- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

26842 Courses delivered Online

Special Executive Master's Programme in Information Management

4.9(261)By Metropolitan School of Business & Management UK

Special Executive Masters Programme (S.E.M.P) This programme is geared at enhancing professionals' careers. The SEMP is an encapsulated Senior Management Programmes are short certificate modules designed for anyone who would benefit from more in-depth business knowledge delivered in a short and intensive programme What makes us different? We are a world class business school located in the heart of London, Dubai, Islamabad and Lagos. We are one of the fastest growing British business schools with a stylish blended learning model that is both online and on campus. Learn more about the programme Special Executive Master's Programme in Information Management Course Overview The MSBM Special Executive Masters Programmes (SEMP) allows you to update your skills, develop new skills, and explore and develop interests in a wide range of topics. These courses can be taken as personal or professional development and may enhance your employability. This Programme offers new ways of using information and Internet-based and emerging technologies to revolutionize the structure and operation of an organization's Information. Today, information management enables integrated business processes that extend the entire information supply chain from consumer to provider to government to user. Corporate profitability and non-profits alike are transformed in ways we never imagined, and as a result, enhance the effective delivery of public services. Staying competitive and productive in commercial business, non-profit and government demands a strategic response to the changes and innovations evolving from the collection of massive data repositories, rapidly emerging technologies, increased computing performance, increased communication capabilities, and improved information dissemination and visualization. Course Details Mode of Study Using Web-based technology, this program provides self-paced, individualized instruction that can be taken anywhere and anytime an individual has access to a computer and the Internet. This Programme is suitable for successful professionals or specialists in the private, public, or voluntary sectors who have new management responsibilities and need to quickly expand their management knowledge. This Programme serves as a refresher course for those who have had their Masters a long time ago and need quick reminders and professional/ academic updates while it serves as a primer for those very experienced Professionals who never made time out for their masters yet they require the academic and practical relevance of this master’s experience. It is a short executive training that runs online for 3 months. Candidates will run 2 months of active lectures and series of assignments and 1 month for their dissertation. Upon successful completion of the Programme, candidates will be awarded a Continuing Professional Development (CPD) certificate in the specific Programme they have completed. What is a CPD Course? Continuing Professional Development (CPD) is the means by which professionals maintain and enhance their knowledge and skills. The world is constantly moving at a very fast pace so undertaking CPD is essential to support a professional in his/her current role as well as helping them with career progression. CPD is all about upgrading knowledge, skills, and capabilities to remain effective and compliant. A CPD course is an investment that you make in yourself. It’s a way of planning your development that links learning directly to practice. CPD can help you keep your skills and knowledge up to date and prepare you for greater responsibilities. It can boost your confidence, strengthen your professional credibility, and help you become more creative in tackling new challenges. Is the SEMP Information Management Programme right for me? Our supported distance learning mode of delivery allows you to study online from any location and is designed to fit in around your work commitments. You will be taught and supported by experienced industry professionals who will recreate the same challenging interactive format of the on-campus courses for those studying at a distance. Why SEMP Strategic Information Management? This program provides the practical skills and strategic mindset needed to become a successful reputation management professional. Enhance your abilities to work more effectively with those who manage the reputation and brand of the organization. World-class faculty bring an unparalleled depth of knowledge and real-world experience, which participants can draw upon in Questions and Answers. It is a virtual learning experience, so it will not disrupt your normal workflow and there are no travel expenses. Develop your network to help you address your own challenges and engage with peers throughout and after the program. Who should enrol in this online Certificate Program? This non-credit-bearing course benefits professionals at all levels who want to contribute to their organization’s performance. Here are some of the people who will benefit from the online Programme: Executives with responsibility for corporate communications, and/or investor relations. Functional leaders who are involved with defining or executing brand and reputation strategies, such as leaders from human resources, public affairs, environmental relations, and legal Managers seeking to move into leadership positions in their organization Individuals seeking knowledge for career advancement in the field of Information management Cross-functional teams from within an organization can take the program, as that accelerates the impact and engenders a common language and understanding in the organization Accreditation The content of this course has been independently certified as conforming to universally accepted Continuous Professional Development (CPD) guidelines. Entry Requirements There are no strict entry requirements for this course. Work experience will be added advantage to understanding the content of the course. Workshops This is a self-study programme with unlimited tutor support. You will never be more than a message or phone call away from our tutors. Visa Requirements There are no Visa Requirements for this Course as its an Online Course.

Certified Associate in Project Management (CAPM) Exam Prep: On-Demand

By IIL Europe Ltd

Certified Associate in Project Management (CAPM)® Exam Prep: On-Demand: On-Demand This course gives you the knowledge you need to pass the exam and covers CAPM®-critical information on project management theory, principles, techniques, and methods Are you planning on taking the CAPM® examination? This course gives you the knowledge you need to pass the exam and covers CAPM®-critical information on project management theory, principles, techniques, and methods. You'll also have an opportunity for practical applications and time to review the kinds of questions you'll find in the CAPM® Exam. What you Will Learn Apply for the CAPM® Examination Develop a personal exam preparation plan Describe the structure, intent, and framework principles of the current edition of the PMBOK® Guide Explain the PMBOK® Guide Knowledge Areas, as well as their inter-relationships with the each other and the Process Groups Getting Started Program orientation The CAPM® certification process Certified Associate in Project Management (CAPM®) Examination Content Outline CAPM® eligibility requirements Code of Ethics and Professional Conduct Application options Foundation Concepts Skills and qualities of a project manager Project management terminology and definitions Relationship of project, program, portfolio, and operations management Project lifecycle approaches Project Integration Management Review Project Integration Management Knowledge Area Develop Project Charter Develop Project Management Plan Direct and Manage Project Work Manage Project Knowledge Monitoring and Controlling Perform Integrated Change Control Close Project or Phase Project Stakeholder Management Review Project Stakeholder Management Knowledge Area Identify Stakeholders Plan Stakeholder Engagement Manage Stakeholder Engagement Monitor Stakeholder Engagement Project Scope Management Review Project Scope Management Knowledge Area Plan Scope Management Collect Requirements Define Scope Create WBS Validate Scope Control Scope Project Schedule Management Review Project Schedule Management Knowledge Area Plan Schedule Management Define Activities Sequence Activities Estimate Activity Durations Develop Schedule Control Schedule Project Cost Management Review Project Cost Management Knowledge Area Plan Cost Management Estimate Costs Determine Budget Control Schedule Project Resource Management Review Project Resource Management Knowledge Area Plan Resource Management Estimate Activity Resources Acquire Resources Develop Team Manage Team Control Resources Project Quality Management Review Project Quality Management Knowledge Area Plan Quality Management Manage Quality Control Quality Project Risk Management Review Project Risk Management Knowledge Area Plan Risk Management Identify Risks Perform Qualitative Risk Analysis Perform Quantitative Risk Analysis Plan Risk Responses Implement Risk Responses Monitor Risks Project Communications Management Review Project Communications Management Knowledge Area Plan Communications Management Manage Communications Monitor Communications Project Procurement Management Review Project Procurement Management Knowledge Area Plan Procurement Management Conduct Procurements Control Procurements Summary and Next Steps Program Review Mock CAPM® Exam Getting Prepared for the CAPM® Exam After the CAPM® Exam

Essential Elements of International Contracts Laws and Contracts Lifecycle Management

By EnergyEdge - Training for a Sustainable Energy Future

About this Training Course In context of trade, seamless supply chains and dependence on international resources, world is becoming one single market. Even though because of internet and widespread access to legal resources, business managers tend to share the common legal principles, but unfortunately, the legal framework and national laws of different countries still maintain a certain degree of uniqueness and protectionism. Thus, the success of an international contract will depend on the 'know how' in identifying the differences in legal regimes, diversity of legislature, scoping, contract drafting, negotiation and execution competencies in each context. It is getting not only important but crucial to consider risks from remote and unforeseen events, sanctions, and proxy wars. As a contract gets bigger in monetary value and wider in scope, more attention is needed in drafting and interpreting terms and conditions of any contract before signing on the last page or accepting it online. This 2 full-day course endeavours to enable the participants gain an understanding of the essential ingredients of contracts and mastering the international contracting principles. This course will equip participants to identify vague and ambiguous clauses, avoid dangerous and often hidden terms, and better understand the controlling position in a project. The participants will learn from the Case Law Reports and analysis to take home lessons learned from bitter experiences of peers in the industry. It is designed to help those who need a solution to manage current contractual issues or those who execute international contracts regularly and want to be more proficient in managing their contracts and projects, with changing contexts. Training Objectives On completion of this course, the participants will have learnt: Project management strictly in accordance with the contract and the corporate strategies How to ensure that Variations Order claims are appropriately managed in turnkey and lump-sum contracts Manage contemporary challenges and market factors with direct or indirect impact on the contracts Managing all members of the Supply Chain from vendors to logistics services providers Cost Engineering and Performance Management How to manage Consortium Partners, Contractors and Owners representatives When and how to obtain / grant extension of time (EOT) and costs Ability to identify rights and obligations of each party to a contract instead of making subjective decisions Ability to be firm in negotiations without violating the terms of the agreements Ability to spot different legal systems, contract laws and arbitration rules Ability to negotiate and avoid disputes and resolution in an amicable manner, in accordance with the provisions of the contract Competency in developing and maintaining documentary evidence and traceability for all works executed during the project Target Audience This course is intended for professionals from the Oil & Gas Industry, Heavy Engineering & Construction Industries, Terminals, Shipping and Maritime Logistics Services Providers. This course is not to be missed by, especially those who are involved in Contract Management and with roles related to Contracts e.g. Commercial Managers, Engineers, Procurement Managers and Finance Managers, with a non-legal background and Para-legal executives. Course Level Intermediate Trainer Principal Management Consultant Chartered Valuer and Appraiser (CVA) FACICA | FAMTAC | FAIADR | M.S.I.D | Member, AIEN LL.M. (IP Law), M. Sc. (Maritime Studies), M. Tech (Knowledge Engineering), MBA, First Class CoC (MCA, UK), B. E. (Elect) Your expert course leader, during the last 47 year period, has worked and consulted in the industry verticals encompassing: Technology, Oil & Gas Exploration & Production, Petrochemical Process Plants and Power Plant Construction Projects, Logistics & Warehousing, Marine, Offshore, Oil & Gas Pipelines, Infrastructure Development Projects (Ports, Offshore Supply Bases, Oil & Gas Terminals and Airports etc), EPCIC Contracts, and Shipyards, in South East Asia, Africa, Middle East, Americas and Europe. He serves as the Principal Management Consultant with a management consultancy in Hong Kong and Singapore, specialising in the fields of corporate management consultancy, international contracts reviews and alternative dispute resolutions services. He undertakes special assignments for conducting audits and valuation of intangible properties involving proprietary processes for licensed production, and licensing of intellectual property rights (IP Rights) in patents, trademarks, and industrial designs. He is frequently engaged for assignments like due diligence, acquisitions, mergers, resolving various operational issues, technology transfer and agency services contracts reviews, cost controls, and enhancement of Supply Chain Management. He has been conferred the credentials of Chartered Valuer & Appraiser (CVA) by SAC and IVAS, in accordance with the international valuation standards setting body IVSC. His consulting experience includes Charterparty Management, Business Process Re-engineering, Diversifications, Corporate Development, Marketing, Complex Project Management, Feasibility Studies, Dispute Resolutions and Market Research. He has successfully assisted Marine and offshore E & P clients in managing contractual disputes arising from various international contracts for upgrading & conversion projects. He continues to be actively engaged in claims reviews, mediation, arbitration, litigation, and expert witness related assignments, arising from international contracts and Charterparty Agreements. He graduated with a Bachelor's degree in Electrical Engineering, MBA in General Management, Master of Technology in Knowledge Engineering, Master of Science in Maritime Studies, and LL.M. (IP Law). He also holds professional qualifications in Business Valuations and Appraisers for CVA, arbitration, law, and marine engineering, including the Chief Engineer's First-Class Certificate of Competency (MCA, UK). He is further qualified and accredited as Certified International Arbitrator, Chartered Arbitrator, Sports arbitrator under CAS Rules, WIPO Neutral, Australian Communications and Media Authority (ACMA) Bargaining Code Arbitrator, Accredited Adjudicator and Accredited Mediator (Malaysia). He is admitted to the international panels of arbitrators and neutrals with WIPO, Geneva; ACICA, AMTAC and ACMA, Australia; BVIAC (British Virgin Islands); JIAC (Jamaica); HKIAC Hong Kong; AIAC, Malaysia; AIADR, Malaysia; KCAB, Seoul, South Korea; ICA, Delhi, India; ICC (Singapore); SISV, Singapore; SCMA, Singapore; SCCA, Saudi Arabia; VIAC Vienna, Austria; Thailand Arbitration Centre (THAC), and Mediator with AIAC Malaysia, CMC, and SIMI Singapore. POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

The objective of Level 6 Diploma in Business Management qualification (accredited by Othm) is to provide learners with an excellent foundation for a career in a range of organisations. It is designed to ensure that each learner is 'business ready': a confident, independent thinker with a detailed knowledge of business and management and equipped with the skills to adapt rapidly to change. The content of the qualification is focused on leadership and people management, strategic human resource management, operations management, sustainable business practice, financial decision making as well as the business research skills expected of a manager. The qualification is ideal for those who have started, or are planning to move into, a career in private or public sector business. Successful completion of the Level 6 Diploma in Business Management qualification will provide learners with the opportunity to progress to further study or employment. Program Overview Key Highlights Program Duration: 9 Months (Can be Fast tracked) Program Credits: 120 Designed for working Professionals Format: Online No Written Exam. The Assessment is done via Submission of Assignment Tutor Assist available Dedicated Student Success Manager Timely Doubt Resolution Regular Networking Events with Industry Professionals Become eligible to gain direct entry into relevant Master's degree programme. LSBR Alumni Status No Cost EMI Option Who is this course for? Working Professionals, Level 5 / Year 2 of a three-year UK Bachelor's degree holders or learners who are looking for Career Progression and a formal undergraduate qualification leading to award of degrees in future.

Level 6 NVQ Diploma in Construction Site Management

By REX Training Services

Level 6 NVQ Dipolma in Construction Management Operations

Innovation Project Management: On-Demand

By IIL Europe Ltd

Innovation Project Management: On-Demand Companies need growth for survival. Companies cannot grow simply through cost reduction and reengineering efforts. This program describes the relationship that needs to be established between innovation, business strategy, and project management to turn a creative idea into a reality. We will explore the importance of identifying the components of an innovative culture, existing differences, challenges, and the new set of skills needed in innovation project management. Companies need growth for survival. Companies cannot grow simply through cost reduction and reengineering efforts. Innovation is needed and someone must manage these innovation projects. Over the past two decades, there has been a great deal of literature published on innovation and innovation management. Converting a creative idea into reality requires projects and some form of project management. Unfortunately, innovation projects, which are viewed as strategic projects, may not be able to be managed using the traditional project management philosophy we teach in our project management courses. There are different skill sets needed, different tools, and different life-cycle phases. Innovation varies from industry to industry and even companies within the same industry cannot come to an agreement on how innovation project management should work. This program describes the relationship that needs to be established between innovation, business strategy, and project management to turn a creative idea into a reality. We will explore the importance of identifying the components of an innovative culture, existing differences, challenges, and the new set of skills needed in innovation project management. What you Will Learn Explain the links needed to bridge innovation, project management, and business strategy Describe the different types of innovation and the form of project management each require Identify the differences between traditional and innovation project management, especially regarding governance, human resources management challenges, components of an innovative culture and competencies needed by innovation project managers Establish business value and the importance of new metrics for measuring and reporting business value Relate innovation to business models and the skills needed to contribute in the business model development Recognize the roadblocks affecting innovation project management and their cause to determine what actions can be taken Determine the success and failure criteria of an innovation project Foundation Concepts Understanding innovation Role of innovation in a company Differences between traditional (operational) and strategic projects Innovation management Differences between innovation and R&D Differing views of innovation Why innovation often struggles Linking Innovation Project Management to Business Strategy The business side of innovation project management The need for innovation targeting Getting close to the customers and their needs The need for line-of-sight to the strategic objectives The innovation enterprise environmental factors Tools for linking Internal Versus External (Co-creation) Innovation Open versus closed innovation Open innovation versus crowdsourcing Benefits of internal innovation Benefits of co-creation (external) innovation Selecting co-creation partners The focus of co-creation The issues with intellectual property Understanding co-creation values Understanding the importance of value-in-use Classification of Innovations and Innovation Projects Types of projects Types of innovations Competency-enhancing versus competency-destroying innovations Types of innovation novelty Public Sector of Innovation Comparing public and private sector project management Types of public service innovations Reasons for some public sector innovation failures An Introduction to Innovation Project Management Why traditional project management may not work The need for a knowledge management system Differences between traditional and innovation project management Issues with the 'one-size-fits-all' methodology Using end-to-end innovation project management Technology readiness levels (TRLs) Integrating Kanban principles into innovation project management Innovation and the Human Resources Management Challenge Obtaining resources Need for a talent pipeline Need for effective resource management practices Prioritizing resource utilization Using organizational slack Corporate Innovation Governance Types of innovation governance Business Impact Analysis (BIA) Innovation Project Portfolio Management Office (IPPMO) Using nondisclosure agreements, secrecy agreements, confidentiality agreements, and patents Adverse effects of governance decisions Innovation Cultures Characteristics of a culture for innovation Types of cultures Selecting the right people Linking innovation to rewards Impact of the organizational reward system Innovation Competencies Types of innovation leadership The need for active listening Design thinking Dealing with ambiguity, uncertainty, risks, crises, and human factors Value-Based Innovation Project Management Metrics Importance of innovation project management metrics Understanding value-driven project management Differences between benefits and value - and when to measure Traditional versus the investment life cycle Benefits harvesting Benefits and value sustainment Resistance to change Tangible and intangible innovation project management metrics Business Model Innovation Business model characteristics Impact of disruptive innovation Innovation Roadblocks Roadblocks and challenges facing project managers Ways to overcome the roadblocks Defining Innovation Success and Failure Categories for innovation success and failure Need for suitability and exit criteria Reasons for innovation project failure Predictions on the Future of Innovation Project Management The Six Pillars of changing times Some uses for the new value and benefits metrics

Diploma In Business Management - Level 4 (Fast Track)

4.0(2)By London School Of Business And Research

This fast track Level 4 Diploma in Business Management programme has been created to develop and reward the business managers of today and the future, and to continue to bring recognition and professionalism to the management sectors. This diploma provides an introduction to the main facets and operations of organisations and the challenges faced by modern day businesses. Furthermore, through this fast track Level 4 Diploma in Business Management we look to create learning that advances the thought leadership of organisations, offering conceptual and practical insights that are applicable in the companies of today and tomorrow Key Highlights of fast track Level 4 Diploma In Business Management qualification are: Program Duration: 6 Months (Regular 9 months duration course also available) Program Credits: 120 Designed for working Professionals Format: Online No Written Exam. The Assessment is done via Submission of Assignment Tutor Assist available Dedicated Student Success Manager Timely Doubt Resolution Regular Networking Events with Industry Professionals Become eligible to gain direct entry into relevant Undergraduate degree programme. Alumni Status No Cost EMI Option Requirements Diploma in Business Management - Level 4 (Fast track)This fast track Level 4 Diploma in Business Management (Accredited by Qualifi) qualifications has been designed to be accessible without artificial barriers that restrict access and progression. Learners will be expected to hold the following: Learners who have demonstrated some ability and possess Qualifications at Level 3 for example 'A' Levels or vocational awards; and/or OR work experience in a business environment and demonstrate ambition with clear career goals; Level 4 qualification in another discipline and want to develop their careers in management. Career path Learners completing the fast track Level 4 Diploma in Business Management can progress to: The Second year of an Undergraduate Degree, or Level 5 Diploma qualifications (click here to view) Directly into employment in an associated profession. Certificates Certificate of Achievement Hard copy certificate - Included Once you complete the course, you would be receiving a Physical hard copy of your Diploma along with its Transcript which we would Courier to your address via DHL or Royal Mail without any additional charge

What does this course cover? This five-day course covers a range of topics, all of which are covered via a mixture of theoretical and practical training – we aim for our courses to be as hands-on as possible. The course specifically covers: An introduction to SCADA systems, including elements, servers, hardware and software, tags, plus more. A range of systems including automatic control, FIELDBUS, and wireless communication systems. An introduction to serial interferences, ethernet networks, fibre optics, and wireless. Process variables Communications include case studies to establish communication with HMI (Siemens, Allen Bradley, and Pro-face) . Programmable Logic Controllers (PLCs), Remote Terminal Units (RTUs), sensors and alarms. Introduction to OPC, covering how to configure OPC UA servers and how to program an OPC UA client. Client and servers development Connection management Security configuration Trends and historical data System components What will I gain from this SCADA HMI course? Upon successful completion of this course, candidates will gain a City & Guilds accredited certificate in Scada, HMI and communications.

Diploma in Business Continuity & Resiliency Management

By BCMcourses.com

This is our new Diploma course in Business Continuity & Resiliency Management. It includes the BCRP (Business Continuity and Resiliency Professional) exam and designation for free ($ 500 value). This course provides an intensive, hands-on workshop experience covering all major aspects for the development, implementation and ongoing management of an effective Business Continuity Plan for corporations, any size of business, healthcare, NGO and government organizations. It is equivalent to our 5-day in-person 'Diploma in BCRP' course. It utilizes a 21st century skills curriculum to enable you to achieve the knowledge and expertise required to succeed in your personal involvement in Business Continuity Planning and within your work environment. The course integrates “Best Principles” for Business Continuity Planning with “Best Practices”, using a case study, real-life scenarios and examples to deepen your understanding. This course is accredited by the National Institute for Business Continuity Management (https://www.NIBCM.net) and leads to their professional designation of Business Continuity & Resiliency Professional (BCRP), as well as our Diploma in Business Continuity and Resiliency Management. In addition, the course provides you with real-life tools for Business Continuity Planning. It follows a case study approach, and engages you in solving meaningful problems with your own organization. The course also provides asynchronous interaction with the course instructor for assignments and any questions that may arise.

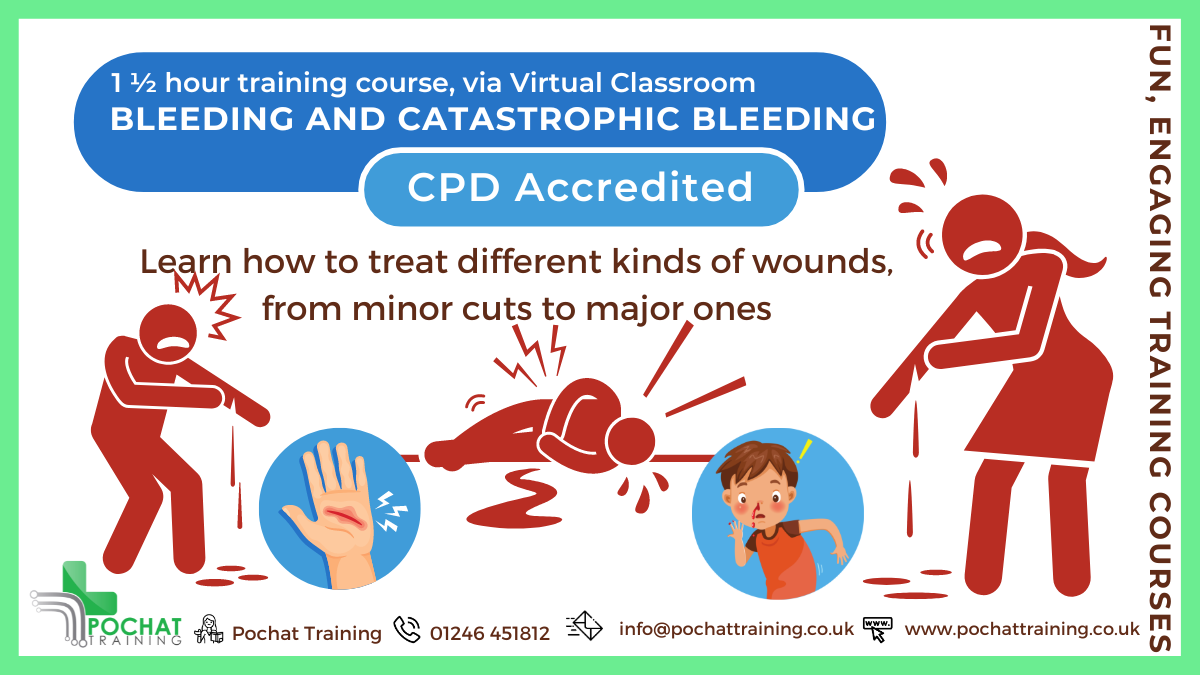

CPD Accredited, Interactive Short Course 1½ hr session Learn to deal with bleeding, from minor bleeds to catastrophic bleeds Become a life-saving hero if ever someone is seriously injured Course Contents: How to treat minor bleeding How to treat major bleeding Types of bleeding How to treat catastrophic bleeding Tourniquets Why to use a tourniquet How to use a tourniquet How to make an improvised tourniquet How to use a Tourni-Key Wound packing How to use Celox Z-Gauze How to improvise packing a wound How to treat gunshot wounds Practical elements: There is an option of learning how to deal with catastrophic bleeding in person, so you get to practice these skills (and play about with fake blood 😀). For that, see our Catastrophic Bleeding course module. Benefits of this Short Course: We all have regular injuries which cause us to bleed If not properly cared for, even a small cut can turn septic and kill or maim Serious car accidents, machinery accidents at work, weapon wounds, terrorist attacks and more can also lead to catastrophic bleeding Did you know that a person could bleed out in just five minutes..? You're got to act quick, decisive and correctly Please don't do what you see in the movies - you will kill the person even quicker...