- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

153 Courses delivered Online

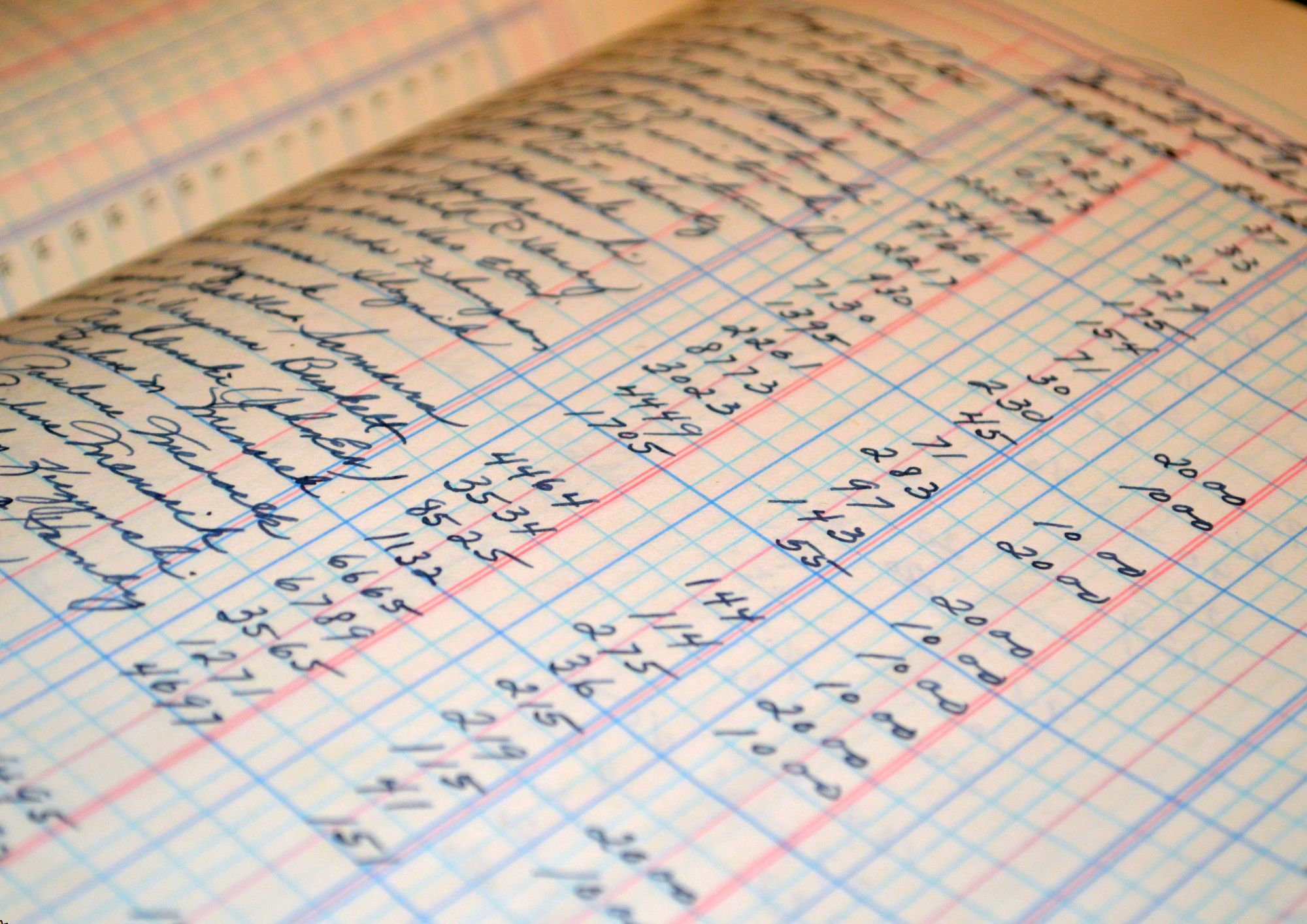

Learning Outcomes Get the basics of accounting for bookkeeping Understand the manual, computerised system of bookkeeping Deepen your understanding of ledgers, trail balance and coding Know the basics of PNL accounting and balance sheet management Enrich your knowledge of debits, credits, budgeting, and financial analysis as well as identify high and low-risk of companies Description For effective bookkeeping, you have to establish a solid understanding of accounting principles. The Accounting Basics For Bookkeepers course is an excellent place to work on your accounting skills. It will give you the opportunity to get quality training without even stepping out of the house. In this course, you will get an overall understanding of the key aspects of accounting in bookkeeping. Besides providing the fundamental of accounting this course will also teach you manual and computerised bookkeeping systems. Alongside that, it will also show you the procedure of ledgers, trail balance and coding as well in this course. Lastly, the course will talk about PNL accounting, balance sheet management further in the course. So, if you are keen to acquire about all these mentioned topics then enrol in our course and start learning. It will also offer you a CPD- certificate to boost your resume. So, hurry up and join now! Certificate of Achievement After the successful completion of the final assessment, you will receive a CPD-accredited certificate of achievement. The PDF certificate is for 9.99, and it will be sent to you immediately after through e-mail. You can get the hard copy for 15.99, which will reach your doorsteps by post. Method of Assessment After completing this course, you will be provided with some assessment questions. To pass that assessment you need to score at least 60%. Our experts will check your assessment and give you feedback accordingly. Career path The knowledge and skills in accounting basics will help you hunt jobs for the mentioned positions: Auditor Tax Accountant Accountant Manager Financial Advisor Financial Executive

Charity Accounting Training

By Compete High

ð Unlock Financial Excellence in the Nonprofit Sector with Charity Accounting Training! ð Are you looking to make a meaningful impact in the world of nonprofits? Do you aspire to contribute your financial expertise to charitable organizations and make a real difference? Look no further! Our comprehensive course, 'Charity Accounting Training,' is designed to equip you with the essential skills and knowledge needed to excel in the field of charity accounting. ð Course Overview: Module 1: Introduction to Charity Accounting Lay the foundation for your journey with a deep dive into the unique aspects of charity accounting. Understand the legal and regulatory frameworks that govern financial management in the nonprofit sector. Learn how to interpret and apply accounting standards specific to charitable organizations. Module 2: Basic Accounting Principles Build a solid understanding of fundamental accounting principles. Master the art of bookkeeping, financial reporting, and preparing financial statements. Acquire skills to analyze and interpret financial data to make informed decisions. Module 3: Budgeting and Financial Planning Develop expertise in creating effective budgets for nonprofit organizations. Understand the importance of financial planning to ensure sustainability and mission success. Learn to navigate the challenges of resource allocation and optimizing financial resources. Module 4: Taxation and Gift Aid Gain insights into the tax implications for charities and how to navigate the complex landscape. Explore the benefits of Gift Aid and learn how to maximize contributions through tax-efficient giving. Ensure compliance with tax regulations while optimizing the financial health of your charitable organization. Module 5: Charity Fundraising Uncover the strategies and best practices for successful fundraising campaigns. Explore diverse fundraising methods and their financial implications. Understand how to align financial goals with the mission and vision of your nonprofit. ð Why Choose Charity Accounting Training? Expert-Led Instruction: Our course is led by seasoned professionals with extensive experience in charity accounting, ensuring you receive top-notch, real-world insights. Practical Application: Each module is designed to provide hands-on experience, allowing you to apply theoretical knowledge to real-world scenarios. Flexible Learning: Access our course materials at your own pace, fitting your studies into your busy schedule without compromising on quality. Networking Opportunities: Connect with like-minded individuals, industry experts, and potential mentors through our community forums and networking events. ð Elevate your career and contribute to the greater good! Enroll in Charity Accounting Training today and become a financial champion for change. Course Curriculum Module 1_ Introduction to Charity Accounting. Introduction to Charity Accounting. 00:00 Module 2_ Basic Accounting Principles. Basic Accounting Principles. 00:00 Module 3_ Budgeting and Financial Planning. Budgeting and Financial Planning. 00:00 Module 4_ Taxation and Gift Aid. Taxation and Gift Aid. 00:00 Module 5_ Charity Fundraising. Charity Fundraising. 00:00

Accounts Assistant

By Compete High

Course Curriculum Module 1 Introduction to Financial Management Introduction to Financial Management 00:00 Module 2 Financial Statements and Analysis Financial Statements and Analysis 00:00 Module 3 Time Value of Money and Investment Appraisal Time Value of Money and Investment Appraisal 00:00 Module 4 Capital Budgeting and Project Evaluation Capital Budgeting and Project Evaluation 00:00 Module 5 Working Capital Management Working Capital Management 00:00 Module 6 Cash Flow Statement and Liquidity Management Cash Flow Statement and Liquidity Management 00:00 Module 7 Financial Analysis and Ratios Financial Analysis and Ratios 00:00 Module 8 Budgeting and Forecasting_ Planning for Success Budgeting and Forecasting_ Planning for Success 00:00 Module 9 Internal Controls and Risk Management Internal Controls and Risk Management 00:00

Accounting for Chartered Accountants

By Compete High

Unlock Your Potential with 'Accounting for Chartered Accountants' Are you ready to elevate your accounting expertise to the next level? Look no further than our comprehensive text course, 'Accounting for Chartered Accountants.' ð Whether you're a seasoned professional or just starting your journey in the world of finance, this course is designed to empower you with the knowledge and skills needed to excel in your career. Benefits of Taking 'Accounting for Chartered Accountants' Advanced Expertise: Dive deep into advanced accounting principles and techniques tailored specifically for chartered accountants. ð Gain a comprehensive understanding of complex financial concepts and strategies that will set you apart in the competitive field of accounting. Practical Application: Learn through real-world case studies and practical examples that bridge the gap between theory and practice. ð¼ Our course equips you with hands-on experience, ensuring that you're prepared to tackle the challenges of the modern accounting landscape. Career Advancement: Enhance your professional credibility and expand your career opportunities with a certification in accounting for chartered accountants. ð Whether you're seeking a promotion or exploring new job prospects, this course will give you the edge you need to succeed. Flexibility: Study at your own pace and convenience with our flexible online platform. ð Whether you're juggling work commitments or personal obligations, our self-paced format allows you to tailor your learning experience to fit your schedule. Expert Guidance: Benefit from the expertise of industry professionals who are committed to your success. ð Our instructors are seasoned accounting professionals with years of experience, ready to guide you every step of the way. Who is this for? 'Accounting for Chartered Accountants' is ideal for: Chartered accountants looking to enhance their skills and expertise. Accounting professionals seeking advanced training in financial management. Finance professionals aiming to earn a competitive edge in the job market. Individuals aspiring to become chartered accountants and excel in their careers. Career Path Upon completing 'Accounting for Chartered Accountants,' you'll be equipped to pursue a variety of rewarding career paths, including: Financial Controller Chief Financial Officer (CFO) Audit Manager Tax Consultant Financial Analyst Management Accountant Forensic Accountant FAQs Is this course suitable for beginners in accounting? While 'Accounting for Chartered Accountants' is tailored for professionals with a foundational understanding of accounting principles, beginners who are committed to learning and dedicated to their studies can also benefit from this course. How long does it take to complete the course? The duration of the course depends on your individual pace and schedule. On average, students typically complete the course within [insert average duration]. Is there a certification upon completion of the course? Yes, upon successfully completing the course and passing the assessment, you will receive a certification in 'Accounting for Chartered Accountants' to showcase your expertise and enhance your professional credentials. What are the prerequisites for enrolling in the course? While there are no strict prerequisites, a basic understanding of accounting principles and terminology is recommended to fully benefit from the course material. Are there any live sessions or is it entirely self-paced? 'Accounting for Chartered Accountants' is entirely self-paced, allowing you to study at your own convenience and pace. However, we do offer optional live webinars and Q&A sessions to supplement your learning experience and provide additional support. Can I access the course materials after completing the course? Yes, you will have lifetime access to the course materials, allowing you to review and revisit the content at any time. Is financial assistance available for the course? We offer various payment options and financial assistance programs to make the course accessible to individuals from diverse backgrounds. Please contact our support team for more information on available options. Don't miss out on this opportunity to take your accounting career to new heights. Enroll in 'Accounting for Chartered Accountants' today and embark on a journey toward professional excellence! ð Course Curriculum Module 1 Introduction to Accounting Principles Introduction to Accounting Principles 00:00 Module 2 Bookkeeping and Journal Entries Bookkeeping and Journal Entries 00:00 Module 3 Financial Statements Preparation and Analysis Financial Statements Preparation and Analysis 00:00 Module 4 Internal Controls and Fraud Prevention Internal Controls and Fraud Prevention 00:00 Module 5 Budgeting and Financial Planning Budgeting and Financial Planning 00:00 Module 6 International Accounting Standards International Accounting Standards 00:00

Household Ledger

By Compete High

ð¡ Master Your Household Finances with Household Ledger Course! ð Are you ready to take control of your household finances and achieve financial freedom? Introducing our Household Ledger course, a comprehensive text-based program designed to empower you with the skills and knowledge needed to manage your finances effectively. Say goodbye to financial stress and hello to financial empowerment with our easy-to-follow lessons and practical exercises. ð Benefits of Taking the Household Ledger Course: Financial Literacy: Gain a solid understanding of basic financial principles, including budgeting, tracking expenses, and managing debt. Improved Money Management: Learn how to create and maintain a household ledger to track income, expenses, and savings accurately. Debt Reduction: Discover strategies for reducing debt and building a solid financial foundation for you and your family. Budgeting Mastery: Develop effective budgeting techniques to allocate funds wisely, prioritize spending, and achieve your financial goals. Financial Planning: Learn how to set realistic financial goals, create a savings plan, and prepare for unexpected expenses or emergencies. Empowerment and Confidence: Gain the confidence to make informed financial decisions and take control of your financial future. Enhanced Communication: Improve communication with family members about financial matters, fostering teamwork and cooperation in managing household finances. ð¨âð©âð§âð¦ Who is this for? Individuals and families looking to gain control over their household finances. Those seeking to improve their financial literacy and money management skills. Anyone struggling with debt or financial stress and in need of practical solutions. Couples or families wanting to work together to achieve their financial goals. ð Career Path: While the Household Ledger course primarily focuses on personal finance management, the skills learned can also be valuable in various career paths, including: Financial Planning: Pursue a career as a financial planner or advisor, helping individuals and families create comprehensive financial plans to achieve their goals. Accounting and Bookkeeping: Apply your knowledge of budgeting and ledger management in roles such as accounting clerk, bookkeeper, or financial analyst. Financial Counseling: Become a financial counselor or coach, assisting clients in overcoming financial challenges, managing debt, and achieving financial wellness. Education: Share your expertise by teaching financial literacy courses in schools, community centers, or online platforms, empowering others to take control of their finances. Entrepreneurship: Use your financial management skills to start your own business or consultancy focused on personal finance education and coaching. ð FAQ: Q: Is this course suitable for beginners? A: Yes! The Household Ledger course is designed for individuals with varying levels of financial knowledge, including beginners. Our easy-to-follow lessons and practical exercises make it accessible to everyone. Q: Do I need any special software to take this course? A: No, you do not need any special software. The Household Ledger course utilizes simple and accessible methods for managing household finances, including manual ledger tracking techniques. Q: How long does it take to complete the course? A: The duration of the course depends on your learning pace and schedule. On average, students complete the course in 4-6 weeks, dedicating a few hours per week to study and practice. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the Household Ledger course, you will receive a certificate of achievement, showcasing your newfound skills in household finance management. Q: Can I apply the skills learned in this course to manage small business finances? A: While the focus of the course is on household finances, many of the principles and techniques taught can be applied to small business finance management as well. Q: Is there any support available if I have questions or need assistance during the course? A: Yes, our dedicated support team is available to assist you throughout your learning journey. You can reach out via email or through our online platform for prompt assistance. ð Ready to Take Control of Your Finances? Don't let financial stress hold you back from achieving your dreams. Enroll now in the Household Ledger course and embark on a journey to financial empowerment and security. Start building a brighter financial future for you and your loved ones today! ð°ð¡â¨ Course Curriculum Module 1 Introduction to Household Ledger Management Introduction to Household Ledger Management 00:00 Module 2 Mastering Budgeting and Financial Tracking Mastering Budgeting and Financial Tracking 00:00 Module 3 Frugal Living and Efficient Spending Frugal Living and Efficient Spending 00:00 Module 4 Building an Emergency Fund for Financial Security Building an Emergency Fund for Financial Security 00:00 Module 5 Mastering Debt Management and Achieving Financial Freedom Mastering Debt Management and Achieving Financial Freedom 00:00 Module 6 Introduction to Investing for Financial Growth Introduction to Investing for Financial Growth 00:00 Module 7 Secure Your Future_ Retirement Planning for a Comfortable Retirement Secure Your Future_ Retirement Planning for a Comfortable Retirement 00:00

Understanding the Association of Accounting Technicians

By Compete High

Unlock the Doors to a Successful Career with Understanding the Association of Accounting Technicians Text Course! Are you looking to embark on a rewarding journey in the world of finance and accounting? Do you aspire to become a proficient accounting technician, equipped with the knowledge and skills to excel in various financial settings? Look no further! Our comprehensive text course, 'Understanding the Association of Accounting Technicians,' is your key to unlocking a world of opportunities in the dynamic field of accounting. ð Why Choose Our Course? Our text course is meticulously designed to provide you with a solid foundation in the principles, practices, and regulations governing accounting and finance. Whether you're a beginner seeking to kickstart your career or a seasoned professional aiming to enhance your skills, our course offers something for everyone. Here are just a few reasons why our course stands out: Comprehensive Curriculum: Our course covers essential topics such as financial accounting, management accounting, taxation, and ethics, ensuring you gain a well-rounded understanding of accounting principles. Flexible Learning: Access the course material anytime, anywhere, at your own pace. Whether you're a full-time student, a working professional, or a busy parent, our flexible learning format allows you to study at your convenience. Expert Guidance: Learn from industry experts and experienced professionals who bring real-world insights and practical knowledge to the table. Benefit from their guidance and expertise as you navigate through the course material. Practical Assignments: Put your knowledge to the test with hands-on assignments and case studies designed to reinforce learning and enhance practical skills. Gain confidence in your abilities as you tackle real-world accounting scenarios. Recognized Certification: Upon successful completion of the course, receive a certification that validates your expertise and enhances your credibility in the eyes of employers and clients. ð Who is this for? Our course is ideal for: Aspiring accounting professionals seeking to kickstart their careers. Finance students looking to supplement their academic studies with practical knowledge. Working professionals aiming to enhance their accounting skills and advance their careers. Small business owners and entrepreneurs who want to gain a better understanding of financial management. No matter your background or experience level, our course is designed to accommodate learners of all profiles and help you achieve your career goals in the field of accounting. ð Career Path Upon completing our course, you'll be well-equipped to pursue a variety of exciting career opportunities in the accounting and finance sector. Some potential career paths include: Accounting Technician: As an accounting technician, you'll play a vital role in supporting the financial operations of organizations, handling tasks such as bookkeeping, payroll processing, and financial reporting. Tax Assistant: Specialize in taxation and assist individuals and businesses with tax planning, preparation, and compliance. Financial Analyst: Analyze financial data, trends, and performance metrics to provide insights and recommendations for strategic decision-making. Auditing Clerk: Conduct internal audits to ensure compliance with regulatory requirements and identify areas for improvement in financial processes and controls. Small Business Advisor: Provide financial advice and support to small businesses and startups, helping them navigate financial challenges and achieve their growth objectives. With the demand for skilled accounting professionals on the rise, the possibilities are endless for those who possess the knowledge and expertise gained from our course. ð FAQs Q: Is this course suitable for beginners with no prior accounting knowledge? A: Absolutely! Our course is designed to cater to learners of all levels, including beginners. We start with the fundamentals and gradually build upon them to ensure a comprehensive understanding of accounting principles. Q: How long does it take to complete the course? A: The duration of the course varies depending on your pace of learning and availability. On average, most learners complete the course within a few weeks to a few months. Q: Will I receive a certificate upon completion of the course? A: Yes, upon successful completion of the course and any associated assessments, you will receive a certificate of completion that can be showcased to employers and clients. Q: Can I access the course material on mobile devices? A: Yes, our platform is mobile-friendly, allowing you to access the course material on your smartphone or tablet for convenient learning on the go. Q: Is there any support available if I have questions or need assistance during the course? A: Absolutely! Our dedicated support team is here to assist you every step of the way. Whether you have questions about course content or technical issues, we're here to help. Don't miss out on this opportunity to take your accounting career to new heights! Enroll in our Understanding the Association of Accounting Technicians text course today and embark on a journey toward professional success and fulfillment. Unlock your potential and achieve your goals with us! Course Curriculum Module 1_ Introduction to Financial Accounting Introduction to Financial Accounting 00:00 Module 2_ Recording Financial Transactions Recording Financial Transactions 00:00 Module 3_ Accounting Standards and Principles Accounting Standards and Principles 00:00 Module 4_ Financial Analysis and Interpretation Financial Analysis and Interpretation 00:00 Module 5_ Budgeting and Financial Planning Budgeting and Financial Planning 00:00 Module 6_ Internal Controls and Risk Management. Internal Controls and Risk Management. 00:00

Diploma in Charity Accounting (DChA) Mini Bundle

By Compete High

Learn charity-specific accounting, business analysis, negotiation, and financial strategy skills in one focused online training bundle. Charity accounting doesn’t mean fuzzy maths and vague budgets—it’s about precise decisions with people in mind. This mini bundle gets to the heart of it, with targeted courses in accounting, business analysis, financial analysis, business management, and negotiation skills. It’s tailored for those working in or supporting financial functions within charitable organisations. Whether you’re trying to make spreadsheets make sense, or you’ve ever been in a funding meeting that felt more like a quiz show, these courses give you the clarity and knowledge to navigate charity finance without the grey areas. It’s built for online study, no suit required, and helps you approach funding, strategy, and board discussions with more confidence (and fewer spreadsheets that mysteriously vanish). Learning Outcomes: Understand accounting methods used in not-for-profit organisations. Apply analytical thinking to budgeting and financial decision-making. Interpret business data to support strategic charity functions. Examine financial trends for reporting and forecast purposes. Communicate clearly in negotiation and budgeting discussions. Explore business management structures within charity contexts. Who Is This Course For: Charity finance officers needing sharper accounting skills. Fund managers working with budgeting and forecasts. Analysts supporting charity performance reporting. Trustees involved in financial decision-making processes. Admins working in charity budgeting or strategy roles. Professionals in grant-based reporting and cost tracking. Business managers in not-for-profit organisations. Finance assistants needing charity sector knowledge. Career Path (UK Average Salaries): Charity Finance Officer – £33,000 per year Business Analyst (Charity) – £38,000 per year Financial Analyst (Non-profit) – £37,000 per year Charity Accountant – £36,000 per year Budget Officer – £32,000 per year Fundraising and Finance Executive – £30,500 per year

Household Purchasing

By Compete High

Unlock Smart Spending Habits with 'Household Purchasing' Text Course! Are you tired of feeling overwhelmed every time you step into a store or browse online for household essentials? Do you wish you had the skills to make informed purchasing decisions that save you money and time? Look no further! Our comprehensive 'Household Purchasing' text course is here to revolutionize the way you shop and manage your household expenses. ð¡ð° What is 'Household Purchasing'? 'Household Purchasing' is a comprehensive text course designed to equip you with the knowledge and skills necessary to make smart purchasing decisions for your home. From groceries and cleaning supplies to furniture and appliances, this course covers everything you need to know to optimize your household spending. Benefits of Taking 'Household Purchasing' Text Course: Save Money: Learn how to identify the best deals, compare prices, and avoid common purchasing pitfalls to maximize your savings. Efficient Shopping: Streamline your shopping process with effective planning and organization techniques, saving you both time and energy. Reduce Waste: Discover strategies for minimizing waste and making sustainable purchasing choices that benefit both your wallet and the environment. Confidence in Decision Making: Gain the confidence to make informed purchasing decisions, knowing that you're getting the best value for your money. Financial Management: Learn how to budget effectively for household expenses and prioritize your spending to achieve your financial goals. Enhanced Quality of Life: By mastering the art of household purchasing, you'll experience less stress and enjoy a higher quality of life as you take control of your finances. Who is This For? Homeowners: Whether you're a first-time homeowner or have been managing your household for years, this course is perfect for anyone looking to optimize their purchasing habits. Renters: Even if you're renting your home, 'Household Purchasing' can help you make the most of your budget and ensure you're getting the best value for your money. Budget-Conscious Individuals: If you're passionate about saving money and living frugally, this course will provide you with the tools and strategies you need to succeed. Career Path: While 'Household Purchasing' is primarily designed for personal use, the skills and knowledge you gain from this course can also be valuable in various professional settings. Here are some career paths where expertise in household purchasing can be beneficial: Retail Management: Understanding consumer behavior and effective purchasing strategies can be invaluable for retail managers looking to optimize inventory management and boost profitability. Finance and Accounting: Knowledge of household purchasing can complement roles in finance and accounting, particularly in budgeting and cost management. Supply Chain Management: Professionals in supply chain management can benefit from insights into consumer purchasing patterns and trends to optimize procurement processes. Entrepreneurship: For aspiring entrepreneurs, understanding household purchasing habits can inform product development, pricing strategies, and marketing efforts. FAQs (Frequently Asked Questions): Q: Is this course suitable for beginners? A: Absolutely! 'Household Purchasing' is designed to cater to individuals of all skill levels, from beginners to seasoned shoppers. Q: How long does it take to complete the course? A: The duration of the course varies depending on your pace of learning. However, most participants complete the course within a few weeks, dedicating a few hours each week to study. Q: Will I receive a certificate upon completion of the course? A: While 'Household Purchasing' does not offer a formal certificate, you'll gain valuable knowledge and skills that you can apply immediately in your everyday life. Q: Can I access the course materials on my mobile device? A: Yes, the course materials are accessible on various devices, including smartphones, tablets, and computers, allowing you to learn on the go. Q: Is there any ongoing support available after completing the course? A: Yes, we provide ongoing support to our students through email assistance and community forums where you can connect with fellow learners and share your experiences. Q: Will this course teach me how to create a household budget? A: Absolutely! 'Household Purchasing' includes modules dedicated to budgeting and financial management, providing you with practical tools and techniques to create and stick to a household budget. Q: Can I apply the skills learned in this course to other areas of my life, such as personal finance or business purchasing? A: Yes, many of the principles and strategies taught in 'Household Purchasing' are applicable to various aspects of personal finance and business purchasing, making it a valuable investment in your overall financial literacy. Don't let inefficient purchasing habits drain your bank account and cause unnecessary stress. Take control of your household spending today with our 'Household Purchasing' text course and unlock a brighter, more financially secure future! ðð³ Course Curriculum Module 1 Understanding Consumer Needs Understanding Consumer Needs 00:00 Module 2 Budgeting for Informed Purchases Budgeting for Informed Purchases 00:00 Module 3 Researching Products for Value Researching Products for Value 00:00 Module 4 Negotiating and Maximizing Deals Negotiating and Maximizing Deals 00:00 Module 5 Sustainable Purchasing for a Better Future Sustainable Purchasing for a Better Future 00:00

Portfolio Building for Property

By NextGen Learning

Portfolio Building for Property Course Overview: This course on "Portfolio Building for Property" offers a comprehensive guide to the key principles of property investment and management. Designed for individuals seeking to develop a successful property portfolio, the course covers various property types, investment strategies, and risk management techniques. Learners will gain an understanding of the financial aspects of property investment, from budgeting and financing to analysing property value and market trends. By the end of the course, participants will be equipped with the knowledge to build and manage a diverse property portfolio and make informed decisions that contribute to long-term financial success. Course Description: "Portfolio Building for Property" explores the essential elements of property investment, focusing on the strategies and tools needed to create a profitable and diversified property portfolio. Key topics include property selection, financing options, market analysis, risk management, and growth strategies. Throughout the course, learners will explore how to evaluate properties, understand market dynamics, and develop a sustainable portfolio. The course also introduces financial models and investment techniques that are critical in today’s property market. Learners will finish with the skills to assess opportunities, maximise returns, and make well-informed decisions within the property industry. Portfolio Building for Property Curriculum: Module 01: Module 02: Module 03: (See full curriculum) Who is this course for? Individuals seeking to enter the property investment market. Professionals aiming to enhance their property investment knowledge. Beginners with an interest in property management and investment. Investors looking to diversify their portfolio. Career Path Property Investor Real Estate Analyst Portfolio Manager Property Consultant Investment Advisor