- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

ICA Advanced Certificate in Managing Sanctions Risk

By International Compliance Association

ICA Advanced Certificate in Managing Sanctions Risk Sanctions are a key tool in the armoury of the global fight against financial crime. Understanding sanctions remains a complex yet fascinating topic and is crucial for the development of well-rounded strategy in combating financial crime. The ICA Advanced Certificate in Managing Sanctions Risk explores the intricacies and challenges of meeting sanctions obligations. You will learn about the latest sanctions challenges and best practice and you will review case studies so you understand the risks sanctions present to firms and the frameworks used to manage these risks. The course will also investigate key areas of sanctions controls such as sanctions screening, managing alerts and sanctions evasion typologies. This course will enable you to: Understand latest sanctions challenges Learn sanctions best practice Review case studies, so you understand the risks sanctions present to firms and the frameworks used to manage these risks Investigate key areas of sanctions controls such as sanctions screening, managing alerts and sanctions evasion typologies. Benefits of studying with ICA: Flexible learning solutions that are suited to you Our learner-centric approach means that you will gain relevant practical and academic skills and knowledge that can be used in your current role Improve your career options by undertaking a globally recognised qualification that hiring managers look for as part of their hiring criteria Many students have stated that they have received a promotion and/or pay rise as a direct result of gaining their qualification The qualifications ensure that you are enabled to develop strategies to help manage and prevent risk within your firm, thus making you an invaluable asset within the current climate This course is awarded in association with Alliance Manchester Business School, the University of Manchester. Students who successfully complete the assessment criteria for this course will be awarded the ICA Advanced Certificate in Managing Sanctions Risk and will be able to use designation - (Adv.Cert(Sanctions). What will you learn? Global sanctions architecture - Political, Legal and Implementation context The international context Transparency, control and ownership Developing the control framework Sanctions lifting and roll back Identifying higher risk jurisdictions and activities

Do you want to grasp the fundamental principles and underlying theory in the conceptual framework for capital maintenance? If yes, then enrol now without any further delay. Description: What is the financial capital maintenance concept? It means that the capital of a company can only be controlled if the financial or monetary amount of its net assets at the end of an economic period is equal to or exceeds the monetary value of its net assets at the beginning of the period, eliminating any distributions or contributions, to or from the owners. Students will learn and make many concepts related to capital maintenance. You will be taught about the key factors that affect both, the requirement of fixed and working capital. You will also be briefed about the difference between own and borrowed capital. Detailed information related to capital maintenance will be shared through this course. Who is the course for? For people who are interested in study related to capital maintenance. Accounting students can benefit from this course. For individuals who are looking forward to starting a business or enhance the current business capital. Entry Requirement: This course is available to all learners, of all academic backgrounds. Learners should be aged 16 or over to undertake the qualification. Good understanding of English language, numeracy and ICT are required to attend this course. Assessment: At the end of the course, you will be required to sit an online multiple-choice test. Your test will be assessed automatically and immediately so that you will instantly know whether you have been successful. Before sitting for your final exam, you will have the opportunity to test your proficiency with a mock exam. Certification: After you have successfully passed the test, you will be able to obtain an Accredited Certificate of Achievement. You can however also obtain a Course Completion Certificate following the course completion without sitting for the test. Certificates can be obtained either in hard copy at the cost of £39 or in PDF format at the cost of £24. PDF certificate's turnaround time is 24 hours, and for the hardcopy certificate, it is 3-9 working days. Why choose us? Affordable, engaging & high-quality e-learning study materials; Tutorial videos/materials from the industry leading experts; Study in a user-friendly, advanced online learning platform; Efficient exam systems for the assessment and instant result; The UK & internationally recognised accredited qualification; Access to course content on mobile, tablet or desktop from anywhere anytime; The benefit of career advancement opportunities; 24/7 student support via email. Career Path: Capital Maintenance Course would be beneficial for the following professionals: Accountants Administrative Services Manager Advertising, Promotions and Marketing Managers Compensation and Benefits Managers Financial Managers Food Services Managers Human Resources Managers Management Directors Sales Specialist And other Top Executives. Capital Maintenance Course Capital Finance Basics 01:00:00 Important Factors Affecting The Requirement Of Fixed Capital 00:30:00 Important Factors Affecting The Requirement Of Working Capital 00:30:00 The Differences Between Own And Borrowed Capital 00:30:00 Importance Of Constant Purchasing Power Accounting 00:15:00 Services Provided By Financial Instruments 00:30:00 Financial Institutions And Short Term Loans For Businesses 00:30:00 Mock Exam Mock Exam - Capital Maintenance Course 00:20:00 Final Exam Final Exam - Capital Maintenance Course 00:20:00 Certificate and Transcript Order Your Certificates and Transcripts 00:00:00

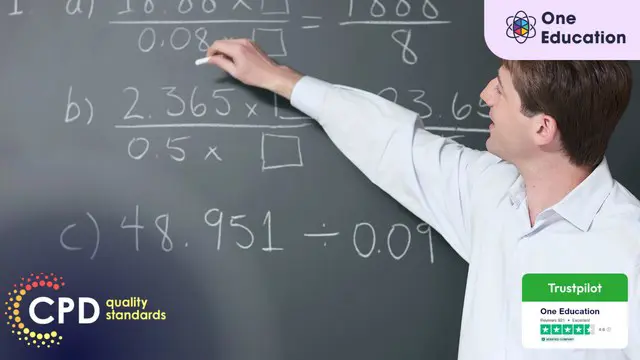

Functional Maths Training Course

By One Education

Functional Maths is about making numbers make sense – not just for passing exams, but for managing life’s everyday calculations with confidence. Whether it’s understanding bills, working out measurements, or getting to grips with percentages, this course is designed to build a solid foundation in essential maths skills, with clarity and a touch of common sense. Created for learners who want to feel more in control when numbers show up in daily life, this course breaks down the basics in a straightforward and engaging way. No confusing jargon, no unnecessary waffle – just clear explanations and useful examples. Perfect for brushing up rusty skills or gaining the confidence to take the next step, it’s a practical route to sharper numeracy that fits neatly into your schedule. Learning Outcomes: Master mathematical concepts such as integers, rational numbers, and decimals. Apply mathematical principles to solve everyday problems with ease. Simplify complex calculations using BODMAS rules. Estimate values using scientific notation and approximation techniques. Understand basic financial calculations such as profit, loss, discounts, and taxes. Work confidently with resources and materials to improve your mathematical skills This Functional Maths Training Course provides an extensive curriculum designed to help you gain practical mathematical skills. You will learn the principles of integers, rational and decimal numbers, percentages, ratios and proportions, and the unitary method. Additionally, you will understand how to calculate profit, loss, discounts, and taxes, making you an expert in basic financial calculations. The course provides a range of benefits, including the ability to estimate values using scientific notation, apply BODMAS rules to simplify complex calculations, and use fractions to solve problems. You will also gain the ability to work with resources and materials that help improve your mathematical skills. By the end of this course, you will have a solid foundation in maths, making it easier to solve problems in everyday life. How is the course assessed? Upon completing an online module, you will immediately be given access to a specifically crafted MCQ test. For each test, the pass mark will be set to 60%. Exam & Retakes: It is to inform our learners that the initial exam for this online course is provided at no additional cost. In the event of needing a retake, a nominal fee of £9.99 will be applicable. Certification Upon successful completion of the assessment procedure, learners can obtain their certification by placing an order and remitting a fee of £9 for PDF Certificate and £15 for the Hardcopy Certificate within the UK (An additional £10 postal charge will be applicable for international delivery). CPD 10 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The course is ideal for highly motivated individuals or teams who want to enhance their professional skills and efficiently skilled employees. Requirements There are no formal entry requirements for the course, with enrollment open to anyone! Career path Upon completing the Functional Maths Training Course, you can venture into diverse job opportunities across various industries, encompassing positions and pay scales that include: Data entry clerk (£17,000 - £23,000) Retail sales assistant (£14,000 - £22,000) Bank cashier (£15,000 - £25,000) Administrative assistant (£17,000 - £25,000) Stock control clerk (£16,000 - £23,000) Certificates Certificate of completion Digital certificate - £9 You can apply for a CPD Accredited PDF Certificate at the cost of £9. Certificate of completion Hard copy certificate - £15 Hard copy can be sent to you via post at the expense of £15.

ICA Specialist Certificate in Trade Based Money Laundering

By International Compliance Association

ICA Specialist Certificate in Trade Based Money Laundering Trade-based money laundering is a highly effective way to launder the proceeds of crime or finance terrorism. By exploiting the complexities of international trade, criminals can transmit vast amounts of value across borders and fund wider organised crime. This course will enable you to understand and compare trade-based money laundering typologies such as variable pricing and goods, understand how financial crime risk can manifest and be mitigated against in this huge global marketplace. ICA Specialist Certificates, awarded in association with Alliance Manchester Business School, the University of Manchester, will help you quickly gain actionable knowledge to boost your confidence and credibility. What will I learn? In addition to the essential concepts of AML and CTF, you will also cover the following areas: International trade and receivables finance Introduction to money laundering, terrorist financing and proliferation International laws, regulations and industry guidance Managing risk Money laundering typologies Terrorist financing, resourcing and sanctions Further financial crime risk considerations

Exploration & Production (E&P) Cost Control, Budgeting & Cost Estimation

By EnergyEdge - Training for a Sustainable Energy Future

About this training course This 3-day training will provide a comprehensive understanding on the nature of costs and cost drivers in the E&P industry providing in-depth understanding on the budgeting process, proactive management, effective control and optimization of costs together with focused and relevant performance reporting. Training Objectives After the completion of this training course, participants will learn: Understand the nature of costs and cost drivers in the E&P industry through the Field Life Cycle Purpose of the Budget. Planning and Budgeting models. The Strategic and Medium-term plan Using budgets to make effective decisions. Prepare and understand costs in planning, budgeting & forecasting processes e.g. fixed / variable, capex / opex and routine / non-routine. Cost Accounting. Importance of timely cost capture and accurate recording e.g. VOWD / accruals, consistency of coding and clarity on accountability Strategic solutions in delivering cost optimization - 'do more for less' Management of costs in PSC and JV environments. Avoiding cost leakage and ensuring audit preparedness Cost Control Framework - budgets, AFEs, progress reports and variance analysis. Understanding key components and ensuring seamless interaction Cost Performance Reporting - use of KPI's, variance analysis and trend analysis. Tracking and monitoring cost optimization initiatives and targets Target Audience This training course is suitable and will greatly benefit the following specific groups: Finance staff with accounting and financial management responsibilities Those responsible for devising budgets, managing and controlling budgets Professionals engaged in planning, budgeting and management reporting Finance & Audit staff engaged on cost and financial controls Business unit managers and personnel whose responsibilities include cost management, controlling budgets and performance reporting Course Level Basic or Foundation Training Methods The training instructor relies on a highly interactive training method to enhance the learning process. This method ensures that all participants gain a complete understanding of all the topics covered. The training environment is highly stimulating, challenging, and effective because the participants will learn by case studies which will allow them to apply the material taught in their own organization. Course Duration: 3 days in total (21 hours). Training Schedule 0830 - Registration 0900 - Start of training 1030 - Morning Break 1045 - Training recommences 1230 - Lunch Break 1330 - Training recommences 1515 - Evening break 1530 - Training recommences 1700 - End of Training The maximum number of participants allowed for this training course is 25. This course is also available through our Virtual Instructor Led Training (VILT) format. Trainer Your expert course leader has more than 30 years of experience in the international oil and gas industry, covering all areas of Finance and Audit, including involvement in Commercial roles. During her 19 years with ENI she worked in Italy, Netherlands, Egypt and UK and was CFO for 2 major ENI subsidiaries. She has delivered training courses in Accounting, Audit, Economics and Commercial topics in many Countries. She has a Degree in Economics & Accounting and is a Certified Chartered Accountant. She is also a Chartered Auditor and an International Petroleum Negotiator. Outside of work, she is inspired by the beauty of nature and art, helping disadvantaged people, sports (football, golf) and her cat. Courses Delivered Internationally: E&P Accounting, Auditing in the Oil & Gas Industry Cost Control & Budgeting Introduction to the Oil & Gas Industry Petroleum Project Economics Contracts Strategy International O&G Exploitation Contracts POST TRAINING COACHING SUPPORT (OPTIONAL) To further optimise your learning experience from our courses, we also offer individualized 'One to One' coaching support for 2 hours post training. We can help improve your competence in your chosen area of interest, based on your learning needs and available hours. This is a great opportunity to improve your capability and confidence in a particular area of expertise. It will be delivered over a secure video conference call by one of our senior trainers. They will work with you to create a tailor-made coaching program that will help you achieve your goals faster. Request for further information post training support and fees applicable Accreditions And Affliations

Sage 50 Accounting

By IOMH - Institute of Mental Health

Overview of Sage 50 Accounting Sage 50 Accounting helps make business finance simple and clear. In the UK, more than half of small and medium-sized businesses use Sage 50 Accounting for their day-to-day accounts. This has created a steady demand for people who know how to use this software well. This course will guide you through all the important parts of Sage 50 Accounting — from setting up the system to preparing detailed financial reports. You will learn how to manage customers and suppliers, do bank reconciliations, handle fixed assets, and process VAT. The course also includes Sage 50 Payroll, where you will be shown how to handle employee records, run payroll, make online submissions, and complete year-end tasks. These skills are used every day in UK businesses and are important for keeping company finances on track. This course is designed to help you understand each feature step by step. With the UK accounting industry growing by 5% every year, learning Sage 50 Accounting gives you a strong advantage. Many employers look for people who can confidently use Sage 50 Accounting in real work settings. Whether you are just starting or want to build on your current skills, this course will help you manage a full range of accounting tasks. By the end, you’ll feel ready to support businesses with practical and valuable Sage 50 Accounting knowledge. Learning Outcomes By the end of this course, you will be able to: Set up the Sage 50 Accounting system and add customer and supplier details Handle invoices, credit notes, and payments quickly and accurately Reconcile bank accounts, including different account types Complete VAT returns and carry out year-end tasks Run payroll, including adding new employees and sending online submissions Create budgets and prepare management reports for better business decisions Who is this course for? Accountants who want to build confidence using Sage 50 Accounting, widely used in UK businesses Bookkeepers wanting to offer more services with strong Sage 50 skills Business owners who wish to manage their own accounts with trusted software Office staff who deal with company accounts and need to understand both the Accounts and Payroll features of Sage 50 Finance team members who want to be confident with everyday tasks like bank reconciliation, VAT, and payroll Process of Evaluation After studying the Sage 50 Accounting Course, your skills and knowledge will be tested with an MCQ exam or assignment. You have to get a score of 60% to pass the test and get your certificate. Certificate of Achievement Certificate of Completion - Digital / PDF Certificate After completing the Sage 50 Accounting Course, you can order your CPD Accredited Digital / PDF Certificate for £5.99. (Each) Certificate of Completion - Hard copy Certificate You can get the CPD Accredited Hard Copy Certificate for £12.99. (Each) Shipping Charges: Inside the UK: £3.99 International: £10.99 Requirements You don't need any educational qualification or experience to enrol in the Sage 50 Accounting course. Career Path The Sage 50 Accounts course can prepare individuals for a variety of job titles, including: Bookkeeper Accountant Financial Manager Financial Analyst Business Accountant Financial Advisor Tax Specialist Payroll Manager These career opportunities can provide you with a salary ranging from £20,000 to £65,000 in the UK. Course Curriculum Sage 50 Accounts Sage 50 Bookkeeper - Course book 00:00:00 Introduction and TASK 1 00:17:00 TASK 2 Setting up the System 00:23:00 TASK 3 a Setting up Customers and Suppliers 00:17:00 TASK 3 b Creating Projects 00:05:00 TASK 3 c Supplier Invoice and Credit Note 00:13:00 TASK 3 d Customer Invoice and Credit Note 00:11:00 TASK 4 Fixed Assets 00:08:00 TASK 5 a and b Bank Payment and Transfer 00:31:00 TASK 5 c and d Supplier and Customer Payments and DD STO 00:18:00 TASK 6 Petty Cash 00:11:00 TASK 7 a Bank Reconnciliation Current Account 00:17:00 TASK 7 b Bank Reconciliation Petty Cash 00:09:00 TASK 7 c Reconciliation of Credit Card Account 00:16:00 TASK 8 Aged Reports 00:14:00 TASK 9 a Payroll 00:07:00 9 b Payroll Journal 00:10:00 TASK 10 Value Added Tax - Vat Return 00:12:00 Task 11 Entering opening balances on Sage 50 00:13:00 TASK 12 a Year end journals - Depre journal 00:05:00 TASK 12 b Prepayment and Deferred Income Journals 00:08:00 TASK 13 a Budget 00:05:00 TASK 13 b Intro to Cash flow and Sage Report Design 00:08:00 TASK 13 c Preparation of Accountants Report & correcting Errors (1) 00:10:00 Sage 50 Payroll Payroll Basics 00:10:00 Company Settings 00:08:00 Legislation Settings 00:07:00 Pension Scheme Basics 00:06:00 Pay Elements 00:14:00 The Processing Date 00:07:00 Adding Existing Employees 00:08:00 Adding New Employees 00:12:00 Payroll Processing Basics 00:11:00 Entering Payments 00:12:00 Pre-Update Reports 00:09:00 Updating Records 00:09:00 e-Submissions Basics 00:09:00 Process Payroll (November) 00:16:00 Employee Records and Reports 00:13:00 Editing Employee Records 00:07:00 Process Payroll (December) 00:12:00 Resetting Payments 00:05:00 Quick SSP 00:09:00 An Employee Leaves 00:13:00 Final Payroll Run 00:07:00 Reports and Historical Data 00:08:00 Year-End Procedures 00:09:00

Leveraged Buyout Modelling

By Capital City Training & Consulting Ltd

Enroll today and master LBO modelling - a vital competency for careers in private equity, investment banking, corporate development, and finance. 3.5+ Hours of Video 5+ Hours to Complete15+ Interactive Exercises1 Recognised Certificate Course Overview Our comprehensive LBO Modelling certification program teaches the essential skills needed to model leveraged buyouts and prepare investment pitches. Through step-by-step video lessons and hands-on exercises, this course provides the necessary concepts, tools, and methods to become an expert in LBO analysis. With a focus on hands-on learning and real-world applications, this course will set you up for success in investment banking, private equity, mergers and acquisitions, business valuation, and corporate finance roles. With over 4 hours of content and 35+ exercises, our program provides all the necessary concepts, tools, and methods to become an expert on valuation. “I was previously unsure of all the financial jargon and concepts, now I feel I have taken steps towards getting the big picture of finance. I really liked the Excel web integration!” Rachel Crawford Course Highlights Introduction to LBOs and Leveraged Finance Sources and Uses Framework for Funding Strategies Debt Structuring, Repayments, and Cash Flow Analysis Returns Analysis Across Multiple Scenarios Quantifying Value Creation with the Value Bridge 15+ Practice Exercises with Solutions Certificate Upon Completion

Tired of searching and accumulating all the relevant courses for this specific field? It takes a substantial amount of your time and, more importantly, costs you a fortune! Well, we have just come up with the ultimate solution for you by giving this all-inclusive Finance & Accounting mega bundle. This 37 courses mega bundle keeps you up-to-date in this field and takes you one step ahead of others. Keeping in mind the latest advancements in this ever-emerging sector, the Finance & Accounting bundle covers all the state-of-the-art tools and techniques required to become a competent worker in this area. You will encounter specific courses relevant to the sector. We take you from the most introductory fundamentals to advance knowledge in a step-by-step manner. In addition, the Finance & Accounting bundle also consists of courses related to some soft skills that you will need to succeed in any industry or job sector. This Finance & Accounting Bundle Consists of the following Premium courses: Course 01: Accounting and Finance Course 02: Applied Accounting Course 03: Managerial Accounting Masterclass Course 04: Changes in Accounting: Latest Trends Encountered by CFOs in 2022 Course 05: Tax Accounting Course 06: Introduction to VAT Course 07: Xero Accounting and Bookkeeping Online Course 08: Quickbooks Online Course 09: Sage 50 Accounts Course 10: Cost Control Process and Management Course 11: Learn to Read, Analyse and Understand Annual Reports Course 12: Financial Statements Fraud Detection Training Course 13: Finance Principles Course 14: Financial Management Course 15: Financial Modelling Course - Learn Online Course 16: Improve your Financial Intelligence Course 17: Financial Analysis Course 18: Banking and Finance Accounting Statements Financial Analysis Course 19: Financial Ratio Analysis for Business Decisions Course 20: Make Business Plans: Forecasting and Budgeting Course 21: Develop Your Career in Finance: Blue Ocean Strategy Course 22: Anti-Money Laundering (AML) Training Course 23: Document Control Course 24: Payroll Management Course Course 25: Key Account Management Course Course 26: Commercial Law Course 27: Risk Assessment & Management Course 28: Excel Vlookup, Xlookup, Match and Index Course 29: Excel Data Analysis Course 30: Time Management Training - Online Course Moreover, this bundles include 7 career-focused courses: Course 01: Career Development Plan Fundamentals Course 02: CV Writing and Job Searching Course 03: Interview Skills: Ace the Interview Course 04: Video Job Interview for Job Seekers Course 05: Create a Professional LinkedIn Profile Course 06: Business English Perfection Course Course 07: Networking Skills for Personal Success Our cutting-edge learning package offers top-notch digital aid and first-rate tutor support. You will acquire the crucial hard and soft skills needed for career advancement because this bundle has been thoroughly examined and is career-friendly. So don't overthink! Enrol today. Learning Outcomes This unique Finance & Accounting mega bundle will help you to- Quench your thirst for knowledge Be up-to-date about the latest advancements Achieve your dream career goal in this sector Know the applicable rules and regulations needed for a professional in this area Acquire some valuable knowledge related to Finance & Accounting to uplift your morale The bundle incorporates basic to advanced level skills to shed some light on your way and boost your career. Hence, you can strengthen your expertise and essential knowledge, which will assist you in reaching your goal. Moreover, you can learn from any place in your own time without travelling for classes. Certificate: PDF Certificate: Free for all 37 courses Hard Copy Certificate: Free (For The Title Course: Previously it was £10) CPD 370 CPD hours / points Accredited by CPD Quality Standards Who is this course for? The Finance & Accounting bundle is designed to assist anyone with a curious mind, anyone looking to boost their CVs or individuals looking to upgrade their career to the next level can also benefit from the learning materials. Requirements The courses in this bundle has been designed to be fully compatible with tablets and smartphones. Career path This Finance & Accounting bundle will give you an edge over other competitors and will open the doors for you to a plethora of career opportunities. Certificates Certificate of completion Digital certificate - Included Certificate of completion Hard copy certificate - Included You will get the Hard Copy certificate for the title course (Accounting and Finance) absolutely Free! Other Hard Copy certificates are available for £10 each. Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

Mastering Xero Accounting, Bookkeeping, QuickBooks & Payroll Management - CPD Certified

4.8(9)By Skill Up

17-in-1 CPD Certified Bundle | Free 17 PDF & Transcript Certificate Included | 24/7 Learner Support

Learn the Fundamentals of Analytics - Become an Expert in Web & Marketing Analytics

4.5(3)By Studyhub UK

Do you want to prepare for your dream job but strive hard to find the right courses? Then, stop worrying, for our strategically modified Learn the Fundamentals of Analytics - Become an Expert in Web & Marketing Analytics bundle will keep you up to date with the relevant knowledge and most recent matters of this emerging field. So, invest your money and effort in our 33 course mega bundle that will exceed your expectations within your budget. The Learn the Fundamentals of Analytics - Become an Expert in Web & Marketing Analytics related fields are thriving across the UK, and recruiters are hiring the most knowledgeable and proficient candidates. It's a demanding field with magnitudes of lucrative choices. If you need more guidance to specialise in this area and need help knowing where to start, then StudyHub proposes a preparatory bundle. This comprehensive Learn the Fundamentals of Analytics - Become an Expert in Web & Marketing Analytics bundle will help you build a solid foundation to become a proficient worker in the sector. This Learn the Fundamentals of Analytics - Become an Expert in Web & Marketing Analytics Bundle consists of the following 30 CPD Accredited Premium courses - Course 01 :Diploma in Data Analysis Fundamentals Course 02 :Google Data Studio: Data Analytics Course 03 :Statistics Course 04 :Statistical Analysis Course 05 :Statistics & Probability for Data Science & Machine Learning Course 06 :Quick Data Science Approach from Scratch Course 07 :Business Intelligence and Data Mining Course 08 :Financial Analysis Course 09 :Financial Statement Analysis Masterclass Course 10 :Financial Modeling Using Excel Course 11 :Fundamentals of Business Analysis Course 12 :Business Intelligence Analyst Course 13 :Investment Course 14 :Investment Analyst Course 15 :Financial Ratio Analysis for Business Decisions Course 16 :Banking and Finance Accounting Statements Financial Analysis Course 17 :Technical Analysis Masterclass for Trading & Investing Course 18 :Strategic Planning and Analysis for Marketing Course 19 :Learn to Read, Analyse and Understand Annual Reports Course 20 :Financial Analysis : Finance Reports Course 21 :Stakeholder Management Analyst Course 22 :Purchase Analyst Course 23 :RCA: Root Cause Analysis Course 24 :Root Cause Analysis: Toolkit Course 25: Excel Data Analysis Course 26: Receptionist Skills Course 27: Minute Taking Executive Training Course 28: Time Management Training - Online Course Course 29: Complete Communication Skills Master Class for Life Course 30: Public Speaking 3 Extraordinary Career Oriented courses that will assist you in reimagining your thriving techniques- Course 01 :Career Development Plan Fundamentals Course 02 :CV Writing and Job Searching Course 03 :Interview Skills: Ace the Interview Learning Outcome This tailor-made Learn the Fundamentals of Analytics - Become an Expert in Web & Marketing Analytics bundle will allow you to- Uncover your skills and aptitudes to break new ground in the related fields Deep dive into the fundamental knowledge Acquire some hard and soft skills in this area Gain some transferable skills to elevate your performance Maintain good report with your clients and staff Gain necessary office skills and be tech savvy utilising relevant software Keep records of your work and make a report Know the regulations around this area Reinforce your career with specific knowledge of this field Know your legal and ethical responsibility as a professional in the related field This Learn the Fundamentals of Analytics - Become an Expert in Web & Marketing Analytics Bundle resources were created with the help of industry experts, and all subject-related information is kept updated on a regular basis to avoid learners from falling behind on the latest developments. Certification After studying the complete training you will be able to take the assessment. After successfully passing the assessment you will be able to claim all courses pdf certificates and 1 hardcopy certificate for the Title Course completely free. Other Hard Copy certificates need to be ordered at an additional cost of •8. CPD 330 CPD hours / points Accredited by CPD Quality Standards Who is this course for? Ambitious learners who want to strengthen their CV for their desired job should take advantage of the Learn the Fundamentals of Analytics - Become an Expert in Web & Marketing Analytics bundle! This bundle is also ideal for professionals looking for career advancement. Requirements To participate in this course, all you need is - A smart device A secure internet connection And a keen interest in Learn the Fundamentals of Analytics - Become an Expert in Web & Marketing Analytics Career path Upon completing this essential Bundle, you will discover a new world of endless possibilities. These courses will help you to get a cut above the rest and allow you to be more efficient in the relevant fields.