- Professional Development

- Medicine & Nursing

- Arts & Crafts

- Health & Wellbeing

- Personal Development

6729 Courses in London delivered Online

Compliance and Business Law - Double Endorsed Certificate

By Imperial Academy

2 QLS Endorsed Course | CPD Certified | Free PDF + Hardcopy Certificates | 80 CPD Points | Lifetime Access

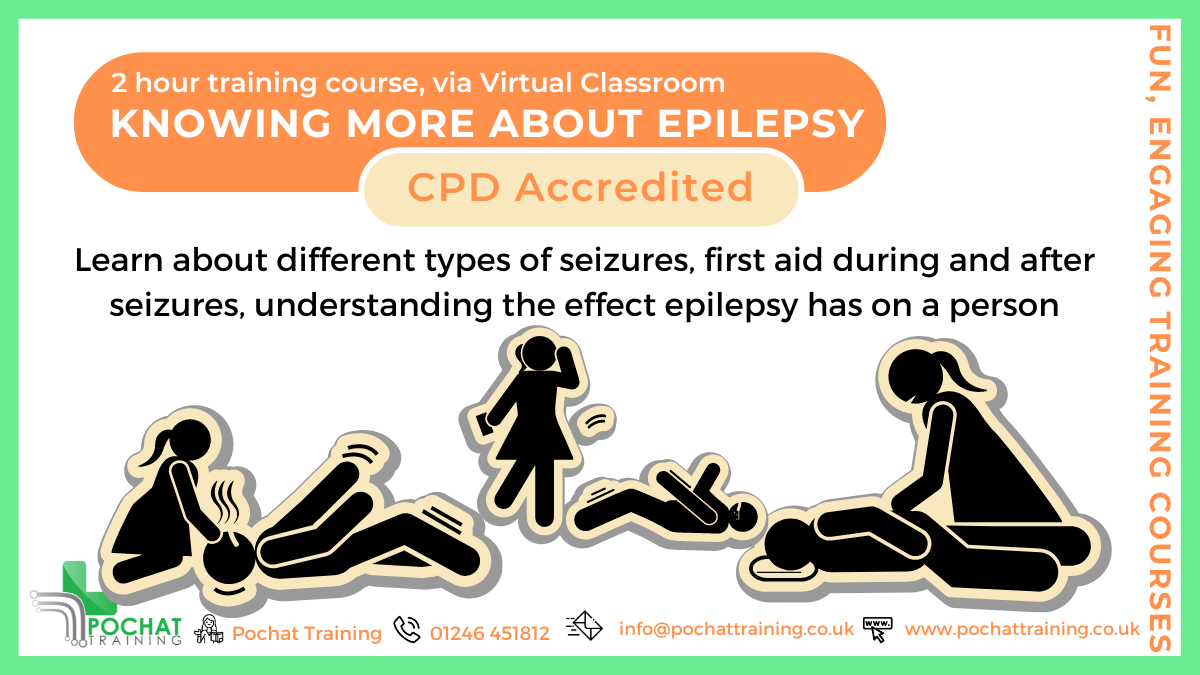

CPD Accredited, Interactive Short Course 2 hr session This training session gives a good introduction to epilepsy How can you best understand and help those affected with different types of seizures Great for those who have contact with people with epilepsy, such as family and friends, those working in education and afterschool clubs, sports and good CPD for nurses Course Contents: What is Epilepsy The different types of seizures Keeping someone safe while they're having a seizure Understand how having epilepsy affects someone's life Great for teachers and TAs in schools, for those working in care or community events, and those close to people with epilepsy Benefits of this Short Course: Epilepsy is one of the most common neurological conditions In the UK, there are over 600,000 people with a diagnosis of epilepsy That is about 1 in 103 people, or 1 child or young person in every 3 classrooms Every year, 1000 people in the UK die due to their epilepsy Help avoid unnecessary suffering or even death by knowing what to do to help while they're having an epileptic seizure, and keep them safe

Completing Client and Matter Risk Assessments Course

By DG Legal

Despite being a requirement under the Money Laundering Regulations 2017 (MLR 2017), in 2023/24 the SRA found that 19% of files reviewed did not contain a client and matter risk assessment (CMRA), with a further 12% of files containing ineffective CMRAs. At best, the firms conducting these files were putting themselves at risk of regulatory action for failure to comply with the MLR 2017. More seriously, firms may have been facilitating money laundering through their failure to adequately assess and address the risks posed by clients and matters. The SRA has issued a number of significant fines to firms with no, or insufficient, CMRAs in place. In the year August 2024 to July 2025, firms were fined over £950,000 where ineffective or missing CMRAs were noted. Although a firm’s MLRO, MLCO or its managers bear ultimate responsibility for ensuring its compliance with the MLR 2017, it is the responsibility of all those working on behalf of the firm to conduct and document the appropriate processes and checks on a day-to-day basis. Therefore, it is imperative that all staff understand not only how to complete a CMRA, but also the importance of doing so thoroughly and correctly. This course will assist fee earners and support staff in confidently and competently completing client and matter risk assessments, understanding the types of risks to be identified and the importance of correctly identifying these. Where the SRA has found failings at firms in respect of CMRAs, it has almost unanimously also found shortcomings in other areas of AML compliance. Where concerns are raised regarding a firm’s compliance with any aspect of the MLR 2017, the SRA will probe further and look into all areas of AML compliance. For information about DG Legal’s full range of AML training courses, please visit https://dglegal.co.uk/training/upcoming-premier-training-courses/. Target Audience This online course is suitable for staff of all levels, from support staff to senior partners. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Paul Wightman, Consultant, DG Legal A qualified barrister, Paul graduated in Law from Birmingham University and was called to the Bar in 1994. He subsequently spent almost 20 years working for the Law Society of England and Wales, initially within the Office for the Supervision of Solicitors, then the Legal Complaints Service (LCS), and ultimately the Solicitors Regulation Authority (SRA). Paul is adept at undertaking audits and providing succinct reports on areas for improvement and can assist firms with advice on all aspects of SRA compliance and Anti-Money Laundering procedures.

Compliance, Risk Management and Quality Management

By Imperial Academy

2 QLS Endorsed Course | CPD Certified | Free PDF + Hardcopy Certificates | 80 CPD Points | Lifetime Access

Compliance and Risk Management - QLS Level 3, 4 & 5

By Imperial Academy

QLS Level 5 Endorsed Course with FREE Certificate | 150 CPD Points | Lifetime Access | Tutor Support

Level 3, 4, 5 Compliance and Risk Management

By Imperial Academy

Level 5 QLS Endorsed Course with FREE Certificate | CPD & CiQ Accredited | 150 CPD Points | Lifetime Access

Source of Funds and Source of Wealth Checks Course

By DG Legal

Source of funds and source of wealth are two important verification steps a firm can take to identify potential money laundering activities or other financial crime. The Money Laundering Regulations 2017 (MLR 2017) require firms, where necessary, to scrutinise the source of funds of a transaction to ensure they are consistent with their knowledge of the customer, their business and risk profile. In addition, where a matter is considered to be higher risk and therefore subject to enhanced due diligence, firms must also investigate the client’s overall source of wealth. Law firm staff must be able to differentiate between source of funds and source of wealth, having knowledge of how to verify each and identify any anomalies that do not align with their understanding of the client or the matter. Staff must have the knowledge and confidence to challenge clients and seek further clarification where the source may be unclear or highlight concerns. A number of firms who failed to sufficiently identify the source of funds and/or source of wealth have recently been fined by the SRA. In the year August 2024 to July 2025, fines in excess of £475,000 were recorded for AML breaches that included source of funds and source of wealth failings. This course will assist fee earners and support staff in understanding the difference between source of funds and source of wealth, enabling them to capably identify and verify funds in a matter. Where the SRA has found failings at firms in respect of source of funds or source of wealth, it has almost unanimously also found shortcomings in other areas of AML compliance. Where concerns are raised regarding a firm’s compliance with any aspect of the MLR 2017, the SRA will probe further and look into all areas of AML compliance. For information about DG Legal’s full range of AML training courses, please visit: https://dglegal.co.uk/training/upcoming-premier-training-courses/. Target Audience This online course is suitable for staff of all levels, from support staff to senior partners. Resources Comprehensive and up to date course notes will be provided to all delegates which may be useful for ongoing reference or cascade training. Please note a recording of the course will not be made available. Speaker Paul Wightman, Consultant, DG Legal A qualified barrister, Paul graduated in Law from Birmingham University and was called to the Bar in 1994. He subsequently spent almost 20 years working for the Law Society of England and Wales, initially within the Office for the Supervision of Solicitors, then the Legal Complaints Service (LCS), and ultimately the Solicitors Regulation Authority (SRA). Paul is adept at undertaking audits and providing succinct reports on areas for improvement and can assist firms with advice on all aspects of SRA compliance and Anti-Money Laundering procedures.

Compliance Management

By SkillWise

Overview Uplift Your Career & Skill Up to Your Dream Job - Learning Simplified From Home! Kickstart your career & boost your employability by helping you discover your skills, talents, and interests with our special Compliance Management Course. You'll create a pathway to your ideal job as this course is designed to uplift your career in the relevant industry. It provides the professional training that employers are looking for in today's workplaces. The Compliance Management Course is one of the most prestigious training offered at Skillwise and is highly valued by employers for good reason. This Compliance Management Course has been designed by industry experts to provide our learners with the best learning experience possible to increase their understanding of their chosen field. This Compliance Management Course, like every one of Skillwise's courses, is meticulously developed and well-researched. Every one of the topics is divided into elementary modules, allowing our students to grasp each lesson quickly. At Skillwise, we don't just offer courses; we also provide a valuable teaching process. When you buy a course from Skillwise, you get unlimited Lifetime access with 24/7 dedicated tutor support. Why buy this Compliance Management? Unlimited access to the course forever Digital Certificate, Transcript, and student ID are all included in the price Absolutely no hidden fees Directly receive CPD Quality Standard-accredited qualifications after course completion Receive one-to-one assistance every weekday from professionals Immediately receive the PDF certificate after passing Receive the original copies of your certificate and transcript on the next working day Easily learn the skills and knowledge from the comfort of your home Certification After studying the course materials of the Compliance Management there will be a written assignment test which you can take either during or at the end of the course. After successfully passing the test you will be able to claim the pdf certificate for free. Original Hard Copy certificates need to be ordered at an additional cost of £8. Who is this course for? This Compliance Management course is ideal for Students Recent graduates Job Seekers Anyone interested in this topic People already working in the relevant fields and want to polish their knowledge and skills. Prerequisites This Compliance Management does not require you to have any prior qualifications or experience. You can just enroll and start learning. This Compliance Management was made by professionals and it is compatible with all PCs, Macs, tablets, and smartphones. You will be able to access the course from anywhere at any time as long as you have a good enough internet connection. Career path As this course comes with multiple courses included as a bonus, you will be able to pursue multiple occupations. This Compliance Management is a great way for you to gain multiple skills from the comfort of your home. Compliance Management - Updated Version Module 01: Introduction to Compliance 00:17:00 Module 02: Five basic elements of compliance 00:25:00 Module 03: Compliance Management System (CMS) 00:26:00 Module 04: Compliance Audit 00:38:00 Module 05: Compliance and Ethics 00:26:00 Module 06: Risk and Types of Risk 00:25:00 Module 07: Introduction to Risk Management 00:25:00 Module 08: Risk Management Process 00:18:00 Mock Exam Final Exam Compliance Management - Old Version Module 1: Introduction to Compliance 00:10:00 Module 2: Compliance Management System 00:15:00 Module 3: Basic Elements of Effective Compliance 00:15:00 Module 4: Compliance Audit 00:20:00 Module 5: Compliance and Ethics 00:20:00 Module 6: Introduction to Risk and Basic Risk Types 00:20:00 Module 7: Further Risk Types 00:20:00 Module 8: Introduction to Risk Management 00:10:00 Module 9: Risk Management Process 00:10:00 Module 10: Risk Assessment and Risk Treatment 00:20:00 Module 11: Types of Risk Management 00:20:00 Assignment Assignment - Compliance Management 02:40:00 Recommended Materials Workbook - Compliance Management 04:00:00

Certificate in Compliance

By Imperial Academy

Level 5 QLS Endorsed Course | CPD & CiQ Accredited | Audio Visual Training | Free PDF Certificate | Lifetime Access

Compliance Management Training

By Imperial Academy

Level 5 QLS Endorsed Course | CPD & CiQ Accredited | Audio Visual Training | Free PDF Certificate | Lifetime Access