefits SMEs and contributes to the efficiency of cross-border transactions. Real-world examples of successful we.trade implementations will be explored to showcase practical applications of the platform in diverse trade scenarios. Immerse yourself in the world of blockchain platforms with a focus on we.trade. Uncover the foundational concepts, features, and functionalities of the platform, while exploring real-world use cases that highlight its transformative impact on trade finance. Gain practical insights into how we.trade benefits SMEs and plays a crucial role in facilitating seamless cross-border transactions. Course Structure and Assessment Guidelines Watch this video to gain further insight. Navigating the MSBM Study Portal Watch this video to gain further insight. Interacting with Lectures/Learning Components Watch this video to gain further insight. Blockchain platforms and use cases in Trade and Finance Self-paced pre-recorded learning content on this topic. Blockchain Platforms And Use Cases In Trade And Finance Put your knowledge to the test with this quiz. Read each question carefully and choose the response that you feel is correct. All MSBM courses are accredited by the relevant partners and awarding bodies. Please refer to MSBM accreditation in about us for more details. There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. The certificate is designed to enhance the learner's knowledge in the field. This certificate is for everyone eager to know more and get updated on current ideas in their respective field. We recommend this certificate for the following audience. Blockchain Solutions Architect for Trade Finance Trade Finance Blockchain Developer Blockchain Platform Analyst in Finance Trade Finance Operations Manager - Blockchain Blockchain Integration Specialist for Trade Platforms Trade Finance Blockchain Consultant Blockchain Project Manager in Finance Blockchain Business Analyst for Trade Operations Trade Finance Platform Administrator - Blockchain Blockchain Trade Compliance Specialist Average Completion Time 2 Weeks Accreditation 3 CPD Hours Level Advanced Start Time Anytime 100% Online Study online with ease. Unlimited Access 24/7 unlimited access with pre-recorded lectures. Low Fees Our fees are low and easy to pay online.

ITIL 4 Specialist: High Velocity IT: In-House Training

By IIL Europe Ltd

ITIL® 4 Specialist: High Velocity IT: In-House Training The ITIL® 4 Specialist: High-Velocity IT module is part of the Managing Professional stream for ITIL® 4. Candidates need to pass the related certification exam for working towards the Managing Professional (MP) designation. This course is based on the ITIL® 4 Specialist: High-Velocity IT exam specifications from AXELOS. With the help of ITIL® 4 concepts and terminology, exercises, and examples included in the course, candidates acquire the relevant knowledge required to pass the certification exam. This module addresses the specifics of digital transformation and helps organizations to evolve towards a convergence of business and technology, or to establish a new digital organization. It was designed to enable practitioners to explore the ways in which digital organizations and digital operating models function in high-velocity environments. Working practices such as Agile and Lean, and technical practices and technologies such as Cloud, Automation, and Automatic Testing are included. What You Will Learn At the end of this course, participants will be able to: Understand concepts regarding the high-velocity nature of the digital enterprise, including the demand it places on IT. Understand the digital product lifecycle in terms of the ITIL operating model. Understand the importance of the ITIL guiding principles and other fundamental concepts for delivering high-velocity IT. Know how to contribute to achieving value with digital products. Course Introduction Let's Get to Know Each Other Course Learning Objectives Target Audience Characteristics ITIL® 4 Certification Scheme Course Components Course Agenda Module-End Exercises Exam Details Introduction to High-Velocity IT High-Velocity IT Digital Technology Digital Organizations Digital Transformation High-Velocity IT Approaches Relevance of High-Velocity IT Approaches High-Velocity IT Approaches in Detail High-Velocity IT Operating Models Introduction ITIL® Perspective High-Velocity IT Aspects High-Velocity IT Applications ITIL® Building Blocks for High-Velocity IT Digital Product Lifecycle Service Value Streams Four Dimensions of Service Management ITIL® Management Practices High-Velocity IT Culture Key Behavior Patterns ITIL® Guiding Principles Supporting Models and Concepts for Purpose Ethics Design Thinking Supporting Models and Concepts for People Reconstructing for Service Agility Safety Culture Stress Prevention Supporting Models and Concepts for Progress Working in Complex Environments Lean Culture ITIL® Continual Improvement Model High-Velocity IT Objectives and Techniques High-Velocity IT Objectives High-Velocity IT Techniques Techniques for Valuable Investments Prioritization Techniques Minimum Viable Products and Services Product / Service Ownership A/B Testing Techniques for Fast Developments Basic Concepts Related to Fast Development Infrastructure as Code Reviews Continual Business Analysis Continuous Integration / Continuous Delivery (CI/CD) Continuous Testing Kanban Techniques for Resilient Operations Introduction to Resilient Operations Technical Debt Chaos Engineering Definition of Done Version Control Algorithmic IT Operations ChatOps Site Reliability Engineering (SRE) Techniques for Co-created Value Basic Concepts of Co-created Value Service Experience Techniques for Assured Conformance DevOps Audit Defense Toolkit DevSecOpsPeer Review

WiMax training course description Broadband wireless access is an emerging technology area. This course looks at WiMAX, where it can be used, how it works and the alternative technologies. What will you learn Describe WiMAX. Explain how WiMAX works. Compare and contrast WiMAX with alternative broadband wireless access technologies. WiMax training course details Who will benefit: Anyone wishing to know more about WiMAX. Prerequisites: None. Duration 2 days WiMax training course contents Introduction What is WiMAX? WiMAX applications, The Internet, Internet access choices, wireless broadband access, WiMAX benefits. WiMAX overview Spectrums, LOS vs. non-LOS, bit rates, modulation, mobility, channel bandwidth, cell radius. WiMAX standards The WiMAX forum, IEEE, ETSI, HIPERACCESS, HIPERMAN, 802.16, 802.16-2004, 802.16a, 802.16e, 802.16f. WiMAX architecture Subscriber Stations (SS), Indoors, outdoors, antennas, Radio Base Stations (BS), LOS, Non LOS BackHaul, Point to multipoint, mesh support. Physical layer 10 - 66GHz, TDMA, TDD, FDD, 2 -11 GHz, SC2, OFDM, OFDMA, QPSK, QAM, Radio Link Control (RLC), uplink, downlink. MAC layer Traffic types (continuous, bursty), QoS, service types. MAC operations, connection oriented, frame structure, addressing. Convergence sublayers, service specific, common part, profiles (IP, ATM). Bandwidth request-grant, ARQ, Management messages. Security MAC privacy sublayer, network access authentication, AAA, 802.1x, key exchange and privacy. WiMAX alternatives WiMAX vs. 3G, WiMAX vs. 802.20.

Essential SDN training course description Software Defined Networking (SDN) has become one of the industries most talked technologies. This training course cuts through the hype and looks at the technology, architecture and products available for SDN along with looking at the impact it may have on your network. What will you learn Explain how SDN works. Describe the architecture of SDN. Explain the relationship between SDN and OpenFlow. Recognise the impact SDN will have on existing networks. Essential SDN training course details Who will benefit: Anyone wishing to know more about SDN. Prerequisites: None. Duration 2 days Essential SDN training course contents Introduction What is SDN? What is OpenFlow? SDN benefits. The SDN stack and architecture. SDN architecture SDN applications, SDN switches, SDN controllers, Network Operating Systems. Control plane, data plane. Control to Data Plane Interface (CDPI), Northbound interfaces. SDN components, control and data plane abstractions. Network Operating Systems Finding the topology, Global view, control program, configuration based on views, graph algorithm. OpenFlow Just one part of SDN. Open Networking Foundation, OpenFlow ports, Flow tables, OpenFlow Channels. The OpenFlow protocol, OpenFlow header, OpenFlow operations. OpenFlow versus OpFlex. SDN and open source OpenDaylight, OpenVSwitch, Open Networking Forum, Open Network Operating System. OpenStack Neutron. SDN implications Separation of control and data plane, NOS running on servers, Emphasis on edge complexity, core simplicity, OpenvSwitch, Incremental migration, importance of software. SDN vs NVF.

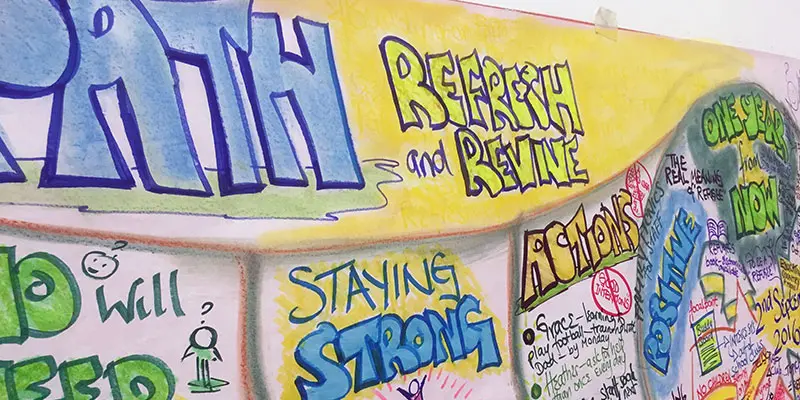

School Improvement Planning

By Inclusive Solutions

Give your team the opportunity to pause and reflect on what matters most to them about the work they do. The act of listening to each other creates relationship and strengthens trust and inclusion within the team – in creating a shared vision, groups of people build a sense of commitment together. Using the PATH or MAP processes of group facilitation and the creating of a large wall sized graphic we will provide a School Improvement Plan to be proud of! Course Category Visioning and Problem Solving Person Centred Planning Strategic Work Team Building and Leadership Description There is an old Japanese proverb, “Vision without action is a daydream. Action without vision is a nightmare” “There is no power for change greater than a community discovering what it cares about” MARGARET WHEATLEY – ‘TURNING TO ONE ANOTHER’ (2002) Give your team the opportunity to pause and reflect on what matters most to them about the work they do. The act of listening to each other creates relationship and strengthens trust and inclusion within the team – in creating a shared vision, groups of people build a sense of commitment together. They develop images of ‘the future we want to create together’, along with the values that will be important in getting there and the goals they want to see achieved along the way. Unfortunately, many people still think ’vision’ is the top leader’s job. In schools, the ‘vision task’ usually falls to the Headteacher and/or the governors or it comes in a glossy document from the local authority or the DfES. But visions based on authority are not sustainable. Drawing on the planning tools MAPS and PATH (Pearpoint, Forest and O’Brien 1997) and other facilitation sources we use both process and graphic facilitation to enable the group to build their picture of what they would love to see happening within their organisation/community in the future and we encourage this to be a positive naming, not just a list of the things they want to avoid. ??Let us join you to explore your vision and the ‘roadblocks’ to your vision. Testimonials “Thank you so much for the work you did with us yesterday – I have since been in 2 schools today and have spoken to an number of other colleagues who were present – all were totally overwhelmed by the session – they loved it.” “I was totally blown away, so nice to reflect and realise what a long way we have come” “That was so powerful and motivational” “Our Primary is now an OFSTED rated ‘Outstanding School’ – we were in Special Measures – the Visioning and Planning using the PATH process for 3 years has seriously contributed to this”. Learning Objectives To create a far reaching and shared vision of the future for the school team/group you are working with and ensure that each person present contributes to this To create a visual representation (a graphic) of the vision and use this to plan future actions and to inform school improvement and development plans To facilitate the group in thinking through what some of the barriers to achieving their vision are and to begin work on how these can be removed To build a sense of commitment, common purpose and trust within the team/group Who Is It For ? Headteachers School managers EIP Managers Whole staff – including everyone Course Content The facilitation of a shared vision can be delivered as a full or a half day but, unlike our other training days this day depends on your and your team’s needs and the time you have available The course will cover: Creating the vision The Story So Far Headline Themes Naming the Nightmare A Year from Now Naming Roadblocks and Barriers Building strength Who will we need to take with us on the journey towards the vision Who are we? – Gifts, Strengths and Talents Charting Specific Actions

Register on the UK Insurance Complete Course today and build the experience, skills and knowledge you need to enhance your professional development and work towards your dream job. Study this course through online learning and take the first steps towards a long-term career. The course consists of a number of easy to digest, in-depth modules, designed to provide you with a detailed, expert level of knowledge. Learn through a mixture of instructional video lessons and online study materials. Receive online tutor support as you study the course, to ensure you are supported every step of the way. Get an e-certificate as proof of your course completion. The UK Insurance Complete Course is incredibly great value and allows you to study at your own pace. Access the course modules from any internet-enabled device, including computers, tablet, and smartphones. The course is designed to increase your employability and equip you with everything you need to be a success. Enrol on the now and start learning instantly! What You Get With The UK Insurance Complete Course Receive a e-certificate upon successful completion of the course Get taught by experienced, professional instructors Study at a time and pace that suits your learning style Get instant feedback on assessments 24/7 help and advice via email or live chat Get full tutor support on weekdays (Monday to Friday) Course Design The course is delivered through our online learning platform, accessible through any internet-connected device. There are no formal deadlines or teaching schedules, meaning you are free to study the course at your own pace. You are taught through a combination of Video lessons Online study materials Certification Upon successful completion of the course, you will be able to obtain your course completion e-certificate free of cost. Print copy by post is also available at an additional cost of £9.99 and PDF Certificate at £4.99. Who Is This Course For: The course is ideal for those who already work in this sector or are an aspiring professional. This course is designed to enhance your expertise and boost your CV. Learn key skills and gain a professional qualification to prove your newly-acquired knowledge. Requirements: The online training is open to all students and has no formal entry requirements. To study the UK Insurance Complete Course, all your need is a passion for learning, a good understanding of English, numeracy, and IT skills. You must also be over the age of 16. Course Content Module 01: Insurance Industry Insurance Industry 00:29:00 Module 02: The UK Insurance Industry The UK Insurance Industry 00:50:00 Module 03: Principles of Insurance Principles of Insurance 01:04:00 Module 04: General Insurance General Insurance 00:38:00 Module 05: Personal Lines Insurance Personal Lines Insurance 01:23:00 Module 06: Commercial Lines Insurance Commercial Lines Insurance - Part 01 01:00:00 Commercial Lines Insurance - Part 02 00:28:00 Module 07: Liability Insurance Liability Insurance 00:46:00 Module 08: Life Insurance Life Insurance 00:38:00 Module 09: Insurance Fraud Insurance Fraud 00:22:00 Module 10: Underwriting Process Underwriting Process 00:12:00 Frequently Asked Questions Are there any prerequisites for taking the course? There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course. Can I access the course at any time, or is there a set schedule? You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience. How long will I have access to the course? For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime. Is there a certificate of completion provided after completing the course? Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks. Can I switch courses or get a refund if I'm not satisfied with the course? We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase. How do I track my progress in the course? Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course. What if I have technical issues or difficulties with the course? If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

Fintech : Embedded Finance, Payments, BaaS and API Banking - CPD Certified

4.7(26)By Academy for Health and Fitness

***24 Hour Limited Time Flash Sale*** Fintech: Embedded Finance, Payments, BaaS and API Banking - CPD Certified Admission Gifts FREE PDF & Hard Copy Certificate| PDF Transcripts| FREE Student ID| Assessment| Lifetime Access| Enrolment Letter Did you know that the UK Fintech market is expected to reach a staggering £315 billion by 2025? This explosive growth is driven by innovative trends like embedded finance, where financial services seamlessly integrate into non-financial platforms. Are you curious about how these technologies are transforming the financial landscape? If so, then this Fintech : Embedded Finance, Payments, BaaS and API Banking bundle is for you! With this Fintech course, you will get 30 CPD Accredited PDF Certificates, 3 QLS endorsed Certificate of FinTech and our exclusive student ID card absolutely free. Courses Are Included In This Fintech: Embedded Finance, Payments, BaaS and API Banking Bundle: Course 01: FinTech Course 02: Digital Banking Course 03: Cryptocurrency and Stock Trading Course 04: Corporate Finance: Working Capital Management Course 05: Financial Modelling for Decision-Making and Business plan Course 06: Financial Analysis for Finance Reports Course 07: Capital Budgeting & Investment Decision Rules Course 08: Accountancy Course 09: Forex Trading Diploma Course 10: Stock Trading Course 11: Inflation: Modern Economies Course 12: Raise Money and Valuation for Business Course 13: Investment Banking Course 14: Financial Management Course 15: Business Analysis Diploma Course 16: Strategic Business Management Course 17: Strategic Marketing & Planning Course 18: Central Banking Monetary Policy Course 19: Insurance Agent Training Course 20: BUSINESS INTELLIGENCE AND DATA MINING DIPLOMA Course 21: Google Analytics for Everyone Course 22: Google Data Studio: Data Analytics Course 23: Introduction to VAT Online Training Course 24: UK Tax Accounting Course 25: Anti-Money Laundering (AML) Course 26: Xero Accounting - Complete Training Course 27: Payroll Administrator Training Course 28: Excel Data Analysis Course 29: Microsoft Excel Training: Depreciation Accounting Course 30: Risk Assessment Training Embarking on Fintech training bundle is more than just taking an online course; it's an investment in your future. By completing this Fintech bundle, you'll not only gain invaluable skills but also open doors to new career opportunities and advancements, boosting your earning potential. Don't miss this chance to elevate your career and skillset. Enrol in Fintech training bundle today and take the first step towards achieving your goals and dreams. Why buy this Fintech training bundle? Get 3 free QLS endorsed Certificate upon completion of Fintech bundle Get a free student ID card with Fintech training bundle Lifetime access to the Fintech course materials Get instant access to this Fintech training bundle Learn Fintech bundle from anywhere in the world 24/7 tutor support with the Fintech training bundle Fintech bundle is an entirely online, interactive lesson with voice-over audio. Start your learning journey straightaway with our Fintech Training! Fintech premium bundle consists of 30 precisely chosen courses on a wide range of topics essential for anyone looking to excel in this field. Each segment of Fintech training bundle is meticulously designed to maximise learning and engagement, blending interactive content and audio-visual modules for a truly immersive experience. Certification of Fintech training bundle You have to complete the assignment given at the end of the Fintech course and score a minimum of 60% to pass each exam. After passing the Certificate in FinTech at QLS Level 3 course exam You will be entitled to claim a QLS endorsed Certificate completely free. CPD 700 CPD hours / points Accredited by CPD Quality Standards Who is this course for? This bundle is ideal for: Students seeking mastery in this field Professionals seeking to enhance their skills Anyone who is passionate about this topic Requirements This Fintech training bundle doesn't require prior experience and is suitable for diverse learners. Career path This Fintech training bundle will allow you to kickstart or take your career in the related sector to the next stage. FinTech Consultant Payment Specialist BaaS Product Manager API Banking Developer FinTech Entrepreneur Certificates Certificate in FinTech at QLS Level 3 Hard copy certificate - Included CPD Accredited Digital certificate Digital certificate - Included Diploma in Financial Analysis at QLS Level 5 Hard copy certificate - Included Diploma in Online Financial Modelling at QLS Level 5 Hard copy certificate - Included

September 2025 Fundamentals Organisation & Relationship Systems Coaching Training

By CRR UK

CRRUK equips professionals with the concepts, skills and tools to build conscious, intentional relationships, and to coach relationship systems of any size.

Transmission demystified training course description Transmission is the process of sending information along a medium of, copper, fibre or wireless. This course looks at transmission techniques for both telecommunications and data communications with a particular focus on Microwave, SDH, DWDM transmission. The course aims to demystify these technologies by explaining all the buzzwords used in transmission. What will you learn Describe various transmission technologies such as multiplexing and demultiplexing. Explain how Microwave works. Explain how SDH works. Explain how DWDM works. Transmission demystified training course details Who will benefit: Anyone working in telecommunications. Prerequisites: None. Duration 2 days Transmission demystified training course contents Transmission basics Systems, media, signals. Signal degradation, noise, distortion, attenuation. Digital, analogue. Modulation, encoding. RF Frequency, wavelength. Distance / range issues, interference, Antenna, power, dB, RF propagation, testing. Microwave transmission What is microwave transmission, point to point communications, line of sight, parabolic antenna, relays, planning considerations, rain and other issues Wired transmissions Copper, Fibre, optical transmission, fibre characteristics, fibre component parts. Multi Mode Fibre (MMF). Single Mode Fibre (SMF). Fibre connections. Lasers. Attenuations, dispersion, optical signal noise ratios (OSNR) and their effects. Channel Spacing and Signal Direction. Limiting factors to single wavelength. Introduction to SDH Timing and synchronisation of digital signals, the plesiochronous digital hierarchy (PDH), the synchronous digital hierarchy (SDH), service protection with SDH. TDM. SDH6 Standards, basic units, frames, STM1 frame, bit rates, STM0, STM1, STM4, STM16, STM64, STM256, SDH architecture, rings, Add drop multiplexors. SDH network topologies, structure of SDH equipment, SDH synchronisation, protection switching in SDH networks, SDH alarm structure, testing of SDH, equipment and systems, Ethernet over SDH. WDM overview Multiplexing, TDM, WDM benefits. WDM standards. CWDM vs. DWDM. Four Wave Mixing (FWM). Impact and countermeasures to FWM on WDM.tructure of SDH equipment, SDH synchronisation, protection switching in SDH networks, SDH alarm structure, testing of SDH, equipment and systems, Ethernet over SDH. DWDM ITU G.694.1, channel and spacing. Optical Terminal Multiplexers (OTM). Optical Add/Drop Multiplexers (OADM). Adding versus dropping. Optical Amplifiers. Erbium Doped Fibre Amplifiers (EDFA). Transponders and Combiners. Optical and Electrical Cross Connects (OXCs/DXCs). Cross Connect types (Transparent/Opaque). Advantages and disadvantages of various Optical cross connects. IP transmission Telecommunications versus data communications, IP transmission, VoIP, MPLS.